Many years ago, when I first entered the semiconductor industry, I embarked on a lifelong learning journey. This amazing industry evolves so rapidly that you only need to understand the developments of the past few years to keep up. When I entered the leadership ranks, although I still received directives from my superiors, I also needed to cultivate a team, for which I required direction. This was the first time I lifted my gaze from my desk to look towards the horizon.

It was the era of “market research” (which still is today), where companies navigated by looking at Excel spreadsheets filled in by a junior analyst at a research firm.However, navigating with Excel data from three years ago is like driving while only looking in the rearview mirror. When the iPhone was launched, Nokia was still studying Motorola and Sony Ericsson. After years of mocking its lack of buttons, market research results still favored Nokia, even though the mobile phone market itself had changed.

A large portion of leaders base their plans on self-interest rather than considering the actual situation. These leaders are looking for data to support their plans rather than formulating a data-driven plan. Although I remained in the semiconductor industry, I knew I had to break away to blend into the data stream without disturbing it. When I began analyzing the financials of semiconductor companies, I could see market trends and better understand the cyclicality of the semiconductor industry. It was like looking through the side window of a car to see what was happening at the moment.

However, it wasn’t until I started analyzing the balance sheets and cash flow statements of semiconductor companies that I began to glimpse the future through the windshield. Analyzing capital expenditures (CapEx), depreciation, and property, plant, and equipment (PPE) allowed me to see further and predict the industry’s ups and downs.

Before long, I realized there was an entirely new market worth studying. The semiconductor industry cannot be viewed in isolation, as it is embedded in a global, intricate supply network with highly specialized products. Some of these are so specialized that the entire industry relies on their technology.

And it all starts with a piece of equipment, and while I track about 50 segments within and outside the semiconductor industry, the equipment market is one of my favorites because it leads “market research” by 4-5 years.

The Equipment Cycle, or the Absence of a Cycle

The cyclicality of the semiconductor industry is closely related to the time required to build a wafer fab and fill it with expensive “toys” (equipment). The timeline for constructing a semiconductor fab is about two years. Because everyone invests during good times, all capacities come online simultaneously, leading to the arrival of bad times—this is a recurring pattern.

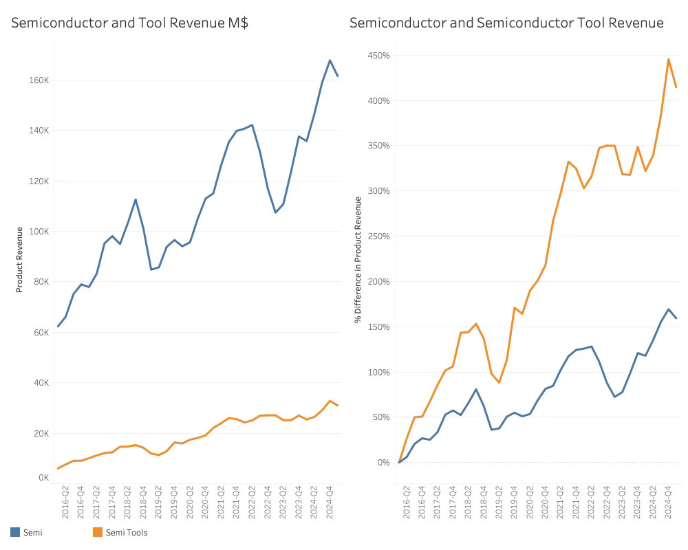

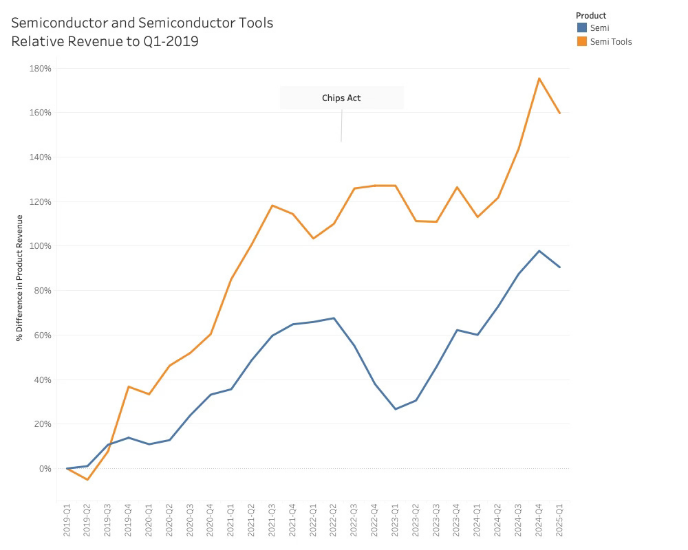

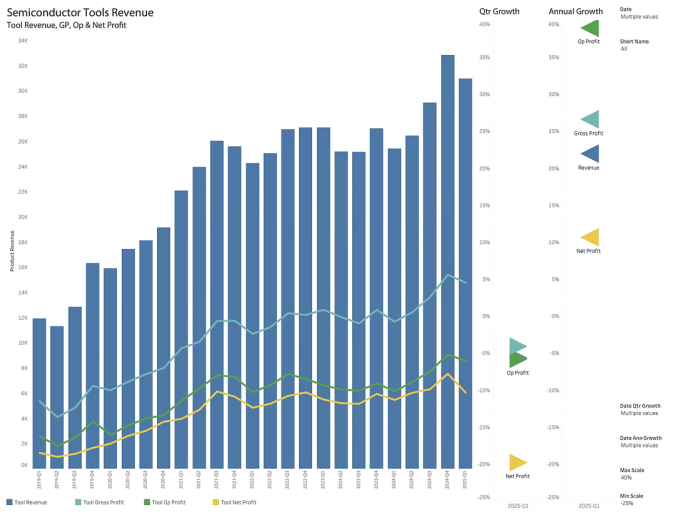

This cycle has remained stable at around four years, with neither the financial crisis nor the COVID-19 pandemic significantly altering it. The chart below illustrates this.

From the chart, it can also be seen that at the peak in 2018, the equipment cycle was synchronized with the semiconductor cycle. This did not repeat in the upward cycle of 2022. The equipment market skipped the downward cycle of 2023, remaining steady until the end of 2024, before joining the upward cycle again.

This represents a significant and well-known shift in the semiconductor industry. While the U.S. embargo on China has been ongoing for some time, the approval of the CHIPS Act marks a shift from economic logic to political logic.

The construction of fabs is no longer based on the economic logic of supply and demand, but rather on the availability of generous subsidies from the U.S. and other major trading blocs. While the Chinese semiconductor industry has long benefited from government subsidies, the embargo and the CHIPS Act have accelerated this development, leading Chinese semiconductor companies to begin purchasing all the equipment they can obtain.

This is the beginning of the story for the first quarter of 2025.

The Current State of the Semiconductor Equipment Market

When analyzing total equipment revenue, it is important to note that this only includes equipment revenue, excluding services or other income. Although total equipment revenue in the first quarter of 2025 (Q1-25) decreased by 5.5% quarter-over-quarter, it remains high, with a year-over-year (YoY) growth of 22%. This once again leads the growth of the semiconductor market, which saw a YoY growth of 19% in Q1-25.

The chart only shows equipment sales, excluding service revenue. Although the decline in net profit is greater than that of revenue, operating profit has not been affected. The decline is mainly due to financial adjustments that do not have long-term impacts.

As shown in the chart, while achieving YoY revenue growth, operating profit is significantly higher, indicating that equipment companies currently have a strong market position.

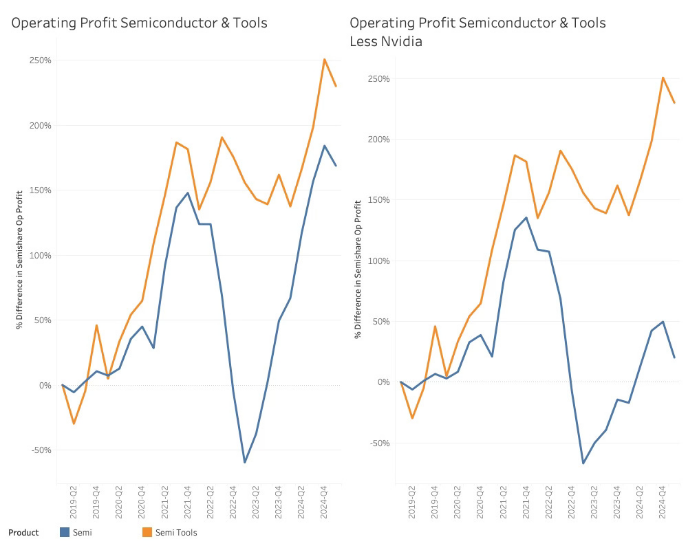

If you are an investor in the semiconductor field, this is worth noting. While the operating profit margins of equipment and semiconductors have been similar in recent years, this has been overshadowed by Nvidia’s(Nvidia) success. Excluding Nvidia, the growth rate of equipment operating profit has significantly outpaced that of semiconductor operating profit.

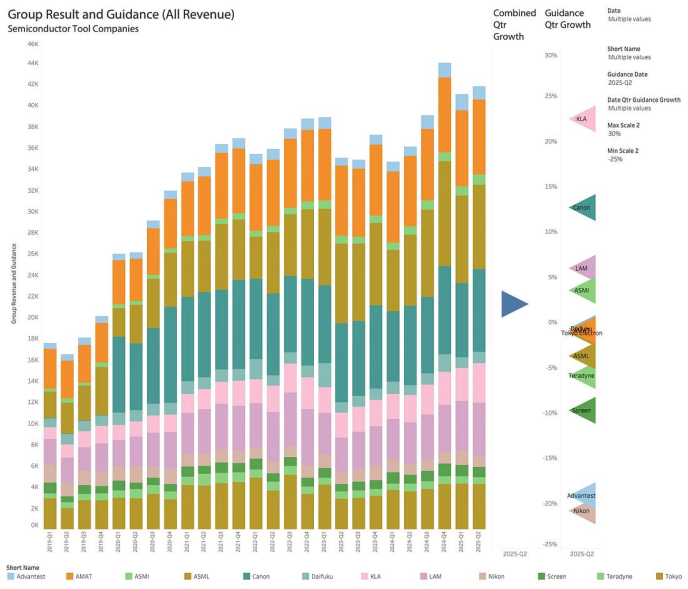

Turning to performance guidance, the current revenue outlook encompasses total company revenue, including services and other products. The guidance analysis is based on the top 12 companies. Overall, the guidance is positive, with an expected growth of 1.7%, which corresponds to a YoY growth of 15.7%. Overall, equipment companies are generally optimistic and expect their specific segments of the equipment chain to grow faster than others.

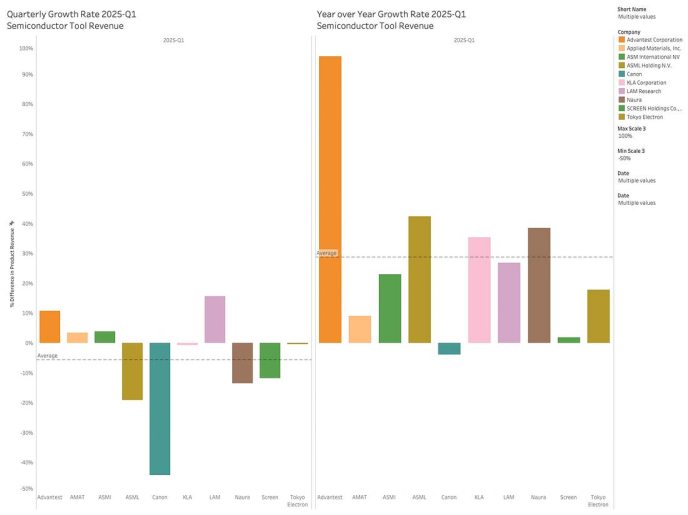

Shifting the focus back to pure semiconductor equipment revenue, the winners and losers are listed below.

Canon’s (Canon) sharp decline in revenue is not uncommon, as the lithography business is volatile, but it also affects annual growth. Canon has been impacted by low growth in smartphones and PCs, with customers delaying purchases. As with the semiconductor industry, the ability to supply manufacturers participating in the AI server boom is crucial. For lithography equipment, this is entirely favorable for ASML.

From an annual perspective, Advantest is clearly the winner. Its growth is entirely driven by AI applications, including support for increasingly complex GPUs (TSMC) and high-bandwidth memory (Korean giants).

Advantest believes this trend will continue for the foreseeable future.

Inventory levels remain stable, indicating a good balance of supply and demand, which also suggests that the Chinese purchasing frenzy and high backlog orders are coming to an end. I will explore this in more detail later.

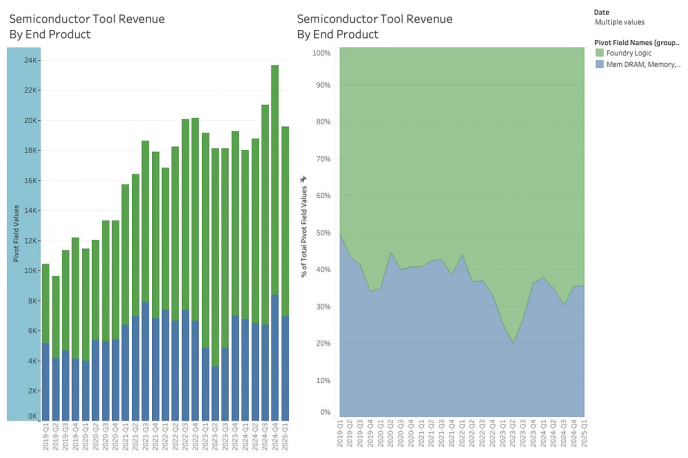

The end-use of equipment remains stable, with logic/foundry (Logic/Foundry) and memory (memory) holding steady at 65%/35%. Once memory companies believe the market is hot enough to forget the downturn, the trend of declining memory equipment revenue may quickly reverse.

AI servers are driving the current semiconductor cycle; however, AI servers require a large amount of memory, so I expect this ratio to remain relatively stable. More on this later.

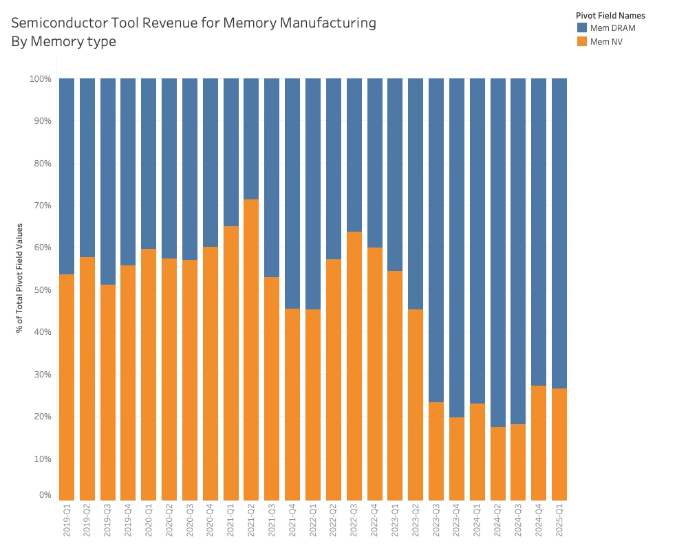

In memory equipment revenue, DRAM (especially HBM) continues to dominate, while investment in NAND shows signs of recovery after a prolonged slump.

*Original media:Semiconductor Business

*Original author:Claus Aasholm

*Original link:

https://clausaasholm.substack.com/p/the-latest-drivers-and-trends-in

Empowering the Future, Innovating the Ecosystem

Bay Chip Expo 2025 looks forward to seeing you!