China, leveraging its advantages in the entire electric vehicle industry chain and rapid technological iteration capabilities, has become a global leader in automotive semiconductor innovation. Automotive companies and chip manufacturers are deeply collaborating to reshape the supply chain landscape and accelerate the global industrial technology evolution.

China, leveraging its advantages in the entire electric vehicle industry chain and rapid technological iteration capabilities, has become a global leader in automotive semiconductor innovation. Automotive companies and chip manufacturers are deeply collaborating to reshape the supply chain landscape and accelerate the global industrial technology evolution.

The latest white paper from Yole Group, titled “Driving the Future: China’s Pivotal Role in Automotive Semiconductor Innovation,” points out that the automotive industry is currently undergoing an unprecedented technological revolution. From the quiet rise of electric vehicles to the gradual approach of intelligence; from the comprehensive penetration of smart connectivity to the stunning debut of the 800V high-voltage platform, semiconductor technology acts as a powerful “heart,” becoming the core driving force behind the transformation of the entire industry.

In this grand wave of transformation, China, with strong policy support, close industrial collaboration, and continuous technological innovation, is transforming from a former technology follower to a key driver of global automotive semiconductors. Policies act like a beacon, illuminating the path for the development of China’s automotive semiconductor industry; industrial collaboration serves as a solid bridge, connecting various links to achieve optimal resource allocation; while technological innovation is a continuous source of power, driving the Chinese automotive semiconductor industry to constantly break through itself.

The unique charm of the Chinese market lies in its astonishing rapid technological iteration capabilities. Yu Yang, Chief Analyst of Automotive Semiconductors at Yole Group, keenly pointed out: “China is not only the world’s largest automotive market but also demonstrates strong leadership in supply chain integration, technological innovation, and market application.” This viewpoint accurately summarizes China’s unique position in the global automotive semiconductor field.

In China, automotive manufacturers and semiconductor companies are like comrades in arms, accelerating their layout in key areas such as Advanced Driver Assistance Systems (ADAS), power electronics, and intelligent cockpits. ADAS technology acts like a “smart eye” for vehicles, making driving safer and more convenient; power electronics technology serves as the “heart pacemaker” of automotive power systems, providing solid support for efficient vehicle operation; while intelligent cockpit technology creates a comfortable and intelligent “mobile home,” enhancing the user driving experience. The collaborative development of these three areas is driving the global automotive semiconductor industry into a new development stage, opening up a future full of infinite possibilities.

01

From Electrification Transformation to Semiconductor Competition

The white paper emphasizes that China’s success in the electric vehicle sector is no accident, but rather the result of long-term and precise strategic planning. Compared to European and American automakers’ reliance on traditional internal combustion engine (ICE) technology, China has chosen a more innovative path—fully embracing electrification and meticulously constructing a complete industrial chain around batteries, motors, and electronic controls (the three electric systems).

Pierrick Boulay, Chief Analyst of Automotive Semiconductors at Yole Group, states: “We have always closely monitored industry changes, especially focusing on how semiconductor technology empowers new mobility functions. Today, ADAS and electrification are gradually becoming industry standards, laying a solid foundation for the development of intelligent technology and electric vehicles.”

In this process, semiconductor device manufacturers have become a key strategic focus. Chinese automakers are gradually increasing their procurement of domestic semiconductor devices, replacing global suppliers such as Infineon, NXP, STMicroelectronics, Texas Instruments, Renesas Electronics, and ON Semiconductor, and instead supporting local enterprises. This is undoubtedly a significant transformation for non-Chinese IDM manufacturers. For example, STMicroelectronics has begun implementing a “Made in China for China” localization strategy in the Chinese market. Other international manufacturers that do not formulate corresponding countermeasures will find it difficult to participate in the fierce competition in the Chinese market.

Yu Yang, Chief Analyst of Automotive Semiconductors at Yole Group, points out: “Chinese automakers are strengthening their control over semiconductors, striving to promote the next technological leap. They are willing to take on greater risks and accelerate their actions through bold strategic investments.”

In contrast, traditional European and American automakers, once seen as having advantages in ICE vehicle development and production infrastructure and a large workforce, have now become significant obstacles to adapting to the electrification transformation.

As the automotive supply chain develops, Chinese companies are increasingly venturing into the SoC and Microcontroller Unit (MCU) fields. Due to the strict safety standards in the automotive SoC and MCU markets, such as ISO26262 certification, this is undoubtedly a daunting challenge. However, the rewards are also substantial, including capturing a larger share of the largest market for MCU revenue and long-term design contracts.

In recent years, semiconductors have become the core focus of competition in the automotive industry. Initially, the US-China trade war and the supply chain disruptions caused by the COVID-19 pandemic brought semiconductor supply into sharp focus. Subsequently, a trend of vertical integration emerged, with companies increasing investments and focusing on the automotive electronics sector, covering silicon carbide (SiC), SoC, and MCU technologies.

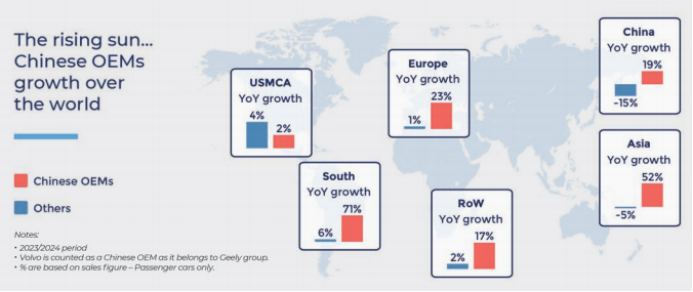

Yole Group believes that the expansion of China’s semiconductor production capacity is benefiting from the booming domestic automotive market. Since 2009, China has been the world’s largest automotive market, previously dominated by international brands. However, with the commercialization of all-electric and plug-in hybrid vehicles becoming a turning point, the Chinese government has introduced a series of incentive measures over the past decade to support traditional automakers and electric vehicle startups in emerging domestically and actively expanding into overseas markets. These measures have collectively driven the vigorous development of China’s semiconductor industry.

Figure: Growth of Chinese Automakers Worldwide

02

ADAS: Setting New Standards in the Automotive Industry

Driven by the wave of automotive intelligence, Advanced Driver Assistance Systems (ADAS) are rapidly rising from being an optional “nice-to-have” feature to becoming the “default” configuration for future vehicles, profoundly reshaping the development landscape of the entire automotive industry. BYD has taken the lead in fully equipping its models with ADAS, while Geely, Li Auto, NIO, and XPeng are also viewing ADAS as a key strategic capability, increasing investments and actively researching to seize the initiative in this intelligent race.

Yole Group states in the white paper that the rapid development of the local supply chain in China has laid a solid foundation for the popularization of ADAS. Automakers such as BYD, Geely, Dongfeng, and Great Wall are turning to self-developed MCUs to control core technologies. Meanwhile, companies like Horizon Robotics, Hesai Technology, Autowise Technology, and OmniVision Technologies are continuously breaking through in key areas such as sensors and chips, reducing costs through technological innovation and economies of scale, making ADAS technology more widely applicable across various vehicle models. In the chip field, Mobileye leads in front camera chips, while NVIDIA and Tesla excel in central processing units. Meanwhile, local Chinese companies like Horizon Robotics, Huawei, and NIO, which is equipped with 5nm ADAS chips, are accelerating their catch-up, continuously narrowing the technological gap with international giants.

As competition in the electric vehicle market intensifies, automakers are increasingly focusing on ADAS technology as a key factor for standing out in the market. ADAS is undergoing rapid evolution from basic functions to advanced features. From early “feet off” functions, such as adaptive cruise control and advanced emergency braking, to current lane centering, parking assistance, and intelligent driving navigation, and to the future potential of high-speed navigation assistance, ADAS is gradually enhancing driving safety and convenience.

However, achieving these advanced functions is not easy. It requires all major vehicle systems to have redundant designs, ensuring reliable operation under various conditions from sensors to power supply, steering, and braking systems. This architectural transformation marks a significant breakthrough in vehicle design at the structural level. As system complexity increases, the demand for sensors in vehicles is also growing, with the number of sensors such as radar, cameras, and LiDAR continuously rising, equipping vehicles with more “eyes” to perceive the surrounding environment more comprehensively and accurately.

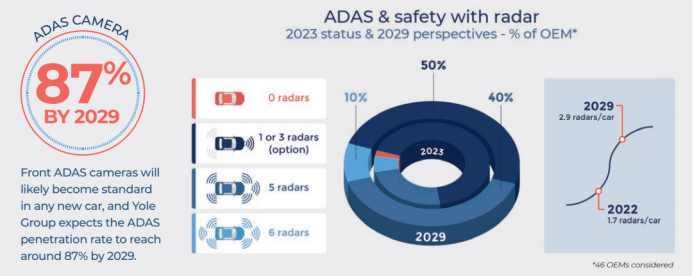

From market data, the trend of ADAS popularization is becoming increasingly evident. The adoption rate of ADAS cameras is leading in China and the United States. Yole Group predicts that by 2029, the penetration rate of ADAS will reach approximately 87%. Meanwhile, ADAS cameras are expected to become standard equipment for all new vehicles, with their resolution continuously improving from 1.2-2.4MP in 2021 to the current 5-8MP, and potentially further developing to 12MP by 2030 to meet the demand for recognizing objects at greater distances. Additionally, the increase in vehicle display sizes and the integration of panoramic cameras for observation and parking assistance functions are also driving the enhancement of observation camera resolution.

Radar technology is also developing rapidly, evolving from initially tracking only a few moving objects to now achieving high-resolution imaging with 4D radar, capable of tracking stationary targets and seeing all objects. Yole Group predicts that by 2029, each vehicle will be equipped with nearly three radars, up from 1.7 in 2022. The improvement in camera resolution and the upgrade of radar technology are jointly driving the evolution of ADAS and safe driving, enabling vehicles to detect smaller objects more accurately and providing a safer and more comfortable driving experience for drivers.

Figure: Outlook for ADAS and Radar in 2029

The rise of ADAS is not only a reflection of technological progress but also an inevitable trend in the future development of the automotive industry. As technology continues to mature and the market gradually popularizes, ADAS will bring unprecedented changes to our mobility.

03

Smart Sensing: The Path to Next-Generation Electric Vehicle Architecture Innovation

In the development process of next-generation electric vehicles, the significant increase in sensor complexity and quantity is triggering profound changes in automotive architecture, giving rise to diverse response strategies.

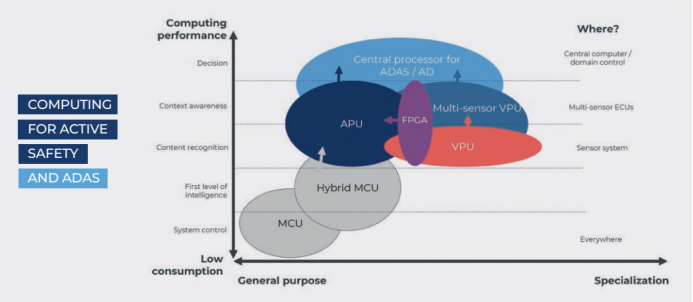

A multitude of sensors continuously deliver raw data to regional or domain controllers, which are then deeply integrated with other information in high-performance processors. This process places stringent demands on sensors, requiring them to deliver data accurately to ultra-high-performance processors capable of processing massive sensor data while controlling costs, size, and weight. However, while high-performance processor strategies can meet data processing needs, they inevitably drive up costs. In this regard, integrating MCUs with specific sensors presents an attractive alternative, enabling data calibration and preprocessing, which not only enhances safety but also significantly reduces the processing burden on domain controllers.

Figure: Active Safety Computing and ADAS

LiDAR stands out in this transformation. Currently, the average price of vehicles integrated with LiDAR is about $49,000, down $7,000 from 2023, mainly due to Chinese automakers integrating LiDAR into vehicles priced below $25,000. Looking ahead to 2030, LiDAR prices are expected to approach those of cameras and radars, but due to their unique 3D mapping capabilities, they will still maintain a certain premium.

Yole Group predicts that in the future, the LiDAR market will exhibit a bifurcated trend, with LiDAR for ADAS priced around $200, while LiDAR for high-performance no-eye systems will be priced between $400-500.

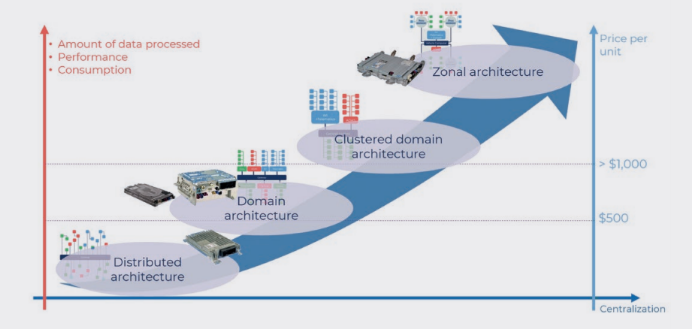

Vehicle architecture is undergoing a significant evolution from distributed to centralized intelligence. As ADAS functions become increasingly rich, manufacturers are concentrating ADAS electronic control units (ECUs) and processors, driving changes in automotive architecture. In traditional distributed designs, processing functions are embedded in various sensors; whereas in centralized architectures, sensor processing tasks are integrated, and domain controllers uniformly process data from multiple cameras, radars, and LiDARs, thereby enhancing the performance and cost-effectiveness of the domain architecture. In fact, many cameras today no longer integrate processing functions, and in the future, radars and LiDARs will gradually follow this trend.

Yole Group believes that the rise of software-defined vehicles (SDVs) has a profound impact on the semiconductor industry. The most advanced central platforms typically use two central processors to ensure redundancy, with the next phase focusing on integrating multiple domains into the same system. Automakers initially focused on combining ADAS with infotainment systems. Infotainment systems have installed more cameras in vehicles, such as rearview cameras and surround cameras, providing clearer environmental visualization for parking and other operations. The increase in the number of cameras has prompted cockpit architecture to move towards centralization, with functions integrated into a central controller. The trend in vehicles is to replace traditional small driver displays with large high-resolution displays, and some models even add rear-seat passenger displays, which raises the performance requirements for processors, needing to handle multiple applications such as video streams, social media, and music simultaneously.

Figure: The Impact of SDVs on Semiconductors

In this new architecture, one or several large central processors will manage most cockpit functions, achieving flexibility in information transmission and optimization of hardware resources, while also giving rise to new business models such as AI-assisted or entertainment services. For example, Leap Motor integrates two different circuit boards into one box, showcasing innovative practices in architectural integration. At the Consumer Electronics Show in Las Vegas earlier this year, several Tier 1 suppliers demonstrated SoCs that can combine ADAS and entertainment, with products expected to gradually be applied in vehicles over the next three to five years, and Chinese automakers are likely to take the lead in this field.

Yole Group warns that due to the high computational demands of ADAS, ADAS domain controllers tend to remain independent in E/E architectures requiring ADAS functions, while in vehicles with lower autonomy, they may merge with infotainment systems. Additionally, as the transition to more centralized E/E architectures progresses, vehicle power systems are also upgrading from 12/24V to 48V, which requires a series of analog devices, such as 48V to low-voltage DC/DC converters, 48V motor drivers, discrete power switches with output voltages of 48V, and more advanced E/E architecture electronic fuses (E-Fuses), providing strong support for the innovation of automotive electrical systems.

Over the past two decades, the automotive industry has been trapped in the dilemma of a surge in the number of independent ECUs, leading to increased CAN bus data traffic, rising control complexity, and increasingly prominent issues such as excessive costs, weight, space occupation, and energy consumption. To address this challenge, two major strategic paths have emerged in the past decade. The first is to migrate to CAN-FD, Ethernet, and wireless networks, significantly increasing bandwidth and data transmission rates while reducing weight and saving space. The second is to change and integrate data processing locations, consolidating them into higher-performance, more efficient processor and MCU clusters to reduce the number of ECUs.

Theoretically, the removal of ECUs may have a huge impact on revenue. However, in reality, network upgrades and performance improvements have been highly successful, giving rise to new functions such as ADAS and infotainment. While the number of ECUs has not decreased, they have evolved, and the value of MCUs that can integrate multiple functions is increasing day by day.

Today, new safety requirements, especially OTA updates and software-defined vehicles (SDVs), impose a new mission on MCUs to protect ECUs and networks. The reshaping of the vehicle intelligence distribution pattern and the demand for complex functions are leading to a continuous increase in the demand for processors, MCUs, and memory.

04

Connectivity: Unlocking New Opportunities in the Automotive Industry

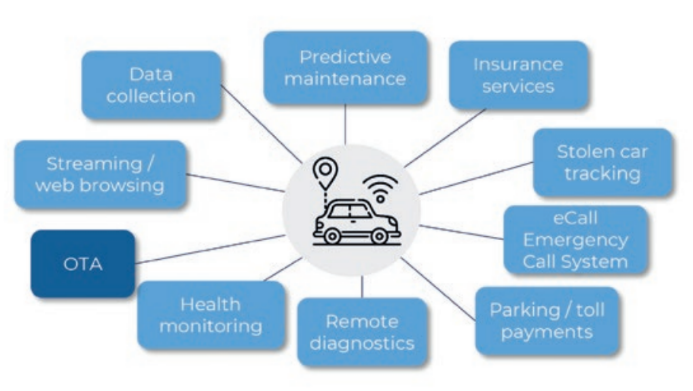

At this critical stage of transformation in the automotive industry, in-vehicle connectivity plays a crucial role. Automakers leverage the concept of software-defined vehicles (SDVs) to achieve remote upgrades of vehicles through OTA updates. This initiative not only opens up new recurring revenue streams for automakers, such as integrating streaming movies, online games, and other entertainment features, but also allows SDVs to continuously receive functional updates throughout their lifecycle, resulting in a depreciation rate that is significantly slower than that of hardware-defined vehicles.

In addition to providing new functions and services, automakers can also collect data from vehicles receiving OTA updates, thereby offering diagnostic services and achieving two-way interaction between vehicles and automakers.

In the realm of software-defined vehicles (SDVs) and electronic electrical architecture (E/E architecture), the frequency of updates has become an urgent question to be addressed. Smartphone manufacturers can provide up to seven years of update support for flagship models, while the average ownership time for smartphones in the U.S. is 2.8 years. In contrast, the automotive industry has yet to clearly define the update support window for the entire lifecycle of vehicles. Rivian has proposed seven years of software updates, which aligns with the smartphone market, but still falls short compared to the average 12.8 years of vehicle ownership in the U.S.

Figure: SDV and E/E Architecture: From Single ECU to Domain and Regional Controllers

Yole Group emphasizes that software-defined vehicles (SDVs) have a profound impact on the semiconductor industry, primarily involving processing, memory, and microcontroller devices. The transition to software-defined vehicles (SDVs) promotes the adoption of partitioned architectures, simplifying implementation processes. However, SDVs require 300-500 million lines of code, which places higher demands on memory capacity, necessitating faster read and write speeds for storage devices such as DRAM and NAND. In the face of the demand for more powerful and cheaper SoCs, automotive manufacturers are viewing chiplet technology as a potential solution.

Figure: Various Functions of Smart Vehicles

Finally, Yole Group states that innovations in sensors, processors, and power electronics technology are redefining vehicle safety and autonomy, while the development of electrification and ADAS is accelerating the demand for semiconductors. In the face of market upheaval and increasing pressure, keeping pace with technological changes is more critical than ever.

Original English Text | CHINA’S PIVOTAL ROLE IN AUTOMOTIVE SEMICONDUCTOR

Source | https://www.yolegroup.com/

Compiled by | Liu Hong