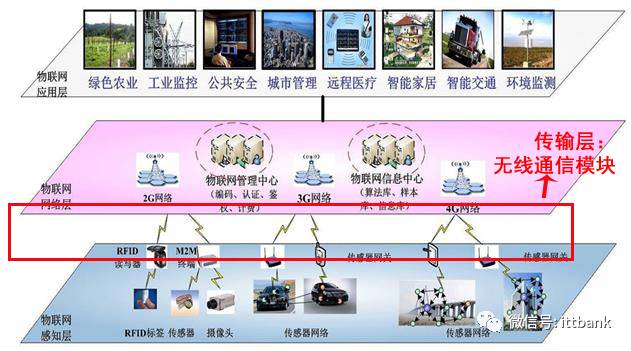

Wireless communication modules enable various terminal devices to have the capability of networked information transmission. They are a key link connecting the perception layer and the network layer of the Internet of Things (IoT). They belong to the lower-level hardware segment and possess irreplaceability.

There is a one-to-one correspondence between wireless communication modules and IoT terminals.

In M2M (Machine-to-Machine) application scenarios, wireless communication modules mainly refer to cellular modules (2G/3G/4G modules), LPWAN modules (Lora/NB-IOT modules), and positioning modules (GPS, GNSS modules).

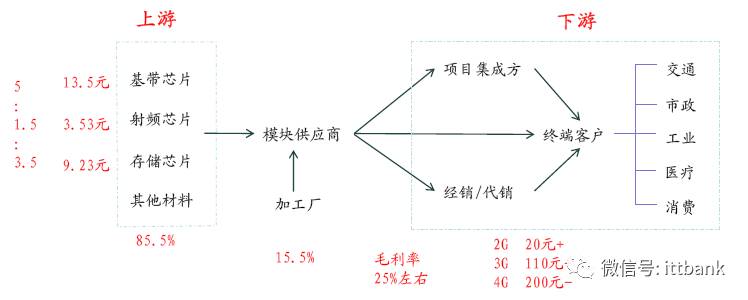

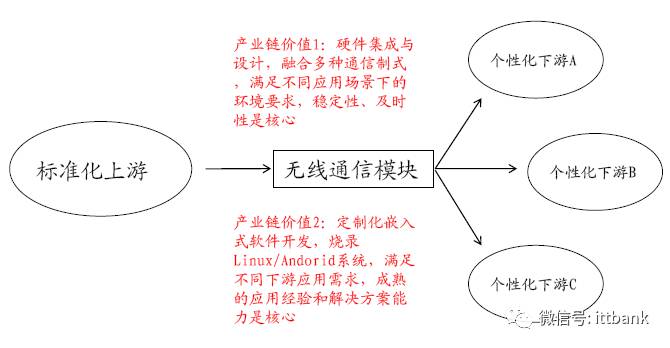

Wireless Communication Module Industry Chain

Upstream consists of production materials such as baseband chips, which have a high degree of standardization;

Downstream consists of various segmented application fields, which are extremely dispersed. Often, the communication intermediaries flow into various fields;

Module providers procure upstream materials, are responsible for design and sales, and outsource production to third-party processing plants.

Upstream

Baseband chips (communication chips) are core components, accounting for about 50% of material costs, with high technical barriers. Major suppliers include Qualcomm, Intel, MediaTek, RDA, Huawei, ZTE, etc., with high concentration and strong bargaining power.

Downstream

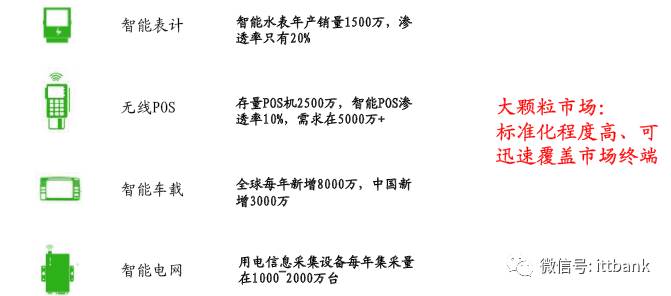

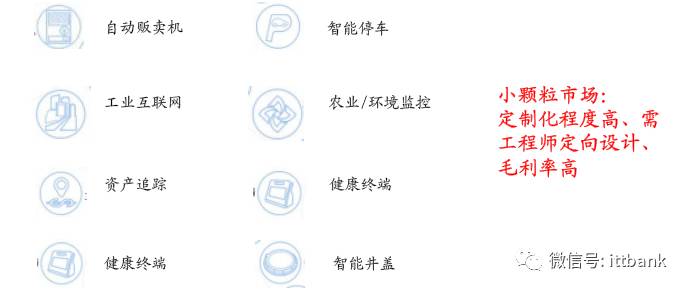

Applications are extremely widespread and dispersed. Based on the size of the application market, they can be divided into large particle markets and small particle markets. The large particle market has a high volume of IoT modules, a high degree of standardization, and intense competition, suitable for generating large revenues and establishing brands, with relatively fewer R&D personnel required, but strong market development capabilities; the small particle market has a low volume of IoT modules, a high degree of customization, high gross profit margins, but high R&D investment requirements for suppliers.

Large particle market:

Small particle market:

The IoT module segment itself is positioned as an intermediary between standardized upstream chips and the dispersed vertical fields downstream. Its hardware structure design and customized software development become the value-added segments, which is also where the value of the industry chain lies.

Industry Chain Value 1: Hardware integration and design, integrating multiple communication standards to meet environmental requirements in different application scenarios, with stability and timeliness as the core.

Industry Chain Value 2: Customized embedded software development, burning Linux/Android systems to meet different downstream application needs, with mature application experience and solution capabilities as the core.

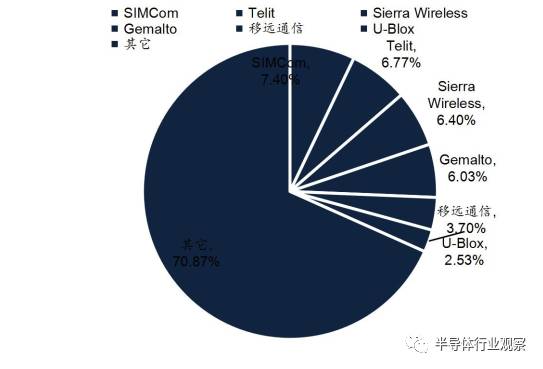

The wireless communication module market currently has a relatively low concentration, with the leading group of companies occupying about 30% of the global market share. With the rise of downstream applications and the expansion of the overall market size, a number of high-quality module suppliers focusing on specific vertical application fields are beginning to emerge. Overall, a competitive landscape is forming with the international and domestic first-tier companies leading, while the domestic second-tier companies gradually strengthen.

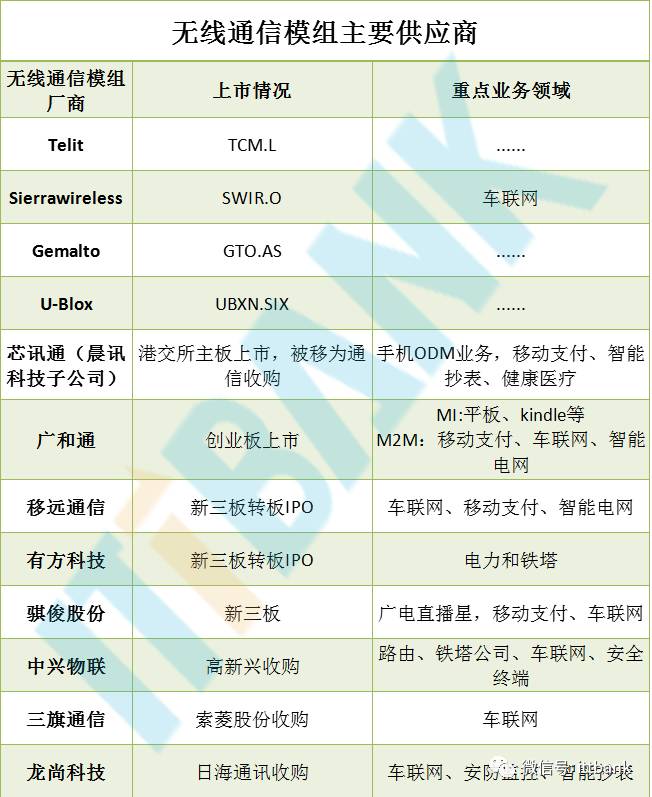

Major suppliers of wireless communication modules

Overall, a competitive landscape is forming with the international and domestic first-tier companies leading, while the domestic second-tier companies gradually strengthen.

Global module supplier market share in 2015 (by shipment volume)

1. Shanghai Quectel Communication Technology Co., Ltd.

Headquarters: Shanghai

Main business: Quectel Wireless Solutions is a global leading supplier of GSM/GPRS, UMTS/HSPA/(+), LTE, and GNSS modules.

Introduction: Quectel was established in 2010 and has grown rapidly, with its products achieving significant success in the domestic smart POS market, overseas automotive OEM market, and operator market. It has a leading position in the NB-IOT module field and was one of the early production partners for Huawei’s NB-IOT chips. Quectel was previously listed on the New Third Board and is currently planning to list on the A-share market, having submitted relevant materials to the Shanghai Regulatory Bureau.

Interestingly, the founders of Weichip, Liao Ronghua, and the founders of Quectel, Qian Penghe, both came from Simcom. Weichip and Quectel were originally one company (Weichip), but due to differences in business development directions, they became independent.

Website: http://www.quectel.com/

Weichip Communication

Headquarters: Shanghai

Introduction: Weichip Communication was established in 2009, primarily focusing on positioning modules, and went public in January 2017. The wireless communication module shipment volume of Simcom, the parent company, reached the global first position in 2015. If this acquisition is successful, Weichip Communication will become the largest IoT wireless communication company globally, solidifying its monopoly position in the IoT communication terminal field.

Website: http://www.queclink.com/

2. Gaoxin Technology (ZTE IoT)

Headquarters: Guangzhou

Introduction: Gaoxin Technology is a provider of IoT applications and services for smart cities. In 2016, it acquired ZTE’s wireless communication module subsidiary, ZTE IoT. ZTE IoT focuses on the enterprise market and has a strong foundation in automotive networking and satellite communication applications.

Website: http://www.gosuncn.com/

3. Simcom Wireless Technology (Shanghai) Co., Ltd.

Main business: A global leading supplier of M2M modules and solutions. It has been committed to providing modules or terminal-level solutions for various technical platforms such as GSM/GPRS/EDGE, WCDMA/HSPA/HSPA+, CDMA 1xRTT/EV-DO, FDD/TDD-LTE wireless cellular communication, as well as GPS/GLONASS/BEIDOU satellite positioning.

Introduction: Simcom is a subsidiary of the Hong Kong-listed company Simcom Technology. Its products have a significant market share in the smart POS, smart metering, and healthcare industries. Due to the traditional nature of Simcom’s wireless communication module business, it does not align with Simcom Technology’s current strategic direction towards high-margin service industries.

In January of this year, Simcom Technology planned to sell its wireless communication module assets (wholly-owned subsidiaries Shanghai Simcom and Simcom Wireless) for $52.5 million to Swiss u-blox. It is estimated that due to the disruption caused by Weichip Communication, this acquisition did not reach consensus, and Simcom Technology ultimately announced that Simcom would be sold to Weichip Communication and a company owned by internal directors’ sons, while also packaging another asset, Xintong Electronics, for sale.

According to the latest announcement from Weichip Communication, the Shenzhen Stock Exchange is still reviewing this transaction plan.

Website: http://www.simcomm2m.com/

4. Rihai Communication (Longshang Technology (Shanghai) Co., Ltd.)

Headquarters: Shenzhen

Introduction: Rihai Communication is the largest supplier of physical connection devices for communication networks in China. In September, Rihai acquired Longshang Technology, a leader in 4G wireless communication modules, and along with its previous investment in Aila IoT, achieved a layout of IoT cloud platform + modules. While providing cloud platforms for traditional enterprises, it can also directly package modules for integrated sales of products.

Website: http://www.sunseagroup.com/

5. Shenzhen Guanghetong Wireless Co., Ltd.

Headquarters: Shenzhen

Main business: The first listed (stock code: 300638) provider of wireless communication modules and solutions in China. Fibocom brand products comprehensively cover LTE, NB-IoT/eMTC, HSPA+, GSM/GPRS wireless communication modules and solutions, with major shareholders including the world’s largest personal computer parts and CPU manufacturer, Intel Corporation.

Introduction: Guanghetong was established in 1999 and is an established company. It initially provided OEM services for Motorola, but in 2008, Telit acquired Motorola’s mobile communications division, nullifying all contracts with Guanghetong. Subsequently, it transformed into its own brand, successfully entering the high-margin electronic consumer market for laptops, tablets, etc., after receiving investment from Intel. In April of this year, Guanghetong successfully went public.

Website: http://www.fibocom.com.cn/

6. Qijun Co., Ltd.

Headquarters: Xiamen

Introduction: Qijun Co., Ltd. was established in 2012 and obtained the qualification for producing live satellite set-top box positioning modules recognized by the State Administration of Radio, Film and Television in 2013. It has been applied by nearly thirty enterprises including Haier, Hisense, Changhong, TCL, and Konka, capturing a large share of the domestic set-top box positioning terminal market.

Website: http://www.cheerzing.com/

Future Trends

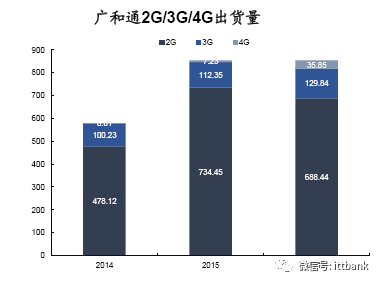

4G technology spilling into the M2M field, structural growth in market size

The penetration rate of 4G technology in mobile phones is already very high, but its application in the Internet of Things is still in the initial stage.

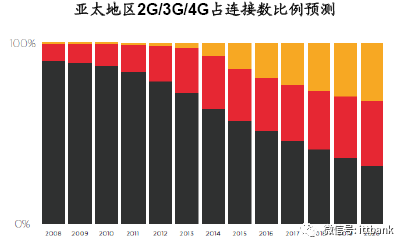

According to Ericsson’s statistical analysis, by the end of 2013, the global share of M2M solutions using 2G was about 64%, while those using 4G LTE accounted for only 1%. With technological upgrades and extensions, the proportion of 4G LTE will continue to grow, and it is expected that by 2019, M2M solutions using 4G LTE will become mainstream.

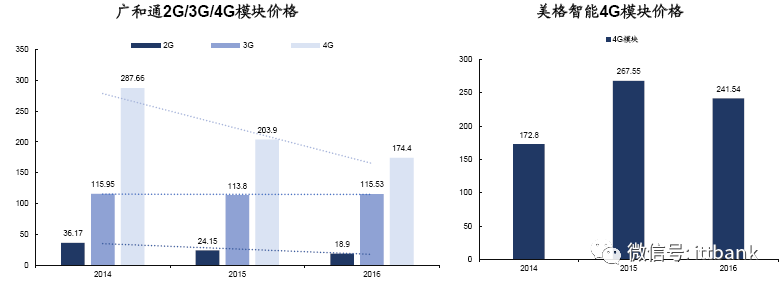

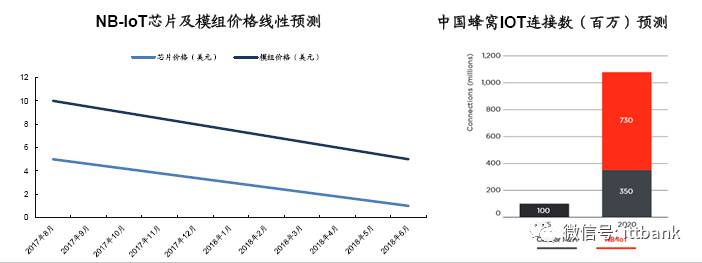

Regarding prices, there is a long-term downward trend, especially as 4G modules transition from testing to mass production, prices will drop rapidly, as shown in the left image.

However, with the increase in integration, including the integration of Android systems, WiFi and Bluetooth functions, and GNSS functions, the price of a single 4G module may further increase, as shown in the right image.

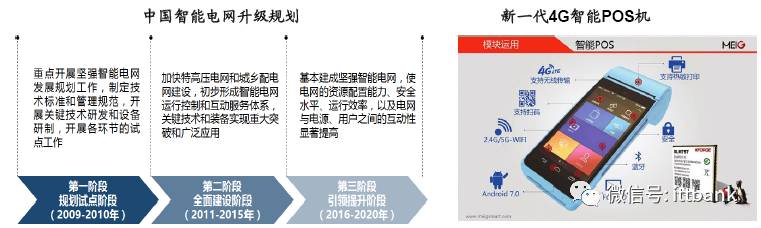

Policy promotion + market self-driven, comprehensively advancing the application of 4G technology in the M2M field.

In terms of policy, the state promotes the popularization of 4G technology in key areas, such as the smart grid field, where the upgrade of the strong smart grid raises new demands for the integrity, reliability, and timeliness of meter information collection, making the introduction of 4G wireless communication technology urgent. In terms of the market, the emergence of new applications demands 4G communication technology, such as the smart POS market, which requires the integration of 4G, Bluetooth modules, and Android systems to complete a series of innovative applications.

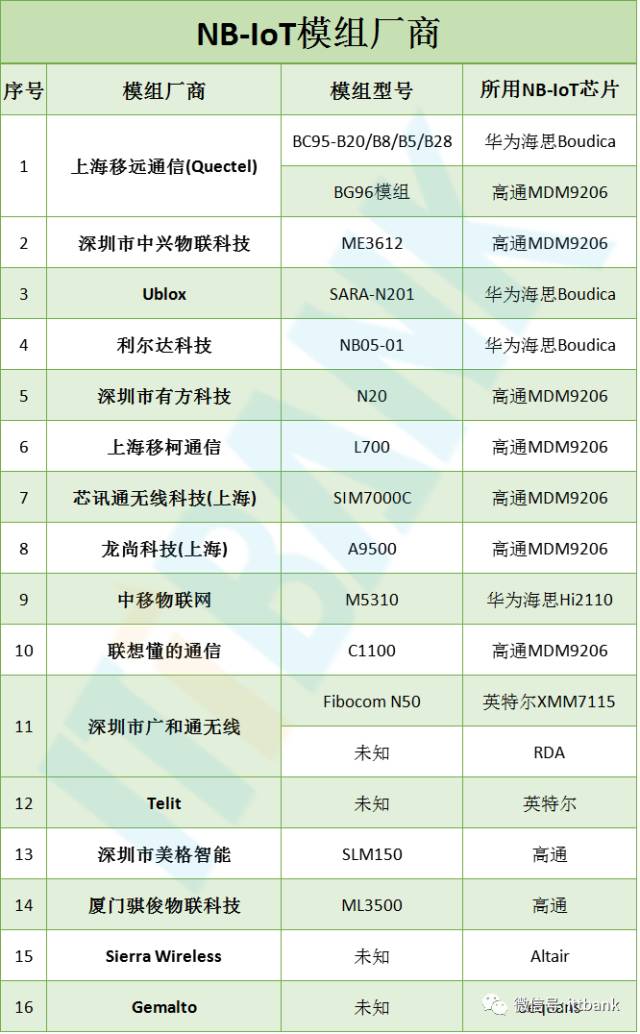

LPWAN module quantity is expected to increase significantly starting in 2018

LPWAN (Low Power Wide Area Network) modules represented by NB-IOT/eMTC are expected to achieve large-scale commercial use by 2018 as technology matures and costs decrease. At that time, shipment volumes will rapidly increase.

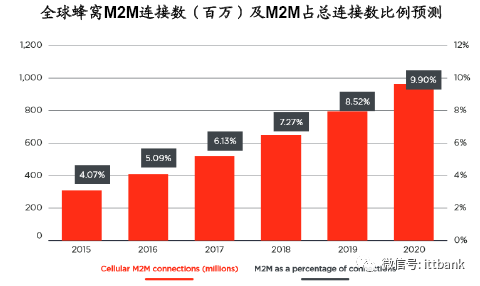

GSMA and CAICT jointly predict that China is currently the largest M2M market globally, with approximately 100 million cellular M2M connections, and by 2020, this number is expected to increase to 350 million; LPWA technology will provide an additional 730 million connections, bringing the total number of connections to over 1 billion. By 2025, it is expected that 50% of the 28 billion connected devices globally will be suitable for LPWA network connections.

The era of the Internet of Everything may begin in 2020

With the full explosion of downstream applications in the Internet of Things, by 2020, the number of connected devices globally is expected to reach the tens of billions, marking the official arrival of the era of the Internet of Everything.

According to GSMA, by 2020, the number of global cellular IoT connections is expected to reach around 1 billion, accounting for about 10% of global connections, with a compound growth rate of 26%. China’s M2M connections will reach around 1 billion, accounting for about 10% of the global total.

The current wireless communication module market is in its early development stage, with many brands and low market concentration. In the long run, module suppliers will become increasingly brand-loyal like mobile phone suppliers, leading to a continuous increase in industry concentration, ultimately resulting in only the first-tier suppliers surviving, with only a few leading companies becoming increasingly profitable, forming a “winner takes all” situation.

Source: ITTBANK Network Compilation

Welcome to join the ITTBANK QQ group

Note: One person is limited to joining one group (each person can only join one group, if multiple groups are joined and are rejected, please understand!)

1. Mobile industry technology exchange group 3 (134917677)

2. Tablet technology exchange group (378173769)

3. Set-top box OTT box exchange group (361764225)

4. Capacitive touch technology exchange group 2 (257209943)

5. Camera technology exchange group (377648136)

6. LCD screen technology exchange group 2 (249572580)

7. Wireless WIFI technology exchange group 2 (416431905)

8. Security technology exchange group (308535073)

9. Memory storage exchange group (204191613)

10. Mobile phones, MID, capacitive touch, LCD screen trading group (374763457) —- exclusive sales and procurement group

11. Cross-border e-commerce exchange (384299409)

12. Global maker space (188561451)

13. Dashcam (294132591) — the most professional dashcam evaluation group

14. Global electronic technology exchange platform (370733047) —- (this group is purely a technical exchange group, exclusive for technical engineers, traders are not allowed! Thank you! When joining the group, please add a standard note, region + industry + nickname, for example, Shenzhen – Bluetooth WiFi solution – Engineer Xie!)

15. Welcome to join the AR/VR technology exchange group (527375006)

16. Welcome to join QQ group (199699487) — Amlogic S802/S805/S812 and other solution platform network players

Submission email: [email protected]

ITTBANK customer service hotline:

400-0933-666

Click “Read the original text” to enter the ITTBANK micro mall