Author: Zhao Xiaofei

IoT Think Tank Original

Please indicate the source and origin when reprinting

Introduction

In scenarios requiring public networks, NB-IoT and LoRa have strong complementary characteristics. However, in projects that require industry or enterprise-level private networks, NB-IoT private network solutions have a clear substitute relationship with other technologies such as LoRa, Weightless, and ZETA.

Recently, during the “Tianyi Eco-Expo”, Yang Jie, chairman of China Telecom, revealed that 400,000 NB-IoT base stations have been built, achieving full coverage in urban and rural areas. Coupled with the previous 300,000 base stations commercialized by China Unicom and the ongoing NB-IoT construction by China Mobile nationwide, it is no longer in doubt that NB-IoT has become the only choice for operator-level low-rate IoT large networks. In the future, a medium-rate eMTC network may be introduced at an appropriate time. However, the rich scenarios of IoT create a strong demand for industry-level and enterprise-level private networks outside of large networks. In the near future, the development speed of IoT private networks may outpace that of public networks.

Clear Demand, Readily Available Resources

In the traditional phase of person-to-person communication, in addition to the voice and data services provided by the three major operators’ 2G/3G/4G public networks, many key industries also have private networks built and operated independently, such as railways, electric power, civil aviation, and public security. Due to the particularity of these industries, there are special communication service needs during operation, especially for high reliability and security, which has given rise to the industry cluster private network format and spawned many enterprises providing industry private network services.

The IoT network faces various physical devices, and in many industries, the need for specialized attributes of connected devices is very obvious. Therefore, similar to the demand for cluster private networks, these industries also require IoT private networks to ensure the efficiency, safety, and reliability of various production and operational processes.

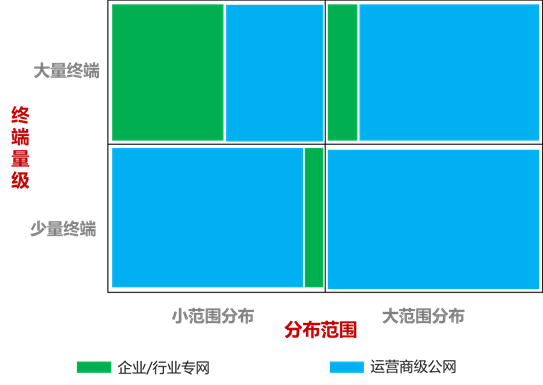

Regarding the demand for public and private networks, the author has listed the final formed business formats as shown in the figure below based on the scale and distribution of user terminals.

As can be seen from the figure above, when users have only a very small number of terminals, if these terminals are widely distributed, the significance of building a private network is small. However, when these terminals are more concentrated, depending on the user’s trade-off between network autonomy and cost, a small number of self-built private networks may be established. When users have a large number of terminals, if these terminals are widely distributed, a small number of users may also consider self-building private networks based on controllability, but most private networks are still concentrated in scenarios where users have a large number of terminals, and these terminals are relatively concentrated.

For the electric power industry, it may be more located in the “large number of terminals, large range distribution” quadrant, but the specificity of electric power makes the demand for building private networks even stronger. For urban subway companies, airports, and other scenarios, it may be more located in the “large number of terminals, small range distribution” quadrant, where the cost-effectiveness of building private networks is higher.

In recent years, broadband cluster private networks have been applied in various key industries, and some broadband cluster private networks are also used for the connection of things in these industries. However, narrowband private networks specifically for IoT have not yet landed. In the past few years, the development of NB-IoT, LoRa, and other low-power wide-area networks has provided many choices for industry private networks. In fact, many industries have very clear demands for IoT and possess many resources for operating private networks.

(1) Basic Resources Required for IoT Private Networks

Due to historical reasons and the characteristics of the industry itself, many vertical industry enterprises possess certain basic resources, which greatly lower the threshold for building IoT private networks. Among these, spectrum resources and site resources are key, as they have proprietary spectrum resources and facilities available for base station deployment in their business deployment areas, forming readily available sites. For example, the electric power industry has proprietary 230MHz spectrum, and all its transmission and distribution towers can serve as sites for base station deployment. Recently, China Tower and the State Grid signed an agreement to fully utilize electric power tower resources as a supplement to communication towers.

(2) Experience in Network Operations

For those industry users who have operated private networks, they have rich experience in network operations. Many industries have established dedicated private network operation companies or teams. Thus, when building a network specifically for IoT, they can reuse their previous private network operation teams and experience to accelerate the landing of their IoT projects.

(3) Scale Effect

Many potential users of industry private networks possess a large number of terminals. After these terminals are connected, they form a scaled IoT connection. For example, the electricity information collection business faces millions of metering terminals in each city. The scale effect ensures that the usage rate of self-built IoT private networks is high, and the number of connections will be much higher than that of traditional cluster private networks.

(4) Demand for Dedicated Management

Due to the particularity of the industry, many enterprises have clear demands for autonomous and controllable private networks, which makes the construction of previous cluster private networks very necessary. Many IoT solutions introduced by these industries are directly applied to their core production and operational processes, which raises the demand for autonomy and control, further enhancing the demand for IoT private networks.

Various Technologies Competing in the IoT Private Network Market

This article mentioned at the beginning that NB-IoT has become the only choice for public networks in IoT. However, a unified pattern has not yet formed in the private network market. Regarding industry-level and enterprise-level IoT private networks, the optional technologies are richer. In addition to the currently fastest developing LoRa, NB-IoT private network solutions have also entered the market. Although technologies like Weightless and ZETA have small industrial ecosystems, they have also found their place in some vertical fields.

In the past three years, LoRa has developed very rapidly in China, but most of the landed LoRa projects are more in the form of industry and enterprise private networks. Although many of these projects do not have a strong demand for autonomous and controllable networks, most of them could have been satisfied by using NB-IoT. Initially, either due to insufficient coverage of the NB-IoT network or because the relative cost of NB-IoT was too high, they chose the LoRa solution, and LoRa suppliers also provided end-to-end communication solution delivery.

In some smart city and smart park projects, there is often a third-party operator that builds and operates the LoRa network, providing network services to relevant application parties in the city and park. However, this form is still more like a “quasi-private network” built and operated by the operator for the covered industry applications.

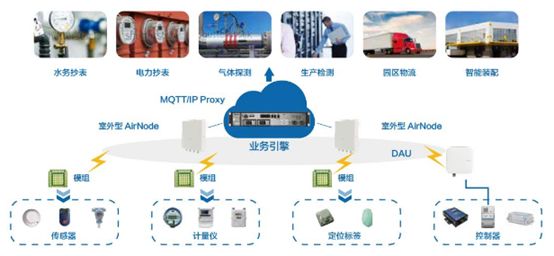

For NB-IoT, in addition to the deployment by the three major operators, there are also NB-IoT solutions for industry-level and enterprise-level private network forms. As early as June 2016, Huawei launched the eLTE-IoT private network solution based on NB-IoT, which the Huawei Enterprise Network BG described as follows:

The eLTE-IoT solution is designed for the unlicensed IoT market built by enterprises, providing low-power, medium-to-long-range IoT wireless technology based on Sub-GHz unlicensed spectrum. For typical M2M application scenarios requiring low data rates, a large number of terminal connections, and wide coverage, eLTE-IoT can open up vast IoT markets for government and enterprise customers, such as smart cities, electric power, and gas/water companies. The eLTE-IoT chip will fully reuse the 3GPP NB-IoT chip, and similar to LTE technology on unlicensed spectrum, participants in the eLTE-IoT industrial chain are also players in the 3GPP NB-IoT.

It can be seen that the NB-IoT private network solution has long been in development. With the maturation of the NB-IoT industrial chain, the private network industrial chain is also ready. Previously, the Mexican power company adopted the eLTE-IoT solution to deploy an electric power IoT private network on the ISM band for electricity information collection applications. In September last year, the State Grid Tianjin Electric Power Company piloted an NB-IoT private network on 470M, and the State Grid has revealed its hope to introduce NB-IoT private networks in the 230MHz band. The narrowband and broadband private networks of NB-IoT can complement each other, covering most of the wireless communication scenarios required by users.

The electric power industry is a relatively closed field with a demand for IoT private networks. It possesses a large number of metering devices and asset equipment, making it a potential large-scale IoT market. Facing such a large-scale market, NB-IoT can be customized from chips, modules to final network deployment, such as specially developing chips and base station equipment that support 230M. If such projects can be landed, it may form a private network with hundreds of millions of connections within a few years, which would greatly promote the NB-IoT industrial chain, comparable to the extensive deployment of operator networks. Of course, if such models are formed and are replicable, they will have a certain impact on the NB-IoT public network of operators. However, compared to public networks, private networks have higher costs, so NB-IoT private networks are more applied in industries where cost sensitivity is not high.

At the “IoT Communication and Sensor Fusion Innovation Forum” held on Monday, two domestic enterprises focusing on Weightless and ZETA technologies introduced their development status. Weightless and ZETA are also low-power wide-area network technologies specifically for IoT. Weightless currently has cooperation intentions and some project tests in domestic water, gas, and other public utility industries, providing dedicated private network services for these fields; ZETA has been launched in China for several years and is currently providing private network services in vertical fields such as lighting and building energy conservation, and recently achieved technology output in Japan.

In addition to LoRa, NB-IoT, Weightless, and ZETA, there are currently other technologies providing similar private network services in some vertical industries. Due to the heterogeneity of demands across industries, there is no requirement for a unified technical standard, so these technologies all have their stage to perform and have positive competitive relationships.

Since low-power wide-area networks entered the public eye, the debate over the competition between NB-IoT and LoRa has always existed. In fact, in some projects that adopt the NB-IoT public network, the two are more complementary. In many existing applications, due to insufficient coverage of NB-IoT or in scenarios at the network edge, leveraging the flexibility and low-cost advantages of LoRa has allowed projects to succeed.

However, in projects requiring industry or enterprise-level private networks, the NB-IoT private network solution has a clear substitute relationship with other technologies such as LoRa, Weightless, and ZETA. Although the current cost of NB-IoT private network solutions is relatively high, as the overall industrial chain of NB-IoT matures, its cost will decrease rapidly. We can envision a scenario where, in due course, when many enterprises participate in the NB-IoT private network industrial chain, a large number of manufacturers may provide modules, equipment, simplified core networks, and network operation platforms, and the NB-IoT solution may also be flexibly deployed on unlicensed spectrum like LoRa. Ultimately, private network users will evaluate it from multiple dimensions to choose suitable solutions.

Although private networks have a fragmented characteristic, their targeted and customized nature allows industry users to land faster. In a short time, low-power wide-area network (LPWAN) private networks may give rise to more IoT application cases while providing references for public networks. In the future, most low-rate IoT terminals will connect through NB-IoT public networks, and this market scale will certainly be larger than that of private networks. However, private networks are easier to form rich landing use cases in the short term.

Previous Hot Articles (Click the title to read directly):

-

“How Difficult Is It to Make Smart Locks for Shared Bicycles?”

-

“Cognitive Computing, Blockchain IoT, IoT Security… Those Who Understand Will Control the Future”

-

“[Heavy Release] 2017-2018 China IoT Industry Panorama Report – The IoT’s Deep Transformation of the Industry Has Begun”

-

“[Heavy] The IoT Industry Panorama Report, Leading the Domestic IoT Industry’s Two-Dimensional Perspective Panorama”

-

“A Cartoon Explains: What Can the Recently Popular NB-IoT Do Besides WiFi and Bluetooth?”

-

“A Cartoon Explains: What Is LoRa, Which Is Also Being Talked About Alongside NB-IoT?”