1. Zhao Haijun of SMIC: Wafer foundry demand is returning to local markets, with full capacity utilization in Q1;

2. From “Service Provider” to “Co-builder”: Advantest’s 30 Years of Mutual Empowerment with China’s Semiconductor Industry;

3. Industry Observation: The return of Zeekr’s US-listed stocks points the way for domestic chip listings;

4. Trump’s tariffs hit US companies hard: Nvidia, AMD, Apple, GM, and others will lose billions;

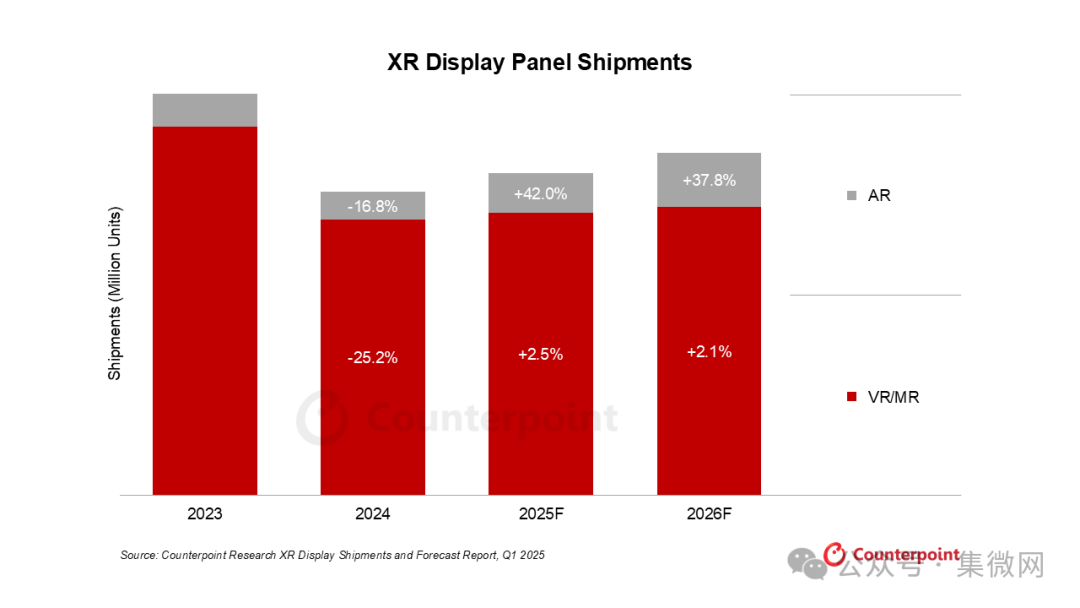

5. Institutions: Global XR display shipments are expected to grow by 6% in 2025;

6. DSP chip manufacturer Chuangcheng Microelectronics enters bankruptcy liquidation; creditors must file claims in a timely manner;

7. Semiconductor tariffs strike hard: Is US tech hegemony “tying itself up” again?

8. The 18A process attracts attention; Intel and Microsoft are reportedly discussing foundry contracts;

1. Zhao Haijun of SMIC: Wafer foundry demand is returning to local markets, with full capacity utilization in Q1;

On the morning of May 9, SMIC held a performance briefing for its Q1 financial report. Zhao Haijun, co-CEO of SMIC, stated that the company has seen positive signals of recovery across various industries, including industrial and automotive sectors, with a continued strengthening of local supply chain transformation and more wafer foundry demand returning to local markets. After the introduction of tariff policies, SMIC conducted internal assessments and engaged in in-depth discussions with suppliers and domestic and international customers, with the government also closely communicating with the industry. The conclusion is that the actual direct impact on the industry is very small, “less than one percent.”

More demand returning to local markets, capacity utilization improving

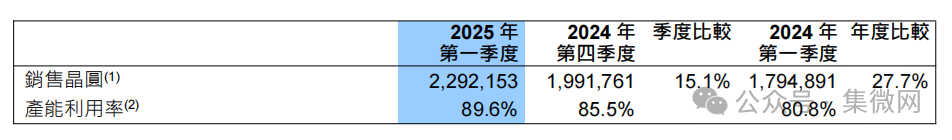

SMIC’s Q1 performance report shows that the company’s quarterly sales revenue reached $2.247 billion, an increase of 1.8% compared to the previous quarter, with a gross margin of 22.5%, remaining stable compared to the previous quarter, and capacity utilization reaching 89.6%, an increase of 4.1 percentage points quarter-on-quarter.

From a business composition perspective, wafer manufacturing continues to dominate, contributing 95% of revenue, while supporting service revenue remains stable at 5%. Among them, wafer business revenue increased by 5% quarter-on-quarter, with 8-inch wafers performing particularly well, showing an 18% quarter-on-quarter revenue increase, while 12-inch wafers achieved a moderate growth of 2%.

Wafer revenue by region shows that China, the US, and Eurasia account for 84%, 13%, and 3% respectively, with stable revenue in China and an increase in revenue from overseas customers quarter-on-quarter.

In terms of application classification, revenue from smartphones, computers and tablets, consumer electronics, and connected and wearable devices remains relatively stable, accounting for 24%, 17%, 41%, and 8% respectively. Revenue from industrial and automotive sectors increased by over 20% quarter-on-quarter, rising from 8% to 10%.

In platform business, SMIC is actively promoting process iteration and product upgrades. Demand for BCD, MCU, and special storage is strong, with revenue increasing by about 20% quarter-on-quarter; in the high-voltage display driver HVCMOS field, the 40nm and 28nm AMOLED small-screen display driver platforms are in short supply due to limited capacity, and high-value-added 40nm HV-RRAM display driver chips have been mass-produced; the company is increasing its technical deployment and capacity construction for image sensors (CIS) and image signal processors (ISP) to secure more orders.

Zhao Haijun believes that the recovery in market demand is mainly due to multiple overlapping factors. Changes in international geopolitical dynamics are prompting customers to accelerate their shipping pace, while domestic “trade-in” policies and consumer subsidy measures have effectively boosted demand for bulk electronic products, and the industrial and automotive sectors have entered a replenishment cycle after inventory adjustments.

In terms of capacity release, SMIC’s wafer shipments reached 2.29 million pieces (equivalent to 8-inch), achieving a 15% quarter-on-quarter increase.

Regarding production fluctuations caused by production line adjustments, which led to a decline in the average selling price (ASP) of products in the later part of Q1, Zhao Haijun stated that after the performance meeting held in February this year, on one hand, due to unexpected situations during the annual maintenance of the company’s facilities, the precision and yield of products were affected; on the other hand, the company introduced a significant amount of new equipment in Q1, and during the equipment validation process, it was found that the performance and process of the equipment needed improvement, leading to fluctuations in product yield. These impacts are expected to continue for the next four to five months, and the company’s management is actively optimizing production line operational efficiency to address the challenges of price fluctuations in the current market environment.

Facing downward price pressure, actively implementing cost reduction and efficiency enhancement measures

At the same time, SMIC announced its Q2 performance guidance, expecting sales revenue to decline by 4% – 6% quarter-on-quarter, with gross margins in the range of 18% – 20%, and shipments to remain relatively stable, although the average selling price is expected to decrease.

Regarding the Q2 performance guidance, Zhao Haijun explained that the company is actively taking cost reduction and efficiency enhancement measures to buffer the impact of price fluctuations. However, due to the continuous increase in equipment depreciation in Q2, the gross margin expectation is lower than that of Q1.

Previously, the market had high hopes for the growth prospects of consumer electronics such as smartphones and computers, expecting significant growth. However, according to SMIC’s observations and analysis in May this year, the actual situation in the smartphone market deviates significantly from expectations. The originally estimated total shipment data for smartphones has been revised, and due to factors such as lower-than-expected market demand, it is likely that customer stocking targets will be adjusted downward in Q3.

In the personal computer sector, while product sales remain stable, there has not been the significant growth that the market previously anticipated. From the perspective of the downstream supply chain’s stocking situation, PC manufacturers have completed necessary inventory reserves at this stage, and there will not be large-scale new order demand in the short term.

In the face of such a market environment, Zhao Haijun clearly stated that the company will help customers reduce production costs and enhance their product competitiveness in the market through optimizing production processes and improving operational efficiency, but SMIC will not adopt a proactive price reduction strategy to compete for a larger market share.

2. From “Service Provider” to “Co-builder”: Advantest’s 30 Years of Mutual Empowerment with China’s Semiconductor Industry;

With the intensive deployment of 5G base stations, satellite direct connection to mobile phones has become a reality; the “Hundred Models War” is driving a surge in demand for high-performance chips; the rapid advancement of new energy vehicles has made the reliability of automotive chips a core concern for millions of drivers; advanced packaging continues to “rewrite” Moore’s Law, with Chiplet becoming a common choice in the era of computing power—amid this global “chip” wave, an invisible battlefield is being pushed to the forefront: chip testing. Testing equipment throughput has doubled, millimeter-wave frequency bands have broken through 70GHz, automotive-grade chip fault tolerance is approaching “zero defects”, and Chiplet has given rise to new die-level testing demands such as Known Good Die (KGD) and Partial Assembly—every frame of industrial upgrading is forcing the innovation of testing technology.

2025 marks the 30th anniversary of semiconductor testing giant Advantest’s entry into the Chinese market. This 30-year development journey resembles a history of collaboration that resonates with the local industry, always centered on technological innovation and localized services, deeply integrating into the development wave of China’s semiconductor industry.

In the context of the semiconductor industry moving towards the “post-Moore era”, Advantest (China) Deputy General Manager Li Jintie stated in an exclusive interview with Jiemicro Network at SEMICON China 2025: “The increase in chip integration and functional complexity has raised higher requirements for the precision, speed, and scalability of testing equipment. We always focus on providing customers with testing solutions that cover the entire lifecycle, helping them cope with the challenges brought by technological iterations.”

Image: Li Jintie, Deputy General Manager of Advantest (China)

Emerging RF technologies are continuously emerging, and chip testing is facing challenges of high frequency and large bandwidth

With the large-scale deployment of 5G, Wi-Fi 6E/7, satellite communication, and the Internet of Things, the performance and functionality of RF chips are continuously improving. Li Jintie pointed out that future RF chips are moving towards higher frequencies, larger bandwidths, higher integration, and more ports, which makes RF chip testing face more complex challenges.

With deep technical accumulation and continuous R&D investment, Advantest has launched a series of innovative solutions. Its full range of RF boards covers low frequencies from 10MHz to 72GHz millimeter-wave bands, meeting testing needs in different application scenarios, achieving comprehensive RF performance evaluation with high performance, high integration, scalability, and large-scale parallel capabilities, significantly improving testing efficiency and reducing overall testing costs.

In the Chinese market, many emerging standards have emerged in the communication technology field in recent years, posing unique requirements for RF testing in terms of multi-scenario compatibility and cost efficiency. Li Jintie emphasized that Advantest has customized development to meet local customer needs, addressing many unique pain points in the Chinese market. In terms of technology, Advantest has developed customized signal demodulation libraries for Star Flash, 5G RedCap, satellites, and has officially joined the Star Flash Alliance, quickly launching corresponding signal demodulation solutions. In terms of cost optimization, Advantest has helped customers quickly launch a 16-site mass production solution for Bluetooth and Wi-Fi chips through innovative testing solutions, effectively reducing testing costs.

“In the face of the popularization of RF technologies such as WiFi 7 and UWB, testing equipment must also be laid out in advance to ensure that testing solutions keep pace with industry needs,” Li Jintie emphasized. “Our product update cycle is usually two to three years, and we will reserve a certain margin to cover technological needs for the next five years, fully responding to technological iterations over the next decade. RF testing is not only about technological competition but also about balancing efficiency and cost. In the future, Advantest will continue to focus on the Chinese market, deepening cooperation with local customers to better adapt to the continuously changing market demands.”

Chinese automotive companies are accelerating the transformation of “chips defining cars”, with testing safeguarding the “zero defects” of new energy vehicles

Under the trend of intelligence, China’s new energy vehicle industry is transforming from traditional mechanical manufacturing to “chips defining cars”, where the performance, reliability, and safety of automotive chips have become one of the core competitive advantages for automotive companies, driving testing to evolve from functional verification to quality assurance throughout the entire lifecycle. Advantest’s close cooperation with the industry chain has formed a complete ecosystem, accumulating rich experience in automotive testing. Li Jintie believes that testing for automotive chips must form a closed loop from R&D to mass production to ensure compliance with automotive-grade standards.

He pointed out that Advantest has built a “testing ecosystem community” with local automotive companies, chip design companies, and tier-one suppliers, covering the complete chain from R&D verification to mass production optimization, ensuring the “zero defects” goal for these automotive chips: providing a high-performance testing environment in the early stages of R&D to shorten cycles; conducting comprehensive assessments of chip performance through engineering validation after manufacturing, providing feedback for process improvements; monitoring quality in real-time during mass production to ensure zero faults; and optimizing testing strategies based on user feedback after market launch, forming closed-loop management to ensure the highest quality standards for chips.

Specifically, Advantest’s testing platform can cover testing for various automotive SoC chips, especially for the more intelligent vehicle requirements in new energy vehicles, such as intelligent cockpit, autonomous driving ADAS, domain control MCU, communication Tbox RF, in-vehicle Ethernet Serdes, battery management BMS chips, etc.

Li Jintie highlighted Advantest’s V93000 BMS solution and T2000 testing platform, which have become core supports for the “zero defects” strategy of new energy vehicles. As the “safety hub” of new energy vehicles, BMS chips need to monitor key parameters such as voltage, current, and temperature of the battery system in real-time, accurately measuring and evaluating the battery system to ensure safety and reliability. Advantest’s V93000 BMS solution uses AVI64 boards with ultra-high precision testing capabilities and FVI16 boards covering future BMS product testing needs of 200V, combined with a powerful integrated software development environment, effectively improving testing development efficiency and accuracy, enabling customers to quickly develop and deploy testing programs, optimizing testing costs.

For testing needs of intelligent cockpit display chips and autonomous driving camera sensor chips, the T6391 display driver chip testing platform and T2000 CIS camera sensor testing platform can provide higher testing coverage, precision, and reliability, making them the preferred platforms for testing such chips in automotive-grade applications.

As Chinese automotive companies globalize, pushing automotive chip testing standards towards “global compliance”, high-reliability hardware and professional software solutions are required to ensure accurate and dynamically optimized testing data. Li Jintie pointed out that in the “chips defining cars” era, the speed of innovation in testing technology directly determines the efficiency of the industry chain. Advantest has transformed into an ecosystem co-builder, continuously injecting zero-defect assurance into chips through ongoing technological innovation.

Industry “evergreen” V93000 series: a continuously evolving testing flagship platform

With the continuous evolution of semiconductor processes and the maturation of advanced packaging technologies, testing for more complex chips, including high-performance computing chips, faces unprecedented challenges. Li Jintie pointed out that the testing demands for high-performance chips have evolved from traditional functional verification to multidimensional aspects such as high power management, DFT (Design for Testability) technology iteration, and 2.5D/3D advanced packaging testing.

First, high-performance chips bring challenges of high power current and hardware protection. Advantest’s power boards have multiple functions to effectively prevent and monitor current fluctuations and energy accumulation during high-power chip testing, quickly providing warnings and protective measures. Secondly, DFT technology iteration has given rise to the demand for high-speed Scan testing. Advantest’s V93000 solution can be equipped with high-speed digital boards, optimizing through hardware and algorithm collaboration, not only meeting the testing demands of high-performance chips but also significantly reducing the testing costs per chip through parallel testing strategies. Finally, the popularity of 2.5D/3D advanced packaging technologies has given rise to die-level testing demands such as KGD and partial assembly, making traditional packaging testing unable to meet the complexity of heterogeneous integrated chips, necessitating that the testing process be advanced to the die-level stage. The V93000 solution achieves automated testing under precise temperature control by configuring die-level handlers and ATC (Active Thermal Control) technology.

It is evident that as an evergreen in the semiconductor testing field, the V93000 series continues to occupy a leading position after decades of market validation, and it continues to thrive by continuously adding functions, such as launching a series of new products on the latest EXAScale platform to meet different needs in high-performance digital, RF, power analog, and high-speed testing fields. Li Jintie stated: “The core advantage of V93000 lies in its single scalable concept, which allows packaging and testing factories to maintain efficient utilization of investments over the long term.”

“We will continue to promote the concepts of modularity and scalability, expanding in both cost and performance directions, providing the industry with more flexible and forward-looking solutions,” Li Jintie emphasized. At the same time, Advantest is actively laying out new fields such as silicon photonics and chip verification, integrating the latest technologies into products to create greater value for customers.

30 Years of Localization: From Service Provider to Industry Co-builder

2025 marks the 30th anniversary of Advantest’s entry into the Chinese market, witnessing the rise of China’s semiconductor industry and completing the transformation from “service provider” to “co-builder”. Li Jintie summarizes this 30 years of localization practice as a trinity of “employees, products, and services”: over 90% local talent; developing localized products based on leading global strategic vision to meet the needs of the Chinese market; and localized services covering core areas of China’s semiconductor industry, truly achieving “wherever the customer is, Advantest is there.”

Meanwhile, Advantest has actively engaged in various levels of cooperation and exchanges with multiple integrated circuit centers (ICCs) and educational institutions over the years, promoting the ecological construction of testing talent, fulfilling its commitment to give back to the industry chain and society, and practicing “localization”.

Under the carbon neutrality goal, Advantest is also promoting sustainable development in the industry through technological innovation. Its testing equipment integration level is increasing year by year, allowing customers to cover multiple types of chip testing with a single machine, reducing energy consumption and space occupation; factory operations also practice energy conservation and emission reduction, having been rated AA by MSCI ESG for five consecutive years (the highest in the industry is AAA).

“Semiconductor testing is not only a technical issue but also a social responsibility,” Li Jintie emphasized. “We are committed to helping customers achieve green transformation with efficient and low-consumption solutions.”

Looking ahead, Advantest will continue to empower the Chinese semiconductor ecosystem through multi-field layouts from RF to automotive electronics, and by focusing on key investments in emerging fields such as high-performance computing, helping to enhance the global competitiveness of Chinese chip design and manufacturing. As Li Jintie emphasized at the end: “We believe that advancements in testing technology will inject reliable vitality into every chip, and this is Advantest’s mission and commitment in China for thirty years.”

3. Industry Observation: The return of Zeekr’s US-listed stocks points the way for domestic chip listings;

In May last year, Zeekr landed on the New York Stock Exchange, with a market value approaching $7 billion, becoming one of the few successful Chinese new energy vehicle companies to go public in the US that year. However, just a year later, with Geely Auto recently announcing its plan to acquire all issued shares of Zeekr, Zeekr has once again initiated the privatization process. This reflects the current trend of returning Chinese concept stocks against the backdrop of increasing international geopolitical influences. Although there are currently no Chinese chip companies listed in the US stock market, IPO listings remain a necessary path for the development and growth of domestic chips. It can be anticipated that the return of Chinese concept stocks, along with “A-shares + Hong Kong stocks”, will become the main choice for domestic chip companies to raise funds in the future.

Return of Chinese concept stocks? Zeekr becomes the “first stock” in the market’s hot discussion

On May 7, Geely Automobile Holdings Limited announced its plan to acquire all issued shares of Zeekr Intelligent Technology Co., Ltd. Geely currently holds about 65.7% of Zeekr’s shares, and if the transaction is completed, Zeekr will be privatized and delisted from the New York Stock Exchange, fully merging with Geely. The Geely Holding Group stated that this move is an important step to further implement the “Taizhou Declaration”, focusing on the automotive main business, improving resource utilization efficiency, and deepening brand synergy. External evaluations suggest that under the backdrop of US-China tariff frictions, Zeekr’s delisting has become the “first stock” in the topic of returning Chinese concept stocks.

As an important part of Geely’s high-end intelligent new energy strategy, Zeekr has gathered hot topics such as the 800V high-voltage platform, laser radar intelligent driving, and ZEEKR OS intelligent cockpit, and has experienced a high point in the US stock market. However, during the year of listing, its stock price has mostly remained low, with a current market value of around $5 billion, a decline of nearly 30%.

This is partly due to the insufficient recognition of Chinese new energy brands in the US stock market, and on the other hand, the environment of the US stock market is also changing. Against the backdrop of US-China tariff frictions, the current hot topic in the market includes the “return of Chinese concept stocks”. Reports indicate that US Treasury Secretary Janet Yellen stated in response to whether Chinese companies would be kicked out of the US stock market, “All policy options are possible in tariff negotiations.”

Geely’s acquisition makes Zeekr the “first stock” in this round of market hot topics.

“A-shares + Hong Kong stocks”, dual paths become the main choice for chip companies to raise funds

Currently, there are no typical Chinese chip companies in the US stock market. Previously, SMIC and Spreadtrum Communications were listed on the New York Stock Exchange and NASDAQ respectively, but SMIC delisted from the NYSE in 2019, and Spreadtrum was acquired by Unisplendour Group. Among the Chinese concept stocks listed in the US stock market, there are currently no other Chinese chip companies.

Previously, Chinese companies went public in the US to access larger financing channels, a more mature investor system, and a more influential market mechanism. However, with the US SEC (Securities and Exchange Commission) continuously promoting the implementation of the “Foreign Companies Accountability Act”, the US side’s scrutiny of Chinese supply chain companies and the upstream and downstream of the chip industry is intensifying. Due to the restrictions on the US semiconductor industry, many Chinese chip companies are now more inclined to list in China’s A-shares or Hong Kong rather than in the US stock market.

In fact, apart from the A-share Sci-Tech Innovation Board, the Hong Kong stock market has become the main listing and financing channel for domestic chip companies. Companies such as SMIC, Hua Hong Semiconductor, Horizon Robotics, Black Sesame Intelligence, Fudan University, and China Electronics Technology have already covered the entire industry chain of semiconductor design, manufacturing, packaging testing, equipment, and materials in the Hong Kong stock market. Companies like Naxin Micro, Guanghetong, Lens Technology, Jingao Technology, and Tianyue Advanced also have plans to list or refinance in the Hong Kong stock market.

As one of the world’s important international financial centers, Hong Kong also has a mature financial market system and a sound regulatory framework. Listing in the Hong Kong stock market also helps Chinese chip companies attract investors from around the world. In addition, compared to some other capital markets, the listing rules of the Hong Kong stock market are relatively flexible, with certain elasticity in terms of profitability requirements for companies. This makes the Hong Kong stock market a more inclusive listing platform for some chip companies that are in a period of rapid development, have not yet achieved profitability but have good growth prospects.

Currently, the Chinese government attaches great importance to the development of the chip industry and has introduced a series of supportive policies to encourage chip companies to grow and strengthen, including support for companies’ listing and financing. Choosing to list in the Hong Kong stock market aligns with the national policy direction of promoting companies to utilize multi-level capital markets for development. At the same time, as an important part of the Guangdong-Hong Kong-Macao Greater Bay Area, Hong Kong benefits from the development planning and policy support of the Greater Bay Area. After listing in the Hong Kong stock market, companies can better leverage the advantages of technology, talent, and industrial support in the Greater Bay Area, strengthen cooperation and exchanges with other companies in the Greater Bay Area, achieve resource sharing and collaborative development, and further enhance their overall strength.

4. Trump’s tariffs hit US companies hard: Nvidia, AMD, Apple, GM, and others will lose billions;

From Nvidia and Apple to General Motors, US companies are preparing to face losses of billions of dollars caused by Trump’s trade war—this does not include the arrival of most affected goods.

Among the US companies that have disclosed financial forecasts so far, General Motors expects to suffer a loss of $5 billion this year, while Apple anticipates an increase of $900 million in costs in the second quarter. Nvidia has accounted for $5.5 billion in expenses to cope with new export control measures.

AMD stated that due to the new restrictions on chips imposed by the US, the company expects to lose $1.5 billion in revenue this year. According to the new regulations, AMD needs to obtain licenses to export advanced AI processors to China.

Trump’s new tariffs could cost US semiconductor equipment manufacturers more than $1 billion annually. The three largest chip equipment manufacturers in the US—Applied Materials, Lam Research, and KLA—each could face losses of about $350 million within a year, while smaller competitors like Onto Innovation may also face tens of millions of dollars in additional expenses.

In summary, US semiconductor companies such as Nvidia, AMD, Apple, Applied Materials, Lam Research, and KLA estimate losses of up to $8.95 billion.

The Trump administration has imposed tariffs on most imported products and additional taxes on certain countries/regions and industries.

Meta Platforms has raised its capital expenditure expectations for 2025 by up to $7 billion, partly attributing this change to the higher-than-expected costs of global equipment procurement. Meta Platforms CFO Susan Li stated: “Given the ongoing trade negotiations, there is a lot of uncertainty in this area.”

“Uncertainty” has become a common term for many executives in quarterly financial performance calls. So far, the term “uncertainty” has appeared over 9,000 times in this quarter’s corporate conference calls—more than the peak reached during the early days of the COVID-19 pandemic.

Dozens of companies have yet to disclose their latest financial reports and have not answered analysts’ questions about the impact of tariffs, including Nvidia and Oracle. Corporate management is taking various measures to respond, including attempting to shift production out of China and ordering materials in advance before expected price increases.

Microsoft stated that due to customers stockpiling inventory, the sales growth of its Windows software and other products has exceeded expectations.

Amazon accelerated some inventory procurement in the first quarter to cope with expected tariffs. Coupled with unrelated costs associated with customer returns, this move led to a decline of about $1 billion in its first-quarter profits. “Clearly, none of us know when and where tariffs will ultimately land,” said Amazon CEO Andy Jassy.

General Motors, which imports cars from South Korea, Canada, and Mexico, is one of the largest losers among US companies. General Motors and other automakers are among the hardest-hit companies, with most imported cars subject to a 25% tariff. Additionally, separate tariffs on imported parts have also impacted cars produced by US automakers.

Ford Motor Company produces 80% of the cars it sells in the US domestically. The company stated that it expects tariffs to reduce its EBITDA by about $1.5 billion this year. Motorcycle manufacturer Harley-Davidson estimates that tariffs could cost it up to $175 million this year.

It is not only US automakers that are affected. Japan’s Toyota Motor Corporation stated that the tariffs imposed since Trump’s trade “liberation day” on April 2 will reduce its operating income by $1.3 billion.

Aerospace and defense giant RTX Corporation stated that even with mitigation measures, its operating profit will still suffer a loss of $850 million. Honeywell International, GE Healthcare, and GE Aviation are all expected to incur losses of about $500 million in 2025, not accounting for supply chain changes and price increases.

Boeing expects tariffs to increase its manufacturing costs by less than $500 million annually, including a 10% tariff on large components of its 787 Dreamliner manufactured in Japan and Italy.

Diversified industrial products manufacturer 3M Company stated that tariffs will cost it up to $850 million annually. Chemical giant DuPont is taking measures to reduce the expected $500 million tariff cost to $60 million.

GE Vernova, the energy business that GE divested last year, expects tariffs to increase its costs by up to $400 million this year. The company plans to offset this impact by utilizing inflation protection clauses and legal change clauses in contracts, while also cutting expenses and restructuring its supply chain to reduce reliance on China.

5. Institutions: Global XR display shipments are expected to grow by 6% in 2025;

Recently, market research firm Counterpoint Research reported that global XR (AR/VR) display shipments are expected to grow by 6% year-on-year in 2025. Although AR remains a relatively niche field, its year-on-year growth rate is expected to reach 42%, while VR’s year-on-year growth rate is only 2.5%.

Counterpoint Research stated that AR display shipments are expected to grow by 38% in 2026, while VR display shipments are expected to grow by 2.1%. However, there are still many uncertainties regarding how US tariffs on Chinese products will affect the demand for XR devices. If the trade war does not ease quickly, the forecasts for the next quarter may be adjusted downward.

The firm expects LCDs to continue to dominate the VR field, accounting for 87% of shipment share by 2025. LCDs are used not only in entry-level headsets but also in high-end devices equipped with advanced features such as quantum dots and MiniLED. In the AR field, the share of silicon-based OLED is expected to drop to 75%, making way for greater space for MicroLED and LCoS displays. Although Meta and Google recently showcased fully functional MicroLED smart glasses, they have yet to announce commercialization plans. However, some Chinese brands and European companies like Even Realities are already selling lightweight AR glasses that use MicroLED and waveguide technology.

6. DSP chip manufacturer Chuangcheng Microelectronics enters bankruptcy liquidation; creditors must file claims in a timely manner;

The winter of the semiconductor industry continues to spread, and another chip company has fallen during the industry’s low period. Recently, Jiangxi Chuangcheng Microelectronics Co., Ltd. officially entered bankruptcy liquidation procedures, becoming the latest semiconductor company to fall during the industry’s winter, following Huaxia Chip, Wusheng Semiconductor, Century Jinguang, and Ningbo Hualong.

On April 28, 2025, the People’s Court of Jishui County, Jiangxi Province issued announcement (2025) Gan 0821 Po 2, unveiling the bankruptcy proceedings of Jiangxi Chuangcheng Microelectronics Co., Ltd. On March 31, 2025, the court accepted the execution application for bankruptcy liquidation filed by Shenzhen Boyi Electronics Co., Ltd. against Jiangxi Chuangcheng Microelectronics Co., Ltd., and on April 2, appointed Jiangxi Ganzhong Law Firm as the administrator.

According to the announcement, the company’s creditors must file claims with Jiangxi Ganzhong Law Firm by June 16, 2025. When filing, creditors should provide a detailed written explanation of the amount of the claim, whether there is any property guarantee, and whether it is a joint claim, along with corresponding evidence materials.

Data shows that Jiangxi Chuangcheng is a high-tech enterprise specializing in chip design and application. The company was established in 2012, mastering rich IC design and verification technologies, possessing independent intellectual property rights for DSP architecture, and has successfully developed more than ten DSP chips validated by users. Its core business includes digital signal processing (DSP) chip design, digital signal processing algorithm research, audio system design, clock chip design, automotive electronic water pump controller design, etc., covering fields such as audio and video applications (live streaming karaoke equipment), smart speakers, automotive electronics (in-vehicle audio-visual systems, dashboard system solutions, in-vehicle wireless charging, electromechanical control systems, etc.), smart home, and industrial control, receiving unanimous recognition from clients such as Pioneer, Philips, Edifier, Kugou, Tencent, Lenovo, and Xipeng Co., Ltd.

7. Semiconductor tariffs strike hard: Is US tech hegemony “tying itself up” again?

The US tariff policy targeting chips is about to take effect.

Currently, the Trump administration has concluded the public opinion solicitation for the “232 national security investigation on imported semiconductors and semiconductor manufacturing equipment” and may announce the final results soon. However, when it will be implemented remains to be seen. Previously, the industry had deduced three “scripts” for Trump’s chip tariffs based on dynamic situations, with the implementation policy possibly based on the “origin of wafers”.

In the US semiconductor tariff policy system, China is an important target. However, on one hand, the previous tariff levels in the US are already high, and on the other hand, the scale of China’s semiconductor products directly exported to the US is relatively small, so the related impact is bound to be limited and controllable. Relatively speaking, this policy will “lift the stone and hit its own foot”, shaking the foundation of the US semiconductor industry, failing to achieve the goals of promoting manufacturing return and self-sufficiency, and may provoke retaliatory measures from various countries, further disrupting the global supply chain.

In the short term, the US semiconductor tariff policy is not only a trade tool but also an extension of technological competition, which may exacerbate global supply chain chaos and inflationary pressures. The future effectiveness of this policy will depend on the dynamic balance of global supply chain resilience and policy competition.

Impending schemes to profit

Given Trump’s repeated promises to impose tariffs on imported chips and the ongoing push, the countdown to US tariffs on chips has begun.

On April 16, the US Department of Commerce initiated an investigation under Section 232 to assess the national security risks of semiconductor imports, semiconductor manufacturing equipment (SME), and related products. The scope of the investigation covers key semiconductor components such as substrates, bare wafers, traditional chips, advanced chips, microelectronic components, and SME components. The deadline for public opinion solicitation was May 7.

After concluding the public opinion solicitation, the Trump administration may announce the investigation results soon. Industry analysis indicates that President Trump may announce tariffs on imported chips as early as this week, with market estimates suggesting a tax rate between 25% and 100%. However, TD Cowen analysts suggest that the US government may impose tariffs of up to 25% on semiconductors as early as July. It remains unclear how these tariffs will be implemented, as most chips enter the US in finished form, such as servers and smartphones.

Given that the Trump administration’s policies “change almost daily”, the industry does not have an accurate expectation of when the chip tariff measures will be implemented, but previously, the industry had deduced three “scripts” for Trump’s chip tariffs based on the overall situation.

First, a formula for taxation based on the global semiconductor output of countries or manufacturers and the difference from US manufacturing, known as the “big reservoir model”. Previously, the US imposed equivalent tariffs on various countries/regions based on the difference between their exports and imports to the US. If the “big reservoir model” is used to calculate chip tariffs, the impact on the semiconductor industry will be the most severe, with rates possibly reaching 100%. Secondly, tariffs could be imposed on chips that are “directly imported” into the US, but this would directly penalize attempts to assemble in the US. Lastly, tariffs could be imposed on all end electronic products containing semiconductors, but the biggest challenge lies in the complexity of execution and the difficulty of tracing.

Of course, it is also possible that the Trump administration may “heavily impose and lightly lift” in complex operations, adopting another “fourth script”. It is reported that the US chip tariff policy may be based on the “origin of wafers”, that is, the actual production location of the chips.

However, before the chip tariffs are introduced, the US government has already been continuously raising tariffs on Chinese semiconductors, realizing that high tariffs may backfire on domestic industries. On April 11, it announced exemptions for 20 key products, including semiconductors, smartphones, and laptops, from “equivalent tariffs”. At that time, US Secretary of Commerce Gina Raimondo stated that these exemptions are only temporary measures, lasting until the US government formulates a new tariff plan for the semiconductor industry. To ensure the return of chip manufacturing, the US is expected to introduce special semiconductor tariffs within “one or two months”.

Liang Huaixin, a researcher at the National Security and Governance Research Institute of the University of International Business and Economics, believes that this is a negotiation strategy of the Trump administration. The US’s exemption of semiconductor “equivalent tariffs” followed by a statement to establish special semiconductor tariffs is “on one hand a manifestation of a phased softening of stance, but at the same time trying to gain initiative in negotiations through policy fluctuations to obtain more benefits.”

Heavy-handed targeting, little ripple

Before pushing for the formulation of semiconductor tariffs, the US has been continuously raising tariffs on Chinese semiconductors, but the impact has been relatively limited.

Statistics show that since 2024, the US has continuously imposed tariffs on China’s semiconductor products, including a 25%-100% tariff on 14 categories of products based on Section 301 in September 2024, among which 16 types of products related to semiconductors (solar silicon wafers, polysilicon, tungsten materials, etc.) have seen rates raised from 25% to 50%, with this rule taking effect from January 1, 2025. Since Trump’s administration, as of April 2025, the cumulative tariff on China has reached 20%. With the accumulation of multiple tariff policies, the US is now set to impose tariffs of up to 70% on Chinese semiconductor-related products, far exceeding normal tariff ranges.

Industry analysis suggests that the US semiconductor tariff policy has expanded from initial intellectual property protection to a comprehensive supply chain security strategy, with broader coverage and higher rates, and is being promoted in conjunction with export control and other policies, becoming a tool in the US trade war.

As for the impact of the Trump administration’s chip tariff policy on China’s semiconductor industry, it is bound to be limited and controllable, as on one hand, the previous tariff levels in the US are already high, and on the other hand, the scale of China’s semiconductor products directly exported to the US is relatively small.

In terms of scale, in 2024, the total export value of China’s semiconductor products to the US was 23.141 billion yuan, accounting for less than 1% of China’s total exports to the US of 3.8 trillion yuan, and 1.53% of China’s total semiconductor product exports of 1.5 trillion yuan.

Experts from Beiguo Consulting analyze that China’s integrated circuits, semiconductor devices, semiconductor equipment, and components have relatively small export values to the US, and the semiconductor industry has been temporarily exempted from the 34% tariffs, so the impact on China’s semiconductor industry is limited and controllable. Among the exported product categories, the total export value of integrated circuits and semiconductor devices to the US is 22.6 billion yuan, while the total export value of semiconductor equipment and components to the US is 501 million yuan. Therefore, relatively speaking, the US tariff policy has a greater impact on China’s semiconductor products, while the impact on the supply chain of semiconductor equipment is minimal.

However, some industry analyses indicate that US-China trade frictions and bilateral tariffs will have a significant impact on China’s basic semiconductors, wafers, polysilicon, and semiconductor manufacturing equipment imports and exports, thereby exacerbating uncertainties in the global supply chain. Depending on the positioning of enterprises, product types, and production chain positions, Chinese semiconductor companies are affected by tariffs to varying degrees. Although Chinese companies face dual pressures from US export controls and tariffs, there are also new opportunities for domestic analog chips and exploring non-US markets.

It is worth mentioning that in recent years, the US has been investigating China’s mature process chips, as many US products use mature process chips imported from China, including chips used in smartphones, automobiles, and other fields. Therefore, although the specific details of the US semiconductor tariffs are still being formulated, it is likely that Chinese mature process chips exported to the US will be specifically targeted.

Self-inflicted wounds, unfulfilled aspirations

Due to a deep reliance on the global supply chain system, the new round of chip tariff policies in the US will be “lifting the stone and hitting its own foot”, shaking the foundation of the US semiconductor industry and threatening the further development of the global industry at a time when recovery momentum is emerging.

Although there are reasons to believe that relevant measures are about to be introduced, what is their purpose? Chris Miller, author of “Chip War”, believes that “if the US really imposes tariffs on semiconductors, companies may further turn to offshore manufacturing to offset the increased costs. They may not import chips into the US to embed them in locally produced appliances or cars, but may instead directly shift the entire manufacturing process overseas. The final products may still be subject to tariffs, but at least the manufacturing costs will be lower.”

According to trade data, the US imports about $30 billion worth of chips annually, mainly from Southeast Asia. Miller points out that will tariffs encourage companies to replace these imported chips with domestically produced ones? Not necessarily. Since the 1960s, the US has outsourced almost all labor-intensive chip assembly and packaging processes to Asia, and currently, there is almost no domestic capacity for such production.

Despite Trump’s claims that chip tariff measures will promote the return of manufacturing to the US, industry experts express skepticism. A survey of semiconductor companies shows that almost no companies plan to relocate production capacity back to the US, due to widespread doubts about the sustainability of tariff policies. Miller states, “If tariffs are imposed on chips manufactured in Taiwan, it will undoubtedly stimulate TSMC to continue investing in manufacturing in the US, but building chip factories takes time. Unless tariffs are phased in over several years, the additional costs resulting from these tariffs may push the already unstable US economy into recession.”

However, if chip tariffs are implemented, they will impact TSMC and the Taiwanese chip industry, especially if tariffs are based on the origin of wafers. Industry analysis suggests that if tariffs are too high, US customers may turn to other countries/regions for alternative suppliers, or it may accelerate the process of self-manufacturing chips in mainland China. At the same time, the US’s dependence on TSMC and geopolitical tensions may lead to the “American manufacturing” goal being accelerated, making tariff policies likely to provoke retaliatory measures, further disrupting the global supply chain.

Moreover, if the new system is as speculated in the market, imposing tariffs based on the wafer manufacturing location may promote some production capacity to return to the US. However, this shift may disrupt supply chains, extend delivery times, and harm the profits and global advantages of US chip manufacturers.

In addition to promoting the return of manufacturing, some US government officials hope to achieve a larger goal—self-sufficiency. In this regard, Miller states, “Completely dismantling globalization will come at a huge cost and involves profound contradictions. Imposing tariffs on certain key equipment will raise the costs of producing chips domestically and weaken the competitiveness of the US, making domestic chip manufacturers one of the victims of broadly imposed chip tariffs. Broadly imposed tariffs will not achieve this goal.”

8. The 18A process attracts attention; Intel and Microsoft are reportedly discussing foundry contracts;

Intel is reportedly in talks with Microsoft to sign a large-scale wafer foundry contract for the production of chips using the advanced 18A process, which has also attracted the interest of tech giants like Nvidia and Google, challenging TSMC’s dominance. Tech website Wccftech describes this as potentially the “iPhone moment” for the 18A process.

According to the Chosun Ilbo, Intel has signed a wafer foundry contract for the 18A process with Microsoft and is also in discussions with Nvidia and Google regarding the 18A process, potentially positioning it as an alternative to TSMC’s N2 process.

Intel stated at its recent Direct Connect event that the 18A process is the most advanced chip process in the US, with some reports claiming that its performance rivals TSMC’s N2 process.

Industry analysts have stated that Intel’s pursuit of a 1nm process seems unrealistic, but Intel has repeatedly expressed confidence.

A representative from Intel stated that the 18A process is currently in the risk trial production stage, with stable mass production expected within this year.

Intel’s new CEO, Pat Gelsinger, has recently taken office, and Wccftech reports that under Gelsinger’s vision, Intel will focus on electronic design automation (EDA), packaging, and wafer foundry.

US tech giants’ interest in the 18A process includes seeking to reduce geopolitical risks and alleviate tariff pressures.

Reports indicate that as Trump threatens to impose semiconductor tariffs, large enterprises face risks, and Intel’s supply chain appears to be more diversified compared to TSMC and Samsung Electronics.

If Intel can achieve stable mass production of the 18A process, it is expected to gain a geopolitical advantage. Economic Daily

Hot Topics:

1.Trump plans to abolish new AI export control regulations, US Department of Commerce confirms;

2.Domestic mobile phone supply chain giant under investigation!

3.Over 60% of A-share semiconductor companies reported net profit growth in Q1, with 46 achieving a doubling of profits

4.Warren Buffett to retire at the end of the year! Key points from the shareholder meeting at a glance

5.Nvidia launches China-specific AI chip, samples expected in June

6.Smuggling chips into China using “fake pregnancy belly + lobster”? Nvidia furious

7.Valued at over 77 billion yuan, two major chip manufacturing projects halted!

8.US export restrictions impact, chip giants’ profits plummet by 62%