1

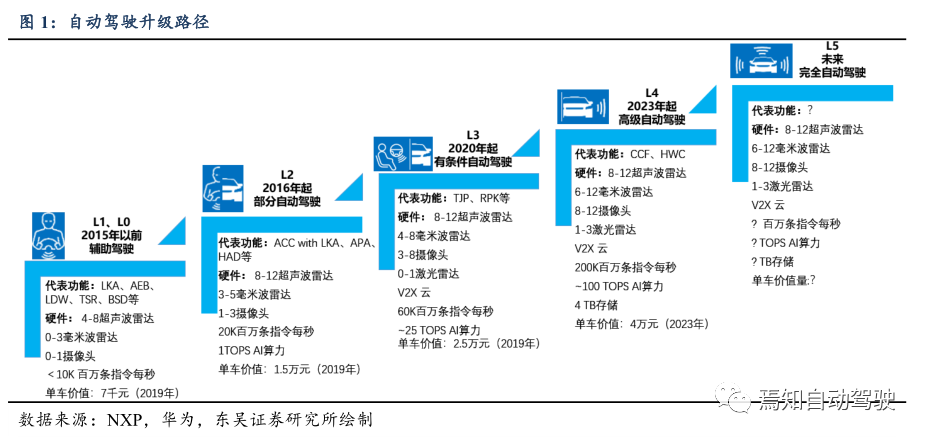

Pathways to Upgrading Autonomous Driving

2

What is the Market Size for Autonomous Driving?

2.1. Global Autonomous Driving Market Estimated at Approximately $100 Billion in 2020

Improving efficiency and safety is the value that autonomous driving brings to society, creating a vast global market for autonomous driving. There are various forecasts regarding the global autonomous driving market size. According to Kearney’s data, the global autonomous driving market (including vehicle-side, road, cloud, etc.) is expected to reach $80 billion by 2025, and $280 billion by 2030.

According to Roland Berger’s data, the market size of global autonomous driving vehicle-side systems is estimated to be $113.8 billion in 2020, and will reach approximately $500 billion by 2030, with chips, sensors, and software algorithms contributing the majority of market growth.

2.2. Domestic Autonomous Driving Market Reached 84.4 Billion Yuan in 2020

We estimate the front-mounted market capacity for ADAS function products as follows:

Step 1: Forecasting the passenger vehicle market capacity. According to data from the China Association of Automobile Manufacturers, the production of passenger vehicles in China reached 21.36 million units in 2019. Drawing on the experiences of developed countries, we believe that the passenger vehicle ownership per thousand people in China will gradually rise to 200 units from 2019 to 2025, with an expected compound growth rate of 3% from 2019 to 2025.

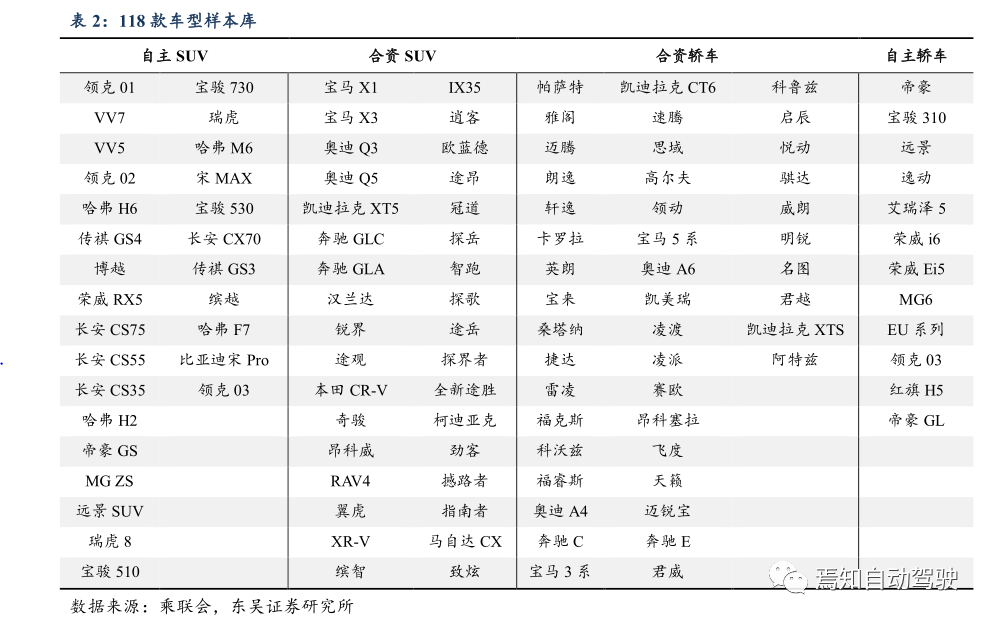

Step 2: Forecasting the penetration rates of various front-mounted products. According to the configuration disclosed by Autohome, the product penetration rates are obtained from a self-built sample library. The sample includes 118 models, and for each model, the installation status of high, medium, and low-level products is collected. (Note: The calculations in this article only refer to the front-mounted market; the twelve main ADAS functions mentioned below refer to 360-degree panoramic imaging, adaptive high and low beam lights, fatigue driving alerts, lane departure warnings, lane change assistance, road traffic sign recognition, rear side warning systems, cruise control, lane keeping assistance, active braking systems, adaptive cruise control, and automatic parking, in that order.)

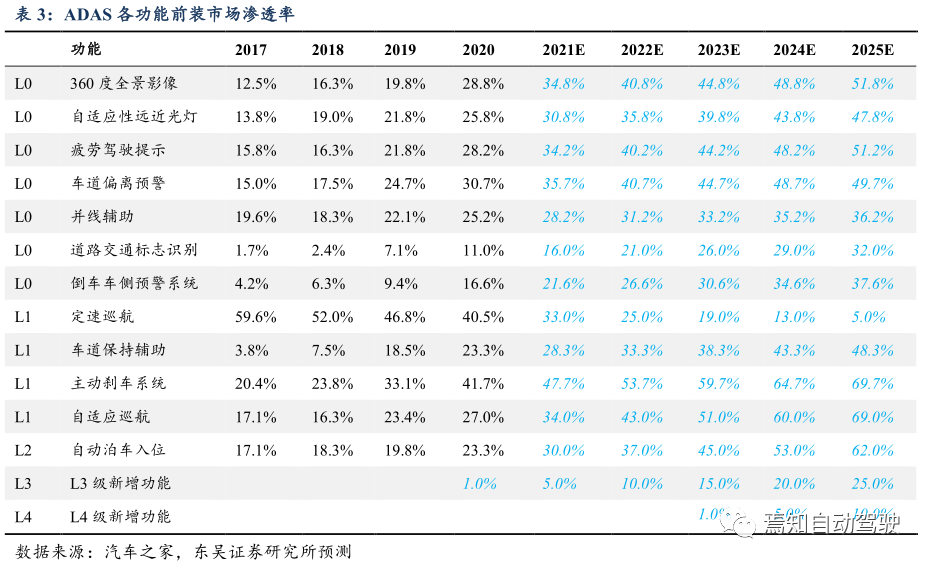

Assuming that the penetration rates of the functions in the self-built sample system from 2017 to 2020 will represent the penetration rates of each function in the front-mounted market. According to sample statistics, the penetration rates of ADAS products (360-degree panoramic imaging, adaptive high and low beam lights, fatigue driving alerts, lane departure warnings, lane change assistance, road traffic sign recognition, rear side warning systems, cruise control, lane keeping assistance, active braking systems, adaptive cruise control, automatic parking) in 2019 were 19.8%, 21.8%, 21.8%, 24.7%, 22.1%, 7.1%, 9.4%, 46.8%, 18.5%, 33.1%, 23.4%, and 19.8%, respectively. Among them, the active braking system and cruise control system are relatively mature with higher penetration rates of 33.1% and 46.8%, respectively; the other functions are still in the popularization stage, with penetration rates below 25%.

We focus on the penetration rates of each function in recent years and at different price levels (see appendix) and assume that by 2025, the penetration rates of ADAS functions in the front-mounted market will be 52%, 48%, 51%, 50%, 36%, 32%, 38%, 5%, 48%, 70%, 69%, and 62%, respectively. In addition, L3 and L4 functions are expected to be gradually launched in 2020 and 2024, respectively.

We believe that the penetration rates of ADAS functions will accelerate in the coming years (except for adaptive cruise replacing traditional cruise), mainly due to: 1) increasing consumer demand for automotive safety features, making them more willing to pay for ADAS functions; 2) automakers using ADAS features as highlights for new models to increase market competitiveness; 3) as new intelligent technologies mature and 5G commercializes, user experiences improve, leading to increased sales and further cost reductions.

Step 3: Forecasting the single vehicle value of each function. Functions like automatic parking, adaptive cruise control involve functional safety and are difficult to implement. The 360-degree panoramic imaging has stringent hardware requirements, leading to higher functional costs. In 2019, the single vehicle value for each function was about 2,000 yuan/set, while each remaining function had a single vehicle value of about 1,000 yuan/set. The new L3 functions had a single vehicle value of 11,000 yuan/set in 2020, while L4 functions had a single vehicle value of 20,000 yuan/set in 2023.

Among them, automatic parking is in a process of continuous integration, so its single vehicle value will gradually increase and stabilize. The remaining functions, as technology matures and penetration rates increase, will initially see a decrease in single vehicle value, followed by stabilization. We expect that by 2025, the single vehicle values will be 360-degree panoramic imaging (1,184 yuan), adaptive cruise control (1,772 yuan), automatic parking (2,431 yuan), L3 new functions (6,495 yuan), L4 new functions (16,200 yuan), and the remaining functions (592 yuan each).

By 2025, the ADAS market size will reach 225 billion yuan, with a CAGR of 21.3% from 2019 to 2025. According to our calculations, the market size for major ADAS functions in 2020 reached 84.4 billion yuan, a year-on-year increase of 19.3%. With the gradual implementation of 5G, automakers are launching new models equipped with ADAS functions, leading to accelerated penetration rates of various ADAS functions. By 2025, the market size is expected to reach 225 billion yuan, with automatic parking and adaptive cruise control being the largest two markets among L2 and below functions, contributing 38.4 billion yuan and 31.2 billion yuan, respectively.

3

How is Each Segment of the Autonomous Driving Industry Developing?

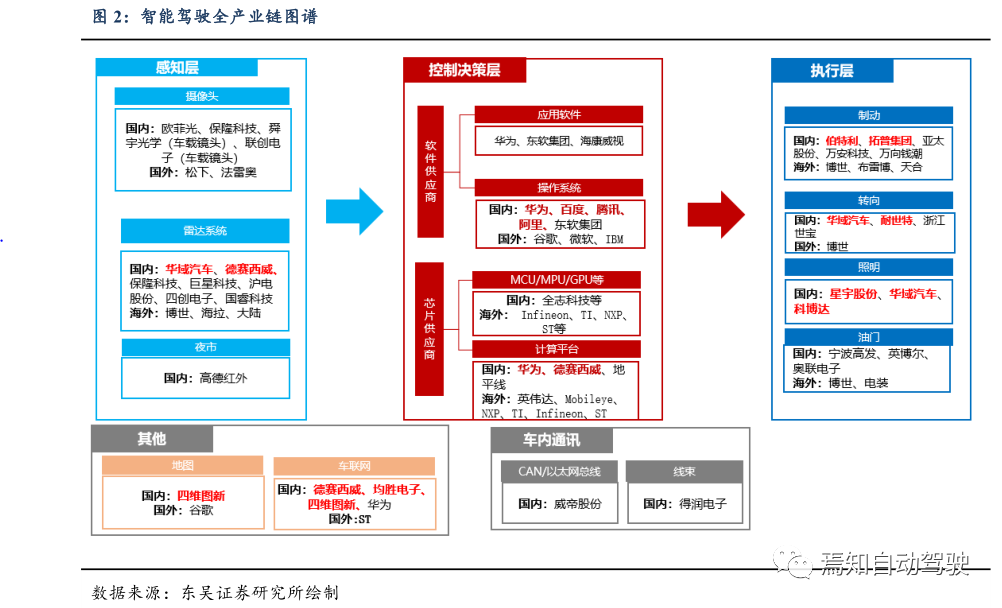

Autonomous driving senses the surrounding environment through the perception layer (millimeter-wave radar, lidar, monocular/double cameras, etc.), then identifies, computes, and analyzes through the decision layer, and completes operations through the execution layer, thereby enhancing the comfort and safety of driving.

There are various standards for classifying autonomous driving levels. For ease of analysis, we refer to standards from the US SAE, NHTSA, and the Chinese version of the classification standard (draft for declaration) to classify functions into the following levels, where L0 mainly refers to warning functions, L1 refers to independent active control and driving assistance, L2 refers to combined active control and driving assistance, and L3 and above refers to higher-level autonomous driving.

The entire autonomous driving industry chain can be roughly divided into three major segments: perception – control decision – execution. The perception layer mainly includes radars (lidar, millimeter-wave radar, ultrasonic radar), and visual systems (cameras, infrared cameras, etc.); the control decision layer includes operating systems, application software, chips/computing platforms; the execution layer includes braking, steering, lighting, throttle, airbags, etc. Additionally, it includes in-vehicle communication, maps, and vehicle networking.

3.1. Multi-Sensor Fusion is the Main Development Trend

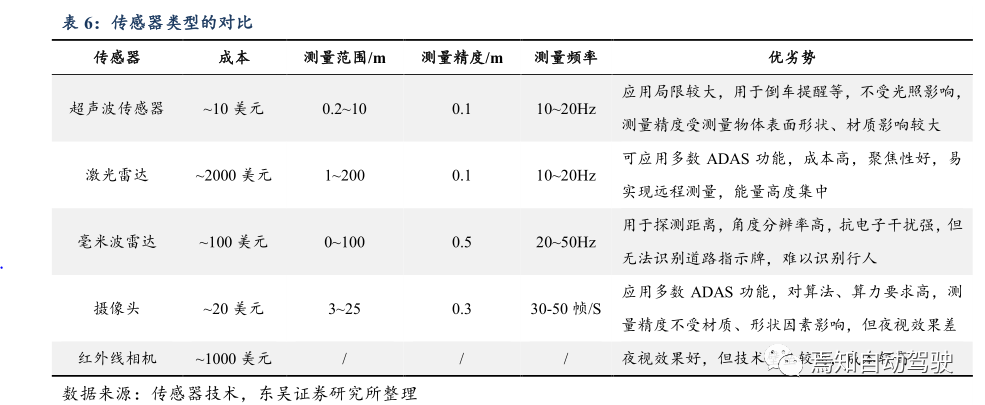

The main environmental perception sensors include visual recognition types (including monocular, binocular, multi-camera, and infrared cameras) and radar-based distance measurement sensors (lidar, millimeter-wave radar, ultrasonic radar, etc.). Each type of sensor has different working principles, material properties, and manufacturing processes, resulting in varying performance and costs.

1) Cameras are widely used and low-cost, capable of detecting and recognizing feature symbols such as lane line detection, traffic sign recognition, traffic light recognition, pedestrian and vehicle detection, etc., but perform poorly in adverse weather or low-light conditions.

2) Ultrasonic radar is the cheapest but has a short detection range, commonly mounted on the front and rear bumpers for parking assistance;

3) Millimeter-wave radar has advantages such as small size, strong penetration, and immunity to adverse weather and lighting conditions. It can be used to detect vehicle distance and speed, serving as the basis for active braking and adaptive cruise control.

4) Lidar provides the best results, capable of obtaining parameters such as target distance, orientation, height, speed, and even shape, but is the most expensive. However, there are low-cost camera-lidar fusion sensors being introduced that may change the industry’s perception of lidar.

Each function adopts different sensor schemes based on their requirements. Functions with high recognition requirements, such as intelligent headlights, road departure warnings, lane keeping assistance, emergency braking, pedestrian detection, and road sign recognition, adopt a camera-dominant combination scheme, while functions with high distance measurement requirements, such as adaptive cruise control, adopt a radar sensor-dominant scheme.

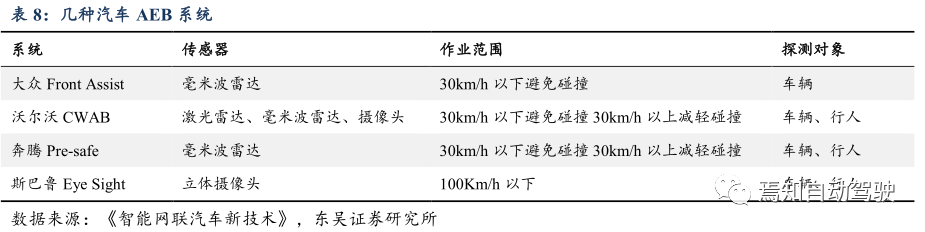

ADAS functions are continuously evolving, and multi-sensor fusion is the main development trend. The AEB system is divided into several levels. From the consumer experience perspective, the first to appear is the FCW (Forward Collision Warning) system with warning and sound reminders; if the driver does not respond, a speed limit automatic prompt appears; finally, automatic braking intervention occurs.

From a hardware configuration perspective, different automakers adopt varying solutions. The initial systems often used a single radar or single camera for warning functions, such as millimeter-wave radar (with suppliers like Bosch, Continental, etc.) and monocular vision cameras (with suppliers like Mobileye, etc.). As functional safety becomes more important, the integration of multiple types of the same sensor for braking (with suppliers like Bosch, Continental, Aptiv, and Veoneer) has gradually become the main implementation form for automakers to achieve AEB functionality.

3.2. The Decision Layer is the Brain of Autonomous Driving Technology

The core technology driving the decision layer is the continuous optimization of software algorithms and the exponential increase in processing power of computing platforms. The decision layer is responsible for algorithm fusion or feature extraction of signals from similar sensors as preprocessing, then the main processor performs data fusion of multiple sensor signals, evaluates and makes decisions, and outputs commands to the controller for operations such as braking, steering, and acceleration.

Currently, each ADAS function operates relatively independently, with separate chips handling preprocessing, data fusion, and control command output for each function. With the rapid increase in chip computing power and continuous optimization of software algorithms, a significant amount of computation will be handled by a single main chip.

Emerging companies in the autonomous driving computing platform chip market are divided into two main categories: traditional automotive chip suppliers, primarily providing MCU chips for lower-level autonomous driving functions, which perform adequately in command processing but are weaker in AI computing power; and new entrants from consumer electronics, startups, or telecommunications giants, which excel in AI computing power and energy consumption.

The competitive landscape for computing platform chip companies shows a two-tiered structure. Mobileye and Nvidia are in the first tier, Tesla, Huawei, and Horizon in the second tier, while other traditional automotive chip suppliers targeting the autonomous driving function market are in the third tier.

1) Mobileye, backed by Intel, occupies the L3 and below market, providing algorithms and hardware, with products gradually transitioning from visual processing to multi-sensor fusion, but later power increases appear insufficient, and bundled sales of algorithms and platforms reduce flexibility, making it challenging for customers to create differentiated products;

2) Nvidia, with a dominant advantage in GPU chips, occupies the L4 and above pre-research market, with high computing power and support for multi-sensor data fusion, having passed functional safety standards, but is relatively expensive;

3) Tesla develops its chips, allowing for the creation of dedicated chips based on demand, significantly reducing development cycles, and targeted designs will greatly reduce chip hardware resources, but has not yet certified functional safety standards;

4) Huawei and Horizon are still in adaptation testing; Huawei’s model is similar to Nvidia, with high computing power and having passed functional safety standards, mainly targeting the L3 and above market. Horizon’s model is similar to Mobileye, mainly targeting the L2/L3 market. Huawei and Horizon may have mass-produced vehicles equipped by 2020-2021, becoming important components in the autonomous driving field.

3.3. Execution Mechanisms are Core to Ensuring Driving Safety

Active control functions and automatic parking are the most valuable and effective experiences. However, implementing functions like AEB, ACC, AKS, and AP requires the participation of execution mechanisms. Traditional purely mechanical execution mechanisms cannot be controlled by electronic technology, necessitating electronic upgrades to facilitate integration into driving assistance systems and achieve autonomous driving functions.

Foreign giants like Bosch and Continental, leveraging their deep automotive powertrain and chassis technology advantages, are the main suppliers of intelligent driving execution mechanisms and ADAS functions at this stage. To facilitate intelligent driving functions, execution mechanisms should first be controlled electronically, with typical electronic control examples including electronic braking, steering, and throttle.

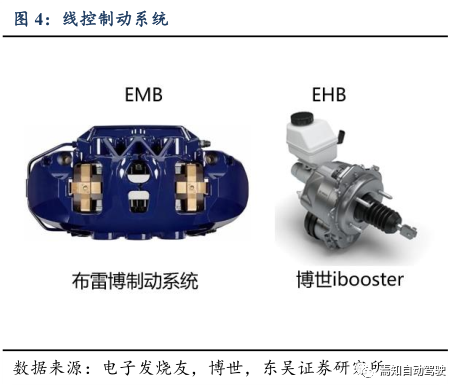

Electronic braking technology is challenging, with EMB systems being the future development trend. Electronic braking systems are divided into mechanical electronic braking (EMB) and hydraulic (EHB). Traditional braking systems primarily use pistons at both ends of the wheel cylinder to push the brake shoes outward, creating friction with the brake drum to generate braking. EHB is an upgraded version of traditional hydraulic braking systems, while EMB eliminates the hydraulic system, directly using motors to drive mechanical pistons for braking.

Electronic braking systems have the following advantages: 1) Significantly shorten braking times, with EMB response times around 90 milliseconds, while EHB (representative product: Bosch iBooster) has a 120 milliseconds response time, faster than traditional braking systems’ 300 milliseconds response time. Moreover, EMB has no hydraulic system, preventing liquid leaks that could cause short circuits or component failures.

Domestic companies engaged in research include Bertel and Asia-Pacific Co., as well as Top Group, which has achieved mass production of electronic vacuum pumps (one of the core components of the braking system).

The electronic steering system can achieve electric control steering during the autonomous driving process. Unlike traditional steering systems, the electronic steering system eliminates the mechanical connection between the steering wheel and the actuator, implementing steering via electrical control, facilitating integration with other subsystems (such as perception, power, chassis, etc.) and improving vehicle active safety and maneuverability.

The electronic throttle system, also known as the electronic accelerator system, is now widely used. The electronic throttle system mainly comprises the accelerator pedal, pedal position sensor, ECU, data bus, servo motor, and throttle actuator. The position sensor monitors the accelerator pedal’s position to determine the driver’s intention, thereby using the motor to drive the throttle opening.

Currently, electronic throttles are widely applied, and vehicles with cruise control generally come equipped with electronic throttles. The advantages of electronic throttles include: 1) Ease of integration with driving assistance systems; 2) Fuel savings compared to traditional cable throttles; 3) High control accuracy and stability, reducing the risk of stalling. For example, Bosch’s electronic throttle can save 7% fuel. Additionally, integrated driving assistance systems can achieve front collision warning functions by vibrating the throttle to remind the driver not to accelerate.

4

Where is the Core Positioning of Autonomous Driving?

How is the Competitive Landscape Evolving?

4.1. The Automotive Electronic and Electrical Architecture is the Core of the Future Autonomous Driving Industry Chain

The automotive electronic and electrical architecture (also known as E/E architecture) refers to the overall layout plan of the vehicle’s electronic and electrical systems, integrating various sensors, processors, wiring harnesses, electronic and electrical distribution systems, and software/hardware to achieve the vehicle’s functions, computation, power, and energy distribution. The key changes in electronic and electrical architecture mainly reflect on hardware architecture, software architecture, and communication architecture.

4.1.1. Key Changes in E/E Architecture Upgrades

Traditional electronic and electrical architectures cannot meet the increasingly complex autonomous driving applications. The key to upgrading E/E architecture lies in:

1) Meeting the Demand for Performance Improvement.

① Hardware Architecture Upgrade. Transitioning from distributed ECUs to domain controllers or central computing platforms. The main benefits include:

a) Higher Utilization of Computing Power, Reducing Overall Demand for Computing Power. Typically, chips are designed with parameters based on demand and leave a margin to ensure redundancy, but during actual operation, the effective utilization of computing power is relatively low.

Distributed ECUs can result in many chips being idle most of the time, leading to underutilization. By adopting a domain controller approach, a lower total computing power can be designed while still ensuring redundancy in overall vehicle computing power.

b) Unified Interaction, Achieving Collaborative Functions Across the Vehicle. Achieving advanced autonomous driving requires not only multi-sensor perception of the external environment but also real-time monitoring of various operational data within the vehicle, unified comprehensive judgment, and execution decisions. Traditional distributed architectures struggle to achieve real-time interaction, necessitating centralized controllers/central computing platforms for unified processing and decision-making.

c) Shortening Wiring Harnesses, Reducing Weight. With the increase in distributed architecture, more ECUs lead to longer wiring harnesses, and the complex arrangement of wiring harnesses can cause electromagnetic interference, increasing failure rates. Additionally, this makes the vehicle heavier. A centralized controller/central computing platform can reduce the length of wiring harnesses and lighten the overall vehicle weight.

② Software Architecture Upgrade. Decoupling software and hardware, achieving software-defined vehicles. The main benefits include:

a) Decoupling Software and Hardware, Achieving Online Upgrades of Software/Firmware, Soft Real-Time Software Architecture, and Portability of Operating Systems. Traditional automotive embedded software is highly coupled with hardware. To address increasingly complex autonomous driving applications and functional safety needs, software architectures represented by AutoSAR provide standardized definitions for interfaces, promoting software universality, further achieving soft real-time, online upgrades, and portability of operating systems.

b) Reusability of Collected Data Information, Effectively Reducing Hardware Requirements, Truly Achieving Software-Defined Vehicles. If software and hardware are not decoupled, adding an application function may require a separate set of hardware. The collected data information can only be utilized by one application function. After decoupling, multiple applications can share a set of collected information, effectively reducing the number of hardware components needed.

③ Communication Architecture Upgrade, Transitioning from LIN/CAN Bus to Ethernet.The main benefits include: meeting high-speed transmission requirements. As autonomous driving applications become increasingly complex, large amounts of unstructured data (such as images and videos) carry rich information but require high data transmission capabilities. Traditional automotive electronic and electrical architectures’ LIN/CAN bus cannot meet the high-speed transmission demands.

2) Controlling Core Technologies.

In the traditional automotive industry chain, ECU modules are directly supplied by suppliers, but the entire ECU is a black box (not providing the underlying architecture of the ECU), making it impossible for automakers to grasp the fundamental design principles and interfaces of each control component. Moreover, the standards/protocols for various components differ, making it difficult for vehicle manufacturers to achieve coordinated control of software and hardware.

Through the development and design of a new E/E architecture, OEMs can define software standards/protocols, develop core operating systems, components, etc., and connect the entire software and hardware system architecture, thus achieving a single onboard computer control to realize the vehicle’s functions and management.

3) Reducing Costs.

In terms of hardware, distributed architectures require numerous processing chips, but most of the time, chip utilization is low, leading to resource waste. By implementing centralized architecture, transmission losses, switching devices, and overall computing power demand costs can be reduced. In terms of software, traditional automotive software and hardware are designed in a closed manner, making it difficult to achieve modular development, thus increasing redundant work. By standardizing definitions, R&D costs can be further reduced; in terms of communication, shorter wiring harnesses reduce raw material costs and installation measurement costs.

4.1.2. How is Tesla Performing?

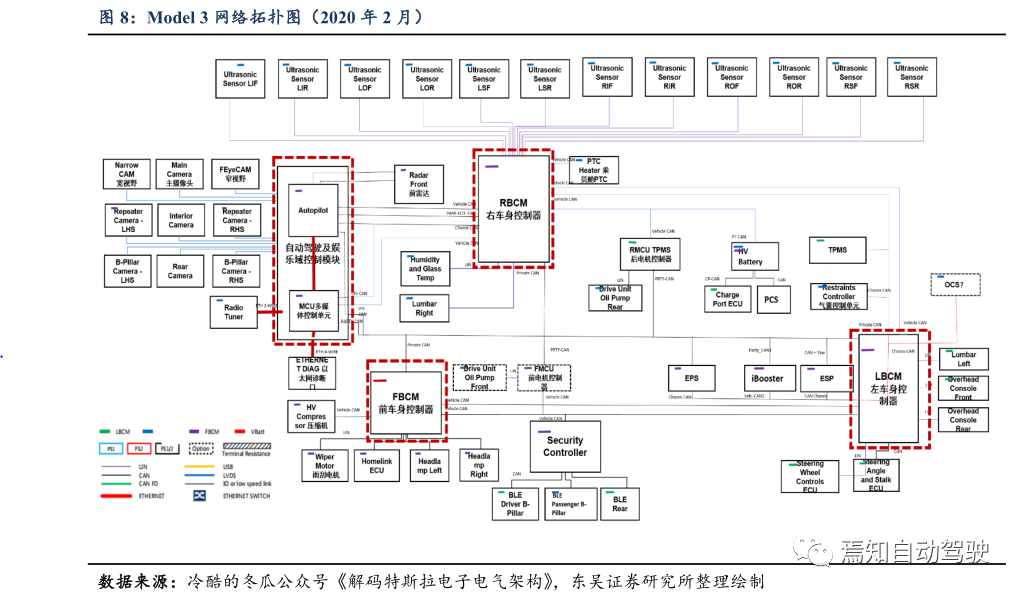

Tesla’s E/E architecture hardware control modules include CCM and three major domain controllers. According to technology expert Cold Winter Melon (WeChat public account), the hardware modules of Model 3’s E/E architecture mainly include the autonomous driving and entertainment control module (CCM) and three body domain controllers (BCM FRONT/LEFT/RIGHT), among which:

1) CCM manages all sensors related to assisted driving, such as cameras and millimeter-wave radar;

2) The front body controller is responsible for executing signal control for the autonomous driving module (such as steering systems, body stability systems, braking systems, etc.), compressors, and front lights;

3) The right body controller is responsible for airbag control, 12 ultrasonic radars (for parking), thermal management, and torque control;

4) The left body controller is responsible for interior lights, rear motor control, and charging modules.

The Model 3 achieves upgrades in hardware, software, and communication. Its major upgrades include:

1) The computing hardware of Model 3 is highly centralized, with the central computing module (CCM, core being the FSD chip) providing most of the processing power;

2) The major controllers are interconnected in a ring, with key functions backing each other, thus ensuring redundancy;

3) The vehicle operates on Tesla’s operating system, managing the entire automotive software system, allowing for bug fixes, feature imports, and software optimizations throughout the vehicle’s lifecycle.

4) The Model 3’s communication network simultaneously adopts Ethernet and traditional CAN/LIN buses, with the CCM connected via Ethernet and other ECUs primarily linked to the CCM through bus networks.

The Model 3’s E/E architecture is not the end point; Tesla plans to reduce the wiring harness to only 100 meters in the future, with control modules becoming even more highly integrated.

4.1.3. How are Other Competitors Performing?

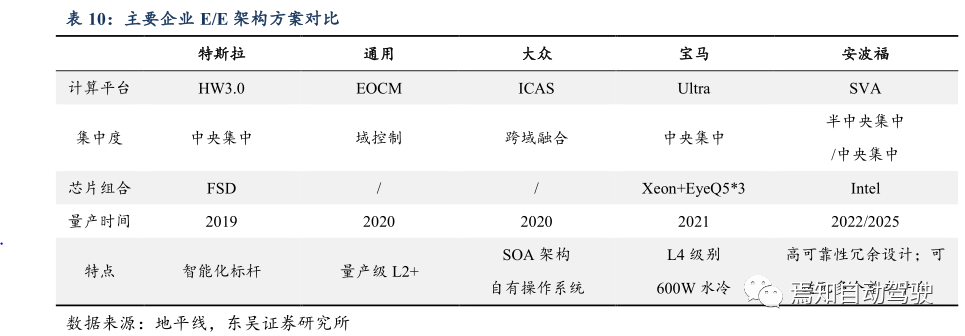

From the perspective of automakers, the ranking of E/E architecture integration is as follows: Tesla, strong traditional foreign brands, and domestic independent/new energy vehicle manufacturers.

1) Domestic independent brands and new energy vehicle manufacturers still belong to the distributed E/E architecture according to Bosch’s E/E architecture standards, characterized by hardware still primarily corresponding to single functions with single ECUs; the communication architecture still relies on traditional CAN buses; and the software has weak or no online upgrade capabilities.

2) Strong foreign automakers like Volkswagen, Audi, and General Motors have the latest (or recently planned) models with E/E architectures that belong to domain or cross-domain centralized E/E architecture types, transitioning from distributed to domain control or cross-domain control; the communication architecture employs core high-speed CAN backbone buses and has online upgrade capabilities for software.

3) Tesla is the most advanced, with the Model 3 adopting a centralized E/E architecture, equipped with an onboard computer (CCM) and three domain controllers, self-developed operating systems, enabling OTA for the entire vehicle, and incorporating some Ethernet.

Major automakers are accelerating the deployment of new E/E architectures. According to Zosi Automotive Research, BMW’s next-generation E/E architecture will develop a universal software framework based on a hybrid of Classic AutoSAR and Adaptive AutoSAR, creating its own operating system; in terms of hardware, it is also gradually modularizing and integrating to form a new central centralized E/E architecture that is upgradable, expandable, reusable, and portable, expected to achieve mass production by 2021.

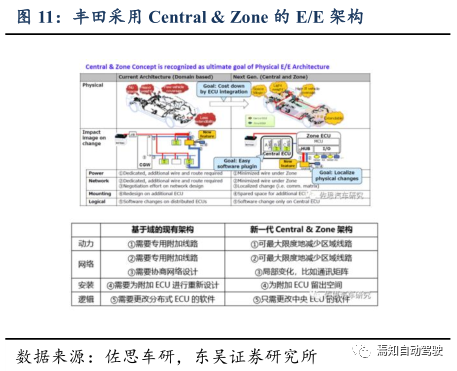

Additionally, Volkswagen’s ID.3 will be equipped with a new E/E architecture called E3, achieving cross-domain integrated architecture, with mass production expected in 2020, still lagging behind Tesla’s generation. Toyota will adopt a central + zone E/E architecture solution; General Motors’ new generation E/E architecture Global B will be mounted on the new Cadillac CT5, still being a domain centralized E/E architecture.

Moreover, Tier 1 suppliers/technology companies such as Aptiv and Huawei are also deploying E/E architectures. Aptiv officially launched its new SVA architecture in January 2020 and plans to achieve a semi-centralized architecture by 2022 and a centralized architecture by 2025.

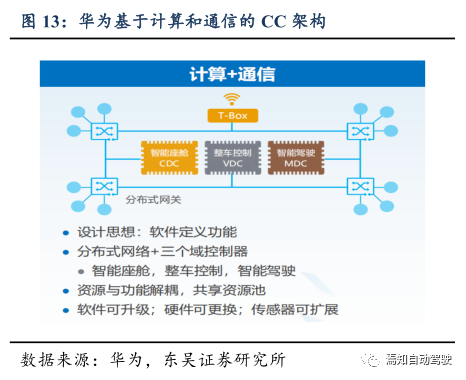

Huawei proposes a CC architecture based on computing and communication, consisting of distributed networks and three major domain controllers for intelligent cockpit, vehicle control, and intelligent driving. Additionally, Continental and Bosch are also proposing next-generation E/E architectures.

4.2. How is the Autonomous Driving Industry Landscape Reshaping?

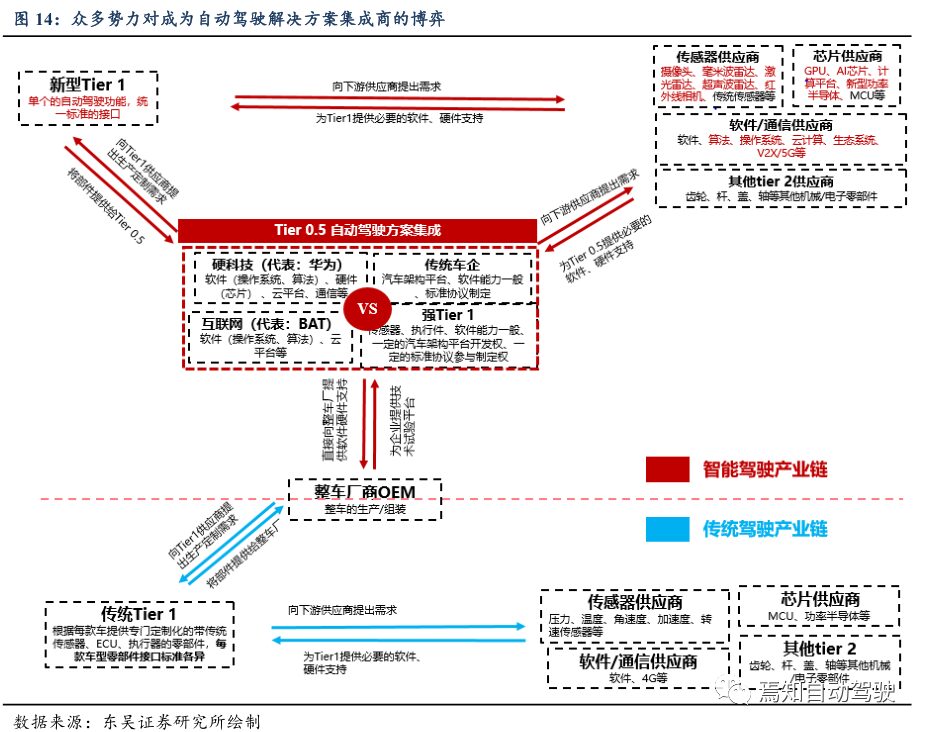

The traditional driving industry chain is dominated by vehicle manufacturers, with prominent binding cooperative relationships among various suppliers. The traditional driving industry chain is primarily led by vehicle manufacturers, with traditional Tier 1 suppliers customizing products including traditional sensors, black-box ECUs (not disclosing product architecture), and execution mechanisms based on the design requirements of each vehicle model. Core secondary components come from their long-term cooperative Tier 2 suppliers.

Due to the differing overall electronic and electrical architectures of each vehicle model, the various components, especially in terms of software interface standards and protocols, differ, leading to significant redundant development and design needs. Some components even exhibit software and hardware incompatibility, making the binding cooperative relationships among suppliers particularly pronounced.

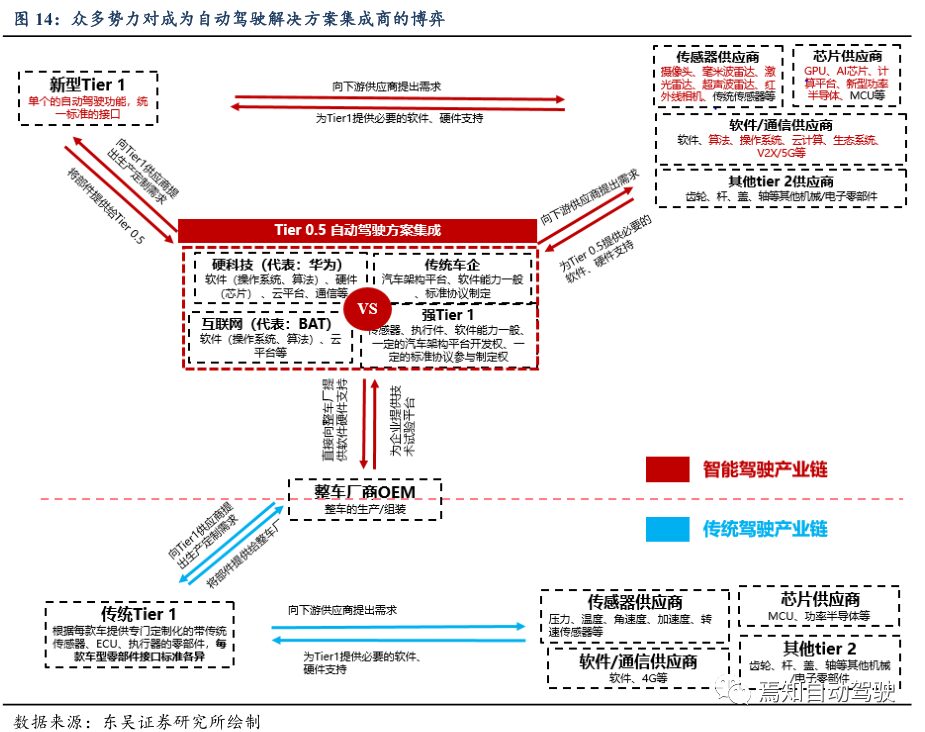

Many forces are vying for the Tier 0.5 position in the intelligent driving industry chain. In this competition, several prominent forces include: main engine factories, strong Tier 1 suppliers, hard technology, and the internet. Traditional upstream component manufacturers seek to extend downward to enhance their influence, while downstream main engine factories seek to extend upward to avoid becoming mere OEMs. Hard technology and internet companies, leveraging their advantages in hardware chips, software, and algorithms, are aggressively entering the intelligent driving industry chain, competing for the Tier 0.5 position as integrators of autonomous driving solutions.

The competition among Tier 0.5 suppliers essentially boils down to the battle for defining E/E architecture. We believe that currently, main engine factories, strong Tier 1 suppliers, hard technology, and the internet all have their respective advantages and disadvantages in this competition for defining automotive electronic and electrical architectures.

1) Main engine factories are the standard protocol definers of the traditional automotive industry chain, possessing mature automotive modular architecture platforms and comprehensive R&D, production, and supply chain systems, but generally have weak software development capabilities.

2) Strong Tier 1 suppliers provide advantages in sensor and actuator offerings, although lacking in operating systems and core algorithm development capabilities, they possess certain software and hardware development capabilities. Additionally, their long-term cooperative relationships with main engine factories give them some automotive architecture platform development capabilities and standard protocol customization rights.

3) Hard technology companies, such as Huawei, have strong operating system and core algorithm development capabilities, as well as advantages in decision-making hardware chips/computing platforms, and communication and cloud platforms. However, their cooperation with automotive manufacturers has been relatively limited in the short term, resulting in a lack of experience in hardware integration development for automobiles, but their overall advantages are prominent.

4) Internet companies possess strong operating system and core algorithm development capabilities, along with advantages in cloud platforms, but are somewhat lacking in hardware computing platforms, communication, and software/hardware integration. We believe that in the current competition for defining E/E architecture, the short-term advantages lie with main engine factories and strong Tier 1 suppliers, while in the long term, hard technology and main engine factories may emerge as the final competitors.

5

Who Will Benefit from the Autonomous Driving Industry Dividend?

By 2025, beneficiaries of the autonomous driving industry dividend are expected to exceed 200 billion:

1) In the traditional industry chain, companies relying on product upgrades or new business expansions will see increases in single vehicle value, benefiting targets include [Desay SV+Four-Dimensional Map+Bertel+Xingyu Co.+Coboda+Jiangsu Electronic].

2) Hard technology and internet giants leverage their advantages in chips/software algorithms/communication to enter the autonomous driving field, benefiting targets include [Huawei+Baido+Alibaba+Tencent].

3) Main engine factories enhance product customer experience through autonomous driving upgrades, thereby gaining higher market share.

5.1. Desay SV

Desay originated from Central European Electronics, infused with German cultural elements, and is now controlled by the state-owned assets supervision and administration commission of Huizhou.

Three major product modules: core business of intelligent cockpit (over 90% of revenue), strategic business of intelligent driving + connected services.

Core business model: connecting pure software with the needs of main engine factories, acting as an intermediary, requiring integrated capabilities of software and hardware.

Core competitiveness: continually increasing R&D investment to build technical barriers while ensuring excellent manufacturing processes and cost control capabilities. Due to the downturn in domestic passenger vehicle demand and continued investment in strategic business R&D, the performance entered a downturn cycle in 2018-2019.

Intelligent cockpit business: acceleration of domestic substitution + multi-screen upgrade, with volume and price expected to rise. Desay positions itself as a midstream level one supplier in the intelligent cockpit industry chain, with a global market share of 4% in in-vehicle entertainment systems (primarily central control screens) and approximately 13.9% in domestic in-vehicle information entertainment systems (central control screens + software solutions).

The core growth logic of Desay’s intelligent cockpit business is:

1) Leveraging technology + cost + customer advantages to accelerate the domestic substitution of in-vehicle entertainment systems, gradually eliminating tail-end competitors, with market share expected to continue rising.

2) The integration of multiple screens with one chip, transitioning from distributed discrete control to highly integrated cockpit domain control, is the most important upgrade direction for the intelligent cockpit. Downstream main engine factories are still in the process of developing their own capabilities, which presents a good time window for Desay’s growth.

Strategic business: ADAS products are ramping up production, and connected vehicle platforms are actively being promoted. Desay established its ADAS business unit in 2016, producing 360-degree high-definition surround systems + fully automatic parking systems + 24G/77G millimeter-wave radar, which are expected to become new profit points in the next three years.

In 2019, the company secured a platform project for next-generation fully automatic parking and valet parking products from leading domestic automakers. The 360-degree high-definition surround system has been mass-produced in multiple models; the 77G millimeter-wave radar has received orders from independent brand automakers. By 2020, the L3 autonomous driving domain controller is expected to be mass-produced on the Xiaopeng P7.

With the commercial rollout of 5G and policies from 11 ministries promoting the development of smart cars, V2X connected vehicle applications are accelerating. Desay established its connected vehicle business unit in 2018, with T-Box + V2X + connected vehicle platforms gradually being commercialized. By 2019, T-Box products have been mass-produced in multiple models; V2X products have received project designations from joint venture brand automakers, with mass production planned for 2020.

5.2. Xingyu Co.

Xingyu Co. is a leading domestic car light manufacturer, providing solutions and complete car light assemblies by connecting chips, modules, and the needs of main engine factories. The single vehicle value of car lights ranks just below that of engines, gearboxes, and seat assemblies. Xingyu focuses heavily on the car light business, with nearly 90% of revenue coming from car lights, supplying major domestic automakers such as FAW-Volkswagen, FAW-Toyota, and Shanghai Volkswagen.

The car light industry has significant potential for import substitution, benefiting from LED and intelligent upgrades. The car light industry has high technical barriers and concentration levels, with the international car light market dominated by five major giants: Koito, Stanley, Hella, etc., accounting for nearly 60% market share. The domestic market shows a pattern of one strong player and multiple strong competitors, with Huayu Vision’s market share at approximately 28% following its acquisition of Shanghai Koito, while Xingyu, Stanley, Hella, and Valeo each hold around 10% market share.

By leveraging technological advancements, cost control, and rapid response, Xingyu has emerged as the strongest competitor against foreign manufacturers in China, with significant potential for market share growth. Technological advancements push car lights to upgrade from halogen lights to xenon lights to LED lights, increasing single vehicle value. Driven by safety concerns, consumers are willing to pay for upgrades, prompting automakers to actively enhance the penetration of intelligent car lights (such as AFS and ADB systems).

Customer expansion + product upgrades + capacity expansion are expected to steadily improve gross margins. Xingyu is actively penetrating Japanese and luxury customers, having secured orders from luxury brands such as BMW, Audi, Volvo, Jaguar Land Rover, and Beijing Benz since 2016, achieving an upgrade in its customer structure from independent to joint venture to luxury.

Additionally, the ADB intelligent front light system supplied to FAW Car is entering mass production, with single vehicle value increasing twofold compared to ordinary LED lights. Xingyu’s overseas expansion began in 2019, with plans to establish a production base in Serbia with an annual capacity of 570 car lights, expected to partially commence production in 2021. This overseas factory is expected to further penetrate mid-to-high-end customers like ABB and enhance profitability.

5.3. Four-Dimensional Map

Four-Dimensional Map is a leading navigation map supplier in China. The company is committed to the fields of mapping, autonomous driving, chips, location big data services, and vehicle networking. In the mapping sector, Four-Dimensional Map is the only national-level enterprise created by the National Administration of Surveying, Mapping, and Geoinformation, and after years of innovation, its navigation maps rank first in China and fifth globally.

Navigation & ADAS Business: Mass production of L3 maps is expected to see long-term growth. In 2019, Four-Dimensional Map’s navigation/ADAS business achieved revenues of 830 million/100 million yuan, respectively, with year-on-year increases of 7.2%/96.5%, accounting for 36.0%/4.5% of total revenue. The navigation business mainly includes map data, data compilation, and navigation software.

The ADAS business products mainly include ADAS maps, HD map data, high-precision positioning products, and comprehensive ADAS solutions. Four-Dimensional Map has the capability for mass production of L3 autonomous driving high-precision maps and is entering the near-mass production stage for L4. In February 2019, Four-Dimensional Map signed an agreement with BMW to provide Level 3 and above autonomous driving map products and related services for BMW Group’s brands sold in China from 2021 to 2024, marking the first order for L3 and above autonomous driving maps in China, showcasing the company’s leading position in mapping.

Other Businesses: Location big data, vehicle networking, and chips continue to achieve breakthroughs, further enhancing the intelligent connected ecosystem. In 2019, the vehicle networking/chips/location big data businesses achieved revenues of 700 million/410 million/240 million yuan, with year-on-year increases of 28.5%/29.2%/36.6%, accounting for 30.2%/17.7%/10.4% of total revenue. In the vehicle networking sector, the jointly-owned company Four-Dimensional Intelligence is driven by big data/AI to enhance ecosystem resource integration, creating a universal vehicle networking cloud platform and service components.

In terms of chips, IVI chips have gained certain advantages in the aftermarket and continue to expand their market share in the front-mounted market; the AMP vehicle power electronics chip shipment volume continues to rise; MCU and TPMS chips achieved mass production at the end of 2018 and 2019, respectively. In the area of location big data services, three-dimensional visualization and analysis capabilities are continuously improving, and the sensor cloud platform can support massive in-vehicle sensor data and autonomous driving data access and governance, providing data, algorithm models, and application support for autonomous driving applications.

5.4. Bertel

Bertel is a manufacturer focusing on automotive braking system-related products. The company’s revenues from disc brakes/electronic braking products/lightweight braking components account for 43%/28%/23%, respectively. While maintaining its advantages in disc brakes, the company is actively expanding its electronic braking product offerings (EPB, ABS, ESC) and lightweight braking components. With high cost-performance ratios, technological advancements, and rapid response capabilities, the company has seized good development opportunities in import substitution.

Domestic substitution + mass production of electronic braking systems are expected to drive rapid growth in electronic braking business. Bertel became the first domestic manufacturer to mass-produce EPB in 2012, leading the domestic independent brand market, with foreign competitors including Bosch, Continental, and ZF, while domestic competitors include Libang Hexin (main clients being Zotye and Leopard) and Asia-Pacific Co. (mass production in 2019).

With increasing penetration rates among existing clients such as Geely, Chery, and Changan, along with continuous expansion into joint venture brands like Dongfeng Nissan, the EPB business is expected to maintain steady growth. The line control braking system (WCBS) is a core component for L2 and above autonomous driving execution ends, with a single vehicle value of approximately 2,000 yuan, about twice that of EPB. According to the 2019 annual report, Bertel’s line control braking system (WCBS) completed its new product launch in July 2019, receiving unanimous praise from clients.

Lightweight products are being rolled out overseas, with long-term growth potential. Bertel’s aluminum lightweight braking components have been recognized by internationally renowned automakers like General Motors, Volvo, and Ford, with the supply order signed with General Motors in early and late 2019 covering a total lifecycle value of 1.8 billion yuan.

5.5. Junsheng Electronics

Junsheng is a leading global automotive parts supplier. In 2019, the company’s automotive safety, automotive electronics, functional components, and intelligent vehicle networking businesses achieved revenues of 47.07 billion/7.48 billion/3.84 billion/2.69 billion yuan, respectively, with year-on-year increases of 9.7%/18.8%/7.0%/-8.2%, accounting for 77.1%/12.2%/6.3%/4.4% of total revenue, serving mainstream domestic and foreign automakers.

Since 2011, the company has achieved its strategic objectives of globalization and transformation through international acquisitions of German PREH (automotive electronics), German IMA (robotics), German QUIN (automotive parts), American KSS, and Japanese Takata (automotive safety systems).

Based in the automotive safety field, Junsheng is rapidly implementing electronic and intelligent vehicle networking solutions, with synergistic effects gradually emerging. In the safety business, Junsheng primarily offers active safety (ADAS products) and passive safety (airbags, etc.), and through the construction of four major regional “super factories” globally, it accelerates the integration of global resources and optimizes capacity layout to achieve cost reduction and efficiency enhancement.

In the electronics business, Junsheng provides HMI, new energy vehicle electronics, etc., with clients including Volkswagen, BMW, Mercedes-Benz, Ford, General Motors, and other globally renowned automakers. In the intelligent vehicle networking business, Junsheng integrated Ningbo Pruy Intelligent Vehicle Networking and German Pruy Vehicle Networking into a new Junsheng Vehicle Networking Division in December 2019, providing entertainment systems, navigation systems, and vehicle networking products and software.

5.6. Coboda

Coboda is a leading domestic manufacturer of automotive intelligent and energy-saving electronic components. In 2019, its lighting control systems/vehicle electrical and electronic/electronic control systems achieved revenues of 1.55 billion/650 million/510 million yuan, with year-on-year increases of 11.7%/24.1%/-15.9%, accounting for 53%/23%/18% of total revenue. Coboda supplies dozens of well-known domestic and foreign automakers, with nearly 35% of revenues coming from overseas.

In the field of lighting controllers, Coboda is a global leader, benefiting from category expansion and customer expansion. Coboda holds over 10% market share in the lighting control field, ranking among the top three globally. The core logic for Coboda’s business growth includes:

1) The LED + intelligent upgrade in the car light industry presents wide development prospects for Coboda;

2) The company has ample orders on hand, with rapid growth expected. According to the 2019 annual report, Coboda secured 66 new project designations throughout the year, including its first global project designation for the main light source controller from Ford and entering the North and South Volkswagen systems for its electric vehicle cooling system controller project.