First, let’s set a small goal: an average revenue of 1 million per person.

Author| Wang Yutong

Editor| Huochai Q

In the AIoT track, there is a “small goal” that everyone is secretly striving for—an average annual revenue of 1 million per person. Don’t underestimate this goal; a detailed analysis of market players shows that very few achieve it. From the Internet to the Internet of Things, a single word difference leads to vastly different revenue potentials. The revenue myth of the Internet has been validated by companies like Google, Facebook, and Alibaba, but replicating the Internet’s miracle in the Internet of Things faces multiple real-world challenges:Physical environment and terminal diversity;Non-standard products are difficult to replicate;Uncontrollable deployment and maintenance costs… Ultimately, companies often end up doing a lot of hard work without making a profit. How can we ensure that terminal devices operate well in dispersed and variable environments? How can we reduce excessive investment in services and maintenance? How can we move from product usability to scalable replication? These are common challenges faced in the AIoT data intelligence track. Today’s protagonist is a young company—Whale. In a not-so-optimistic market, Whale, established only a year and a half ago with a team of about 100 people, achieved tens of millions of RMB in revenue in the first half of 2019, a 1000% increase compared to the second half of 2018, with an average revenue close to 1 million per person. Although it is still early to estimate this figure at Whale’s current stage, their development has already begun to show a rare characteristic in the non-standard technical service industry—high human efficiency. The rapid growth in revenue is attributed to Whale’s chosen business model and its experience in creating standardized products in a non-standard industry. In simple terms, Whale’s business is to transfer the online advertising model to offline scenarios, connecting consumers, brand owners, and scene providers (supermarkets, shopping malls, banks, hotels, etc.) that control foot traffic, using AIoT data intelligence technology to create a marketing content distribution platform in the Internet of Things. Whale has achieved an 80% productized + 20% customized product form, initially finding a balance between scalable profitability and customer demand, and has already acquired over 20 large brand clients including Procter & Gamble, Unilever, AB InBev, and Watsons. This article features an in-depth interview with Whale’s founding team, brand clients, ecological partners, and investors, revealing Whale’s thoughts and experiences in establishing an “Internet of Things marketing content distribution platform.” With a clever entry point and a clear productization approach, this young company attempts to prove that AIoT technical services do not have to be so laborious.

1. Replicating the Most Profitable Model of the Internet

In August 2018, Watsons held the HWB Health and Beauty Awards in Guangzhou. Popular celebrities, fashion icons, beauty industry suppliers, and many well-known fast-moving consumer goods brands including Procter & Gamble, Unilever, L’Oréal, and Henkel were present. However, the most eye-catching feature of the day was the smart shelf display area, which occupied a quarter of the venue. In 2018, Watsons HWB, Whale’s shelf attracted a crowd What captivated everyone was a novel interactive shopping experience. For example, when a girl approaches the shelf and picks up a L’Oréal lipstick in a nude shade, the embedded sensor in the shelf captures this action and plays related promotional, try-on videos, and reviews that L’Oréal has placed in the system; when she picks up another lipstick in a darker shade, all marketing content adjusts accordingly; when she hesitates about which one to buy, the screen may promptly push promotional information: two for 30% off. Great, I’ll take them both. Behind this natural interaction, the smart shelf completed a series of operations including facial recognition, emotion capture, path tracking, gravity sensing, content distribution, AR interaction, and promotional decision-making seamlessly.

In 2018, Watsons HWB, Whale’s shelf attracted a crowd What captivated everyone was a novel interactive shopping experience. For example, when a girl approaches the shelf and picks up a L’Oréal lipstick in a nude shade, the embedded sensor in the shelf captures this action and plays related promotional, try-on videos, and reviews that L’Oréal has placed in the system; when she picks up another lipstick in a darker shade, all marketing content adjusts accordingly; when she hesitates about which one to buy, the screen may promptly push promotional information: two for 30% off. Great, I’ll take them both. Behind this natural interaction, the smart shelf completed a series of operations including facial recognition, emotion capture, path tracking, gravity sensing, content distribution, AR interaction, and promotional decision-making seamlessly.  Whale’s smart shelf prepared this display for the event, despite being only half a year old and having a team of just 20 people. The impressive demo helped Whale open up the market. They received orders from several Fortune 500 retail brands and ultimately secured a batch of benchmark clients. Breaking down the value provided by Whale’s products, it essentially replicates the most profitable business model of the Internet within the Internet of Things: a marketing content distribution platform. To understand the similarity between online and offline scenarios, we can compare it to e-commerce platforms like Taobao: If we imagine Taobao as a large shopping mall, its initial business model was to charge store owners “rent” and service fees; however, with the accumulation of massive online consumer behavior data and the full exploitation of data value through technologies like AI, a significant portion of Taobao’s current revenue actually comes from product and store recommendations and various UGC and PGC content distribution marketing services, with paying parties including fast-moving consumer goods brands and Taobao store owners. This business model has brought substantial revenue to online e-commerce, but in the past, similar marketing value was difficult to fully exploit in offline physical spaces like large shopping malls or convenience stores. This is because previous technologies could not perceive and collect offline consumer behavior data at low costs, lacking a basis for precise marketing decision-making; secondly, the retail industry is highly fragmented, making it difficult to form monopolistic traffic oligopolies, thus the scale effect of marketing services is relatively weak. These two obstacles have provided opportunities for AIoT data intelligence players like Whale. Opportunities arise from new technologies: the Internet of Things, sensors, data intelligence, recommendation algorithms, and other cutting-edge technologies have brought fresh air to offline scenarios. On the other hand, the fragmented commercial landscape also provides more opportunities for third-party marketing content distribution platforms that connect brand owners and scene providers, unlike platforms like Taobao and Facebook that have their own platforms and do their own marketing, forming a closed loop of traffic business. Whale has certain advantages in doing this.The founding team of this company comes from one of the most successful advertising and marketing companies globally, Facebook. CEO Ye Shengxuan worked in Facebook’s Feed Ranking & Data department for three years, creating and managing the world’s largest machine learning ranking data pipeline platform, and is an expert in recommendation, ranking, and prediction systems; CTO Wang Zun was responsible for advertising products and data frameworks in Facebook’s Feed Ads department; CDO Xie Shukun was in charge of data operations in Facebook’s Feed Machine Learning department. COO Chen Andi, from McKinsey, has rich experience in digital retail transformation, balancing the team’s technical and industry knowledge. Ye Shengxuan, CEO of Whale, compared to “Jiazi Guangnian”:“Assuming a store has a foot traffic of 1,000 per hour, that’s at least 10,000 a day, and a city has at least 1,000 convenience stores, that’s 10 million foot traffic a day. An app with 10 million daily active users, what does that mean?” This is a good story:Replicating the most successful business model of the Internet within the Internet of Things. But as the saying goes, “What grows in Huainan is orange, what grows in Huaibei is bitter orange.” Can the Internet’s traffic + marketing methods work in the Internet of Things?

Whale’s smart shelf prepared this display for the event, despite being only half a year old and having a team of just 20 people. The impressive demo helped Whale open up the market. They received orders from several Fortune 500 retail brands and ultimately secured a batch of benchmark clients. Breaking down the value provided by Whale’s products, it essentially replicates the most profitable business model of the Internet within the Internet of Things: a marketing content distribution platform. To understand the similarity between online and offline scenarios, we can compare it to e-commerce platforms like Taobao: If we imagine Taobao as a large shopping mall, its initial business model was to charge store owners “rent” and service fees; however, with the accumulation of massive online consumer behavior data and the full exploitation of data value through technologies like AI, a significant portion of Taobao’s current revenue actually comes from product and store recommendations and various UGC and PGC content distribution marketing services, with paying parties including fast-moving consumer goods brands and Taobao store owners. This business model has brought substantial revenue to online e-commerce, but in the past, similar marketing value was difficult to fully exploit in offline physical spaces like large shopping malls or convenience stores. This is because previous technologies could not perceive and collect offline consumer behavior data at low costs, lacking a basis for precise marketing decision-making; secondly, the retail industry is highly fragmented, making it difficult to form monopolistic traffic oligopolies, thus the scale effect of marketing services is relatively weak. These two obstacles have provided opportunities for AIoT data intelligence players like Whale. Opportunities arise from new technologies: the Internet of Things, sensors, data intelligence, recommendation algorithms, and other cutting-edge technologies have brought fresh air to offline scenarios. On the other hand, the fragmented commercial landscape also provides more opportunities for third-party marketing content distribution platforms that connect brand owners and scene providers, unlike platforms like Taobao and Facebook that have their own platforms and do their own marketing, forming a closed loop of traffic business. Whale has certain advantages in doing this.The founding team of this company comes from one of the most successful advertising and marketing companies globally, Facebook. CEO Ye Shengxuan worked in Facebook’s Feed Ranking & Data department for three years, creating and managing the world’s largest machine learning ranking data pipeline platform, and is an expert in recommendation, ranking, and prediction systems; CTO Wang Zun was responsible for advertising products and data frameworks in Facebook’s Feed Ads department; CDO Xie Shukun was in charge of data operations in Facebook’s Feed Machine Learning department. COO Chen Andi, from McKinsey, has rich experience in digital retail transformation, balancing the team’s technical and industry knowledge. Ye Shengxuan, CEO of Whale, compared to “Jiazi Guangnian”:“Assuming a store has a foot traffic of 1,000 per hour, that’s at least 10,000 a day, and a city has at least 1,000 convenience stores, that’s 10 million foot traffic a day. An app with 10 million daily active users, what does that mean?” This is a good story:Replicating the most successful business model of the Internet within the Internet of Things. But as the saying goes, “What grows in Huainan is orange, what grows in Huaibei is bitter orange.” Can the Internet’s traffic + marketing methods work in the Internet of Things?

2. New Value Brought by AIoT

Is a convenience store visited by 10 million people a day really similar to an app with 10 million daily active users? Actually, there are significant differences between the two.The first difference is the network effect.

The network effect refers to the increase in marginal returns of the network as new nodes join, and the already joined nodes serve as examples for those not yet joined. For example, in e-commerce platforms, the larger the scale, the higher the efficiency of matching buyers and sellers, and more buyers and sellers attract each other, leading to continuous expansion of the network scale, gradually forming monopolies and oligopolies; however, currently, it seems difficult to have a “network effect” in the Internet of Things: scene providers and brand owners are relatively dispersed and independent, making it difficult for nodes to influence each other. The second difference is the strength of the relationship between content distributors and users. In the Internet world, PCs, smartphones, and other information terminals are personal items, allowing marketing content distribution platforms to directly reach individual consumers. In contrast, the terminals of the Internet of Things are screens, sensors, etc., embedded in B-end scenarios like shopping malls, elevators, and buildings, meaning that companies like Whale, as marketing content distribution platforms, face a layer of scene providers before reaching C-end consumers—it is challenging to scale quickly. This makes the Internet of Things unable to simply mimic the logic of the Internet. However, in terms of marketing content distribution, the Internet of Things has new imaginative space. First, the growth potential is enormous: According to the Yiou “2018 Offline Big Data Industry Application Research Report,” if we include the catering industry, currently 80% of consumer behavior still occurs offline; and in high-value categories like beauty and jewelry, the proportion of offline sales is particularly high. Currently, offline sales behavior has only achieved 7% digitization, indicating vast development space. Second, giants do not have absolute advantages, and new large-scale companies may emerge: This is like someone who is used to running on land having to go into the water; the vast physical world, which previously had low levels of informatization and digitization, is an unknown territory for players of all sizes.Third, scene providers will also benefit from this: To distribute electronic marketing content in the physical world, it is necessary to deploy sensors and screens in retail venues, banks, and other channel scenarios, which accumulates behavioral data for these physical spaces and brings new interactive experiences—this investment can not only help fast-moving consumer goods brands advertise but is also very valuable for the retail venues, banks, and other scene providers. Considering the comprehensive differences between online and offline, Whale has explored a business model that is slightly different from the Internet marketing content distribution platform: As of today, the typical Internet advertising model is to provide services to consumers for free, charging brand owners for advertising fees, “the wool comes from the pig.” In contrast, Whale’s services are free for both consumers and scene providers— primarily installing smart screens in retail venues, banks, hospitals, etc., for free, and ultimately charging brand owners for revenue. This brings value to the three main roles in offline commerce: Value for consumers:

New interactive experiences, precise promotional information, and assistance in purchasing decisions.

Value for brand owners:

Precise marketing content delivery, promoting consumer purchasing behavior, ultimately increasing overall revenue.

Value for scene providers:

Data services including user profile analysis, foot traffic analysis, operational decision support; enhancing consumer attraction with smart interactive screens.

In this model, due to the dispersed nature of Internet of Things scenarios, Whale is unlikely and does not need to obtain data from scene providers and brand owners; however, in the process of processing and analyzing large amounts of data, Whale can iterate products and gain industry insights, thus more efficiently managing content distribution. In specific industries, Whale emphasizes utilizing existing resources. Ye Shengxuan told “Jiazi Guangnian”: “What we want to do is connect online and offline data, not abandon the already mature online data and start from scratch offline.” In terms of client selection, Whale adopts the “80/20 rule”: focusing 80% of its efforts on serving international big brands like Procter & Gamble, Unilever, and high-value products in beauty—large brands and companies in high-value categories care more about consumer shopping experiences: Dior spends millions designing offline TV content; L’Oréal invests heavily in acquiring AR company ModiFace; giants are more receptive to the idea of using technology to gain deep insights into consumer behavior. Thus, by integrating online and offline data and mastering consumer behavior, while distributing content based on behaviors like dwell time, picking up products, and selection, Whale has formed a data closed loop of “online behavior – offline behavior – marketing content effect feedback” and a commercial closed loop of “brand owner – Whale – scene provider – consumer“, finding a unique entry point in the AIoT data intelligence track and establishing its product.

3. Three Layers of Product and Content Ecosystem

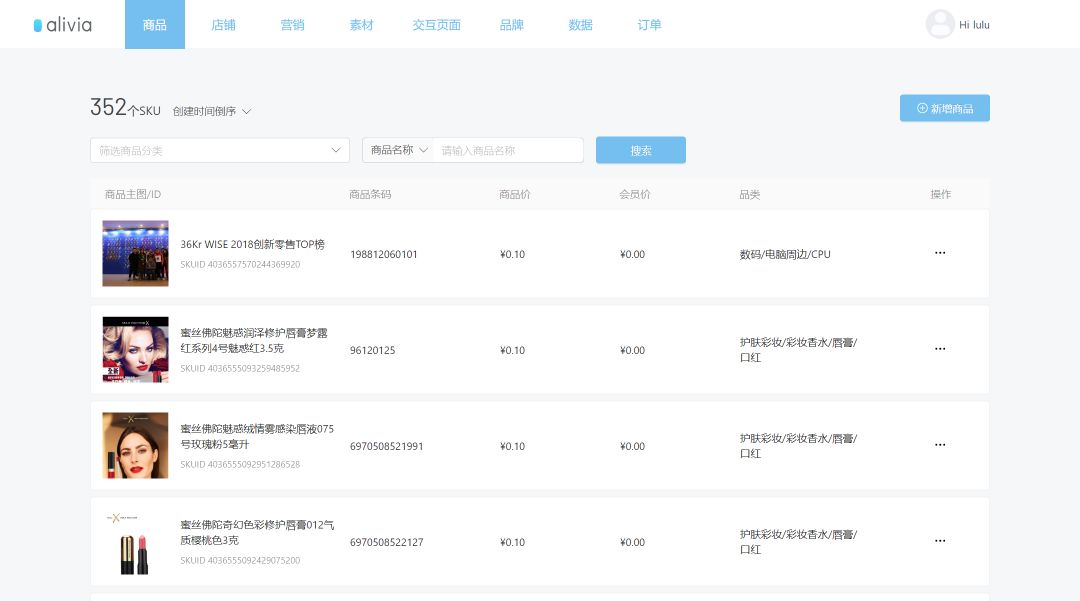

“Jiazi Guangnian” has previously summarized that technology companies face three checkpoints for implementation:Technical validation, product validation, and mass production validation. Whale is currently at the critical point between product validation and mass production validation: the product has been implemented and has won benchmark clients like Procter & Gamble and Unilever, and the next question is how to scale replication. From the results, Whale has performed well. In the first half of this year, its revenue grew over 1000%, thanks to Whale’s “80% productization + 20% customization” clear product strategy. Among them, 80% productization has three levels. First, the upper layer of hardware devices. This includes visible smart shelves with screens, Whale Hub (commercial-grade AIoT edge computing unit), and invisible sensors, cameras, etc., which clients can choose and combine based on their different needs. Second, the middle application layer. Whale has launched the “Alivia Morning Platform” for brand clients. Brand owners can view deployed content, feedback data in real-time on a simple interface, and update content based on recommended optimization strategies, achieving remote unified management of content materials, information flow, and data.  Alivia Morning Platform interface In terms of data applications for scene providers, Whale has also launched standard modules covering sales funnel tracking, conversion rate analysis, space efficiency analysis, and trial analysis. Third, the underlying technology standardization. Whale has developed its own AIoT technology development solution, which has been integrated into Whale’s new product Whale Hub launched in May this year, enabling rapid implementation of new AIoT functions. For example, Whale’s own facial access control system was hacked together by the Whale team using their AIoT product solution in one night. The 20% customization part mainly involves content operations. “For example, on Douyin, users can watch a 30-second video or a 3-minute video online; but offline, you must attract consumers within 10 seconds.” Ye Shengxuan told “Jiazi Guangnian” that there are significant psychological and physical differences (screens, interaction methods, etc.) between online and offline content, and offline cannot simply replicate online, which requires Whale to effectively connect content providers and brand owners. Currently, Whale has established partnerships with several short video MCN organizations (economic organizations for influencers and content creators; or group content creation organizations) to invite them to create suitable content for offline scenarios. For example, in the recent “Shanghai Waste Sorting” hot topic, AB InBev’s Corona beer, with Whale’s help, executed a brilliant offline marketing campaign.

Alivia Morning Platform interface In terms of data applications for scene providers, Whale has also launched standard modules covering sales funnel tracking, conversion rate analysis, space efficiency analysis, and trial analysis. Third, the underlying technology standardization. Whale has developed its own AIoT technology development solution, which has been integrated into Whale’s new product Whale Hub launched in May this year, enabling rapid implementation of new AIoT functions. For example, Whale’s own facial access control system was hacked together by the Whale team using their AIoT product solution in one night. The 20% customization part mainly involves content operations. “For example, on Douyin, users can watch a 30-second video or a 3-minute video online; but offline, you must attract consumers within 10 seconds.” Ye Shengxuan told “Jiazi Guangnian” that there are significant psychological and physical differences (screens, interaction methods, etc.) between online and offline content, and offline cannot simply replicate online, which requires Whale to effectively connect content providers and brand owners. Currently, Whale has established partnerships with several short video MCN organizations (economic organizations for influencers and content creators; or group content creation organizations) to invite them to create suitable content for offline scenarios. For example, in the recent “Shanghai Waste Sorting” hot topic, AB InBev’s Corona beer, with Whale’s help, executed a brilliant offline marketing campaign. Corona’s classic drinking method People who love Corona usually put a slice of lime in the bottle, but lime is wet waste, and the bottle is dry waste, leading to the problem of not being able to separate the lime slice after drinking, complicating the sorting process. To capitalize on this hot topic, the brand placed interactive content on the screen of the shelf selling Corona, teaching people to use 1/16 of a lime with Corona, making it easy to sort after drinking. This changed the previous static shortcomings of offline marketing that were insulated from hot topics. After this campaign, the dwell time of consumers in front of the Corona shelf increased by 5 times. The long-ignored value of offline traffic and data has become prominent at this time. Following the 80% productization and 20% customization approach, Whale currently focuses on two ends:Brand owners and underlying technology while fully opening the middle link to hardware suppliers, content providers, and other partners. This also lays the foundation for Whale’s future vision—”building an offline marketing content ecosystem.” Whale’s COO Chen Andi stated: “Whale is like the iPhone; we provide hardware and systems, and third parties can develop apps or produce content around offline marketing, content, and behavior analysis on our underlying technology, enhancing the consumer experience together.” This will also bring new changes to the content ecosystem, and the next Douyin or Kuaishou may emerge in the Internet of Things field.

Corona’s classic drinking method People who love Corona usually put a slice of lime in the bottle, but lime is wet waste, and the bottle is dry waste, leading to the problem of not being able to separate the lime slice after drinking, complicating the sorting process. To capitalize on this hot topic, the brand placed interactive content on the screen of the shelf selling Corona, teaching people to use 1/16 of a lime with Corona, making it easy to sort after drinking. This changed the previous static shortcomings of offline marketing that were insulated from hot topics. After this campaign, the dwell time of consumers in front of the Corona shelf increased by 5 times. The long-ignored value of offline traffic and data has become prominent at this time. Following the 80% productization and 20% customization approach, Whale currently focuses on two ends:Brand owners and underlying technology while fully opening the middle link to hardware suppliers, content providers, and other partners. This also lays the foundation for Whale’s future vision—”building an offline marketing content ecosystem.” Whale’s COO Chen Andi stated: “Whale is like the iPhone; we provide hardware and systems, and third parties can develop apps or produce content around offline marketing, content, and behavior analysis on our underlying technology, enhancing the consumer experience together.” This will also bring new changes to the content ecosystem, and the next Douyin or Kuaishou may emerge in the Internet of Things field.

4. Opportunities Noticed by Giants

On the road to realizing the offline content ecosystem, Whale has achieved some “small goals.” Since this year, Whale has expanded from its initial retail scenarios to broader commercial fields, entering hospitals, hotels, schools, and more scenarios. On May 9 of this year, Whale launched the integrated hardware and software edge computing device Whale Hub, which provides a hybrid AI computing engine, unified real-time processing API, various recognition, analysis, interaction algorithms, and models, and allows simultaneous access to 1,000 sensors and 2 cameras, freeing developers from the complex tasks of building edge AI systems to focus on application layer development, which is the customization part. Commercial-grade edge computing unit Whale HubYe Shengxuan told “Jiazi Guangnian” that the motivation behind building the AIoT platform and launching Whale Hub is Whale’s consistent technical value view:Not to get lost in flashy technology, but to use technology to solve problems. However, based on current customer feedback, products from Whale and other AIoT data intelligence companies still face some customer experience bottlenecks that affect problem-solving, including “high offline operation costs” and “digitalization not integrating into business.” A technical department head from a large comprehensive shopping mall that introduced various smart shelf products told “Jiazi Guangnian” that they encountered high training costs and difficulties in subsequent operations: “Sales clerks in shopping malls generally have no technical background, and asking them to scan this and sense that… training clerks is very troublesome; therefore, to achieve offline digitization, we need technology companies to work with us to find the optimal closed-loop solution and best processes to reduce overall operation costs.” Digitalization not integrating into existing business processes is a product design issue. Good experience design pursues “zero perception,” subtly integrating into the process. The current situation is that many companies have produced a lot of products, but the processes are not optimized enough, leading to clerks or consumers having to scan and recognize multiple times, making it impossible to seamlessly connect identity reading, payment, and member acquisition, which instead creates resistance among consumers.Although the road ahead is difficult, the entire AIoT data intelligence market is heating up, with increasing public attention and various players entering the field.

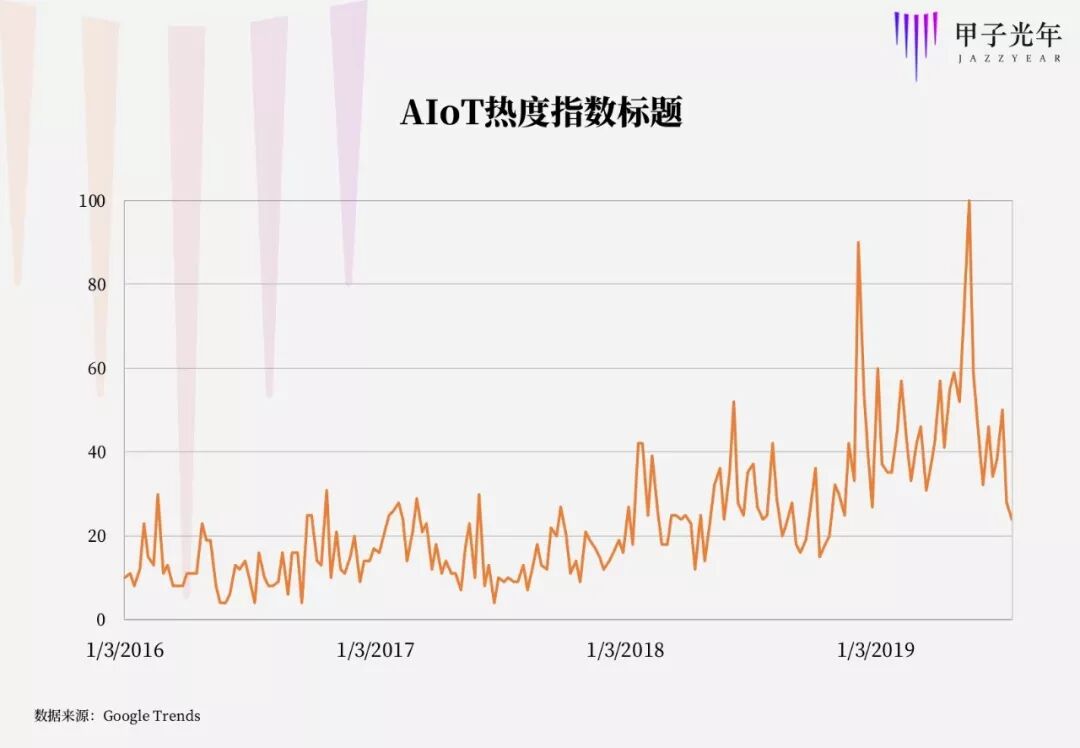

Commercial-grade edge computing unit Whale HubYe Shengxuan told “Jiazi Guangnian” that the motivation behind building the AIoT platform and launching Whale Hub is Whale’s consistent technical value view:Not to get lost in flashy technology, but to use technology to solve problems. However, based on current customer feedback, products from Whale and other AIoT data intelligence companies still face some customer experience bottlenecks that affect problem-solving, including “high offline operation costs” and “digitalization not integrating into business.” A technical department head from a large comprehensive shopping mall that introduced various smart shelf products told “Jiazi Guangnian” that they encountered high training costs and difficulties in subsequent operations: “Sales clerks in shopping malls generally have no technical background, and asking them to scan this and sense that… training clerks is very troublesome; therefore, to achieve offline digitization, we need technology companies to work with us to find the optimal closed-loop solution and best processes to reduce overall operation costs.” Digitalization not integrating into existing business processes is a product design issue. Good experience design pursues “zero perception,” subtly integrating into the process. The current situation is that many companies have produced a lot of products, but the processes are not optimized enough, leading to clerks or consumers having to scan and recognize multiple times, making it impossible to seamlessly connect identity reading, payment, and member acquisition, which instead creates resistance among consumers.Although the road ahead is difficult, the entire AIoT data intelligence market is heating up, with increasing public attention and various players entering the field. Among them, there are hardware vendors transforming: such as Taiwan’s BenQ, which previously provided comprehensive digital display solutions for retailers, and their advantage is having hardware production lines and existing commercial channels; currently, BenQ’s new smart store solutions include interactive smart screens and smart cloud shelves. There are those already occupying offline scenarios: such as Focus Media, which started in elevator media and can now reach 500 million people daily across 230 cities in China; as early as 2017, Focus Media began promoting interactive screens, and now they can achieve intelligent advertising push based on crowd characteristics; unlike Whale, they have not yet ventured into the MCN content ecosystem.There are even internet giants with data and technology advantages: such as JD Digits’ sub-brand JD Mumei, which has entered a market similar to Whale’s. Currently, Mumei claims to have deployed over 2 million offline smart screens nationwide, covering community, work, travel, campus, consumption, and other offline scenarios, mastering a rich user tagging system to provide precise services for B-end advertisers. It is worth mentioning that Focus Media also has the shadow of giants: Alibaba became the second-largest shareholder of Focus Media last July with an investment of 15 billion RMB, and in the announcement released by Focus Media on the same day, it was clearly stated that “the two parties will jointly explore innovative models for digital marketing under the new retail trend.” The attention of big players towards the AIoT offline marketing market is both a potential danger and another form of validation for newcomers like Whale. After all, meat that is not coveted is not good meat.

Among them, there are hardware vendors transforming: such as Taiwan’s BenQ, which previously provided comprehensive digital display solutions for retailers, and their advantage is having hardware production lines and existing commercial channels; currently, BenQ’s new smart store solutions include interactive smart screens and smart cloud shelves. There are those already occupying offline scenarios: such as Focus Media, which started in elevator media and can now reach 500 million people daily across 230 cities in China; as early as 2017, Focus Media began promoting interactive screens, and now they can achieve intelligent advertising push based on crowd characteristics; unlike Whale, they have not yet ventured into the MCN content ecosystem.There are even internet giants with data and technology advantages: such as JD Digits’ sub-brand JD Mumei, which has entered a market similar to Whale’s. Currently, Mumei claims to have deployed over 2 million offline smart screens nationwide, covering community, work, travel, campus, consumption, and other offline scenarios, mastering a rich user tagging system to provide precise services for B-end advertisers. It is worth mentioning that Focus Media also has the shadow of giants: Alibaba became the second-largest shareholder of Focus Media last July with an investment of 15 billion RMB, and in the announcement released by Focus Media on the same day, it was clearly stated that “the two parties will jointly explore innovative models for digital marketing under the new retail trend.” The attention of big players towards the AIoT offline marketing market is both a potential danger and another form of validation for newcomers like Whale. After all, meat that is not coveted is not good meat.

END.

| Jiazi Guangnian Reader Survey|

To improve Jiazi Guangnian’s content production capabilities and better serve readers, we officially launched the “2019 First Reader Survey.” All Jiazi Guangnian followers who complete the survey will receive a gift package—a “latest technology industry research report compiled by the Jiazi Guangnian think tank team, 500 copies.” In the background, reply “Survey” or click the end of the article “Read the original text” to fill out the survey, thank you for your support!

| Selected Previous Issues |

– Science and Technology Innovation Board –

Science and Technology Innovation Board, a bottle of AI makeup remover?

Rushing to the Science and Technology Innovation Board, from value creation to value management

Science and Technology Innovation Board, ambition and determination

– Technology Industry –

PRA: The successor of AI implementation

The data middle platform, the next platform-type entrepreneurial opportunity

“Isn’t it just selling machine tools?”

Why have large companies finally started using SaaS?

A nameless entrepreneur’s ten-year journey of life and death

Why do people say the To B era in China has finally arrived?

The 18 months of disappearance of Fenxiangxiaoke

Why are AI companies both financing and investing?

Hangzhou’s cloud-making record

In-depth visit to the cryptocurrency circle: once you enjoy a night of wealth, you can never forget the shortcut

– Technology Humanities –

Mathematics of Fireworks

Memoirs of the Great Space Age

The era calls for mathematicians

Defenders of the black industry

The era of genius extinction

Wandering Earth, cosmic nostalgia

Those who mark data

– Miss Jia’s Dialogues –

Dialogue with Li Zhifei: One must have a ruler in their heart

Dialogue with Wu Jun: Humans belong to humans, machines belong to machines

Dialogue with Cao Xudong: There will be no billion-dollar companies in the autonomous driving track

Dialogue with Terence: Evolution is smarter than you

Dialogue with Chen Tianshi: The AI chip market is vast, and Cambricon has friends everywhere

Dialogue with Silicon Valley investor Zhang Lu: The investment path in To B