“

From ST to Infineon and now to NXP, overseas chip giants are collectively increasing their investment in the Chinese market, advancing in manufacturing and R&D. Is the global semiconductor industry quietly shifting its focus to China?

Cover | NXP

Author | Xiaocao

Recently, NXP Semiconductor CEO Kurt Sievers visited China with incoming CEO Rafael Sotomayor and was received by Shanghai Mayor Gong Zheng.

During the meeting, Sievers stated, “The Chinese market has become NXP’s largest single market globally. We value cooperation with Chinese companies, and we believe that if we succeed in China, we can succeed globally.”

Image source: Shanghai Municipal Government official website

This Dutch-headquartered chip giant is reassessing the role of the Chinese market in its global landscape.

NXP’s actions are not an isolated case; more and more chip giants are restructuring their presence in China through various means—from local manufacturing to customized R&D, from supply chain collaboration to ecosystem development. “In China, for China” is becoming an undeniable industry trend.

01

From Establishing a China Division to Seeking Local Manufacturing

NXP is Redefining Its Role in China

Since the beginning of this year, NXP has been active in its strategic moves in the Chinese market.

At the structural level, NXP made significant adjustments to its China business structure at the beginning of the year—officially establishing a “China Division,” with the general manager of the China Division reporting directly to NXP CEO Kurt Sievers.

The establishment of the NXP China Division integrates resources such as sales, R&D, operations, quality, and technical support, granting the NXP China team greater autonomy.

This adjustment also signifies that NXP is transforming China from a traditional “sales terminal” into a strategic region with product definition and organizational autonomy capabilities.

Image source: NXP

At the product level, NXP has successively launched several products developed by the Chinese team. For example, its recently launched 18-channel lithium battery cell controller BMx7318/7518 series IC products. This is a new IC product defined, designed, and developed in China, specifically for Chinese customers. Currently, the NXP China R&D team has completed the development of over 200 products.

In early July, NXP also signed multiple cooperation plans with several domestic automotive manufacturers, including establishing a joint innovation laboratory with Geely Automotive Research Institute; renewing the joint innovation center with Deep Blue Automotive; and deepening cooperation with Great Wall Motors and Leap Motor.

Image source: NXP

In terms of manufacturing, NXP is currently collaborating with three different wafer fabs in China, including TSMC’s Nanjing plant responsible for 16nm and 28nm processes; SMIC for products above 28nm; and Hua Hong as a partner for NXP’s mixed-signal chips. Additionally, it has a large backend packaging and assembly plant in Tianjin.

NXP recently stated that it is looking for a domestic wafer fab partner to transfer the entire production process from front-end to back-end to China.

It can be said that from structural empowerment, product R&D to manufacturing collaboration, NXP is building a more complete value closed loop around the “Chinese market”.

The strategic adjustments reflect not only a company’s emphasis on the local market but also an inevitable choice made by the entire industry in response to the dual trends of “global supply chain restructuring” and “the rise of the automotive market in China”.

02

“In China, for China” has Become a Trend

It is noteworthy that NXP is not an exception. In recent years, “In China, for China” has become a collective strategy among overseas chip giants, a consensus shift.

European semiconductor giants STMicroelectronics and Infineon have previously clearly proposed and actively promoted local manufacturing, local R&D, and local ecosystem cooperation, with increasingly evident intentions to deepen their presence in China.

ST was one of the first international chip manufacturers to explicitly propose promoting “local manufacturing” in China. In June 2023, ST launched a joint venture factory in Chongqing with Sanan Optoelectronics, planning to invest $3.2 billion, and the factory has already started production earlier this year.

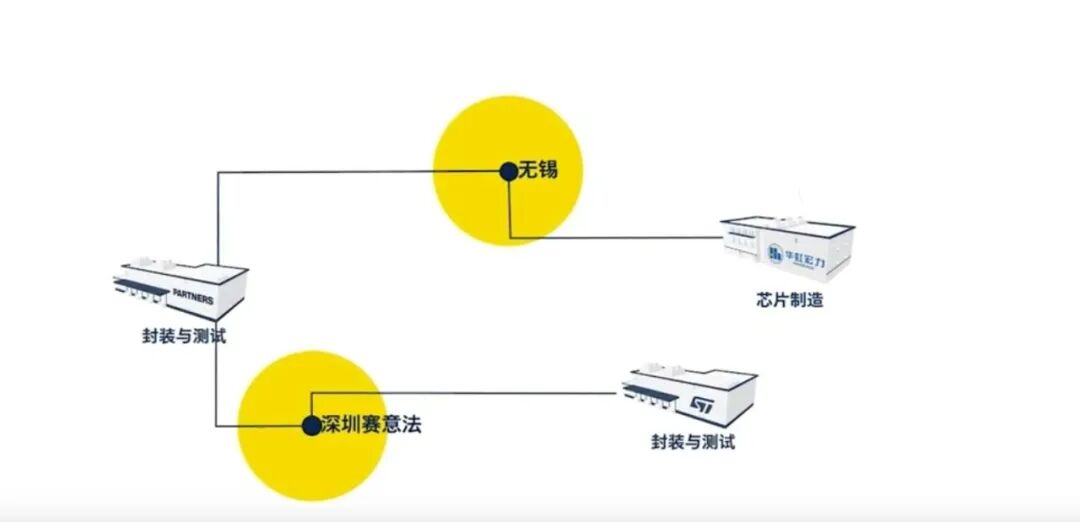

In addition to SiC, ST has also entrusted its core microcontroller product line to domestic wafer fabs for foundry. At the end of last year, ST announced an expansion of its cooperation with Hua Hong, planning to mass-produce 40nm node STM32 MCUs in China by the end of 2025.

Image source: ST

Furthermore, ST is also engaging in complementary cooperation with Chinese manufacturers in the new generation of power devices, GaN (gallium nitride). In March of this year, ST signed a joint development and manufacturing agreement with Innoscience, allowing ST to utilize its 8-inch GaN wafer production line in mainland China, while Innoscience gains access to ST’s manufacturing resources in Europe.

From the SiC production line in Chongqing, Hua Hong’s MCU manufacturing, to the GaN cooperation with Innoscience, ST has already formed a local manufacturing network in China.

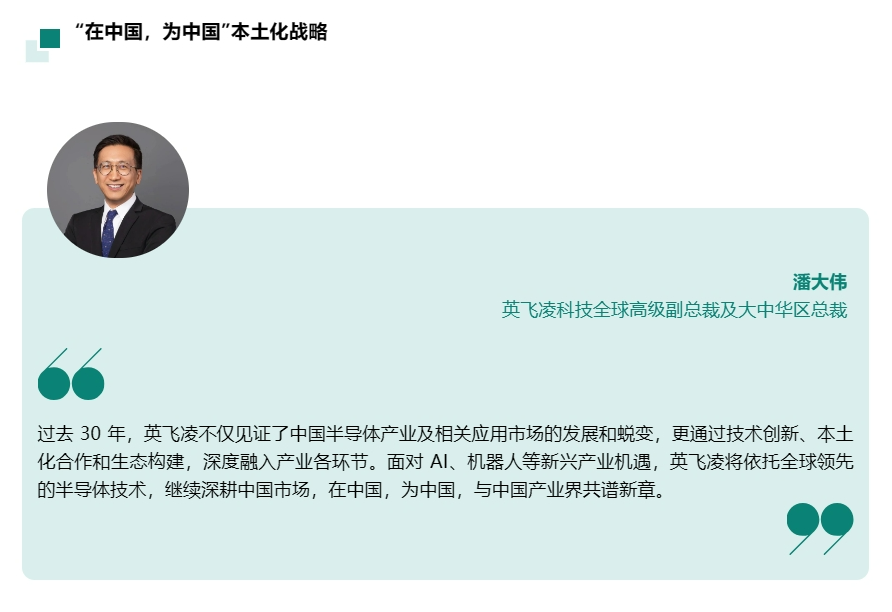

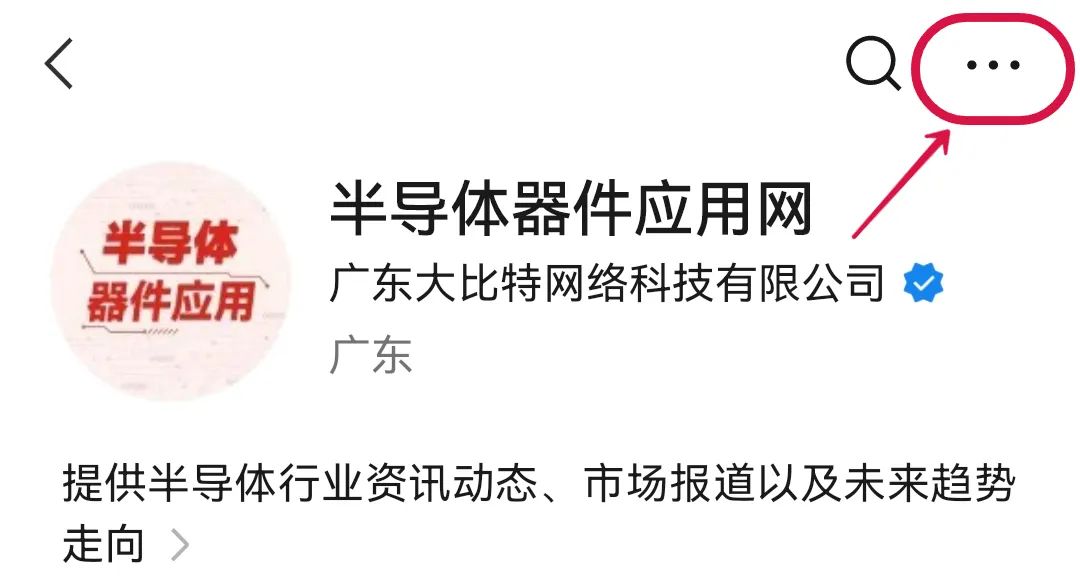

Infineon also officially launched its “In China, for China” localization strategy at last month’s “2025 Infineon Media Day,” detailing it into four pillars: local innovation, operations, production, and ecosystem.

The goal is to fully support the systematic implementation of its three major business segments—automotive, industrial, and AI—in China, further integrating into the Chinese industrial system through “local definition, local manufacturing, and local delivery.”

Image source: Infineon WeChat public account screenshot

One of the key focuses of this strategic upgrade is the deep transformation of the Wuxi factory. This factory will undertake more local manufacturing tasks for core products such as MCUs and MOSFETs, especially in the automotive business, where Infineon plans to achieve full local mass production of core products by 2027.

For example, Infineon plans for the next generation of 28nm TC4x series MCUs to be completed in China, emphasizing the combination of domestic manufacturing and customization needs of the Chinese market.

At the same time, Infineon is building multiple capability centers and laboratories in China around system capabilities, establishing joint development and validation mechanisms for local customers, including the “Teaching Customer” program and “Infineon University,” to promote system-level delivery capabilities in key scenarios such as new energy vehicles, renewable energy, and AI servers.

In the industrial and infrastructure sectors, Infineon has achieved local mass production of low-power IGBT modules and is building a local customized support system around high-growth sectors such as wind power and photovoltaics; in the AI data center and robotics sectors, it is creating a system path from the grid to computing through green power supply and full-stack solutions.

These substantial strategic moves indicate that international giants are shifting from “serving the Chinese market” to “using China as a base.” The core of this shift lies not only in getting closer to customers and shortening delivery times but also in a systematic recognition of China’s local technological capabilities, supply chain collaboration capabilities, and industrial policy environment.

This collective localization shift is not a coincidence. It is a response to the reality of the size and growth momentum of the Chinese market and reflects strategic considerations under geopolitical pressures and supply chain security games.

03

Why Are Chip Giants Shifting Collectively?

NXP, ST, Infineon, and other overseas chip giants are accelerating their layout in China, driven by three deep-seated motivations behind the formation and expansion of the “In China, for China” strategy:

First, the Chinese market has become a growth pole against the global trend, significantly increasing its importance to multinational chip manufacturers.

In the context of a general slowdown in global demand, China, especially the new energy vehicle and related electronics markets, has shown strong growth momentum, providing valuable incremental space. In the past two years, the global semiconductor market has been volatile, with demand sluggish in many regions, while the Chinese market has remained relatively stable, even achieving counter-cyclical expansion in sectors such as automotive, power, and industrial control, making China a major engine for the performance growth of many chip companies.

From the financial reports of major chip companies, it is evident that the revenue share from China is steadily increasing, with Infineon reaching 34% and NXP as high as 36%. It can be said that the Chinese market has risen from being an “important overseas market” to one of the centers in these giants’ global landscape, with its strategic position and priority rising accordingly.

Second, considerations of supply chain security and stability have driven a significant increase in local manufacturing demand.

The uncertainties in the geopolitical and trade environment have made multinational chip companies pay more attention to the security and controllability of their supply chains.

On one hand, governments have introduced policies requiring key chip production to be localized to reduce dependence on external sources. Major automotive chip suppliers such as ST, Infineon, NXP, and Renesas have been actively exploring cooperation with Chinese wafer foundries and packaging and testing factories in recent years to accelerate the establishment of local supply capabilities.

Image source: ST official website screenshot

On the other hand, companies are also proactively building “two supply chains” for risk management needs. Without local production, companies may lose the Chinese market or be quickly replaced by local competitors in the event of trade friction or export controls.

Moreover, local production can bring advantages in cost and response speed—proximity to materials and human resources can reduce some costs; being closer to customers can significantly shorten delivery cycles, allowing companies to seize opportunities in the rapid product iteration of “Chinese speed.”

Third, automotive semiconductors have become the core segment for revenue and growth for many chip manufacturers, and China is indisputably the largest automotive electronics market in the world.

In recent years, the wave of automotive electrification and digitalization has led traditional chip manufacturers to shift their strategic focus to the automotive sector. The automotive business revenue share of companies like NXP and Infineon exceeds half (for example, Infineon’s automotive division accounts for 56% of its revenue, while NXP’s automotive business accounts for about 60%). It can be said that capturing the automotive market is crucial for the performance of these companies.

Currently, China has become the center of the global automotive industry: new trends such as new energy vehicles and intelligent driving are being led by China. This means that any company engaged in automotive semiconductors cannot ignore the decisive role of the Chinese market. As ST’s CEO stated, China, as the largest and most innovative market for electric vehicles, is “indispensable” for chip manufacturers; abandoning China would mean handing over the future to others.

At the same time, the rise of Chinese automotive companies is also changing the global competitive landscape—domestic manufacturers are rapidly growing based on huge domestic demand and expanding overseas. Overseas chip companies can only secure a place in this wave by deeply participating in the Chinese automotive electronics ecosystem and innovating together with domestic automotive customers.

04

Conclusion

Clearly, in the global race for automotive intelligence and electrification, China is not only the largest application market but also a major battleground for technological innovation. For chip giants, increasing their investment in the “Chinese battlefield” is no longer a choice but a necessary course for long-term survival and leadership.

In summary, “In China, for China” is evolving from a corporate slogan into a collective action in the global semiconductor industry. Faced with the Chinese market, a global growth highland and innovation hotbed, chip giants are choosing deeper localization to embrace opportunities and share risks.

In the foreseeable future, this trend will continue and deepen. On one hand, as these layouts gradually take shape, the integration between overseas manufacturers and the Chinese industry will become closer; on the other hand, it is also foreseeable that competition in the Chinese market will become more intense, with local players and foreign giants engaging in a new round of competition in technology and supply chains.

However, for industry practitioners, this is an era worth paying attention to and participating in—the focus of the future international semiconductor landscape is quietly shifting to China.

#NXP #ST #Infineon #Chip

This article is an original piece by the Semiconductor Device Application Network. Unauthorized reproduction is prohibited, and legal action will be pursued.

More quality public account recommendations

▲Click the card above to follow

Deeply track the dynamics of connector giants and analyze industry hot technology trends

▲Click the card above to follow

Focus on the latest news and authoritative interpretations in the electronic transformer and inductor industry

— Previous Recommendations —

END

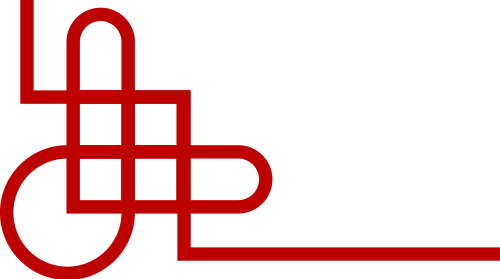

Mark us · Don’t miss any new posts

① Click the card area “…”

② Click “Set as Star”

Looking forward to your one-click three connections~

Like

Forward

Looking