Currently, there is a continuous stream of information regarding the semiconductor industry reaching a fundamental turning point in Q2 2023. Typically, a semiconductor cycle lasts 3-5 years, with the market often anticipating changes 1-2 quarters ahead of the fundamentals.

As we look towards mid-next year, the industry turning point is something everyone is eagerly anticipating.

In tracking and implementing the emergence of this industry turning point, Jianzhi Research believes that attention should be focused on the recovery of capital and demand.

The trend of capital tightening must stop or slow down

The trend of capital tightening must stop or slow down

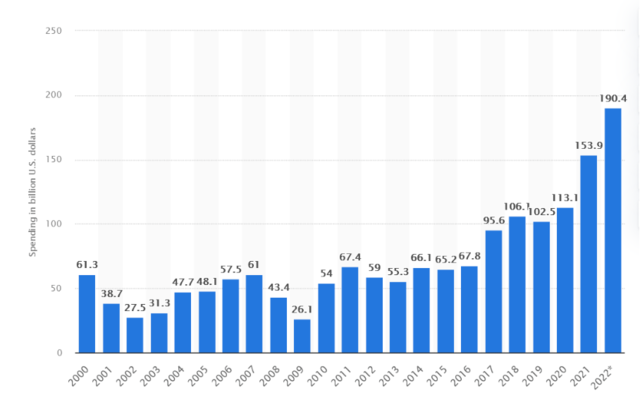

Capital expenditure has always been a leading indicator for predicting turning points in the semiconductor industry. This was analyzed in detail in the article “Is the Turning Point for Chips Coming?”.

Observing this year, the tightening of capital in the semiconductor industry has been the main theme throughout the year.

Whether there will be any improvement next year has become one of the key signals.

This year has not met expectations: Semiconductor market research firm IC Insights has previously revised down the global semiconductor capital expenditure for 2022, now expected to reach $185.5 billion, a year-on-year increase of 21%. (The initial forecast was $190.4 billion)

The downward revision for next year’s expectations is even greater:

Recently, the global Semiconductor Equipment and Materials International (SEMI) has again lowered its forecast for global semiconductor capital expenditure next year.

The purpose is: To cope with a demand downturn that may last longer than before, chip manufacturers are cutting costs and reducing capital expenditure plans.

The latest forecast is: Next year’s global semiconductor capital expenditure is expected to be $138.1 billion, a decrease of 16.5% from the April estimate of $165.5 billion, a reduction of $27.4 billion.

What does $138.1 billion mean?

What does $138.1 billion mean?

Looking back at the capital expenditure situation in the semiconductor industry over the past 20 years. Since 2017, this has been the starting point for rapid growth in capital expenditure in this semiconductor cycle.

By 2022, over nearly seven years, capital expenditure has accumulated to over $756 billion.

Compared to previous cycles, the recent cycle has seen greater capital expansion and lasted longer.

(Data source: Statista)

Even with this year’s investment of $185.5 billion, it still sets a historical high.

Next year marks the first year of large-scale capital withdrawal. The investment amount of $138.1 billion not only represents a decline of over 34% compared to this year but also falls below the investment amount of 2021 ($153.9 billion).

From a timeline perspective, each cycle is accompanied by a two-year period of declining capital expenditure. This is also related to the duration and scale of previous capital expansions. If we follow the deduced patterns, perhaps the year after next will not be so optimistic either.

Currently, major companies such as TSMC, Intel, Samsung, Texas Instruments, Micron Technology, and Wolfspeed are still in a trend of lowering their expected expenditures. Moreover, some companies have recently provided performance expectations for next year that fall far short of market expectations.

This means that high growth in performance next year is hard to guarantee. This leads us to another important driving factor for a fundamental turnaround: demand.

Demand improvement, focus on these four areas

Demand improvement, focus on these four areas

The cycle is fundamentally about supply and demand.

Reducing expenditure and cutting new capacity construction plans indicates a lowered expectation for future demand.

The driving force that can reverse the direction of capital must be linked to demand improvement.

Jianzhi Research has compiled statistics on all areas of downstream demand in the semiconductor sector, showing that the four fastest-growing areas are automotive, industrial, data centers, and mobile phones.

(Data source: Statista)

The automotive sector will remain the fastest-growing track until 2030.

The compound annual growth rate from 2020 to 2025 is expected to be 16.02%; even after 2025, the growth rate will still be the highest.

The rapid growth in industry scale is due to both increased demand and a relatively low base. (After all, the automotive sector has the smallest semiconductor demand among downstream fields.)

Secondly, the demand growth in industrial and data centers has also become key driving forces to watch before 2030. Meanwhile, mobile phones will become the largest sector in terms of scale, but its growth rate will not match the top three fields.

(This demand statistics also include downstream fields such as consumer electronics, computers, and communications, but their industry output growth rates rank at the bottom three.)

What is the current state of the industry?

What is the current state of the industry?

From the current market expectations, there are no clear signs of recovery in downstream demand growth for next year.

1. The growth rate of new energy vehicles next year will be far less than this year.

The demand for semiconductors in the automotive sector is primarily focused on new energy vehicles (including pure electric and hybrid), so the expected shipment volume (sales) of new energy vehicles is an important factor in assessing semiconductor demand.

So, what about next year’s growth?

China’s new energy vehicle sales account for about half of the global total. In 2021, the shipment volume of new energy vehicles in China was 6.5 million, achieving a year-on-year doubling growth (331 million in 2020).

According to the China Passenger Car Association’s expectations, the sales of new energy vehicles may exceed 8.4 million in 2023, with a growth rate of about 29%. This means that the expected growth in shipment volume next year will be far lower than this year. (The total number of new energy vehicles accounts for less than 7% of the total automotive volume.)

2. Industrial demand is beginning to show signs of decline.

As the second fastest-growing downstream sector for semiconductor demand, the industrial sector has also begun to show expectations of demand decline. Last month, Jianzhi Research detailed in the article “The Cold Wave of Semiconductors Expands, Texas Instruments Indicates Industrial Sector is ‘Suffering'” that Texas Instruments, as a bellwether for industrial semiconductor demand, has clearly indicated expectations of weak industrial demand, with a high rate of order cancellations in the industry.

3. Data center demand is still struggling to hold up.

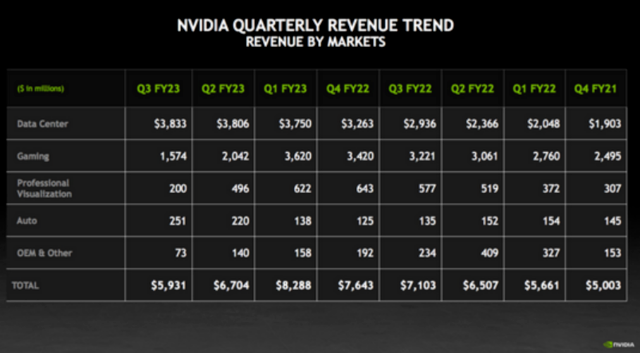

According to NVIDIA’s third-quarter financial report on November 17 (data as of the end of October), data centers are still maintaining a certain level of growth, but the pace has noticeably slowed compared to before.

Additionally, the relatively small demand for automotive electronics is the only remaining source of growth, while demand in other areas is shrinking.

However, in the current environment where American tech companies are cutting back on investments, the slowdown in demand for cloud computing and AI computing has also become a market concern. In the backdrop of an economic downturn, counter-cyclical growth requires more demand to support it. Currently, this seems somewhat difficult to achieve. We will continue to monitor changes in data center demand.

4. Few people want to buy phones.

The decline in mobile phone sales has been discussed extensively; on one hand, the innovation in new phones is minimal, making it hard to motivate consumers to upgrade;

On the other hand, the release of high-performance CPUs that used to boost purchasing demand seems to have fallen short of expectations this year.

This is enough to validate that, behind global economic inflation, the reduction of non-essential expenditures is an inevitable trend.

On November 18, Samsung announced plans to halt operations at its Vietnamese smartphone factory for more than two weeks starting in December. Samsung’s Vietnamese factory is the largest smartphone production base in the world, accounting for half of Samsung’s output. Foreign media believe that if the halt begins, it may also spread to production lines in India, Brazil, and Indonesia. This is considered the most severe inventory destocking cycle in history.

Conclusion

Conclusion

We are all witnessing the history of semiconductors, waiting to see if the recovery of the semiconductor industry will arrive as expected.

The key is when the endless signals of recession can hit the pause button;

The improvement in demand is the driving force to reverse capital;

The largest scale of expansion will inevitably be accompanied by the largest scale of destocking. Whether the targets can be met as expected and whether the cycle turning point will arrive remains unclear, and there may still be many variables.

⭐ Mark Jianzhi Research to not miss out on great content⭐

This article does not constitute personal investment advice and does not take into account individual users’ specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. The market carries risks, and investment requires caution; please make independent judgments and decisions.