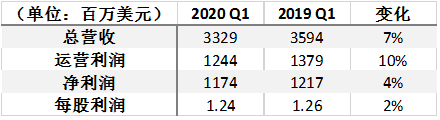

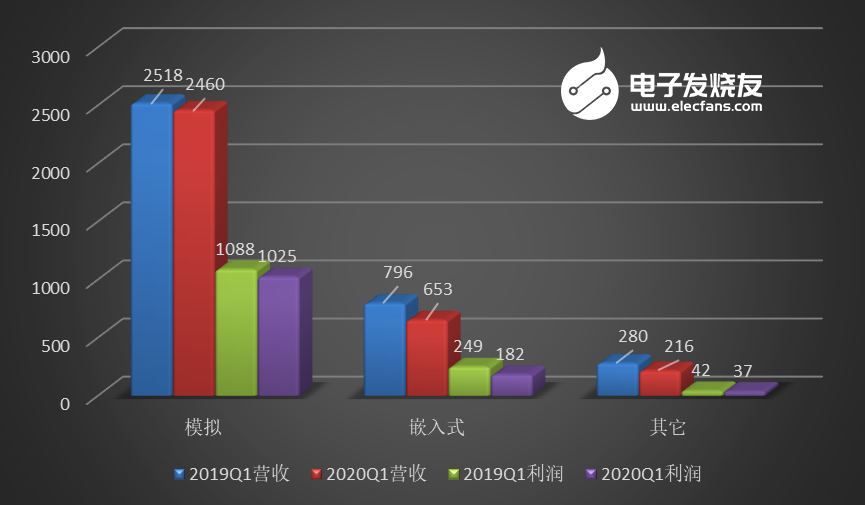

Although the demand for chips is currently on a downward trend, there has not been a cliff-like drop.The demand for chips in the automotive, smartphone, industrial equipment, and communication device sectors has weakened, while the demand in end markets such as laptops, gaming consoles, and data center hardware has grown, offsetting some of the impact.Nevertheless, after major electronics industry giants recently released their significantly impacted Q1 financial reports, they have also made pessimistic forecasts for Q2.2020 Q1 Texas Instruments Financial Report DetailsTexas Instruments (TI) announced its Q1 2020 financial report on April 21, with total revenue of $3.33 billion, net profit of $1.17 billion, and earnings per share of $1.24. Revenue decreased by 7% compared to the same quarter last year, with revenue from analog devices down 2% year-on-year and revenue from embedded processors down 18% year-on-year. The revenue and profit of the analog and embedded businesses compared to the same quarter last year are as follows (in millions of dollars)

The revenue and profit of the analog and embedded businesses compared to the same quarter last year are as follows (in millions of dollars) Compared to the same quarter last year: In the analog business, revenue from signal chains and high-volume products decreased, offsetting growth in power management. In the embedded processing business, revenue from both microcontrollers and processors declined, leading to a reduction in gross profit and operating profit. Other businesses (DLP products, calculators, and custom ASIC products) saw a revenue decline of $64 million and an operating profit decrease of $5 million.At the same time, TI compared its revenue in the end markets to the same quarter last year:1. Revenue in the industrial sector saw a slight increase compared to the same quarter last year and the previous quarter.2. Revenue in the automotive sector declined by 4% to 6%, due to factory closures affecting demand.3. Revenue from personal electronic devices also saw a slight decline, with smartphones down 10% to 30%, while computer products increased by 10% to 30%.4. Compared to the strong communication equipment market in the first quarter of last year, revenue this quarter decreased by about 50%, but there was an increase compared to the previous quarter.5. With a surge in demand for data center products, revenue from enterprise systems saw double-digit growth.Q2 ExpectationsWith the economic contraction brought on by COVID-19 and reduced visibility of customer demand, Texas Instruments will use the model from the 2008 financial crisis to forecast Q2 revenue prospects. During that time, demand fell sharply for two consecutive quarters (26% and 16%), followed by a rebound over the next six quarters. By Q2 2010, revenue had returned to the levels of Q3 2008.However, TI also cautioned that economic crises are not all the same. To further reflect the increased uncertainty, TI has also expanded its guidance range for the next quarter, expecting Q2 revenue to be between $2.61 billion and $3.19 billion. At the same time, factories will continue to operate at the levels of Q1 in Q2 and possibly lead to an increase in inventory, but this can best support customers with limited visibility.In response to investor questions, TI mentioned: “50% of our products are shipped to China. However, electronic products like smartphones may only be assembled in China, designed in the U.S., and finally shipped to Europe. So while we have seen signs of factories in China resuming operations, we still cannot determine how much actual demand there will be afterward, which is the greatest uncertainty in our forecast for the next quarter.”Response to the PandemicTI also explained its impact from the pandemic in an order delivery status update released at the end of March.1. TI’s investments will minimize the impact on customersTI has long established a Business Continuity Plan (BCP) mechanism to respond to emergencies. Over the past few years, TI has not only invested in building inventory but also expanded its global manufacturing lines. Strategies such as utilizing multiple manufacturing bases will be employed to reduce the impact on customers.2. Impact on TI’s productionTI follows the policy guidelines of its locations, and its operations in China (Chengdu factory and outsourced factories) have been minimally affected. Operations in Malaysia and the Philippines have been significantly scaled back.3. Delivery and Shipping Times (ESD)Under the current assumptions, TI does not expect to extend delivery times. However, due to restrictions in the Philippines, less than 3% of products originally scheduled for shipment in April will have changes in their shipping dates.4. Future DemandTI’s manufacturing capacity plans are set until the end of 2022, with a new 300mm/12-inch wafer fab in Texas expected to be completed by the end of 2021.Meanwhile, TI will increase the proportion of its own inventory, while distributor inventory may decrease. Currently, they have about 4 weeks of distribution inventory, which is the lowest level since Q3 2017. TI’s own inventory can ensure short lead times and high availability, providing better support to customers through direct sales.Finally, TI’s CFO and CAO concluded that they will continue to invest in strengthening TI’s four competitive advantages: manufacturing technology, breadth of portfolio, market reach, and long product life cycles. They will also continue to pursue the company’s three main goals: strengthening company control, adapting to changes in the global landscape, and ensuring that every employee feels proud of the company.

Compared to the same quarter last year: In the analog business, revenue from signal chains and high-volume products decreased, offsetting growth in power management. In the embedded processing business, revenue from both microcontrollers and processors declined, leading to a reduction in gross profit and operating profit. Other businesses (DLP products, calculators, and custom ASIC products) saw a revenue decline of $64 million and an operating profit decrease of $5 million.At the same time, TI compared its revenue in the end markets to the same quarter last year:1. Revenue in the industrial sector saw a slight increase compared to the same quarter last year and the previous quarter.2. Revenue in the automotive sector declined by 4% to 6%, due to factory closures affecting demand.3. Revenue from personal electronic devices also saw a slight decline, with smartphones down 10% to 30%, while computer products increased by 10% to 30%.4. Compared to the strong communication equipment market in the first quarter of last year, revenue this quarter decreased by about 50%, but there was an increase compared to the previous quarter.5. With a surge in demand for data center products, revenue from enterprise systems saw double-digit growth.Q2 ExpectationsWith the economic contraction brought on by COVID-19 and reduced visibility of customer demand, Texas Instruments will use the model from the 2008 financial crisis to forecast Q2 revenue prospects. During that time, demand fell sharply for two consecutive quarters (26% and 16%), followed by a rebound over the next six quarters. By Q2 2010, revenue had returned to the levels of Q3 2008.However, TI also cautioned that economic crises are not all the same. To further reflect the increased uncertainty, TI has also expanded its guidance range for the next quarter, expecting Q2 revenue to be between $2.61 billion and $3.19 billion. At the same time, factories will continue to operate at the levels of Q1 in Q2 and possibly lead to an increase in inventory, but this can best support customers with limited visibility.In response to investor questions, TI mentioned: “50% of our products are shipped to China. However, electronic products like smartphones may only be assembled in China, designed in the U.S., and finally shipped to Europe. So while we have seen signs of factories in China resuming operations, we still cannot determine how much actual demand there will be afterward, which is the greatest uncertainty in our forecast for the next quarter.”Response to the PandemicTI also explained its impact from the pandemic in an order delivery status update released at the end of March.1. TI’s investments will minimize the impact on customersTI has long established a Business Continuity Plan (BCP) mechanism to respond to emergencies. Over the past few years, TI has not only invested in building inventory but also expanded its global manufacturing lines. Strategies such as utilizing multiple manufacturing bases will be employed to reduce the impact on customers.2. Impact on TI’s productionTI follows the policy guidelines of its locations, and its operations in China (Chengdu factory and outsourced factories) have been minimally affected. Operations in Malaysia and the Philippines have been significantly scaled back.3. Delivery and Shipping Times (ESD)Under the current assumptions, TI does not expect to extend delivery times. However, due to restrictions in the Philippines, less than 3% of products originally scheduled for shipment in April will have changes in their shipping dates.4. Future DemandTI’s manufacturing capacity plans are set until the end of 2022, with a new 300mm/12-inch wafer fab in Texas expected to be completed by the end of 2021.Meanwhile, TI will increase the proportion of its own inventory, while distributor inventory may decrease. Currently, they have about 4 weeks of distribution inventory, which is the lowest level since Q3 2017. TI’s own inventory can ensure short lead times and high availability, providing better support to customers through direct sales.Finally, TI’s CFO and CAO concluded that they will continue to invest in strengthening TI’s four competitive advantages: manufacturing technology, breadth of portfolio, market reach, and long product life cycles. They will also continue to pursue the company’s three main goals: strengthening company control, adapting to changes in the global landscape, and ensuring that every employee feels proud of the company.

Statement:This article is compiled by Electronic Enthusiasts, referencing TI’s financial report. Please indicate the source and origin when reprinting.If you need to reprint or join the group for communication, please add WeChat elecfans999, and for submission of interview requests, please send an email to [email protected]

More exciting articles to read

-

“New Infrastructure” is on fire, but AI’s underlying support is struggling…

-

TWS headphones are booming, and this domestic Bluetooth SoC manufacturer has been accepted by the Sci-Tech Innovation Board

-

Completely on fire! NB-IoT breaks through the 100 million mark! Accelerating towards 1 billion!

-

Net profit surged by 1954%! How did the semiconductor giant form?

-

Three returnees founded an analog semiconductor company that successfully passed the first hurdle of the Sci-Tech Innovation Board