——By 2026, shipments will surpass GPUs, and the edge battlefield will determine the outcome

1. Critical Point: The Countdown to ASIC’s ‘Overtake’

“When Tesla’s autonomous driving smoothly navigates through heavy rain, and when a smartphone camera instantly removes bystanders from photos—behind it all are ASIC chips working silently.”

2026 will become a historical turning point in the computing power market:

- ⚡️ Nomura Securities confirms: ASIC annual shipments will surpass GPUs for the first time;

- 📊 Goldman Sachs data corroborates: By 2025, 38% of global servers will be equipped with ASICs (driven by explosive growth in inference demand);

- 💡 Performance crushing facts: In AI inference scenarios, the cost per unit of computing power for ASICs is 40% lower than that of GPUs, with energy consumption only 1/3 (as measured by Google TPU V7).

2. Power Games: The ‘World War of Computing Power’ Among Four Major Forces

▶️ Offense: The ASIC Alliance

| Faction | Secret Weapon | Key Actions |

|---|---|---|

| Cloud Giants | Google TPU V7 | Performance benchmarks against NVIDIA B200, OpenAI has rented for testing |

| Chip Manufacturers | Broadcom AI Chips | Quarterly revenue surged by 46% |

| Automotive Newcomers | Tesla FSD | Completely replacing NVIDIA’s automotive chips |

🛡️ Defense: The GPU Empire Strikes Back

- NVIDIA urgently opens NVLink Fusion (allowing ASICs to access its ecosystem);

- However, allies are dwindling: MediaTek and Marvell have joined the semi-open camp.

⚠️ Warning: Microsoft’s self-developed ASIC chip Braga has been delayed due to manufacturing issues, revealing the industry’s high barriers to entry.

3. Edge Revolution: ASIC’s ‘Rural Encirclement of Cities’ Strategy

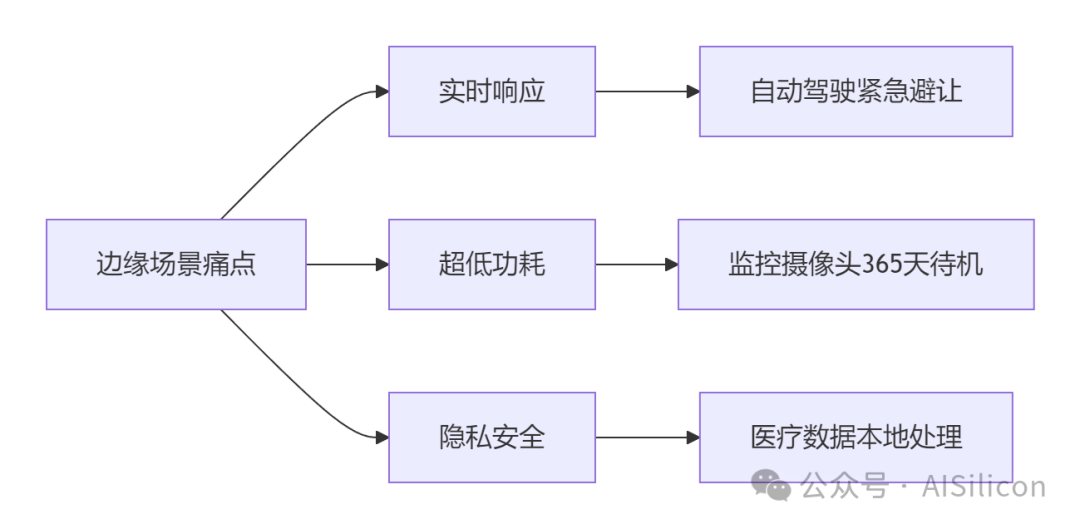

Why have factories, cars, and smartphones become the main battleground for ASICs?

mermaid

Breakthrough Points for Chinese Enterprises:

- 🚗 Automotive Sector: Horizon Journey 6 chip (used by BYD/Li Auto), computing power consumption ratio surpassing Tesla;

- 👁️ Security Sector: HiSilicon Hi3519 chip, enabling 4K cameras to instantly recognize faces;

- 🏭 Industrial Sector: Huawei Ascend 310, replacing manual labor in power grid inspection robots.

4. The Chinese Team: Breaking Through in a ‘Choke Point’

| Company | Counterattack Strategy | Current Shortcomings |

|---|---|---|

| Huawei Ascend | Deploying over 200P computing power centers nationwide | Limited by 14nm process |

| Horizon | Secured orders from 20 automotive companies | Reliant on TSMC for foundry |

| Cambricon | Automotive-grade chips on BYD vehicles | Weak software ecosystem |

Breakthrough Code:

- 🚀 Technological Substitution: Alibaba Pingtouge uses RISC-V architecture to build chips;

- 🤝 Scenario Feedback: Chinese new energy vehicles hold a 60% global market share, forcing chip innovation;

- 🔧 Manufacturing Breakthrough: SMIC’s N+2 process racing towards 7nm.

5. Future Outcome: A Race with No Retreat

“ASICs will not kill GPUs, but they will take away the most lucrative parts of the market.”

- By 2028: ASICs will account for 52% of the AI computing power market (according to Boston Consulting Group);

- Survival Rules:

- Cloud vendors must develop their own ASICs to reduce costs (otherwise profits will be drained by NVIDIA);

- Chip companies need to bind with leading scenarios (such as automotive manufacturers/smartphone giants);

- China must break through Chiplet technology (3D packaging to bypass process limitations).

📌 Core Conclusion in One Sentence:

ASICs are using a ‘specialized blade’ to cut through NVIDIA’s computing power iron curtain, and the ability to implement edge scenarios will determine who becomes the architect of the new world order.

(All data sources: Nomura Securities/Goldman Sachs/Boston Consulting Group/company annual reports; technical parameters taken from official white papers)