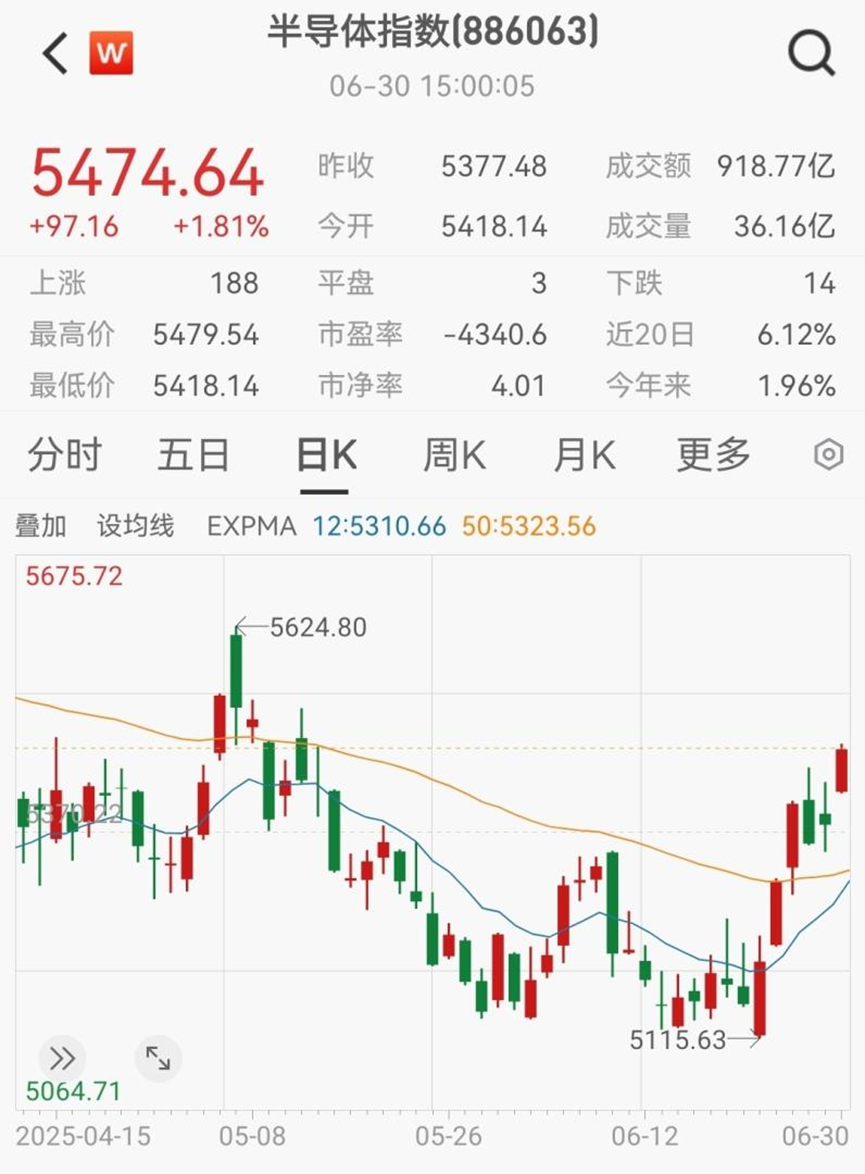

On June 30, the A-share semiconductor sector continued its strong performance, with the semiconductor index (886063.WI) rising 1.81%. According to Wind data, on that day, semiconductor companies with a market capitalization exceeding 100 billion yuan generally saw their stock prices rise. This includes companies like SMIC, Haiguang Information, Cambricon Technologies-U, Northern Huachuang, and Zhongwei Company. This is closely related to the recent improvement in the industry fundamentals, global capacity expansion, and domestic mergers and acquisitions.

In terms of individual stock performance, Cambricon Technologies-U led the 100 billion market cap semiconductor companies with an increase of nearly 3%, reflecting the market’s continued optimism towards the AI chip sector. Additionally, SMIC, Haiguang Information, Northern Huachuang, and Zhongwei Company all experienced collective gains. As of the time of publication, the collective rise of these five companies indicates the market’s focus on leading enterprises in the semiconductor industry.

The recent strength in the semiconductor sector is attributed to a combination of favorable factors. The global semiconductor manufacturing industry continues to improve, and the ongoing expansion of advanced process capacity may become a key driving force for industry development. At the same time, the domestic semiconductor industry is witnessing a wave of mergers and acquisitions, which is expected to reshape the industry landscape. Furthermore, the rapid penetration of AI applications and the ongoing process of domestic substitution provide solid support for the sector.

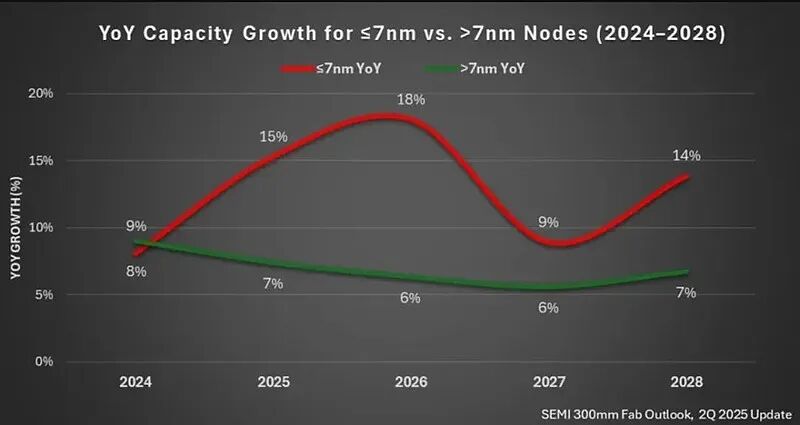

Advanced processes are expected to become the growth engine

Recent international data shows an improvement in industry prosperity. On June 26, SEMI released the results of its latest survey on the outlook for 300mm wafer fabs, indicating that the global semiconductor manufacturing industry is expected to maintain strong momentum, with capacity projected to grow at a compound annual growth rate (CAGR) of 7% from the end of 2024 to 2028, reaching a historical high of 11.1 million wafers per month (wpm).

Among these, the key driving force is the continuous expansion of advanced process capacity. SEMI predicts that the capacity for 7nm and below will grow by approximately 69%, increasing from 850,000 wpm in 2024 to a historical peak of 1.4 million wpm in 2028, with a CAGR of about 14%, which is twice the industry average. The rapid expansion of advanced processes reflects the strong demand for cutting-edge chips driven by AI and high-performance computing applications.

The strong growth in market demand is validated by industry data. Recently, market research firm Counterpoint Research pointed out in a report that in the first quarter of 2025, the global semiconductor wafer foundry market revenue is expected to grow by 13% year-on-year to $72.29 billion, primarily driven by the surge in demand for artificial intelligence and high-performance computing chips, which has stimulated demand for advanced nodes (3nm, 4nm, 5nm) and advanced packaging.

A wave of mergers and acquisitions is sweeping through the domestic semiconductor industry, with vast potential for domestic substitution

In the domestic semiconductor industry, a report from Ping An Securities shows that a wave of mergers and acquisitions is underway, with companies across various sectors of the supply chain actively planning acquisition strategies, accelerating the industry towards a new phase. Mergers and acquisitions cover semiconductor materials, equipment, EDA, packaging, chip design, and other fields, with typical cases including BGI’s acquisition of Chip Semiconductor, Haiguang Information’s absorption and merger with Zhongke Shuguang, and Northern Huachuang’s acquisition of Chip Source Micro. Companies are expanding their scale through horizontal mergers and perfecting the supply chain through vertical mergers, reshaping the domestic semiconductor industry landscape.

Looking ahead, the semiconductor industry will continue to benefit from the rapid development of AI applications and the ongoing process of domestic substitution. Ping An Securities states that by 2025, with the support of improving demand in AIGC and consumer-oriented downstream sectors, the semiconductor industry will continue to thrive, while the domestic semiconductor industry’s process of localization is expected to accelerate further. It is recommended to focus on investment opportunities in AI+ self-controllable sectors, especially in areas with significant potential for domestic substitution, including AI edge computing, equipment, materials, design, and EDA sectors.

Guangfa Securities also points out that the localization of semiconductor equipment is continuously advancing, with the government increasing support for domestic semiconductor manufacturing in terms of industrial policies, taxation, and talent cultivation, making the accelerated development of domestic wafer manufacturing and its supporting industries imperative. Furthermore, under the leadership of new technologies such as AI, the semiconductor industry is showing a growth trend, with the penetration and demand growth of new technologies and products in fields such as automotive electronics, new energy, the Internet of Things, big data, and artificial intelligence becoming important drivers for the growth of the semiconductor sector.