For more details, please visit www.cpcashow.com

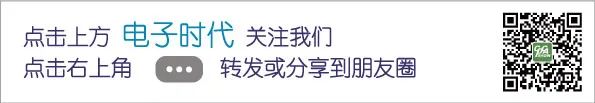

Structure of the Printed Circuit Board Industry ChainThe printed circuit board (PCB) manufacturing industry has a long value chain, with specialized wood pulp paper, electronic-grade fiberglass cloth, electrolytic copper foil, copper-clad laminate (CCL), and printed circuit boards (PCBs) being closely interconnected upstream and downstream products.From the perspective of the industry chain, the upstream of printed circuit boards (PCBs) mainly includes raw material industries such as copper foil, copper foil substrates, fiberglass cloth, and resin; the midstream refers to the PCB manufacturing process, which involves producing PCB boards from copper-clad laminates through processes like etching; the downstream mainly includes application fields for printed circuit boards (PCBs), including communications, optoelectronics, consumer electronics, automotive, aerospace, military, and industrial precision instruments. Ecological Map of the Printed Circuit Board Industry ChainFrom the perspective of representative enterprises in each segment of the industry chain, the upstream raw material segment mainly includes copper foil suppliers such as Nordson Corporation and Jiayuan Technology, fiberglass cloth companies like China Jushi and Changhai Co., epoxy resin companies such as Sinopec, Sanmu Group, and Dongcai Technology, as well as copper-clad laminate companies like Kingboard Laminates, Unimicron Technology, and Nanya New Material. The midstream of the industry chain mainly consists of PCB manufacturers such as Pegatron, Dongshan Precision, Shenzhen Santek, Huadian Technology, and Jingwang Electronics. The downstream applications are widespread, including communications, computers, automotive electronics, and consumer electronics.

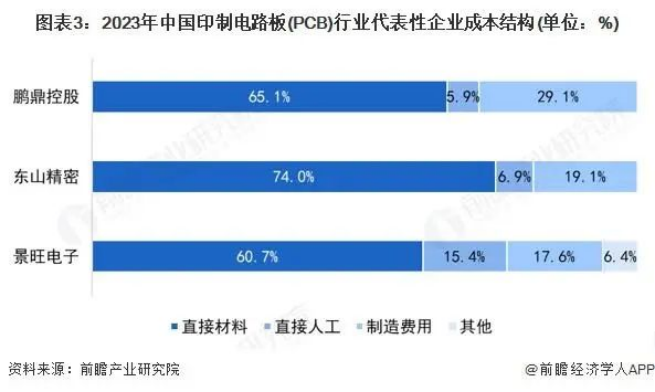

Ecological Map of the Printed Circuit Board Industry ChainFrom the perspective of representative enterprises in each segment of the industry chain, the upstream raw material segment mainly includes copper foil suppliers such as Nordson Corporation and Jiayuan Technology, fiberglass cloth companies like China Jushi and Changhai Co., epoxy resin companies such as Sinopec, Sanmu Group, and Dongcai Technology, as well as copper-clad laminate companies like Kingboard Laminates, Unimicron Technology, and Nanya New Material. The midstream of the industry chain mainly consists of PCB manufacturers such as Pegatron, Dongshan Precision, Shenzhen Santek, Huadian Technology, and Jingwang Electronics. The downstream applications are widespread, including communications, computers, automotive electronics, and consumer electronics. Cost Structure Analysis of the Printed Circuit Board IndustryThe cost of printed circuit boards (PCBs) mainly consists of raw materials, labor costs, and manufacturing expenses. Statistics on the product cost data of leading enterprises in the PCB industry show that raw materials account for the largest proportion of costs in the PCB industry, generally over 60%.

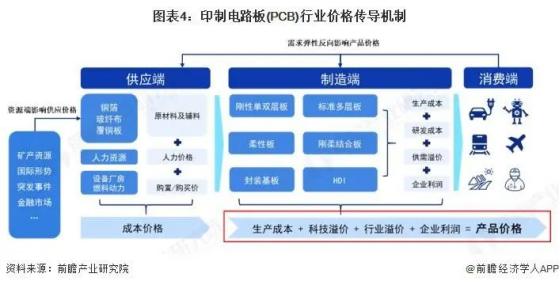

Cost Structure Analysis of the Printed Circuit Board IndustryThe cost of printed circuit boards (PCBs) mainly consists of raw materials, labor costs, and manufacturing expenses. Statistics on the product cost data of leading enterprises in the PCB industry show that raw materials account for the largest proportion of costs in the PCB industry, generally over 60%. Price Transmission Mechanism of Printed Circuit BoardsThe market price of printed circuit boards (PCBs) is formed and transmitted step by step through the joint action of the industry supply side, manufacturing side, and application side. The cost prices on the supply side include raw material and auxiliary material prices, labor prices, and equipment and factory prices, among which raw material prices are significantly affected by mineral resources, land supply, and international situations; the price transmission from the supply side to the manufacturing side forms the production cost, which includes the comprehensive supply and demand premium of the manufacturing industry, R&D costs, and corporate profits, forming the “manufacturing side price” that transmits to the application side, while the market demand elasticity in application scenarios also reacts back to the supply side and manufacturing side, forming a “price-demand-price” transmission path that influences the market pricing of printed circuit board (PCB) products.

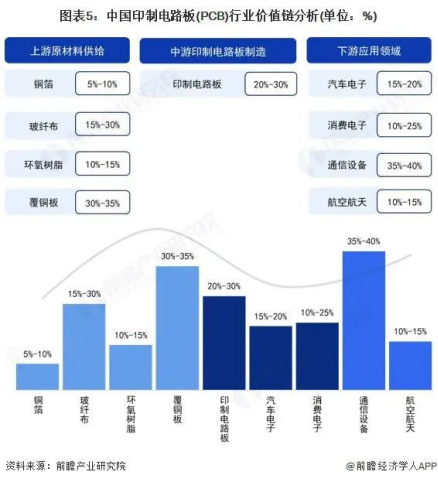

Price Transmission Mechanism of Printed Circuit BoardsThe market price of printed circuit boards (PCBs) is formed and transmitted step by step through the joint action of the industry supply side, manufacturing side, and application side. The cost prices on the supply side include raw material and auxiliary material prices, labor prices, and equipment and factory prices, among which raw material prices are significantly affected by mineral resources, land supply, and international situations; the price transmission from the supply side to the manufacturing side forms the production cost, which includes the comprehensive supply and demand premium of the manufacturing industry, R&D costs, and corporate profits, forming the “manufacturing side price” that transmits to the application side, while the market demand elasticity in application scenarios also reacts back to the supply side and manufacturing side, forming a “price-demand-price” transmission path that influences the market pricing of printed circuit board (PCB) products. Value Chain Analysis of Printed Circuit BoardsIn the cost structure of China’s printed circuit boards (PCBs), the proportion of raw materials is high. Specifically, the gross profit margin of copper-clad laminates is relatively high, with a product gross profit margin of around 30% to 35%; the gross profit margin of midstream PCB manufacturing is about 20% to 30%; the downstream application fields are very diverse, with significant differences in gross profit margin levels across industries, among which the communication equipment industry has a higher gross profit margin, overall around 35% to 40%.

Value Chain Analysis of Printed Circuit BoardsIn the cost structure of China’s printed circuit boards (PCBs), the proportion of raw materials is high. Specifically, the gross profit margin of copper-clad laminates is relatively high, with a product gross profit margin of around 30% to 35%; the gross profit margin of midstream PCB manufacturing is about 20% to 30%; the downstream application fields are very diverse, with significant differences in gross profit margin levels across industries, among which the communication equipment industry has a higher gross profit margin, overall around 35% to 40%. (Excerpted from Qianzhan Industry Research Institute)

(Excerpted from Qianzhan Industry Research Institute)

Remember to leave yourlikes and views for me~