This article is reprinted fromWeChat Official Account: Electronic Engineering Magazine

Author: Zhang Xuan

Recently at the Tech-G Shanghai International Consumer Electronics Show, we noticed that Allwinner Technology showcased its chips used across various industries, including smart living, smart automotive, smart industrial, and smart vision, among others. In fact, Allwinner gained early fame due to its audio and video interaction products, such as applications on tablets; now, it has expanded its vision to various industries.According to Allwinner’s 2022 annual report, the types of chips the company is currently developing include smart terminal AP SoCs, PMICs, wireless communication, and voice signal chips. At the Allwinner booth, we also saw many star products, such as Tmall Genie, Xiaomi Sound Pro, Insta360 GO 3, as well as projectors, medical display control integrated machines, industrial gateways, and in-vehicle central control systems, showcasing a dazzling array of customer products.“We see that there is a demand for intelligence across various industries, and this demand is continuously expanding and increasing. We have been trying to expand into different industries,” said Hu Dongming, Vice President of Allwinner Technology Group, as a representative of chip companies at the Tech-G opening forum. He mentioned that Allwinner is a chip design manufacturer that “provides high-quality chips and services around smart living, smart cities, and smart industries.” In an interview with Electronic Engineering Magazine, he stated, “With Allwinner’s technological accumulation and our deeper understanding of each segmented market—especially those markets that align closely with us.”

Hu Dongming, Vice President of Allwinner Technology Group

Hu Dongming, Vice President of Allwinner Technology Group

As a major and comprehensive market participant in China, spanning different fields, what mindset and technical reserves do they have for market planning? In the face of the trend of digitalization and intelligence in society, how do they think about market trends? We believe that Allwinner should be one of the most authoritative market players among domestic chip companies in this regard.Wide Coverage Creates AdvantagesWe know that the consumer electronics market supports Allwinner’s chip volume. Although Allwinner has not disclosed the revenue proportions of different business directions, it is evident that consumer electronics has always been one of Allwinner’s focal points. This can be seen from the revenue trends of Allwinner in the past two years, in comparison with the overall trends in the consumer electronics market.However, Mr. Hu Dongming emphasized that Allwinner’s business growth in the industrial and robotics sectors is also very rapid. “We adopt an iterative development approach, with platforms and segmented markets iterating every other year. Once the platform iteration is successful, it will be directed towards various industries.” “At any given time, there will inevitably be a segment market with large volume or relatively good returns. These markets alternate and iterate year by year; currently, Allwinner’s iteration direction is leaning towards industrial and robotics, which is the AI scenario application direction.”This actually aligns with the strong cyclical nature of the electronics industry and the different cyclical performance of various vertical fields. Generally, international chip giants and upstream market participants tend to leverage broader market coverage to mitigate the risks inherent in the industry: when one market is in a slow period, they simultaneously push into other markets. This should also be an objective capability that chip companies like Allwinner possess and a goal they aspire to achieve in the future.Allwinner’s annual report discusses its market advantages, stating, “The company builds an intelligent application platform based on diversified product layouts, constructs a complete chain of AI voice and AI vision applications through comprehensive empowerment with AI, and establishes strategic partnerships with several industry benchmark customers, integrating with customers in terms of computing power, algorithms, products, and services, focusing on the mass production of segmented AI products such as smart speakers, smart home appliances, smart security, smart cockpits, and smart industrial control.”In 2017, Mr. Hu Dongming mentioned Allwinner’s MANS big video strategy in an interview, with products focusing on multimedia, analog, network, and service dimensions. The establishment of different business units has also been guided by this. From the zoning at the exhibition site and the display of different categories of products, it can be seen that Allwinner has successfully implemented this guideline over the years.

Mr. Hu Dongming’s understanding of Allwinner’s market advantages is as follows: “In the intelligent industry chain, we prefer to empower terminal products, which are intelligent terminal products across various industries.” “A wider coverage allows us to combine the elements needed for achieving intelligence, which many chip manufacturers do not possess.” “For example, some intelligent applications require real-time responses.” We know that industrial applications have high real-time requirements. “Therefore, we can draw on our experience in the industrial field.”“Additionally, we invest a lot of effort in each market.” Mr. Hu Dongming believes that Allwinner’s accumulated experience in different fields enables it to better understand the core elements of terminals and to have the capability to “balance the cost structure of the industry chain,” integrating “the professional technologies accumulated across various industries,” allowing us to achieve high cost-performance implementations. This is another advantage that can be achieved by covering different fields.Achieving Cross-Field Product LayoutsAllwinner’s AP SoC chip products have different letter series, initially categorized based on scenarios and applications. For example, the well-known T series is more focused on industrial and automotive applications, the F series is for human-computer interaction, and the V series covers general vision AI products. Cross-field and wide coverage naturally have several benefits mentioned earlier: technology borrowing from different fields and balancing cost structures, etc. However, there is a question: how do chip manufacturers achieve layouts in multiple markets simultaneously, what is the business logic behind this, and how is it implemented on a technical level?Taking Allwinner’s automotive chips as an example, the automotive components Allwinner is currently involved in include virtual displays, HUDs, intelligent headlights, 360-degree surround view, “as well as some intelligent assistance” implementations.Of course, the automotive industry’s shift towards electrification and intelligence provides Allwinner with an opportunity to showcase its capabilities in this market. However, more importantly, “the categories we discuss have a characteristic: they are all visually oriented, and they focus on the interaction between the car and people, as well as between the car and the outside world. Allwinner started with audio and video interaction products, so this is our advantage.” Mr. Hu Dongming mentioned, “Based on our strengths, we plan automotive products, so we focus on intelligent assistance visual products.”This explanation essentially returns to the MANS strategic thinking and clarifies the business logic of field layout.

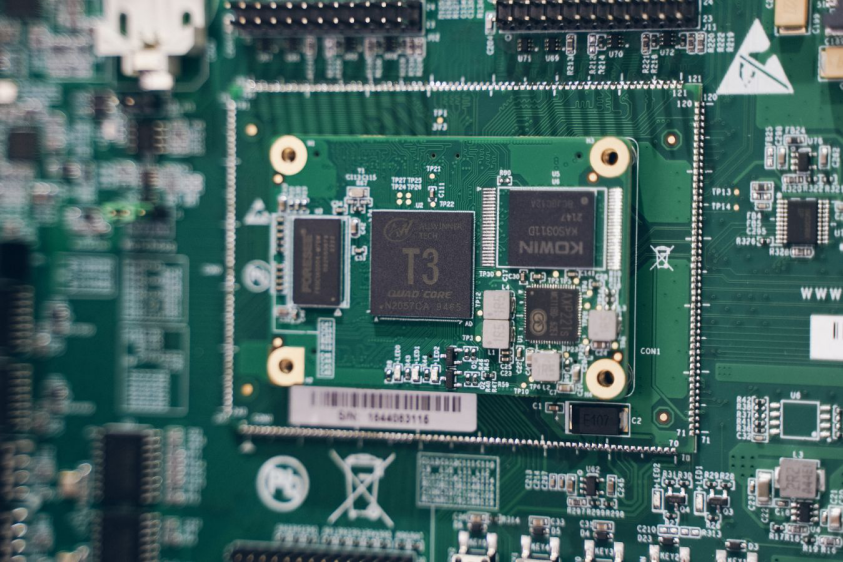

Allwinner’s partner Guangzhou Chuanglong showcases an industrial evaluation board centered around the T3 main control unit

Allwinner’s partner Guangzhou Chuanglong showcases an industrial evaluation board centered around the T3 main control unit

On the other hand, generally speaking, in industries like electronics with long production chains, the more upstream (or foundational) market participants are, the more they can abstract commonalities for downstream (application layer) products. Based on commonalities to create products naturally allows for coverage across different application fields. For example, in materials, the same material often adapts to many downstream applications; chip design has similar attributes.“Commonality issues are essentially bottom-level abstractions,” Mr. Hu Dongming explained to us. “Starting from different scenarios, abstracting common technical requirements, and their bottom-level requirements, such as how chip circuits need to be designed, and how the structural ecosystem should be.” As mentioned earlier, industrial applications often have high real-time requirements, “For example, if a robotic arm is operating and receives another signal, the operation cannot be interrupted, and it needs to respond to this signal quickly.”“Abstracting this requirement involves considering whether to use polling solutions or to make timely responses. There are also more abstractions, such as whether channels need to be isolated, and which scenarios need to be adapted, etc. Perhaps household robots also have such needs. Once these commonalities of applications are abstracted and integrated into the chip, the product can have a broader application span.”Once the chip meets the commonalities of numerous upper-layer applications, it also needs to consider the differentiation required for implementation in different fields and applications—constructing a platform is a common solution for companies in the chip and semiconductor fields with different ecological niches. “Our platform chips will leave enough differentiated features, such as higher computing power, more interfaces, and a richer variety of processors that can be expanded.”The aforementioned different series of products defined by Allwinner are also aimed at different application fields. It is worth mentioning that Mr. Hu Dongming also mentioned in the interview that Allwinner has a considerable number of software team members, and the “lower-level parts of the software will be handled by us,” while also leveraging partnerships with solution providers to “connect the application layer”—this way, Allwinner’s chips empower various industries; moreover, in the software part, “our share may even be higher.”Intelligent Future Focused on AIThis year at the Tech-G exhibition, Allwinner specifically opened an area to showcase two series of “AI chips” (A523 and T527); in Allwinner’s 2023 semi-annual report, several ongoing projects are also strongly related to AI— including video decoding, automotive-grade SoCs, and wireless voice chips; the theme of Mr. Hu Dongming’s speech at the opening forum was also related to AI and even generative AI.“Focusing on AI voice, AI vision,” and “mass production of AI products” are also frequently mentioned descriptions in Allwinner’s financial reports. These should indicate Allwinner’s emphasis on AI technology and its investment in this technological trend. From a product perspective, it is not just about the commonly discussed TinyML and CPU instruction-level AI inference acceleration; Allwinner has also laid out NPU and AIPU acceleration units in more chip products.Mr. Hu Dongming introduced that the planned AIPU is “hard AI, oriented towards scenarios and modules,” while the NPU is a more general neural network inference accelerator. Currently, Allwinner’s AI chip products on the market can achieve NPU computing power of up to 2-3 TOPS, “with planned products also reaching 6-8 TOPS, considering different scenarios.” Although Mr. Hu Dongming also added that, in fact, with the current scenarios and chip categories laid out by Allwinner, many scenarios do not require high-power accelerators.

Allwinner’s partner Suozhi showcases a development board centered around the V536-H main control unit

Allwinner’s partner Suozhi showcases a development board centered around the V536-H main control unit

However, Allwinner seems to have a longer-term vision regarding AI. Mr. Hu Dongming repeatedly emphasized the value of large models and generative AI in his keynote speech. In fact, in the work summary of the semi-annual report, Allwinner also mentioned that the company is “seizing the development trend of generative AI technology” in the first half of the year.In Mr. Hu Dongming’s view, today’s AI has made an important step towards “the second stage.” “Previously, AI was just an algorithm that penetrated a scene. The algorithm is an application, a black box, and users find it difficult to change the model of the black box. The model is more like a combination of human wisdom and machine capability”; “Now, the new AI must first deconstruct and reconstruct all scenes. This requires us to input multimodal information, conduct scene-based encoding during information input, and perform scene-based analysis, outputting the need for scene-based reconstruction and decoding, which ultimately leads to decision-making and execution.”This process “essentially corresponds to the reconstruction and deconstruction process of the human brain in cognitive science.” “In fact, many customers are already using our chips for generative AI applications. Allwinner needs to provide underlying computing power and toolkits, as well as input and output interfaces. We hope that through our efforts, generative AI products can be made simpler and more competitive.”“Because the ecosystem of each segmented market is very important to us, we need to form a model that fits its ecosystem for different markets. Although Allwinner itself does not develop application algorithms, we need to understand algorithms and then provide tools to customers.” This is a key element of the AI ecosystem, and at the same time, for establishing a broader “ecosystem,” “from application algorithms, system integration, to chip computing power, as well as perception and execution chips,” “are all our partners, and each model is co-built together.” These should be the aspects that Allwinner has spent a lot of time and effort on.Mr. Hu Dongming also listed some generative AI industry applications based on Allwinner chips, “For example, in scenarios that require high process and order, such as banking or retail, where virtual people need to connect with customers, this process requires voice synthesis and visual synthesis. These scenarios are relatively standardized and do not change frequently, so the development of generative AI will be relatively fast.” “There are also applications in the education sector, targeting children’s learning difficulties, problems, and deficiencies.”In Allwinner’s view, China has a vast AI application market, and AI technologies, including generative AI, will thrive due to stimulation from the application side. This is not only part of the social digitalization and intelligent transformation but also a potential market opportunity for Allwinner. “The Chinese market is large and can be implemented,” “Where AI will go in the future, and how it will develop most appropriately, no one has a conclusion. This requires experimentation.” China has an inherent advantage in this regard.

In fact, we also discussed more intelligent-related topics with Mr. Hu Dongming, including smart industrial applications, automotive ADAS, and intelligent cockpits. The reason we specifically highlighted AI is that it is a direction of focus for Allwinner and is representative of these topics, showcasing Allwinner’s embrace of innovative technology. For instance, when discussing market trends such as software-defined vehicles and changes in automotive EE architecture, Mr. Hu Dongming always holds a positive attitude towards these technologies and emphasizes that Allwinner is fully committed to “embracing new technologies” and “embracing new architectures.”In our view, Mr. Hu Dongming’s summary of smart industrial applications is likely applicable to the intelligent evolution trends across various industries and can also be used to summarize the entire article: “Before we talk about smart industries, we are actually discussing more about digitalization. With the advancement of digitalization, people find that the reconstruction and efficiency processes that digitalization can achieve have become more numerous.” “Intelligence reflects higher quality, higher efficiency, and lower costs. The addition of intelligent devices is to solve these problems.” If the first stage is “digitalization,” then “in the second stage, digitalization pursues more lean production and management, and intelligence naturally becomes very popular.”Extending this statement to the digitalization and intelligence of society across various industries seems entirely applicable. These will become future market opportunities for Allwinner Technology, especially as a chip company covering such a wide market.