The drone industry has established a comprehensive and intricate industrial chain. This chain encompasses every aspect from research and development to manufacturing, sales, and service, while deeply integrating technological innovation, market applications, and policy support across multiple dimensions, showcasing a high level of maturity and vigorous development vitality.

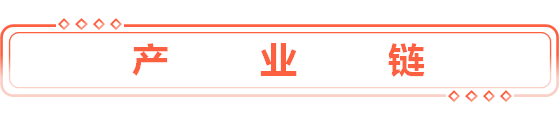

The upstream of the drone industry chain mainly consists of raw materials dominated by metal and composite materials. Metal materials include steel, aluminum alloys, and magnesium-aluminum alloys, while composite materials include carbon fiber materials, resin materials, and ceramic materials. The midstream involves the manufacturing of complete drones, including flight platform systems, payload systems, ground systems, and the drones themselves. The flight platform system mainly includes the main control chip, battery, motor, navigation system, communication system, electrical system, and structural components. The payload system includes cameras, LiDAR, sensors, imaging systems, and gimbals. The ground system includes auxiliary equipment, remote control detection, monitoring systems, data processing systems, and takeoff and landing systems. The complete drones include military and civilian drones. The downstream consists of the application fields of drones, including military reconnaissance, logistics transportation, geographic surveying, and aerial photography.

Image source: China Business Industry Research Institute

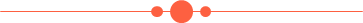

Steel production shows a growth trend, with China’s steel output reaching 1.363 billion tons in 2023, a year-on-year increase of 5.2%. From January to May 2024, China’s steel output was 574 million tons, a year-on-year increase of 2.9%.

Data source: China Business Industry Research Institute Database

In recent years, aluminum alloy production has steadily increased, with China’s aluminum alloy output rising from 9.421 million tons in 2019 to 14.587 million tons in 2023. From January to May 2024, China’s aluminum alloy output was 6.558 million tons, a year-on-year increase of 12.5%.

Data source: China Business Industry Research Institute Database

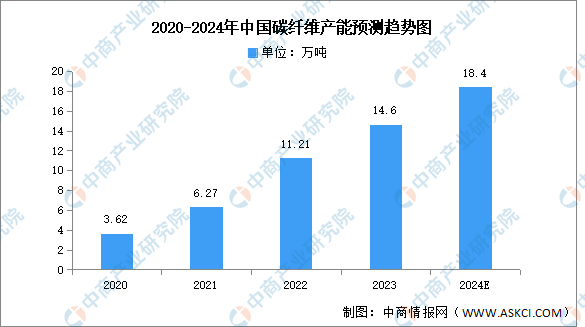

Currently, China’s carbon fiber production capacity has exceeded 100,000 tons, making it the world’s largest producer. According to the “2024-2029 China Carbon Fiber Industry Market Survey and Investment Prospect Research Report” released by the China Business Industry Research Institute, the carbon fiber production capacity in mainland China was 112,100 tons in 2022, accounting for approximately 43.3% of global capacity, and about 146,000 tons in 2023. Analysts predict that with policy support for further development of carbon fiber, China’s carbon fiber production capacity will grow to 184,000 tons in 2024.

Data source: Compiled by the China Business Industry Research Institute

The carbon fiber industry is a strategic emerging industry in the country, with broad development prospects in the lightweight market and irreplaceable advantages in national defense and aerospace sectors. The “2024-2029 China Carbon Fiber Industry Market Survey and Investment Prospect Research Report” released by the China Business Industry Research Institute indicates that the market size of carbon fiber in China was 12.81 billion yuan in 2022, a year-on-year increase of 20.69%, and approximately 15.37 billion yuan in 2023. Analysts predict that the market size of carbon fiber will reach 17.14 billion yuan in 2024.

Data source: Compiled by the China Business Industry Research Institute

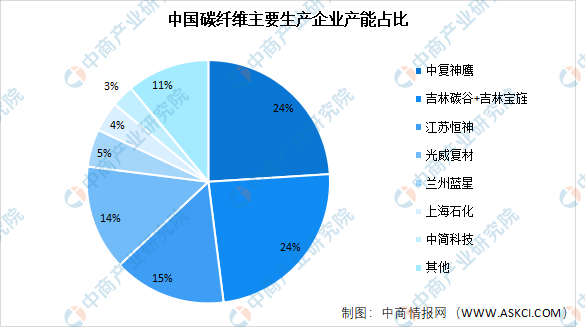

Currently, the main carbon fiber manufacturers in China include Zhongfu Shenying, Jilin Carbon Valley, Jilin Baojing, Jiangsu Hengshen, and Guangwei Composites. Among them, Jilin Carbon Valley focuses on precursor production; Jilin Baojing and Lanzhou Blue Star primarily produce large tow carbon fiber, while Jiangsu Hengshen and Lanzhou Blue Star have both precursor production and carbon fiber production capabilities; other companies mainly focus on high-performance carbon and small tow carbon fiber. Data shows that Zhongfu Shenying and Jilin Carbon Valley + Jilin Baojing each account for 24% of the production capacity; Jiangsu Hengshen accounts for 15%; and Guangwei Composites accounts for 14%.

Data source: Compiled by the China Business Industry Research Institute

In recent years, with the development of information warfare, the demand for new equipment such as drones has significantly increased. Coupled with the ongoing security issues and territorial disputes, equipping drones has become an effective means to enhance national defense capabilities at a lower cost, leading to a continuous expansion of global military drone demand. According to the “2024 Global and China Market In-Depth Research Report on Drones” released by the China Business Industry Research Institute, the global military drone market size reached 12.124 billion USD in 2023, and analysts predict that the global military market will maintain sustainable and stable development, with the global military drone market size expected to reach 12.203 billion USD in 2024.

Data source: Tiel Group, compiled by the China Business Industry Research Institute

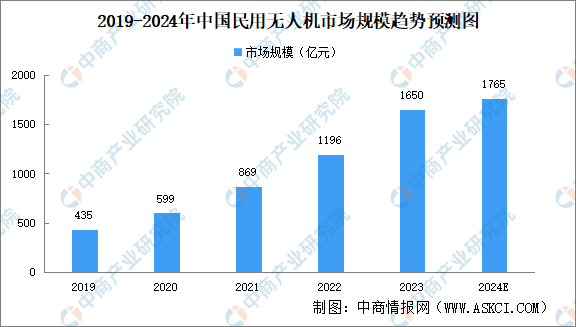

In recent years, the process of civilianizing drones in China has accelerated, leading to rapid development of the civilian drone industry. According to the “2024-2029 China Drone Industry Market Research and Outlook Report” released by the China Business Industry Research Institute, the market size of civilian drones in China reached 119.6 billion yuan in 2022, increasing to 165 billion yuan in 2023. Analysts predict that the civilian drone market size will reach 176.5 billion yuan in 2024.

Data source: Compiled by the China Business Industry Research Institute

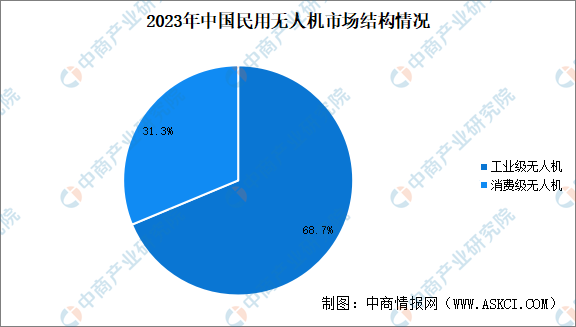

Civilian drones are divided into industrial and consumer categories. Consumer drones are aimed at ordinary consumers for aerial photography, tracking, and professional institutions for film production. The industrial drones have entered more mature fields such as agricultural protection, geological exploration, inspection, surveying, and transportation. Currently, industrial drones play a leading role, accounting for 68.7% of the market size, while consumer drones account for 31.3%.

Data source: Compiled by the China Business Industry Research Institute

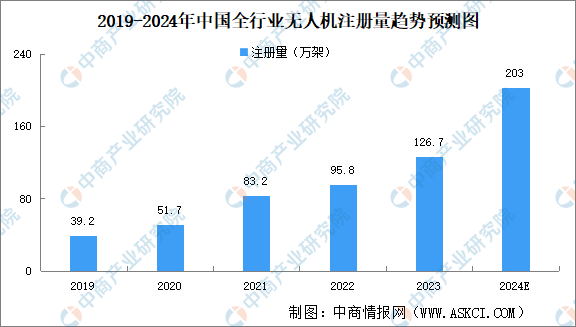

Benefiting from industry development and policy support, the number of registered drones in China has rapidly increased in recent years. By the end of 2023, there were a total of 1.267 million registered drones in the industry, a 32.2% increase compared to the end of 2022. In the first half of this year, over 600,000 new drones were registered, with the total number of drones increasing by 48% compared to the end of last year. Analysts predict that the number of registered drones will exceed 2 million in 2024.

Data source: Civil Aviation Administration of China, compiled by the China Business Industry Research Institute

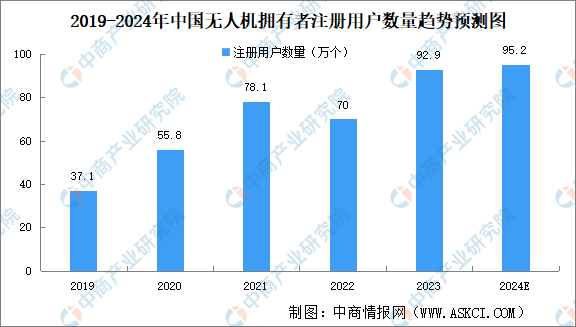

By the end of 2023, there were 929,000 registered drone owners in the industry, of which 849,000 were individual users and 80,000 were users from enterprises, institutions, and government agencies. Analysts predict that the number of registered drone owners will reach 952,000 in 2024.

Data source: Civil Aviation Administration of China, compiled by the China Business Industry Research Institute

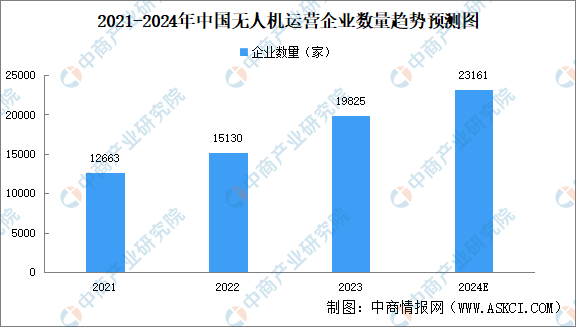

The number of drone operating companies has increased from 12,663 in 2021 to 19,825 in 2023, with an average annual compound growth rate of approximately 25.1%. Analysts predict that the number of drone operating companies will reach 23,161 in 2024.

Data source: Civil Aviation Administration of China, compiled by the China Business Industry Research Institute

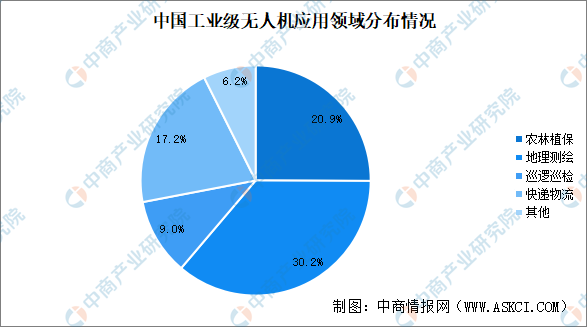

The downstream applications of industrial drones currently focus on agricultural protection, geographic surveying, and inspection. Agricultural drones have been widely used in agricultural production in China. Through high-altitude photography and intelligent analysis, detailed agricultural information can be obtained in a timely manner, improving agricultural production efficiency and suitable for various scenarios such as flight inspection, seeding, fertilization, pest monitoring, and disaster investigation. Among these, the agricultural protection field accounts for 20.9%, geographic surveying accounts for 30.2%, and express logistics accounts for 17.2%.

Data source: Compiled by the China Business Industry Research Institute

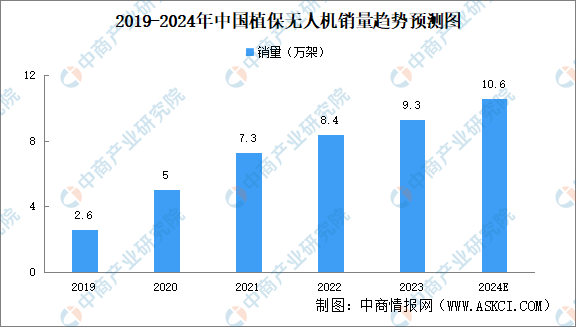

With the introduction of local subsidies, the agricultural protection drone market in China is very hot, showing a growth trend in sales. According to the “2024-2030 China Agricultural Protection Drone Market Survey and Industry Outlook Report” released by the China Business Industry Research Institute, the sales of agricultural protection drones in China were approximately 93,000 units in 2023, and analysts predict that sales will reach 106,000 units in 2024.

Data source: Compiled by the China Business Industry Research Institute

With the advancement of efficient agriculture and the development of smart agriculture, the mechanization and intelligence level of agricultural protection work have further improved, leading to rapid expansion of the industry scale. According to the “2024-2030 China Agricultural Protection Drone Market Survey and Industry Outlook Report” released by the China Business Industry Research Institute, the market size of agricultural protection drones in China reached 15 billion yuan in 2023. Analysts predict that the market size will reach 17.126 billion yuan in 2024.

Data source: Compiled by the China Business Industry Research Institute

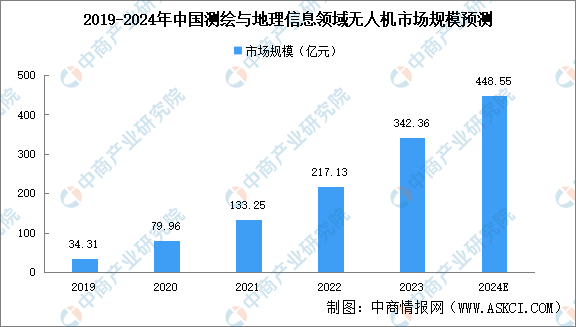

The market size of drones in the surveying and geographic information field continues to expand. According to the “2024-2029 China Drone Industry Market Research and Outlook Report” released by the China Business Industry Research Institute, the market size of drones in the surveying and geographic information field in China reached 34.236 billion yuan in 2023. Analysts predict that the market size will reach 44.855 billion yuan in 2024.

Data source: Compiled by the China Business Industry Research Institute

The above information is for reference only. If there are any omissions or deficiencies, please feel free to correct!