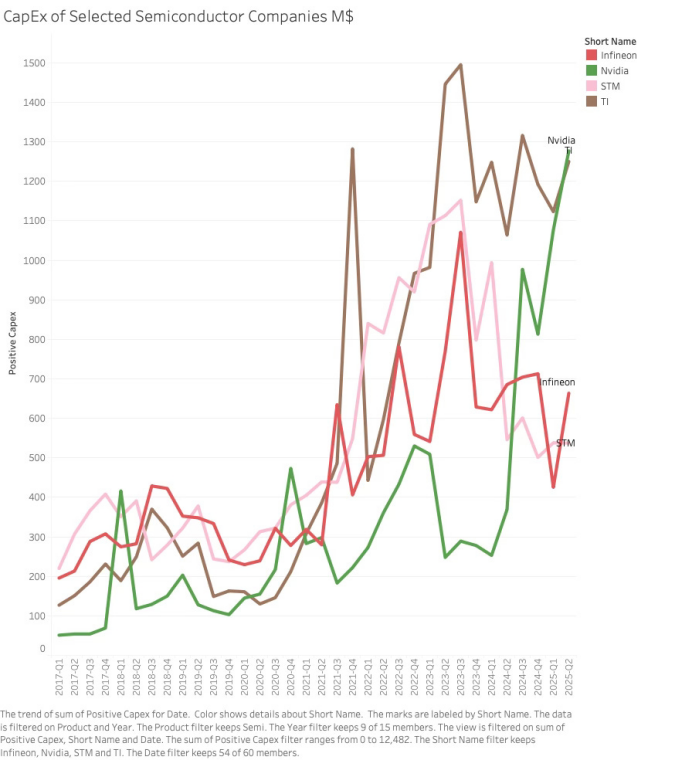

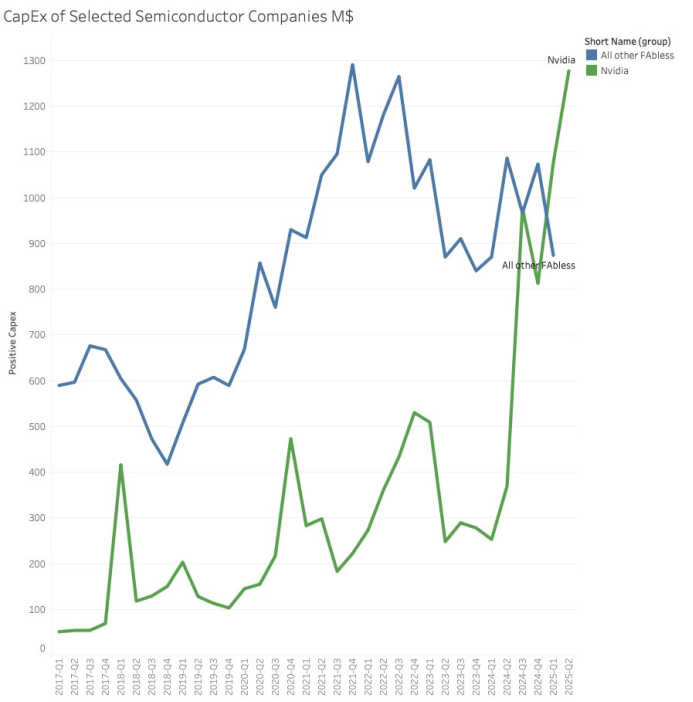

There are several other interesting developments in NVIDIA’s data. First is the development of capital expenditures. While this is typically not a number worth studying for fabless companies, it is becoming significant for NVIDIA.

Capital expenditures are now approaching 1.3 billion dollars or more, comparable to those large integrated device manufacturers (IDMs) that require investment in wafer fabrication capacity. NVIDIA’s capital expenditures now exceed the total capital expenditures of all other fabless semiconductor companies combined.

This is not just for equipment to increase manpower. NVIDIA is also doing other things. Occasionally, I try to ask questions during investor calls, which should be possible, but somehow Goldman Sachs, UBS, Bank of America, and Wells Fargo always seem to be ahead of me. While the questions these analysts ask are usually good, they are also compensated to fill their company’s forecasting models so they can estimate the next quarter’s numbers.

A more curious question is: what is NVIDIA spending 1.3 billion dollars each quarter to build?

I have never heard this question asked during NVIDIA’s calls.

A bold guess is that NVIDIA is using their servers to build something related to AI. Interestingly, NVIDIA uses their own servers, costing only a quarter of what cloud companies pay. If this is server-based, then this capital expenditure investment would equate to over 5 billion dollars each quarter, surpassing the expenditures of Apple, Oracle, Alibaba, and Tencent.

There are several other interesting things:

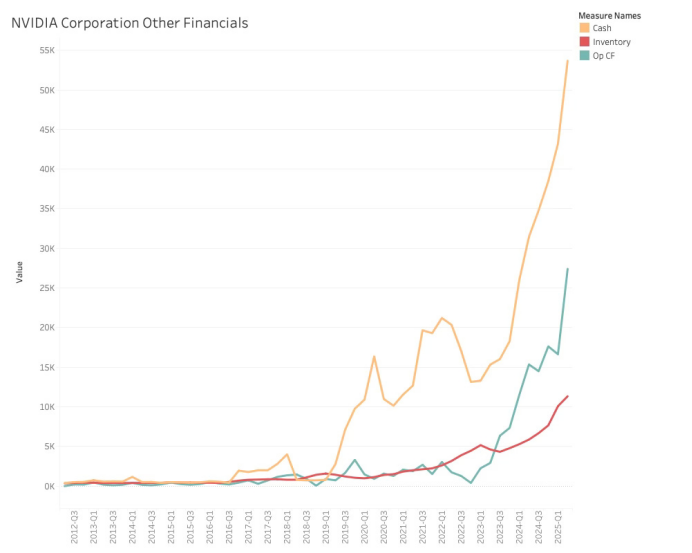

The first is the cash reserves skyrocketing. NVIDIA increased its cash reserves by over 10 billion dollars in a quarter negatively impacted by export restrictions. Despite the company having 8.5 billion dollars in debt, early repayment may not be reasonable. This is thanks to a strong cash flow of over 27 billion dollars each quarter. Although deferred payments have some impact on operating cash flow, it remains strong, growing 65% quarter-over-quarter.

This is important in traditional discounted cash flow (DCF) valuation models. While classic standards cannot measure NVIDIA, the company’s tangible value has just significantly increased.

Additionally, inventory has quietly increased by 1.3 billion dollars again. This is mainly due to a 2 billion dollar increase in work-in-progress inventory, which typically indicates an increase in manufacturing activity, leading to positive revenue results later.

Most likely, this is a result of salvaging materials that can be used for other product configurations, which will be consumed over time. So far, the most interesting topic is the network business, and it is time to delve deeper into NVIDIA’s latest strategic initiatives.

NVIDIA’s Network Business

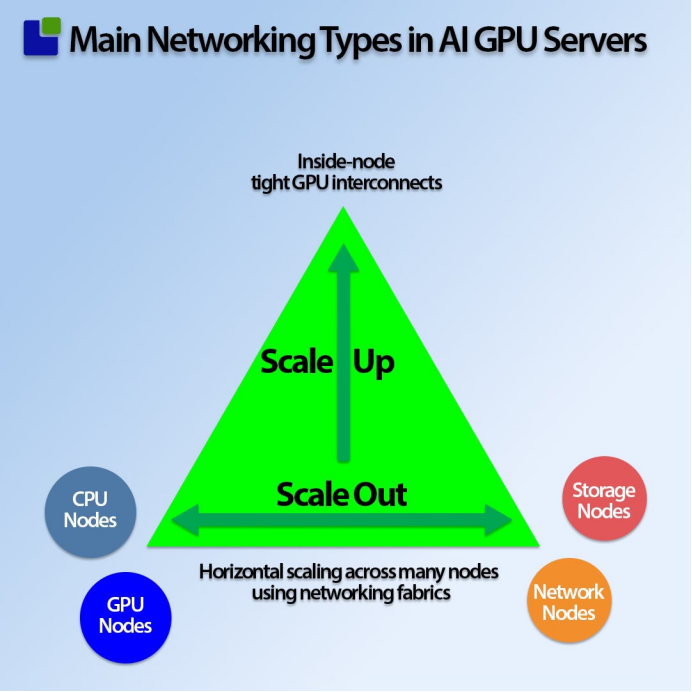

A key concept in AI networks is the distinction between vertical scaling and horizontal scaling.

NVIDIA’s significant bets on AI historically began with the acquisition of Mellanox, which provided the foundation for the company to vertically scale its network.

From Jensen Huang’s recent talks, it is clear that the next battleground is the network. Just a few months ago, it seemed that inference would be the area where NVIDIA would face severe competition, but as the demand for NVIDIA’s golden GPU cages remains unmet, that competition has quietly faded.

The moat has widened, and NVIDIA’s strategic priorities have also broadened. The network business was not previously unimportant; the change is that the network has now become NVIDIA’s primary strategic focus.

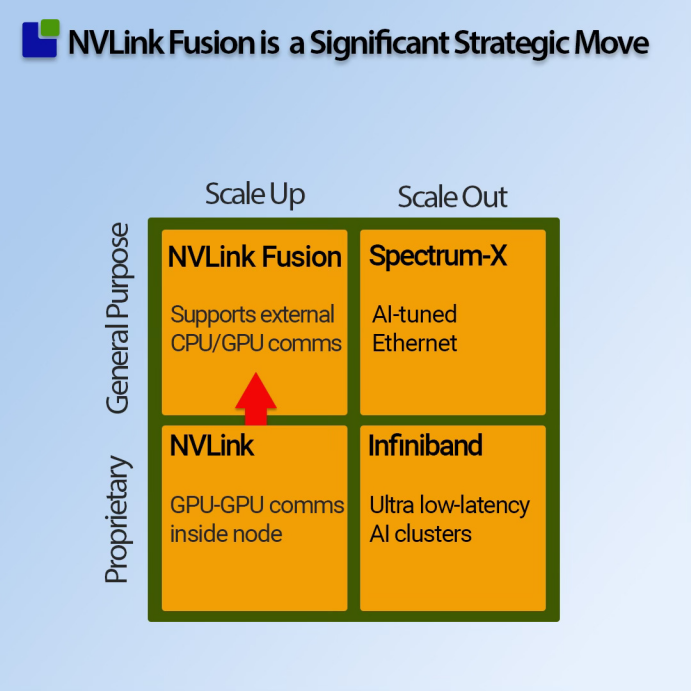

With the launch of NVLink Fusion at Computex, Jensen Huang stated that the company now has four major network platforms. But NVLink Fusion is not just a product launch; as will be shown below, it is a significant strategic move.

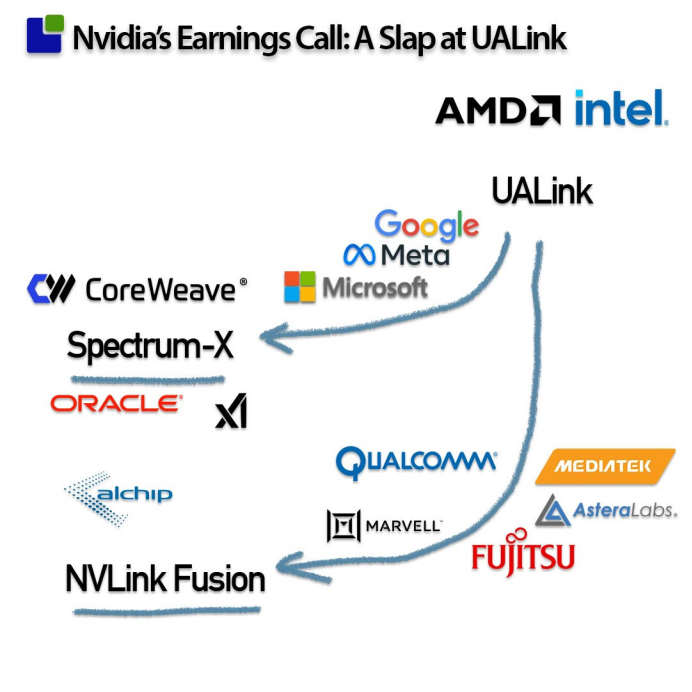

While the horizontal scaling front between NVIDIA’s Spectrum-X and the rebellious UALink alliance continues, NVLink Fusion is a powerful move that positions NVIDIA in the space that AI computing competitors have managed to carve out.

Having products does not equate to them being adopted. But when NVIDIA makes a strong move, their customers cannot sit still, as delaying the adoption of the latest technologies from AI technology leaders could be fatal in the race for AI supremacy. NVIDIA’s competitors have mixed feelings upon receiving news of NVLink Fusion. This move represents both a threat and an opportunity.

The investor call revealed the progress NVIDIA has made:

Excluding Intel and AMD, which became losers after NVIDIA’s earnings call, these are key companies that NVIDIA has successfully attracted to join the NVLink Fusion network. Among the supporters of UALink, five are also adopting NVLink Fusion, and three are adopting Spectrum-X. All influential accelerator companies are now part of NVIDIA’s vertical scaling network camp.

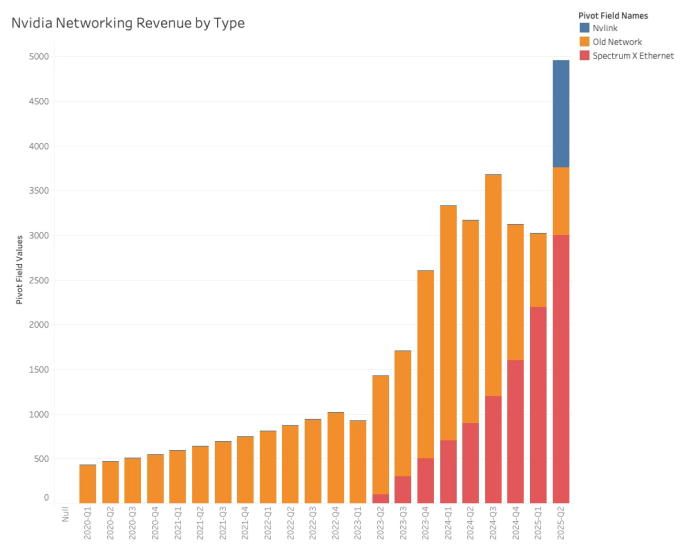

NVIDIA will not mention a company unless there is already substantial activity underway. NVIDIA did not leave us guessing but instead disclosed network business revenue data, showing that progress is real and tangible:

NVLink Fusion business has generated over 1 billion dollars in revenue each quarter, and Spectrum-X business revenue has reached 3 billion dollars. If NVIDIA’s network business were an independent company, it would be the ninth largest semiconductor company, ahead of MediaTek, Texas Instruments, and Infineon.

As I have seen analysts attempt to deduct NVIDIA’s internal network consumption from this number, I must remind my readers that this is network business revenue, entirely from external customers. Any network resources consumed by NVIDIA for its server products are of a cost nature, not revenue-generating.

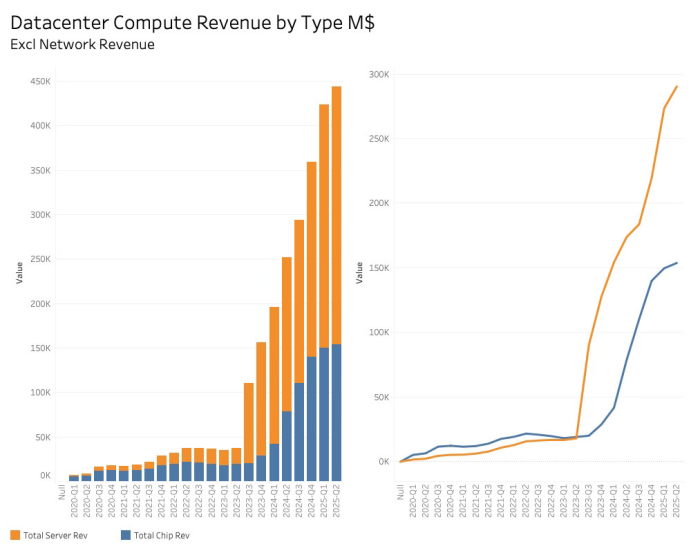

Analyzing data center revenue by server and GPU (board) (excluding network revenue) shows that the revenue from the server segment is quite substantial:

While the Spectrum-X products can also be adjacent to servers, NV-Link will primarily relate to the revenue of GPU and accelerator companies, mainly Marvell and Qualcomm.

NVIDIA can now interface with nearly all AI workloads in data centers and is also open to CPU workloads. While it is unclear whether AMD and Intel need to take any action to adapt to NVLink Fusion, these two server CPU companies will have to adapt to this new development as their customers are already integrating NVLink Fusion.

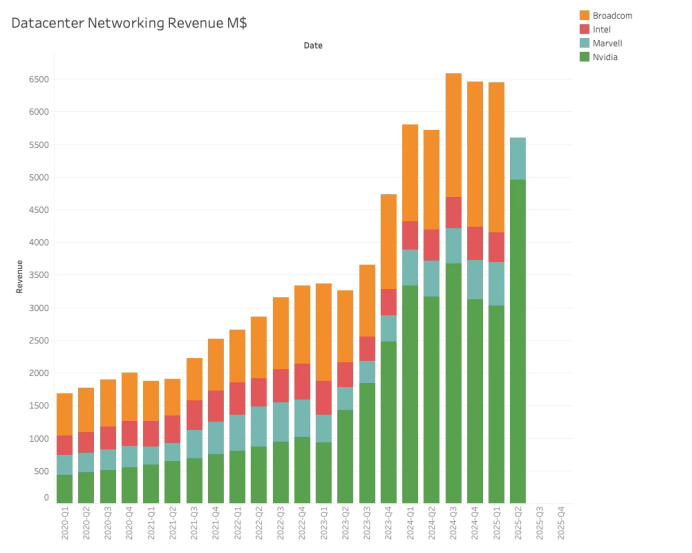

After five consecutive quarters of flat network revenue, NVIDIA’s strong moves have become evident:

After winning in data center AI training, NVIDIA is also dominating inference, and now the network. The company is no longer playing the role of a semiconductor company but is more like a company that utilizes semiconductors in its products. While a few products are “white-labeled” by other server manufacturers, the core components and all value are captured by NVIDIA. NVIDIA is an AI factory company and is poised to dominate all corners of this new field that will continue to disrupt the semiconductor industry and everything else.

This is the most important technology company of all time. No matter where you live or what you do, NVIDIA has already and will profoundly impact your life, even if you have not yet realized it.

*Original media:Semiconductor Business Intelligence

*Original author:Claus Aasholm

*Original link:

https://clausaasholm.substack.com/p/nvidias-next-strategic-power-move

Chip-Enabled Future,Intelligent Ecosystem Creation

Bay Chip Expo 2025Looking forward to seeing you!