A good company ≠ good prices; discovering a good company ≠ encountering a good opportunity!

Domestic high-end chips are about to experience explosive growth!

It is well known that high-end chips and related materials and equipment have been banned from sale, viewed as a lethal weapon by both parties in the U.S. to curb China’s development.

However, the facts prove that this is merely their wishful thinking. China’s high-end chips are expanding production capacity at an astonishing rate.

In terms of storage, South Korean media reported that domestic Changxin Memory (CXMT) will significantly exceed initial forecasts for DRAM chip (memory module) production capacity this year, with an expected increase of over 68%, and the proportion of high-end DDR5 will significantly rise.

Regarding GPUs, several foreign media outlets have recently reported that Huawei’s Ascend new products are about to be launched, with performance even comparable to NVIDIA’s high-end H100 products.

Clearly, the explosive development of domestic high-end chips will inevitably drive the prosperity of domestic semiconductor equipment.

As a core component, testing equipment will naturally benefit even more.

Chip production requires dozens or even hundreds of process steps, and any error in any step can lead to device failure.

Therefore, testing equipment is the key “quality inspector” that runs through the entire chip manufacturing process.

Semi-conductor testing equipment includes inspection and measurement devices, which can be roughly understood as corresponding to qualitative and quantitative testing, respectively.

Due to the significant increase in demand for high-end chips driven by AI, chip production companies are clearly expanding capacity. The global semiconductor equipment industry is expected to be very prosperous in 2024, with a market size of $110 billion, a year-on-year growth rate of 10%.

Among them, testing equipment is particularly encouraging, with a year-on-year increase of 20%, reaching a market size of $22 billion.

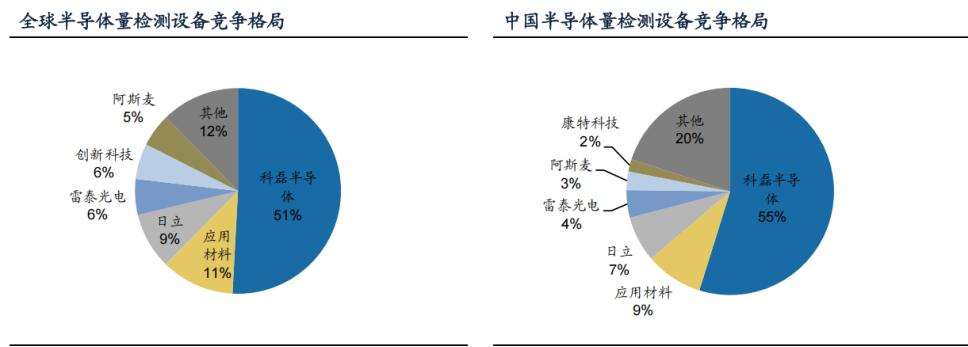

However, such a huge market is basically divided among a very few companies from the U.S. and Japan.

Currently, in the front-end testing equipment sector, the top five companies hold a market share of 82.4%, all of which are U.S. and Japanese companies.

Among them, only KLA from the U.S. holds more than half of the market share in both the global and Chinese markets.

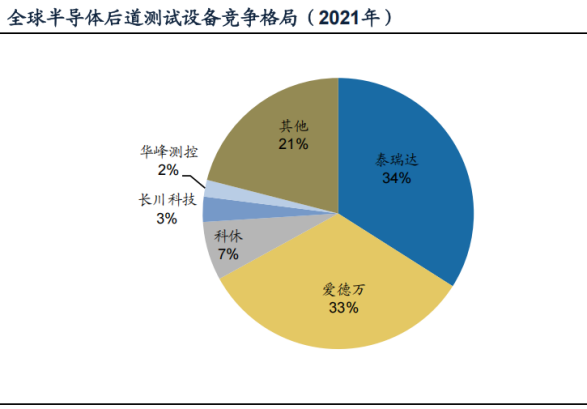

In the back-end equipment sector, in 2021, Teradyne (U.S.) and Advantest (Japan) accounted for two-thirds of the entire market’s sales.

Therefore, semiconductor testing equipment must quickly achieve domestic substitution to ensure the safety of the high-end chip industry.

Currently, the main domestic testing equipment companies include Changchuan Technology, Jingce Electronics, Huafeng Measurement and Control and a few others.

Although the four companies have overlapping businesses, their focuses are different.

Among them, Changchuan Technology and Huafeng Measurement and Control focus on back-end testing, with most of their revenue coming from testing machines, probe machines, etc.

On the other hand, 【Jingce Electronics】 covers both front-end measurement (such as film thickness/OCD/electron beam) and back-end testing (such as storage/SoC/burn-in testing), making it the most comprehensive company in the domestic semiconductor testing equipment layout.

In the front-end measurement equipment sector, Jingce Electronics has outstanding advantages.

On one hand, the domestic chip production line has a very low localization rate; on the other hand, the value of front-end testing equipment is greater than that of back-end equipment.

Many of the company’s main front-end measurement products have been recognized by numerous first-tier customers, with orders in this field accounting for over 90% of semiconductor orders, establishing good cooperative relationships with many clients such as SMIC, Huahong Group, Changjiang Storage, Hefei Changxin, and Guangzhou Yuexin.

Progress in the back-end testing field is also rapid.

Storage chip testing equipment and burn-in product lines have received bulk repeat orders from first-tier domestic customers; chip detection and factory testing product lines have obtained corresponding orders and completed deliveries; wafer-level products have been delivered, and the self-developed probe card product series has also achieved mass production.

With the development of AI, the performance requirements for chips have also significantly increased, making advanced processes of 14nm and above increasingly critical.

Currently, core products in the semiconductor field have covered processes of 1xnm and above, with film thickness products, OCD equipment, and electron beam defect review equipment having received advanced process orders.

Among them, the bright field defect detection equipment for 14nm advanced processes has been officially delivered to customers, and other main products have completed delivery and acceptance for 7nm advanced processes, with even more advanced products currently under verification.

Currently, due to the inability to obtain EUV lithography machines, processes such as 7nm and 5nm are almost a ceiling for high-end chips in China. Therefore, the company’s advanced process products are already sufficient to meet domestic demand.

Moreover, the performance of the company’s semiconductor equipment sector is also quite impressive.

In 2024, the entire semiconductor sector achieved sales revenue of 768 million yuan, a year-on-year increase of 94.65%. The orders on hand amount to 1.668 billion, providing important support for the company’s subsequent performance.

It is precisely due to the strong drive from the semiconductor equipment sector that the company’s non-recurring profit in the first quarter of 2025 increased by 149% year-on-year, reaching 11.72 million.

Although the total profit is not significant, it should be noted that the company has invested heavily in R&D.

The company invested 358 million yuan in R&D in the semiconductor testing field in 2024, a year-on-year increase of 32.76%, with this single sector accounting for 14% of R&D expenses.

The overall R&D investment reached 730 million, accounting for 28.48% of operating revenue.

In addition to semiconductor equipment, the company’s testing technology is also applied in the display screen and power battery fields.

In the display screen sector, the company’s six or seven core products have broken the foreign monopoly, receiving repeat bulk orders from core domestic and international customers.

Especially in the AR/VR and other forward-looking technology fields, it maintains an absolute leading advantage.

It has reached strategic cooperation with global AR/VR industry leaders, building a full-process testing solution covering “core components – modules – complete machines”.

Successfully secured exclusive orders for full-process testing equipment from global TOP customers MicroOLED micro-displays and Pancake optical modules.

The Pancake optical module is one of the most ideal technological paths for next-generation AR/VR devices, significantly reducing size and overcoming the technical bottleneck of dizziness caused by prolonged wear.

In the light engine, eyepiece module, and complete machine assembly process testing stages, the technology is even a generation or more ahead of competitors.

In the new energy battery sector, deep binding has been achieved with leading domestic companies.

In 2022, the company signed a “Strategic Partnership Agreement” with Zhongchuang Xinhang, while its holding subsidiary Changzhou Jingce also participated in Zhongchuang Xinhang’s Hong Kong stock issuance.

Zhongchuang Xinhang ranks third in China, only behind CATL and BYD. By achieving deep binding with Zhongchuang Xinhang, the company can ensure higher order guarantees.

On one hand, domestic high-end chips are on the verge of explosion; on the other hand, the company’s product technology is also outstanding. With this dual support, Jingce Electronics is naturally ushering in its best development period.

Finally, don’t forget to click“See First”— your support is my motivation for creation!