Introduction: In the context of a sluggish global economy, both manufacturers and brand companies faced significant inventory and shipment pressures in the first half of 2019, leading to a simultaneous decline in both volume and price of NAND Flash and DRAM. This situation severely impacted the Q1 financial reports of storage manufacturers, resulting in halved profits or even losses. Consequently, manufacturers had to implement production reduction strategies to balance market supply and demand, hoping for an improvement in market conditions in the second half of the year.

01

Market Analysis

Due to a year-on-year decline in global smartphone shipments, ongoing shortages of Intel processors, and continuous adjustments in data center inventories, coupled with tense trade relations and currency fluctuations, the demand in the Chinese market has been very poor. South Korea’s semiconductor exports have also seen a consecutive decline for several months. Under the dual impact of falling volume and price in the market, manufacturers’ inventories of 64-layer/72-layer 3D TLC NAND have continued to rise. Since the beginning of 2019, the oversupply situation in the NAND Flash market has not improved; rather, it has become more severe.

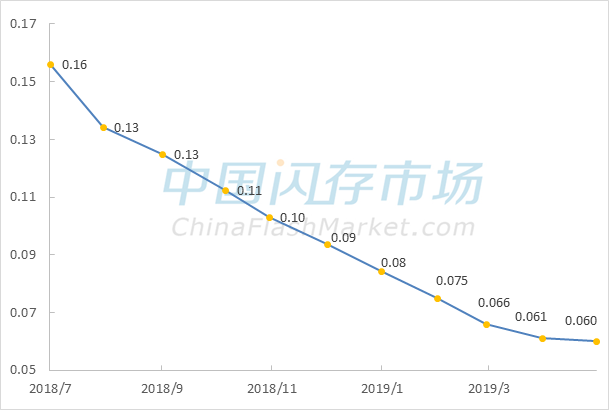

After experiencing a significant drop in 2018, as of May 20, 2019, the cumulative decline in the consumer NAND Flash price index has approached 30%, with the price per GB dropping to $0.06. Prices for SSDs, eMMCs, and flash memory cards have all fallen by more than 20%. The continuous decline in NAND Flash prices, along with a significant drop in DRAM prices, has led to a faster-than-expected decrease in storage chip prices, resulting in a noticeable decline in revenues for storage manufacturers, including original manufacturers and controllers, in Q1 2019, with profits halved or even losses reported.

Consumer NAND Flash Comprehensive Price Index Trend

Data from China Flash Market, as of May 20, 2019

Consumer NAND Flash Price Trend per GB

Data from China Flash Market, unit: USD

02

Financial Report Analysis

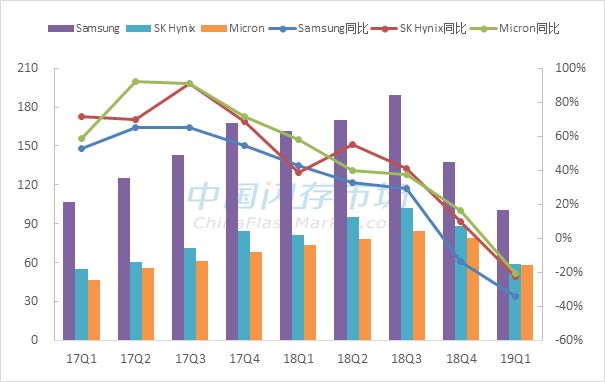

Due to the sluggish market demand, the latest financial reports from manufacturers show that Samsung’s Q1 net profit was 5.04 trillion KRW, a year-on-year decline of 56.9%; SK Hynix’s Q1 net profit was 1.1 trillion KRW, a year-on-year decline of 65%; Micron’s Q2 fiscal net profit was $1.97 billion, a year-on-year decline of 43.6%; Intel’s Q1 net profit was $4 billion, a year-on-year decline of 11%; Western Digital reported a net loss of $581 million in Q3; and Toshiba Memory Corporation (TMC) reported a net loss of 19.3 billion JPY in Q4.

Changes in Original Manufacturers’ Storage Business Revenue

Data from China Flash Market, unit: USD

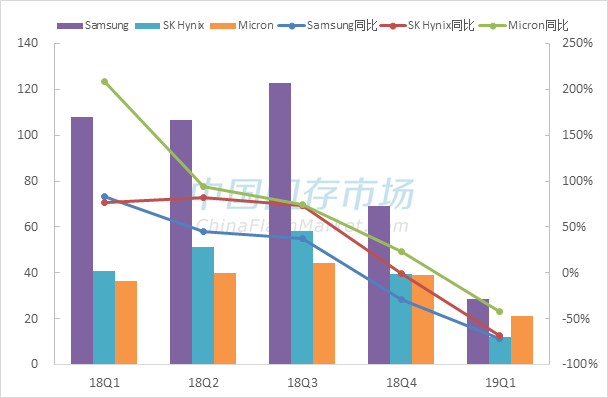

Changes in Original Manufacturers’ Storage Business Operating Profit

Data from China Flash Market, unit: USD

Since the price drop in 2018, the growth rate of revenue and profit for manufacturers has slowed down quarter by quarter, with a decline starting in Q4 2018. The Q1 2019 financial reports further deteriorated, especially for Toshiba Memory and Western Digital, which were most affected by the drop in NAND Flash prices. To balance market supply and demand, slow down the price decline of NAND Flash and DRAM, and improve financial conditions, flash manufacturers have adopted production reduction strategies. Following Western Digital’s announcement to slow down investments at the end of 2018, Samsung cut its Q1 2019 capital expenditures by half, and Micron, Intel, SK Hynix, and Toshiba Memory also announced reductions in NAND Flash wafer production.

Under the influence of the news of production cuts from flash manufacturers, and with NAND Flash prices hitting rock bottom, prices stabilized somewhat in May. However, due to significant inventory and shipment pressures still faced by manufacturers and brand companies, prices for some products continued to decline. Industry insiders believe that by the second half of 2019, the shortage of Intel processors will significantly improve, coupled with the demand from the shopping season, it is expected that the NAND Flash market will see some improvement. However, the inventory pressure on manufacturers remains, and the possibility of price increases is very low, while the speed of price declines may slow down, and the challenges faced by companies continue to escalate.

03

Industry Hotspots Focus

Facing Challenges, Advanced Technology is the Core Competitiveness

The storage industry is encountering headwinds. Manufacturers are implementing production reduction strategies to balance market supply and demand while actively introducing 96-layer 3D NAND into mainstream SSD and embedded product applications to enhance their competitiveness in the market. They are also promoting the development of new and advanced technologies, such as HBM2E, 1znm DRAM, EMRAM, DDR5, and 128-layer 512Gb 3D TLC, to improve core technology levels.

1. SK Hynix’s new semiconductor factory plan in Yongin, Gyeonggi Province has been approved.

2. Samsung’s 1znm 8Gb DDR4 production efficiency has increased by over 20%, with mass production expected in the second half of the year.

3. Samsung has released a new generation of HBM2E products, with a 33% performance improvement and doubled capacity.

4. Samsung’s Pyeongtaek plant is set to scale up production of 12GB LPDDR4X, with a threefold increase in supply expected in the second half of the year.

5. New heights! It is reported that Western Digital and Toshiba have developed 128-layer 512Gb 3D TLC.

More …

China’s Layout in Various Segments, Building an Integrated Circuit Industry Ecosystem

China continues to strengthen its investment in the integrated circuit industry, not only enhancing the construction of ecosystems in various regions but also expanding investments abroad. Chinese companies are also attracting enterprises like Gree, Foxconn, and Konka to join through cooperation and investment, expanding their layout in critical segments such as raw materials, silicon wafer manufacturing, chip manufacturing, and packaging, thereby improving the industrial ecosystem chain.

1. The Unisoc Chip Cloud Industrial Park project has commenced, with a total planned investment of 6 billion yuan.

2. Huawei plans to invest £37.5 million to build a chip factory in the UK.

3. Is a semiconductor factory settling in Zhuhai? Foxconn has signed a strategic cooperation agreement with Zhuhai.

4. Guangzhou Yuexin Semiconductor held an equipment moving-in ceremony, with mass production expected in September.

5. The Zhongjing Semiconductor project for an annual production of 4.8 million 12-inch silicon wafers has commenced.

More …

For the latest market analysis, financial report data, data analysis, and financial report downloads, click “Read the original text” to enter the special topic page.