Sensors, as a cutting-edge technology in modern science, are considered one of the three pillars of modern information technology and are recognized as a high-tech industry with great potential for development both domestically and internationally. Experts in automation in China point out that sensor technology is directly related to the development of the automation industry in our country, stating, “If sensor technology is strong, then the automation industry is strong.” This illustrates the importance of sensor technology to the automation industry and even to the entire industrial construction of the country.

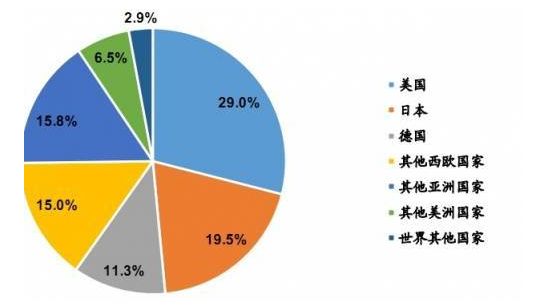

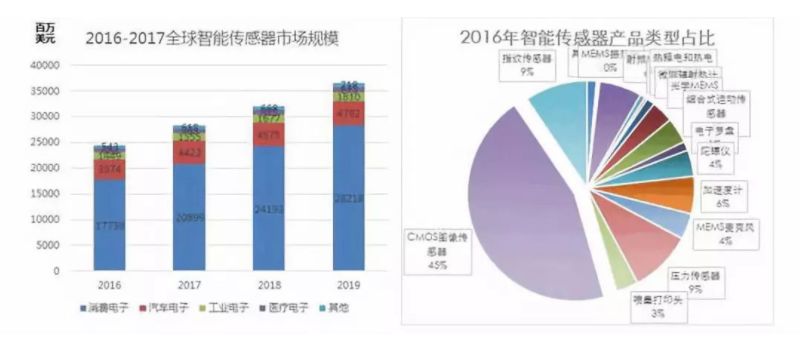

However, while the sensor industry is experiencing a springtime, the Chinese public still seems to be witnessing a feast dominated by foreign semiconductor giants. Industry insiders believe that although China’s sensor market is developing rapidly, there is still a significant gap between local sensor technology and the global level.

This gap manifests itself in two ways: on one hand, there is a lag in the ability of sensors to perceive information; on the other hand, there is a technological lag in the intelligence and networking of sensors themselves. Due to a lack of sufficient large-scale applications, domestic sensors are not only low in technology but also high in price, making it difficult to be competitive in the market.

-

Sensor Development in Various Countries

-

Current Status of the Domestic Sensor Industry

-

Differences in Sensor Development Between China and Foreign Countries

-

The Main Reasons for the Development Gap in China’s Sensors

Source: Robot Design Handbook

END

● The wave of embodied intelligent robots is coming, and another industry grand event is about to set sail

● Dialogue with Tsinghua University’s Zhao Mingguo: Accelerating evolution to replicate Boston Dynamics’ actions, what we need is confidence and innovation!

● The preliminary results of the 2023 National Science and Technology Awards have been announced! 9 985 universities are out! XJTU and Huazhong University of Science and Technology are in the top three! (List attached)

● Unprecedented! American engineers collaborate with ChatGPT4 to design artificial intelligence chips

● Russian President Putin approves the new version of the “2030 National Strategy for Artificial Intelligence Development”

● A town in Denmark with a population of less than 200,000! How did Odense become a global robotics center?

● The “Year of Commercialization” has begun, and humanoid robots have gained a new player with strength

● Swiss researchers develop a new type of artificial muscle, lighter, safer, and stronger!

● The EU terminates Amazon’s acquisition of iRobot; where does the former sweeping robot giant go from here?

● The top ten news in the robotics industry in 2023

● A bipedal robot driven by muscle tissue has been born, marking a breakthrough in biological hybrid robots!

● Professionals discuss the robot-as-a-service model – the future of automation

● A comprehensive overview of China’s humanoid robot research teams

● Under the heat of humanoid robots, the struggle between advancement and resistance

● Who is the most stylish? Highlights from the 2023 semi-annual report of 53 listed robot companies

● Download the semi-annual report of 53 listed robotics companies (PDF attached)

● Academician report | Pan Yunhe: Behavioral intelligence and product intelligence of artificial intelligence

● Academician discusses the new driving force for promoting collaborative intelligent manufacturing with robots

● Academician discusses six key technologies for innovative robot design

● Ximu Technology expands new perspectives on humanoid robot research

● Academician discusses the dual driving model for future artificial intelligence development

● Academician discusses how institutional intelligence brings “Transformers” from the screen to reality