1. The Foundation of Automotive Intelligence—Sensors

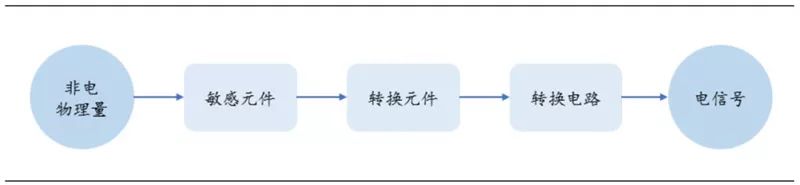

Sensors are the information sources for automotive electronic control systems and are essential components of vehicle electronic control systems. Sensors typically consist of sensitive elements, conversion elements, and conversion circuits. The sensitive element refers to the part of the sensor that can directly sense or respond to the measured quantity. The conversion element converts the aforementioned non-electric quantities into electrical parameters, while the conversion circuit processes the output electrical signals from the conversion element into a format suitable for processing, displaying, recording, and controlling. Currently, automotive sensors can be categorized into two main types based on their purposes: traditional micro-electromechanical sensors that enhance the information level of individual vehicles and intelligent sensors that support autonomous driving.

▲ Composition of Automotive Sensors

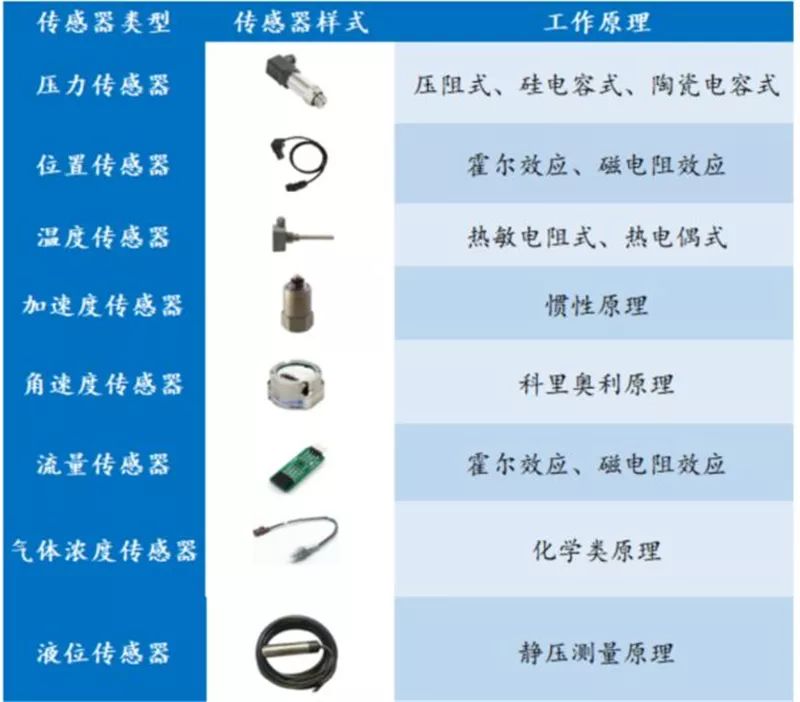

Traditional Sensors: Various system control processes rely on sensors for feedback, achieving automatic control, making them the “neurons” of the vehicle. Traditional automotive sensors can be classified into eight categories based on their functions: pressure sensors, position sensors, temperature sensors, acceleration sensors, angular velocity sensors, flow sensors, gas concentration sensors, and liquid level sensors. Automotive sensors are mainly applied in powertrain systems, body control systems, and chassis systems. In these systems, automotive sensors are responsible for collecting and transmitting information, which is processed by the electronic control unit to form commands sent to actuators, completing electronic control.

▲ Classification of Traditional Sensors

Intelligent Sensors: Intelligent sensors are the “eyes” of autonomous vehicles. Cars are rapidly evolving into safe, connected autonomous driving robots, performing environmental perception and planning decisions to ultimately reach their destinations safely. The mainstream sensor products currently used for environmental perception mainly include four categories: LiDAR, millimeter-wave radar, ultrasonic radar, and cameras.

▲ Classification of Intelligent Sensors

2. MEMS Sensors: The Micro Sensory Systems of Automobiles

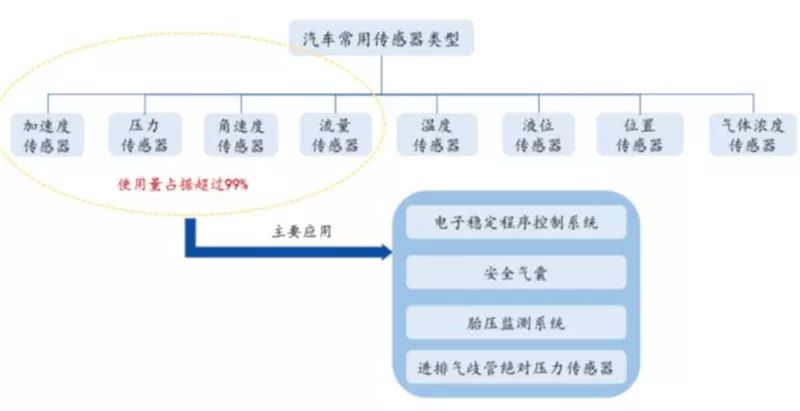

MEMS sensors are new types of sensors developed based on semiconductor manufacturing technology, utilizing microelectronics and micromechanical processing technologies. MEMS sensors are widely used in electronic stability programs (ESP), anti-lock braking systems (ABS), electronic control suspensions (ECS), and tire pressure monitoring systems (TPMS). Among these, pressure sensors, accelerometers, gyroscopes, and flow sensors are the most commonly used MEMS sensors in automobiles, accounting for 99% of automotive MEMS systems.

▲ Extensive Applications of MEMS

▲ Extensive Applications of MEMS

▲ Concentrated Value of MEMS Sensors

▲ Concentrated Value of MEMS Sensors

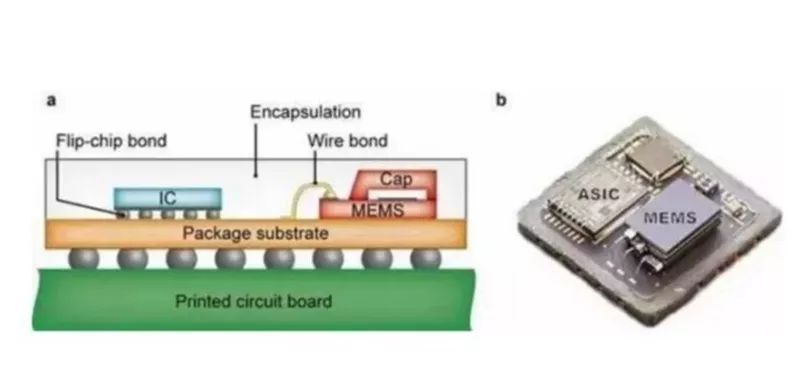

MEMS have significant advantages and are one of the main choices for building the perception layer of the Internet of Things in the future. Their advantages mainly include: 1) Miniaturization, 2) Silicon-based processing technology, 3) Mass production, 4) Integration.

1) Miniaturization:MEMS devices are small, with individual dimensions measured in millimeters or even micrometers, lightweight, and low energy consumption. The higher surface-to-volume ratio of MEMS can enhance the sensitivity of surface sensors.

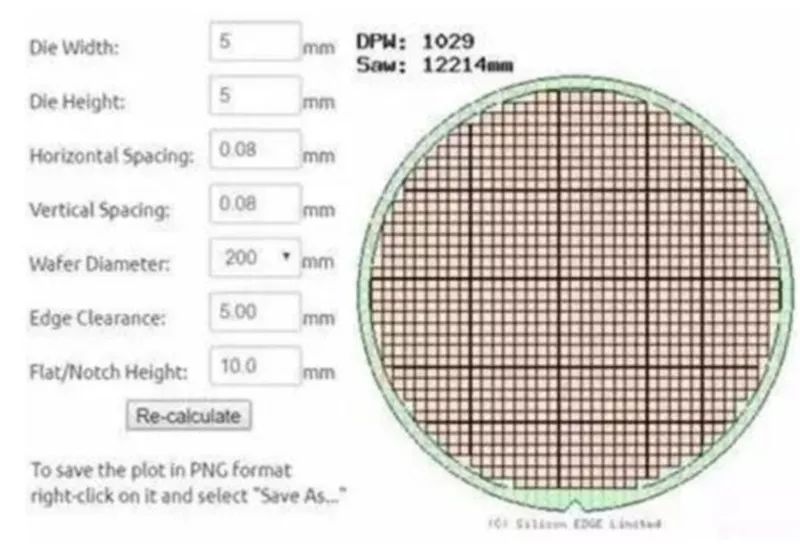

2) Mass Production:Taking a single 5mm x 5mm MEMS sensor as an example, about 1,000 MEMS chips can be simultaneously cut from an 8-inch silicon wafer using silicon micromachining technology, significantly reducing the production cost of individual MEMS.

3) Integration:Generally, a single MEMS chip often integrates an ASIC chip that controls the MEMS chip and converts analog signals into digital outputs simultaneously.

▲ Integration Packaging of MEMS and ASIC Chips

▲ Integration Packaging of MEMS and ASIC Chips

▲ Mass Production of MEMS Reduces Manufacturing Costs

▲ Mass Production of MEMS Reduces Manufacturing Costs

Large foreign manufacturers dominate the MEMS sensor market, resulting in a high market concentration. According to HIS Automotive statistics, in 2017, the top three global MEMS suppliers (Bosch, Sensata, and NXP) accounted for 57% of the market share, with Bosch leading at a market share of 33.62%, Sensata at 12.34%, and NXP at 11.91%. Other manufacturers such as Denso (8.94%), Analog Devices (8.51%), Panasonic (7.45%), and Infineon (7.23%) also hold certain shares.

Foreign manufacturers have extensive product lines, leading technologies, numerous customers, and have established high entry barriers. The difficulty of R&D and the complexity of MEMS manufacturing processes are the main reasons for the formation of industry barriers. Companies like Invensense and Infineon have 2 to 3 product lines, while Bosch, Denso, and STMicroelectronics have more than 4 product lines. In contrast, smaller suppliers find it difficult to achieve mass production in a short period, resulting in a relatively stable market share for the leading suppliers and high market concentration.

The assembly quantity and value of MEMS sensors are proportional to the price level of the vehicles they are equipped in. Currently, on average, each vehicle contains 24 MEMS sensors, while high-end vehicles may use 25-40 MEMS sensors. For example, high-end BMW models may use 20-40 sensors just for the engine, while entry-level models may use only around 5. The value of commonly used MEMS sensors in aftermarket vehicles ranges from 2,000 to 20,000 yuan; joint venture vehicles usually do not cost less than 4,000 yuan, while domestic brands are around 2,000 yuan, and high-end models range from 10,000 to 20,000 yuan. It is expected that by 2019, the MEMS sensor market size could reach 42.013 billion yuan; with the increase in intelligence and electrification, the market size could reach 44.621 billion yuan and 47.227 billion yuan in 2020 and 2021 respectively, with a compound annual growth rate of 6.5% from 2015 to 2021.

3. Intelligent Sensors: The Core of Autonomous Driving

1. Millimeter-Wave Radar: Core Sensor of ADAS Systems

Millimeter-wave radar refers to radar that utilizes wavelengths of 1-10mm and frequencies of 30GHz-300GHz, calculating distance by measuring the time difference of echoes. Millimeter-wave radar was initially used in military applications but has gradually been applied in the automotive field as technology has advanced.

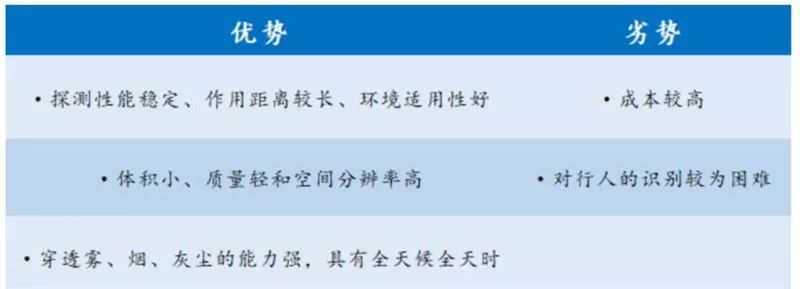

The advantages of millimeter-wave radar mainly include the following three aspects:

1) Stable detection performance, long effective range, and good environmental adaptability.

2) Smaller size, lighter weight, and higher spatial resolution compared to ultrasonic radar.

3) Compared to optical sensors, millimeter-wave radar has strong penetration abilities through fog, smoke, and dust, making it effective in all weather conditions. However, it also has drawbacks, such as high costs and difficulties in recognizing pedestrians.

▲ Advantages and Disadvantages of Millimeter-Wave Radar

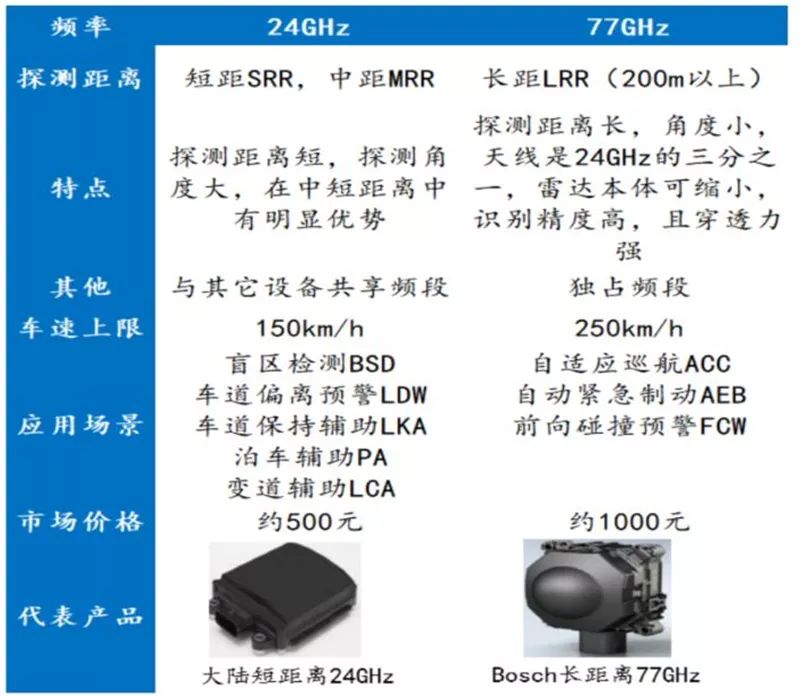

77 GHz has advantages in both performance and size. Currently, vehicle-mounted radars are mainly divided into 24GHz and 77GHz frequency bands. Compared to 24GHz millimeter-wave radar, 77GHz offers higher distance resolution and is one-third smaller. In 2018, China’s New Car Assessment Program (C-NCAP) included automatic emergency braking systems (AEBS) in its scoring system, which will drive future market demand for 77GHz millimeter-wave radar. In the long run, the smaller size and longer detection range of 77GHz millimeter-wave radar will offer greater market space compared to 24GHz millimeter-wave radar.

▲ Comparison of 24GHz and 77GHz Millimeter-Wave Radar

Both 24GHz and 77GHz millimeter-wave radars are used for long and short-range detection in ADAS. Due to their small hardware size and resilience to adverse weather conditions, millimeter-wave radars are widely used in ADAS systems. Currently, 24GHz is commonly used for blind spot monitoring and lane change assistance. The radar is installed within the rear bumper of the vehicle to monitor whether there are vehicles in the lanes behind the car and whether a lane change is possible. The 77GHz radar, which has superior detection accuracy and distance capabilities compared to the 24GHz radar, is primarily installed in the front bumper of vehicles to detect the distance and speed of the vehicle in front, enabling functions such as emergency braking and adaptive cruise control in active safety areas. To fully implement all functions of ADAS, generally, “1 long + 4 medium-short” (5) millimeter-wave radars are required; for instance, the Audi A8 is equipped with 5 millimeter-wave radars (1 LRR + 4 MRR), while the Mercedes-Benz S-Class is equipped with 6 millimeter-wave radars (1 LRR + 6 SRR). Currently, the unit price of 77GHz millimeter-wave radar systems is around 1,000 yuan, while the unit price of 24GHz millimeter-wave radar is around 500 yuan.

▲ Application of Millimeter-Wave Radar in ADAS Systems

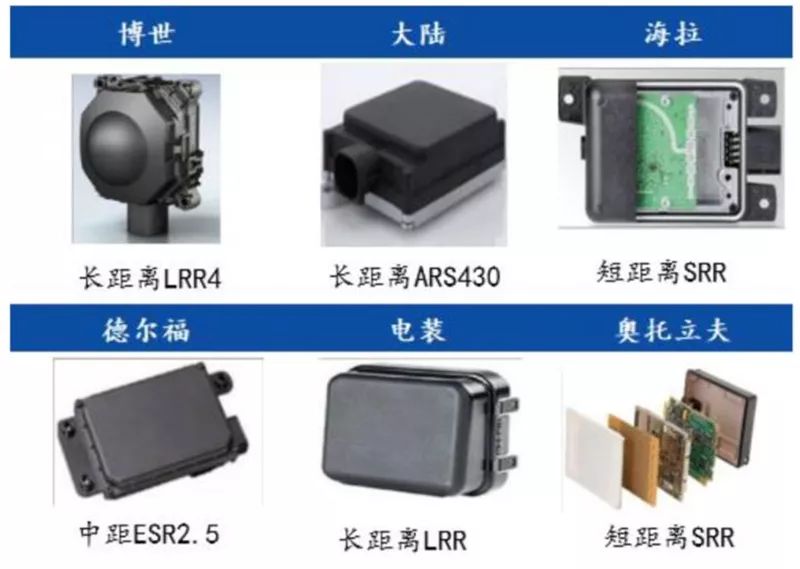

Key technologies of millimeter-wave radar are monopolized by foreign companies, leading to high concentration in the market. In the global millimeter-wave radar market, leading countries include Germany, the USA, and Japan. Currently, the technology for millimeter-wave radar is mainly dominated by traditional giants such as Continental, Bosch, Denso, Autoliv, and Delphi; among them, the 77GHz millimeter-wave radar technology is monopolized by Bosch, Continental, Delphi, Denso, TRW, Fujitsu, and Hitachi. In 2016, Bosch and Continental both held a 17% share of the global millimeter-wave radar market, ranking first, while Denso and Hella ranked second with an 11% share, ZF held 8%, Delphi held 6%, and Autoliv held 4%. The top seven suppliers accounted for 73% of the market share.

▲ Major Foreign Suppliers and Products of Millimeter-Wave Radar

Domestic millimeter-wave radar relies on imports and is restricted by foreign technology blockades, with 24GHz millimeter-wave radar as the mainstream direction. Currently, all millimeter-wave radar sensors equipped in mid-to-high-end vehicles in the Chinese market depend on foreign imports, with the market dominated by American, Japanese, and German companies, making prices expensive, and technology blockade is urgent for self-control. Domestic automotive millimeter-wave radar products are still in the development stage overall. Considering the R&D costs and limitations in developing 77GHz technology, domestic manufacturers are concentrating their R&D efforts on 24GHz. In the domestic market, the product system for 24GHz millimeter-wave radar is relatively mature, and the supply chain is relatively stable. Core chips for 24GHz can be obtained from chip suppliers like Infineon and Freescale. According to MaiMas Consulting Research, in 2016, the number of pre-installed millimeter-wave radars in Chinese cars reached 1.05 million, with 63.8% being 24GHz radar and 36.2% being 77GHz radar.

It is estimated that the market size for millimeter-wave radar in 2019, 2020, and 2025 can reach 470 million yuan, 3.6 billion yuan, and 8 billion yuan respectively, with a compound growth rate of about 58% from 2017 to 2025.

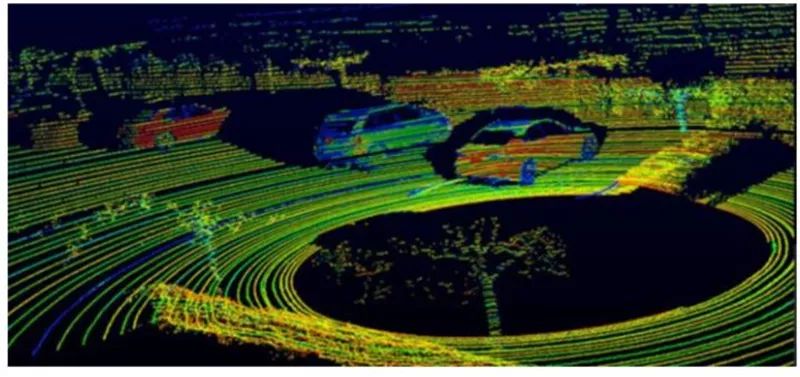

2. LiDAR: The Key in L3-L5 Autonomous Driving

LiDAR is a comprehensive light detection and ranging system that emits and receives laser beams, analyzing the time it takes for the laser to return after hitting a target to calculate the relative distance between the target and the vehicle. Common types include 8-line, 16-line, and 32-line LiDAR. The more lines a LiDAR has, the higher its measurement accuracy and safety. LiDAR is not a new technology; it has long been used in aerospace, surveying, and other fields. With the development of automotive intelligence, LiDAR has begun to be applied in L3 autonomous driving, becoming the most critical sensor in L3-L5 stages due to its high precision and real-time 3D environmental modeling capabilities.

▲ Working Principle of LiDAR

▲ Velodyne HDL-64E LiDAR 3D Imaging

▲ Velodyne HDL-64E LiDAR 3D Imaging

The solid-stateization of LiDAR is a future trend, with advantages of miniaturization and low cost. The industry aims to reduce LiDAR costs primarily through two methods:

1) Canceling mechanical rotating structures and adopting solid-state technology fundamentally reduces the cost of LiDAR. Solid-state LiDAR is smaller, easier to integrate, and has improved system reliability, hence the trend towards solid-state development.

2) Reducing the number of LiDAR lines and using multiple low-line-count LiDARs in combination. Transitioning from mechanical rotating to mixed solid-state and finally to pure solid-state LiDAR, as production scales increase and technology iterates, costs continue to decrease, and LiDAR is also moving towards miniaturization, low power consumption, and integration.

The core technologies of LiDAR are mainly held by three companies: Velodyne, Ibeo, and Quanergy. Velodyne’s mechanical LiDAR started early, leading in technology, and has recently launched a 128-line prototype product VLS-128, establishing partnerships with global autonomous driving leaders like Google, General Motors, Ford, Uber, and Baidu, capturing a large share of the vehicle-mounted LiDAR market.

Companies like Google, Baidu, Ford, Audi, and BMW have successively adopted LiDAR perception solutions. BMW announced a partnership with LiDAR startup Innoviz to develop autonomous vehicles, expected to launch in 2021. According to the company’s official websites, the price of a single vehicle LiDAR sensor ranges from $30,000 to $80,000.

In the short term, LiDAR will not be widely used in the automotive field. Although the accelerating development of autonomous driving creates a favorable application prospect for the LiDAR industry, many pain points in the development of LiDAR itself limit its application in autonomous vehicles. The limiting factors mainly include three aspects:

1) High costs. The leading Velodyne 16-line product costs $8,000, the 32-line product costs $40,000, and the 64-line product costs about $80,000. The high product prices also suppress the application of LiDAR in autonomous vehicles.

2) Difficulty in mass production and long delivery cycles. The production cycle for Velodyne’s 64-line product takes 4-8 weeks, while the 32-line and 16-line products take 2-4 weeks. To ensure the precision of the signals transmitted and received by LiDAR, the complexity of assembly and calibration processes extends the delivery cycle.

3) Lack of relevant automotive regulations. Currently, autonomous driving is merely a forward-looking concept without practical implementation, and there are no mandatory policies or regulations, which limits the popularization of LiDAR in the autonomous driving field to some extent.

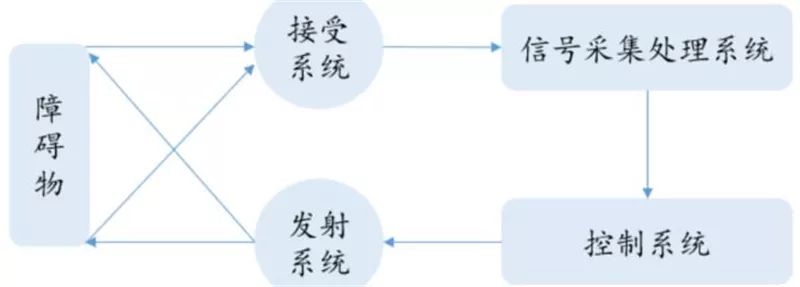

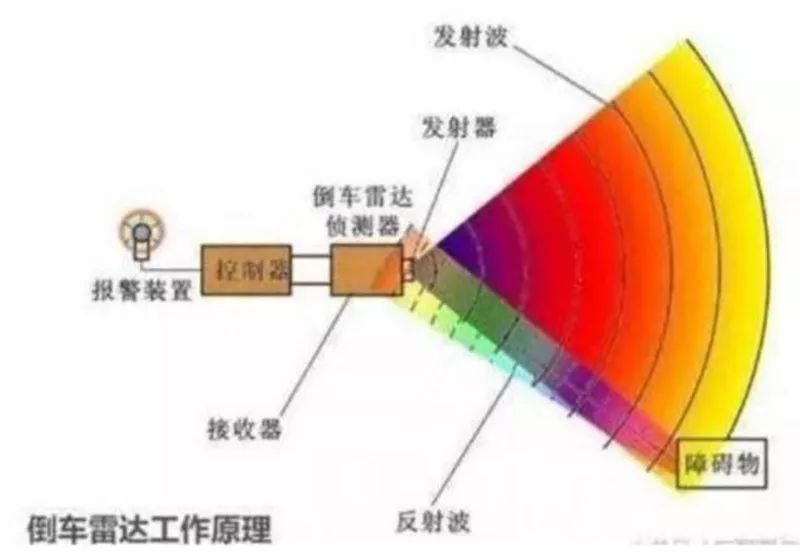

3. Ultrasonic Radar: The Mainstream Sensor for Automatic Parking Systems

The working principle of ultrasonic radar is to emit ultrasonic waves through an emitting device and measure the distance by calculating the time difference when the waves are received back. In autonomous driving, the basic applications of ultrasonic radar include parking assistance warnings and collision warnings in blind spots. Ultrasonic radar is cost-effective and excels at short-range measurements, with a detection range of 0.1-3 meters and high accuracy, making it particularly suitable for parking applications. However, its measurement distance is limited and is easily affected by adverse weather conditions.

▲ Working Principle of Ultrasonic Radar

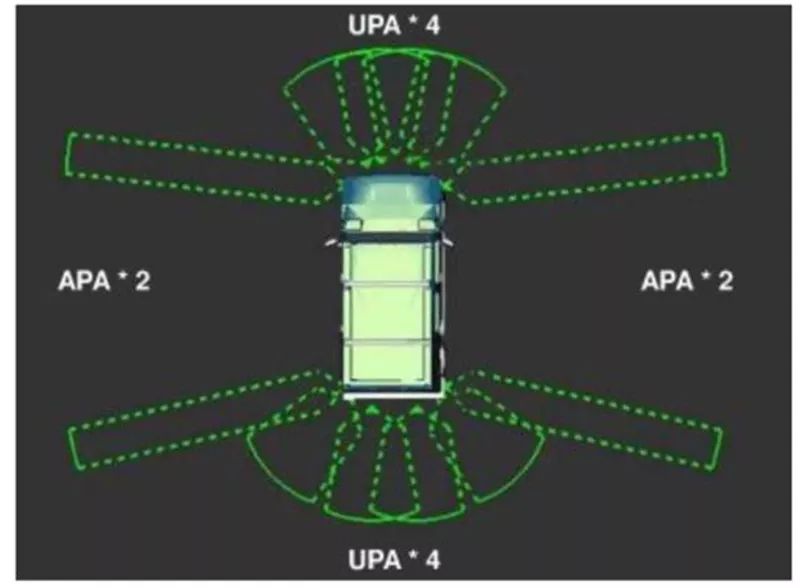

The popularization of automatic parking has stimulated the demand for ultrasonic radar. Ultrasonic radar is generally installed in the bumpers or sides of vehicles; the former is called UPA, typically used to measure obstacles in front and behind the vehicle, while the latter is called APA, used to measure side obstacles. APA ultrasonic sensors are core components of automatic parking assistance systems, capable of detecting distances to measure parking space widths and obtain vehicle positioning information. Ultrasonic radar is mainly used in reversing radar and automatic parking systems for near-range obstacle monitoring. Reversing radar has already been adopted in mid-to-low-end models, with a penetration rate of around 80%. Reversing radar systems typically require 4 UPA ultrasonic radars, while automatic parking radar systems require 6-12 ultrasonic radars, with a typical configuration of 8 UPA + 4 APA.

▲ Application of Ultrasonic Radar in Automobiles

▲ Comparison of UPA and APA Ultrasonic Radars

▲ Comparison of UPA and APA Ultrasonic Radars

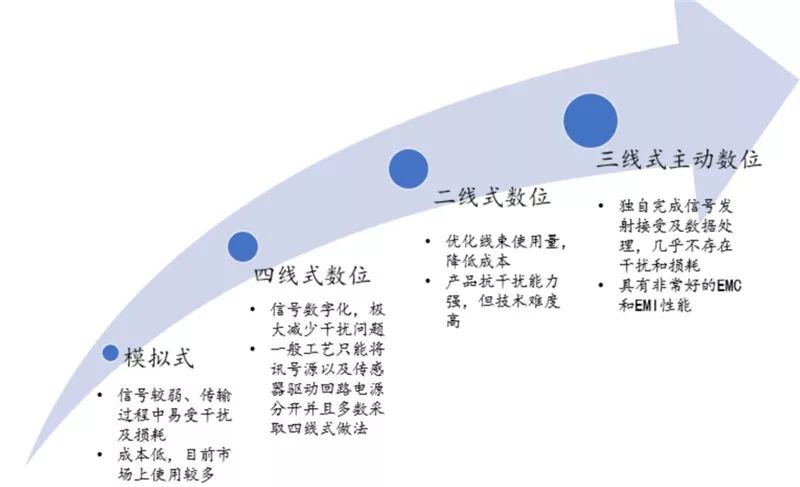

Ultrasonic radar technology solutions have their pros and cons, with analog radar occupying the main market. Generally, there are four types of technology solutions for ultrasonic radar: analog, four-wire digital, two-wire digital, and three-wire active digital, each improving signal interference handling. Currently, the most commonly used technology route in the market is the “analog” technology, which is cost-effective but easily affected by external environmental interference. In the future, under the trend of intelligence, the “digital” technology route will become more popular. Under the “digital” technology route, signal digitalization can greatly enhance radar’s anti-interference capabilities, but it is more costly and technically challenging, leading most current processes to adopt the four-wire approach.

▲ Four Technology Route Solutions for Ultrasonic Radar

The ultrasonic radar market is mainly occupied by Bosch, Murata from Japan, and Nicera from Japan, while domestic companies like Aodiwei and Tongzhi Electronics are highly competitive. Aodiwei is a leading domestic ultrasonic sensor manufacturer, with sales of 26.27 million vehicle-mounted ultrasonic sensors in 2016, while the global market capacity for vehicle-mounted ultrasonic sensors is about 27.4 million units, with Aodiwei holding a 9% market share in the global passenger vehicle market. Aodiwei’s largest customer is Taiwan’s Tongzhi Electronics, whose core product is reversing radar and ranked first in market share in Asia in 2016.

The short to medium-term market for ultrasonic radar is expected to continue improving, but in the long term, it may face replacement pressure from other radar sensors. Currently, the backward ultrasonic radar installation rate is the highest at 45.2%, while the “forward + backward radar” installation rate is 28.3%, and the non-installed proportion is 26.5%. With the development of automated driving, the “forward + backward” radar is expected to become a standard configuration. Therefore, it is anticipated that the penetration rate of ultrasonic radar will continue to improve in the short to medium term, but in the long term, some or all ultrasonic radars in high-level autonomous driving vehicles may be replaced by millimeter-wave radars, LiDAR, and other sensors with better overall performance.

According to estimates, the market size for ultrasonic radar will reach 4.2 billion yuan, 8.7 billion yuan, and 19.2 billion yuan in 2019, 2020, and 2025 respectively, with a compound growth rate of about 38% from 2016 to 2025.

4. Cameras: The Main Visual Sensor for ADAS Systems

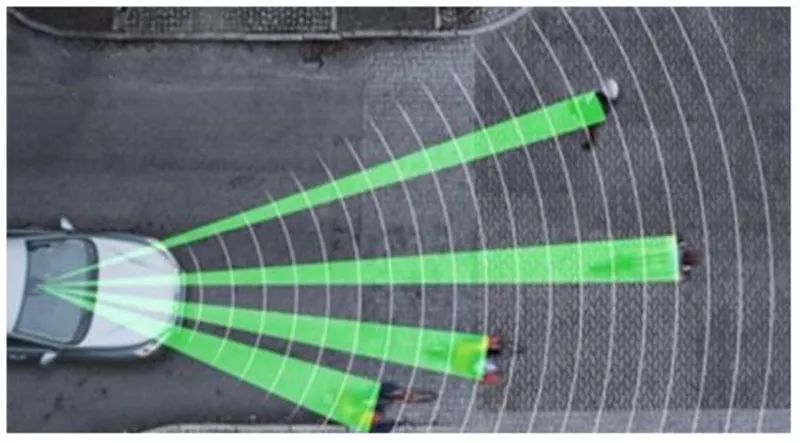

Vehicle-mounted cameras are the main visual sensors in ADAS systems and are among the most mature vehicle-mounted sensors. By capturing images through lenses, the image processing and control components within the camera convert the images into digital signals that can be processed by computers, thereby perceiving the road conditions around the vehicle. Cameras are primarily used in 360-degree panoramic imaging, forward collision warning, lane departure warning, and pedestrian detection in ADAS functions.

▲ Camera Detecting Road Pedestrians

▲ Application of Cameras in Panoramic Parking Systems

ADAS systems typically require more than six cameras. Depending on the needs of different ADAS functions, the installation positions of cameras vary, mainly divided into front view, rear view, side view, and internal. To achieve full ADAS functionality for autonomous driving, more than six cameras need to be installed, with the front-view camera requiring complex algorithms and chips, priced around 1,500 yuan, while rear, side, and internal cameras are priced around 200 yuan each. The widespread application of ADAS has created a significant market space for vehicle-mounted camera sensors.

▲ Installation Positions and Features of Cameras

In the short term, monocular cameras will be the mainstream technology route. The front-view camera ADAS system can be divided into two technical routes: one using monocular cameras and the other using binocular cameras. Compared to monocular cameras, binocular cameras have more powerful functions and greater measurement accuracy, but they are more expensive, thus more commonly used in high-end vehicles. The binocular camera solution faces challenges in cost, manufacturing processes, reliability, and accuracy, making it difficult to promote in the market, while the monocular camera solution is low-cost and reliable, complementing other sensors and fully meeting the functionality of L1, L2, and some L3 scenarios. Therefore, under the current market environment, the monocular camera solution will continue to be mainstream.

Cameras primarily serve as radar auxiliary sensors. Although cameras have high resolution and can detect the texture and color of objects, their visual performance is poor in backlight or complex lighting conditions and is easily affected by adverse weather, so the image information captured by cameras will mainly handle traffic sign recognition and other limited areas, serving as a supplement to LiDAR and millimeter-wave radar.

The camera industry chain can be roughly divided into three parts: upstream component production, midstream module packaging and integration, and downstream product application.

1) Upstream components mainly include CMOS sensors, lens groups, DSPs, etc. In the upstream market, CMOS sensors and DSPs are mainly monopolized by foreign companies like Sony, Samsung, TI, and ON Semiconductor, while domestic companies have advantages in lens group production, with local brands like Sunny Optical having high competitiveness;

2) Midstream packaging and integration include module packaging and system integration. The packaging and integration processes are complex, and the market is dominated by foreign companies, with major manufacturers including Panasonic, Sony, and Valeo.

3) Downstream products are applied to vehicle manufacturers and 4S stores.

The production process for vehicle-mounted cameras has high technical requirements and long certification cycles. Compared to mobile phone cameras, vehicle-mounted cameras face harsher working conditions, needing to meet multiple requirements such as high temperature resistance, shock resistance, magnetic resistance, and stability. Especially for front-view cameras used in ADAS systems, which are related to driving safety, the reliability requirements must be extremely high, resulting in very high production process requirements for vehicle-mounted cameras. Companies must undergo numerous types of strict testing before becoming first-tier suppliers to vehicle manufacturers, and once they enter the supply system of vehicle manufacturers, it creates high barriers to entry, making it difficult to replace, with high replacement costs. For example, the foreign visual sensor leader Mobileye took 8 years to transition from R&D to the front-mounted market.

According to estimates, it is expected that the camera sensor market will reach 15 billion yuan in 2019, and by entering the L3 stage, the market size could reach 20.5 billion yuan and 31.5 billion yuan in 2020 and 2025 respectively, with a compound growth rate of about 17% from 2016 to 2025.

4. Multi-Sensor Fusion is an Inevitable Trend

ADAS integrates multiple sensors, driving the development of the sensor market. With the increasing proportion of intelligent vehicles in the future, the ADAS market will accelerate its growth. According to Goldman Sachs’ global investment research department, the current global ADAS penetration rate is generally low, with penetration rates in Europe, the USA, and Japan only at 8%-12%. According to estimates from the Automotive Research Institute, the ADAS penetration rate in China is around 2%-5%; from a lifecycle perspective, ADAS has crossed from the introduction phase to the growth phase. Overall, under the trends of intelligent driving and autonomous driving, the level of automotive electronics and intelligence is continuously improving, and ADAS has significant growth potential. Environmental perception, as the hardware foundation of ADAS, makes the application of sensors essential, and the increase in ADAS penetration will significantly boost the demand for vehicle-mounted sensors, further expanding the market size for sensors in the future.

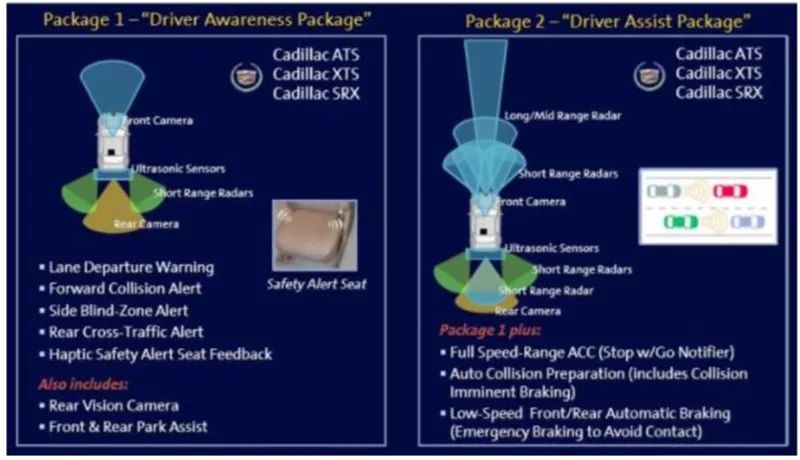

▲ ADAS Integrates Multiple Sensors

▲ ADAS Integrates Multiple Sensors

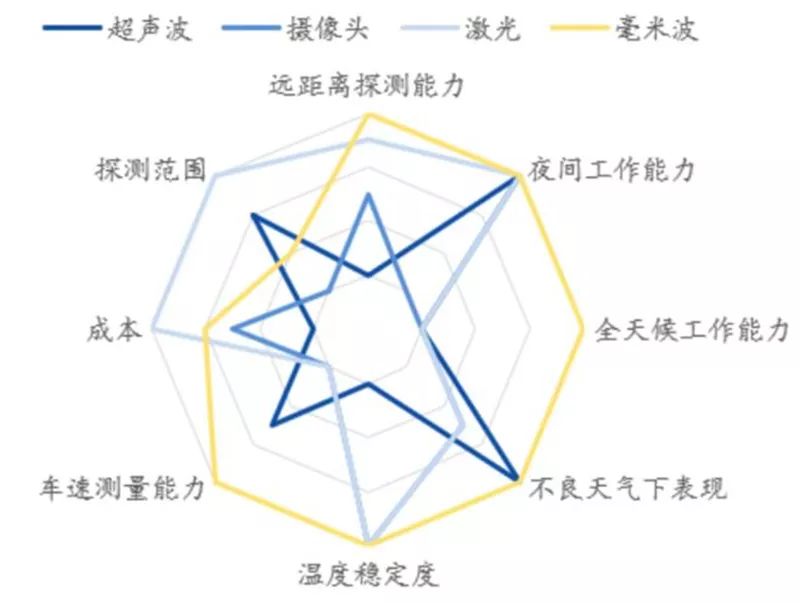

Environmental perception sensors are the eyes of the vehicle, with millimeter-wave radar having outstanding comprehensive advantages. In the context of the intelligent era, environmental perception is particularly important, with different sensors having varying principles and functions, each leveraging their advantages in different scenarios, making it difficult to replace one another. Millimeter-wave radar stands out with its comprehensive advantages and is expected to become the main sensor in ADAS systems.

▲ Comparison of Various Sensors’ Advantages and Disadvantages

▲ Millimeter-Wave Radar’s Comprehensive Advantages

▲ Millimeter-Wave Radar’s Comprehensive Advantages

The characteristics of individual sensors are prominent, but none can provide complete information coverage, making multi-sensor fusion an inevitable trend for future development. It also provides essential technical reserves for achieving Level 3 to Level 5 autonomous driving solutions. Currently, the technical routes for autonomous driving environmental perception mainly include two types: one represented by Tesla, which is a vision-dominant multi-sensor fusion solution, and the other is based on low-cost LiDAR, with Google Waymo as a typical representative. Major foreign automakers like Tesla, Audi, and General Motors have released their multi-sensor plans for autonomous vehicles. Multi-sensor fusion is crucial for ensuring the vehicle’s global positioning and understanding of the surrounding environment.

In summary, the sensors used in ADAS mainly include cameras, radars, LiDAR, and ultrasonic sensors, capable of detecting light, heat, pressure, or other variables used to monitor vehicle status, typically located on the front and rear bumpers, side mirrors, inside the steering column, or on the windshield. Each subsystem within ADAS relies on the collection, processing, and judgment of information, and after judgment, the system issues commands to the vehicle to execute different actions at various stages. In this process, sensors like radars and cameras, as well as processors like MCUs or image processing ICs, become the primary components used. The maturity and perfection of the ADAS system are essential guarantees on the road to achieving Level 5 autonomous driving.

Welcome to the angel round of the entire automotive industry chain (including the electrification industry chain),Around enterprises to join the group (Friendly connections with 500 automotive investment institutions including top institutions; some quality projects will be selected for thematic roadshows to existing institutions); There is a communication group for leaders of science and technology innovation companies, , the automotive industry, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and the Internet of Vehicles, and dozens of other groups. Please scan the administrator’s WeChat to join the group (Please indicate your company name)