Apr.

Click the blue text to follow us

2025.04

Introduction:China Resources Microelectronics is transforming from a local power device manufacturer into a system-level supplier with both product strength and platform capabilities.

The Chinese semiconductor industry has developed over several decades, evolving from nothing to a robust sector, giving rise to a number of outstanding local chip design companies. These companies either delve deeply into niche markets or bravely scale new heights in technological innovation, becoming the backbone of the rise of Chinese chips. The launch of the “Top 100 Chip Rankings” aims to discover these “invisible champions,” document their growth trajectories, and showcase the vibrant vitality of Chinese chips.

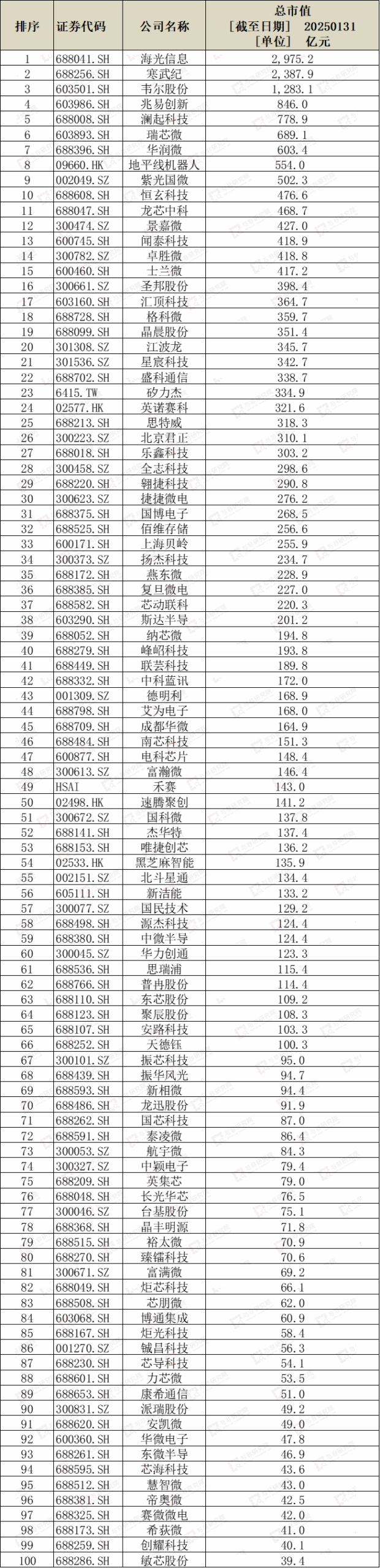

The “Top 100 Chip Rankings” series focuses on the chip design field, excluding passive components/EDA/IP and other non-chip directions; it primarily studies publicly listed companies, using their market capitalization as a reference. It compiles a list of the top 100 chip design companies by market capitalization across A-shares, Hong Kong stocks, Taiwan stocks, and US stocks, although some omissions may exist. (A complete list of the top 100 chip design companies by market capitalization is attached at the end of the article.)

We will continue to monitor the dynamics of the ranked companies and select distinctive and representative firms for in-depth analysis, focusing on the survival status and future prospects of local chip design companies, their opportunities and challenges, in order to present a true picture of the Chinese semiconductor industry.

This issue brings you the sixth installment of the “Top 100 Chip Rankings” series—China Resources Microelectronics (688396). As one of the few domestic IDM companies with capabilities in chip design, mask manufacturing, wafer fabrication, and packaging testing, China Resources Microelectronics is transforming from a local power device manufacturer into a system-level supplier with both product strength and platform capabilities.

Click the business card below to follow Eefocus,

and stay updated on the latest content in this series.

01

Core Business Lines and Product Lines: Focusing on New Energy and Consumer Electronics

China Resources Microelectronics Co., Ltd. (hereinafter referred to as “China Resources Micro”) is a leading semiconductor company in China, affiliated with China Resources Group, focusing on the design, manufacturing, and packaging testing of power semiconductors, discrete devices, and integrated circuits, serving multiple fields including automotive electronics, energy management, and communications.

According to data from Omdia and the China Semiconductor Industry Association (CSIA), in 2021, China Resources Micro ranked second among Chinese power device companies, with the largest scale in MOSFETs and third in the MEMS market, while also ranking first in mask manufacturing. As of April 2023, Omdia’s statistics show that China Resources Micro has risen to become the number one power semiconductor manufacturer in China and the leading manufacturer of MOSFETs, demonstrating its sustained growth capability in core areas.

As a leading domestic IDM semiconductor company, China Resources Micro has integrated capabilities across the entire industry chain from chip design, mask manufacturing, wafer fabrication to packaging testing, focusing on key areas such as power semiconductors, analog-digital mixed devices, intelligent sensors, and intelligent control. After years of development and integration, the company has continuously strengthened its technical capabilities, product performance, and market coverage, becoming one of the few companies in China with a complete power product portfolio and industry chain capabilities.

China Resources Microelectronics Product and Service Release (2024~2025), Source: Eefocus Research Institute

In terms of power semiconductor products, China Resources Micro’s core offerings include MOSFETs, IGBTs, and third-generation wide bandgap semiconductor devices. China Resources Micro has the capability to supply a full range of low, medium, and high voltage MOSFET products from -100V to 1500V, widely used in various scenarios such as industrial control, power management, automotive electronics, and consumer electronics. In the industrial sector, products meet the needs of motor control and power conversion, while in the automotive sector, they are widely used in battery management systems and electric drive systems, having entered the supply chains of mainstream automotive companies such as BYD, Geely, FAW, Changan, and Wuling.

The core business of China Resources Microelectronics includes power devices, intelligent sensing, integrated circuits, and manufacturing services, showcasing its system capabilities across the entire industry chain as an IDM company. Its application markets cover key areas such as automotive, industrial control, AI servers, and consumer electronics.

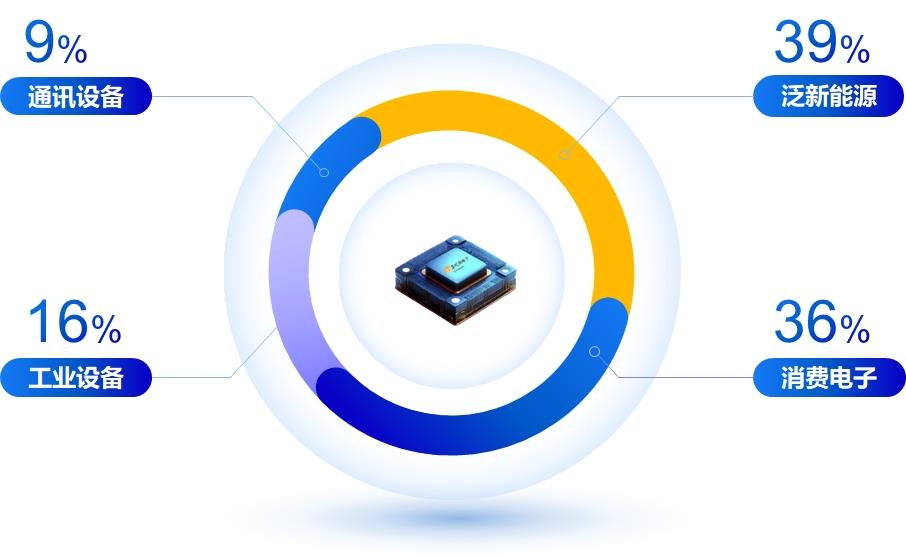

In the first half of 2024, the application situation of China Resources Micro’s products and solutions in downstream terminal applications, Source: China Resources Microelectronics 2024 Semi-Annual Report

The new energy business has been a key focus for China Resources Micro in recent years. In 2023, its automotive electronics and new energy products and solutions accounted for 39% of total revenue, with automotive electronics reaching 22%. The company has established strategic partnerships with several leading automotive manufacturers and Tier 1 suppliers, launching automotive-grade power devices including MOSFETs, IGBTs, SiC, and power ICs. In the new energy sector, such as photovoltaic inverters and energy storage inverters, China Resources Micro continues to expand its customer base, with products entering the core customer systems of Sunshine Power, Deye, and Inovance Technology. The revenue share of the new energy business increased from 16% in 2022 to 20% in 2023. According to China Resources Microelectronics’ 2024 Semi-Annual Report, the largest application scenarios are new energy (39%), consumer electronics (36%), industrial equipment (16%), and communication equipment (9%). China Resources Microelectronics is accelerating its transformation from a single chip manufacturer to a high-end system-level device and intelligent manufacturing platform, continuously consolidating its comprehensive competitiveness in the power semiconductor and automotive-grade chip markets.

The Power Device Matrix Continues to Expand, Modularization Drives Penetration into High-End Markets

In terms of power devices, China Resources Micro’s MOSFET products are widely used in automotive electronics, industrial control, and data centers. The mid-to-low voltage MOS series continues to expand its AEC-Q101 automotive certification capabilities, with G3/G4 advanced trench gate products reaching international advanced levels. The high-voltage super junction MOSFETs cover the 250V-1200V platform, fully entering mainstream application markets.

In the IGBT sector, over 70% of sales come from industrial and automotive electronics, with automotive-grade products having been mass-produced for key systems such as powertrains and OBCs. The new generation of 650V and 750V platform products matches international mainstream levels, catering to the needs of photovoltaic storage and high-voltage applications.

In the third-generation semiconductor field, China Resources Micro’s silicon carbide product series is progressing rapidly, covering the 650V to 1700V platforms. The SiC MOS G2 and SiC JBS G3 performance have reached international mainstream levels, with automotive-grade modules being mass-shipped, and trench structure products are in progress. In terms of gallium nitride, D-mode products have achieved G2 and G3 mass production, while E-mode product development covers 40V to 650V and is currently in the reliability verification stage.

In terms of modularization, China Resources Micro is building various types of power modules based on IGBTs, MOSFETs, TMBS, etc. In the first half of 2024, the module business grew by 85% year-on-year, and SiC modules also contributed to sales.

Intelligent Sensing and Control Products Target the New Energy Vehicle Market

China Resources Micro’s sensor product line includes high-performance pressure, temperature and humidity, and optoelectronic sensors, serving smart terminals and automotive electronics. Power ICs and intelligent control chips are widely deployed in motor control, automotive electronics, and new energy equipment. Currently, several automotive-grade chips from China Resources Micro have passed AEC-Q100 certification and have obtained ISO 26262 ASIL D functional safety certification, marking a substantial breakthrough in the construction of automotive safety systems.

Manufacturing and Service Platform Enhancements Across the Entire Chain

China Resources Micro continues to strengthen its wafer manufacturing, mask production, and packaging testing service capabilities, achieving significant progress in core process platforms and advanced packaging directions, including:

0.11μm and 0.15μm high-performance BCD platforms

New generation HVIC

CMOS-MEMS single-chip inkjet printing platform

0.18μm SOI BCD and 0.15μm high-reliability CMOS platforms have also been launched

Strong Growth in Packaging and Mask Business

China Resources Micro’s packaging business has significantly improved overall capacity utilization. The advanced packaging (PLP) business led by Silan Microelectronics saw revenue growth of 136% year-on-year, and SiP packaging achieved large-scale mass production. The power packaging business managed by Runan Technology saw revenue growth of 1241%, with IPM module packaging entering large-scale delivery stages.

Mask business sales increased by 22.4% year-on-year, with a continuous increase in the proportion of high-grade products, maintaining a yield rate of over 98%. The on-time delivery rate for key customers reached 99.97%. In June 2024, China Resources Micro successfully completed the first batch of 90nm high-end mask product shipments, marking the maturity and reliability of its manufacturing platform.

02

Growth History and Key Milestones

Predecessor Establishment (1983~2020)

The predecessor of China Resources Micro can be traced back to 1983, established by the former Ministry of Machinery Industry, Ministry of Aerospace Industry, Ministry of Foreign Trade and Economic Cooperation, and China Resources Group in Hong Kong as Hong Kong Huake Electronics, which established the first domestic four-inch wafer production line. In 1988, China Resources Group fully acquired Hong Kong Huake. In 1999, Wuxi Huajing Shanghua Semiconductor was established in Wuxi, starting the mainland wafer foundry business.

In January 2003, China Resources Microelectronics Co., Ltd. was established, becoming the unified semiconductor business platform of China Resources Group. In 2004, its subsidiary Shanghua Technology was listed on the Hong Kong Stock Exchange (code 0597.HK). It was delisted in 2011 and subsequently underwent privatization and restructuring.

In 2017, China Resources Micro acquired Chongqing AVIC Microelectronics, integrating the 8-inch wafer production line. Under the guidance of the Group’s 13th Five-Year Plan strategy, China Resources Micro became one of the new industries prioritized for cultivation by China Resources. On February 27, 2020, China Resources Micro was officially listed on the Sci-Tech Innovation Board, stock code 688396.SH, becoming the first semiconductor company to return to A-shares with a red-chip structure.

Mergers and Integrations (2001~2024)

During its development, China Resources Micro has completed several key acquisitions and integrations:

In 2001, it acquired Huaren Xike Microelectronics, entering the power device design field;

In 2002, it acquired China Huajing Electronics Group, integrating its wafer manufacturing capabilities;

In 2008, it integrated assets from Huaren Huajing, Huaren Ansheng, Huaren Saimeike, etc.;

In 2017, it gained control of AVIC Microelectronics, achieving the first microelectronics asset restructuring between central enterprises;

In 2019, it acquired a 35% stake in Jiequn Electronics, expanding its automotive-grade packaging business;

In 2024, it acquired a 36.86% stake in Nanjing Xinnait, further expanding its power device field.

These acquisitions have propelled China Resources Micro to form an IDM full industry chain layout covering design, manufacturing, and packaging testing.

Technological Breakthroughs (2019~2025)

In recent years, China Resources Micro has achieved multiple technological breakthroughs in power semiconductors, SiC, and IGBTs:

2019: Launched the 0.18-micron segmented BCD process platform;

2020: Key technology project for MEMS devices won the second prize of the National Science and Technology Progress Award;

2021: Successfully developed SiC MOSFET devices and established the first domestic 6-inch SiC production line;

2022: Released the second-generation 650V SiC JBS, with IGBT performance reaching international advanced levels;

2023: Developed the fifth-generation micro trench IGBT, promoting the industrialization of 12-inch power devices;

2024: Completed research and process integration of 8-inch ferroelectric storage materials;

2025: Released the second-generation automotive-grade SiC MOS main drive module at the Munich Shanghai Electronics Show.

Capital Operations (2004~2022)

The development of China Resources Micro has also been accompanied by multiple capital operations:

2004: Listed on the Hong Kong Stock Exchange, issuing 621 million shares, raising approximately HKD 310 million;

2011: Privatized and delisted;

2020: Listed on the Sci-Tech Innovation Board;

Since 2021: Completed a 5 billion yuan private placement for the construction of a 12-inch production line and packaging testing base in Chongqing;

2022: Gained control of Runxin Microelectronics, initiating the construction of a 12-inch specialty analog production line in Shenzhen.

Currently, China Resources Micro has established 6-inch, 8-inch, and 12-inch wafer production lines and supporting packaging testing centers in Wuxi, Chongqing, Shenzhen, and Dalian.

Key milestones, Source: China Resources Micro Sci-Tech Innovation Board IPO Prospectus, Eefocus Research Institute

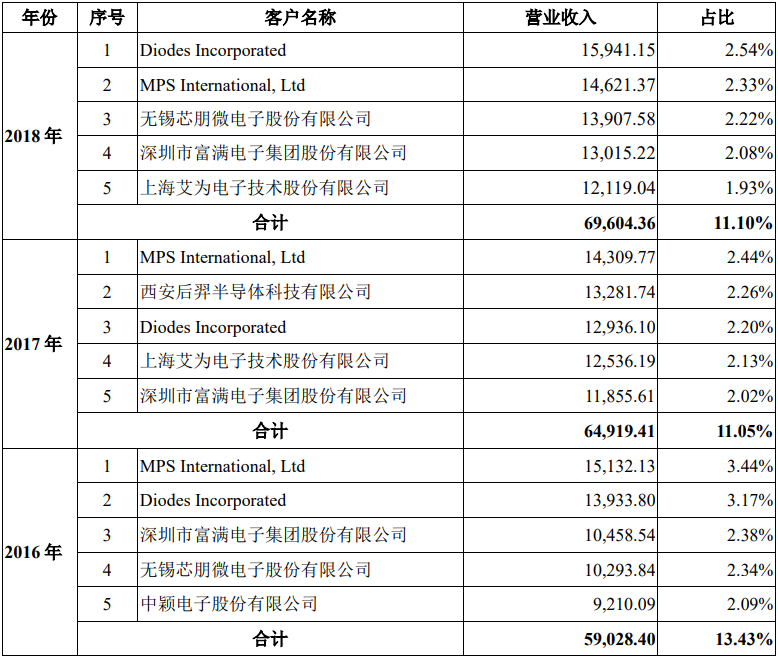

Top five customers of China Resources Microelectronics (2016~2018), Source: China Resources Micro Sci-Tech Innovation Board IPO Prospectus

03

Key Financial Data Analysis: Recovering from the Cycle Low

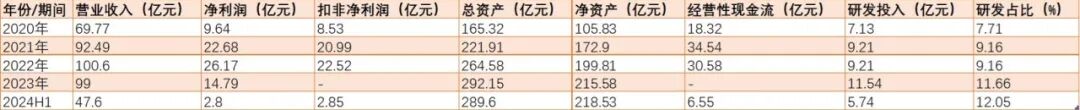

Key financial data of China Resources Microelectronics, Source: China Resources Microelectronics 2020, 2021, 2022, 2023 Annual Reports, 2024 Semi-Annual Report, Eefocus Research Institute

According to China Resources Microelectronics’ annual reports over the years, from 2020 to 2022, there was a continuous growth trend, with operating revenue increasing from 6.977 billion yuan in 2020 to 10.06 billion yuan in 2022, with a compound annual growth rate of over 20%. During the same period, net profit attributable to the parent company surged from 964 million yuan to 2.617 billion yuan, nearly tripling in three years, thanks to its deep layout in power devices, intelligent sensors, integrated circuit design, and manufacturing.

2022 was a highlight year for China Resources Micro, not only achieving record high revenue but also a net profit of 2.252 billion yuan, indicating good profitability quality in its main business. R&D expenditure also maintained above 9% of revenue, with over 2000 patents, of which more than 80% are invention patents, demonstrating China Resources Micro’s deep accumulation in core technologies. High gross margins and full capacity utilization rates also supported its steadily increasing profitability.

However, 2023 entered an adjustment period, with significant impacts from the decline in industry prosperity, leading to a slight decrease in annual revenue to 9.9 billion yuan, a year-on-year decline of 1.59%; net profit attributable to the parent company dropped sharply to 1.479 billion yuan, a year-on-year decline of 43.48%. Nevertheless, China Resources Microelectronics still maintained growth in asset scale and net assets, with year-on-year increases of 10.42% and 7.89%, respectively, indicating stable fundamentals without significant setbacks due to external shocks.

During the industry adjustment period, China Resources Micro’s response strategy is “counter-cyclical” expansion and increased R&D investment. In 2023, R&D investment reached 1.154 billion yuan, accounting for over 11%, a record high. Two 12-inch wafer lines and multiple packaging testing bases are progressing as planned, laying the groundwork for medium- to long-term growth. China Resources Micro continues to focus on high-end markets such as new energy vehicles, industrial automation, and photovoltaic communications, aiming to position itself for the next cycle of growth.

In the first half of 2024, although the industry remains sluggish, performance has shown marginal improvement. Revenue in the first quarter was 2.12 billion yuan, rising to 2.64 billion yuan in the second quarter, a quarter-on-quarter increase of 25%, with net profit jumping 644% quarter-on-quarter, indicating a recovery in capacity utilization and market demand. The layout in intelligent grids and automotive-grade devices is gradually translating into actual benefits.

Overall, China Resources Micro is at a turning point from the cycle low to the recovery phase. While maintaining stable operations, it continues to increase R&D investment, optimize product structure, and expand market boundaries, reflecting its long-term strategy of “high-tech self-research + industry chain integration.” In the future, its ability to continue increasing the proportion of mid- to high-end products and strengthen overseas market expansion will be key to determining whether it enters the next growth cycle.

04

Competitive Analysis: Standing Firm as a Domestic IDM Leader, Facing Global Giants

With the acceleration of domestic substitution and strong downstream demand in new energy vehicles, industrial control, and AI, China Resources Micro has entered a period of rapid development. However, its development path also faces a complex competitive landscape: it must cope with technological suppression from international giants while maintaining market share in domestic competition, and it also faces the diversion pressure from wafer foundry companies in the manufacturing sector.

International Competitors: Dominating Technological Rhythm, Solid Market Share

International IDM manufacturers represented by Infineon, ON Semiconductor, and STMicroelectronics have long dominated the power semiconductor market, especially forming deep technological barriers and customer stickiness in the fields of IGBTs, MOSFETs, and SiC devices. Infineon holds 19% of the global power semiconductor market share and is a major supplier in the new energy vehicle and industrial sectors, maintaining a leading position in SiC technology iteration with a renewal cycle as short as 12 months.

At the same time, Texas Instruments (TI) and Renesas Electronics are leading in the analog chip and automotive-grade MCU fields, with TI holding about 18% of the global analog chip market share and Renesas having technological advantages in automotive controllers, sensors, and mixed-signal chips, with high coverage among global automakers.

In contrast, the biggest pressure faced by China Resources Micro is insufficient technological maturity and customer stickiness, especially in overseas market expansion. Nevertheless, China Resources Micro has achieved performance benchmarking in mid-range products (such as 650V IGBTs and 800V MOS) through cost control and manufacturing flexibility; at the same time, its 8-inch SiC wafers are set to achieve mass production in 2024, becoming one of the few domestic manufacturers mastering this technology, demonstrating its rapid catch-up capability.

Domestic IDM Peers: Overlapping Products, Cross-Customer Base, Different Paths

Silicon Microelectronics is China Resources Micro’s most direct competitor, both adopting the IDM model, with products covering IGBTs, MOSFETs, and MEMS sensors. In 2023, Silicon Micro achieved revenue of 9.35 billion yuan, with power devices accounting for over 50%. Its 12-inch production line layout predates that of China Resources Micro, providing better economies of scale.

On the application side, Silicon Micro’s IPM smart power modules hold over 30% market share in the air conditioning market, with major appliance giants like Gree and Midea as its customers. In contrast, China Resources Micro emphasizes automotive and industrial applications, accelerating the introduction of customers such as BYD and Huawei while gradually advancing the AEC-Q certification system to build long-term barriers in automotive electronics.

Yangjie Technology has built differentiated advantages in the photovoltaic and discrete device markets. It holds the number one global market share in rectifier bridges, with a 30% share in photovoltaic diodes. In 2023, its revenue reached 6 billion yuan. Yangjie operates the MCC brand through a dual-brand strategy, rapidly opening up the European and American markets, making it one of the few domestic discrete device companies with overseas channel capabilities. In response to Yangjie’s leading position in photovoltaics, China Resources Micro has chosen to accelerate the introduction of SiC devices in the new energy sector to seize the high-voltage, high-efficiency conversion market.

Huayi Electronics primarily focuses on traditional power devices such as thyristors and silicon-controlled rectifiers, with revenue in 2023 falling short of 3 billion yuan and R&D investment accounting for only 5%. It lags significantly behind China Resources Micro in terms of technological innovation, customer structure, and capacity synergy.

Wafer Foundries: Structural Competition in the Manufacturing Sector

Huahong Semiconductor, as a major domestic foundry for power devices, has revenue (143.9 billion yuan in 2024) primarily from CIS/MCU foundry services, but its 55nm BCD process is leading, serving customers including Star Semiconductor and New Clean Energy. In contrast, China Resources Micro focuses on mature processes above 0.11μm, emphasizing design and manufacturing closed loops, improving capacity utilization (over 95%), forming stable delivery advantages as an IDM.

SMIC focuses on advanced processes for logic chips, with revenue reaching 57.8 billion yuan in 2024 and a global market share of about 5%. Although it primarily targets processes below 14nm, it still serves a large number of analog/power chip customers in the 40-90nm range, indirectly competing with China Resources Micro for manufacturing customers.

R&D capability is the core competitiveness of IDM manufacturers. In 2023, China Resources Micro’s R&D investment was about 920 million yuan, accounting for 9.16% of revenue, focusing on SiC, automotive-grade IGBTs, and intelligent sensors. Its product update cycle is about 18 months. Silicon Micro’s R&D investment ratio also reached 9.44%, with nearly 900 million yuan invested, focusing on IPM modules and improving the efficiency of 12-inch production lines, with a higher iteration frequency (2-3 times/year). Yangjie Technology, due to its conservative revenue structure, has a lower R&D investment ratio of only 5.5%, mainly used for optimizing packaging processes. In international comparisons, giants like Infineon and TI maintain R&D ratios above 12%, especially in the field of wide bandgap power devices, establishing strong technological barriers.

Comparison of major customers of competitors, Source: Eefocus Research Institute

China Resources Micro’s progress in introducing strategic customers such as BYD and Huawei builds future growth space. However, compared to Silicon Micro’s high self-holding rate and Yangjie Technology’s global channels, its supply chain still needs to further balance manufacturing flexibility and cost control.

Through comparison, it is evident that China Resources Micro has secured a favorable position in the first tier of domestic IDM. It has a “first-mover advantage” in power semiconductors, automotive-grade devices, and SiC industrialization. However, in global competition, it still needs to continue to strengthen its efforts in advanced processes, self-developed IP, and overseas ecosystem cooperation.

05

Core Competitiveness: From Domestic Power Leader to Platform Manufacturer

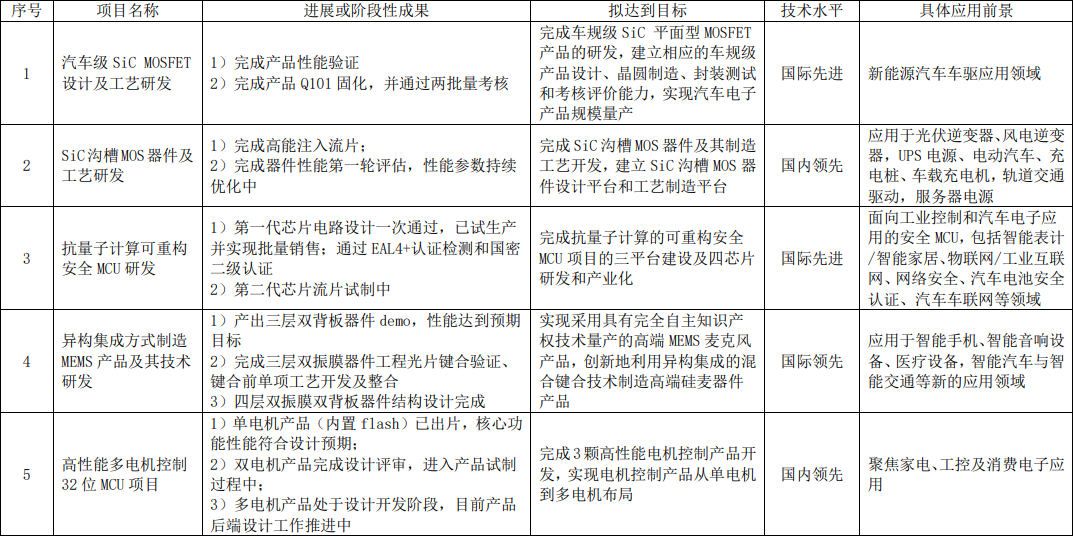

Research projects: China Resources Microelectronics 2024 Semi-Annual Report

China Resources Microelectronics is a highly representative enterprise in the Chinese semiconductor industry chain, occupying a leading position in the domestic power semiconductor field due to its integrated operation model across the entire industry chain, extensive product portfolio, strong R&D capabilities, and solid customer base.

1. Full Chain Capability under the IDM Model

As one of the few IDM companies in China with capabilities in chip design, mask manufacturing, wafer fabrication, and packaging testing, China Resources Micro possesses a high degree of integration from product definition to mass production delivery. This integrated operation model not only accelerates product iteration speed but also enhances flexibility in process optimization and resource allocation, ensuring its products remain leading in multiple subfields. Compared to fabless companies, China Resources Micro has significant advantages in customized process features and production line collaboration, allowing for quicker responses to customer needs.

2. Comprehensive Product Line Covering Diverse Markets

China Resources Micro has built a complete product system centered on power semiconductors, with over 1600 products, including more than 1100 discrete devices and over 500 IC products, covering self-owned brands such as CRMICRO and Huajing. Its technology platforms encompass low- and medium-voltage trench MOS, SJMOS, SBD, FRD, IGBT, etc., widely applied in high-growth markets such as automotive electronics, industrial control, power management, photovoltaic energy storage, and consumer electronics. Its products support core application areas including motors, batteries, and power supplies, adapting to diverse terminal needs.

3. Emphasis on Advanced Process Platforms and Manufacturing Capabilities

In manufacturing, China Resources Micro masters industry-leading processes such as BCD, MEMS, and IPM, with a monthly production capacity of 230,000 6-inch wafers and 140,000 8-inch wafers, and is constructing a 12-inch wafer production line (designed capacity of 40,000 wafers/month), with the Chongqing production line already in ramp-up phase. This comprehensive manufacturing system ensures large-scale production capabilities and product process consistency, laying the foundation for its foundry services.

4. Sustained High Investment in R&D

China Resources Micro has consistently maintained a high proportion of R&D investment, with R&D expenses reaching 1.15 billion yuan in 2023, accounting for 11.66% of revenue; in the first half of 2024, over 570 million yuan has been invested, with the proportion increasing to 12.05%. The company currently employs over 10,000 people, with R&D personnel accounting for over 40%. Its R&D team covers multiple directions including power devices, packaging testing, and process platforms, with deep technical accumulation. The company leads and participates in several national-level major scientific research projects and collaborates with universities to build key laboratories and joint platforms, establishing a good collaborative ecosystem between industry and academia. As of mid-2024, China Resources Micro has been granted 2,288 valid patents, of which over 83% are invention patents.

China Resources Microelectronics R&D Investment Situation, Source: China Resources Micro 2024 Annual Quality Improvement and Efficiency Return Special Action Plan Semi-Annual Evaluation Report

5. High-Quality Customer Base and Brand Stickiness

With solid technical capabilities and a complete service system, China Resources Micro has accumulated numerous well-known domestic and international customers in automotive, industrial, communication, and consumer electronics fields, building a high-sticky customer network. Its products and system solutions are widely used in scenarios such as UPS, inverters, charging piles, electric vehicles, fast charging, lighting, energy storage, and smart grids. At the same time, China Resources Micro also provides manufacturing services for leading international semiconductor companies, deeply participating in upstream and downstream industry cooperation, forming a stable industrial alliance.

6. High-Quality Management Team Ensuring Development Strategy

The executive team, represented by President Dr. Li Hong, has rich industry management and technical backgrounds, with long-term deep involvement in the power semiconductor industry, maintaining high sensitivity to industry trends. Dr. Li has achieved significant results in promoting the strategy across the two rivers and three regions, accelerating the transformation towards “marketization, industrialization, and internationalization,” providing support for the company’s further expansion into overseas markets.

7. Comprehensive Quality System Building Brand Trust

China Resources Micro has established multiple international quality certification systems, including ISO/IATF16949, ISO9001, ISO45001, and has obtained certifications such as RoHS, GP, CNAS, and ISO26262, demonstrating excellent performance in product quality, environmental and safety management. In 2024, it also won multiple QC competition awards, with its quality control capabilities highly recognized in the industry.

06

Opportunities and Challenges for China Resources Microelectronics

In the context of the global semiconductor industry accelerating domestic production and self-control, China Resources Microelectronics has emerged as a leading enterprise in the domestic IDM camp, thanks to its IDM (Integrated Device Manufacturing) model in the power semiconductor track. Here we outline the opportunities and challenges faced by China Resources Microelectronics:

Opportunities: The Window Period for Third-Generation Semiconductors Has Arrived

As the demand for high-voltage, high-frequency power devices in application scenarios such as new energy vehicles, photovoltaics, and energy storage continues to increase, wide bandgap materials like SiC and GaN are accelerating their penetration. SiC, with its characteristics of high voltage, high temperature, and high efficiency, has become the preferred choice for electric drive and control systems. According to Omdia’s forecast, the global SiC/GaN market will exceed $17.5 billion by 2030. China Resources Micro has layouts in SiC devices, wafer manufacturing, and packaging; if it can solve yield and cost issues, it is expected to achieve a leap from product end to system value chain.

Opportunities: The Domestic Automotive Electronics Industry is Exploding

The reliance of new energy vehicles on power semiconductors has significantly increased, with the value per vehicle being more than twice that of fuel vehicles. China Resources Micro has entered the systems of mainstream manufacturers such as BYD, Sunshine Power, and Inovance Technology, and is advancing the automotive-grade certification system for products such as SiC MOS, intelligent motor MCUs, and safety MCUs, laying the foundation for subsequent volume production.

Opportunities: Expanding Production Capacity to Solidify Foundations

China Resources Micro is accelerating the construction of its 12-inch production line, aiming for a monthly capacity of 100,000 wafers by 2025, providing foundational support for high-power products such as mid- to high-voltage MOSFETs and SiC devices. Combined with its own design capabilities, it will further optimize process collaboration and iteration efficiency.

Opportunities: Advanced Packaging and Platform Products Enhance Added Value

Targeting scenarios with high integration and reliability requirements, such as automotive and industrial applications, China Resources Micro is advancing the development of technologies such as Fan-Out, embedded, and system-level packaging (SiP), thereby enhancing product added value and differentiating itself.

Opportunities: Policy Dividends and Support from State-Owned Enterprises

Leveraging the China Resources Group platform, China Resources Micro has strong financial backing and policy support, possessing resource integration advantages in the strategic direction of semiconductor domestic substitution. Its participation in national major science and technology projects and local industrial fund support provides backing for high-intensity R&D and capacity expansion.

Challenges: High-End Technology Still Subject to International Giants

Despite ranking high in the domestic MOSFET market, it still faces strong pressure from companies like Infineon and ON Semiconductor globally, especially in the areas of super junction, high voltage, and high reliability, where significant gaps remain. Currently, China Resources Micro’s global market share in MOSFETs is less than 10%, and its SiC products have not yet formed large-scale shipments.

Challenges: Insufficient International Market Expansion

Currently, China Resources Micro’s overseas revenue accounts for less than 10%, with relatively lagging global layout. In the context of increasingly stringent compliance requirements for semiconductor technology and products in Europe and the United States, enhancing overseas market share faces high barriers.

Challenges: Slow Commercialization of Third-Generation Semiconductors

Although China Resources Micro has laid out in SiC and GaN for several years, compared to international competitors like Wolfspeed and Infineon, its mass production capacity, customer stickiness, and depth of industry chain integration are still insufficient, making it difficult to contribute large-scale revenue in the short term.

Challenges: Intensifying Domestic Competition and Homogenization Risks

Domestic manufacturers such as Silicon Micro, Yangjie Technology, and Huachuang Semiconductor are also accelerating their layouts in new fields such as IGBTs and SiC, leading to concerns about product price wars and technological homogenization in the domestic market, posing challenges to China Resources Micro’s profitability.

In summary, China Resources Micro is transforming from a local power device manufacturer into a system-level supplier with both product strength and platform capabilities. While it has established a foothold in the main industrial track, whether it can navigate the semiconductor cycle and achieve a leap in global competitiveness will require progress on three fronts: technology, capital, and market. The next stage for China Resources Micro will be a “dual test” of high-quality growth and industrial breakthrough.

Appendix: Top 100 Chip Rankings List

END

Note: The cover image of this article comes from Shetu Network, self-made by the author, and media public information, all authorized.

Welcome to leave comments and exchange in the comment area!

Industry Community

Related Recommendations

Top 100 Chip Rankings—Weir Shares, Is High Market Value a Bubble or a New Starting Point?

Top 100 Chip Rankings—Rockchip, How to Make a Comeback?

Top 100 Chip Rankings—Allwinner Technology, Can the Tablet King Lead the AI Era?

Author’s Column

Tap “Looking“↘ to share your world with friends

Please click “Read the Original” for more information

Please click “Read the Original” for more information