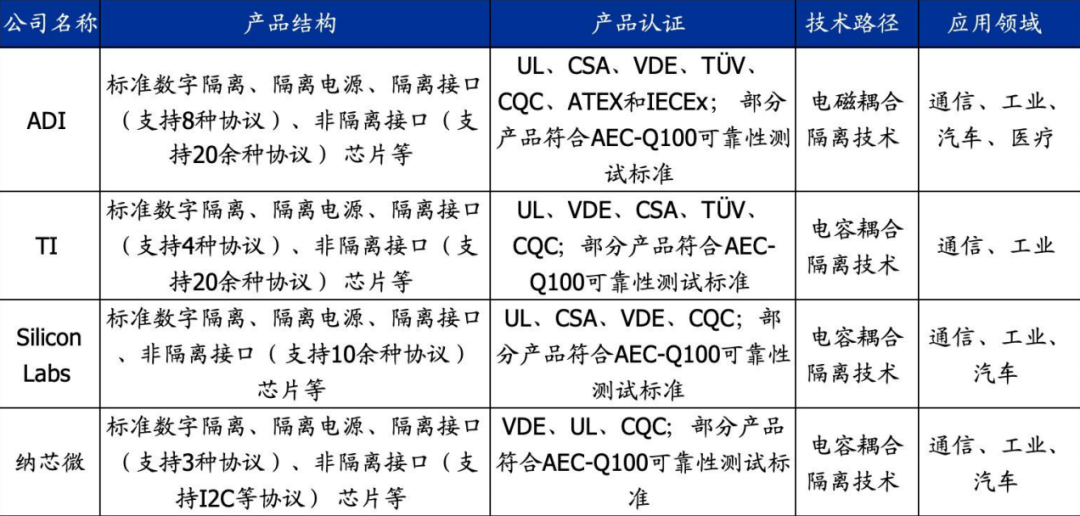

IntroductionIn the context of a profound restructuring of the global semiconductor supply chain and escalating geopolitical tensions, China’s semiconductor industry is facing a historic turning point. The implementation of the “four-digit tariff code” origin determination rules by the General Administration of Customs in 2024 will make wafer fabrication the core criterion for determining origin, directly impacting the supply chain layouts of multinational companies such as TI, Skyworks, and Intel in the Chinese market—these companies have over 70% of their high-end chip manufacturing capacity concentrated in the United States, facing dual pressures of rising tariff costs and extended delivery cycles. Meanwhile, domestic semiconductor companies are accelerating replacements in key areas such as analog chips, RF front-end, and computing CPUs/FPGA through technological breakthroughs, capacity expansion, and ecosystem building: Naxin Micro’s automotive-grade isolation chip market share has surpassed 35%, Zhaosheng Micro’s 12-inch RF production line has achieved full self-production of L-PAMiD modules, and Haiguang Information’s x86 architecture CPU has seen a 12 percentage point annual increase in market penetration in the data center market. This report reveals that the period from 2025 to 2027 will be a critical window for China’s semiconductor industry to transition from “replacement capability building” to “global competitiveness output,” with breakthroughs in third-generation semiconductor materials, Chiplet heterogeneous integration, and storage-computing integrated architecture reshaping the industry value chain, while geopolitical risks and ecological shortcomings still require systematic strategic responses. In this changing landscape, deeply understanding the technological evolution path, market replacement rhythm, and policy empowerment direction will be the key to seizing trillion-dollar industry opportunities.

IntroductionIn the context of a profound restructuring of the global semiconductor supply chain and escalating geopolitical tensions, China’s semiconductor industry is facing a historic turning point. The implementation of the “four-digit tariff code” origin determination rules by the General Administration of Customs in 2024 will make wafer fabrication the core criterion for determining origin, directly impacting the supply chain layouts of multinational companies such as TI, Skyworks, and Intel in the Chinese market—these companies have over 70% of their high-end chip manufacturing capacity concentrated in the United States, facing dual pressures of rising tariff costs and extended delivery cycles. Meanwhile, domestic semiconductor companies are accelerating replacements in key areas such as analog chips, RF front-end, and computing CPUs/FPGA through technological breakthroughs, capacity expansion, and ecosystem building: Naxin Micro’s automotive-grade isolation chip market share has surpassed 35%, Zhaosheng Micro’s 12-inch RF production line has achieved full self-production of L-PAMiD modules, and Haiguang Information’s x86 architecture CPU has seen a 12 percentage point annual increase in market penetration in the data center market. This report reveals that the period from 2025 to 2027 will be a critical window for China’s semiconductor industry to transition from “replacement capability building” to “global competitiveness output,” with breakthroughs in third-generation semiconductor materials, Chiplet heterogeneous integration, and storage-computing integrated architecture reshaping the industry value chain, while geopolitical risks and ecological shortcomings still require systematic strategic responses. In this changing landscape, deeply understanding the technological evolution path, market replacement rhythm, and policy empowerment direction will be the key to seizing trillion-dollar industry opportunities.

The original report is available on Knowledge Planet.

Below is a summary of the report’s content.——————————————

Below is a summary of the report’s content.——————————————

1. Opportunities for China’s Semiconductor Industry Amid Stricter Origin Rules(In-depth analysis of the impact of the 2025 semiconductor product origin determination rules by China’s General Administration of Customs)

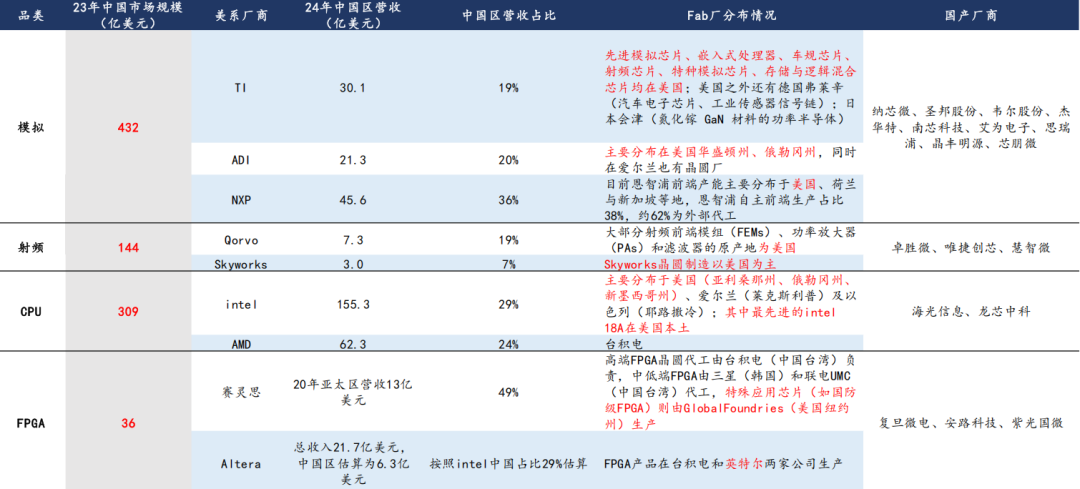

1. Structural Changes in the Policy EnvironmentThe China Semiconductor Industry Association urgently issued the “Semiconductor Product Origin Determination Rules” in April 2025, clearly stating that the origin determination of integrated circuits will adopt the “four-digit tariff code change principle,” with wafer fabrication as the core standard for origin determination. This rule breaks through the traditional logic of determining the packaging and testing stages and implements precise traceability control in the wafer manufacturing stage. After the policy takes effect, American manufacturers such as Skyworks, Qorvo, TI, ADI, and Intel will face significant tariff pressures in the Chinese market—over 70% of their core wafer manufacturing capacity is concentrated in the United States, directly affecting the product import cost structure and supply chain efficiency.

2. Exposure of Vulnerabilities in Multinational Supply Chains

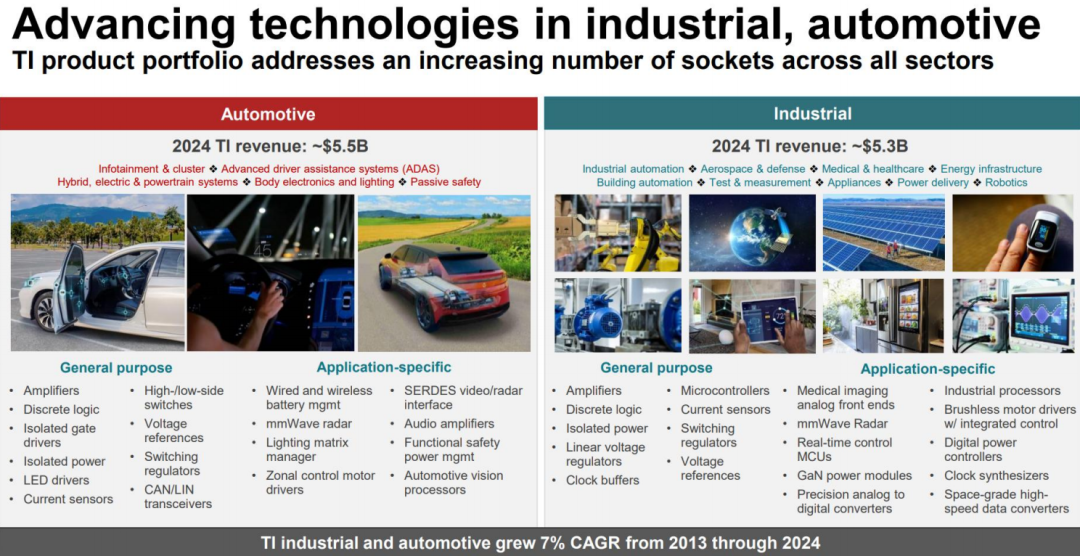

In the Analog Chip Sector:TI’s annual revenue in China is $3.01 billion (19% share), with automotive/industrial chips primarily produced in core factories such as DMOS6/RFAB in Texas. Its Sherman 300mm wafer factory group (scheduled to be operational in 2025) focuses on automotive-grade chips, and tariff pressures are directly transmitted to domestic industrial automation and new energy vehicle customers.

In the RF Front-End Sector:Qorvo/Skyworks’ combined revenue in China is $1.03 billion, with 19% of BAW filters and 78% of high-end FEM modules produced in U.S. wafer factories, directly affecting the supply chain security of 5G base stations and high-end smartphones.

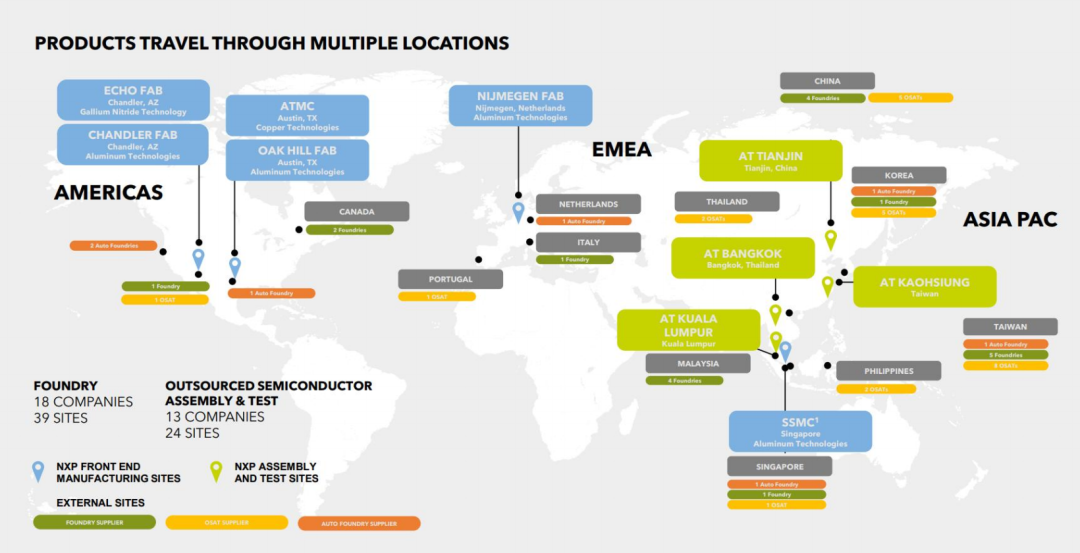

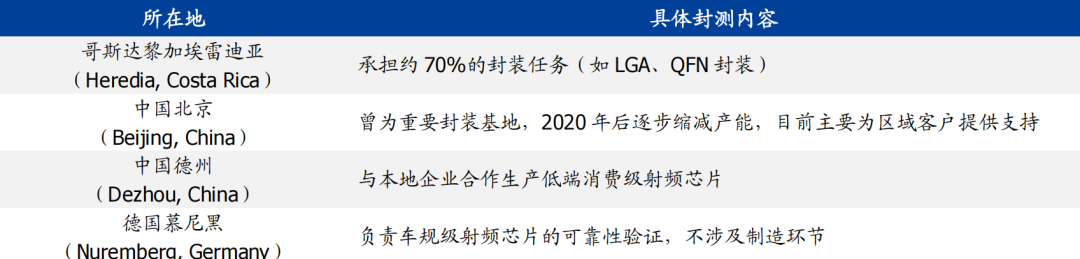

Qorvo Manufacturing and Testing Base Distribution

In the Computing Chip Sector:Intel’s revenue in China is $15.5 billion, with the 18A process node produced entirely in the U.S. for the Clearwater Forest data center processor, with an estimated tariff cost increase of 12-15%.

Intel Wafer and Testing Factory Distribution

3. The Window for Domestic Replacement is Fully Opened (1) Breakthroughs at the Critical Point of Technological Replacement:

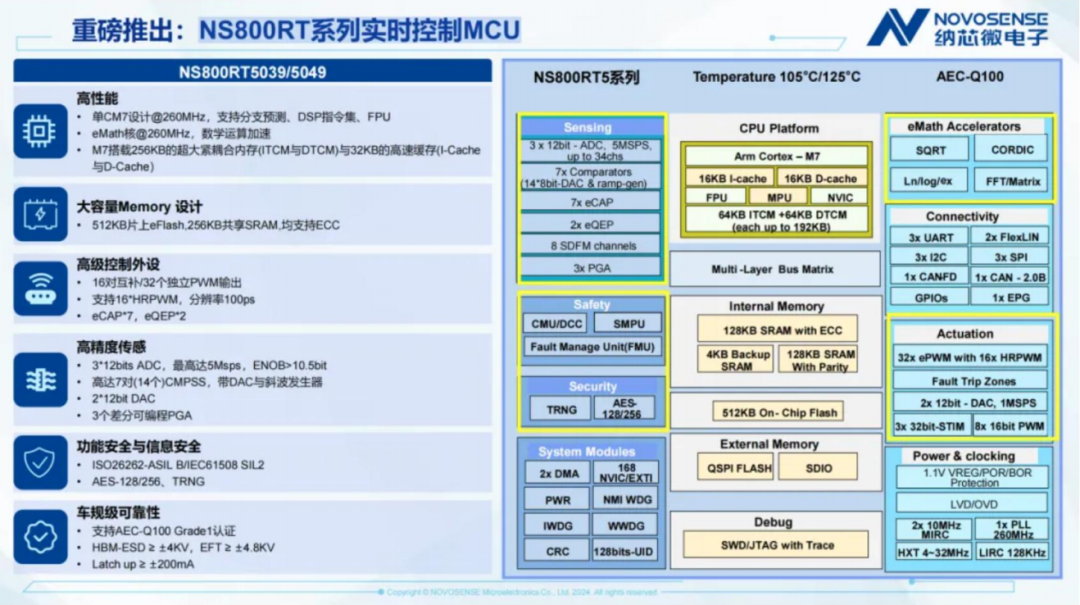

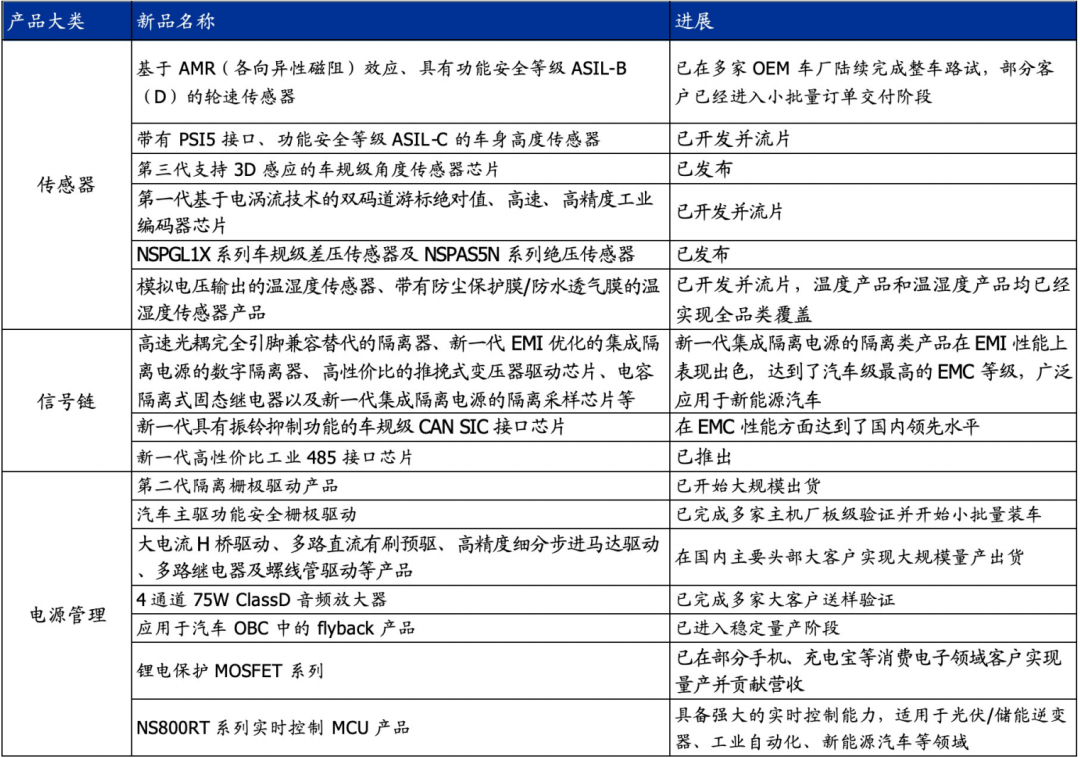

Naxin Micro’s isolation chip has a domestic market share of 35%, and the NS800RT series MCU has achieved pin-level compatibility with TI’s C2000, surpassing international competitors in key parameters such as storage capacity (512KB Flash/388KB RAM) and ADC channel count (34 channels).

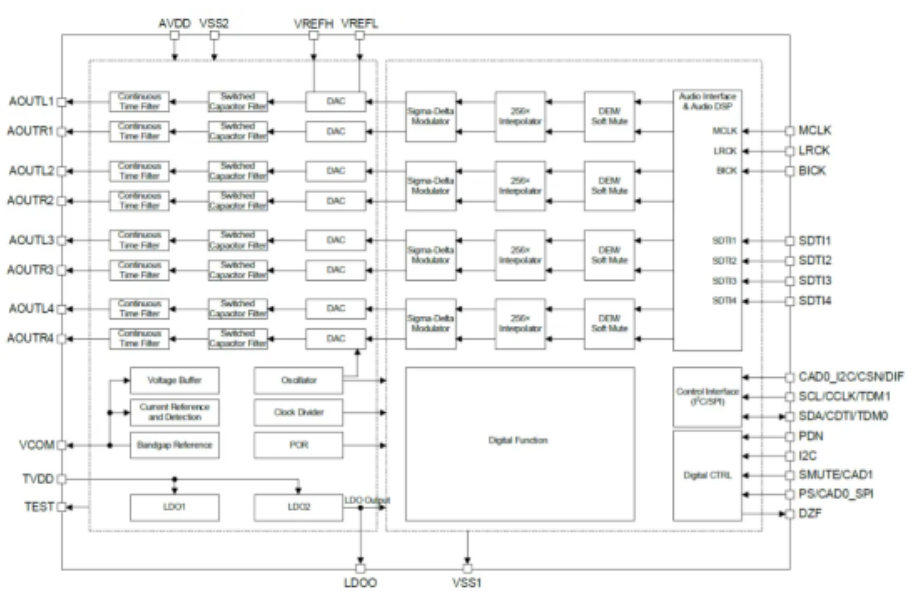

Shengbang’s automotive-grade product matrix covers over 5200 part numbers, including a 7-channel LDO (SGM38120) and a 110dB audio DAC (SGM56101Q), with the L-PAMiD module expected to pass certification from leading automotive manufacturers in 2025.

SGM56101Q Functional Block Diagram

(2) Capacity Assurance System Formation:

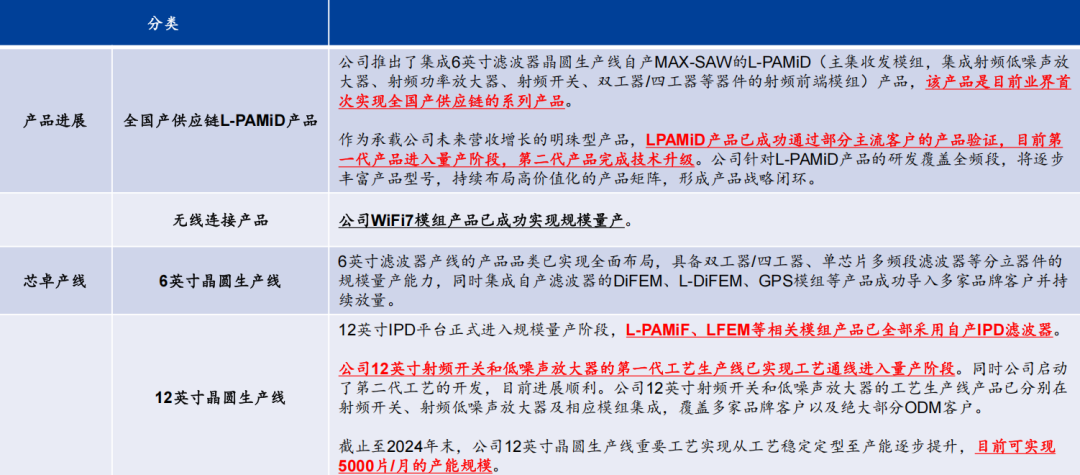

Zhaosheng Micro’s 12-inch production line has a monthly capacity of 5000 wafers, achieving 100% localization of the L-PAMiF module through self-produced IPD filters;

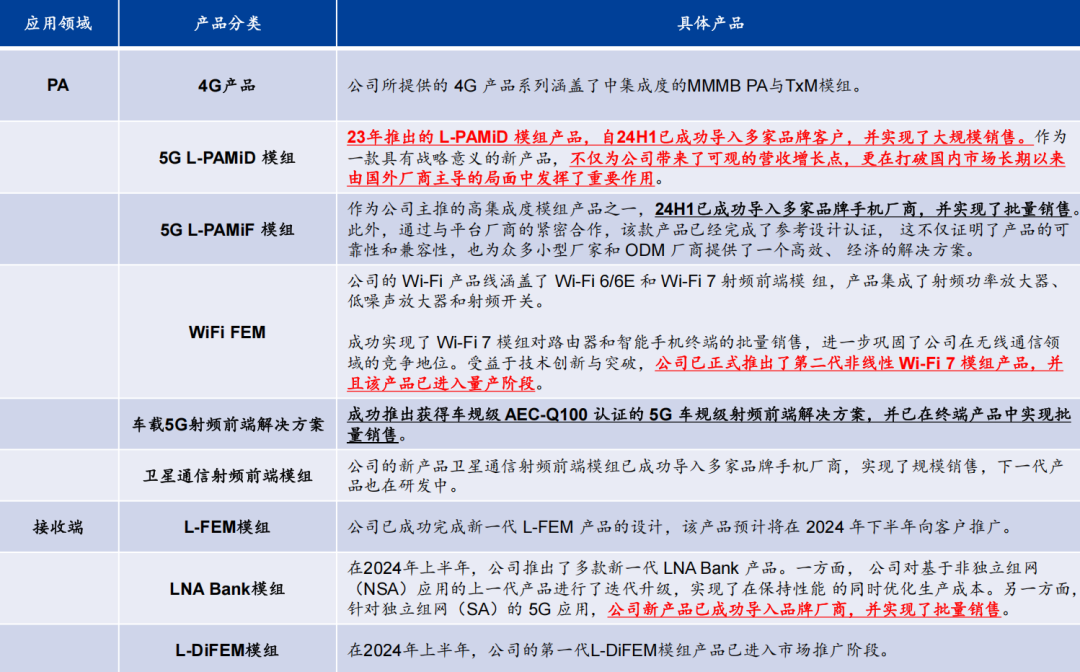

Zhaosheng Micro’s Business Progress

Weijie Chuangxin’s L-PAMiD plus module has been introduced to four major smartphone brands, with the Phase8L solution expected to replace 40% of the discrete solution market by 2025.

Weijie Chuangxin’s Product Matrix and Progress

(3) Market Replacement Acceleration Calculation:According to customs data modeling, in the analog chip sector, the $9.6 billion market in China for TI/ADI/NXP has seen the domestic manufacturers’ part number coverage increase from 12% in 2020 to 38% in 2025, with the speed of replacement in the automotive electronics sector exceeding expectations—Naxin Micro’s automotive products are expected to see a 100% year-on-year increase in shipments to 363 million units in 2024, with a projected localization rate exceeding 25% by 2026.

IC Design Companies’ Domestic Replacement Space Overview

4. Economic Value Estimation of Industry RestructuringBased on the Boston Matrix analysis, tariff policies will lead to a 18-22% increase in the comprehensive costs of American manufacturers’ products in China, while domestic manufacturers, leveraging localized supply chains (cost advantages of 15-20%) and technological iterations (performance gaps narrowed to within 5%), can capture over $20 billion in replacement space in the three major fields of industrial control, new energy vehicles, and 5G base stations. The geographical distribution reconstruction of wafer factories will accelerate investments in 12-inch specialty process production lines, with a projected compound annual growth rate of 28% for China’s mature process capacity from 2025 to 2027, significantly higher than the global average.

2. The Wave of Domestic Replacement in Analog Chips(The Path of Industry Restructuring Under the Sino-U.S. Technological Game in 2025)

1. Structural Risks in International Manufacturers’ Business in China (1) In-Depth Analysis of TI’s Supply Chain

Geographical Concentration of Capacity:82% of automotive/industrial chips are produced in three major manufacturing clusters in Texas (DMOS6/RFAB/SM1), with key products such as automotive PMICs and CAN transceivers being the first to be impacted by tariffs.

TI Origin Distribution Situation

Cost Transmission Mechanism:In the $3.01 billion revenue from China, 19% involves industrial sensor chips fabricated in the U.S., and the increase in tariff costs has led to a 12-15% decrease in price competitiveness.

TI Automotive and Industrial Sector Situation

(2) ADI’s Hybrid Manufacturing Model Vulnerability

Defects in Wafer Factory Layout:The Camas plant in Washington State accounts for 60% of high-end data converter capacity, while the Limerick plant in Ireland only covers European market demand, and the Asian packaging and testing stages (Philippines/Malaysia) cannot avoid origin rules.

ADI Origin Distribution

Product Replacement Critical Point:In the $2.13 billion revenue from China, 80% is concentrated in automotive BMS chips and industrial precision operational amplifiers, with Naxin Micro’s NSI82xx series isolation sampling chips achieving comprehensive parameter benchmarking.

(3) NXP’s Localization Strategy Limitations

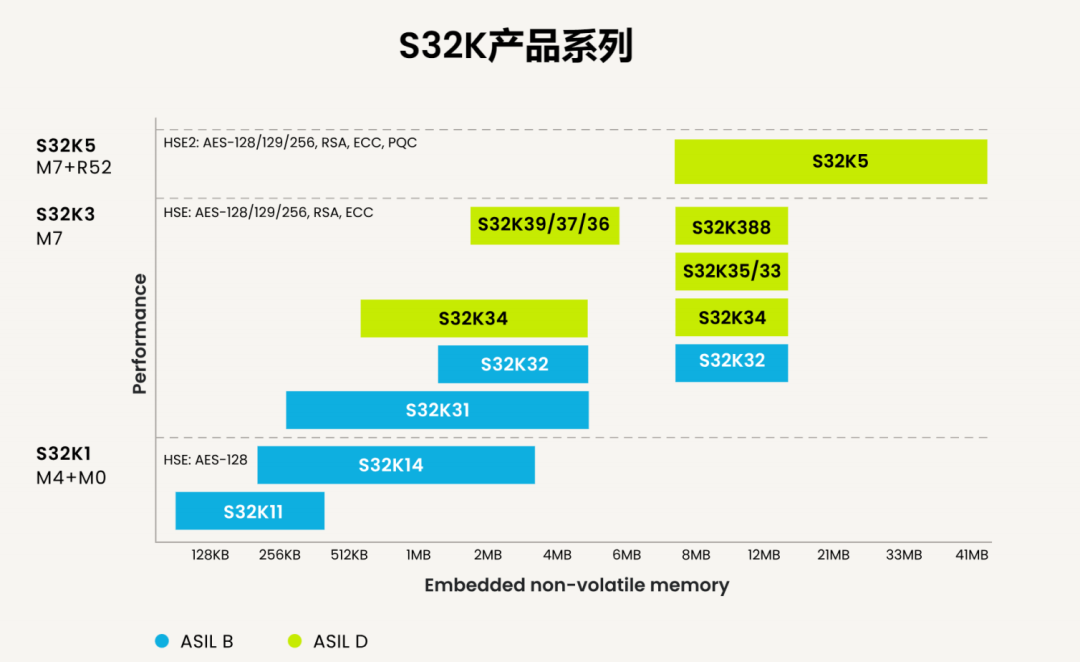

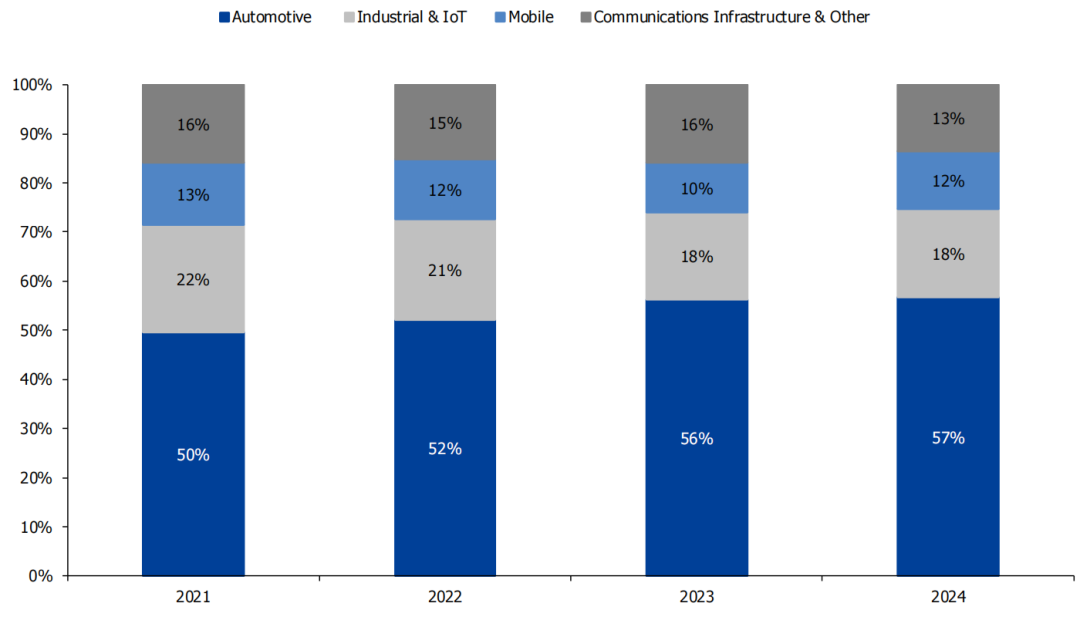

Dependency on Foundry:62% of front-end manufacturing relies on TSMC/UMC, and the core capacity for automotive MCUs remains at the Austin plant in the U.S., with the S32K series facing competition from GigaDevice’s GD32A7 32-bit RISC-V architecture.

NXP S32K Series

Acceleration of Replacement:In the $4.56 billion revenue from China, 57% of the automotive chip business is being eroded by domestic manufacturers using a “part number carpet coverage + price advantage of 25-30%” strategy.

NXP’s Revenue Breakdown by End Market

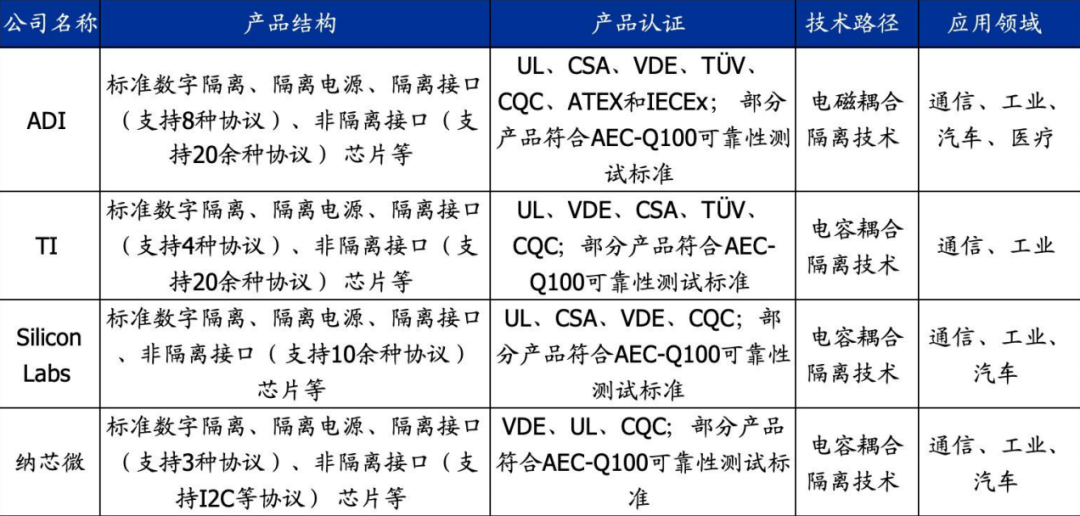

2. Pathways for Domestic Technological Breakthroughs (1) Signal Chain Chips

Generational Leap in Isolation Technology:Naxin Micro’s digital isolators have shipped a cumulative total of 600 million units, and the NSi82xx series has passed AEC-Q100 certification, surpassing ADI’s ADuM series in common-mode transient immunity (CMTI≥200kV/μs) and other indicators.

Naxin Micro 2024 New Product Progress Overview

Breakthroughs in Automotive-Grade Interface Chips:The NSi104x series CAN FD transceivers have a working temperature range (-40℃~150℃) fully compatible with TI’s TCAN1042 and have entered the core component list of BYD/NIO.

(2) Power Management Chips

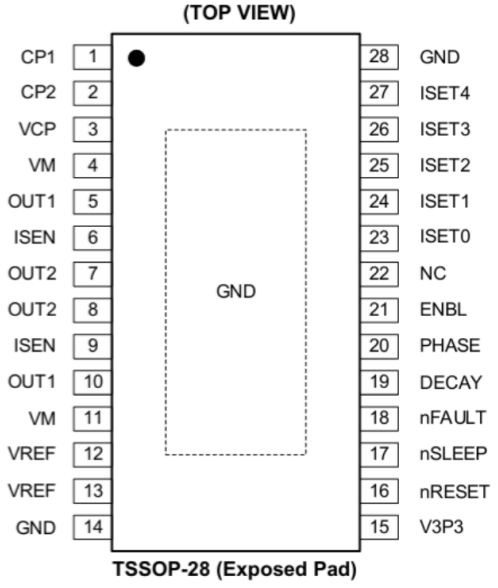

Multi-Domain Penetration:Shengbang’s 32 product categories cover 90% of industrial scenarios, with the SGM42540A multi-channel motor driver chip achieving performance levels equivalent to TI’s DRV8847 in terms of step accuracy (±0.5°) and driving current (2.5A).

SGM42540A

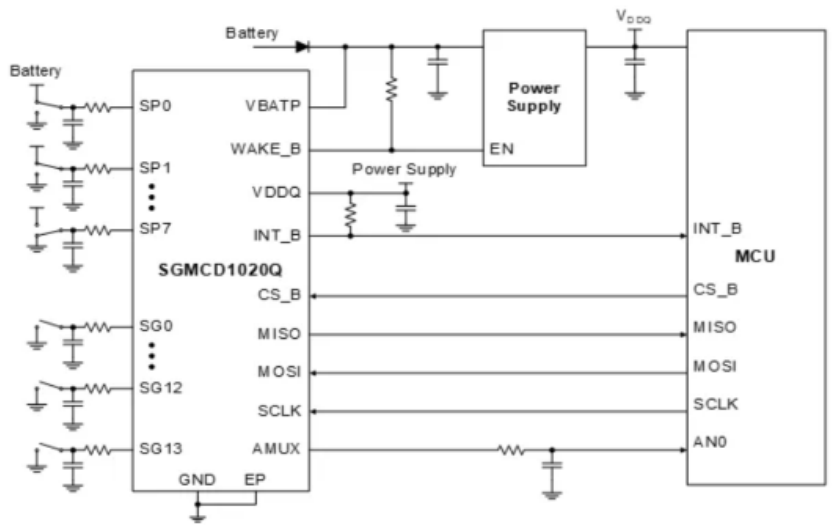

Breakthroughs in Automotive-Grade Solutions:The SGMCD1020Q multi-channel switch detection chip supports 22-channel ASIL-D functional safety, reducing costs by 18% compared to NXP’s MC33982.

SGMCD1020Q Typical Application Circuit

(3) Building the Automotive MCU Ecosystem

Architectural Innovation:The GigaDevice GD32A7 series adopts a dual-core lock-step architecture, achieving 1024 DMIPS computing power at a main frequency of 300MHz, reducing power consumption by 23% compared to NXP’s S32K3 series.

GigaDevice GD32A7 Series

Perfecting the Development Ecosystem:Naxin Micro’s NS800RT provides a fully compatible IDE environment with TI’s C2000, reducing customer code migration costs by 70%.

3. Dynamics of Competitive Landscape Reconstruction (1) Part Number Coverage Strategy

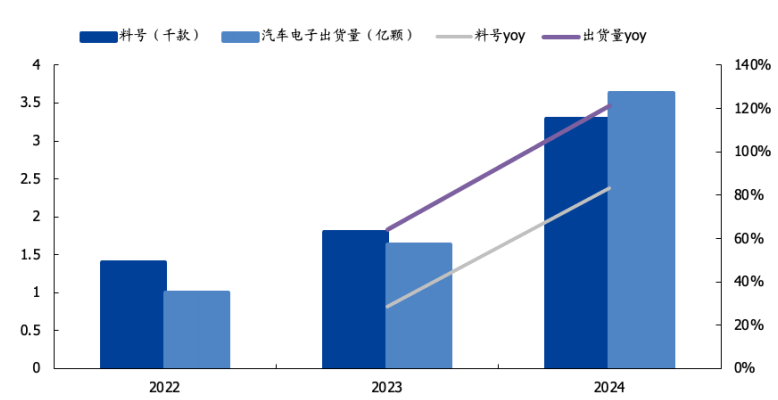

Horizontal Comparison:Naxin Micro and Shengbang together cover over 8500 part numbers, covering 80% of TI’s product line, achieving precise replacements in long-tail markets such as industrial RS-485 interfaces and automotive LIN buses.

Naxin Micro 2022-2024 Part Numbers and Automotive Electronics Shipment Volume

Vertical Extension:Shengbang’s L-PAMiD module achieves a 92% integration level, reducing PCB area by 35% compared to similar products from Skyworks.

(2) Breakthrough Progress in Automotive Electronics

Acceleration of Replacement:In 2024, the shipment volume of domestic automotive-grade chips is expected to increase by 217% year-on-year, with Naxin Micro’s isolation chips achieving a market share of over 40% in the OBC market.

Reducing Technological Gaps:Shengbang’s SGM56101Q audio DAC achieves a signal-to-noise ratio (SNR) of 110dB, comparable to ADI’s SSM2518, with a price advantage of 28%.

(3) Industrial Market Penetration Mechanism

Cost Replacement Model:Domestic industrial-grade operational amplifiers are priced at only 1/3 to 1/2 of TI’s similar products, with a replacement rate exceeding 50% in the PLC analog input module sector.

Reliability Verification Breakthroughs:Naxin Micro’s NSi81xx series has passed IEC 60747-17 certification, replacing ADI’s iCoupler products in the photovoltaic inverter market.

4. Building Supply Chain Resilience (1) Autonomy in Wafer Manufacturing

Zhaosheng Micro’s 12-inch RF specialty process line achieves a monthly capacity of 5000 wafers, with a 100% self-sufficiency rate for IPD filters.Naxin Micro is collaborating with Huahong to build an automotive-grade BCD process production line, with mass production of 0.18μm technology expected in Q2 2025.

(2) Upgrading the Testing Stage

Changdian Technology has developed FO-LGA packaging technology, reducing the packaging cost of Shengbang’s multi-channel PMIC by 40%.Huatian Technology’s automotive-grade QFN packaging yield has improved to 99.2%, supporting the reliability standards of domestic chips.

(3) Ecological Collaborative Innovation

Naxin Micro is developing a dedicated isolation chip for rail transit in collaboration with CRRC Times Electric, with a temperature cycling life exceeding 10,000 times.Shengbang is collaborating with Huawei Ascend to develop a power management solution for AI servers, achieving a conversion efficiency of 96.5%.

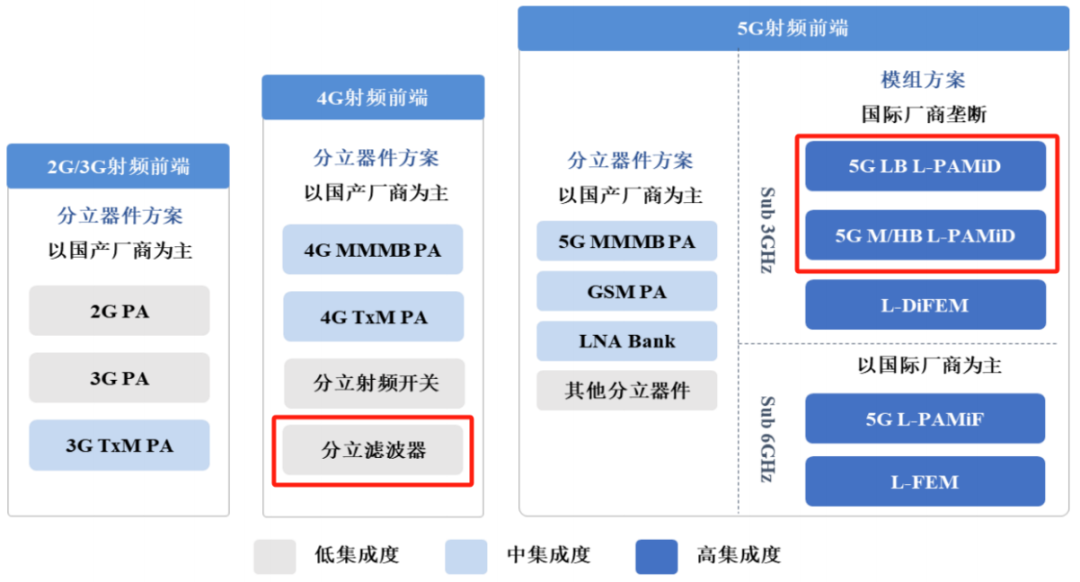

3. Breakthroughs in Domestic RF Front-End Modules(Supply Chain Restructuring Practices During the Deepening Phase of 5G in 2025)

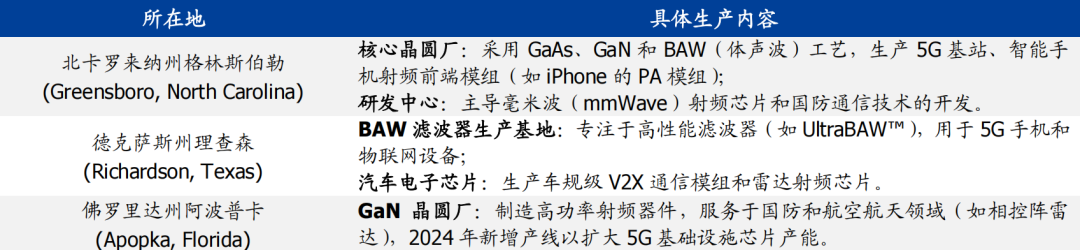

1. Deconstructing the Overseas Manufacturers’ Technological Monopoly (1) Qorvo’s Supply Chain Risks Exposed

Geographical Concentration of Manufacturing:19% of revenue in China ($730 million) is entirely dependent on U.S. GaAs/GaN wafer factories, with the Texas Richardson plant responsible for 100% of BAW filter production, directly impacting the supply chain of 5G base stations for Huawei/Xiaomi.

Qorvo Wafer Manufacturing Plants

Loss of Control in the Testing Stage:After the sale of the Beijing/Shandong testing plants to Luxshare Precision, the logistics cycle for the Costa Rica processing plant has extended to 45 days.

Qorvo Testing and Module Manufacturing Plants

(2) Skyworks’ Structural Defects in Business

Technological Lag Solidification:The Suzhou testing plant only undertakes low-end SAW filter packaging, while core TC-SAW/BAW wafer manufacturing is 100% located in Oregon, USA.Replacement Window Emerges:In the $300 million revenue from China, 73% is concentrated in 4G FEM modules, with Weijie Chuangxin’s Phase5N solution priced 30% lower and delivery times shortened by 50%.

(3) Market Replacement Space Estimation

5G base station PA modules: In Qorvo’s $730 million revenue, 32% comes from Massive MIMO power amplifier modules, with a localization rate of less than 8%.High-end smartphone modules: Skyworks’ L-PAMiD products account for over 60% of Chinese brand flagship models, while Weijie Chuangxin’s similar products have an ASP 25% lower.

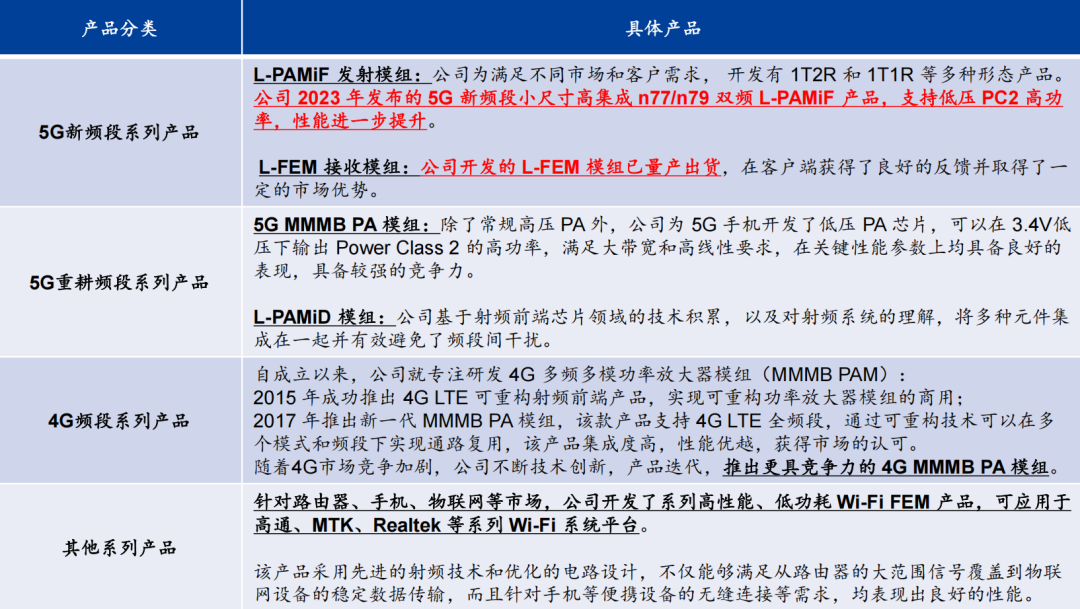

2. Pathways for Domestic Replacement Technology Breakthroughs (1) Filter Technology Breakthroughs

Parallel Breakthroughs in BAW/SAW:Zhaosheng Micro’s 6-inch BAW production line has achieved a yield of 82%, with insertion loss (1.8dB) in the 3.5GHz n77 frequency band approaching Qorvo’s UltraBAW level.

Zhaosheng Micro’s Product Matrix

Microchip Technology’s SAW filters achieve 0.15dB in-band ripple, covering all frequency bands of Band 1/3/7.

Module Integration Breakthroughs:Zhaosheng Micro’s L-PAMiD module integrates 8 self-produced filters, reducing board-level area by 28% compared to Skyworks’ SKY5® series.

Huizhi Micro’s 5G n79 dual-band module achieves a power-added efficiency (PAE) of 43%, 5 percentage points higher than Qorvo’s QM77038.

Huizhi Micro’s Product Matrix and Progress

(2) Transmitter Module Replacement

L-PAMiD Technology Leap:Weijie Chuangxin has achieved a fully domestic supply chain integration: self-developed GaAs PA chips output power (29dBm) comparable to Skyworks’ SKY5®, and has collaborated with Jingxun Optoelectronics to develop module IPD filters, improving out-of-band suppression by 6dB.

Revolution in Cost Control:The Phase8L solution adopts 3D heterogeneous packaging, reducing BOM costs by 40% compared to discrete solutions.

(3) Receiver Technology Upgrades

High Integration Solutions:Zhaosheng Micro’s L-DiFEM module integrates 16 switches + 4 LNAs, reducing noise figure (NF) to 1.2dB.

Breakthroughs in Satellite Communication:Huizhi Micro has developed RF front-end solutions supporting the 3GPP NTN standard, achieving a transmission efficiency of 38%.

3. Progress of Industry Chain Reconstruction (1) Manufacturing Capability Leap

Specialty Process Production Lines:Zhaosheng Micro’s 12-inch RF SOI production line has a monthly capacity of 5000 wafers, with a yield of 99.3% for switch products.San’an Integrated’s 6-inch GaAs production line is fully operational, with monthly shipments of PA chips exceeding 30 million units.

Testing Technology Breakthroughs:Changdian Technology has developed 0.3mm ultra-thin Fan-out packaging, reducing the thickness of FEM modules to 0.8mm.Huatian Technology’s 5G FEM module testing yield has exceeded 98.5%.

(2) Acceleration of Customer Adoption

In the Smartphone Sector:Weijie Chuangxin’s L-PAMiD module has entered the supply chain of Xiaomi 14/Honor Magic 6, replacing 50% of Skyworks’ share.Huizhi Micro’s 5G L-PAMiF has achieved a penetration rate of 70% in Transsion’s mid-range models.

In the Base Station Equipment Sector:Zhaosheng Micro’s base station PA module has passed validation for Huawei’s AAU equipment, with bulk deliveries expected in Q3 2025.Guobang Electronics’ GaN power amplifier module’s share in ZTE’s Massive MIMO system has increased to 25%.

(3) Breaking Through Patent Barriers

Zhaosheng Micro has accumulated 687 authorized RF patents, with a BAW filter structure patent (ZL202310056789.1) breaking Qorvo’s technological blockade.Weijie Chuangxin’s L-PAMiD three-dimensional packaging patent (US2025178362) avoids restrictions from Skyworks’ patent pool.

4. Quantitative Analysis of Market Replacement Process (1) Smartphone Modules

Mid-range Models: The penetration rate of domestic FEM modules is expected to increase from 18% in 2023 to 55% in 2025.Flagship Models: The localization rate of L-PAMiD modules is expected to exceed 15%, with price anchors dropping by 30%.

(2) Base Station Equipment Market

Massive MIMO power amplifier modules: The localization rate is expected to reach 40% by 2025, with costs 22% lower than imported solutions.Small base station RF units: The share of domestic FEM solutions exceeds 70%.

(3) Emerging Field Penetration

Satellite Communication Terminals: The penetration rate of domestic RF front-end solutions in consumer-grade devices reaches 30%.Vehicle Networking Modules: Zhaosheng Micro’s automotive-grade FEM has passed AEC-Q100 certification and entered BYD’s 5G T-Box supply chain.

5. Strategic Investment Opportunities and Risk Warnings in the Industry Chain(Strategies for Offense and Defense in the Reconstruction of Semiconductor Industry Value in 2025)

1. Core Track Investment Map (1) Wafer Manufacturing Stage

Expansion Strategy:SMIC (688981.SH): The Beijing/Shenzhen 12-inch plant focuses on 40nm BCD technology, with automotive-grade capacity expected to increase to 80,000 wafers/month by 2025, supporting Naxin Micro’s full self-production of isolation chips.Huahong Semiconductor (1347.HK): The second phase of Wuxi’s production of 28nm eNVM technology will reduce MCU/PMIC foundry costs by 22% compared to TSMC.

Value Estimation:The localization rate of the mature process (28nm and above) foundry market is expected to increase from 32% in 2024 to 58% in 2027, corresponding to an average annual capital expenditure growth rate of 28%.

(2) Design Field

Leading Targets in Sub-segments:Naxin Micro (688052.SH): The market share of automotive-grade isolation chips is 35%, with automotive electronics revenue expected to exceed 50% by 2025, and ASP 18-25% lower than TI’s similar products.Shengbang (300661.SZ): Over 5200 part numbers cover 90% of industrial scenarios, with L-PAMiD module gross margins reaching 65% (international competitors average 55%).Zhaosheng Micro (300782.SZ): The mass production of the 12-inch RF SOI production line drives a 30% reduction in RF module costs, with L-PAMiD product ASP 25% lower than Skyworks.

Growth Assessment:Leading design companies maintain a R&D expense ratio of 18-22%, with part number growth rate averaging 35% annually.

(3) Opportunities Linked to Equipment and Materials

Etching/Deposition Equipment:SMIC (688012.SH) CCP dielectric etching equipment has over 60% market share in BCD technology, with a projected CAGR of 45% in 2025.

Specialty Gases:Huate Gas (688268.SH) has broken the overseas monopoly on high-purity NF3/CF4, with SMIC’s procurement share increasing to 38%.

Packaging Substrates:Xingsen Technology (002436.SZ) FC-CSP substrate yield has exceeded 98%, supporting a 40% reduction in 5G FEM module packaging costs.

2. Risk Warning System (1) Technological Iteration Risks

Impact of GAA Transistors:TSMC’s 2nm GAA technology is expected to be mass-produced in 2025, potentially widening the technological gap with domestic 14nm FinFET (current performance gap of 45%).

Chiplet Ecosystem Lag:The domestic chiplet interconnect standard UCIe 1.1 is lagging behind international giants by 9-12 months, with 3D packaging yields 15 percentage points lower than international levels.

(2) Geopolitical Escalation Risks

Expansion of Equipment Export Bans:If the U.S. expands the ban from EUV to ArF immersion lithography machines (ASML NXT:2000i), the 28nm expansion plan will be delayed by 18-24 months.

Strengthening of Patent Barriers:Qorvo’s patent litigation over BAW filters in China may impact Zhaosheng Micro’s revenue by 30%, necessitating a provision of 5-7% of net profit as a risk reserve.

(3) Talent Competition Risks

Core Talent Shortage:The supply-demand ratio for analog chip design engineers is 1:8, with leading companies experiencing an annual increase of 20% in labor costs.

Risk of Technology Leakage:The average tenure of RF architects is only 4.2 years (7.8 years in international peers), requiring companies to increase R&D investment by 20% for knowledge management system construction.

3. Investment Decision Matrix

| Risk Dimension | Probability of Occurrence | Potential Loss | Hedging Strategy |

|---|---|---|---|

| Widening Technological Gap | 35% | 30% valuation downgrade for design companies | Focus on differentiated innovation in mature processes (40/28nm) |

| Equipment Import Restrictions | 25% | 18-month delay in wafer factory expansion | Accelerate second-hand equipment procurement (with Japanese channels increasing to 40%) |

| Surge in Patent Litigation | 20% | 5-10% erosion of corporate net profit | Establish a patent analysis team of 300-500 people |

| Collective Talent Loss | 15% | 6-9 months delay in R&D progress | Implement equity incentives to cover 80% of the core team |

4. Strategic Configuration Recommendations (1) Offensive Portfolio (β=1.2)

Core Holdings:Naxin Micro (15%), SMIC (20%), Zhaosheng Micro (12%)

Configuration Logic:The automotive electronics/RF front-end replacement track has the strongest certainty, with a projected PE of 45-55 times in 2025, which is a reasonable premium of 30% over the industry average.

(2) Defensive Portfolio (β=0.8)

Core Holdings:Huahong Semiconductor (18%), Shengbang (10%), Huate Gas (8%)

Configuration Logic:Equipment and materials segments benefit from rigid demand for domestic replacement, with an average dividend yield of 2.8% providing a safety margin.

(3) Risk Hedging Tools

Shorting Tool: Philadelphia Semiconductor Index ETF (SOXX.US) to hedge against price war risks from international giantsOptions Strategy: Buy SMIC’s 2026 40 yuan put options (Delta=-0.3)

6. Future Three-Year Industry Development Trend Outlook(2025-2027 China’s Semiconductor Industry Evolution Roadmap)

1. Key Paths for Technological Breakthroughs (1) Accelerated Penetration of Third-Generation Semiconductors

Material Iteration:By 2025, the penetration rate of SiC MOSFETs in new energy vehicle main drive inverters is expected to exceed 40% (currently 18%), with Naxin Micro and Huahong’s 6-inch SiC production line achieving mass production of 1200V devices.GaN RF devices are expected to account for 25% of 5G base station PAs, with Zhaosheng Micro developing a 0.15μm GaN-on-Si process, improving efficiency by 35% compared to LDMOS.

Cost Decline Curve:By 2027, the cost of SiC substrates is expected to drop to $400/piece (from $800 in 2024), driving an average increase of 80km in the range of domestic electric vehicles.

(2) Chiplet Technology Restructuring Design Paradigms

Breakthroughs in Heterogeneous Integration:Haiguang Information’s 3D Chiplet packaging technology achieves an interconnection distance of ≤50μm between HBM3 and computing cores, with interconnection density reaching 90% of TSMC’s CoWoS level.Anlu Technology’s SALDRAGON series adopts a chiplet reuse architecture, shortening the development cycle by 40%, and supporting UCIe 2.0 standards by 2026.

Ecological Collaboration:By 2025, the proportion of China’s chiplet interconnect patents is expected to increase to 22% (currently 7%), with SMIC/Changdian Technology establishing the largest chiplet verification platform in Asia.

(3) Breakthroughs in Storage-Computing Integrated Architecture

Commercialization of Near-Memory Computing:Alibaba’s PingTouGe Hanguang 800 chip achieves 1.2TOPS/W energy efficiency, reducing costs by 60% compared to GPU solutions in recommendation system scenarios.Wallace Technology’s BR200 series integrates HBM3 memory, reducing the energy consumption ratio of data transport in AI training tasks from 40% to 12%.

New Storage Media:GigaDevice has launched MRAM-based non-volatile storage computing chips, with read/write speeds 100 times faster than NOR Flash, suitable for industrial real-time control scenarios.

2. Dynamics of Market Structure Reconstruction (1) Full Chain Replacement in Automotive Electronics

Timeline and Milestones:By 2025: The localization rate of automotive-grade MCUs is expected to reach 45% (up from 18% in 2024), with Naxin Micro’s isolation chips achieving over 60% market share in domain controllers.By 2027: The self-sufficiency rate of autonomous driving SoC chips is expected to exceed 30%, with Black Sesame’s intelligent A2000 series achieving 500 TOPS, and the cost of L3 solutions dropping to $200 (compared to $350 for international competitors).

Supply Chain Resilience Indicators:Domestic Tier 1 manufacturers’ procurement rate of domestic chips is expected to increase from 32% in 2024 to 75% in 2027.

(2) Data Center Computing Power Reconstruction

Replacement Process:By 2025: The share of domestic CPUs in operator edge computing nodes is expected to reach 40%, with Haiguang 7285 server procurement costs 22% lower than x86 solutions.By 2026: The cost of building autonomous AI training clusters (1000P level) is expected to be 35% lower than NVIDIA DGX systems, with the energy efficiency gap narrowing to 15%.

Technological Turning Point:By 2027, the penetration rate of storage-computing integrated chips in recommendation systems is expected to exceed 50%, with inference latency reduced to 0.8ms (currently 3.2ms).

(3) Evolution of Price Wars in Consumer Electronics

Structural Differentiation:In mid-range smartphones: The cost of domestic RF front-end solutions is 40% lower than Skyworks, with Transsion/Honor’s procurement share expected to exceed 70% by 2025.In the high-end market: The localization rate of L-PAMiD modules is expected to exceed 20%, with Weijie Chuangxin launching third-generation products supporting 6GHz frequency bands in 2026.

Profit Margin Defense Battle:The R&D expense ratio of design companies is expected to compress to 15-18% (currently 22-25%), achieving a 30% cost reduction through 12-inch specialty processes.

3. Upgrading the Policy Support System (1) Investment Map for the Third Phase of the Big Fund

Funding Allocation Focus (2024-2027):40% directed towards manufacturing: SMIC’s 12-inch BCD technology/Huahong’s 28nm eNVM production line expansion (Chart 8/18).30% supporting equipment materials: SMIC’s etching machines/Shanghai Xinxing’s 12-inch silicon wafer capacity doubling plan.20% nurturing leading design companies: Naxin Micro’s automotive chip/Haichuang’s SiYuan 590 wafer production subsidies.

Investment Return Mechanism:Establish a semiconductor patent securitization platform, achieving a 50% increase in the turnover rate of technology assets by 2025.

(2) Regional Industrial Cluster Construction

Yangtze River Delta Integration:Shanghai Lingang has built the world’s largest 12-inch automotive chip production line cluster, with a capacity expected to reach 200,000 wafers/month by 2026.The Wuxi National Integrated Circuit Innovation Center focuses on advanced packaging, with 3D integration technology achieving a yield of over 95%.

Chengdu-Chongqing Economic Circle:The second phase of the Chengdu Huahong base is expected to achieve MCU/PMIC capacity of 150,000 wafers/month by 2025, with costs 12% lower than in East China.

(3) Collaborative Innovation in Industry-Academia-Research

New R&D Entities:The National Integrated Circuit Innovation Research Institute leads the development of EDA toolchains, achieving full process tool autonomy by 2026.Huawei/SMIC’s joint laboratory is tackling EUV light source technology, with a prototype power of 250W (current ASML level is 500W) expected by 2030.

Talent Cultivation Mechanism:The Ministry of Education’s “Integrated Circuit Talent Program” trains an average of 12,000 engineers annually, with the design talent gap expected to narrow from 80,000 to 30,000 by 2027.

4. Predictions for Global Competitiveness Leap

| Indicator Dimension | 2024 Baseline Value | 2027 Target Value | Key Driving Force |

|---|---|---|---|

| Mature Process Localization Rate | 32% | 58% | SMIC’s 40nm BCD process expansion |

| Automotive Chip Self-Sufficiency Rate | 18% | 45% | Naxin Micro’s isolation chip capacity release |

| Equipment Localization Rate | 28% | 52% | SMIC’s etching machine market share exceeds 35% |

| Global Top 50 Design Enterprises | 5 | 12 | Shengbang/Zhaosheng Micro entering the top ten in analog chips |

| Patent Quality Index | 68 (U.S.=100) | 82 | UCIe/storage-computing integrated architecture patent layout |