With the global economic outlook declining and traditional consumer electronics demand falling, the semiconductor industry is beginning to face a wave of order cuts.

On July 1, market news reported that the storm of semiconductor chip order cuts and price reductions has expanded again, this time involving MCUs (Microcontrollers), especially with the largest price drops in consumer applications. Additionally, there are reports of the prices of the five major global MCU manufacturers being halved.

Jianzhi Research (WeChat: Jianzhi Research Pro) believes that the price drop of MCUs is another heavy blow to the semiconductor industry, but in the future, the prices and demand for MCUs will show structural differentiation.

01

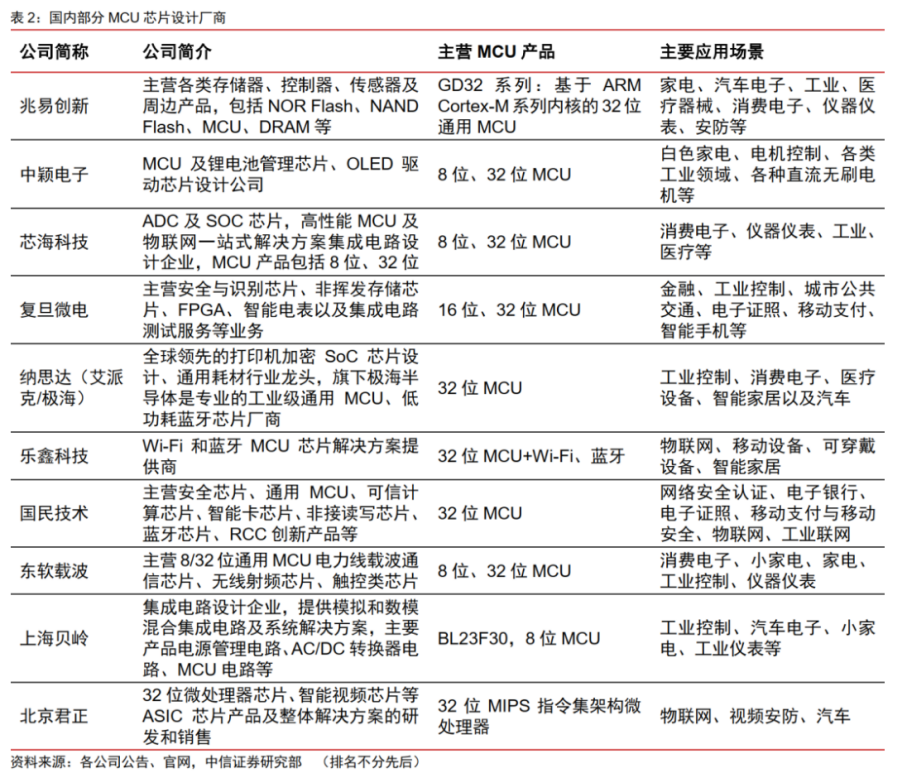

China’s MCU Consumer Applications are the Most Affected

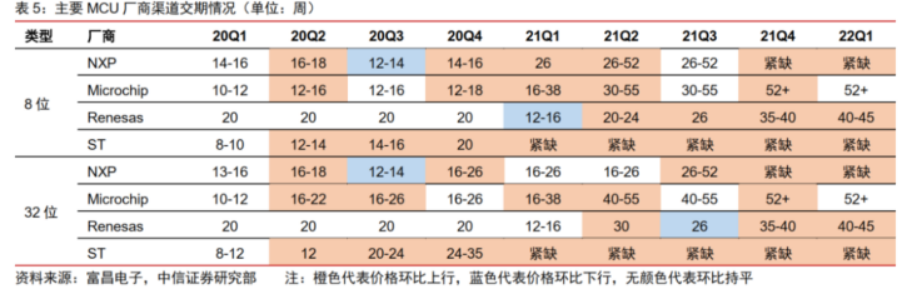

The prices of MCUs remained very firm before June, with leading manufacturers extending delivery times (generally around 50 weeks), and overseas companies initiating multiple rounds of price increases, with domestic manufacturers following suit. This price drop news will suppress and reverse the high point of MCUs.

In 2021, the global MCU market ASP reversed a 20-year trend of price decline, increasing by 10% to $0.64, especially with the rising demand for 32-bit high-end MCUs.

Looking at the global downstream applications of MCUs, automotive accounts for 39%, industrial control for 27%, and consumer for 18%;

However, it is particularly noteworthy that in China’s MCU downstream applications, consumer ranks first, accounting for 27%, followed by automotive and industrial control.

This means that the decline in demand for consumer MCUs has the greatest impact on Chinese manufacturers. Consumer products such as mobile phones and small appliances have already shown a significant downward trend in demand in the first half of the year, leading to a situation where the supply of MCU products exceeds demand, so the price drop of consumer MCUs mentioned in this news is also expected.

02

Automotive and Industrial Control MCU Demand Remains Strong

For automotive and industrial control, the demand for MCUs is not showing a downward trend like in the consumer sector, but rather continues to rise.

From the automotive application perspective: automotive electronics and controls require electronic control units (ECUs), and each ECU needs at least one MCU as the core control chip. With the trend of electrification in vehicles, the usage per vehicle is increasing exponentially. Traditional fuel vehicles typically use around 70 MCUs, while smart electric vehicles use about 300. As the penetration rate of smart electric vehicles increases, the demand for automotive MCUs will also enter a high growth phase.

Automotive MCUs have strict safety requirements and long certification times, so the supply is mainly concentrated among leading overseas companies. For example, STMicroelectronics (market share 22%), NXP (market share 22%), Microchip (market share 15%), Infineon (market share 14%), and Texas Instruments (market share 9%).

Among domestic manufacturers, Zhaoyi Innovation is relatively advanced, but the majority of its shipments are still in consumer applications, although sales in the industrial sector have been continuously growing since 2021.

MCUs are also widely used in industrial applications: for example, in robotics, industrial automation, power tools, etc. Thanks to the development of industrial digitalization, the demand for industrial control MCUs is also quite strong.

03

Full Inventory, Price Decline

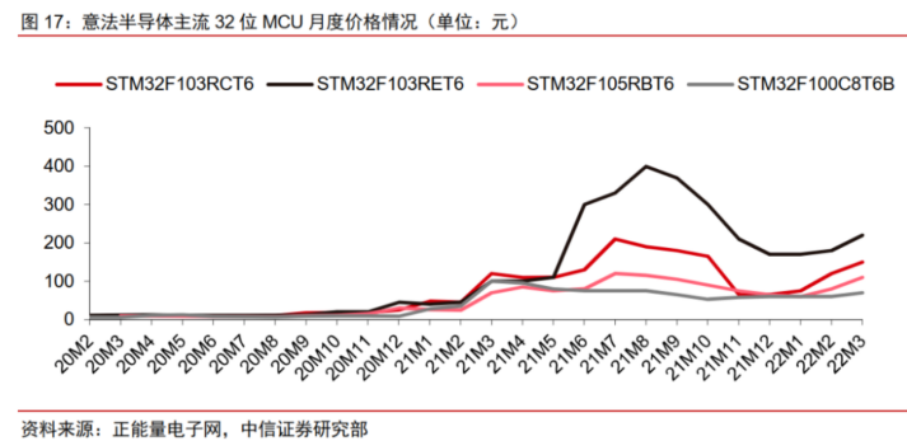

From the price perspective, the average price of MCUs saw its first significant increase in 20 years in 2021. Taking STMicroelectronics’ product prices as an example, some mainstream 32-bit MCUs saw price increases of over 400%, and in the first quarter of this year, prices also reversed from the downward trend at the end of last year.

Additionally, looking at the delivery times of mainstream products, the delivery times for MCUs had not shown significant relief, still reaching around 50 weeks.

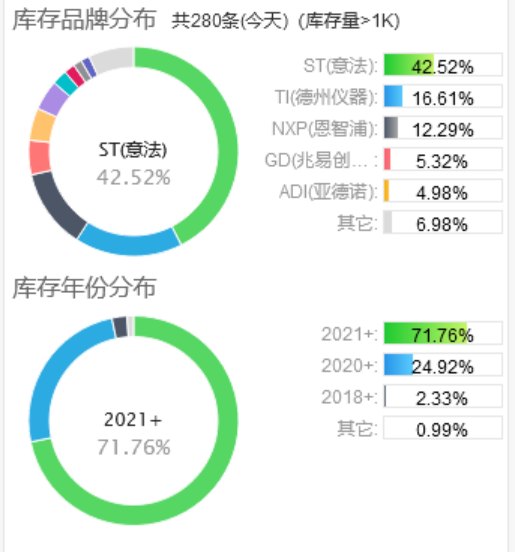

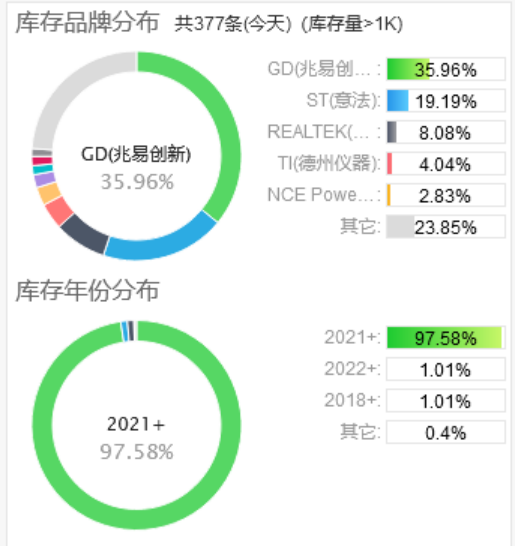

However, according to the inventory levels from domestic procurement channels on July 1: the current inventory of MCUs is very sufficient, and the inventory of 2021 products is still very large, including leading manufacturers such as STMicroelectronics, Texas Instruments, NXP, and Zhaoyi Innovation.

In summary, Jianzhi Research (WeChat: Jianzhi Research Pro) believes that the current market supply of MCUs is very sufficient, consumer demand is significantly declining, while automotive and industrial control demand continues to grow, and product procurement prices will show a downward trend due to excess supply.

Source: Jianzhi Research Pro Author: Han Feng Original Title: “The Semiconductor Order Cut Wave Spreads to MCUs, Price Avalanche is Imminent”

(Click the image to recognize the QR code for event details)

⭐ Bookmark Wall Street Insights, don’t miss great content⭐

This article does not constitute personal investment advice and does not take into account individual users’ specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. The market has risks, and investment requires caution; please make independent judgments and decisions.