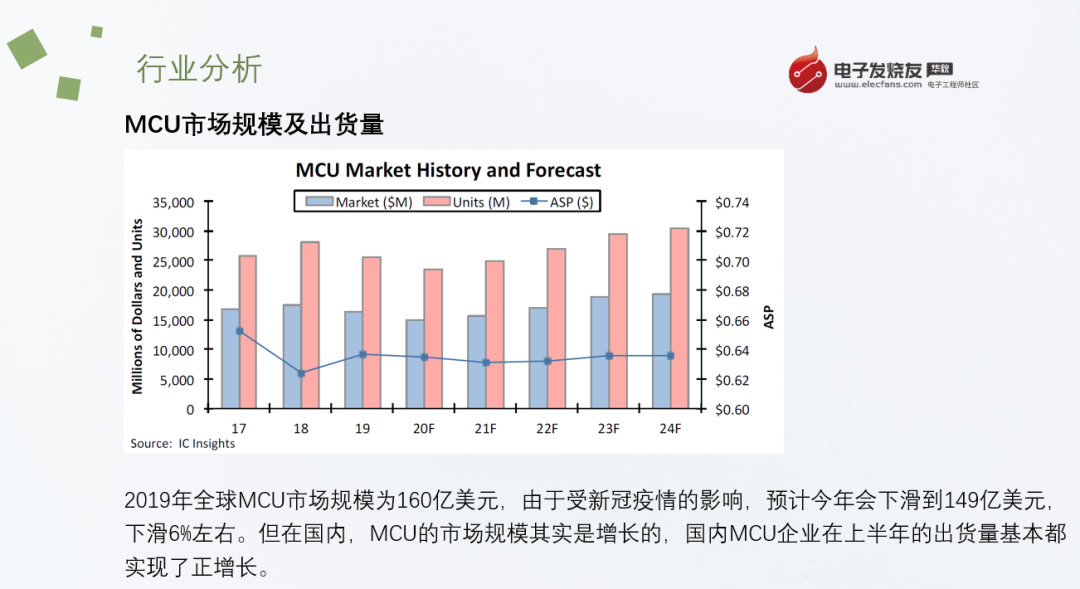

According to a report from Electronic Enthusiasts (by Cheng Wenzhi), with the development of consumer electronics, automotive electronics, industrial control, and Internet of Things applications, the demand for MCU products is increasing, presenting a significant growth opportunity for domestic MCU manufacturers. To discuss this topic, Electronic Enthusiasts invited Liu Tao, Product Director of Zhuhai Jihai Semiconductor Co., Ltd., and Zhong Xinli, Executive Director of Product Planning and Management at Guomin Technology, to our live broadcast to talk about “How Domestic MCU Companies Can Accelerate Growth Amidst Diverse Developments?”We explored why many domestic companies have entered the MCU industry in recent years, the core competitiveness of domestic MCU companies, how they can grow faster and better, and discussed the recent shortage and price increase of wafers leading to tight MCU supply, among other topics.Current Status of the Domestic MCU IndustryAccording to a report released by IC Insights in August this year, the global MCU market was approximately $16 billion in 2019. Due to the impact of the COVID-19 pandemic, it is expected to decline to $14.9 billion this year, a decrease of about 6%. However, in China, the MCU market is actually growing, with domestic MCU companies achieving positive growth in shipment volume in the first half of the year. In fact, the domestic MCU market is not small; statistics show that the market size in China in 2019 was 36.6 billion yuan, and it is expected to reach 48.4 billion yuan by 2024, although the market share of domestic MCU products is still low. According to Zhong Xinli from Guomin Technology, globally, 8-bit and 32-bit MCUs each account for about half of the market, but domestically, 8-bit MCUs dominate, while 32-bit MCUs are still in a catch-up phase with a noticeable growth trend.

In fact, the domestic MCU market is not small; statistics show that the market size in China in 2019 was 36.6 billion yuan, and it is expected to reach 48.4 billion yuan by 2024, although the market share of domestic MCU products is still low. According to Zhong Xinli from Guomin Technology, globally, 8-bit and 32-bit MCUs each account for about half of the market, but domestically, 8-bit MCUs dominate, while 32-bit MCUs are still in a catch-up phase with a noticeable growth trend. Image: Liu Tao, Product Director of Zhuhai Jihai Semiconductor Co., Ltd., in the Electronic Enthusiasts live broadcast.Liu Tao from Jihai Semiconductor shares a similar view, but he provided another figure, stating that the market share of domestic MCU products is currently low, with domestic MCUs accounting for less than 10% of the market, industrial domestic MCUs less than 5%, and automotive domestic MCUs even lower, estimated at less than 1%.Liu Tao is optimistic about this, believing that the current low market share indicates that there is still significant growth potential and many opportunities for domestic MCU companies.Steady Increase in Market Share of Domestic MCUsIn recent years, the shipment volume of domestic MCU companies has been steadily increasing. According to observations from Electronic Enthusiasts, the positive growth in shipment volume of domestic MCU companies is driven by five main factors, bringing new growth momentum to the MCU market.

Image: Liu Tao, Product Director of Zhuhai Jihai Semiconductor Co., Ltd., in the Electronic Enthusiasts live broadcast.Liu Tao from Jihai Semiconductor shares a similar view, but he provided another figure, stating that the market share of domestic MCU products is currently low, with domestic MCUs accounting for less than 10% of the market, industrial domestic MCUs less than 5%, and automotive domestic MCUs even lower, estimated at less than 1%.Liu Tao is optimistic about this, believing that the current low market share indicates that there is still significant growth potential and many opportunities for domestic MCU companies.Steady Increase in Market Share of Domestic MCUsIn recent years, the shipment volume of domestic MCU companies has been steadily increasing. According to observations from Electronic Enthusiasts, the positive growth in shipment volume of domestic MCU companies is driven by five main factors, bringing new growth momentum to the MCU market.

-

First, the development of 5G and the Internet of Things has driven the rise of smart home applications;

-

Second, the upgrade of home appliance MCUs has contributed to market growth;

-

Third, the implementation of new national standards for electric vehicles, combined with the impact of the pandemic, has created new growth opportunities in the electric bicycle market. For example, in Europe, due to government subsidies and the inconvenience of public transportation during the pandemic, many people have chosen electric bicycles for travel, stimulating exports of domestic electric bicycles;

-

Fourth, the increasing application of lithium battery management chips in MCUs;

-

Fifth, the US-China trade war has led more domestic system manufacturers to prefer using domestic chip products.

According to Liu Tao, the aforementioned demand is one aspect; additionally, domestic MCU companies have developed the capability to create 32-bit MCUs, not only being able to develop M0, M3, and M4 but also high-end MCUs like M7, A7, and A9; thirdly, domestic purchasing power has also improved compared to before. He cited an example where people now consider purchasing DC inverter fans first, which require MCU support. Zhong Xinli added insights from the perspectives of technology, talent, and market. He believes that:First, from a technological standpoint, the domestic semiconductor industry chain is becoming increasingly mature, with wafer and packaging testing being completed domestically. Of course, he also acknowledged that domestic MCUs mainly focus on mature processes, primarily 110nm and 130nm products, although some companies are using more advanced 40nm processes.Second, regarding talent, many overseas Chinese have returned to start businesses in China or work for domestic companies, and some employees from Chinese divisions of overseas semiconductor companies have also started their own ventures or joined local firms.Third, from a market perspective, as consumer purchasing power has increased, the requirements from OEMs for products have also risen, necessitating stricter energy-saving and noise reduction standards, many of which require MCU support.These factors have contributed to the gradual increase in market share for domestic MCUs over the years.Core Competitiveness of Domestic MCU CompaniesCurrently, most domestic MCU products come from fabless companies, with 32-bit MCUs primarily based on Arm cores. Statistics show that there are no fewer than 100 MCU companies in China. So how can domestic MCU companies maintain competitiveness among so many players? The core competitiveness of domestic MCU companies is mainly reflected in three aspects.

Zhong Xinli added insights from the perspectives of technology, talent, and market. He believes that:First, from a technological standpoint, the domestic semiconductor industry chain is becoming increasingly mature, with wafer and packaging testing being completed domestically. Of course, he also acknowledged that domestic MCUs mainly focus on mature processes, primarily 110nm and 130nm products, although some companies are using more advanced 40nm processes.Second, regarding talent, many overseas Chinese have returned to start businesses in China or work for domestic companies, and some employees from Chinese divisions of overseas semiconductor companies have also started their own ventures or joined local firms.Third, from a market perspective, as consumer purchasing power has increased, the requirements from OEMs for products have also risen, necessitating stricter energy-saving and noise reduction standards, many of which require MCU support.These factors have contributed to the gradual increase in market share for domestic MCUs over the years.Core Competitiveness of Domestic MCU CompaniesCurrently, most domestic MCU products come from fabless companies, with 32-bit MCUs primarily based on Arm cores. Statistics show that there are no fewer than 100 MCU companies in China. So how can domestic MCU companies maintain competitiveness among so many players? The core competitiveness of domestic MCU companies is mainly reflected in three aspects. Image: Zhong Xinli, Executive Director of Product Planning and Management at Guomin Technology, in the Electronic Enthusiasts live broadcast.In this regard, Zhong Xinli believes that the core competitiveness of domestic MCU companies is mainly reflected in three areas: first, technological innovation capability, which must not only match the performance of international manufacturers but also have unique features in energy consumption reduction and enhanced safety; second, engineering capability is also crucial. He cited an example that during market shortages, “whether you can secure wafer and packaging testing capacity is also a core competitiveness”; third, quality control is essential, as many products in China are consumer-driven, and consumer demands for product quality are increasing, necessitating improvements in semiconductor product quality to meet consumer needs.He also emphasized that in addition to these, Guomin Technology has made significant efforts in differentiation, such as incorporating safety features into general-purpose MCUs, integrating technology accumulated from their previous work on safety chips into general-purpose MCUs; they have also made significant efforts to reduce both static and dynamic power consumption, achieving reductions in both; additionally, they have included specialized peripherals in general-purpose MCUs. He cited Guomin Technology’s N32L4X as an example, which integrates a flow measurement unit into a general low-power MCU, helping customers reduce costs and enhance overall solution reliability.From Liu Tao’s perspective at Jihai Technology, as a fabless company, it can be considered a service-oriented enterprise. Therefore, being as close to customers as possible, understanding their needs, and meeting those needs is also a core competitiveness of domestic MCU companies. He believes that domestic MCU companies have a natural advantage in this regard.He not only believes this but also practices it; during our live broadcast, he was participating from a hotel while on a business trip in the north.In addition, Liu Tao believes that the core competitiveness of domestic MCU companies is also reflected in: first, technology, which can collaborate with universities to utilize their resources; second, supply chain, which was notably effective during the pandemic earlier this year, as domestic MCU companies not only did not raise prices but also delivered on time; third, quality management, as the MCUs provided by Jihai Technology are industrial-grade products with a wide temperature range and strong anti-interference capabilities.Moreover, he mentioned that Jihai Technology was incubated from an OEM, which has a clear understanding of OEM needs. The chips they launch generally undergo certifications required for export products, facilitating smoother certification processes for customer products and saving them time.Addressing Internal Issues and Solving Problems Faced by EngineersRegarding some issues faced by domestic engineers when using domestic MCU chips, such as incomplete data sheets, some only available in English without Chinese, and some stability issues, both MCU companies acknowledged that there are indeed gaps compared to international MCU companies, but they are actively addressing these issues to help engineers use domestic MCU products more conveniently and effectively.Liu Tao believes that data sheets are very important because when engineers first receive MCU samples or demo boards, it is like receiving a black box, and documentation is needed to guide engineers on how to use them. Jihai Technology currently provides a complete set of Chinese data sheets.Regarding the data sheet issue, Zhong Xinli stated that he has previously used many foreign MCU products and encountered numerous bugs, but the advantage is that bugs in foreign MCU products are usually described in the data sheets, detailing how the bug occurs and under what circumstances, allowing engineers to avoid them during use. However, domestic MCU companies have not done enough in this regard and have areas for improvement. “We are continuously updating our product manuals to include issues we discover or that customers report,” he stated.Another issue is that international MCU companies typically leave a 20% to 30% margin when writing data sheets, while domestic MCU manufacturers often showcase their performance metrics without leaving sufficient margin. “It’s not that they can’t achieve it; they can, but they may not have left enough margin, or the margin is very small. However, we cannot fully consider the customer’s usage environment, so when customers test, they may find that certain specifications are not met, which leads them to believe that our product stability is an issue,” Zhong Xinli admitted that these problems could be avoided.Regarding stability, Liu Tao believes that this requires a process. With over ten years of experience using foreign MCUs, he noted that international manufacturers also face stability issues when new products are released, which require time to improve through iterations or other means. He believes that the MCUs with high shipment volumes in recent years can now basically meet industrial control requirements. However, automotive applications may still be lacking, as there are relatively few domestic companies producing automotive-grade MCUs.“For industrial applications, we can meet the requirements. The Arm core ecosystem is relatively mature. We are also striving to create a complete ecosystem for domestic MCUs,” Liu Tao emphasized.Although many domestic system manufacturers are willing to try using domestic MCU products, widespread adoption still faces challenges, as most domestic MCU companies are relatively new, and the variety and number of products compared to ST, NXP, Microchip, TI, etc., are significantly lacking.Zhong Xinli cited an example where a customer needs to use over 20 MCU part numbers, “If we can match 5 or 10 part numbers, customers will indeed consider switching to domestic MCUs, but they will still need to procure from European and American manufacturers, which is not favorable for their business negotiation capabilities.”Additionally, regarding high-end products, Zhong Xinli believes that the demand is not large, and the reasons for customer replacement are not based on price but rather on solving specific problems.In other words, the demand for high-end MCU products is small, and the investment is significant, making it challenging for domestic MCU companies to continue investing in the development of high-end MCU products.How Domestic MCU Companies Respond to Global MCU Shortages and Price IncreasesRecently, due to the imbalance between wafer foundry capacity and demand, including TSMC, UMC, GlobalFoundries, and others, orders for the fourth quarter are fully booked, and advanced and mature process capacities for the first half of next year have been completely reserved by customers. Additionally, wafers are also starting to become scarce, leading to shortages of foreign MCUs. For instance, industry insiders have reported that products from a certain international MCU manufacturer have been delayed across the board, and new orders are generally not being accepted.Liu Tao also feels the same way, noting that many orders placed with them require specific part numbers; if it is a commonly used part number, it should be fine, but if it is a less commonly used part number, it may require packaging and testing time, taking one to two months to ship, which may not meet all customer demands.In terms of the overall chip production cycle, wafer production generally takes 3 to 4 months, and packaging and testing take one month. Zhong Xinli stated that currently, Guomin Technology has received many customer supply requests, but if they have stock wafers for the part numbers, they can generally ship within one to one and a half months. “It is currently very difficult to secure capacity, mainly depending on whether companies placed sufficient orders 3 to 4 months ago.”Zhong Xinli analyzed that the reasons for the current tight supply of MCUs are mainly twofold: first, due to the pandemic, both chip design companies and wafer foundries have been relatively conservative in their forecasts for the future; second, due to unexpected events in previous months, a large batch of wafer inventory was shipped to meet a specific customer’s bulk demand, resulting in insufficient wafer inventory.In response to the shortage and price increase of foreign MCUs, Zhong Xinli stated that Guomin Technology will maintain original prices without plans for price increases. However, he also mentioned that if raw material costs rise, prices may be adjusted accordingly.Liu Tao also stated, “We will currently maintain stable prices. If raw material prices rise in the future, we will notify customers in advance about the timing and extent of the increase. However, even if there is a price increase, it will be limited, and we will do our best to absorb market fluctuations from the manufacturer’s perspective to provide domestic customers with stable prices.”ConclusionOn a positive note, both companies participating in our live broadcast are performing well, with their monthly shipment volumes reaching the KK level; however, there are still many areas that need strengthening, such as the current limited number of product part numbers. Guomin Technology currently has over 70 part numbers, while Jihai Technology has nearly 200 part numbers. To develop more comprehensively, they may need to reach thousands of part numbers, which will require continued effort.

Image: Zhong Xinli, Executive Director of Product Planning and Management at Guomin Technology, in the Electronic Enthusiasts live broadcast.In this regard, Zhong Xinli believes that the core competitiveness of domestic MCU companies is mainly reflected in three areas: first, technological innovation capability, which must not only match the performance of international manufacturers but also have unique features in energy consumption reduction and enhanced safety; second, engineering capability is also crucial. He cited an example that during market shortages, “whether you can secure wafer and packaging testing capacity is also a core competitiveness”; third, quality control is essential, as many products in China are consumer-driven, and consumer demands for product quality are increasing, necessitating improvements in semiconductor product quality to meet consumer needs.He also emphasized that in addition to these, Guomin Technology has made significant efforts in differentiation, such as incorporating safety features into general-purpose MCUs, integrating technology accumulated from their previous work on safety chips into general-purpose MCUs; they have also made significant efforts to reduce both static and dynamic power consumption, achieving reductions in both; additionally, they have included specialized peripherals in general-purpose MCUs. He cited Guomin Technology’s N32L4X as an example, which integrates a flow measurement unit into a general low-power MCU, helping customers reduce costs and enhance overall solution reliability.From Liu Tao’s perspective at Jihai Technology, as a fabless company, it can be considered a service-oriented enterprise. Therefore, being as close to customers as possible, understanding their needs, and meeting those needs is also a core competitiveness of domestic MCU companies. He believes that domestic MCU companies have a natural advantage in this regard.He not only believes this but also practices it; during our live broadcast, he was participating from a hotel while on a business trip in the north.In addition, Liu Tao believes that the core competitiveness of domestic MCU companies is also reflected in: first, technology, which can collaborate with universities to utilize their resources; second, supply chain, which was notably effective during the pandemic earlier this year, as domestic MCU companies not only did not raise prices but also delivered on time; third, quality management, as the MCUs provided by Jihai Technology are industrial-grade products with a wide temperature range and strong anti-interference capabilities.Moreover, he mentioned that Jihai Technology was incubated from an OEM, which has a clear understanding of OEM needs. The chips they launch generally undergo certifications required for export products, facilitating smoother certification processes for customer products and saving them time.Addressing Internal Issues and Solving Problems Faced by EngineersRegarding some issues faced by domestic engineers when using domestic MCU chips, such as incomplete data sheets, some only available in English without Chinese, and some stability issues, both MCU companies acknowledged that there are indeed gaps compared to international MCU companies, but they are actively addressing these issues to help engineers use domestic MCU products more conveniently and effectively.Liu Tao believes that data sheets are very important because when engineers first receive MCU samples or demo boards, it is like receiving a black box, and documentation is needed to guide engineers on how to use them. Jihai Technology currently provides a complete set of Chinese data sheets.Regarding the data sheet issue, Zhong Xinli stated that he has previously used many foreign MCU products and encountered numerous bugs, but the advantage is that bugs in foreign MCU products are usually described in the data sheets, detailing how the bug occurs and under what circumstances, allowing engineers to avoid them during use. However, domestic MCU companies have not done enough in this regard and have areas for improvement. “We are continuously updating our product manuals to include issues we discover or that customers report,” he stated.Another issue is that international MCU companies typically leave a 20% to 30% margin when writing data sheets, while domestic MCU manufacturers often showcase their performance metrics without leaving sufficient margin. “It’s not that they can’t achieve it; they can, but they may not have left enough margin, or the margin is very small. However, we cannot fully consider the customer’s usage environment, so when customers test, they may find that certain specifications are not met, which leads them to believe that our product stability is an issue,” Zhong Xinli admitted that these problems could be avoided.Regarding stability, Liu Tao believes that this requires a process. With over ten years of experience using foreign MCUs, he noted that international manufacturers also face stability issues when new products are released, which require time to improve through iterations or other means. He believes that the MCUs with high shipment volumes in recent years can now basically meet industrial control requirements. However, automotive applications may still be lacking, as there are relatively few domestic companies producing automotive-grade MCUs.“For industrial applications, we can meet the requirements. The Arm core ecosystem is relatively mature. We are also striving to create a complete ecosystem for domestic MCUs,” Liu Tao emphasized.Although many domestic system manufacturers are willing to try using domestic MCU products, widespread adoption still faces challenges, as most domestic MCU companies are relatively new, and the variety and number of products compared to ST, NXP, Microchip, TI, etc., are significantly lacking.Zhong Xinli cited an example where a customer needs to use over 20 MCU part numbers, “If we can match 5 or 10 part numbers, customers will indeed consider switching to domestic MCUs, but they will still need to procure from European and American manufacturers, which is not favorable for their business negotiation capabilities.”Additionally, regarding high-end products, Zhong Xinli believes that the demand is not large, and the reasons for customer replacement are not based on price but rather on solving specific problems.In other words, the demand for high-end MCU products is small, and the investment is significant, making it challenging for domestic MCU companies to continue investing in the development of high-end MCU products.How Domestic MCU Companies Respond to Global MCU Shortages and Price IncreasesRecently, due to the imbalance between wafer foundry capacity and demand, including TSMC, UMC, GlobalFoundries, and others, orders for the fourth quarter are fully booked, and advanced and mature process capacities for the first half of next year have been completely reserved by customers. Additionally, wafers are also starting to become scarce, leading to shortages of foreign MCUs. For instance, industry insiders have reported that products from a certain international MCU manufacturer have been delayed across the board, and new orders are generally not being accepted.Liu Tao also feels the same way, noting that many orders placed with them require specific part numbers; if it is a commonly used part number, it should be fine, but if it is a less commonly used part number, it may require packaging and testing time, taking one to two months to ship, which may not meet all customer demands.In terms of the overall chip production cycle, wafer production generally takes 3 to 4 months, and packaging and testing take one month. Zhong Xinli stated that currently, Guomin Technology has received many customer supply requests, but if they have stock wafers for the part numbers, they can generally ship within one to one and a half months. “It is currently very difficult to secure capacity, mainly depending on whether companies placed sufficient orders 3 to 4 months ago.”Zhong Xinli analyzed that the reasons for the current tight supply of MCUs are mainly twofold: first, due to the pandemic, both chip design companies and wafer foundries have been relatively conservative in their forecasts for the future; second, due to unexpected events in previous months, a large batch of wafer inventory was shipped to meet a specific customer’s bulk demand, resulting in insufficient wafer inventory.In response to the shortage and price increase of foreign MCUs, Zhong Xinli stated that Guomin Technology will maintain original prices without plans for price increases. However, he also mentioned that if raw material costs rise, prices may be adjusted accordingly.Liu Tao also stated, “We will currently maintain stable prices. If raw material prices rise in the future, we will notify customers in advance about the timing and extent of the increase. However, even if there is a price increase, it will be limited, and we will do our best to absorb market fluctuations from the manufacturer’s perspective to provide domestic customers with stable prices.”ConclusionOn a positive note, both companies participating in our live broadcast are performing well, with their monthly shipment volumes reaching the KK level; however, there are still many areas that need strengthening, such as the current limited number of product part numbers. Guomin Technology currently has over 70 part numbers, while Jihai Technology has nearly 200 part numbers. To develop more comprehensively, they may need to reach thousands of part numbers, which will require continued effort.

Disclaimer:This article is original to Electronic Enthusiasts. Please cite the source above when reprinting. For group discussions, please add WeChat elecfans999. For submission of reports or interview requests, please email [email protected].

More Hot Articles to Read

-

Legendary Kirin 9000 Officially Unveiled: In-Depth Analysis of the World’s First 5nm 5G SoC’s Powerful Performance

-

Domestic Industrial Robot Manufacturers Begin to Rise, Accelerating Replacement Process

-

Wafer Manufacturing Breakthrough Battle! With EUV Lithography Machines, the Smoke of War Rises Again!

-

iPhone 12 No Longer Includes Charger, Bringing a 150 Billion Cake to Power Chip Manufacturers!

-

Tesla Supplies China-Made Model 3 to Europe, Boosting Domestic Supply Chain Growth