Authoritative, in-depth, and practical financial information is available here.

Is the semiconductor market stagnant? In fact, the fundamentals of the industry are steadily improving, as evidenced by SMIC’s upward revision of its third-quarter performance guidance.

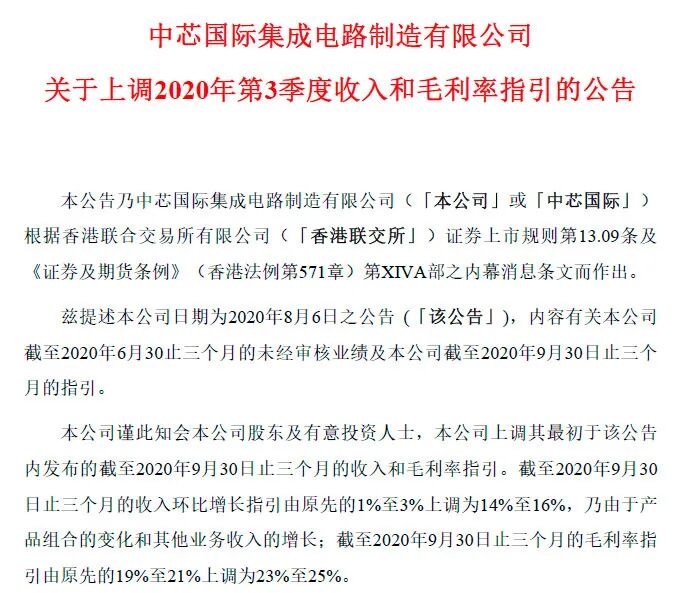

On October 16, SMIC announced an upward revision of its third-quarter revenue and gross margin guidance. The company raised its third-quarter revenue growth forecast from the original 1% to 3% to 14% to 16%, and its gross margin forecast from 19% to 21% to 23% to 25%.

Why the revision? SMIC stated that it was due to changes in the product mix and growth in other business revenues.

Wafer Factory Capacity is Tight Again

Is SMIC’s booming business due to tight wafer factory capacity?

The scenes of last year’s boom are still fresh in memory. See “I’m So Struggling! Waiting a Month for Chips That Aren’t Even Packaged! Is the ‘Packaging Year’ Coming?”

In this regard, the reporter interviewed Yan Zi, the owner of Nanjing Xinxingyuan Microelectronics, a Bluetooth chip company.

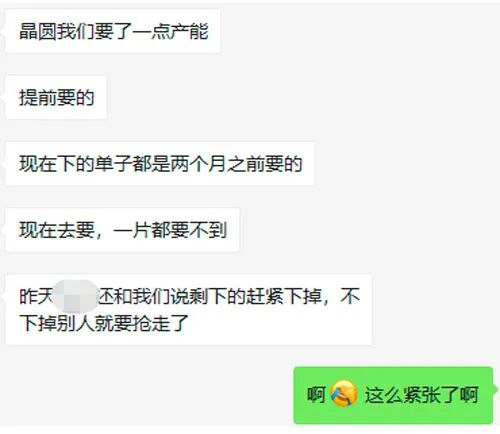

“The capacity we ordered was reserved two months ago, and now if we place an order, we can’t get a single wafer.” Yan Zi told the reporter about the tightness of wafer factory capacity.

The wafer factory also advised Yan Zi to place all reserved capacity orders at once, or else the capacity would be snatched by other customers.

China Resources Microelectronics also stated during a recent institutional survey: “Capacity is tight!”

It is reported that since entering the third quarter, the 8-inch production line of China Resources Microelectronics has been fully loaded, with an overall capacity utilization rate of over 90%.

Another chip design company also informed the reporter that their foundry (wafer factory) capacity is very tight, and many design companies are being asked to shift orders to make way for products with higher ASP (average selling price).

How long will the wafer factory’s capacity remain tight?

Yan Zi told the reporter that all design companies are desperately stocking up. A senior executive from a design company revealed that their company placed a year’s worth of orders with the wafer factory (i.e., stocking volume for a year).

“Some wafer factory orders have already been scheduled into the second half of next year,” an industry insider revealed. However, he emphasized that some of these are duplicate orders, and subsequent reductions may occur.

Packaging Will Be Tight Until the First Half of Next Year

Industry insiders have learned that starting from the end of the third quarter of this year, design companies began placing large orders, and wafer factory capacity started to become tight. Typically, after wafers are processed for three to four months, they reach the packaging and testing stage.

So, will packaging factories also become “capacity tight”?

“Packaging capacity is already starting to tighten now.” Yan Zi, who once experienced “waiting a month for chips that weren’t even packaged,” still feels uneasy, and she is grateful that she reserved capacity in advance this year.

In this regard, a relevant person from a major packaging factory stated that based on current orders, their factory’s capacity will remain tight until the first half of next year.

The high growth of the three major packaging factories’ performance also reflects the high prosperity of the industry.

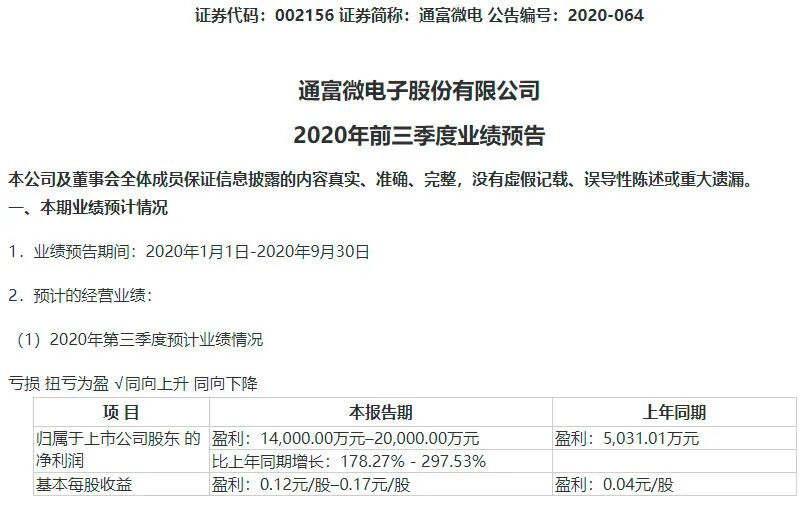

For example, Tongfu Microelectronics stated in its third-quarter performance forecast that the company continues to maintain the growth trend of the first half of the year, with an increase in domestic customer order details and strong demand from international major customers, as well as robust demand for overseas major customer communication products. Tongfu Microelectronics disclosed that its net profit for the first three quarters increased by 178.27% – 297.53% year-on-year.

Three Factors Leading to Capacity “Bottlenecks”

Since the end of last year, the entire semiconductor industry chain has been in a state of “capacity tightness.” So, what are the reasons for this capacity tightness?

In this regard, the aforementioned senior executive from a design company believes there are several reasons based on their company and industry situation:

First, due to the COVID-19 pandemic, demand in the first half of this year was suppressed, and after the pandemic improved, this demand exploded in the second half of the year.

Second, downstream OEMs, after experiencing a half-year of having no goods to sell, have become aggressive and increased their stocking cycles. “Nothing is scarier than having no inventory.”

Third, due to the Sino-U.S. trade friction, a major factory placed a large number of orders before the third quarter, squeezing the demand of other design companies. Now these design companies can secure capacity and start placing concentrated orders, leading to continued tightness in wafer factory capacity.

More importantly, due to uncertainties in the future, such as international trade frictions, the entire industry chain is stocking up in large quantities, leading to capacity bottlenecks.

It is important to emphasize that the current boom in wafers and packaging is accompanied by duplicate orders, and whether these duplicate orders will ultimately be fulfilled or released back as capacity will depend on subsequent market demand.

Editor: Quan Zeyuan

|

Previous Issues Review |

|

A major legal reform affecting 250 trillion yuan in assets is on the way!

The five major banks’ written exams are trending on hot searches! The construction bank and transportation bank’s exam systems crashed; how difficult is it to be a teller?

COMAC “receives” an order for 100 aircraft; which A-share companies will benefit?

This issue’s editor: Shao Ziyi

Supervisor: Pu Hongyi

▼

Copyright Statement

Shanghai Securities News WeChat retains all rights to this work. Without written authorization, no unit or individual may reproduce, excerpt, link, or copy this work in any other way, otherwise legal responsibility will be pursued according to law.

WeChat Hotline: Teacher Wang 021-38967805; Copyright Cooperation: Teacher Fan 021-38967792.

If you find it interesting, please give it a click!