For more report resources, please add WeChat (gasgoo2019) for consultation

The Internet of Vehicles (IoV) technology is driving automobiles into a brand new era, transforming vehicles into “smart equipment” with intelligent perception and communication capabilities. The rapid proliferation of this technology brings higher safety, greater convenience, and an enhanced connected experience for drivers. From vehicle-to-vehicle communication to autonomous driving technology, IoV is paving the way for the future of mobile travel.

The core viewpoints of this report regarding the hot topics surrounding V2X in IoV are:

▶ Since the inception of the V2X concept, it has undergone the evolution of two major standard systems: one is the DSRC-based V2X system proposed by the United States, and the other is the C-V2X standard system led by China. As the United States abandons DSRC and shifts its focus to C-V2X, the C-V2X technology led by China has become the global mainstream standard for IoV communication.

▶ C-V2X technology includes LTE-V2X (a wireless communication technology for IoV based on 4G design) and NR-V2X (a wireless communication technology for IoV based on 5G design). Currently, LTE-V2X has matured and is widely used, while the NR-V2X standard is continuously evolving. NR-V2X technology will see significant improvements in reliability, speed, communication range, positioning accuracy, data rate, and latency.

▶ The C-V2X industry has formed a complete industrial chain. On the upstream side, chip and module manufacturers are gradually maturing. Meanwhile, the increasing penetration of IoV is driving rapid development in the midstream and downstream industries, laying a solid foundation for the industrialization of C-V2X. Several domestic and foreign manufacturers have launched C-V2X chips and modules, roadside units (RSUs) are being deployed on a small scale, and the market for onboard units (OBUs) is seeing participation from multiple manufacturers, including major players like ZTE, Huawei, Qianfang Technology, Wanjie Technology, and Gaoxin Technology.

▶ In terms of vehicle models, some automakers have begun mass production of vehicles equipped with C-V2X technology. In 2022, the Chinese market saw 139,000 passenger vehicles equipped with C-V2X technology, and in 2023, the total is expected to reach 269,000, a year-on-year increase of 93.5%, with an installation rate of 1.27%. It is anticipated that by 2025, the installation rate of C-V2X technology will increase to 10%, with the number of installations expected to exceed 2.7 million.

▶ The technical characteristics of C-V2X lie in integrating vehicles, roads, cloud, networks, and map data into a whole, achieving collaborative perception, decision-making, and control functions. C-V2X technology empowers vehicle intelligence and advanced driver assistance systems, further enhancing vehicle capabilities, reducing individual vehicle costs, supporting intelligent driving, and helping the automotive industry transition from isolated vehicle intelligence to networked intelligence, transforming from individual vehicle optimization to overall traffic optimization.

▶ Various intelligent connected vehicle and smart transportation application demonstration zones across the country are adopting an integrated development path of vehicle-road-cloud, promoting the construction and application of the C-V2X industry. At the same time, the development of new technologies such as IoV, big data, and cloud platforms is driving the large-scale mining, integration, analysis, and output of traffic information, further improving the services and applications of the transportation system, integrating smart transportation into urban construction and development. This trend is of significant importance to the entire transportation and intelligent driving industry.

The C-V2X industrial chain covers various fields, including upstream communication chips and modules, midstream devices and terminals, vehicle manufacturing, and downstream platforms and operations, safety and testing verification, high-precision positioning, and map services. Currently, C-V2X has been adopted by countries such as China, the United States, and South Korea, becoming the mainstream technical standard for IoV globally. China is leading global development, being the first to allocate LTE-V2X frequency bands and achieve large-scale deployment.

Compared to LTE-V2X, NR-V2X technology has significant improvements in reliability, speed, communication range, positioning accuracy, data rate, and latency. The relationship between LTE-V2X and NR-V2X, as well as their relationship with 5G, is not one of substitution but rather one of mutual integration and complementarity.

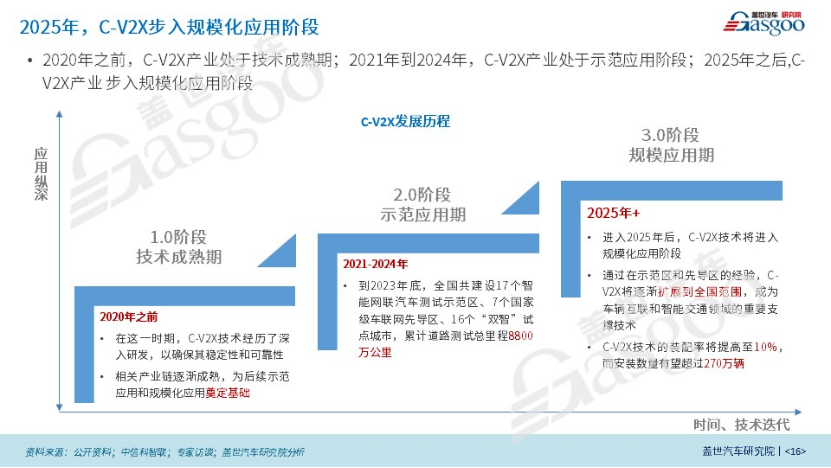

In January 2024, the Ministry of Industry and Information Technology and five other ministries jointly issued a notice on the pilot application of “vehicle-road-cloud integration” for intelligent connected vehicles, announcing that from 2024 to 2026, pilot applications for “vehicle-road-cloud integration” will be carried out. By the end of 2023, a total of 17 intelligent connected vehicle testing demonstration zones, 7 national-level IoV pilot areas, and 16 “dual-smart” pilot cities have been established, with over 22,000 kilometers of testing demonstration roads opened and more than 5,200 testing demonstration licenses issued, accumulating a total road testing mileage of 88 million kilometers.

From the development history, before 2020, the C-V2X industry was in the technology maturity stage; from 2021 to 2024, the C-V2X industry is in the demonstration application stage; and after 2025, the C-V2X industry will enter the stage of large-scale application. It is expected that after 2025, new vehicle-road-cloud integration functions with economic effects will continue to emerge, exceeding industry expectations, which will promote the widespread application and promotion of intelligent transportation systems globally.

In 2022, the Chinese market saw 139,000 passenger vehicles equipped with C-V2X technology, and in 2023, the total is expected to reach 269,000, a year-on-year increase of 93.5%, with an installation rate of 1.27%. It is anticipated that by 2025, the installation rate of C-V2X technology will increase to 10%, with the number of installations expected to exceed 2.7 million.

Currently, China has made positive progress in the field of C-V2X technology, establishing a complete C-V2X industrial chain layout. On the upstream side, chip modules have completed the commercial foundation and are gradually maturing. With the increase in IoV penetration, the midstream and downstream markets are experiencing rapid growth, laying a solid foundation for the commercialization of C-V2X.

C-V2X chips and modules, as core components of IoV technology, play a key role. Currently, many domestic and foreign manufacturers are actively engaged in the production of C-V2X chips and modules, with companies like ZTE, Qualcomm, Huawei, Quectel, ZTE Microelectronics, Xunxin Technology, and Gaoxin Technology providing commercial-grade LTE-V2X direct communication chip modules.

In the midstream of the industrial chain, there are numerous participants in devices and terminals, with over 60 companies including ZTE, Huawei, Nebula Interconnect, Wanjie Technology, Neusoft, and ZTE Communications successively releasing onboard and roadside equipment. More than 10 automakers, including FAW, SAIC, GAC, BAIC, Great Wall, NIO, GM, Ford, and Audi, have achieved mass production of pre-installed applications based on LTE-V2X for V2V, V2I, and other warning applications.

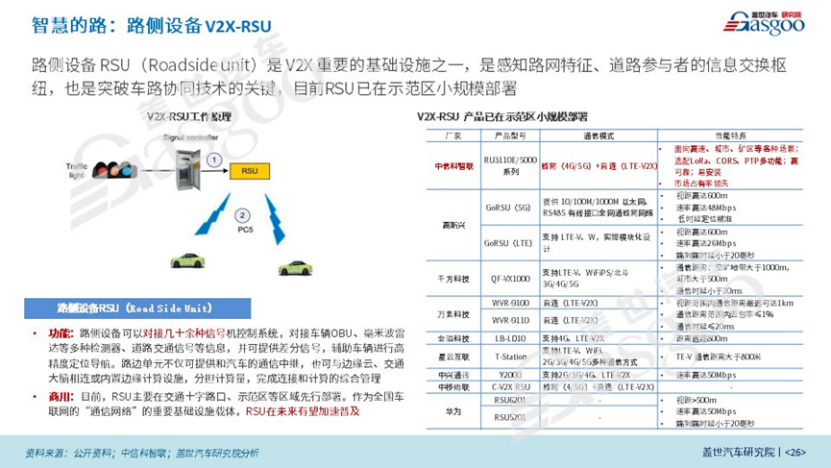

In V2X communication, “smart roads” represent roadside units (RSUs), which can interface with dozens of traffic signal control systems, connect with vehicle OBUs, millimeter-wave radars, and various detectors, as well as road traffic signals, and can provide differential signals to assist vehicles in high-precision positioning and navigation. Representative manufacturers include ZTE, Gaoxin Technology, Qianfang Technology, Wanjie Group, and ZTE. Currently, RSUs are primarily deployed in traffic intersections and demonstration zones. As an important infrastructure carrier for the national IoV “communication network,” RSUs are expected to accelerate in popularity in the future.

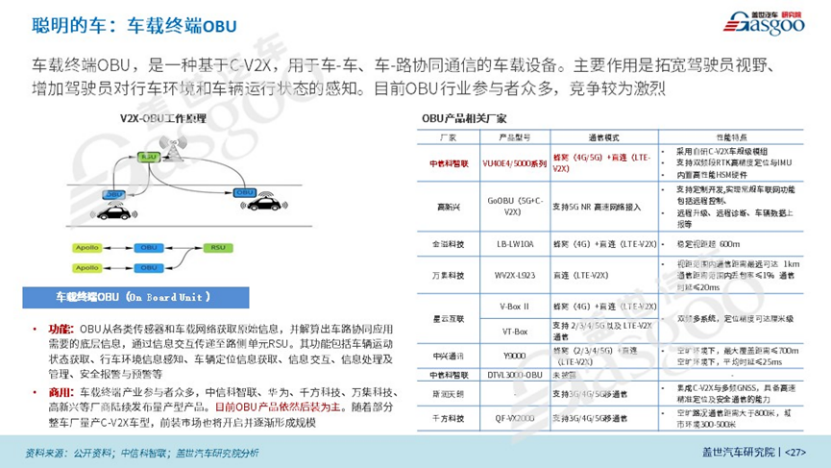

“Smart vehicles” refer to onboard units (OBUs), which are devices based on C-V2X used for vehicle-to-vehicle and vehicle-to-road collaborative communication. Their main function is to broaden the driver’s field of vision and increase the driver’s perception of the driving environment and vehicle operating status. There are many participants in the onboard unit industry, with companies like ZTE, Huawei, Qianfang Technology, Wanjie Technology, and Gaoxin Technology successively releasing mass-produced products. Currently, OBU products are still primarily retrofitted. As some automakers begin mass production of C-V2X vehicles, the pre-installed market will also open and gradually form a scale.

“Precise maps” refer to high-precision maps, which have always been an important component supporting the entire vehicle-road collaboration system, especially as high-precision maps can meet various needs such as map matching, assisting environmental perception, and path planning. Unlike traditional high-precision maps, the maps used in vehicle-road collaboration applications are local dynamic maps. As of now, only 19 companies in China have obtained Class A navigation electronic map qualifications and passed relevant reviews, with Baidu, NavInfo, Yitu Technology, and Amap holding the highest market shares, forming a “four-legged鼎” market structure.

“Collaborative cloud” refers to edge cloud, where edge computing can integrate the computational load of the cloud into the edge layer, completing most of the calculations at the edge computing nodes, and transmitting the results in real-time to the vehicle’s onboard unit (OBU) through transmission means such as LTE-V/5G roadside units (RSUs), meeting the needs of vehicle-road collaboration. It is expected that by 2025, the edge cloud market size will reach 55 billion yuan.

Vehicle-road-cloud integration is a long-term strategic mission that requires all parties to work together to continuously seek suitable development paths across multiple levels, including technology, products, commercialization, and operational models. Over time, the vehicle-road collaboration industry will gradually mature, achieving more commercial applications and contributing to the development of smart cities in China.

/ Get the complete report /

Welcome to scan the code to order

Gaishi Automotive Research Institute Annual Service

More Industry Report Recommendations

Click the theme below to view report details

|

Intelligent Connected Vehicles |

|

|

1 |

Intelligent Vehicle OTA Industry Report (2024 Edition) |

|

2 |

Humanoid Robot Industry Report (2024 Edition) |

|

2 |

Integrated Die Casting Industry Report (2024 Edition) |

|

2 |

Onboard T-Box Industry Report (2024 Edition) |

|

3 |

Onboard HUD Industry Report (2023 Edition) |

|

4 |

Software-Defined Vehicle Industry Report (2023 Edition) |

|

5 |

IoV V2X Industry Report (2023 Edition) |

|

6 |

Intelligent Vehicle HMI Industry Development Trends (2023 Edition) |

|

7 |

Intelligent Driving and Cabin SoC Chip Industry Report (2023 Edition) |

|

8 |

Automotive Grade Power Semiconductor Industry Report (2023 Edition) |

|

9 |

Onboard Voice Interaction System Industry Report (2023 Edition) |

|

10 |

Onboard Infotainment System Industry Report (2023 Edition) |

|

11 |

Onboard Display Technology Industry Report (2023 Edition) |

|

12 |

Automotive Industry ChatGPT Technology Application Outlook (2023 Edition) |

|

13 |

Onboard Acoustic System Industry Report (2023 Edition) |

|

14 |

Cabin Monitoring Industry Report (2023 Edition) |

|

15 |

Automotive Ambient Light Industry Report (2023 Edition) |

|

16 |

Automotive Lighting Industry Report (2023 Edition) |

|

17 |

Flying Car Industry Report (2023 Edition) |

|

18 |

Automotive Cybersecurity Research Report (2022 Edition) |

|

19 |

Intelligent Driving Sensor Industry Report (2022 Edition) |

|

20 |

Onboard Operating System Industry Report (2022 Edition) |

|

21 |

Automotive LCD Instrument Industry Report (2022 Edition) |

|

22 |

Automotive Basic Software Industry Report (2022 Edition) |

|

23 |

Onboard Camera Industry Report (2022 Edition) |

|

24 |

Intelligent Vehicle Domain Controller Industry Report (2022 Edition) |

|

25 |

Intelligent Vehicle Cloud Service Industry Report (2022 Edition) |

|

26 |

Automotive Grade Chip Industry Report (2022 Edition) |

|

27 |

Intelligent Cabin Industry Report (2022 Edition) |

|

Autonomous Driving |

|

|

1 |

Autonomous Driving Perception Technology Industry Report (2023 Edition) |

|

2 |

High-Precision Map and Positioning Report (2023 Edition) |

|

3 |

Intelligent Parking Industry Report (2023 Edition) |

|

4 |

Port Scene Autonomous Driving Industry Report (2023 Edition) |

|

5 |

Automotive Intelligent Chassis Industry Report (2023 Edition) |

|

6 |

Advanced Driver Assistance Systems (ADAS) Industry Report (2023 Edition) |

|

7 |

Onboard LiDAR Industry Report (2023 Edition) |

|

8 |

Onboard Millimeter-Wave Radar Industry Report (2023 Edition) |

|

9 |

Integrated Control Domain Controller Industry Report (2023 Edition) |

|

10 |

Automotive Electronic and Electrical Architecture Report (2023 Edition) |

|

11 |

Trunk Logistics Autonomous Driving Industry Report (2023 Edition) |

|

12 |

Navigation Assistance Driving Industry Report (2023 Edition) |

|

13 |

Intelligent Assistance Driving Trend Outlook (2023 Edition) |

|

14 |

Onboard Computing Platform Industry Report (2022 Edition) |

|

15 |

Intelligent Parking Industry Report (2022 Edition) |

|

16 |

Mainstream Automotive Grade Chip Company Comparison Report (2022 Edition) |

|

17 |

Driverless Industry Research Report (2022 Edition) |

|

18 |

Intelligent Vehicle Line Control Chassis Industry Report (2022 Edition) |

|

New Energy |

|

|

1 |

Passenger Vehicle Hybrid Technology Industry Report (2023 Edition) |

|

2 |

Plug-in Hybrid Technology Industry Report (2023 Edition) |

|

3 |

New Energy Vehicle Motor Controller Industry Report (2023 Edition) |

|

4 |

Solid-State Battery Industry Report (2023 Edition) |

|

5 |

Power Battery Industry and Technology Dynamics Research Report (2023 Edition) |

|

6 |

800V High Voltage Platform Industry Technology Report (2023 Edition) |

|

7 |

New Energy Vehicle BMS Research Report (2023 Edition) |

|

8 |

Hydrogen Fuel Cell Industry Research Report (2023 Edition) |

|

9 |

Power Battery Recycling Industry Report (2023 Edition) |

|

10 |

New Energy Passenger Vehicle Drive Motor Industry Research Report (2023 Edition) |

|

11 |

Integrated Die Casting Industry Report (2023 Edition) |

|

12 |

New Energy Vehicle Charging and Swapping Industry Report (2023 Edition) |

|

13 |

New Energy Vehicle Thermal Management Industry Report (2023 Edition) |

|

14 |

New Energy Vehicle Onboard Power Supply Research Report (2023 Edition) |

|

15 |

Passenger Vehicle Electrification Supply Chain Status and Outlook (2023 Edition) |

|

16 |

Sodium-Ion Battery Industry Report (2023 Edition) |

|

17 |

Power Battery Safety Industry Report (2022 Edition) |

|

18 |

Electric Drive System Technology Trend Outlook (2022 Edition) |

|

19 |

New Energy Vehicle Air Conditioning Thermal Management System Industry Report (2022 Edition) |

|

20 |

China Passenger Vehicle Powertrain Electrification Research (2022 Edition) |

|

Domestic Market Analysis |

|

|

1 |

2023 First Half Summary and Future Outlook of the Chinese Passenger Vehicle Market |

|

2 |

Passenger Vehicle Electrification Supply Chain Status and Outlook (2023 Edition) |

|

3 |

2023 Outlook for the Chinese Passenger Vehicle Market |

|

Overseas Market Analysis |

|

|

1 |

Research and Successful Practice Analysis Report on the Overseas Market of Chinese Automobiles and Parts |

|

2 |

Southeast Asia Automotive Market Analysis Report (2023 Edition) |

|

3 |

European New Energy Vehicle Market Analysis Report (2023 Edition) |

|

4 |

Middle East Automotive Market Research Report (2023 Edition) |

|

5 |

Latin America Automotive Market Research Report (2023 Edition) |

Gaishi Automotive Research Institute Monthly Report/Intelligence

Contact for Consultation

Phone: 021-39586121

WeChat: gasgoo2019

If you like this article, please give me a thumbs up!