Compared to the fierce competition from overseas 3D printing companies, Plater almost exclusively occupies the domestic military industrial sector’s metal 3D printing market, establishing a solid moat.

In the mid-19th century, the first industrial revolution reached its peak. Walking the streets of England, people could not only see “steam locomotives” but also buy clothing produced by “machines.” By 1860, Britain and France were the largest and second-largest exporters in the world, with Europe not only leading in industrialization but also completing the initial transformation into a modern mass society.

The acceleration of economic development hastened technological progress, leading to a commercial photography attempt known as photographic sculpture quietly emerging on the streets of France. Although the promotion of photographic sculpture technology was not successful compared to mainstream shooting techniques, people at the time did not realize that this “failed project” would inspire an important technological advancement—3D printing—one hundred years later.

3D printing technology originated in France but grew in the United States. By the end of the 20th century, American scientists had proposed several key patent technologies, and after a century of accumulation, the first 3D printer based on SLA technology was produced by 3D Systems in the United States in 1988.

Time has passed, and over 30 years of development have made 3D printing a mature technology, applied in high-end fields such as automotive, aerospace, and medical. It can be said that 3D printing is a technology that was inspired in the 19th century, born in the 20th century, and exploded in the 21st century.

Compared to Europe and America, China’s 3D printing technology did not start too late. In the field of 3D printing, the four core patent technologies—SLA, SLS, FDM, and 3DP—were successively introduced between 1984 and 1989, with universities such as Tsinghua University, Huazhong University of Science and Technology, Xi’an Jiaotong University, Northwestern Polytechnical University, and Beijing University of Aeronautics and Astronautics also beginning research on 3D printing technology.

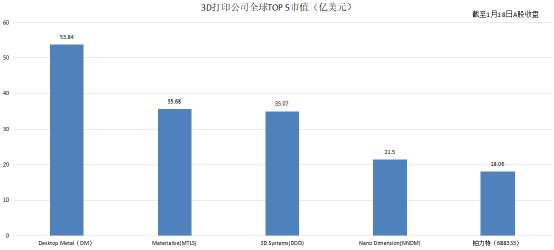

In terms of commercialization, although Plater is the only A-share listed company in China, its market value ranks fifth globally. Behind this valuation undoubtedly reflects the market’s perspective. To assess Plater’s valuation in the simplest way, one must answer three questions:

First, at what stage is the 3D printing industry cycle? Second, what position does Plater occupy within the industry? Third, if the answers to the first two questions are clear, what is the competitive label of Plater, the only authentic A-share entity?

Understanding these three questions clarifies the 3D printing industry and how to measure the value of Plater (688333.SH).

01 At the Intersection of History and the Future

Globally, the 3D printing industry is currently undergoing significant changes, with traditional leading companies failing to convert their market share advantages into valuation advantages. Instead, the emerging “new forces of 3D printing” have garnered more market attention.

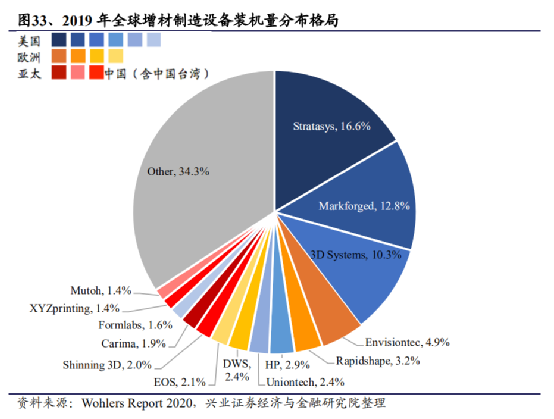

According to the Wohlers Report 2020, the market share of 3D printing in 2019 showed that the leading companies in global market share were all from American enterprises. Stratasys, Markforged, and 3D Systems ranked first, second, and third in the industry with market shares of 16.6%, 12.8%, and 10.3%, respectively, while 3D printing companies in Europe and Asia played the role of followers.

However, in terms of market capitalization rankings, we can only see 3D Systems among the top 5 3D printing companies, while the other top companies belong to the “new forces of 3D printing.”

The highest-valued 3D printing company globally is Desktop Metal, a unicorn that recently went public through a reverse merger. Founded in 2015, Desktop Metal quickly secured funding from giants like Google, BMW, General Motors, Ford, and Saudi Aramco.

Desktop Metal focuses on a technology called metal binder jetting, which can significantly improve printing efficiency, defined by the market as “3D printing 2.0.”

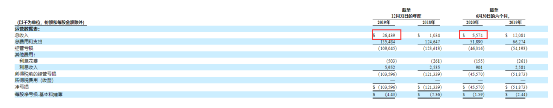

From a performance perspective, Desktop Metal’s R&D capabilities have yet to be reflected in its performance. The reverse merger announcement revealed that Desktop Metal’s revenues for 2019 and the first half of 2020 were $26.439 million and $5.574 million, respectively, but it incurred costs of $135 million and $51.89 million, remaining in severe losses. Nevertheless, Desktop Metal continues to attract the attention of many keen investors.

The second highest-valued 3D printing company globally is Materialise, a Belgian service provider focused on industry solutions, which has nearly 30 years of accumulated experience in 3D printing integrated into a series of software solutions and 3D printing services. Materialise boasts a top-notch software development team, with core applications in healthcare, automotive, and aerospace.

The fourth and fifth highest-valued companies globally are Israel’s Nano Dimension and China’s Plater. Nano Dimension is a leader in 3D printing circuit boards and has achieved multi-layer PCB 3D printing. Similar to Desktop Metal, Nano Dimension is also in losses but possesses promising potential.

Overall, the global 3D printing industry is in a transitional period, with traditional 3D printing giants represented by production capacity being surpassed by more promising “new forces of 3D printing,” resembling the recent innovation between electric vehicles and traditional cars. So, what role does Plater play at the intersection of history and the future?

02 Foundation: The Industry’s Pursuers with Gaps

3D printing technology can be divided into two main categories based on materials: metal 3D printing technology and non-metal material 3D printing technology.

Metal 3D printing technology is primarily applied in industrial fields and is an important method for manufacturing automobiles, aerospace rockets, and turbines. Compared to 3D metal printing, non-metal material 3D printing has a broader range of application scenarios and a larger market share, with even personal-level products already existing.

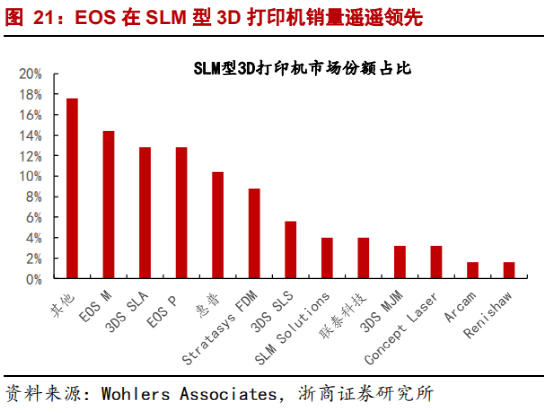

Plater operates in the metal 3D printing sector. Currently, the core technology of metal 3D printing is SLM technology. Looking at the global SLM 3D printing market, the three companies with the highest market shares are Germany’s EOS, 3D Systems, and HP, with shares of 27%, 16%, and 10%, respectively. Compared to international competitors, Plater has a significant market share gap in the global industry, playing the role of a pursuer.

From a business composition perspective, Plater’s operations have penetrated all aspects of the 3D printing industry chain, including 3D printing equipment, 3D printing materials, and 3D printing services. Referring to the performance of overseas “new forces of 3D printing,” it is evident that 3D printing is an industry with extremely high entry barriers, requiring significant equipment and R&D investments, making it difficult for new players to easily enter the market.

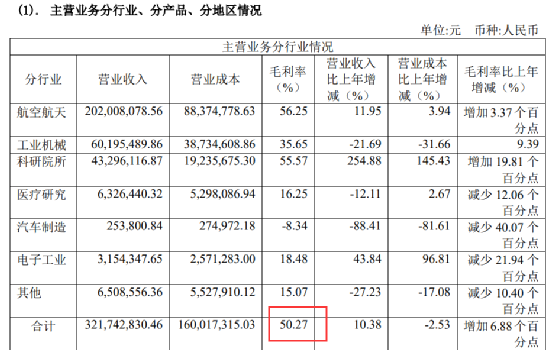

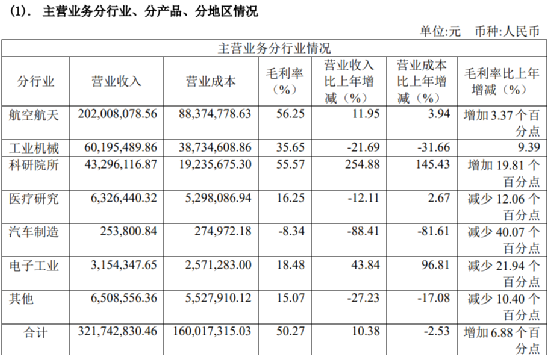

Based on this, Plater’s first-mover advantage in China can help it smoothly convert into production capacity advantages, and customers are willing to pay a premium for this unique customized R&D. The 2019 financial report shows that Plater’s product gross margin exceeds 50% and continues to maintain further growth momentum.

Plater’s technical strength has already aligned with mainstream international metal 3D printing technologies. Under the leadership of Professor Huang Weidong, 154 R&D personnel continuously refine their technology, allowing Plater’s products to compete with the leading EOS.

In fact, Plater’s success, in addition to years of accumulation, has also adopted a strategy of learning from others’ strengths to counteract their own weaknesses. Plater is the Chinese agent for EOS’s metal 3D printing technology and initially formed stable cooperative relationships with downstream customers by distributing EOS equipment.

However, EOS equipment is expensive, and when customer brand demand is not strong, Plater will recommend its own products to them. Acting as an agent for EOS equipment has become a natural traffic entry point for Plater, leveraging EOS’s global leading brand recognition to avoid the hassle of independently developing the market.

Through years of acting as an agent for EOS equipment, Plater has almost surpassed its predecessor, with its self-developed equipment outperforming imported EOS products in many key indicators. Additionally, Plater can customize services based on user needs, which has endeared it to many core users.

03 Flexibility: Plater’s Military Label

Unlike overseas giants, Plater, rooted in the Chinese market, possesses a unique “3D military” label.

Looking back to 2010, Zhou Liangdao, the deputy chief designer of the Commercial Aircraft Corporation of China (COMAC), was anxious. The titanium alloy structural components of the C919 aircraft had been designed, but problems arose during manufacturing due to the immaturity of 3D printing technology, raising safety concerns.

Zhou Liangdao had communicated with several 3D printing service providers, but the results were far from satisfactory. The C919 aircraft is a large commercial aircraft, and there can be no negligence regarding flight safety. Out of caution, Zhou Liangdao always delved into technical issues, but the partners were often vague, causing the aircraft’s manufacturing to come to a standstill.

In January 2011, a turning point arrived. Zhou Liangdao was invited to visit Northwestern Polytechnical University to observe laser stereolithography technology and was quickly attracted by the technology, which was the precursor to Plater. Two months later, a joint working group was established to focus on overcoming technical challenges.

In just over a year, the National Key Laboratory of Solidification Technology at Northwestern Polytechnical University delivered a 3-meter-high central wing edge strip for the C919 aircraft manufactured using 3D printing technology, which successfully passed COMAC’s acceptance. Gaining COMAC’s recognition was a milestone for Plater.

Through years of accumulation, Plater has built a substantial core military customer base, with its products deeply involved in the development of key national model projects, including 7 aircraft models, 4 drone models, 7 aircraft engine models, 2 rocket models, 3 satellite models, 5 missile models, 2 gas turbine models, and 1 space station model, covering military and civilian large aircraft, advanced fighter jets, drones, high-thrust-to-weight ratio aircraft engines, new missiles, space stations, and satellites.

According to the 2019 financial report, Plater’s revenue from aerospace reached 202 million yuan, accounting for 62.9% of total revenue, with a business gross margin of 56.25%. The deep accumulation in the military sector has transformed into Plater’s core competitiveness, establishing a solid moat.

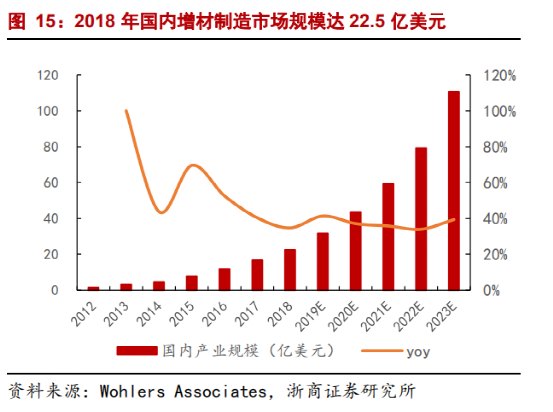

In the Chinese market, 3D printing is still an emerging market, with the industry growth rate expected to remain above 40% for a long time. The market anticipates that the Chinese 3D printing industry will exceed $10 billion in 2023.

Although Plater’s technology is not disruptive, considering that 3D printing is just beginning in China, the future incremental market will drive Plater’s performance growth. Coupled with Plater’s rare military label, these core Chinese technologies cannot be entrusted to overseas manufacturers.

Compared to the fierce competition from overseas 3D printing companies, Plater almost exclusively occupies the domestic military industrial sector’s metal 3D printing market and is gradually completing domestic substitution. From this perspective, Plater, which has long focused on the Chinese market, has higher commercial value and growth expectations.

However, in the long run, the new and old transitions in the entire 3D printing industry have already begun. Plater cannot rely solely on the “3D military” moat for survival; it must also invest in more advanced technology development and explore broader markets.