Mainland China needs to increase investment in the semiconductor manufacturing industry.

After reviewing TSMC’s latest earnings call,

the semiconductor supply chain centered around TSMC will continue to be the driving force of Taiwan’s economy in the coming years.

I have conducted various analyses on the industrial competition between the two sides, and overall, most industries will show a trend of mutual rise and fall in the face of competition from mainland counterparts, but the semiconductor manufacturing industry centered around TSMC is particularly difficult to compete with.

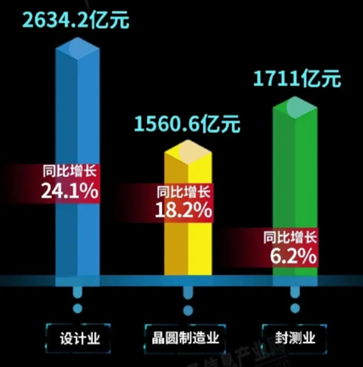

First, let’s look at the development of semiconductor manufacturing in mainland China in 2020. In the first three quarters of 2020, the total revenue of the semiconductor wafer manufacturing industry in mainland China reached 156.06 billion yuan, an increase of 18.2%. Note that this figure includes the total revenue of both domestic and foreign manufacturing plants.

In contrast, TSMC alone generated revenue of 977.722 billion New Taiwan dollars in the first three quarters, approximately 227.4 billion yuan, with a year-on-year growth of 29.9%.

The revenue of TSMC alone has already surpassed the total revenue of all wafer manufacturing plants in mainland China, reaching a level of 1.46 times that of mainland China, and TSMC’s growth rate is even faster at 29.9%. This indicates that the gap between the two sides is actually widening.

On January 14, TSMC held an earnings call, announcing its fourth-quarter figures,

TSMC’s consolidated revenue for the fourth quarter was 361.53 billion New Taiwan dollars, an increase of 14%, which is significantly slower than the growth rate in the first three quarters, bringing the cumulative annual revenue growth rate down to 25.17%.

I believe the likelihood of mainland China’s wafer manufacturing revenue growth reaching 25% for the entire year is very low, given that the growth was only 18.2% in the first three quarters. This means that even when comparing the entire wafer manufacturing industry in mainland China with TSMC alone, the revenue gap is widening in 2020.

From a technical perspective, the shipment of 5nm process technology accounted for 20% of TSMC’s fourth-quarter revenue, 7nm accounted for 29%, and 16nm accounted for 13%, totaling 49% of revenue from advanced processes below 10nm.

Processes of 10nm and below are currently areas blocked by the U.S. for mainland China’s competitors, and they will not be able to access these fields in the coming years. This means that TSMC will have a “broad territory” without facing competition from mainland China in the short term.

Thus, we are not only significantly lagging in revenue but also facing a situation where advanced processes are blocked.

This is a significant obstacle and highlights the importance of domestic production, which goes far beyond merely allowing Huawei to continue to survive.

In addition, TSMC announced that its capital expenditure will increase significantly, indicating its optimism about the global market development.

“TSMC’s capital expenditure last year was 17.24 billion U.S. dollars, and the estimated capital expenditure for 2021 will be between 25 billion and 28 billion U.S. dollars. Of this capital expenditure, it is expected that 80% will be used for advanced processes, including 3nm, 5nm, and 7nm technologies, about 10% will be used for advanced packaging and photomask production, and another 10% will be used for special processes.”

This year, TSMC’s capital expenditure of 25-28 billion U.S. dollars is expected to exceed last year’s by about 10 billion U.S. dollars.

SMIC’s estimated revenue for 2020 is around 4 billion U.S. dollars, and TSMC’s capital expenditure is six to seven times SMIC’s annual revenue. Even if we combine SMIC, Huahong, Changjiang Storage, and Hefei Changxin, they will not reach this level of investment intensity this year.

Moreover, Taiwan also has UMC, Nanya, Vanguard, and Winbond, among others, whose capital expenditures are also significant.

This indicates that Taiwan’s investment intensity in semiconductor manufacturing remains higher than that of mainland China.

There is a voice in mainland China hoping that Huawei can enter semiconductor manufacturing, but even for Huawei, not to mention the significant gap in manufacturing experience, facing TSMC’s annual capital expenditure of over 25 billion U.S. dollars, it is clear that Huawei cannot catch up in the short term given this level of investment intensity. After all, Huawei is a multi-business group with investments in 5G, terminals, IT, and automotive sectors.

In 2019, Huawei’s total revenue was only 122.972 billion U.S. dollars, with R&D expenditure of less than 20 billion U.S. dollars.

TSMC’s significant increase in capital expenditure reflects a strong optimism about the development of semiconductor foundry manufacturing,

primarily driven by four growth platforms: smartphones, high-performance computing, automotive electronics, and the Internet of Things.

TSMC expects a compound annual growth rate of 10%-15% in revenue from 2020 to 2025.

TSMC’s own development will also greatly drive the progress of Taiwan’s packaging, materials, and design industry chain, creating a rich pool of semiconductor talent, which will further attract foreign investment to establish factories and R&D centers in Taiwan.

Micron has two memory factories in Taichung and Taoyuan, Taiwan, and many chip design companies from mainland China have R&D departments in Taiwan to leverage Taiwan’s semiconductor talent resources.

I previously watched an interview video on YouTube featuring a Taiwanese vlogger interviewing his high school classmate.The classmate graduated with a master’s degree from National Taiwan University of Science and Technology and joined TSMC for process and R&D. After seven years, his annual salary reached 3 million New Taiwan dollars, equivalent to about 698,000 yuan at an exchange rate of 4.3.He then moved to ASE Technology Taiwan for chip packaging, where his salary decreased somewhat. After two years at ASE, he switched to a foreign chip design company in Taiwan for supply chain quality management, coordinating with foundries and packaging factories in Taiwan. According to him, foreign chip design companies can offer salaries comparable to TSMC, around seventy thousand yuan.

The semiconductor industry in Taiwan is quite comprehensive, providing numerous positions with annual salaries exceeding 500,000 yuan. This semiconductor cluster is entirely centered around TSMC.Due to Taiwan’s successful occupation of the global semiconductor manufacturing core position, this engine will continue to provide power for Taiwan’s future economic development, helping to maintain the Taiwanese people’s sense of economic superiority over mainland China.

Therefore, engaging in semiconductor manufacturing is of immense significance for mainland China, not limited to industrial upgrading and the Sino-U.S. technology war. If we cannot seize the time to cultivate competitive foundries, not only will the majority of the global semiconductor manufacturing market’s growth continue to flow to Taiwan,but also the industrial capabilities under U.S. control in Taiwan will continue to be a weapon to strike at mainland China’s industrial upgrading. We cannot optimistically assume that the U.S. will limit its actions to not supplying Huawei; what if tomorrow it decides to cut off supplies to other mainland companies?

I still believe that mainland China’s foundries, primarily relying on SMIC and Huahong, are insufficient.

In Taiwan, there are four major foundries: TSMC, UMC, Nanya, and Vanguard.

In terms of foundry business, UMC’s scale alone is already equivalent to the combined size of SMIC and Huahong.

Not to mention TSMC, which accounts for more than half of the global integrated circuit foundry market.

Currently, it seems that even by 2030, mainland China will not have a company that can compete with TSMC, and the semiconductor industry centered around TSMC will remain a long-term driving force for Taiwan’s economic development.

At present, Taiwan is in a comprehensive leading position in terms of scale, technology, and capital investment, and it can be said that it is concentrating its efforts to maintain its strong position in semiconductor manufacturing.

Finally, I would like to share some good news regarding the two major foundries in mainland China.

Currently, the financial reports released by SMIC and Huahong are still acceptable and are both showing growth.

SMIC’s third-quarter financial report released on November 11 showed that its revenue for the third quarter was 1.083 billion U.S. dollars, a year-on-year increase of 32.6%, marking the first time it has surpassed 1 billion U.S. dollars in a single quarter.

In terms of yuan, the total revenue for the first three quarters was 20.8 billion yuan, a year-on-year increase of 30.2%. This growth rate is commendable, but the recent resignation incident at SMIC has revealed some internal issues.

Huahong Semiconductor, a subsidiary of Huahong Group, released its third-quarter report on November 10, showing a record high revenue of 253 million U.S. dollars for the quarter, a year-on-year increase of 5.9%. Of course, this publicly listed Huahong Semiconductor only includes Huahong Hongli, covering processes from 1 micron to 65/55nm.

However, Huahong Group’s subsidiary responsible for advanced processes, Huahong Microelectronics, is not included in the listed company’s financial report. According to news released by the Shanghai State-owned Assets Supervision and Administration Commission in September 2020, Huahong Microelectronics’ sales in the first half of 2020 increased by 38% year-on-year.

On July 29, 2020, Huahong Group held a welcome event for new employees, celebrating the number of employees exceeding 10,000 for the first time, compared to just over 6,000 in 2016.

TSMC has already estimated that its revenue will grow by 10%-15% annually by 2025, while mainland China’s foundries need to maintain a growth rate exceeding this by at least 5 percentage points, meaning they must sustain an annual growth rate of 15%-20% to have a chance of narrowing the gap in the future, which is very challenging.

Additionally, the scale of both SMIC and Huahong Group is still too small, especially since Taiwan’s foundries are not only larger in scale but also growing rapidly, making their growth insufficient.

For instance, SMIC’s growth in the first three quarters of 2020 was 30.2%, but TSMC also grew by 29.9%, and UMC grew by 23.67%. Moreover, the recent issues at SMIC raise concerns about its long-term sustainable growth.

This field has vast potential, and mainland China needs to support more players to enter the market to expand growth.What we do today will show results in a few years; this critical battle has no retreat.

Previous articles:

Countering Extraterritorial Jurisdiction – A Brief Discussion on Blocking Improper Extraterritorial Application of Foreign Laws and Measures

Another Country

Looking at the Next Decade from Early 2021: Two or Three Lines

New Three Lines Construction and the Hopes of Young People

China’s Position in the Global Semiconductor Landscape from the Data

Examining the U.S. Strategy Against China from the Entity List

How Difficult It Is to Become a Developed Country from Two Charts

Reflections on Liang Mengsong and Shenzhen’s Chip Manufacturing Industry

The Mission of Giants – Starting from a Map of China