(Report Authors: Zhongtai Securities, Wang Fang, Zhang Qiong)

1. Intelligent Driving Rises, In-Vehicle Camera Volume and Price Both Increase

Against the backdrop of information technology transformation, the automotive industry is ushering in the trend of intelligence. With the development and application of information technology, automobiles are gradually transitioning from mechanical means of transportation to a smart “third space” centered around people. Automotive intelligence includes three major components: intelligent driving, intelligent cockpit, and intelligent services, with intelligent driving being the cornerstone of automotive intelligence.

1. Intelligent Driving Enters a Golden Development Period, ADAS Accelerates Penetration

As an important carrier of intelligent driving, the popularization of ADAS is a prerequisite for achieving automotive autonomous driving in the future. ADAS (Advanced Driver Assistance System) is the core carrier of intelligent driving, which can be divided into three levels from a technical architecture perspective: 1) Perception Layer: Relies on multiple sensors to collect and process environmental and in-vehicle information, acting as the “eyes” of the vehicle, with cameras, millimeter-wave radar, and LiDAR being key sensors; 2) Decision Layer: Integrates data from multiple sensors to make decisions and formulate control strategies, acting as the “brain” of the vehicle; 3) Execution Layer: Feeds back system decisions to the underlying modules for execution, achieving longitudinal and lateral automatic control of the vehicle, akin to the “limbs” of the automobile.

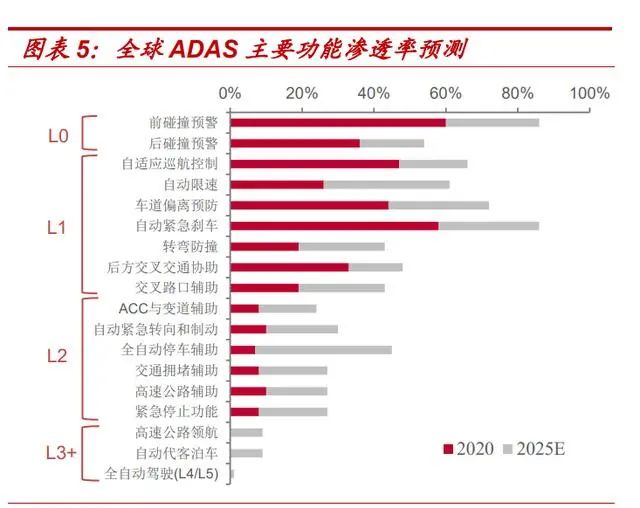

Currently, ADAS is at a transition window from L2 to L3, with 2022 being the inaugural year for L3 development. ADAS can be classified into six levels from L0 to L5, where L0 to L2 are in the category of assisted driving, and L3 to L5 are in the category of autonomous driving. In terms of functionality, compared to L2, L3 and L4 have features such as TJP (Traffic Jam Pilot), HWP (Highway Pilot), CP (City Pilot), and AVP (Automated Valet Parking), capable of achieving conditional autonomous driving. Regarding hardware configuration requirements, as the level of ADAS progresses, higher performance and quantities of perception layer hardware such as cameras and radars are required. Currently, L0 to L2 levels are the most widely adopted, with data from Roland Berger showing that in 2020, the penetration rates of L1 and L2/L2+ in global passenger vehicles were 48% and 10%, respectively. By 2025, the penetration rate of L2/L2+ is expected to rise to 36%, while the penetration rate of L3 is projected to increase from 0 to 8%. It is reasonable to conclude that ADAS is currently in a transition window from L2 to L3. In December 2021, Mercedes-Benz’s L3 autonomous driving system obtained road approval from the German Federal Motor Transport Authority, and other well-known car manufacturers are also gradually advancing the mass production and market launch of L3 models, with 2022 expected to be the inaugural year for L3 models.

The future increase in ADAS penetration is driven mainly by three factors: policy regulations, new energy vehicle manufacturers, and traditional car companies.

1) Policy guidance and regulatory support promote the orderly development of ADAS. In November 2020, China’s Ministry of Transport and four other departments jointly issued the “Technical Roadmap for Intelligent Connected Vehicles 2.0,” proposing development goals for autonomous driving: by 2025, new car sales of L2 and L3 vehicles will account for 50%, and by 2030, will exceed 70%, with L4 accounting for 20%. Europe, the United States, and Japan have also formulated relevant strategic plans to support research in the field of autonomous driving. In terms of regulations, South Korea is the first country globally to establish safety standards for L3 autonomous driving and commercial standards. Global supportive policies and implementation standards work in tandem to safeguard the development of intelligent driving.

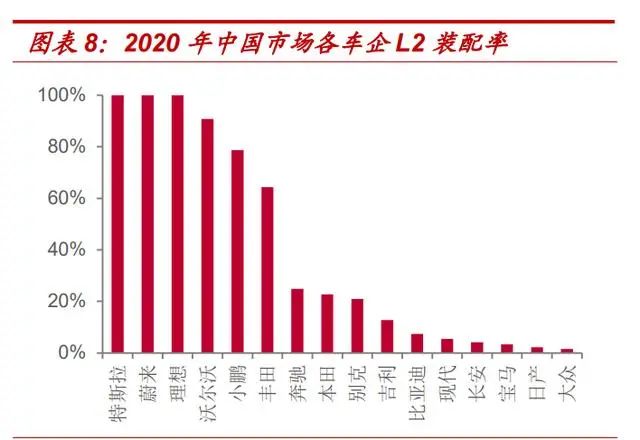

2) Electric vehicle manufacturers lead the wave of intelligence. Electric vehicles have stronger electrical support and higher energy conversion efficiency, better meeting the high power consumption demands of intelligent driving systems. At the same time, the deepening of intelligence also raises higher requirements for computing power. The distributed E/E (Electronic/Electrical) architecture of traditional fuel vehicles struggles to adapt to the massive transmission of information, while the centralized E/E architecture of smart electric vehicles can achieve faster information transmission and processing, making it more compatible with ADAS. New energy vehicle manufacturers such as Tesla and NIO adopt advanced electronic and electrical architectures and upgrade ADAS functions through OTA technology (over-the-air updates), accelerating the penetration of L2/L2+. According to statistics from Zosi Automotive Research, in the Chinese market in 2020, the assembly rates of L2 in Tesla, NIO, Li Auto, and Xiaopeng were 100%, 100%, 100%, and 78.7%, respectively. Currently, new energy vehicle manufacturers are gradually launching L3 and above models, continuing to lead the wave of intelligence and driving the ongoing increase in ADAS penetration.

3) Traditional car manufacturers are following suit and accelerating their layout in intelligence. The rapid development of new energy vehicle manufacturers such as Tesla has forced traditional car manufacturers to undergo intelligent reform and increase R&D investment to enhance electrification and intelligence levels. In December 2021, Mercedes-Benz’s L3 autonomous driving system obtained road approval from the German Federal Motor Transport Authority, while Volvo has partnered with autonomous driving technology company Waymo to jointly develop an L4 autonomous driving solution, expected to launch L4 mass-produced vehicles in 2022. Major manufacturers such as Ford, Toyota, and Hyundai also plan to launch L4 models in 2022. Under the backdrop of major traditional manufacturers accelerating their layout in autonomous driving, the penetration rate of ADAS is expected to accelerate.

Driven by these three major factors, the penetration rate of ADAS is expected to see significant improvement. According to Roland Berger’s forecast, by 2025, the global penetration rates of L2, L3, and L4/L5 will reach 36%, 8%, and 1%, respectively. Combined with the timelines of major car manufacturers for ADAS, 2025 may be the inaugural year for L4. In the long term, we expect that by 2030, the global penetration rates of L2, L3, and L4/L5 will reach 30%, 35%, and 20%, respectively. Due to the higher compatibility of new energy vehicles with ADAS, and the structural limitations of traditional fuel vehicles making it more difficult to equip L4/L5 ADAS systems, we judge that the penetration rates of global new energy vehicles for L3 and L4/L5 will be significantly higher than the overall level, expected to reach 40% and 41% by 2030. (Report Source: Future Think Tank)

2. ADAS Penetration Upgrade Drives the Volume and Price Increase of In-Vehicle Cameras

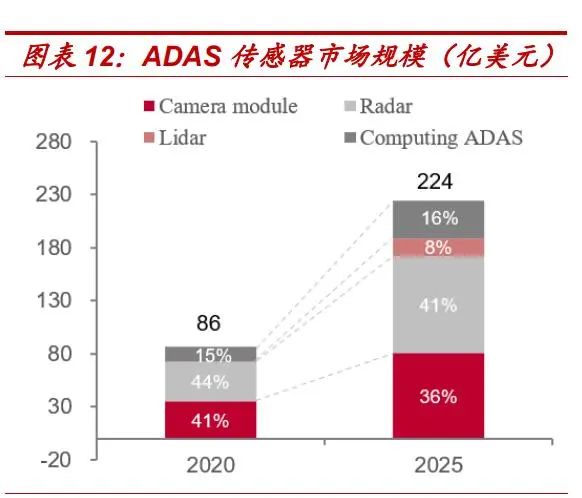

Cameras are the core sensors of the ADAS perception layer. Compared to millimeter-wave radar and LiDAR, in-vehicle cameras are low-cost and have relatively mature hardware technology, with the core advantage of being able to recognize object content (such as distinguishing between signs and road markings), thus becoming the first core sensor to be installed in vehicles. According to Yole’s data, the market size of in-vehicle cameras in 2020 was $3.5 billion, accounting for 41% of the ADAS perception layer sensor market.

Cameras can be categorized into front, surround, side, rear, and internal types based on installation location. Front cameras include monocular, binocular, and multi-lens types, capable of achieving functions such as FCW (Forward Collision Warning), LDW (Lane Departure Warning), and TSR (Traffic Sign Recognition); side cameras can be divided into front and rear types, with front side cameras capable of recognizing traffic signs (TSR); surround cameras are generally four in number, installed around the vehicle, enabling road perception and panoramic parking assistance (SVC); rear cameras are mainly used for parking assistance (PA); internal cameras are installed in front of the driver’s seat to achieve DMS (Driver Monitoring System), OMS (Occupant Monitoring System), etc.

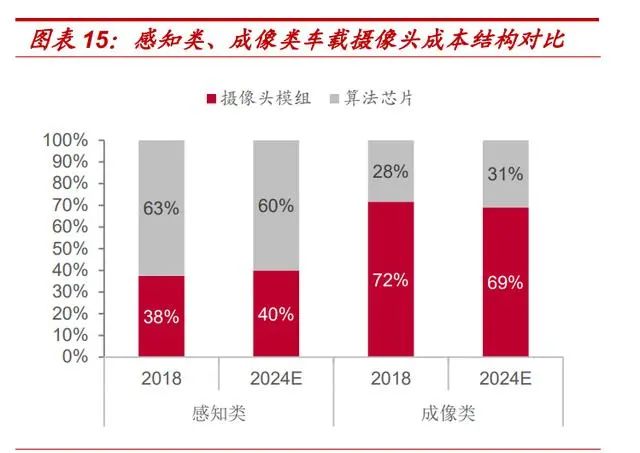

Perception (ADAS) and imaging cameras have different functions and cost structures. Perception-type ADAS cameras are used for active safety and require accurate image capture; imaging cameras are used for passive safety and store or send captured images to users. Generally, front and side cameras are prioritized for perception-type cameras, while surround and rear cameras are generally imaging-type, but as the level of autonomous driving increases, they may be upgraded to perception-type cameras. According to Yole’s data, the CAGR of shipments for perception and imaging cameras from 2016 to 2020 was 19.5% and 16.7%, respectively, with shipments in 2021 expected to reach 51 million and 95 million units. In terms of cost structure, perception cameras have higher algorithm requirements, with algorithm chips accounting for about 60% of the camera’s cost, while the camera module accounts for only 40%; imaging cameras, on the other hand, primarily consist of hardware modules, accounting for about 70%.

2.1 Volume: Referring to the development history of multi-camera smartphones, the number of in-vehicle cameras is expected to increase rapidly.

Reviewing the development history of multi-camera smartphones: The dual drivers of increasing smartphone penetration and upgrading camera functions have led to a continuous increase in the number of cameras per device. The period from 2011 to 2015 was a stage of accelerated penetration for smartphones, with basic penetration exceeding 70% by 2015. After that, smartphones entered a stage of functional upgrades, and the configuration of multi-cameras began. The increase in the number of cameras can enhance light sensitivity and reduce noise, thus meeting higher photography demands. 2016 was the inaugural year for rear dual-camera development, and after 2018, rear multi-camera configurations began to accelerate penetration. By 2021, the penetration rate of single rear cameras dropped to 3%, and multi-camera smartphones have become the market mainstream, with an average number of cameras expected to reach 4.3.

In comparison, the accelerated penetration and structural upgrades of ADAS will drive the continuous increase in the number of cameras installed, with the number of cameras per vehicle expected to exceed expectations.

1) ADAS penetration: Based on our previous forecasts, ADAS will enter an accelerated popularization phase in the next decade, with the penetration rates of L2 and above models expected to rise from 10% in 2020 to 85% by 2030. At the same time, driven by various manufacturers, the structural upgrades of ADAS will become a certain trend, with 2022 and 2025 marking the inaugural years for L3 and L4/L5 developments, respectively, and by 2030, the penetration rates of L3 and above models are expected to reach 55%.

2) ADAS upgrades: As front cameras play a crucial role in assisted driving, L1 vehicles are the first to be equipped with front cameras, and as the level of ADAS increases, front cameras will gradually upgrade to high-definition ADAS cameras; L2/L2+ vehicles will start to be equipped with surround cameras, generally in groups of four, leading to a total number of cameras that can reach 8; L3 and above models will also be equipped with side cameras to achieve more ADAS functions, and rear cameras will also adopt ADAS cameras, leading to a total number of cameras reaching 8-12; for L4/L5 levels, due to a higher reliance on radar, there will be no significant increase in the number of cameras installed.

According to Yole’s data, the global average number of cameras installed in 2020 was approximately 2.3, and it is expected to reach 3.5 by 2025. We believe that with the gradual upgrading and accelerated penetration of ADAS, coupled with the high redundancy in hardware configurations by various manufacturers, the increase in the number of in-vehicle cameras will exceed expectations, with an average number of cameras per vehicle expected to reach 4.9 by 2025.

From specific application solutions, the vision-based solution where cameras play a leading role, and the multi-sensor fusion solution that creates high redundancy will also drive the increase in the number of cameras installed. The perception layer solutions for autonomous driving can be mainly divided into vision-based and multi-sensor fusion solutions. 1) Vision-based solutions are camera-dominated, with low algorithm and high perception requirements: Tesla is a solid advocate of vision-based solutions, with the Model 3 equipped with the Autopilot 2.0 system, which does not include LiDAR, but has 8 cameras, 1 millimeter-wave radar, and 12 ultrasonic radars, including 3 front-facing cameras, 4 side cameras, and 1 rear camera, providing a 360-degree view for the vehicle within a radius of 250 meters.

Mobileye demonstrated an autonomous driving solution equipped with only 12 in-vehicle cameras at the 2020 CES, without using millimeter-wave radar, LiDAR, or other sensors, allowing the vehicle to drive autonomously for about 20 minutes on the streets of Jerusalem. 2) Multi-sensor fusion solutions have high algorithm and low perception requirements, with high system redundancy, leading to a continuous increase in the number of hardware installations such as cameras: high-end models with higher intelligence levels typically have more than 10 cameras, with higher pixel configurations. For example, the NIO ET7 is equipped with 11 high-definition cameras with 8 million pixels, while the Geely Zeekr 001 is equipped with 14 cameras, including 7 high-definition cameras with 8 million pixels.

2.2 Price: Continuous upgrades in pixel functions drive the ASP of in-vehicle cameras higher

High-performance requirements for ADAS in-vehicle cameras increase their value. In-vehicle cameras are designed for driving safety, with higher requirements for anti-magnetic, temperature resistance, and stability than consumer-grade products, leading to correspondingly higher value. According to the industry standards for automotive cameras issued by the Ministry of Industry and Information Technology in 2019, in-vehicle cameras must be able to operate continuously in environments ranging from -40°C to 85°C, be unaffected by moisture immersion, be anti-magnetic and shock-resistant, and have a service life of 8-10 years. Different types of in-vehicle cameras have varying requirements for lens specifications and chip algorithms, with ADAS in-vehicle lenses often using glass lenses, making them more expensive than ordinary in-vehicle lenses. Additionally, ADAS cameras generally use high-pixel-level high-definition image sensing chips, requiring features such as HDR and LED flicker suppression, which further increases the value of the camera module. The value of ordinary in-vehicle camera modules ranges from 150 to 200 yuan, while ADAS in-vehicle camera modules range from 300 to 500 yuan. As the level of autonomous driving increases, front, side, and rear cameras will gradually upgrade to ADAS cameras, driving the average unit price of in-vehicle camera modules higher.

Upgrades in cameras under higher ADAS levels are mainly reflected in pixel and functional aspects:

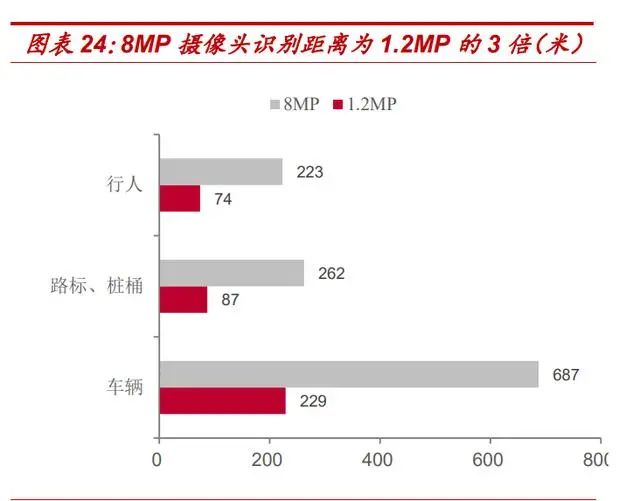

1) Upgrades in ADAS perception functions raise pixel requirements for cameras. Ordinary in-vehicle cameras generally have pixels around 1.2 million, while the upgrade of ADAS perception functions leads to increasingly refined algorithms, thus raising the pixel requirements for cameras. The front camera of the 2021 Li Auto ONE was upgraded from 1.3 million pixels in 2020 to 8 million pixels; the newly launched NIO ET7 is equipped with 11 cameras, all with 8 million pixels; the Geely Zeekr 001 is equipped with 3 front-facing and 4 side cameras, all with 8 million pixels. The application of high-pixel in-vehicle cameras will become a major trend. The pixel count affects the accuracy of target detection, with higher pixel cameras capable of detecting targets at longer distances and gathering more target information. According to NIO’s data, an 8MP pixel camera has a recognition distance three times that of a 1.2MP pixel camera.

2) The enhancement of HDR and LFM functions increases the value of ADAS cameras. Generally, when a vehicle exits a tunnel or underground parking lot, strong light exposure can cause overexposure and loss of shadow images in the camera. The HDR (High Dynamic Range) function can address this issue, allowing in-vehicle cameras to work under high-contrast backlighting conditions, displaying both bright and dark areas simultaneously, thus enhancing driving safety. Moreover, LED flicker phenomena can lead to incomplete capture of traffic signs and traffic light information by in-vehicle cameras, severely affecting the recognition and judgment of ADAS systems. Therefore, it is crucial for vehicles to be equipped with cameras that have LFM (LED Flicker Mitigation) functionality. The principle of LED flicker suppression is to extend the camera’s exposure time to resolve the issue of differing frequencies between LED flicker and shooting frequency, capturing more comprehensive information and eliminating safety hazards for vehicles.

3. The Market for In-Vehicle Camera Modules is Expansive

The current global market space is approximately 50-60 billion yuan, with a CAGR of 19.4% from 2021 to 2025. Assuming the average value of ordinary lens modules is 200 yuan and that of ADAS lens modules is 400 yuan, we calculate the value of camera modules per vehicle at different levels (see Table 4). Considering the potential price decrease after large-scale production, we assume that after 2023, the value of camera modules per vehicle at all levels will decrease at an annual rate of 5%. Combining the above global passenger vehicle sales and ADAS penetration forecasts, we estimate that the market size for in-vehicle camera modules in 2021 will be 45.4 billion yuan, reaching 92.2 billion yuan and 164.5 billion yuan by 2025 and 2030, respectively, with a CAGR of 19.4% from 2021 to 2025.

2. A Large Market with High Barriers Creates a Golden Path for In-Vehicle Cameras, High Certainty for Leading Manufacturers

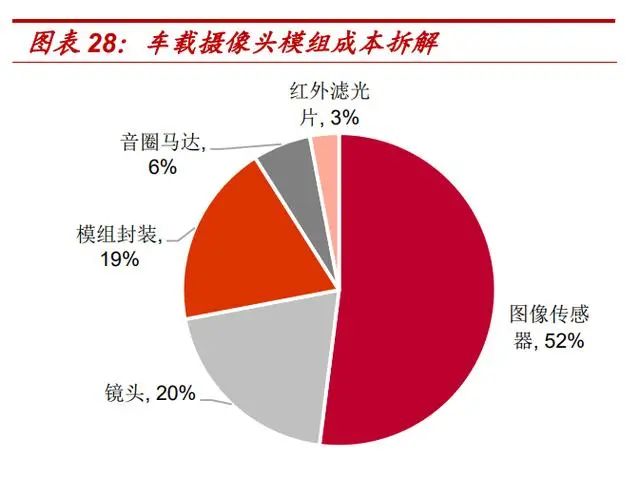

The main hardware structure of in-vehicle cameras includes optical lenses (which include optical glass, filters, protective films, etc.), image sensors, image signal processors (ISP), serializers, connectors, and other components. From a cost structure perspective, image sensors account for about 52%, making them the primary cost component of in-vehicle camera modules; lens groups and module packaging account for 20% and 19%, respectively, with all three being in the midstream of the industry chain. Combining the earlier calculations of the market size for in-vehicle camera modules, we estimate that in 2021, the market space for image sensors, lenses, and modules will be 23.6 billion yuan, 9.1 billion yuan, and 8.6 billion yuan, respectively.

1. CIS: The Market for In-Vehicle CIS is Expansive, with a Highly Concentrated Market Share

CIS is the mainstream imaging chip, and the market for in-vehicle CIS is expansive. Image sensors are mainly divided into CCD (Charged Coupled Device) and CMOS (Complementary Metal-Oxide-Semiconductor). CIS (CMOS Image Sensor) has gained attention and development since the 1990s. With continuous technological optimization, the market share of CIS chips has surpassed that of CCD chips, increasing from 54% in 2007 to 89% in 2017, and has recently exceeded 90%, making it the mainstream imaging chip for in-vehicle cameras. Based on value share calculations, we expect the global market size for in-vehicle CIS to reach 48 billion yuan by 2025, with a CAGR of 21% from 2020 to 2025, and it is expected to reach 85.6 billion yuan by 2030, indicating a vast market space for in-vehicle CIS.

The CIS industry chain is divided into three models: IDM, Fab-lite, and Fabless, with IDM being the mainstream.

1) IDM Model: Integrated design and production, with representative manufacturers including Sony and Samsung. According to Gartner data, the IDM model accounts for over 80% in the CIS field, and the mainstream status of the IDM model is mainly due to two advantages: first, stronger supply chain control; second, integrated design and production can achieve process collaborative optimization, supporting faster implementation of new technologies.

2) Fab-lite Model: A model that lies between IDM and Fabless, allowing manufacturers to achieve partial self-supply of chips, such as ON Semiconductor and Panasonic.

3) Fabless Model: Design companies are responsible only for design and sales, outsourcing wafer manufacturing and packaging testing to foundries and packaging testing factories, represented by Will Semiconductor (OmniVision). The advantage of the Fabless model lies in the ability to selectively partner with cost-effective foundries, allowing for more flexible production arrangements. In 2020, Will Semiconductor issued convertible bonds to raise 1.3 billion yuan to build wafer testing and wafer reconstruction production lines (Phase II) to reduce supply chain risks through improved industry chain integration, achieving an effective balance between Fabless and IDM models, enhancing market response efficiency and profitability.

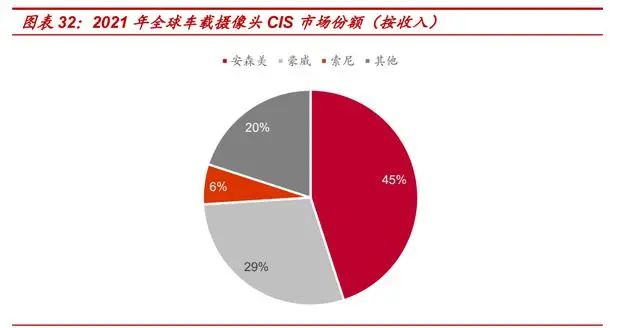

Competitive Landscape: The in-vehicle camera CIS industry has a high concentration, with Will Semiconductor acquiring OmniVision to rank second globally. Major suppliers in the in-vehicle CIS market include ON Semiconductor, OmniVision, Sony, and Samsung, with ON Semiconductor being the largest supplier and Will Semiconductor rising to second globally through the acquisition of OmniVision. According to ICV Tank data, in 2021, ON Semiconductor had a market share of 45%, while OmniVision and Sony had market shares of 29% and 6%, respectively, with a CR3 exceeding 80%, indicating a highly concentrated market share.

Compared to smartphone CIS, automotive CIS has more stringent requirements, resulting in high industry technical barriers. 1) High Pixel: Algorithm upgrades increase the pixel requirements for in-vehicle cameras, necessitating higher pixel automotive CIS, with manufacturers such as OmniVision already launching 8MP automotive CIS. According to EEWorld data, the price of 1-2MP pixel CIS generally ranges from $3 to $8, while the price of 8MP pixel CIS exceeds $10. 2) Low Light Sensitivity: Low light capabilities ensure that cameras can function normally in nighttime or tunnel conditions, safeguarding vehicle safety. Currently, most manufacturers’ products generally have low light functionality.

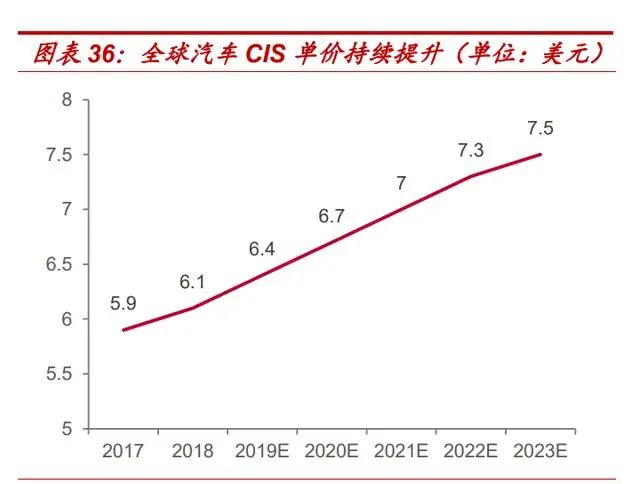

3) High Dynamic Range (HDR): Dynamic range refers to the ratio between high and low light areas in the same scene. High dynamic range CIS can capture high-quality images under high-contrast backlighting conditions. The dynamic range of smartphone CIS generally ranges from 60 to 70 dB, while automotive CIS ranges from 120 to 140 dB. 4) LED Flicker Mitigation (LFM): LED indicators and traffic lights generally flicker at a frequency of 90Hz, and CIS may fail to capture signals due to frequency desynchronization, leading to AI system misjudgments. LFM technology can significantly enhance camera recognition performance, with two technical paths: super exposure and pixel size, with ON Semiconductor adopting the former and OmniVision and Sony adopting the latter. The trends in high pixel requirements and functionalities such as LFM impose high technical barriers for newcomers while driving continuous price increases for automotive CIS. According to Yole’s predictions, the average price of global automotive CIS is expected to rise from $6.1 in 2019 to $7.5 in 2023.

Automotive CIS certification cycles are long, with high entry barriers. The automotive industry has very strict quality control over components, requiring image sensors to pass a series of safety certifications before application, with certification cycles typically lasting 2-3 years. Once manufacturers enter the automotive supply chain, they will receive long-term stable orders, making it difficult for newcomers to capture market share.

2. In-Vehicle Lenses: A Historic New Opportunity for ADAS, Rapid Market Expansion

The market for in-vehicle lenses is rapidly expanding, with Sunny Optical maintaining its leading position. In-vehicle lenses account for about 20% of the cost of lens modules, benefiting from the high demand for in-vehicle cameras, leading to rapid market expansion. Based on value share calculations, we expect the global market size for in-vehicle lenses to grow from 7.1 billion yuan in 2020 to 18.4 billion yuan by 2025, with a CAGR of 21%. Currently, the market landscape shows a leading company with many strong competitors, with Sunny Optical’s in-vehicle lens shipments having ranked first globally for nine consecutive years, with a market share of 32% in 2020, significantly ahead of the second player; second-tier manufacturers are mainly Japanese and Korean companies with more dispersed shares, with Japanese companies such as Maxell, Fujifilm, and Nidec holding shares of 8%, 5%, and 5%, respectively. In the more challenging ADAS perception lens market, Sunny Optical also occupies a leadership position, with a global market share exceeding 50% in 2020 due to its technological and customer advantages.

In-Vehicle Lens Manufacturing Requires Higher Craftsmanship, Mainly Using Glass Lenses and Glass-Plastic Hybrid Lenses. The optical components in the lens group mainly include lenses, filters, and protective films. The lens’s role is to focus light for imaging inside the camera, and the quality of the lens significantly impacts the camera’s imaging quality. Lenses can be classified into glass lenses, plastic lenses, and glass-plastic hybrid lenses based on material. Smartphone lenses mainly use plastic lenses, while in-vehicle lenses primarily use glass or glass-plastic hybrid lenses due to the higher durability and thermal stability requirements for in-vehicle lenses. Glass lenses have higher heat resistance, scratch resistance, and light transmittance compared to plastic lenses, making them more suitable for the working environment and high-performance requirements of in-vehicle lenses. Generally, ADAS high-pixel lenses tend to use more glass lenses. (Report Source: Future Think Tank)

The barriers in the in-vehicle lens industry mainly manifest in two aspects:

1) Technical Barriers to Mass Production of Lenses

In terms of materials, compared to plastic lenses for smartphones, the manufacturing process for automotive glass lenses is more complex and requires higher manufacturing standards. Therefore, the production of glass lenses presents a significant barrier for smartphone camera manufacturers entering the automotive lens field. Sunny Optical and Lianchuang have been laying out glass lens technology for many years, accumulating rich production technology experience and showing significant advantages. In terms of lens structure, glass lenses can be divided into spherical and aspherical types. Spherical glass lenses have aberrations that need to be minimized through the combination of different shapes and numbers of lenses and continuous parameter adjustment and validation, but this also increases weight and reduces light transmittance. Additionally, spherical glass lenses face challenges in terms of complex processes and large-scale production. In contrast, aspherical lenses can eliminate aberrations, and current molding glass technology has achieved large-scale production of aspherical lenses, with companies like Lianchuang Electronics, Sunny Optical, Yutong Optical, and Lante Optical being the main players in this field.

Lianchuang’s molding glass production capacity is second only to Japan’s HOYA, and the ADAS lenses and the high-definition wide-angle lens technology that Lianchuang has been focusing on are derived from the same source, both requiring molding glass. Therefore, in the ADAS in-vehicle lens field, Lianchuang has a first-mover advantage in molding glass production capacity and technology. In terms of pixels, the upgrade of ADAS perception raises pixel requirements for in-vehicle cameras. Currently, Sunny Optical has achieved mass production of 8MP front, side, and rear lenses; Fujifilm’s 8MP in-vehicle lens is still in the testing phase; Lianchuang Electronics has also achieved mass production, exclusively supplying 8M lenses and modules for NIO’s NT2.0 platform, with its 8M lens and module receiving exclusive certification from NVIDIA’s autonomous driving solutions.

2) Customer Barriers Due to Long Certification Cycles

In-vehicle lenses typically need to be combined with image sensors to undergo verification by downstream manufacturers, and similar to CIS, the certification cycle usually lasts 2-3 years. The long certification cycle leads to relatively stable cooperation relationships, and the customer structure of in-vehicle lens manufacturers is also relatively stable. From the customer structure perspective, the main customers of various manufacturers are primarily Tier 1 and traditional car manufacturers. Sunny Optical’s customers include globally renowned automotive module manufacturers such as Mobileye, NVIDIA, and Bosch, with its products widely used in the ADAS systems of brands like Toyota, Volkswagen, and BMW. Lianchuang Electronics also has rich customer resources, supplying ADAS lenses to NIO and Tesla, and has strategic partnerships with NVIDIA, Mobileye, and Huawei. Particularly in the high-pixel field, Lianchuang began cooperating with NIO in 2020, exclusively supplying seven 8M ADAS lenses for the NIO ET5 and ET7, with the ET7 expected to be delivered on March 28, 2021, and the ET5 expected to be delivered in September 2021.

3. Module Packaging: Significant Incremental Space, Domestic Manufacturers Welcome Development Opportunities

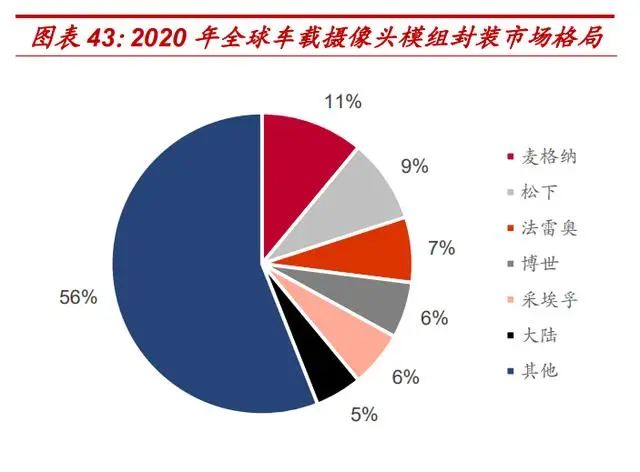

The in-vehicle lens module packaging market has considerable incremental space, with a relatively dispersed structure, and currently, overseas Tier 1 manufacturers dominate. According to our calculations, the market size will reach 17.5 billion yuan by 2025, increasing to 31.3 billion yuan by 2030, indicating considerable incremental space. Overseas Tier 1 manufacturers have a first-mover advantage in the packaging of in-vehicle lens modules. According to ICVTank data, the top three global manufacturers in 2020 were Magna (11%), Panasonic (9%), and Valeo (7%), with a global CR6 of about 44%, indicating that the industry concentration is more dispersed compared to in-vehicle lenses.

The Role of Tier 1 is Softening, Domestic Lens Manufacturers Welcome Development Opportunities. Early in-vehicle cameras had lower requirements for pixels and specifications, leading Tier 1 manufacturers to primarily use lower-end BGA packaging technology. As ADAS technology continues to upgrade, the packaging process for high-pixel, miniaturized in-vehicle cameras has become more complex, gradually adopting COB packaging technology. Due to the high cost of establishing new packaging production lines and the higher profit margins of software compared to hardware, Tier 1 manufacturers are increasingly inclined to outsource packaging to specialized lens manufacturers. On the other hand, domestic manufacturers such as Sunny Optical and Lianchuang Electronics have high market shares in smartphone lens packaging and rich process experience, possessing sufficient technical strength to undertake packaging tasks and directly supply in-vehicle lens modules as Tier 0.5 manufacturers. We believe that under the dual catalysts of industrial upgrades and the accelerated layout of domestic lens manufacturers, domestic manufacturers are expected to continue expanding the scale of their in-vehicle module business, reshaping the industry landscape.

Lens Module Performance Upgrades: Sunny Optical Achieves Mass Production of 8M Front Modules. Front cameras play a crucial role in autonomous driving, leading major manufacturers to prioritize the R&D and upgrade of front modules to achieve more ADAS functions. Sunny Optical’s 8M front modules have achieved mass production and can be applied to L4-level ADAS. Continental AG also has the capability to mass-produce 8M modules, while Entron (a subsidiary of Lianchuang) supplies front camera modules to NVIDIA, achieving 8.3MP; most other manufacturers’ front modules remain below 2MP. Additionally, surround modules are also a development direction, with Sunny Optical, Continental AG, and Entron having all achieved mass production.

3. Positioning in the Golden Path of In-Vehicle Cameras, Leading Manufacturers Expected to Grow Rapidly Over the Next Decade

1. Will Semiconductor: Building a Platform Company, In-Vehicle CIS Positioned Second

“Endogenous + Exogenous” Approach to Build a True Platform Company, with CIS as Will’s Core Business. Will Semiconductor started with distribution business and successfully entered the high-growth CIS field through the acquisition of OmniVision, Spico, and Vision Source in 2019, and has since accelerated its layout in TDDI, DDIC, and analog device products, achieving multi-point flowering and striving to build a true platform company. After consolidating financial statements in 2019, the company’s core business transitioned from electronic component distribution to CIS business, with the proportion of distribution business dropping from 79% to 16%, while semiconductor design business’s proportion increased to 84%, with CIS accounting for over 70%, becoming the core business of the company. OmniVision ranks third in the global CIS market, with rankings of 3rd and 2nd in the smartphone and automotive sectors, respectively, highlighting its industry position. In 2019, 2020, and the first half of 2021, CIS revenue reached 9.8 billion, 14.7 billion, and 9.1 billion yuan, respectively, with year-on-year growth rates of 79%, 50%, and 51%, respectively, driven by the growth of the CIS business, continuously boosting the company’s performance. Additionally, CIS and design-related businesses have higher gross margins, further optimizing the company’s profitability.

The In-Vehicle CIS Business Enjoys High Growth Dividends in the Industry. Looking at the downstream applications of the company’s CIS products, smartphones account for the highest proportion, while automotive and other CIS products are gradually emerging. With the accelerated penetration and upgrade trend of ADAS, the global in-vehicle CIS market remains highly prosperous, expected to reach 48 billion yuan by 2025, with a CAGR of 21% from 2020 to 2025. As the second-largest player in in-vehicle CIS, OmniVision is expected to rapidly grow with the industry’s dividends.

With Multi-Dimensional Advantages, OmniVision is Expected to Achieve Market Share Breakthroughs in the In-Vehicle CIS Field, Reshaping the Industry Landscape. 1) First-Mover Advantage: OmniVision was an early player in the in-vehicle CIS business, launching its first in-vehicle CIS in 2007, and compared to newer entrants like Sony and Samsung, OmniVision has significant first-mover advantages in technology, product offerings, and automotive certification. 2) Technological and Capacity Advantages: At the end of 2019, OmniVision launched two new 8MP pixel front-facing camera CIS products, OX08A and OX08B, with OX08A featuring excellent HDR capabilities and OX08B integrating both HDR and LFM functionalities. Compared to the market leader ON Semiconductor, OmniVision’s layout in the high-pixel automotive CIS field is more advanced, and with a more flexible Fabless model, OmniVision is expected to steadily capture market share from ON Semiconductor amid the rising trend of high-pixel automotive CIS. 3) Customer Advantages: OmniVision has accumulated rich customer resources in the automotive sector, with its automotive CIS already used in renowned domestic and international car manufacturers such as BMW, Mercedes-Benz, Audi, Tesla, Geely, Great Wall, and BYD. In 2020, it successfully onboarded a new customer, Mobileye; moreover, the rise of domestic new energy vehicle manufacturers will also support the increase in OmniVision’s market share, as the Li ONE’s front and surround camera CIS are supplied by OmniVision. In summary, we believe that OmniVision will continue to expand its market share in the in-vehicle CIS sector, with expectations of exceeding 40% by 2025.

2. Sunny Optical: A Leader in the Optical Sector, with Automotive Business Becoming a New Growth Engine

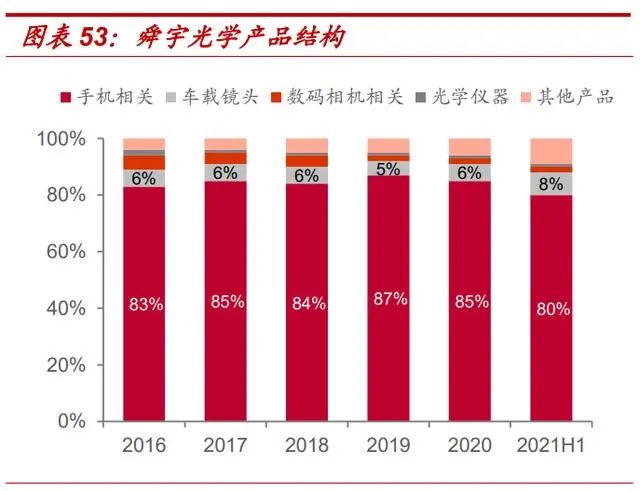

Having Focused on the Optical Sector for Over 30 Years, Sunny Optical Maintains Its Global Leadership Position. Sunny Optical has focused on the optical sector for over three decades, gradually becoming a leader in smartphone and automotive optical fields, achieving revenue of 38.1 billion yuan in 2020, with a ten-year CAGR of 35.5%. The company’s optical products are primarily smartphone-related, accounting for 80%, and Sunny Optical occupies a leading position in the global smartphone lens and module market, ranking first in the automotive lens market with a market share of 32%.

Automotive Lenses: A New Growth Engine, Strong Players in a High Prosperity Sector. Benefiting from the accelerated penetration of intelligent driving, the in-vehicle camera market remains highly prosperous, leading to rapid growth in the company’s automotive lens business, becoming a new growth engine. In 2020, the revenue from the automotive lens business was 2.29 billion yuan, with 67.97 million units shipped in 2021, a year-on-year increase of 21%. Since 2012, Sunny Optical has remained the global leader in in-vehicle lenses, with a market share of 32% in 2020, far surpassing the second place, Maxell (8%).

Sunny Optical’s strong position in the automotive lens sector is primarily due to two aspects: 1) Technological Advantages: In 2019, it completed the R&D of 8MP in-vehicle lenses applicable to L4 autonomous driving; in 2020, it achieved mass production and delivery of 8M all-glass aspherical lenses; in the first half of 2021, it completed the R&D of 5M glass-plastic hybrid cabin monitoring lenses, with its product technology level continuously leading the industry. 2) Customer Resources: Sunny Optical has been in the automotive sector for many years, accumulating rich customer resources, mainly focusing on Tier 1 manufacturers, including Bosch, Magna, Valeo, and Continental, with close cooperation with algorithm manufacturers like Mobileye. Its products are widely used in the ADAS systems of renowned automotive brands such as Mercedes-Benz, BMW, Audi, Toyota, and Honda.

In-Vehicle Modules: Continuous Technological Breakthroughs, Sunny Optical is Expected to Secure a Position. In 2009, Sunny Optical acquired a 13.96% stake in Wuxi Weisen for 170 million yuan, increasing its stake to 60.07%, officially entering the in-vehicle module field. Wuxi Weisen, as Sunny Optical’s specialized in-vehicle module subsidiary, has passed certification from Japan’s Denso, with other companies undergoing certification. In recent years, the company’s in-vehicle module business has made significant breakthroughs, achieving mass production and delivery of 8MP front ADAS in-vehicle modules, DMS, and OMS in-vehicle modules by the first half of 2021, with surround camera modules recognized by Tier 1 manufacturers like Denso and achieving mass production. We believe that Sunny Optical possesses technological advantages in high-pixel, miniaturized in-vehicle module packaging, and under the backdrop of softening Tier 1 roles, the in-vehicle module packaging business will welcome new increments, positioning Sunny Optical in the global in-vehicle module sector.

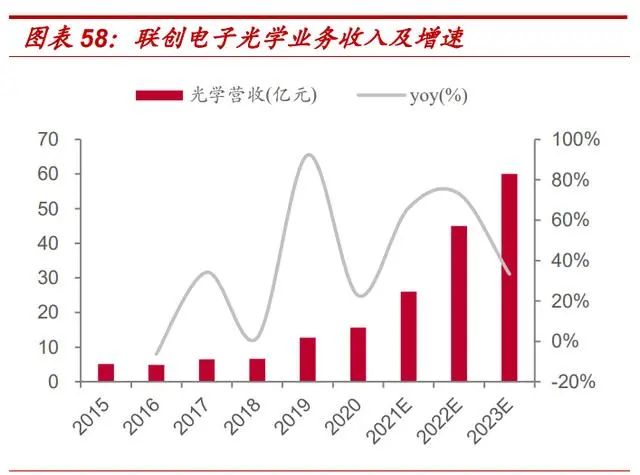

3. Lianchuang Electronics: Leading in Molding Glass Layout, Expected to Become the Global Second in ADAS Lenses and Modules

Focusing on the Optical Sector, Molding Glass Technology is the Core Competitiveness. Lianchuang began laying out mobile glass lens business in 2009, entered the high-definition wide-angle sports camera lens field in 2012, and established close cooperation with clients like GoPro and DJI. In 2015, it passed automotive lens certification and entered Tesla’s supply chain in 2016, subsequently obtaining certification from high-quality clients like Mobileye. In 2020, optical products achieved revenue of 1.565 billion yuan, accounting for 21%. According to the company’s 2022 equity incentive targets, it expects automotive optical revenue to reach no less than 500 million, 1 billion, and 1.5 billion yuan in 2022, 2023, and 2024, respectively, with a CAGR of 73.2%.

The rapid growth of the company in high-end fields such as sports camera lenses and ADAS lenses is primarily attributed to its advantages in molding glass technology, having achieved mass production of key technologies as early as 2015, with a relatively high level of process maturity, and having achieved 100% self-manufacturing of molding glass lenses by 2018, providing a significant cost advantage compared to lens manufacturers relying on external suppliers. Currently, Japan’s HOYA and Lianchuang Electronics are the only two companies globally capable of large-scale production of molding glass. As of the end of 2020, Lianchuang’s molding glass production capacity was approximately 3 million units per month, second only to Japan’s HOYA. With the gradual release of Lianchuang’s production capacity, it is expected to catch up with Japan’s HOYA in 2022.

With a High-Quality Customer Base, the In-Vehicle Business is Entering a Harvest Period. Lianchuang began laying out its in-vehicle lens business in 2015, focusing on the R&D and production of high-threshold ADAS lenses, establishing deep binding and long-term cooperation with many quality clients, ensuring high certainty for growth in the in-vehicle business.

1) Automotive Clients: The company entered Tesla’s supply chain as early as 2016, starting to supply the Model series vehicles in 2017. In 2022, the Tesla lens upgraded from 2MP to 5MP, with Lianchuang likely upgrading to a first supplier; close cooperation with new energy vehicle manufacturers like NIO, supplying seven 8M lenses and modules for the NIO ET7 and ET5.

2) Solution Providers: The company has deep cooperation with globally renowned ADAS solution providers, with Lianchuang passing certification for 8 lenses in Mobileye’s EyeQ5 8M lens; it is also an exclusive strategic supplier for NVIDIA and has won bids for multiple high-end in-vehicle lenses from Huawei, capturing a significant market share. Core solution provider clients serve numerous global car manufacturers, and with the accelerated penetration of ADAS solutions, Lianchuang is expected to benefit significantly.

3) Tier 1 Manufacturers: The company has deep cooperation with Tier 1 manufacturers such as Valeo, ON Semiconductor, Magna, ZF, and Continental, with cooperation with Valeo expected to ramp up in 2023.

Intelligent Driving is Highly Prosperous, and Lianchuang is Increasing its In-Vehicle Lens Production Capacity. Lianchuang’s in-vehicle products have passed certification and road tests from multiple algorithm platform manufacturers and OEMs, with clear growth prospects, leading the company to continuously increase its investments in in-vehicle lens production capacity. In 2021, the company allocated all the funds raised from the originally planned project for the “annual production of 26 million high-end smartphone lens industrialization project” to the “annual production of 24 million intelligent automotive optical lenses and 6 million imaging module industrialization project,” with the new project expected to be completed and put into operation by the end of 2022, generating approximately 1.556 billion yuan in new annual revenue and a net profit margin of 6.7%; at the same time, a joint venture company, Hefei Lianchuang, is planned to establish a production capacity of 50 million in-vehicle lenses and 50 million modules per year, expected to reach production capacity by 2025. Currently, Lianchuang has a sufficient order backlog, and the accelerated expansion of production capacity will provide strong assurance for performance growth, with Lianchuang expected to become the global second player in ADAS lenses and modules in the next 3-5 years.

4. Jingfang Technology: Binding Quality Clients + Expanding Capacity, In-Vehicle CIS Packaging Opens New Growth Space

CIS Packaging Leader, In-Vehicle Business Opens New Growth Space. Jingfang Technology focuses on the packaging and testing business of image sensors, with chip packaging business accounting for over 93% for a long time. It possesses advanced packaging technologies such as WLCSP and TSV, with mass production capabilities for 8-inch and 12-inch wafer-level chip sizes, making it the domestic leader in CIS packaging and a technical leader in global wafer-level packaging. The company’s packaging products mainly include image sensor chips, biometric identification chips, etc., covering fields such as smartphones, security, and automotive electronics. In 2020, the company’s revenue increased by 97% year-on-year, and in the first three quarters of 2021, revenue increased by 41%, mainly due to the trend of multi-camera smartphones and the growing demand in automotive and security CIS sectors.

TSV Process Builds Technical Advantages, and the Company Actively Expands Capacity Layout. In 2014, the company launched the world’s first 12-inch TSV production line, and after years of technological expansion, it has gained a leading position. The TSV process has core advantages in automotive CIS packaging: 1) Packaging products are small and light, almost the same size as bare chips, shortening lead distances and significantly reducing delay and power consumption; 2) Products have good encapsulation and airtightness, better responding to the harsh usage environments of automotive products; 3) Packaging wafers before cutting provides cost advantages compared to traditional processes; 4) Stronger product traceability ensures the safety of automotive products. In summary, the technical advantages of TSV packaging will drive continuous demand for wafer-level packaging in automotive CIS. At the same time, the company is actively expanding its production capacity. In January 2021, it completed a fundraising of 1.03 billion yuan for the new construction of integrated circuits, 12-inch TSV, and heterogeneous integrated smart sensor module projects, which will establish an annual production capacity of 180,000 pieces of 12-inch wafers, specifically applied to automotive CIS and other sensor fields. (Report Source: Future Think Tank)

Deeply Engaged in the In-Vehicle CIS Packaging Field for Many Years, Binding Quality Core Customers. The company began validating automotive-grade products in 2015 and started large-scale production after passing certification from automotive end customers in 2019. In terms of customer cooperation, the company has already onboarded leading in-vehicle CIS manufacturers such as OmniVision and Sony, with major customer OmniVision’s subsidiary Will Semiconductor also participating in the company’s fundraising expansion projects. The company is deeply bound to high-quality automotive customers, and as the 12-inch TSV production line ramps up to full capacity, the company will fully benefit from the growth of the automotive CIS industry.

4. Investment Analysis

Intelligent driving is on the rise, and in the next decade, ADAS will enter an accelerated popularization phase. Meanwhile, driven by various manufacturers, the structural upgrades of ADAS also become a certain trend. As the core sensors of the ADAS perception layer, in-vehicle cameras will benefit from the penetration upgrade of ADAS, achieving simultaneous increases in volume and price, with vast growth potential. We expect that by 2025 and 2030, the market for in-vehicle camera modules will reach 92.2 billion and 164.5 billion yuan, respectively, with a CAGR of 19.4% from 2021 to 2025. The high growth of the downstream market brings opportunities for upstream and midstream layouts, with major links in the industry chain such as in-vehicle CIS, lenses, and modules exhibiting characteristics of large space and high barriers, allowing relevant leading manufacturers to fully benefit from industry growth.

Welcome all automotive industry chain (including electrification industry chain) angel round and A-round companies to join the group(Friendliness connects with 500 automotive investment institutions, including top-tier institutions; some quality projects will be selected for thematic roadshows to existing institutions);There are communication groups for science and technology innovation companies, automotive manufacturing, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking, etc. For joining, please scan the administrator’s WeChat (please indicate your company name)