Rockchip Electronics Co., Ltd. is a wholly-owned domestic professional integrated circuit design company and a nationally recognized integrated circuit design enterprise, focusing on the research and development of digital audio and video, and mobile multimedia chipsets.

1.Business Overview

-

Core Business Areas

- AIoT Chips: Covering smart home, industrial vision, robotics, and other fields, the flagship product RK3588 adopts an 8nm process technology, integrating a self-developed NPU with 6TOPS computing power, supporting 8K video decoding and multi-screen display, applied in complex scenarios such as BYD’s smart cockpit “one chip drives seven screens”.。

- Automotive Electronics: Automotive-grade chip RK3588M enters the pre-installed market of 15 models including BYD and NIO, with a projected 300% year-on-year growth in automotive electronics revenue in 2024, rapidly increasing market share in smart cockpits.。

- Machine Vision and Industrial Control: RV1106/RV1126 chips have over 30% market share in security monitoring and AR glasses, applied in industrial scenarios such as safety monitoring of port tower cranes, with leading real-time data analysis capabilities.。

Technical Advantages

- Process Upgrade: The widespread adoption of 12nm/8nm processes has reduced flagship chip power consumption by 35%, with NPU computing density reaching 6TOPS, suitable for edge AI model deployment (e.g., 0.5B-3B parameter models).。

- Heterogeneous Computing Architecture: Supports edge computing and near-memory computing, compressing latency to microsecond levels, achieving a 300% improvement in inference efficiency in smart wearable devices and industrial robots.。

2.Fundamental Analysis

-

Financial Performance

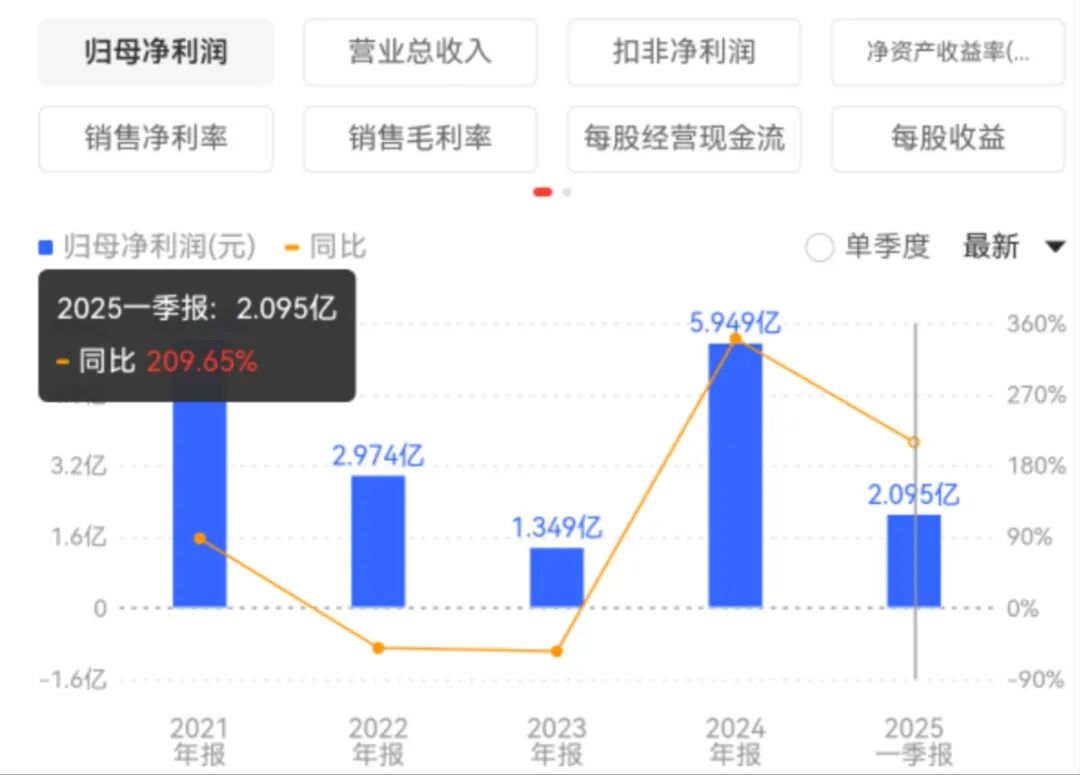

- Explosive Growth in Performance: In Q1 2025, revenue reached 885 million yuan (up 62.95% year-on-year), net profit was 209 million yuan (up 209.65% year-on-year), with a gross margin reaching a historical high of 40.95%, mainly due to product structure optimization and an increase in high-margin orders.。

- R&D Investment Intensity: In 2024, R&D expenses reached 569 million yuan (18.2% of revenue), focusing on 12nm/8nm process iteration and AI algorithm optimization, with a total of 679 invention patents obtained.。

- Healthy Cash Flow: In 2024, net operating cash flow increased by over 100% year-on-year, with a debt-to-asset ratio maintained below 30%, demonstrating strong financial stability.。

Market Position

- Pioneer in Domestic Substitution: Smart cockpit chips have replaced NVIDIA Jetson, with the proportion of Xinchuang orders increasing to 25%, winning the bid for a 2 billion yuan smart computing center project in the Guangdong-Hong Kong-Macao Greater Bay Area.。

- Global Competitiveness: The RK3588 series has entered the supply chains of international clients such as Sony and Alibaba, with a global market share of over 10% for AIoT chips.。

3.2025 Investment Value Analysis

-

Growth Drivers

- Explosion in AIoT Demand: The global AIoT chip market is expected to reach 1.2 trillion USD by 2025, with the company’s edge computing chips accelerating penetration in smart security and industrial robotics.。

- Automotive Electronics Expansion: Automotive chips are being deployed in projects covering Li Auto, BYD, and other automakers, with automotive electronics revenue expected to exceed 20% by 2025, maintaining a gross margin above 40%.。

- Policy Dividends: Support from the National Integrated Circuit Industry Fund combined with Xinchuang demand enhances the certainty of domestic substitution.Deeply integrated with HarmonyOS (adapting to over 150 million devices), contributing to the core code of OpenHarmony (accounting for 3.2%).

Valuation and Risks

- Supply Chain Volatility: The 12nm process relies on SMIC for foundry, and tight capacity may restrict delivery.;

- Pressure from Technological Iteration: Competitors like NVIDIA and Huawei Ascend are accelerating competition in edge computing chips, intensifying market share battles.。

- Valuation Levels: As of April 30, 2025, the current valuation is 71.411 billion yuan, with a PE (TTM) of 96.93 times, significantly higher than the semiconductor industry average (PE 58.93 times), reflecting some future expectations, but considering high growth expectations, PEG is about 1.2 (reasonable range 0.8-1.5).。

-

In conclusion,

Rockchip, leveraging its technological barriers and dual tracks in AIoT and automotive electronics, is expected to maintain a performance growth rate of over 50% in 2025. The current valuation matches its growth potential, with a focus on Q2 revenue and growth rate, making it a core target for semiconductor domestic substitution considerations.。

Disclaimer: This content is for informational reference only and does not constitute specific investment advice.