As Zhou Yu has always insisted:

Champion enterprises, especially invisible champions, should be looked at more closely, and regardless of how the outside world changes, the industry still needs to upgrade, and domestic products must replace imports.

Zhou Yu started to layout from March 14Chuan Yi Co., Ltd., with two rounds of increased holdings in between, especially during those two days of extreme panic, because of optimism, it can be considered as a unity of knowledge and action.

All of this has been recorded and shared on a certain platform.

As of this morning, there has been a floating profit of over 20%, friends who followed have surprises, and those who are not at ease can reduce by 20%, the remaining shares Zhou Yu plans to continue holding.

Regarding Chuan Yi, everyone can also take a look at “The Leading Company in Industrial Automation Instruments, Central Enterprise ‘Premium Acquisition’, Less than 15 PE?” written here.

Parting with some is not because of pessimism, but Zhou Yu’s own habit, hoping to lower costs a bit, making oneself less passive, and having a better holding experience.

………

At the beginning of February, Zhou Yu shared about Rockchip “Rockchip: Challenging HiSilicon, Sprinting to Become the First Domestic SOC Chip Company Worth 100 Billion?”.

After a month of high-level fluctuations, and a few days ago following the market’s breakdown, Zhou Yu decided to talk about Rockchip again.

The industry perspective has not changed significantly, as Zhou Yu is not playing short-term, but due to stock price issues, the investment view has changed, everyone can jump directly to the conclusion at the end of the article..

This article will still answer the following questions:

Is Rockchip, valued at 60.2 billion, expensive?

Will it still become the first domesticSOC chip company with a market value of 100 billion?

Will Rockchip become the next Hanwang?

Additionally, what are the differences between SOC chip companies like Allwinner, Hengxuan Technology, Zhongke Lianxun, and Fuhang Microelectronics compared to Rockchip?

01

Main Business

Rockchip is a familiar name, many friends should have paid attention when the AI industry in 2023 just emerged.

Because its main business isSOC chip design and sales.

To elaborate,SOC chips are a crucial part of the AIOT (Artificial Intelligence of Things) industry.

For example, in Xiaomi’s Xiao Ai smart speaker, various brands of smartphones, and wearable electronic watches, its presence can be seen.

Even in smart driving cars on the road and the Yushu robot performing on the Spring Festival Gala, it is indispensable.

And the reason these electronic products are intelligent is thatthey have a “brain”, and SOC chips are the key components in their “brains”.

Generally speaking, the functions of SOC chips equipped in different electronic products vary.

If it is for the Xiao Ai smart speaker, it integrates voice processing and network connectivity functions;

If it is for smartphones, it integratesCPU, GPU, communication modules, etc.

And if it is for the recently popular humanoid robots, the integrated functions are even more.

Rockchip’sSOC chips are mainly applied to automotive cockpit, tablets, and set-top boxes, previously mentioned to have been introduced into the Yushu robot dog, and there may be more collaborations in the future.

This is also a major reason for its strong performance at the beginning of the year, and Zhou Yu will elaborate on Rockchip’s prospects later, but for now, let’s put this aside.

02

Financial Situation

So how is Rockchip’s financial situation?

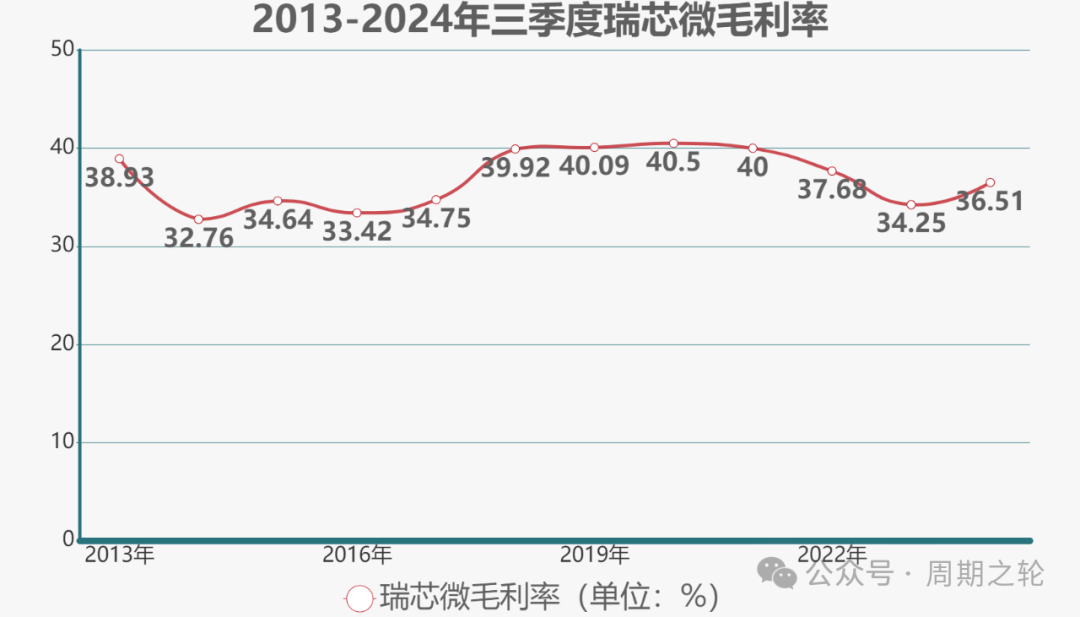

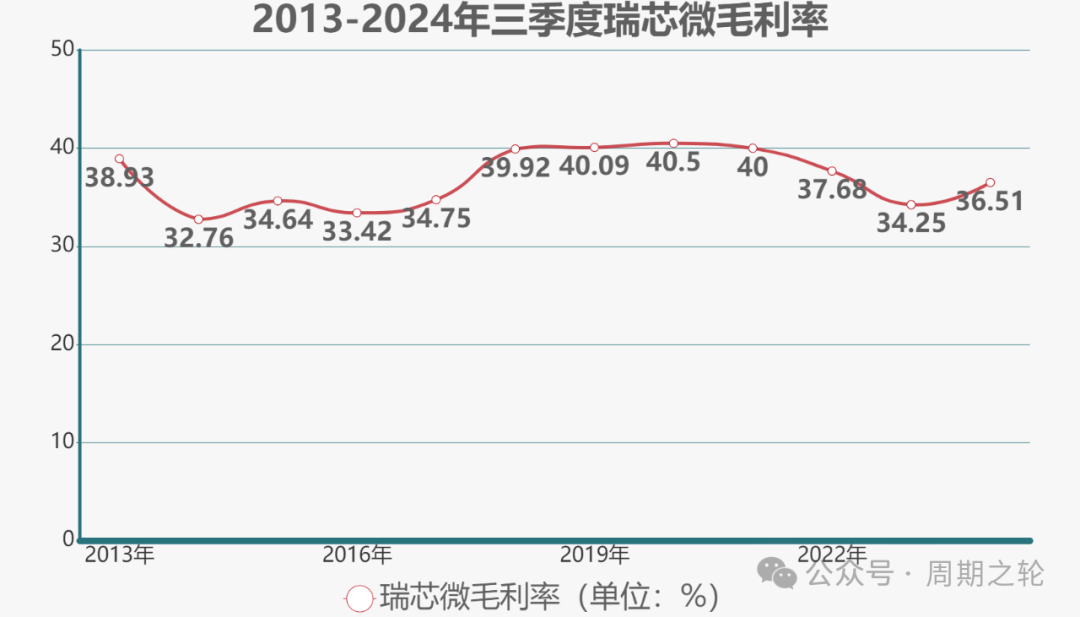

Zhou Yu first looked at the gross profit margin, which reached 36.51% in the third quarter of 2024, meeting the expected passing line.

Looking at it over a longer period, from 2013 to now, the company’s gross profit margin has been above 32%, with some years even exceeding 40%.

From 2014 to 2023, the company’s revenue grew from 1.021 billion to 2.135 billion, an increase of 1.09 times, while net profit increased by 1.45 times during the same period.

It is worth mentioning that the highest revenue and net profit in the company’s history occurred in2021.

In 2022, there was a decline of 25% and 50%, and signs of recovery only began to appear in the fourth quarter of 2023.

This was expected, as the entire semiconductor industry experienced a winter during those two years.

In terms of assets, the highest proportion of Rockchip’s assets is cash, exceeding40%, followed by inventory and accounts receivable, accounting for 23.76% and 10.88%, respectively.

There is basically no short-term or long-term debt, and the debt-to-asset ratio is only13.52%.

Chip design companies indeed do not earn hard money.

Zhou Yu recalls the storage company Zhaoyi Innovation, which is similar, with a low debt ratio of just over 10%, and nearly 10 billion in cash, unlike those heavy asset operating companies.

However, this is determined by the business model, which cannot be completely changed; it can only be said that after widening the moat, the gross profit margin can be gradually improved.

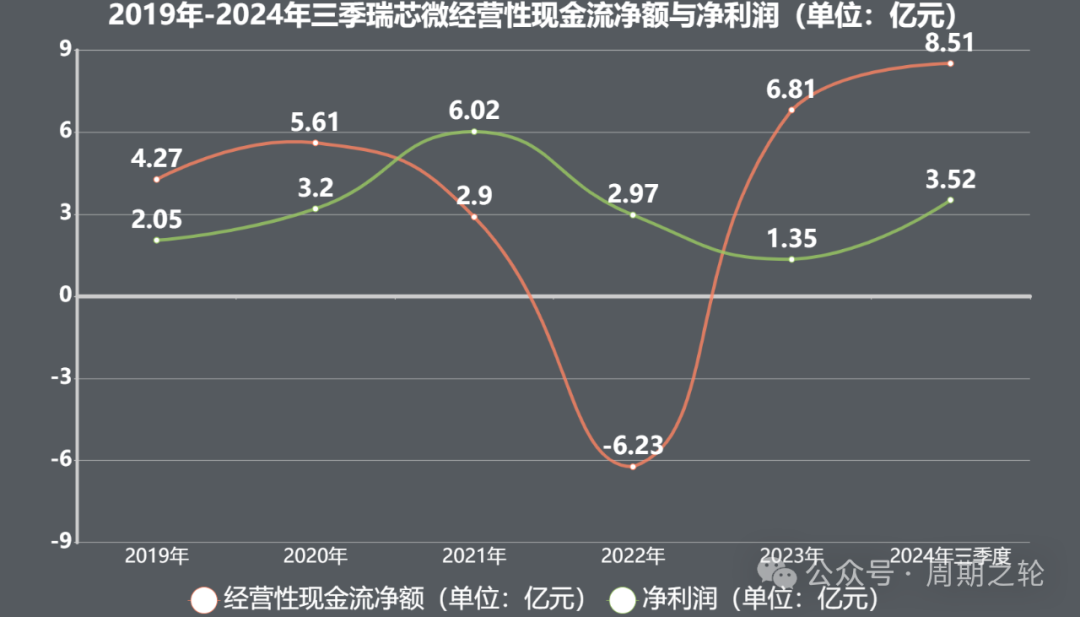

In terms of profit quality, the company’s operating cash flow net amounts from 2019 to the third quarter of 2024 were 427 million, 561 million, 290 million, -623 million, 681 million, and 851 million, respectively.

The net profits during the same period were205 million, 320 million, 602 million, 297 million, 135 million, and 352 million.

Except forthe significant increase in inventory caused by the industry winter in 2022, Rockchip’s operating cash flow net amount has generally been greater than net profit.

Moreover, since 2022, the company’s inventory has been gradually decreasing.

As of the third quarter of 2024, it has decreased from 1.464 billion at the end of 2022 to 926 million.

In terms of R&D, in the past six years, the company’s R&D expense ratio has remained above 20%, which is quite good.

Overall, Zhou Yu believes that Rockchip’s financial situation is still good, with low debt, decent cash flow, and sufficient R&D investment.

03

Company Prospects

So, is Rockchip, valued at 78 billion, expensive?

Will it become the first domesticSOC chip company with a market value of 100 billion?

This statement is not made by Zhou Yu, but comes from some voices online, and some have even begun to ask if Rockchip will become the next Hanwang.

Will it or not? This leads us to discuss Rockchip’s future growth.

Before discussing future growth, Zhou Yu wants to break down the underlying reasons for the recent strong performance of SOC chips, or why Rockchip’s rise has been so fierce this time.

At the beginning, I shared with you what SOC chips are; actually, we can be more specific here.

Several domestic SOC chip companies have significant differences in downstream application industries, as follows:

Hengxuan Technology mainly produces Bluetooth and audio SOC chips, with some AIOT, and has confirmed cooperation with ByteDance to produce AI glasses;

Zhongke Lianxun also has cooperation with ByteDance, but not for glasses but forAI headphones, as its SOC chips are mainly used in Bluetooth and smart headphones;

Lexin Technology also cooperates with ByteDance, but forAI toys, its products are mainly applied in Bluetooth, WIFI, and smart headphones.

As forAmlogic, Allwinner Technology, and Fuhang Microelectronics, these three currently do not have cooperation with ByteDance:

Amlogic is the leader in set-top box SOCs, Allwinner is in industrial and automotive,and Fuhang Microelectronics mainly produces video processing SOCs, a major supplier for Hikvision, and is said to be launching AI glasses chips this year.

So what about our protagonist today—— Rockchip?

Automotive cockpit, tablets, and set-top boxes.

The technical content of the first two is actually quite high, with Qualcomm being the leader overseas and Huawei’s HiSilicon being the domestic leader.

Rockchip’s smart driving cockpit chip was launched in 2021, but it seems to have made little splash.

The reason it has become the market focus this time is mainly due to its integration into the Yushu robot.

As we all know, the performance of robots has been very strong in recent months, and Zhou Yu has previously emphasized that2025 will be the commercialization year for humanoid robots from 1 to 100, with repeated catalysts.

Of course, the strong performance of Rockchip and other SOC chips is not only due to humanoid robots but also influenced by the progress of domestic AI large models, such as Doubao and DeepSeek, especially DeepSeek.

The reason is simple, before DeepSeek, everyone was piling up hardware, and costs were too high, making it difficult for various downstream applications to achieve large-scale commercialization.

However, DeepSeek has lowered costs, making edge-side AI operations more universal, accelerating the arrival of the era of intelligent connectivity, so these SOC chips have been “focused on” by everyone.

Of course, compared to CPU and GPU chips, some SOC chips do not have such high computing power requirements in certain fields, and many SOC chip manufacturers can easily achieve performance results and benefit from the dividends, such as AI glasses.

Returning to Rockchip’s growth in the next two to three years.

Zhou Yu personally believes that the SOC industry is likely to maintain rapid growth in the coming years.

On one hand, this industry is developing rapidly.

According toIDC’s forecast:

By 2025, the number of global IoT devices will exceed 41 billion, generating massive amounts of data;

In the next five years, the global computing power scale will continue to grow at a compound annual growth rate of over50%, with nearly half of the data relying on edge or edge computing.

That is to say, relying onSOC chips for processing.

On the other hand, there is a demand for domestic substitution.

As a leading domestic SOC chip company with decent fundamentals, Rockchip is very likely to benefit from industry dividends.

04

Company Valuation

However, investment still needs to leave some safety margin; good companies also need to be matched with good prices.

Currently, Rockchip’s total market value has reached60.2 billion (it rose slightly to 62 billion in the morning).

The company previously released a performance forecast for 2024, expecting annual net profit excluding non-recurring items to be between 490 million and 570 million.

Assuming a compound annual growth rateof 50%, it should be around 1.6 billion in three years; assuming the market value remains unchanged, this corresponds to a price-to-earnings ratio of about 37 times.

Zhou Yu personally believes that at this position, Rockchip actually has a certain cost performance, but the safety margin may be a bit lacking; it would be better if more could be invested.

As for whether it can reach 100 billion in the short term, if market sentiment is too high, it cannot be ruled out, but personally, I prefer to leave some safety margin.

As for whether it can reach 100 billion in two to three years, we still need to continue tracking.

Many times, a company that is promising does not necessarily have a good price, but we still need to research and track long-term; otherwise, when the golden opportunity arises, we may not be able to seize it.

What do you think?

Welcome to discuss in the comments.

Wishing everyone a prosperous account!

Disclaimer:1. The stock market has risks; invest cautiously;2. The individual stocks mentioned in the article are only Zhou Yu’s personal investment records, for reference only, and do not constitute investment advice!