This week, the ChiNext Index led the two markets, with growth styles initially prevailing. Communications equipment and innovative pharmaceuticals surged, with industry leaders like New Yisheng and Shenghong Technology reporting significant mid-year earnings increases, pushing their market values above one trillion and continuously reaching new highs, contributing significantly to the ChiNext Index’s gains. Institutional funds have begun to become active, boldly investing in mid-to-large-cap growth stocks, and the market’s profit effect has clearly strengthened.

The GDP growth rate in the first half of the year exceeded expectations, reflecting a recovery in confidence about the future. Slightly better economic data, along with endless speculative trading in bank stocks and micro-cap stocks, has led to stagnation or loosening. The dividend yield of the four major banks has fallen below4%, with half of the micro-cap companies reporting losses, and the other half averaging aPE of 150. It is hard to see how they compare to companies with good cash flow and a PE generally in the range of ten to twenty in the consumer sector, as well as technology companies with high growth potential, whose performance and demand are gradually being realized.

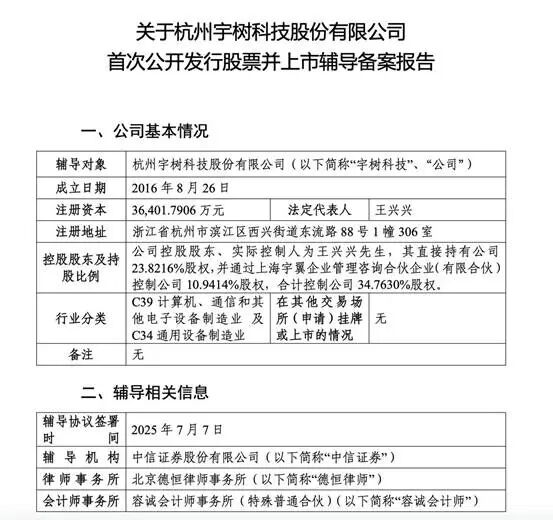

This weekend, the news that Yushu Technology officially launched itsIPO is undoubtedly exciting, as it signifies that the robotics industry, the most important branch of AI applications, has welcomed a leading company similar to Ningde and BYD. The robotics market has reached a point where the speculative trading in the 0-1 phase, which disregarded valuations, has basically ended. Companies related to this theme have already seen significant increases, and further substantial rises will be challenging. The next phase is 1-10, characterized by order-driven performance growth, where industry leaders may experience a “Davis Double” and a tenfold increase, representing the greatest investment opportunity. Although Yushu Technology may not ultimately be the leading company in robotics, it is undoubtedly one of the scarce industry leaders at present.

In the technology sector, the main focus for the second half of the year is onAI applications, innovative pharmaceuticals, and semiconductors. NVIDIA’sH20 chip has resumed supply to China, which will objectively accelerate the development ofAI applications. It is advisable to prioritize investments in robotics and internet e-commerce, which are the two areas most likely to yield results. Focus Technology reached a ten-year high on Friday, and Wolong Electric Drive, which is an indirect shareholder of Yushu Technology and a direct shareholder of Zhiyuan Robotics, will undoubtedly benefit directly from the listing of leading companies and industry development.

The semiconductor sector continued to experience fluctuations and adjustments this week, understood as a response from risk capital to the call for new quality productivity companies. Research and low-cost buying are the way to go. Looking at the attitude of northbound funds towards large-cap hard technology semiconductor companies in the second quarter, SMIC increased its holdings by70%, and Northern Huachuang has increased its holdings for two consecutive quarters, with Changdian Technology, Lanke Technology, and others also generally increasing their holdings. We should maintain confidence and patience, welcoming a similar explosive market for leading semiconductor companies like theCPO industry. We do not know when it will come, but it will certainly not be absent.

As for innovative pharmaceuticals, there is not much to say; it is a highly certain technology growth track. The Hong Kong stock market has already produced12 times the innovative pharmaceutical companies, creating a benchmark effect. Leading companies in the A-share market, such as Heng Rui, are expected to see5-10 times increases in the future, which is not excessive.

This weekend’s discussions with Meituan and JD.com indicate that the anti-involution measures are further advancing and entering the implementation stage through administrative means. Acknowledging insufficient demand and deflation, being able to face the problem, whether it is anti-involution or boosting domestic demand, is the start of solving the problem. Wuliangye and Luzhou Laojiao have both seen nine consecutive days of gains, showing signs of institutional fund absorption. The bottom that emerged under the liquor ban is more reliable. Moreover, investment is about cash flow and dividends; many leading consumer companies, with low valuations+ high cash flow and high dividends, are already a once-in-five or ten-year opportunity.

The two markets continue to rotate upward, targeting3650. Market volatility is decreasing, which is favorable for allocating funds, and a slow bull trend is increasingly evident. During the style transition phase, there is a high probability of a single-day crash in late July, so do not chase the rise and avoid industries and companies that have surged in the short term. There are many good industries and companies at the bottom, including consumer and technology sectors, which are sufficient for investment.

#A股 #股市