Remember to star the public account ⭐️ to receive notifications promptly.

Source: ContentTranslated fromtheregister.

Arm-based servers are rapidly gaining attention in the market, with shipments expected to grow by 70% by 2025. However, this still falls significantly short of the chip designer’s goal of capturing half of the global data center CPU sales by the end of this year.

Market research firm IDC states that the widespread interest in Arm servers is primarily due to the introduction of large rack-scale configurations, such as the Nvidia DGX GB200 NVL72 systems designed specifically for AI processing.

In its latest global quarterly server tracking report, IDC estimates that Arm architecture-based servers will account for 21.1% of global shipments this year, rather than the 50% claimed by Arm’s infrastructure head, Mohamed Awad, in April.

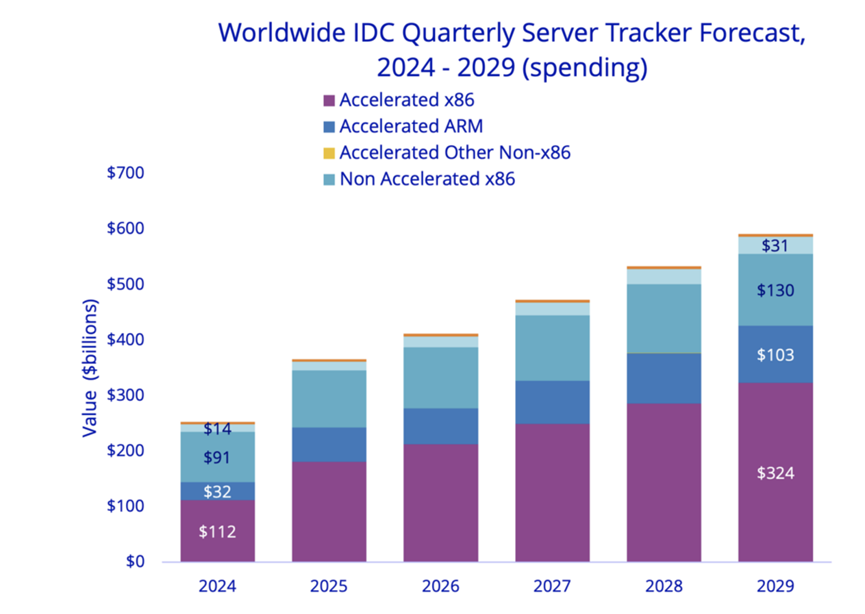

Servers equipped with at least one GPU (often referred to as AI-enabled) are expected to grow by 46.7%, nearly accounting for half of this year’s market value. The rapid adoption by hyperscale customers and cloud service providers is driving the growth of the server market, with IDC indicating that the market size will double in just three years.

In the first quarter of 2025, the overall server market size reached a record $95.2 billion, a year-on-year increase of 134.1%. Consequently, IDC has raised its forecast for the annual server market size to $366 billion, an increase of 44.6%. This will be the highest level on record.

The “industry-standard” x86 segment is expected to grow by 39.9% by 2025, reaching $283.9 billion, while non-x86 systems are projected to grow at a faster rate, with a year-on-year increase of 63.7%, predicting a total of $82 billion.

IDC’s regional market forecasts show that the United States will experience the highest expansion, with a growth of 59.7% by 2024, and by the end of 2025, the U.S. will account for nearly 62% of total server revenue.

China is another region with strong sales growth, with IDC predicting a 39.5% increase, accounting for over 21% of global quarterly revenue. Growth rates in Europe, the Middle East, and Africa, as well as Latin America, are in the single digits, at 7% and 0.7%, respectively, while Canada is expected to see a decline of 9.6% this year due to an unspecified “very large deal” reached in 2024.

Kuba Stolarski, IDC’s Vice President of Global Infrastructure Research, commented on the growth of servers, stating that the demand for more computing power to handle artificial intelligence may persist.

“The evolution from simple chatbots to inference models to agent-based AI will require several orders of magnitude more processing power, especially in terms of inference capabilities.”

Global Server Market Soars 134% in Q1

According to the International Data Corporation (IDC) global server quarterly tracking report, the server market size reached a record $95.2 billion in the first quarter of this year, marking the highest quarterly growth rate ever, with a 134.1% increase compared to the first quarter of 2024.

This outstanding performance has raised market forecasts to a record $366 billion by 2025, representing a 44.6% increase compared to 2024. The x86 server market value is expected to grow by 39.9% by 2025, reaching $283.9 billion, while non-x86 servers will see a year-on-year increase of 63.7%, reaching $82 billion.

Servers with embedded GPUs are expected to grow by 46.7% compared to the same period last year, accounting for nearly 50% of this year’s total market value.

Hyperscale enterprises and cloud service providers continue to rapidly adopt servers with embedded GPUs, driving the growth of the server market, which is expected to double in just three years.

Thanks to the introduction of large rack-scale configurations, Arm-based servers are rapidly gaining attention in the market, with a growth rate of 70.0%, accounting for 21.1% of total annual shipments.

Kuba Stolarski, Vice President of Worldwide Infrastructure Research, stated, “The Stargate project has reaffirmed its commitment to invest up to $500 billion in AI infrastructure to help build Artificial General Intelligence (AGI). Shortly thereafter, the release of DeepSeek’s R1 inference model raised concerns about the necessity of investing so much in infrastructure.”

The infrastructure required for R1 is more than reported, and the evolution from simple chatbots to inference models to agent-based AI will require several orders of magnitude more processing power, especially in terms of inference. Improving model creation efficiency is an expected goal in the industry, and indeed, it is the industry’s target.

Stolarski added, “Efficient models will use fewer resources, allowing for better scalability in multi-user environments, achieving advanced inference, and potentially ultimately realizing AGI.”

The United States is the fastest-growing region in the server market, with a growth of 59.7% compared to 2024, accounting for nearly 62% of total revenue in 2025.

China’s growth rate is also higher than other regions, with a projected year-on-year increase of 39.5% by 2025, accounting for over 21% of global quarterly revenue. Japan and the Asia-Pacific region (excluding Japan) are expected to achieve double-digit growth this year, at 33.9% and 10.8%, respectively.

Europe, the Middle East, and Africa, as well as Latin America, are showing single-digit growth rates of 7.0% and 0.7%, respectively, while Canada is experiencing negative growth of -9.6% due to an unusually large deal in 2024.

Global Server Market Value to Reach $366 Billion by 2025

According to the International Data Corporation (IDC) global server quarterly tracking report, the server market forecast has been raised to a record $366 billion by 2025, representing a 44.6% increase compared to 2024.

By 2025, the x86 server market size is expected to grow by 39.9%, reaching $283.9 billion, while the non-x86 server market size is projected to grow by 63.7%, reaching $82 billion. Servers equipped with embedded GPUs are expected to grow by 46.7% year-on-year, accounting for nearly 50% of the total market size for the year. Hyperscale servers and cloud service providers continue to rapidly adopt servers with embedded GPUs, driving the growth of the server market, which is expected to double in just three years. Thanks to the introduction of large rack-scale configurations, Arm-based servers are rapidly rising in the market, with a growth rate of 70.0%, accounting for 21.1% of total annual shipments.

The “Stargate” project has reaffirmed its commitment to invest up to $500 billion in AI infrastructure to support the development of Artificial General Intelligence (AGI). Shortly thereafter, the release of DeepSeek’s R1 inference model raised concerns about the necessity of investing so much in infrastructure,” said Kuba Stolarski, Vice President of Worldwide Infrastructure Research. “The infrastructure required for R1 is more than reported, and the evolution from simple chatbots to inference models to agent-based AI will require several orders of magnitude more processing power, especially in terms of inference. Improving model creation efficiency is an expected goal in the industry. Efficient models will use fewer resources, thus potentially achieving better scalability in multi-user environments, enabling advanced inference, and possibly ultimately realizing AGI.”

The United States is the fastest-growing region in the server market, with a growth of 59.7% compared to 2024, accounting for nearly 62% of total revenue in 2025. China’s growth rate is also higher than other regions, with a projected year-on-year increase of 39.5% by 2025, accounting for over 21% of global quarterly revenue. Japan and the Asia-Pacific region (excluding Japan) are expected to achieve double-digit growth this year, at 33.9% and 10.8%, respectively.

Reference link

https://www.theregister.com/2025/06/30/arm_server_shipments/

*Disclaimer: This article is original by the author. The content reflects the author’s personal views, and Semiconductor Industry Observation reproduces it solely to convey a different perspective, which does not represent Semiconductor Industry Observation’s endorsement or support of the view. If there are any objections, please contact Semiconductor Industry Observation.

END

This is the 4081st issue shared by “Semiconductor Industry Observation”. Welcome to follow.

Recommended Reading

★A Chip That Changed the World

★U.S. Secretary of Commerce: Huawei’s Chips Are Not That Advanced

★“ASML’s New Lithography Machine, Too Expensive!”

★The Quiet Rise of Nvidia’s New Competitors

★Chip Crash, All Blame Trump

★New Solutions Announced to Replace EUV Lithography!

★Semiconductor Equipment Giants, Salaries Soar by 40%

★Foreign Media: The U.S. Will Propose Banning Software and Hardware Made in China for Cars

Star the public account ⭐️ to receive notifications promptly, the small account to prevent loss.

Like and share!

Request for recommendations!