Today, robots are still the stars of the show.In the morning, PEEK remains strong; I must say this wave of PEEK has indeed exceeded expectations, rising strongly from a low position.After that, it began to spread.In the afternoon, some started talking about Zhiyuan, and it began to circulate after the market closed. To be honest, there were rumors about the big guy’s itinerary a few days ago, and when I saw it, I broke out in a cold sweat. Is it really safe for investors to spread such things?The market is circulating this image.

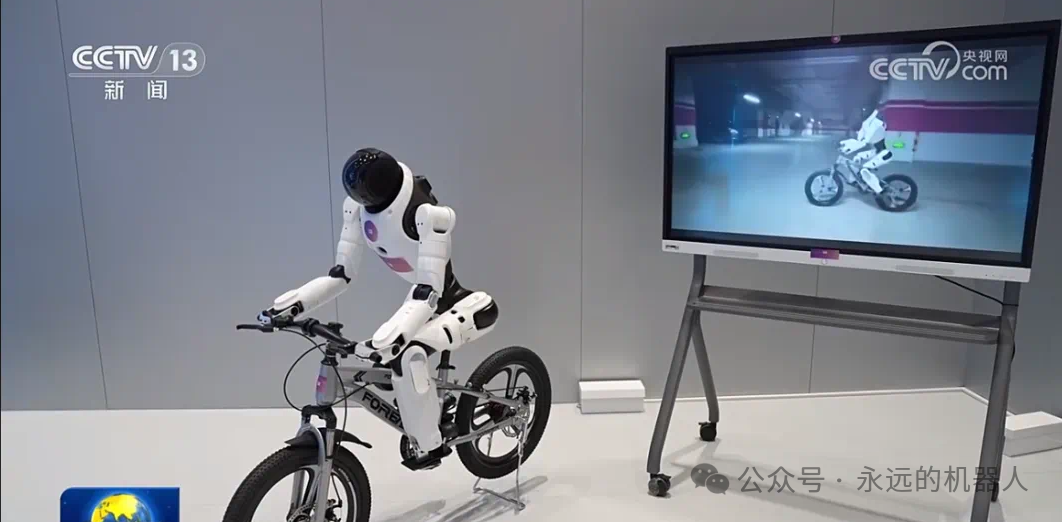

Today, robots are still the stars of the show.In the morning, PEEK remains strong; I must say this wave of PEEK has indeed exceeded expectations, rising strongly from a low position.After that, it began to spread.In the afternoon, some started talking about Zhiyuan, and it began to circulate after the market closed. To be honest, there were rumors about the big guy’s itinerary a few days ago, and when I saw it, I broke out in a cold sweat. Is it really safe for investors to spread such things?The market is circulating this image. The robot next to it, the Qingtong robot, has been completely overlooked by everyone.

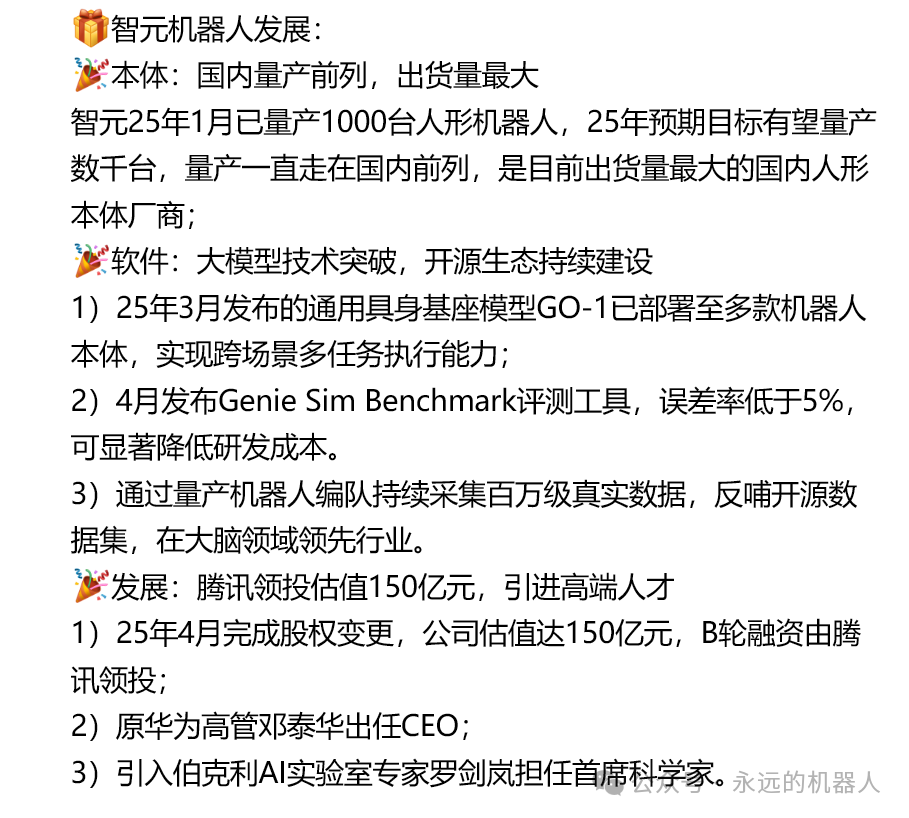

The robot next to it, the Qingtong robot, has been completely overlooked by everyone. All along, the planet has expressed its importance to Zhiyuan; at least from an industrial investment perspective, Zhiyuan is indeed far ahead in the primary market.

All along, the planet has expressed its importance to Zhiyuan; at least from an industrial investment perspective, Zhiyuan is indeed far ahead in the primary market. In the evening, it even appeared on CCTV.

In the evening, it even appeared on CCTV. A sell-side analyst wrote a piece.

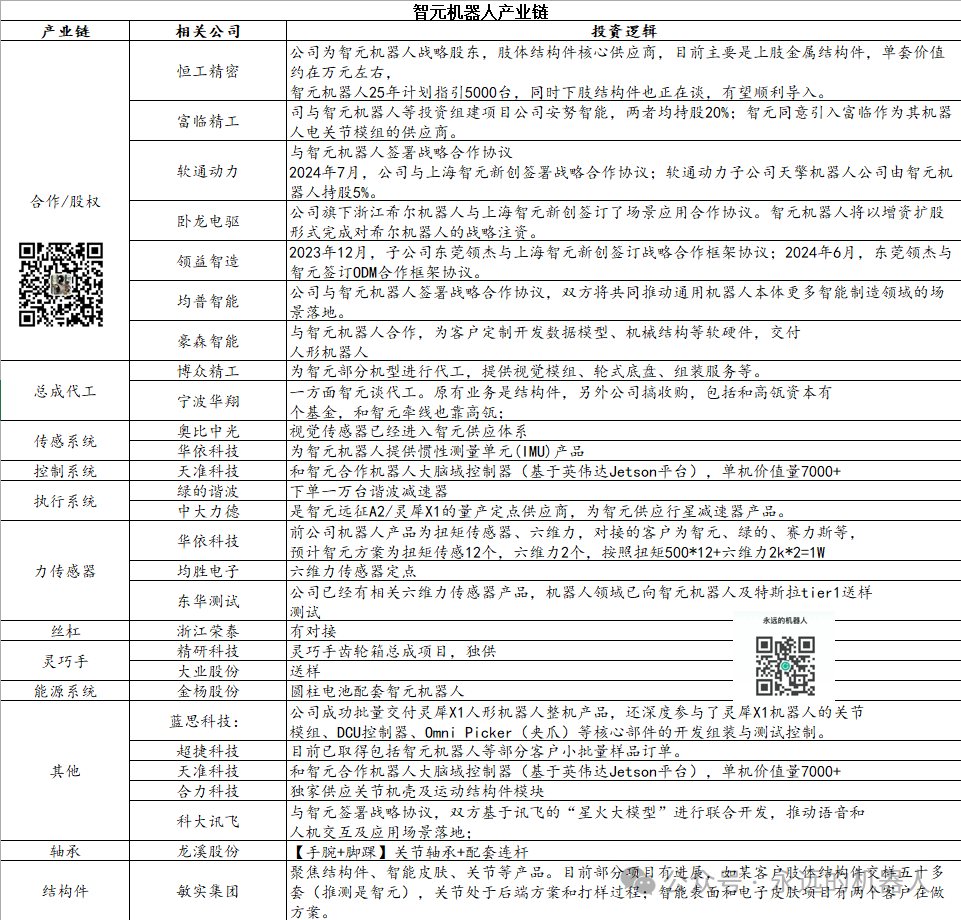

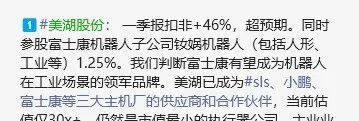

A sell-side analyst wrote a piece. What everyone is most concerned about is actually the Zhiyuan industrial chain; this year, stock trading is once again in focus.Zhiyuan’s supply chain strategy is relatively mature, and there are quite a few players involved.

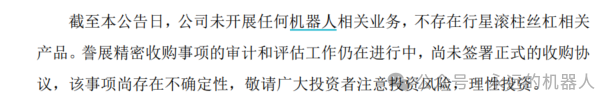

What everyone is most concerned about is actually the Zhiyuan industrial chain; this year, stock trading is once again in focus.Zhiyuan’s supply chain strategy is relatively mature, and there are quite a few players involved. The public account and the planet have previously organized information.The market is paying attention to theRedick announcement; it all depends on whether the story holds up and whether the market believes it.

The public account and the planet have previously organized information.The market is paying attention to theRedick announcement; it all depends on whether the story holds up and whether the market believes it. As one of the earliest targets associated with Rongtai in the planet (this does not constitute investment advice).

As one of the earliest targets associated with Rongtai in the planet (this does not constitute investment advice). This trend is also quite remarkable.The market’s jokes are quite fierce.Zhejiang Rongtai also released its performance; many were worried that the performance would be below expectations, but now it seems not too exaggerated.

This trend is also quite remarkable.The market’s jokes are quite fierce.Zhejiang Rongtai also released its performance; many were worried that the performance would be below expectations, but now it seems not too exaggerated.

2024: Revenue 1.135 billion, year-on-year +42%, net profit attributable to the parent company 230 million, year-on-year +34%, gross margin 34.55%, net profit margin 20%. By business: New energy revenue 900 million, year-on-year +56%, gross margin 40%, non-new energy product revenue 240 million, year-on-year +4.8%, gross margin 13%. By region: Domestic sales 560 million, year-on-year +18%, gross margin 26.2%; foreign sales 570 million, year-on-year +76%, gross margin 42.6%. Annual mica sales 25,800 tons, year-on-year +34.4%.

2025 Q1: Revenue 266 million, year-on-year +24%/quarter-on-quarter -18%, net profit attributable to the parent company 60 million, year-on-year +27%/quarter-on-quarter -7%, gross margin 35.7%, net profit margin 22.4%. As a core target in the T chain, T’s sales were under pressure in Q1, but the company showed very strong resilience, with multiple overseas projects, especially in Europe, continuing to exert force to offset the impact.

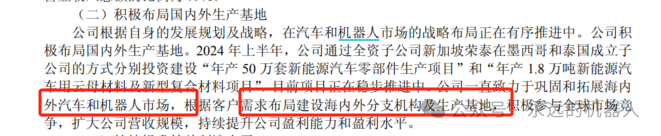

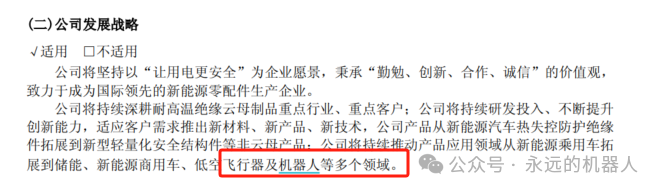

Annual report’s description of robots.

General Zhang from Yongying bought quite a few small targets.

General Zhang from Yongying bought quite a few small targets. The number of shareholders is manageable.

The number of shareholders is manageable. Tomorrow, let’s listen to what the company has to say.

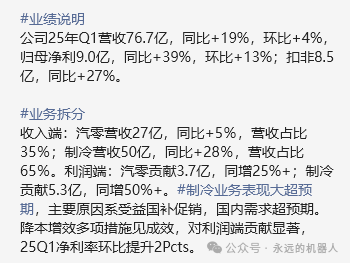

Tomorrow, let’s listen to what the company has to say. Sanhua released its performance.

Sanhua released its performance. Friends who carefully observe the planet know that the company has already discussed the Q1 report at the shareholders’ meeting.The market should have expectations; the core reason is

Friends who carefully observe the planet know that the company has already discussed the Q1 report at the shareholders’ meeting.The market should have expectations; the core reason is Top’s performance was disappointing, which should also have been expected; some major clients indeed performed quite poorly in Q1.

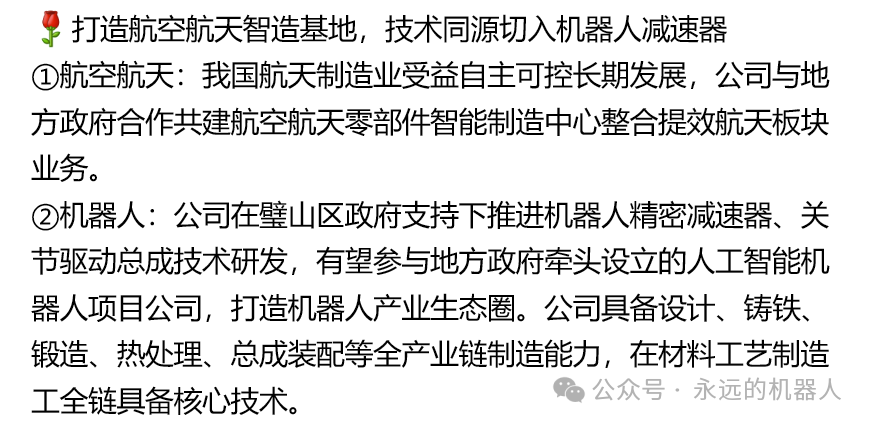

Top’s performance was disappointing, which should also have been expected; some major clients indeed performed quite poorly in Q1. Let’s see what Boss Wu is prepared to say.Meihua Co., Ltd. also has a new story.

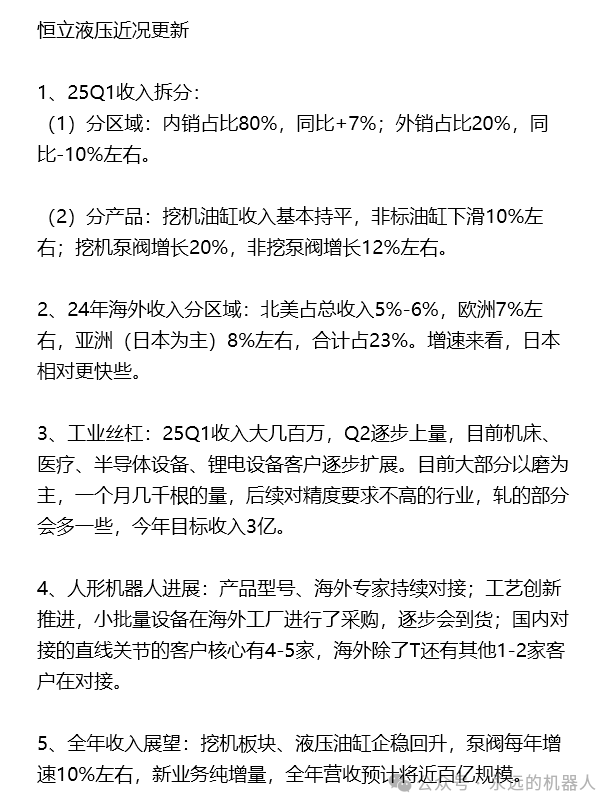

Let’s see what Boss Wu is prepared to say.Meihua Co., Ltd. also has a new story. Hengli Hydraulic (yesterday).

Hengli Hydraulic (yesterday). This news today corresponds with the previously focused screw rod equipment (using cars instead of grinding).

This news today corresponds with the previously focused screw rod equipment (using cars instead of grinding). Previously, I shared the product and process situation of Hanbleg on the planet.Huichuan’s boss’s statement has once again boosted morale.

Previously, I shared the product and process situation of Hanbleg on the planet.Huichuan’s boss’s statement has once again boosted morale. Those playing with electricity actually lack mechanical capabilities, but it’s not impossible to achieve.Others

Those playing with electricity actually lack mechanical capabilities, but it’s not impossible to achieve.Others

Haoneng Co., Ltd.: Q1Net profit excluding non-recurring items100 million2hundred million, year-on-year growth27.46%, exceeding expectations;

Landai Technology’s Q1 report shows that the company’s operating revenue is813 millionyuan, a year-on-year increase of8.1%; net profit excluding non-recurring items is44.06million, a year-on-year increase of119.3%;

Yongmaotai:In the first quarter of 2025, net profit14.52million, a year-on-year increase of42.12%, excluding non-recurring items14.46million, a year-on-year increase of1027%;

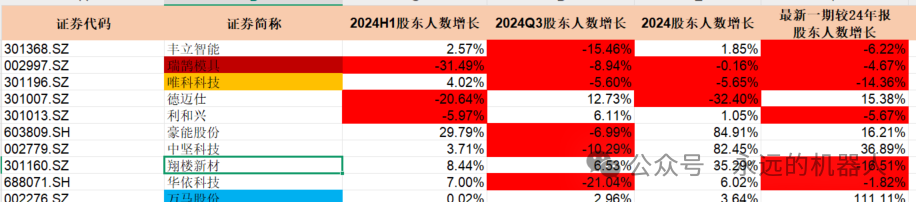

There are also many performance exchange meetings and performance reports, so I won’t elaborate on them one by one.Finally, I made a table to summarize the changes in the number of shareholders for various robot companies.This indicator has always been of personal interest to me.No matter how good the story is, if the number of shareholders increases too much, then the chips must have problems. For example, The detailed statistical table is placed in the planet, everyone can take it.I still see many unexpected places; for example, some stocks that the market generally views positively have seen a sharp increase in the number of shareholders.Some stocks that are ignored or still trending have a good number of locked shareholders.The holiday is coming soon; happy May Day to everyone!!! The robots will fight again next month.

The detailed statistical table is placed in the planet, everyone can take it.I still see many unexpected places; for example, some stocks that the market generally views positively have seen a sharp increase in the number of shareholders.Some stocks that are ignored or still trending have a good number of locked shareholders.The holiday is coming soon; happy May Day to everyone!!! The robots will fight again next month.