The acquisition of Arm has finally concluded.

On September 14, 2020, NVIDIA officially announced that it would acquire Arm, a semiconductor design company under SoftBank Group, for $40 billion (approximately 273.32 billion RMB). NVIDIA will pay $21.5 billion in NVIDIA stock and $12 billion in cash, including an immediate payment of $2 billion.

If the deal goes through, it will be the largest merger and acquisition in the history of the semiconductor industry. $40 billion is also a significant amount for NVIDIA, which currently has a market capitalization of about $300.2 billion, and its total sales for 2019 were $10.918 billion. The acquisition of Mellanox in April this year was NVIDIA’s largest acquisition to date, amounting to $6.9 billion, and now this figure has been refreshed to $40 billion.

The soap opera of Arm’s sale seems to have finally reached a grand conclusion. SoftBank acquired Arm for $32 billion in 2016, at a time when NVIDIA’s market capitalization was also around that range; now NVIDIA’s market value has nearly increased tenfold, while Arm’s selling price has only increased by less than $10 billion, making it possible for NVIDIA to acquire Arm.

With the enormous scale and influence of NVIDIA combined with Arm, if the deal goes through, we will witness the birth of a semiconductor supergiant.

Can Complementarity Bring Them Together?

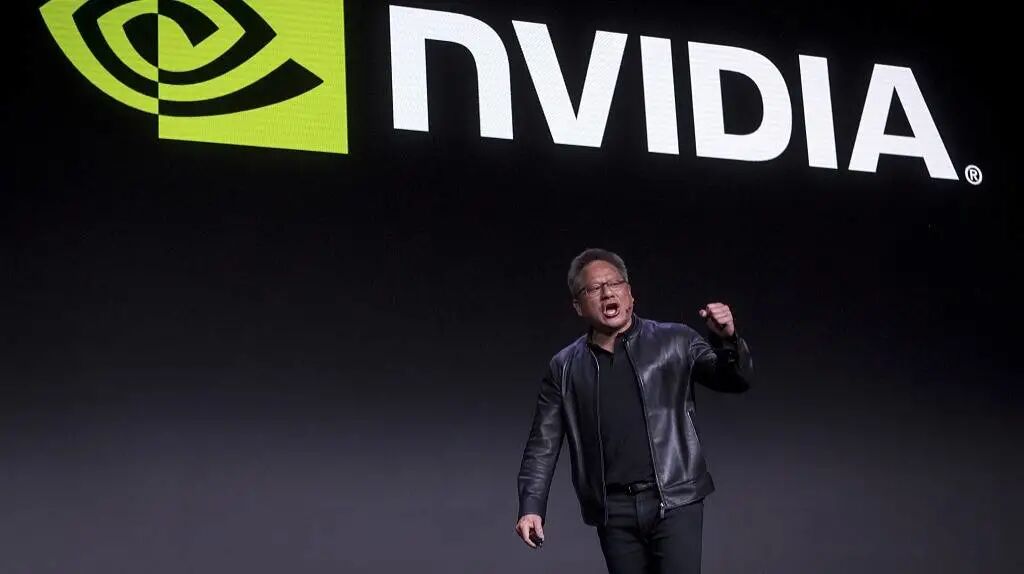

NVIDIA is one of the hottest companies in the tech industry today. In July of this year, NVIDIA surpassed Intel for the first time since its inception to become the highest-valued chip manufacturer in the U.S. and the third-largest semiconductor company globally, with a market cap nearly $100 billion ahead of Intel.

As for gaming, it remains solid in its core business. NVIDIA’s CEO Jensen Huang previously stated in a financial report meeting that the second half of 2020 could be one of the best gaming seasons ever. In the latest quarterly report, the data center business has surpassed gaming, becoming NVIDIA’s largest source of revenue, with 8 out of the top 10 supercomputers in the global TOP500 using NVIDIA GPUs. The data center is rising, and stories about autonomous driving and AI are convincing, all supporting the market’s optimism about NVIDIA’s business development potential.

NVIDIA previously launched the Tegra series processors based on the Arm architecture, but faced setbacks in mobile platforms like smartphones and tablets. However, the Tegra, having left the mobile space, remains active; for example, Nintendo’s Switch uses a customized Tegra X1 chip, and as of December 31, 2019, the Switch console sold 52.48 million units worldwide. In the automotive sector, many vehicle system chips (mainly for navigation and entertainment) from companies like Audi, BMW, and Tesla also come from NVIDIA’s Tegra. Currently, NVIDIA’s rapidly developing autonomous driving business also relies on the Tegra platform, making collaboration with Arm feasible.

At present, NVIDIA has almost no market share in smartphones, tablets, TVs, and IoT, and directly acquiring Arm could fill this gap. Conversely, while Arm has a dominant position in the mobile sector, it has almost no clients in desktop CPUs, GPUs, and data centers, which are NVIDIA’s traditional domains. Is it better for them to be similar or complementary? NVIDIA and Arm believe it is the latter.

The overlap in their businesses is minimal, which also expands the imaginative space. If the deal ultimately goes through, NVIDIA will become a super semiconductor enterprise with leading layouts in IP licensing and design, data centers, gaming, mobile, PC, servers, autonomous driving, AI, 5G, and IoT.

In the short term, this is a significant boon for sales and business. The agreement mentions that NVIDIA will expand Arm’s existing IP licensing strategy, and in the future, bundling sales could be a possibility.

In the long run, a comprehensive NVIDIA will become the “harvester” of the next era. Huang mentioned in an interview with Forbes: “We are entering a new phase, and we want to create an internet that is thousands of times larger than what we use today. Therefore, we hope to create a computer company for this AI era.”

Who Should Be Afraid?

As mentioned above, the “complementarity” between Arm and NVIDIA will lead both to venture into previously unfamiliar battlegrounds, and the combination of their technologies is highly anticipated. Huang stated that the first thing the merged company will do is to “bring NVIDIA’s technology to the vast network covered by the Arm architecture.”

Forbes proposed several scenarios:

More “big core” Arm data center general-purpose processors

Larger combinations of CPU, GPU, NPU, and network data centers

CPU-GPU-NPU combined with shared memory systems suitable for the HPC market

NVIDIA’s smartphone and tablet GPU/NPU IP

Arm-based SoCs suitable for Windows laptops

Arm-based big core CPUs that can provide the highest performance for Windows desktops

Any of these combinations seems worth exploring.

Most directly, the combination of Arm and NVIDIA will put significant pressure on X86. Arm SoCs may gain NVIDIA’s GPU support in the future, and even bring Arm directly to high-performance desktops like Apple; in the server and data center sectors, GPUs are increasingly being tried as accelerators, putting significant pressure on Intel’s traditional business. While X86 architecture remains mainstream in servers, Arm, in partnership with NVIDIA, is directly targeting Intel’s stronghold.

Beyond Intel, Qualcomm and others should indeed feel nervous. Qualcomm has previously defeated NVIDIA in the mobile war, becoming the biggest winner in this field, pushing Tegra to the edge of business. With this acquisition of Arm, NVIDIA can rekindle its ambitions in the mobile sector, and a return of Tegra to smartphones? It’s not impossible.

Additionally, after acquiring Arm, NVIDIA will further widen the gap with AMD. Although the latter has recently been performing well, what Arm can bring to NVIDIA is clearly beyond AMD’s reach.

Numerous Obstacles

It seems promising, but overly optimistic deals are not easy to execute. This transaction will face strict scrutiny and requires approval from China, the U.S., the EU, and the UK, with regulatory approval expected to take 18 months. Governments, antitrust departments, and previously competitive companies will all pose obstacles to this super deal.

Previously, Arm was sold to SoftBank, which is primarily an investment company. In contrast, NVIDIA is a fully operational company and competes with major Arm clients like Qualcomm and Apple, which may lead to a “being both the athlete and the referee” situation, easily attracting the attention of antitrust departments. However, some viewpoints suggest that the two companies’ businesses do not overlap significantly, which may not face too much resistance from antitrust authorities.

In response, Huang expressed his appreciation for Arm’s business model and hopes to expand its broad customer base. He particularly emphasized that NVIDIA has invested heavily in this acquisition and has no motivation to do anything that would drive customers away.

UK authorities also need to consider the impact of the acquisition, as Arm is one of the most important companies in the UK tech industry. To this end, NVIDIA specifically emphasized in its statement that Arm’s headquarters will remain in Cambridge, and it will again build a state-of-the-art AI supercomputer powered by Arm CPUs, supporting Arm’s Cambridge headquarters to become a world-class technology center. Additionally, Arm’s intellectual property will continue to be registered in the UK.

When Arm becomes a U.S. company, it will not be good news for China’s tech industry. Previously, TSMC has been unable to provide foundry services for Huawei, and companies like HiSilicon have obtained permanent licenses for Arm V8. Once NVIDIA becomes a U.S. company, future licensing will become more difficult, and even design capabilities may be locked down, as companies like HiSilicon use Arm’s public architecture. Moreover, Arm has a unique joint venture in China, Arm China, which is currently undergoing leadership changes. Previously, Qualcomm’s acquisition of NXP (for $44 billion, also the largest acquisition in the semiconductor industry before the Arm acquisition) was vetoed by China. NVIDIA and Arm will face similar pressures.

Regarding the situation in China, Huang believes there are ways to resolve the management issues of the Chinese joint venture, and the situation is “under control,” expressing confidence in obtaining approval from Chinese regulatory authorities for the acquisition of Arm.

This transaction carries the risk of being rejected. Finding a suitable buyer for a platform company like Arm, which has such a large market share, is indeed not easy. However, regardless of the outcome, this will be one of the most significant milestones in the semiconductor industry in recent years, with far-reaching implications.

If there are any objections or complaints regarding this article, please contact [email protected]

End