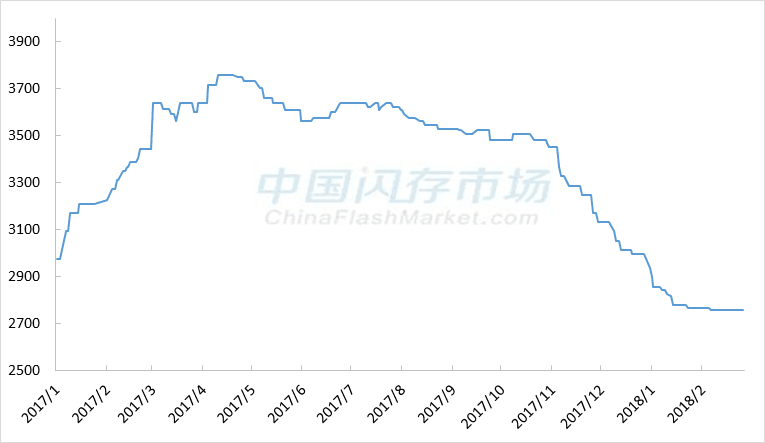

Due to the shortage and price increase of NAND Flash in 2016 and the first half of 2017, the demand in markets such as smartphones and SSDs weakened in the second half of 2017, exacerbated by the seasonal effects at the end of the year. At the beginning of 2018, the prices of NAND Flash-related products showed a continuous downward trend due to factors such as the Lunar New Year holiday, a decline in domestic smartphone shipments, lower-than-expected sales of Apple’s iPhone, and weak demand in the SSD market. According to China Flash Market, the comprehensive price index of NAND Flash fell by 6% over two months in 2018, with the price per GB dropping to $0.22.

NAND Flash Comprehensive Price Index Trend Chart

Source: China Flash Market www.chinaflashmarket.com

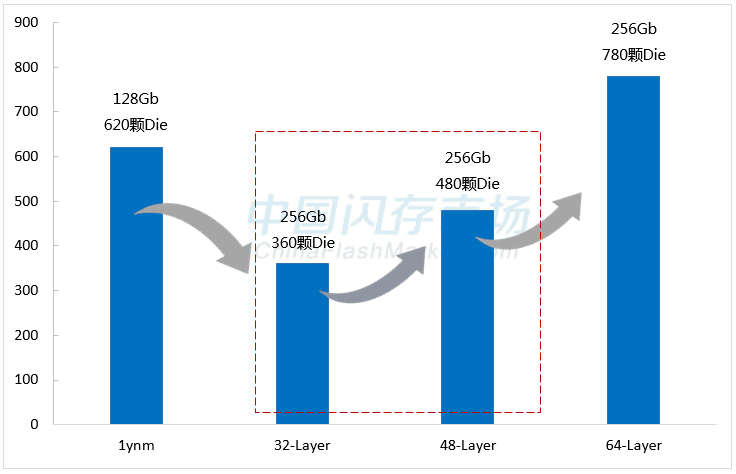

In addition to the impact of weak market demand, the increase in 3D NAND production capacity and declining costs are also significant factors affecting the drop in NAND Flash prices. For example, with the original manufacturer’s 64-layer 3D NAND technology, the number of 256Gb dies cut from a single wafer is approximately 780, which not only doubles the capacity per die compared to the 1ynm 128Gb but also increases output by 25%, a 60% increase over the previous generation of 48 layers. Furthermore, new factories from the original manufacturers are continuously increasing wafer output, further impacting the decline in NAND Flash prices.

Number of Dies Produced per Wafer

Source: China Flash Market www.chinaflashmarket.com

Although the recent NAND Flash market conditions are poor, Samsung has launched its flagship devices Galaxy S9/S9+; at the 2018 MWC (Mobile World Congress), LG, Sony, Nubia, TCL, ZTE, and others released new models. Huawei and Xiaomi are also set to launch their flagship devices in March, which, driven by the concentration of new releases from Android smartphone manufacturers, may bring a new round of orders to the supply chain, potentially improving market demand.

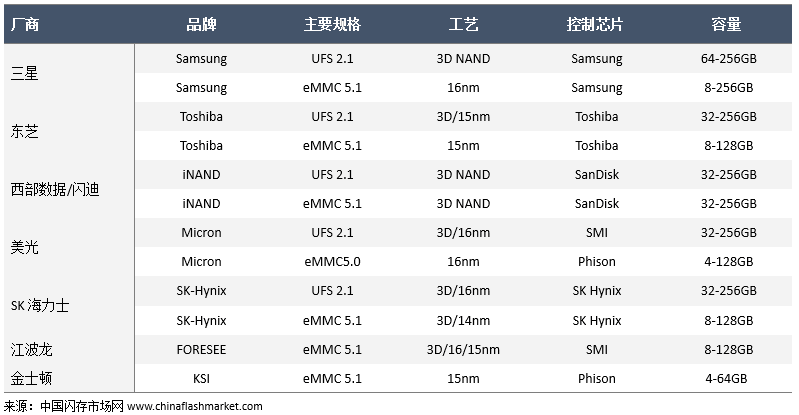

Manufacturers Expand Production of 64/72 Layer 3D NAND, Increasing Demand for 256GB Capacity

In 2018, Flash manufacturers will focus on increasing the production of 64-layer/72-layer 3D technology and utilize advanced high-density 3D NAND technology to launch new generation UFS products with capacities up to 256GB that comply with UFS 2.1 standards, meeting the storage needs of the high-end smartphone market.

Latest Product Specifications from Major Suppliers

Samsung, having invested early in 3D NAND production and continuously increasing its production ratio, has achieved a maximum capacity of 256GB for embedded UFS2.1 and eMMC 5.1 products. In 2018, it will begin mass production of automotive-grade 256GB eUFS products and will also start mass production of 512GB high-capacity UFS2.1 products utilizing the advantages of 64-layer 3D NAND.

Toshiba offers eMMC 5.1 capacities ranging from 8GB to 128GB, and UFS2.1 capacities from 32GB to 128GB, with plans to increase capacity to 256GB based on the new generation of 64-layer 3D NAND starting in 2018. Western Digital/SanDisk launched the 7350 series eMMC5.1 with capacities from 32GB to 256GB based on 3D NAND technology in early 2017, and introduced the 8521 series eMMC5.1 and 7550 series UFS2.1 based on 64-layer 3D NAND, which will be mass-produced in 2018 to meet the storage needs of the next generation of 5G smartphones.

Micron has also released UFS2.1 based on 64-layer 3D NAND, offering capacities from 32GB to 256GB, while SK Hynix provides eMMC5.1 based on 2D NAND with 14nm/16nm technology offering 8GB to 64GB capacities, and 128GB capacity based on 72-layer 3D NAND. UFS2.1 will fully adopt 3D NAND, starting from 32GB, and based on 72-layer 3D NAND technology, it can provide 128GB and 256GB capacities to meet the needs of the high-end smartphone market.

High-End Flagship Devices in 2018 Move to 256GB Capacity, Mitigating the Impact of Slowing Smartphone Shipments on NAND Flash

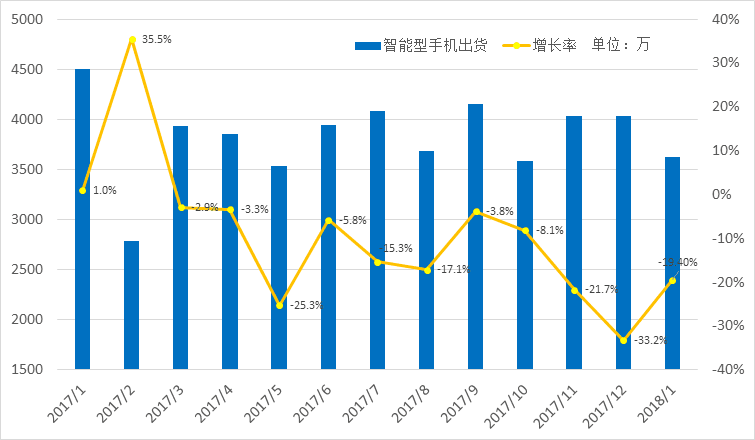

Smartphones are a significant application market for NAND Flash. According to China Flash Market statistics, global smartphone shipments reached 1.49 billion units in 2017, a 3% increase over 2016. According to data from the China Academy of Information and Communications Technology, smartphone shipments in China in 2017 were 461 million units, a year-on-year decrease of 11.6%, marking the first decline in annual shipments in the Chinese smartphone market. Moreover, in January 2018, smartphone shipments in China continued to decline, down 19.4% year-on-year.

Statistics of Smartphone Shipments in China from January 2017 to January 2018

Source: China Academy of Information and Communications Technology, Unit: 10,000

After nearly a decade of rapid growth, the Chinese smartphone market experienced its first decline in shipments in 2017, with Apple’s iPhone also seeing a year-on-year decline during the Q4 peak season. In 2018, smartphone manufacturers, especially small and medium-sized enterprises, will face challenges, casting a shadow over the NAND Flash market.

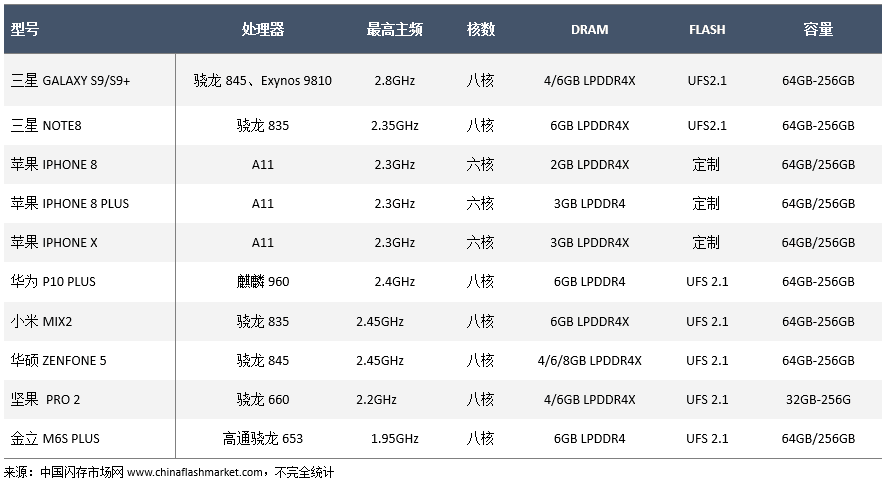

Although the growth of smartphones is slowing, applications such as video, photography, downloads, and apps have doubled the demand for NAND Flash capacity, especially for high-end flagship devices. To meet market demand, Apple first increased the capacity to 256GB with the iPhone 7 in 2016, exacerbating the already tight supply of NAND Flash. In 2017, Samsung’s Note8, Huawei’s P10 Plus, and Xiaomi’s MIX2 followed suit, upgrading to 256GB.

More Flagship Devices in 2018 Featuring 256GB Capacity

By 2018, Samsung’s Galaxy S9/S9+, a trendsetter in the Android smartphone camp, will feature 256GB capacity for the first time. It is expected that flagship devices from Huawei, OPPO, VIVO, Xiaomi, and others will follow suit, leading to high-end flagship devices primarily featuring 64GB, 128GB, and 256GB configurations, with 128GB as the main capacity. This will continuously increase the demand for NAND Flash and also mitigate the impact of slowing smartphone shipments on NAND Flash.