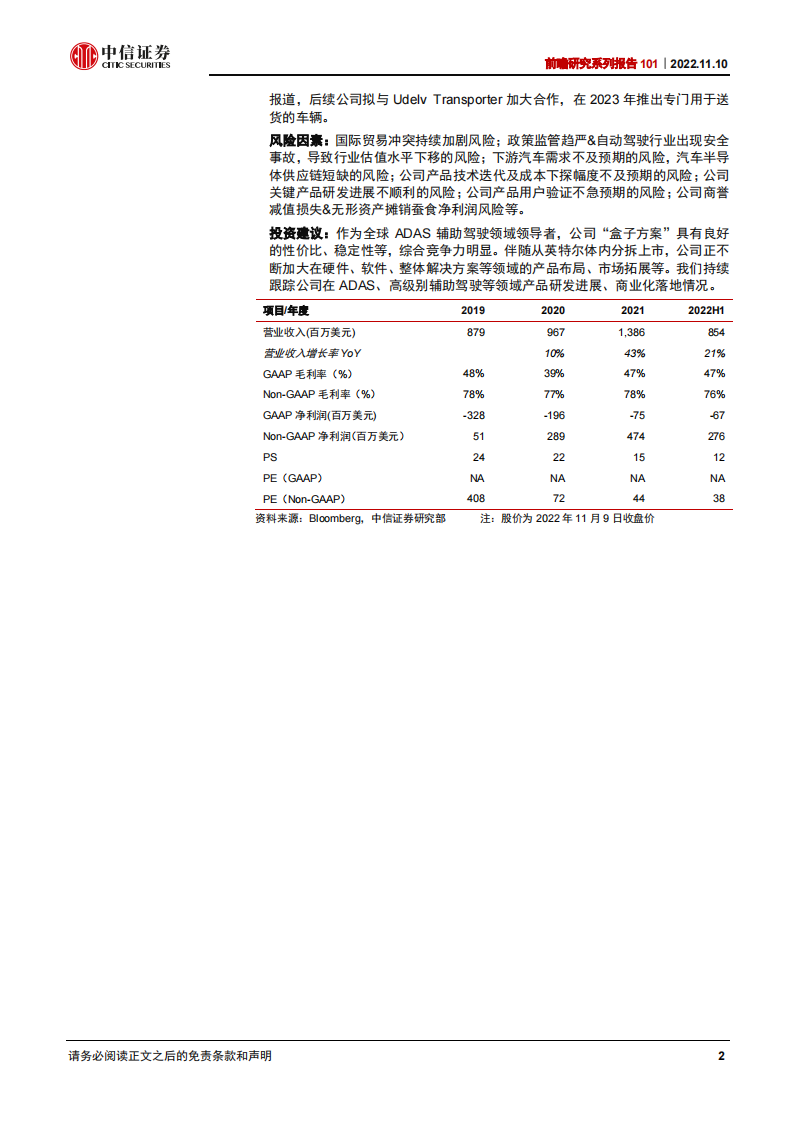

Report

Express

Mobileye Research: Global Leader in ADAS Technology

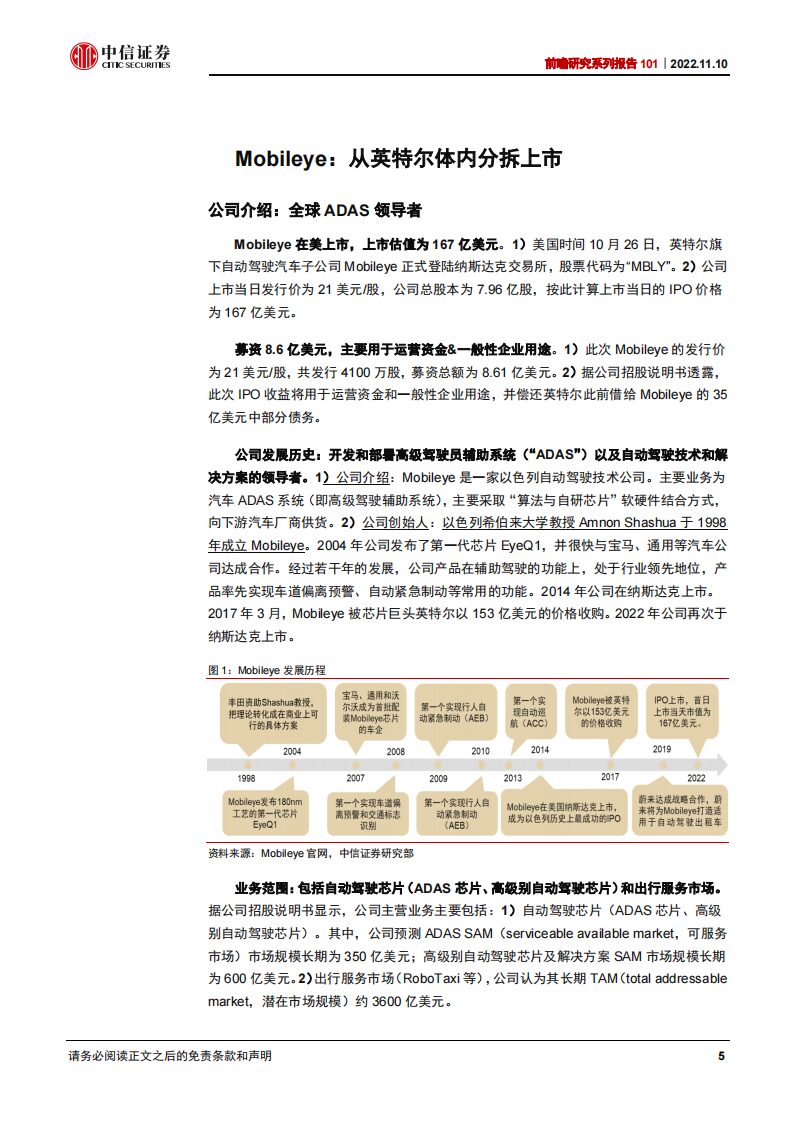

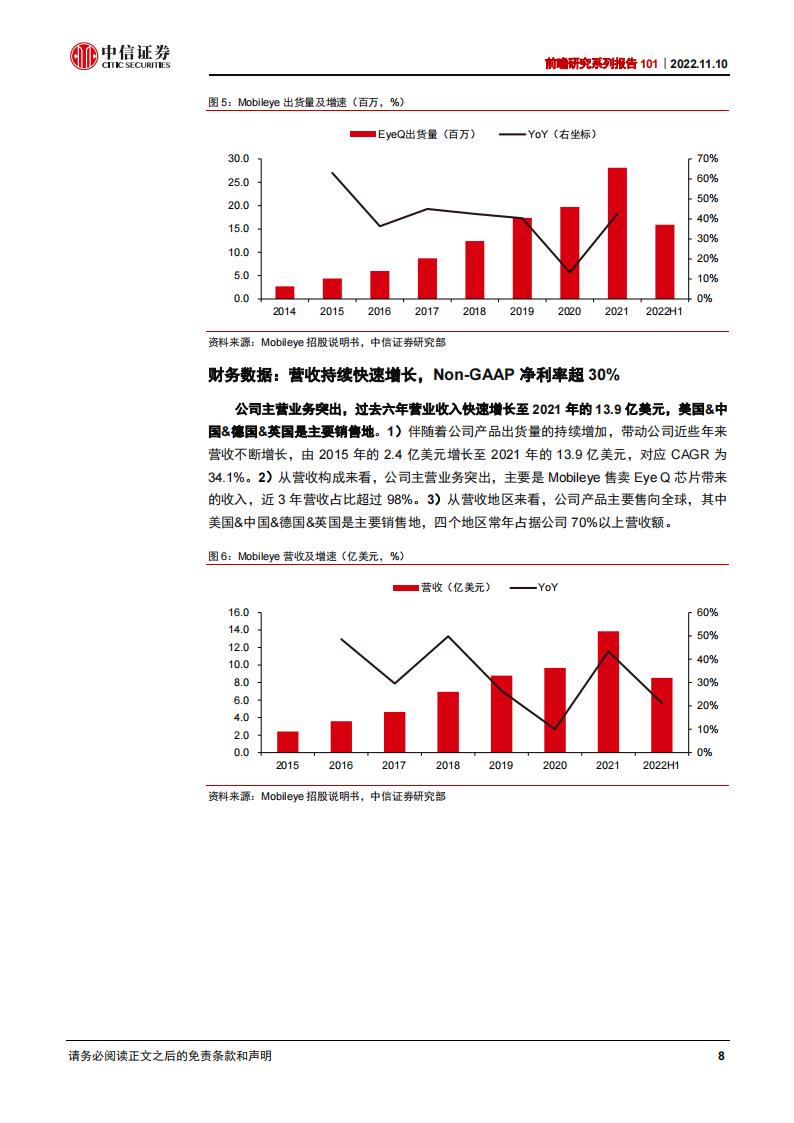

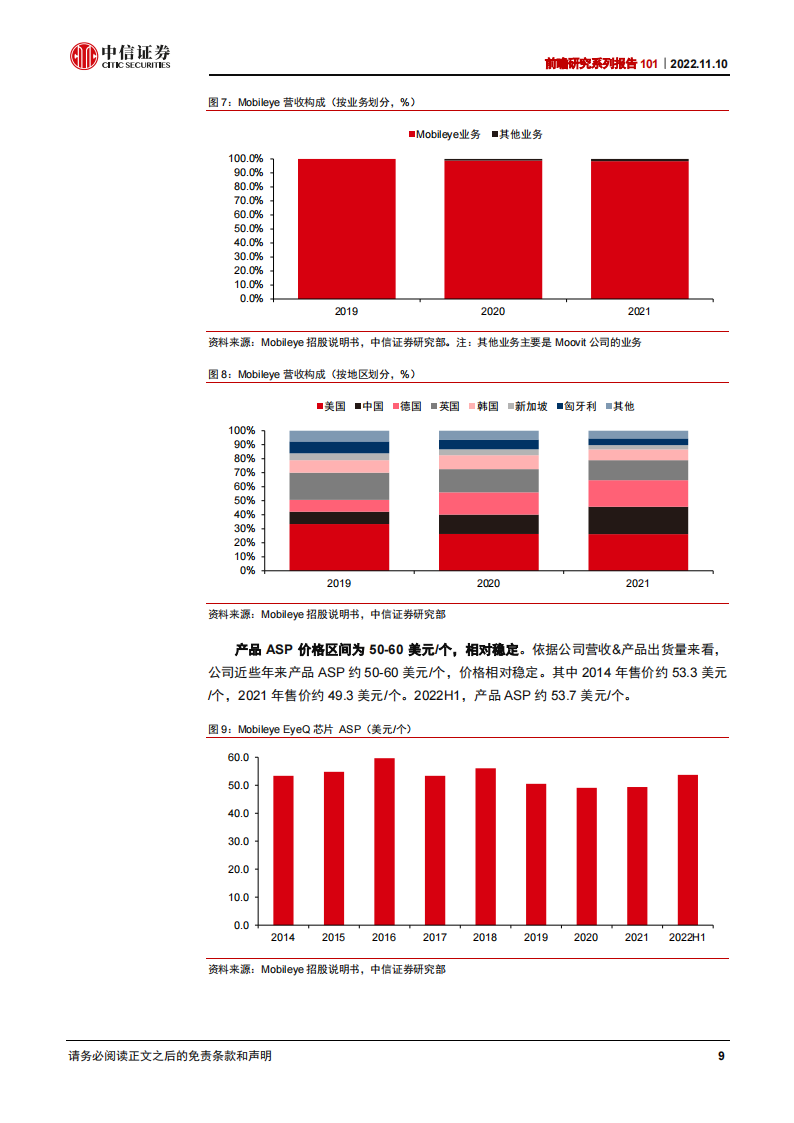

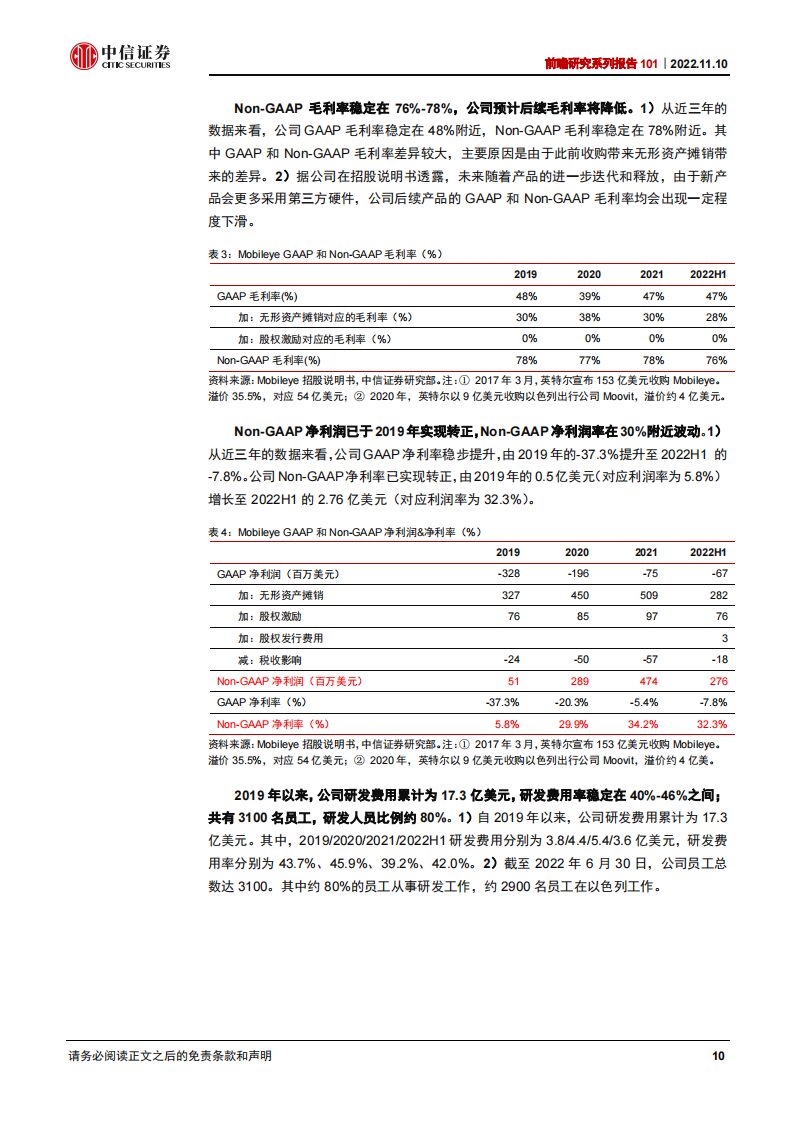

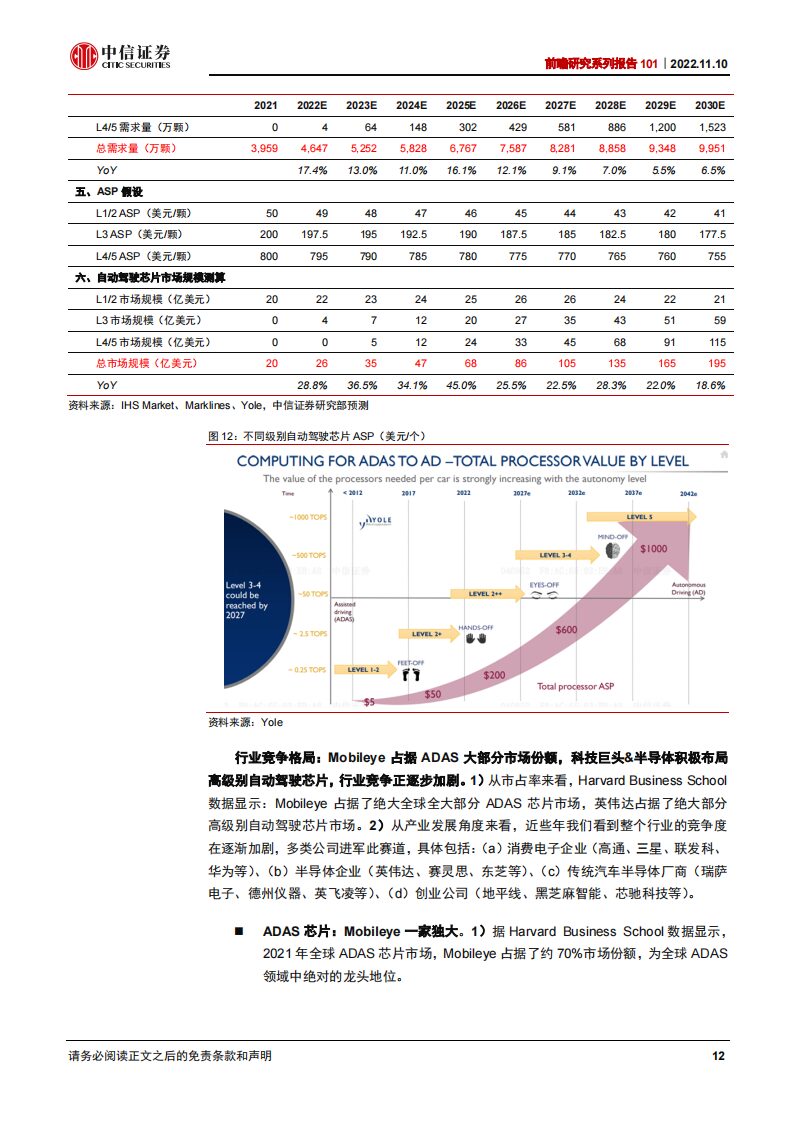

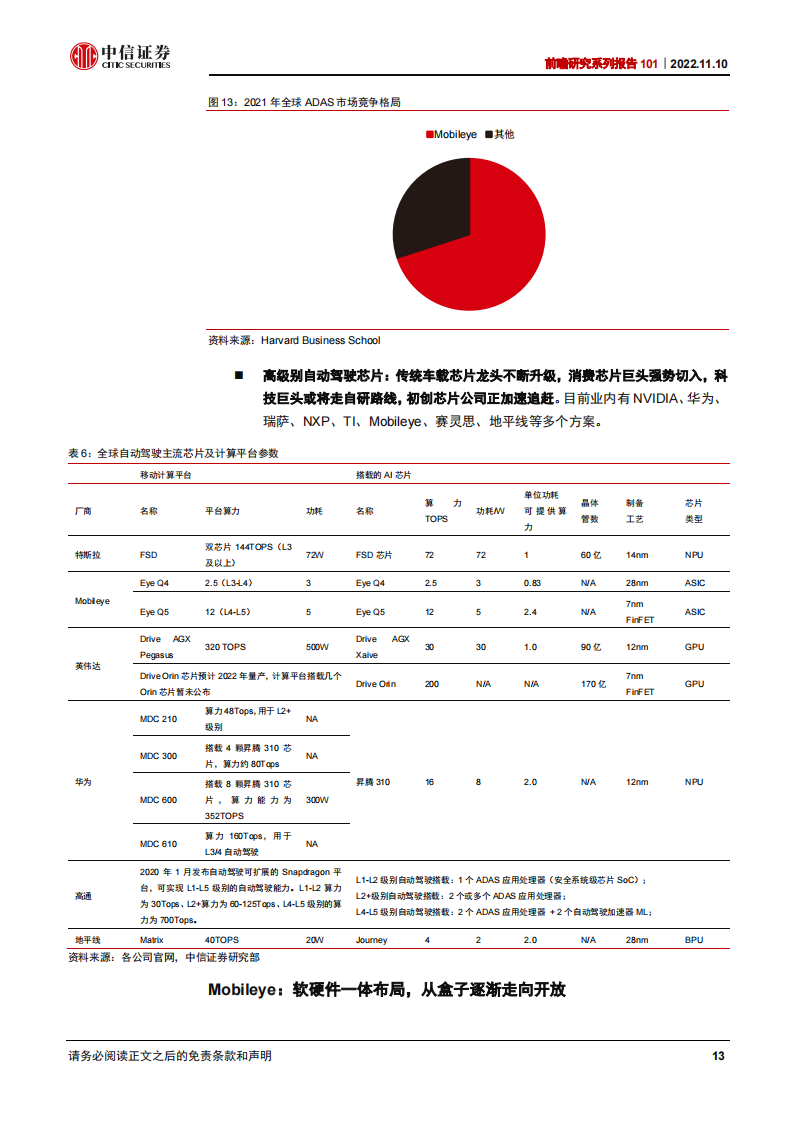

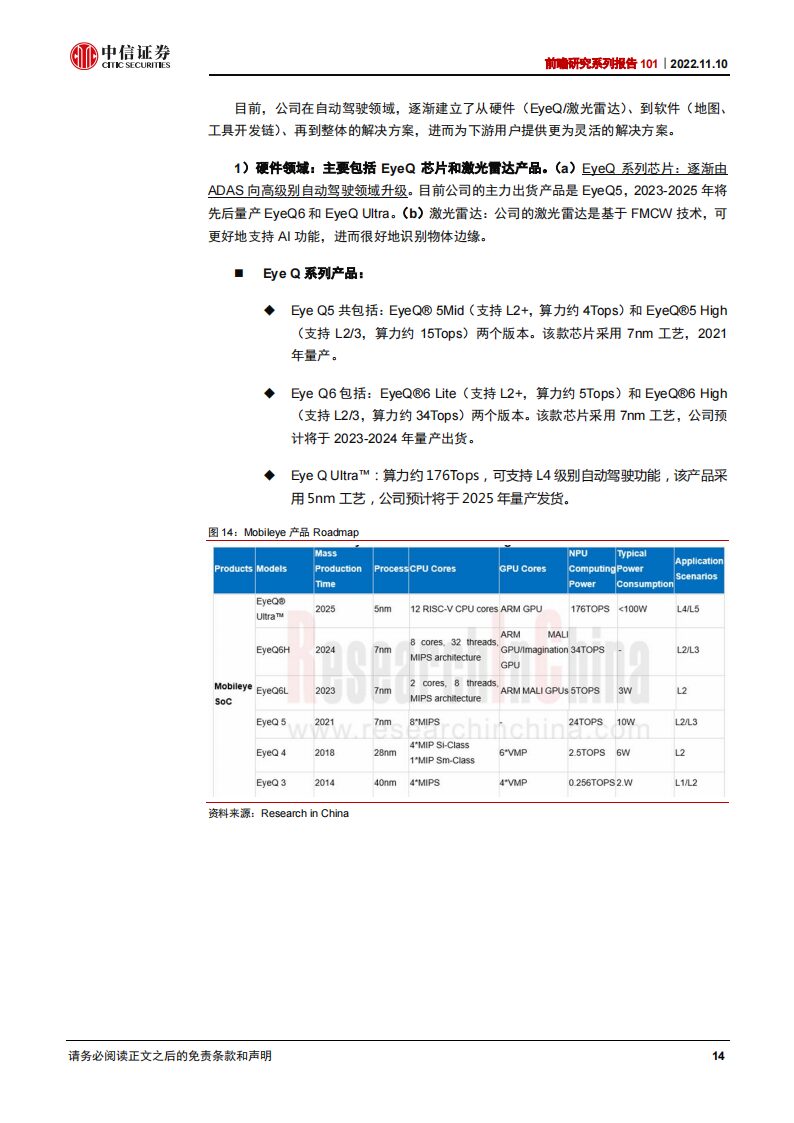

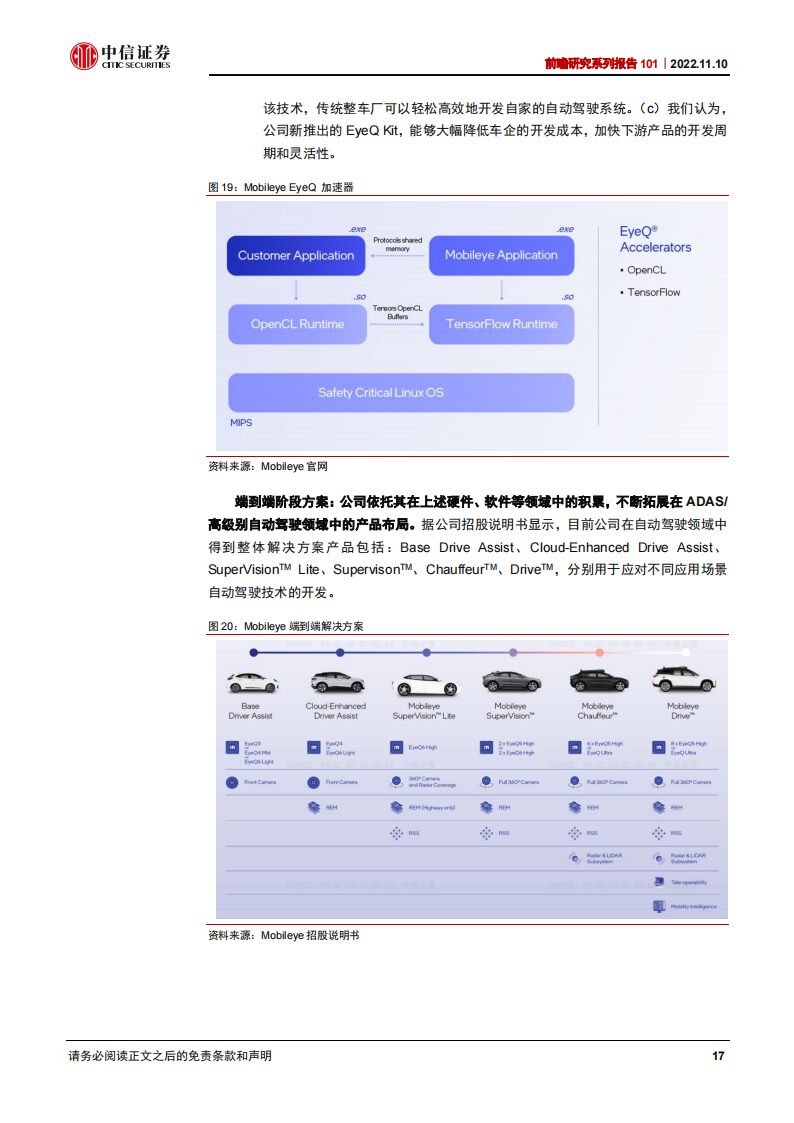

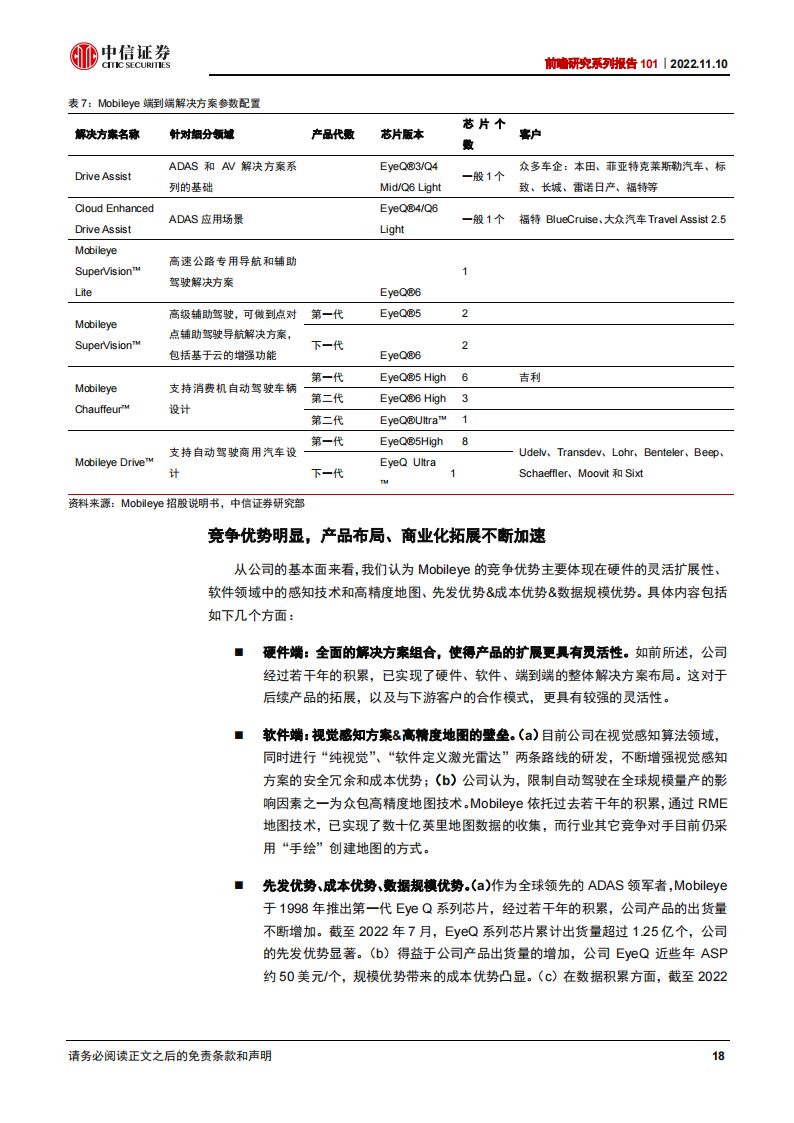

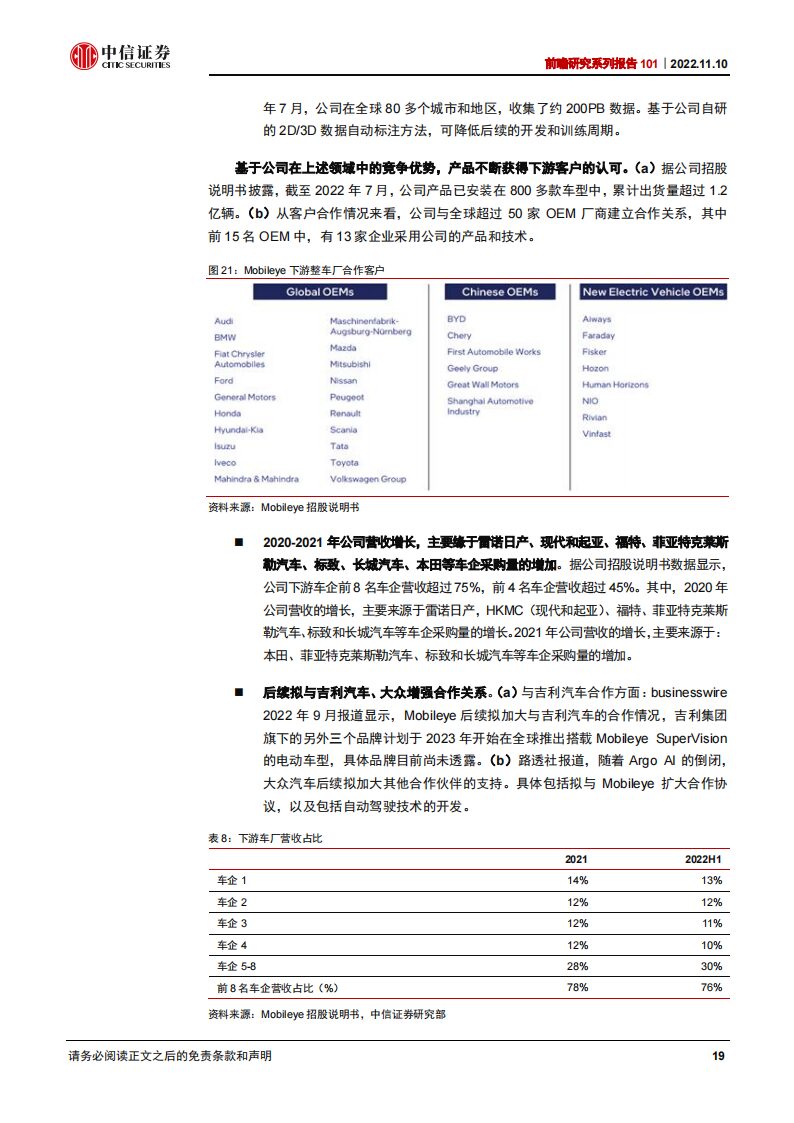

Mobileye is the global leader in ADAS (Advanced Driver Assistance Systems), with its EyeQ series products, thanks to excellent cost-effectiveness and stable product performance, holding a 70% share in the global ADAS market. With the launch of high-performance chip solutions from NVIDIA, Qualcomm, and others, there are concerns about the popularity and technological leadership of Mobileye’s “black box” solutions. Following its spin-off from Intel, the company is gradually increasing its product and technology layout in areas such as “software development chain EyeQ Kit,” “end-to-end solutions,” and “RoboTaxi,” with expectations for continuous improvements in product flexibility and scalability. Currently, the company has significant comprehensive advantages in the ADAS field and is expected to continue benefiting from the increasing penetration rate of automotive driver assistance. In the medium to long term, with the launch of the company’s high-level autonomous driving chips EyeQ6/Ultra between 2023-2025, as well as the commercialization of high-level autonomous driving technologies (SuperVision, Chauffeur, Drive) and RoboTaxi technologies (AMaaS, etc.), the company’s medium to long-term growth potential and competitiveness are worth looking forward to. We will continue to track the company’s product R&D progress and commercialization in the fields of ADAS and high-level autonomous driving.