The rise of microcontrollers (MCUs) began in the 1970s in Europe and America, and the 8051 MCU was introduced in 1981. It has been 36 years since then. In terms of quantity, 8-bit MCUs remain the backbone of the MCU market, and many companies continue to design and produce MCUs based on the 8051 core.

In the early 1990s, 32-bit MCUs were only used in applications requiring high-performance computing due to their cost. After 2008, new technologies represented by the Internet of Things (IoT) emerged, prompting developers to seek MCUs that possess wireless communication capabilities, certain computational abilities, and are reasonably priced.

As ARM Cortex-M core MCUs gradually dominate the market, their applications have become increasingly diverse. More advanced and efficient manufacturing processes are being adopted in chip production, and the price difference between 32-bit and 8-bit MCUs has become negligible; some 32-bit MCUs are even cheaper. Coupled with the robust ecosystem created by ARM, 32-bit MCUs have become the core of today’s global consumer and industrial electronic products. I will review the development of the global MCU market and discuss future trends from the following three aspects.

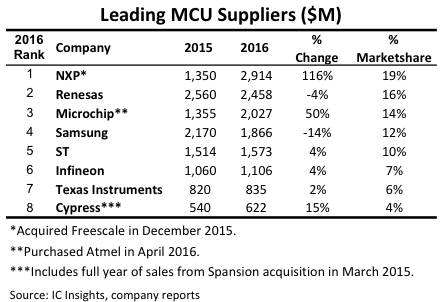

Since 2015, major MCU manufacturers have engaged in several large-scale mergers to compete for market share in the rapidly growing IoT applications. According to market research firm IC Insights, after the completion of these mergers, the sales data for NXP, Microchip, and Cypress showed significant year-on-year growth in their MCU product lines in 2016, resulting in corresponding increases in their rankings. In contrast, MCU manufacturers that did not undergo large-scale mergers, such as ST and TI, showed only modest growth, while some, like Samsung, experienced significant declines (see Figure 1).

Figure 1: Global MCU Market Landscape in 2016

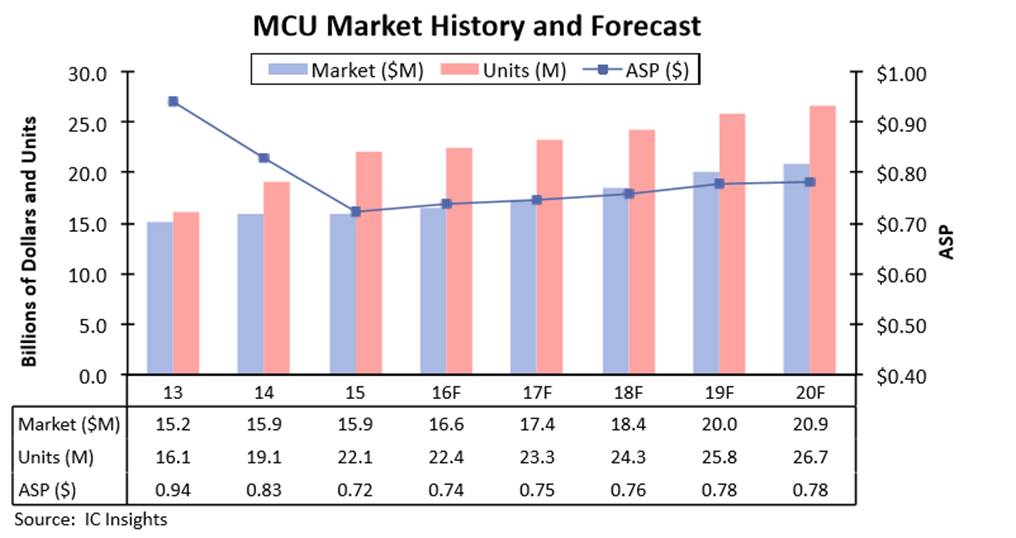

From Figure 1, we can also see that the combined market share of the eight major MCU manufacturers reached 88%. This means that apart from a few large MCU companies, smaller MCU companies have a very small market share. IC Insights’ research report from August 2016 stated that the MCU market is expected to peak in 2020, with sales reaching $20.9 billion and 2.67 billion chips sold (see Figure 2). In light of this market situation, at the recently concluded 2017 STM32 Summit, ST set a target to achieve $4 billion in sales by 2020, increasing its current market share from 10% to 20%.

Figure 2: Global MCU Market Forecast from 2013 to 2020

1Development Tools

In the era of 8-bit MCUs, development tools were quite simple due to the straightforward functionality of MCUs and their small memory capacity. Application code could even be written using assembly language, and simple download and programming tools sufficed for development work. However, as the functionality of MCUs expanded and memory capacity increased, C language gradually became the preferred choice, with Integrated Development Environments (IDEs) and JTAG debugging becoming mainstream. This approach has dominated MCU development for the past 20 years.

With the rise of the Internet of Things, there is an urgent need for a large number of electronic products to undergo intelligent upgrades, with networking becoming a basic requirement, especially wireless networking. Real-Time Operating Systems (RTOS) have transitioned from being a “luxury” in embedded systems to a “necessity” today. Thanks to the support of the open-source community and open-source software, open-source RTOS options such as FreeRTOS, uC/OS, and Contiki have become the developers’ preferred choices. IoT operating systems specifically designed for IoT applications have also emerged, such as ARM mbed OS, Qingke MicoOS, and Huawei LiteOS. In fact, these IoT operating systems are also based on open-source RTOS technology.

The high cost of development tools (IDEs) has deterred entrepreneurs, but with the help of open-source software, MCU companies have launched their own IDEs, such as Renesas’ e2studio, Silicon Labs’ Simplicity Studio, and NXP’s LPCXpresso. These IDEs are based on open-source Eclipse, and the compilation software is also open-source GCC ARM. Although the IDEs from chip companies may not match the functionality and optimization of Keil and IAR, they have reached a usable level. ARM has developed a web-based mbed tool, allowing developers to conduct embedded development without purchasing or installing any IDE; they only need an mbed-compatible development board. If you are using an Arduino development board, the Arduino IDE integrates a wealth of open-source hardware knowledge, making development much easier and more efficient.

Today, with a strong open-source ecosystem, MCU developers no longer need to worry about project delays due to a lack of funding to purchase development tools or obtain technical support.

2Manufacturing Technology

Moore’s Law has propelled the chip industry for 40 glorious years, with the development of manufacturing processes being a significant driving force. Traditional MCUs, such as 8-bit OTP MCUs, have long used a 0.5u manufacturing process. However, with the passage of time and advancements in equipment and technology, the mainstream manufacturing process for MCUs is now 180nm, and even 90nm technology is becoming common. Looking ahead, it is not unrealistic to expect MCUs using 40nm or even 28nm manufacturing processes in the near future.

We know that more advanced manufacturing processes allow for the integration of more transistors within the MCU, enabling processors to achieve more functions and higher performance. As a result, the size of the MCU core is no longer a critical factor; more 32-bit MCU cores will replace 8-bit cores without increasing chip size, and power consumption will actually decrease. Additionally, advanced manufacturing processes can also lead to increased on-chip FLASH capacity, making 1MB or even 4MB FLASH MCUs common products in the future.

Of course, manufacturing processes will pose challenges to the MCU ecosystem, such as increased initial manufacturing costs and increased design complexity of chips. The introduction of 32-bit cores will increase software development difficulty, and the integration of MCUs with RF and sensors for IoT applications will lead to a series of tricky issues in power management and PCB design.

3Application Design Solutions

MCU applications are diverse, ranging from the smallest consumer electronics to large industrial robots, covering nearly all embedded electronic products. In the early days, MCU chip companies only provided application guidelines and reference design code, while solution designs were generally completed by customers themselves or by professional solution companies and agents, then handed over to equipment manufacturers for production. This model still exists widely today.

With the emergence of IoT, there is an increasing demand for intelligent electronic products, and the urgent need for traditional industries to upgrade has become apparent. The electronics industry urgently requires MCU manufacturers to provide more and better innovative design solutions. With the arrival of the e-commerce era and the flattening of channels, traditional chip agents are increasingly unable to invest in the increasingly complex solution designs. The industry is becoming more specialized and in-depth, and traditional solution providers have transformed into product providers, placing the responsibility for application design solutions back on MCU companies.

Today, we see leading global MCU companies, such as ST, NXP, TI, and Renesas, all of which can provide numerous MCU application solutions with increasingly cutting-edge technology and enhanced functionality. For example, the intelligent lock security solution showcased at the STM32 summit prevents hacker intrusions, and the ultra-low-power MCU smartwatch solution can achieve an aesthetically pleasing and smooth gaming interface on a small screen, along with a low-cost LoRa gateway based on the STM32F7 MCU.

The recent maker movement has also been a significant contributor to MCU application solutions. Makers widely use Arduino open-source hardware, which employs Atmel’s AVR series processors; the Pibot robotics project uses Arduino as its core control board. In an open-source hardware environment, developers without a development background but with ideas can still complete their product development. The lowered development barriers will attract more people to realize their ideas, significantly increasing the variety and quantity of products, thereby leading to a growth in demand for MCUs.

130 Years of Chinese MCUs

In the early 1980s, Beijing University of Technology’s electronics factory sparked a development boom for the TP801, while MCS-51 microcontroller development systems were developed in Shanghai and Jiangsu. This wave of microcontroller enthusiasm marked the beginning of a transformative era for intelligent electronics in China. In October 1986, the first national microcontroller academic exchange conference was held at Fudan University in Shanghai, marking the start of China’s microcontroller industry and the beginning of a glorious 30-year development history. In November 2016, the Embedded Systems Association held a commemoration event for the 30 years of Chinese microcontrollers, bringing together workers from three generations to reminisce about this history and discuss the bright future of Chinese microcontroller development.

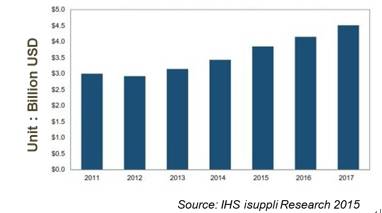

In recent years, the Chinese MCU market has continued to grow. According to a research report by iSuppli Research in 2015 (see Figure 3), the sales revenue of the Chinese MCU market was approximately $3 billion in 2011, rising to $4 billion by 2016, with the market share of 32-bit MCUs expected to continue to increase, showing a compound annual growth rate close to 10%. The earlier mentioned eight major global MCU companies do not include Chinese companies (including Taiwan). Research reports also indicate that both mainland China and Taiwan’s MCU companies each hold a 10% market share. From the recently concluded 2017 STM32 Summit, I learned that in 2016, ST’s revenue from the general MCU market in China accounted for 36% of its global market, maintaining a compound annual growth rate of 27% since 2007, driven by new applications such as IoT, wearables, smartphones, smart buildings, smart meters, electric vehicles, and drones.

Figure 3: Estimated Chinese MCU Market from 2011 to 2017

After 30 years of microcontrollers in China, there are many MCU manufacturers, but most operate in the low-end 8/16-bit market. China is the world’s largest electronic manufacturing base, with a sufficiently large market to support these small manufacturers. However, small and medium-sized MCU manufacturers with low design capabilities, lack of strategic development planning, and insufficient funding find it difficult to change China’s weak position in the MCU market.

2Acceleration of Domestic 32-bit MCUs

In recent years, the growth of Chinese MCU companies has accelerated, especially in the 32-bit MCU market, with companies like GigaDevice, ZhiXiang Technology, and Lingdong Microelectronics emerging. Their ARM Cortex-M based MCU chips have gained market acceptance, and the market strategy for domestic MCU products generally includes lower prices, better performance, attentive local service, and, most importantly, pin-to-pin compatibility with foreign products. These market strategies have proven very effective for domestic companies, yielding fruitful results.

According to financial media reports, in 2016, GigaDevice achieved revenue of 1.489 billion, with a net profit of 176 million, a year-on-year revenue growth of 25% and a profit increase of 12%; MCU chip revenue reached 197 million, a year-on-year growth of 55.2%, with sales of 45.78 million chips. Recently, GigaDevice acquired Beijing Silicon Creation for 6.5 billion. Silicon Creation’s main business focuses on volatile memory chips, primarily designing and selling SRAM, low to medium-density DRAM, and EEPROM products, which are applied in automotive, industrial medical, network mobile communications, and electronic consumer products. This complements GigaDevice’s non-volatile memory chips, including NOR Flash and NAND Flash, as well as its MCU microcontroller product development, technical support, and sales. The acquisition of Silicon Creation will positively impact the future development of GigaDevice’s GD32 series MCUs and may assist in expanding its automotive electronics market plans.

3Challenges for Domestic MCUs

In comparison to the development of domestic high-end CPUs, the progress of domestic 32-bit MCUs has been smoother. The relatively simple and uncomplicated ecosystem for MCU development has been a significant factor aiding the growth of domestic MCUs. Developing smartphone chips requires massive investments in the most advanced manufacturing processes. For example, the Samsung Galaxy S8 model features Qualcomm’s Snapdragon 830 processor, which is exclusively manufactured by Samsung with an astonishing 10nm process. Furthermore, the Android OS, along with the Open Handset Alliance, which has 84 members, complicates matters. If your company is not a member, you may not have access to the latest Android software versions. Even if you are a member, without a significant investment in Android developers, it is challenging to compete with smartphone giants like Qualcomm, Samsung, and Huawei.

As previously mentioned, the technology pathways for MCUs differ significantly from those for smartphones. The MCU market remains diverse; although there are several popular products, such as drones, wearable devices, and smart thermostats, their quantities cannot compare to smartphones, and each has different hardware and software platforms. With basic development tools, 90nm processes, and application solutions, combined with the “nanny-style” service that Chinese companies excel at, domestic MCUs have the opportunity to achieve surprising success and expand their horizons.

However, can domestic MCUs rest easy and expect smooth development? Not at all. If we look at the product lines of leading global MCU companies, it is clear that there is a significant gap between Chinese companies (including Taiwan). STM32 has over 750 MCU models, most using 90nm processes, while ST plans to release the ultra-high-performance STM32H7 using 40nm processes, whereas Lingdong Microelectronics’ mature product F103 still uses the traditional 0.18um process.

In terms of development tools, domestic MCUs largely lack their own development tools (IDEs); recommendations typically include ARM KEIL and IAR. To support their MCUs, companies generally develop a KEIL MDK or IAR plugin, and users without funding often resort to pirated IDEs.

In application design solutions and ecosystem development, domestic MCUs are far behind foreign companies. For instance, on the second day of the STM32 summit, dozens of partners showcased over 100 solutions, including LoRa, Bluetooth and WiFi modules, over-the-air firmware upgrades, NB-IoT diagnostic devices, multifunctional automotive bus communication platforms, and certified RTOS, among others. Additionally, domestic designs and productions based on STM32 products, such as DJI and Xiaomi drones, Huawei sports watches, MOOV headphones, and AERFA smart robots, greatly increased the interest of developers attending the summit (see Figure 4).

Figure 4: STM32 Summit Showcase

The development of the 32-bit MCU market, while chip design and manufacturing technology are crucial, the construction of product line ecosystems, research on development tools, support for embedded OS, innovative application cases, stable supply chains, and technical support are equally important. Each of these elements is essential, and achieving excellence in all is no easy task. For domestic MCUs to become mainstream suppliers for domestic electronics companies and to step onto the international stage, there is a long road ahead. Looking towards the future 5-10 years, the $10 billion IoT device market presents unprecedented opportunities for MCUs, creating an excellent entry point for the development and leap of Chinese MCUs.

Source: EXELCON Electronics Exhibition, Author: He Xiaoqing