Overview

Toyota and Denso announced in December 2019 that they would establish a company to research and develop the next generation of semiconductors by 2020. Against the backdrop of semiconductor research and development by automakers and electronic component manufacturers, the role of semiconductor technology in next-generation automotive systems is becoming increasingly important.

This report will introduce the trends in the reorganization of domestic and foreign automotive semiconductor manufacturers, as well as the initiatives of various companies regarding next-generation automotive semiconductors. With the increasing demand and performance improvement of smartphone semiconductors, automotive semiconductors have also transitioned from “semiconductors as devices” to “semiconductors as systems” (SOC: System On Chip). Recently, semiconductors suitable for in-vehicle information devices that connect to smartphones and those applicable to ADAS have become competitive areas in edge computing for the AI and autonomous driving era.

|

|

|

|

In-Vehicle Information Entertainment System |

Quad View Navigation |

(Exhibited by Faurecia Clarion Electronics)

European and American Automotive SOC Manufacturers

European and American semiconductor manufacturers aim to expand their business through significant M&A activities, with the automotive industry becoming a target for business expansion.

European and American Semiconductor Manufacturers Enter the Automotive SOC Market

|

|

(Source: Author’s production)

NVIDIA

Since the launch of the Tegra series, NVIDIA has been providing high-performance SOCs (System On Chip) for the automotive sector. In this regard, NVIDIA’s competitor in the graphics processing field, AMD, also broke NVIDIA’s monopoly in the computer domain by acquiring ATI (competing with NVIDIA GeForce) and has now set its sights on the next generation of products in the automotive field. The rumors of AMD developing autonomous driving chips with Tesla are part of this trend.

Founded in 1993, NVIDIA is a company that develops and sells graphics processors. The company significantly enhanced graphics performance with the GeForce 250, which was launched in 1999 for computer GPUs, establishing itself as a high-performance graphics brand. Because GPUs designed to process image information have multiple dedicated computational paths, their computational performance can rival that of high-performance workstations compared to processors running through programs. This high-performance image processing later evolved into the image processing technology required for autonomous driving (such as recognizing objects in images captured by cameras through advanced image processing technology).

The company established its market through graphics processors and released the Tegra series, which combines ARM-based CPUs with its GPUs, in 2008. As a result, the Tesla series for supercomputers, the integrated Tegra series, and the GeForce series for gaming graphics processing became the main products of SOCs provided by NVIDIA. Additionally, as automakers accelerated the development of vehicle electronics and driving assistance systems from this point onward, the integrated Tegra series began to be used in automotive manufacturers’ electronic dashboards. Subsequently, due to the outstanding deep learning processing capabilities of the parallel processing architecture known as CUDA (Compute Unified Device Architecture) developed for GPUs, NVIDIA established an overwhelming position in advanced safety driving assistance and autonomous driving technologies.

NXP

NXP acquired Freescale, which already had a foothold in the automotive integrated SOC market, in 2010 and officially entered the in-vehicle information field in 2014.

Qualcomm

As the largest market share holder in the smartphone and communication device fields, Qualcomm entered the automotive industry in 2014. To establish an advantage in an industry it had not previously engaged in, Qualcomm attempted to acquire NXP, which had experience in the automotive sector, in 2016. Although the acquisition ultimately failed, it underscored the fierce competition among companies targeting the automotive industry.

Japanese Automotive SOC Manufacturers

As of the end of 2019, there were three major semiconductor manufacturers developing automotive SOCs (System On Chip) in Japan.

In Japan, advanced graphics display technology has been used in gaming consoles such as the Family Computer, released in 1983, the first-generation PlayStation released in 1994, and SEGA Saturn. Against this backdrop, companies like Hitachi, Fujitsu, and Toshiba have been dedicated to developing graphics processors for automotive systems.

Reorganization of Domestic Semiconductor Manufacturers (Automotive SOC)

|

|

(Source: Author’s production)

Renesas Electronics

Since the 1990s, competition among domestic semiconductor manufacturers in SOC development has been intense, but after Hitachi and Mitsubishi Electric established Renesas Technology (integrating system LSI business) in 2002, the landscape of the industry changed dramatically.

This change was due to the decline in the performance of the main business of each company—home appliances—becoming essential daily necessities, as manufacturers from China, Taiwan, and South Korea entered the Japanese market. Given the high development costs required for SOC development, it became necessary for the developed semiconductors to be applicable to multiple products. Home appliances were indispensable as targets, and the downturn in home appliance business clearly had a significant impact on semiconductor development.

In the past, Hitachi and Mitsubishi supplied semiconductors to the automotive industry as a business goal outside of home appliances, and the semiconductor products (SOC and automotive control LSI) developed by the two companies were competitive products (developing semiconductors in the same content and field). However, to avoid repeating the mistakes of the home appliance business decline, both parties agreed that it was necessary to integrate and establish a company to counter the future influx of overseas forces, leading to the establishment of Renesas Technology.

Subsequently, NEC and Renesas Technology also integrated to establish Renesas Electronics in 2010.

Socionext

In 2015, Fujitsu and Panasonic integrated their system LSI businesses to form a new company, Socionext. Prior to this, Fujitsu sold one of its production lines, the Iwate factory, to Denso in 2012.

Fujitsu utilized the drawing technology cultivated by industrial CAD to develop an integrated graphics controller in 2003. This graphics controller initially adopted technologies such as geometric engines and 3D rendering, and by 2007, it held the largest market share globally as a navigation graphics controller. At that time, Fujitsu’s graphics controller was not only used for navigation but also equipped European automakers for automotive LCD instrument displays.

Toshiba

Toshiba has been reorganizing its semiconductor business under foreign capital but announced in 2019 that it would exit all businesses except automotive SOCs.

Between 2001 and 2005, Toshiba developed the CELL Chip for the PlayStation 2 gaming console in collaboration with SCE (Sony Computer Entertainment) and IBM. The CELL used advanced graphics processing technology and jointly developed an LSI equipped with a 3D graphics controller for Toyota’s Lexus navigation system with Denso in 2005.

South Korean and Chinese Semiconductor Manufacturers

Automotive semiconductors have evolved from smartphone semiconductors (as mentioned). Based on this perspective, the movements of Chinese and Korean manufacturers engaged in the largest global smartphone development are briefly introduced.

Samsung Electronics

When it comes to the largest semiconductor manufacturer in South Korea, Samsung Electronics naturally comes to mind. The company is committed to developing SOCs for automotive applications and is actively working to support the next generation of IVI, such as its Exynos Auto V9, which will be used in Audi’s in-vehicle information system in 2021.

Samsung Electronics manufactures semiconductors on behalf of NVIDIA, indicating its high semiconductor manufacturing capability. In the future, like NVIDIA, Qualcomm, and Intel (Mobileye), the company aims to enter the autonomous driving platform field by proposing next-generation automotive systems that include semiconductors.

Telechips

South Korea’s Telechips is an SOC manufacturer with experience supporting Japanese automotive navigation manufacturers, targeting automotive products including IVI, multimedia systems, and electronic instruments. The company’s advantage lies in its ability to provide low-consumption, low-cost semiconductor devices. By specifically targeting automotive mid-range rather than high-performance semiconductor areas, it manages development costs and prices.

Chinese Semiconductor Manufacturers

Among the large companies developing smartphones in China, Huawei and Xiaomi stand out. These two companies hold significant market shares globally, but there are considerable differences in the semiconductors used for smartphone development.

Xiaomi has historically used Samsung’s semiconductors but announced that its 2019 model, the “Xiaomi 9,” utilized Qualcomm’s Snapdragon 855.

Huawei has traditionally procured semiconductors from Qualcomm for smartphone development, but due to trade restrictions from the U.S. in 2019, it switched to procuring high-performance semiconductors comparable to Qualcomm’s Snapdragon from its subsidiary, HiSilicon. Currently, HiSilicon’s semiconductors are supplied exclusively to Huawei, with no other companies using them, but it is highly likely that they aim to enter the automotive system market, similar to Qualcomm.

Allwinner‘s semiconductors are mainly used in tablets and low-cost smartphones, but they have recently begun to enter the automotive semiconductor market. Allwinner’s primary targets are in IVI and multimedia fields, but they are also actively developing business in the electronic instrument sector.

With the improvement of automotive navigation and smartphone performance, automotive semiconductors have developed

Transforming In-Vehicle Information Device CPUs Starting with Navigation

Navigation products can be said to be the pioneers of in-vehicle information systems. Until now, automotive electronic components have been dominated by single-function automotive audio systems, but with the advent of automotive navigation, vehicles officially began to be equipped with information computers.

Automotive navigation, which debuted in the 1980s, added various functions in the 1990s, including voice driving guidance (route guidance) and VICS/FM multiplex broadcasting, in addition to map display. Additionally, the number of automaker integrations has been increasing daily, leading to the integration of navigation and audio functions into navigation systems (now known as IVI: In-Vehicle Information System).

With the continuous addition of functions, the performance of the computational technology that composes the navigation system has gradually improved.

|

|

|

|

Tolerance Multi-Display Information Entertainment System (Exhibited by Harman) |

Driver Display and HUD (Exhibited by TIANMA) |

The Emergence of Smartphones Promotes the Development of Automotive Semiconductors

Navigation system manufacturers developing for automakers began focusing on developing in-vehicle information systems (IVI: In-Vehicle Infotainment) instead of single-function navigation devices when Apple launched the iPhone in 2007. To process various information, IVI supports multitasking systems, and its operating systems have begun to include Linux and QNX as in-vehicle systems since around 2012.

Since the emergence of smartphones, new SOC manufacturers have gradually entered the semiconductor market. In smartphone semiconductors, the performance and capacity of hardware such as memory have significantly improved, and the growth of integrated function SOCs has also been remarkable. The technology supporting smartphones has gradually evolved into high-performance systems capable of matching the performance of automotive ADAS systems. Therefore, it can be said that the development of automotive SOCs is further advancing through the evolution of smartphone semiconductors.

|

|

|

|

Multi-Display e-Cockpit (Exhibited by Marelli at CES 2019) |

Driver Controller (Exhibited by Aptiv at IAA 2017) |

Developing Deep Learning Processors for ADAS

Major semiconductor manufacturers, both domestic and international, will inevitably be eliminated if they only focus on the current SOC development. The next focus for companies regarding automotive technology is semiconductors for ADAS (Advanced Driving Assistant System). While ADAS requires various technologies, semiconductor manufacturers are focusing on computational processors for deep learning technology used to process information.

Currently, companies actively engaged in automotive deep learning integrated processors include NVIDIA, Intel-Mobileye, Qualcomm, Renesas, and Denso.

NVIDIA

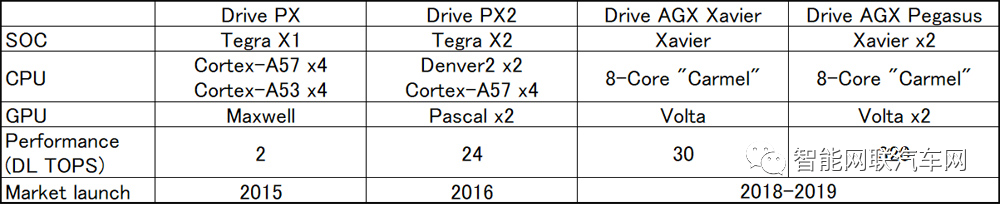

Since the Tegra series, NVIDIA has continuously enhanced its deep learning (DL) computational capabilities. The company not only provides SOCs but also automotive platforms.

According to NVIDIA, with a DL computational processing capability of 320 TOPS using the Drive AGX Pegasus, automotive manufacturers can achieve Level 5 autonomous driving systems solely with this.

*TOPS (Tera Operations per Second: Tera=1012) is a unit that indicates the number of calculations that can be performed per second.

NVIDIA’s Automotive Platform

|

|

(Source: Author’s production based on various materials)

|

|

|

|

DRIVE Xavier and DRIVE Pegasus |

Autonomous Driving Computing Platform |

(Exhibited by NEXTY Electronics and NVIDIA)

Intel-Mobileye

The only manufacturer likely to break NVIDIA’s monopoly is Intel-Mobileye. The memory of Intel’s acquisition of Mobileye for approximately 1.7 trillion yen in March 2017 is still fresh.

|

|

|

Mobileye’s Visual Processing Processor EyeQ Series (Exhibited by STMicroelectronics) |

One of the founders of Mobileye (established in 1999), Amnon Shashua, improved positioning accuracy through unique image processing algorithms based on distance measurement technology using a monocular camera. Since 2000, Mobileye has been collecting image data using monocular cameras, and its vast amount of data supports Mobileye’s technology.

Compared to NVIDIA’s system, which processes information from various sensors using overwhelming computing technology and AI technology, Mobileye only uses image recognition algorithms from monocular cameras. As a Level 2 driving assistance system (ADAS), it can provide affordable prices, accelerating its integration with multiple automakers.

However, a system relying solely on a monocular camera has its limits and will need to integrate high-performance computing technology and AI technology in the near future. Through Intel’s acquisition, it is possible to combine these future technologies with those owned by Mobileye, potentially building a system capable of competing with NVIDIA.

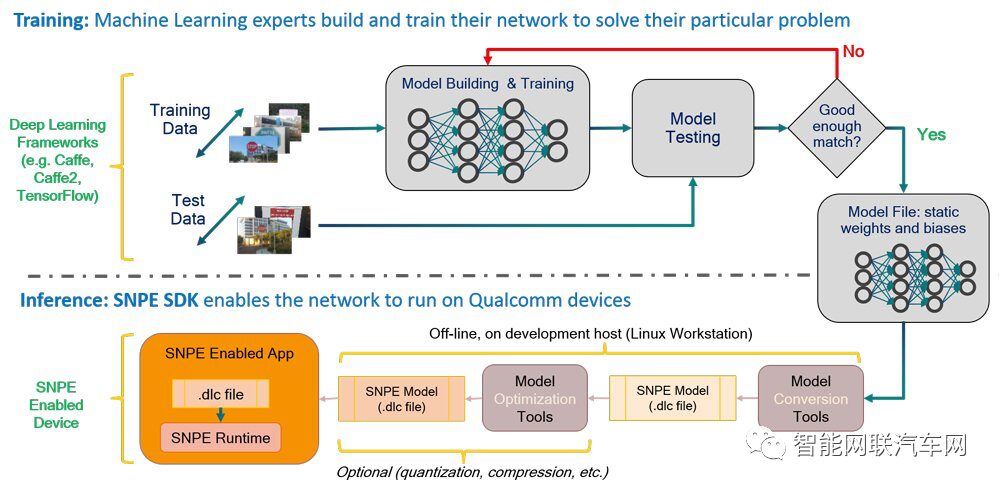

Qualcomm

As an ADAS-specific platform, Qualcomm unveiled its SOC and Snapdragon series, which holds the largest market share in the smartphone market, at CES 2020. This platform, named Snapdragon Ride Platform, will provide a hardware platform that divides autonomous driving technology into three levels. Qualcomm will officially enter the autonomous driving technology field with this platform, competing with leading companies like NVIDIA and Mobileye in the ADAS domain.

Active safety (L1/L2)

Through a single Snapdragon SOC, it can provide a driving assistance system for Level 1/Level 2, including automatic emergency braking, traffic sign recognition, and lane-keeping assistance.

Convenience (L2+/L3)

Through a single Snapdragon Ride SOC, it can provide a driving assistance system for Level 2+/Level 3, supporting autonomous driving, automatic parking, and stop-and-go traffic in urban driving on highways. This platform can provide DL 30TOPS of performance.

Self-Driving (L4/L5)

Through multiple Snapdragon Ride SOCs, it can provide autonomous driving technology for Level 4/Level 5, supporting urban autonomous driving, robot taxis, and robotic logistics. This platform can provide up to DL 700TOPS of performance.

|

|

|

Snapdragon Neural Processing Engine (SNPE) Model Workflow (Source: Qualcomm) |

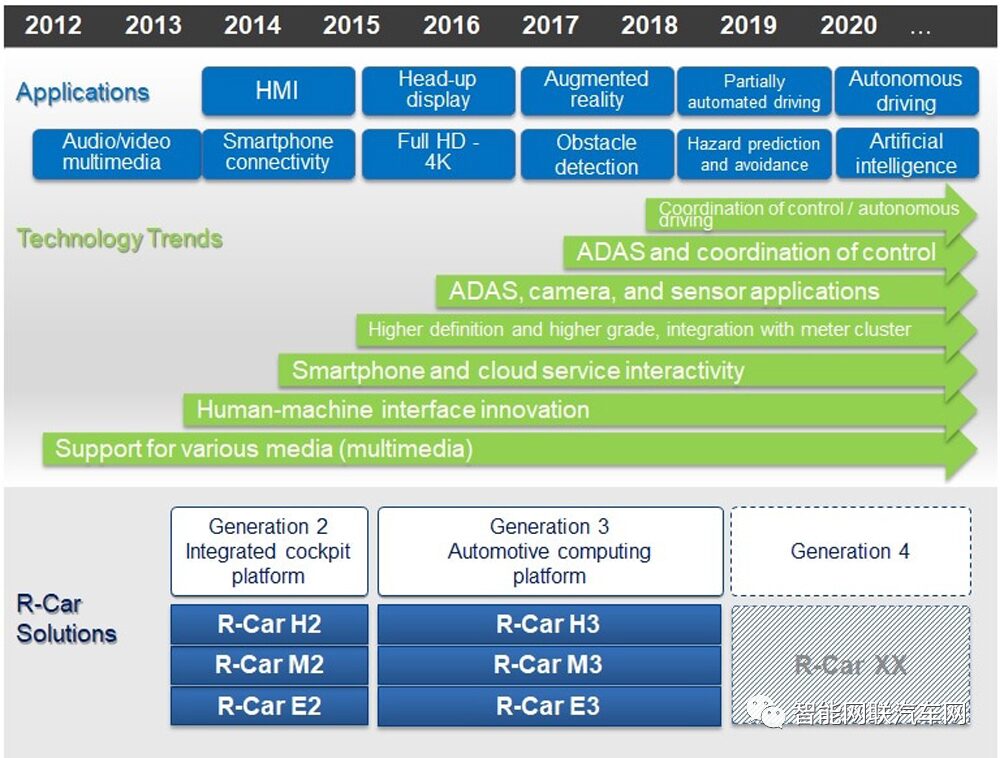

Renesas Electronics

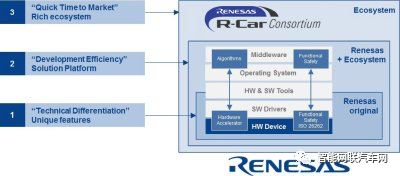

Renesas has successfully entered the ADAS field through its automotive SOC R-Car series. The R-Car series has historically supported navigation systems and other multimedia systems, positioning itself as an in-vehicle computing platform from the R-Car H3 series, and can also be applied to advanced driving assistance systems.

Renesas R-Car Solutions

|

|

(Source: Renesas)

|

|

|

R-Car Cockpit ECU Reference Solution (Exhibited by Renesas at ELIV 2019) |

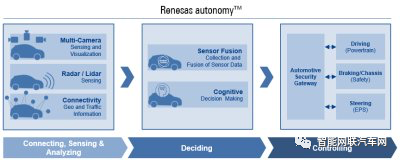

Although there is currently no platform capable of processing deep learning structures like NVIDIA and Qualcomm, Renesas is developing a next-generation AI chip that is low-power and high-performance, aimed for 2020. The next-generation chip, as one of the AI technologies, is based on the recently popular Processing-in-Memory (PIM) architecture, achieving low power consumption and high-speed CNN (Convolutional Neural Network) processing. A test chip equipped with an AI accelerator operates with the world’s highest level of 8.8TOPS/W power efficiency. In comparison, NVIDIA’s Xavier runs at 30W with a performance of 30TOPS, while Renesas’s AI chip can operate with just 3.4W for the same 30TOPS processing.

|

|

|

|

Development Platform for ADAS and Autonomous Driving “Renesas Autonomy” (Source: Renesas) |

Denso

|

|

|

ThinCI Graphics Stream Processing SoC (Exhibited by Denso at the Detroit Auto Show 2019) |

Denso established a wholly-owned subsidiary, NSITEXE, Inc., in 2017 to develop and design semiconductors for autonomous driving technology. In 2018, NSITEXE collaborated with the American company ThinCI to develop a unique AI processor called DFP (Data Flow Processor), which began sales in January 2020.

In December 2019, Toyota and Denso announced the establishment of MIRISE Technologies in 2020 to develop next-generation semiconductors. It is expected that Toyota will strengthen its semiconductor development system, which is key to enhancing autonomous driving technology within the group, striving to join advanced technologies that are prone to black box effects.

The capabilities of Denso’s DFP will undergo various validations and improvements and are still in the enhancement stage, but Toyota’s firm belief that semiconductor strategy is indispensable for next-generation automotive technology is evident.

What Next-Generation Semiconductors (SOC) Need

As establishing high-performance SOCs is key to autonomous driving technology, it is conceivable that major semiconductor manufacturers will concentrate their development resources in this area. However, developing semiconductors requires high development costs, and to recoup these costs, a large volume of completed SOC devices needs to be sold. Systems that require expensive equipment and related devices (such as cooling systems and special circuits) can only be integrated into a portion of luxury cars, making it difficult to expect large-scale sales.

To enable autonomous driving technology to be integrated into all levels of vehicles, low-consumption, high-performance AI chips are essential. Additionally, to enhance AI performance, the data collection technology for re-learning processes is crucial. Considering these factors, the next-generation semiconductors need to possess the following conditions for SOC:

1) Low-consumption, high-performance deep learning processing (no cooling mechanisms required)

2) Learning data (neural network) update functionality

3) Equipped with communication functionality

4) Compliance with functional safety levels (ASIL)

Advanced computational processing technologies have limits if relying solely on integrated single systems, so the application of cloud technology using intelligent connected technology is also necessary. For next-generation semiconductors for autonomous driving technologies, it becomes important to design with consideration for building these automotive-related ecosystems (integrating information processing and cloud distribution, etc.), and recruiting talent is also a significant issue.

The competition for developing semiconductors for autonomous driving technology has just begun. Companies like Toyota are strengthening semiconductor development both within their groups and through alliances with specialized semiconductor manufacturers, among various forms. Understanding the trends in semiconductor development for autonomous driving technology is key to grasping the direction of next-generation vehicles.