Click ↑ the blue text to follow us

Set “Starred” to avoid missing updates

According to TrendForce’s research, after significant production cuts by American and Korean manufacturers starting in May, some suppliers have begun to raise wafer prices, with quotes for the Chinese market slightly higher than the transaction prices in March and April.

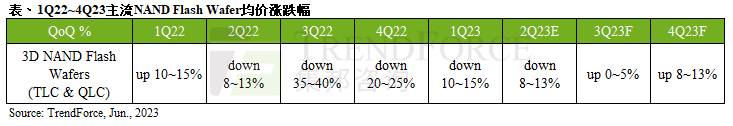

Therefore, TrendForce estimates that in June, as module manufacturers start stocking up, the mainstream capacity of 512Gb NAND Flash wafers is expected to stop falling and slightly rebound, ending the sharp decline that has persisted since May 2022. It is anticipated that prices will begin to rise in the third quarter of this year, with an increase of about 0-5%, and the increase in the fourth quarter will expand to 8-13%. As for SSD, eMMC, and UFS products, inventory still needs to be cleared through promotions, and there are currently no signs of price increases.

The peak stocking period for the second half of the year is approaching. Despite the sluggish demand this year leading to continuous downward adjustments in terminal shipments, the market still believes that the terminal product shipment volume in the second half of the year will outperform that of the first half, with procurement volumes likely to increase quarter by quarter. TrendForce indicates that as of the second quarter, downstream module manufacturers still have relatively high inventory levels, and whether there will be strategic stocking in the future depends on two factors: the actual demand recovery during the peak season and whether the original manufacturers’ quotes become more aggressive.

Compared to other buyers, Chinese module manufacturers have a strong willingness to build low-cost inventory, and they currently have a high acceptance of slight increases in wafer prices from original manufacturers. Therefore, some capacity wafer prices in the Chinese market are expected to stop falling and start rising first. If other markets also show acceptance of reasonable price increases, the trend of original manufacturers raising wafer prices will gain effective support, leading to a more proactive procurement strategy from buyers, further supporting subsequent price increases for wafers.

According to TrendForce’s analysis of the reasons for the active stocking by Chinese module manufacturers, in the short term, some manufacturers plan to push for shipments, thus having a strong purchasing motivation when prices hit bottom and rebound. In the long term, in addition to China’s goal of semiconductor localization, various module manufacturers are actively increasing inventory through low price points to strengthen cost competitiveness, continuously expanding wafer procurement capacity for production of Client SSDs or UFS and eMMC products, aiming to secure orders from leading terminal manufacturers.

▶ About Us

TrendForce is a global high-tech industry research organization spanning storage, integrated circuits and semiconductors, wafer foundry, optoelectronic displays, LEDs, new energy, smart terminals, 5G and communication networks, automotive electronics, and artificial intelligence. The company has accumulated years of rich experience in industry research, government industrial development planning, project evaluation and feasibility analysis, corporate consulting and strategic planning, and brand marketing, making it a quality partner for government and enterprise clients in high-tech industry analysis, planning evaluation, consulting, and brand promotion.

Scroll up and down to view

Share

Collect

Like

Looking