Benefiting from a new round of functional upgrades and performance improvements in smart terminal products, a wave of replacements for smartphones, personal computers, wearable devices, and consumer electronics has emerged, leading to a noticeable increase in terminal demand and significant signs of recovery in the global semiconductor industry.According to data from the World Semiconductor Trade Statistics (WSTS), global semiconductor sales are expected to reach $627.6 billion in 2024, a year-on-year increase of 19.1%. The organization predicts that the growth rate of the global semiconductor market will drop to 11.2% in 2025.

In this context, companies in the A-share semiconductor industry chain have reported continuous significant increases in performance for 2024 and the first quarter of this year. Tianfeng Securities believes that the ongoing technological competition between China and the U.S. continues to catalyze the demand for a self-controlled semiconductor industry chain. The first quarter reports signal a recovery, and there is optimism about growth momentum in the second quarter, as well as opportunities arising from deepening geopolitical competition and cyclical recovery.

Major Semiconductor Companies Report Significant Increases

Leading semiconductor equipment company North Huachuang recently announced its performance, showing that in 2024, the company achieved revenue of 29.838 billion yuan, a year-on-year increase of 35.14%; net profit attributable to shareholders was 5.621 billion yuan, a year-on-year increase of 44.17%. In the first quarter of 2025, the company achieved revenue of 8.206 billion yuan, a year-on-year increase of 37.90%; net profit attributable to shareholders was 1.581 billion yuan, a year-on-year increase of 38.80%.

Regarding the reasons for the performance growth, North Huachuang stated that in 2024, several new products, including Capacitive Coupling Plasma Etching Equipment (CCP), Plasma Enhanced Chemical Vapor Deposition Equipment (PECVD), Atomic Layer Deposition Vertical Furnaces, and Stacked Cleaning Machines, entered customer production lines and achieved mass sales, enriching the company’s product matrix and enhancing the completeness of its product layout.At the same time, as the company’s business scale continues to expand, platform advantages gradually emerge, operational efficiency significantly improves, and cost rates effectively decrease, leading to continuous growth in net profit attributable to shareholders in 2024.

Coincidentally, domestic CIS (CMOS Image Sensor) leader Weir Co., Ltd. also delivered a surprising performance report to investors. In 2024, Weir Co., Ltd. achieved operating revenue of 25.731 billion yuan, a year-on-year increase of 22.41%; net profit attributable to shareholders was 3.323 billion yuan, a year-on-year surge of 498.11%. In the first quarter of this year, Weir Co., Ltd. achieved operating revenue of 6.472 billion yuan, a year-on-year increase of 14.68%; net profit attributable to shareholders was 866 million yuan, a year-on-year increase of 55.25%.

Regarding the reasons for the performance growth, Weir Co., Ltd. stated that with the continuous penetration of its image sensor products in the high-end smartphone market and the automotive autonomous driving application market, the market share in related fields has steadily grown, leading to significant increases in operating revenue and gross profit margin, with operating revenue reaching a historical high. Additionally, to better cope with the impact of industry fluctuations, the company actively promotes product structure optimization and supply chain structure optimization, gradually restoring the gross profit margin of its products and significantly improving overall performance.

Furthermore, domestic advanced packaging and testing leader Tongfu Microelectronics achieved operating revenue of 23.882 billion yuan in 2024, a year-on-year increase of 7.24%; net profit attributable to shareholders was 678 million yuan, a year-on-year increase of 299.90%. The company stated that in 2024, the semiconductor industry gradually entered an upward cycle, with industry destocking gradually in place, demand driven by data centers, automotive electronics, and favorable policies for consumer electronics, leading to a gradual warming of market demand. Meanwhile, the booming development of artificial intelligence in the PC sector is expected to further drive growth in the semiconductor industry.

Domestic CPU industry leader Haiguang Information achieved operating revenue of 9.162 billion yuan in 2024, a year-on-year increase of 52.40%; net profit attributable to the parent company was 1.931 billion yuan, a year-on-year increase of 52.87%. In the first quarter of this year, Haiguang Information achieved operating revenue of 2.4 billion yuan, a year-on-year increase of 50.76%; net profit attributable to shareholders was 506 million yuan, a year-on-year increase of 75.33%.

Regarding the reasons for the performance growth, Haiguang Information stated that the company has always focused on the general computing market, continuously achieving technological innovation and product performance improvement through high-intensity R&D investment, maintaining a leading market position in China. During the reporting period, the company’s CPU products further expanded market application fields and increased market share, supporting a wide range of data centers, cloud computing, and high-end computing applications. In the context of the AIGC era, the rapid iteration of the company’s DCU products has gained broader market recognition, supporting computing infrastructure and commercial computing applications in the AI industry with high computing power, high parallel processing capabilities, and good software ecosystem, further promoting the rapid growth of the company’s performance.

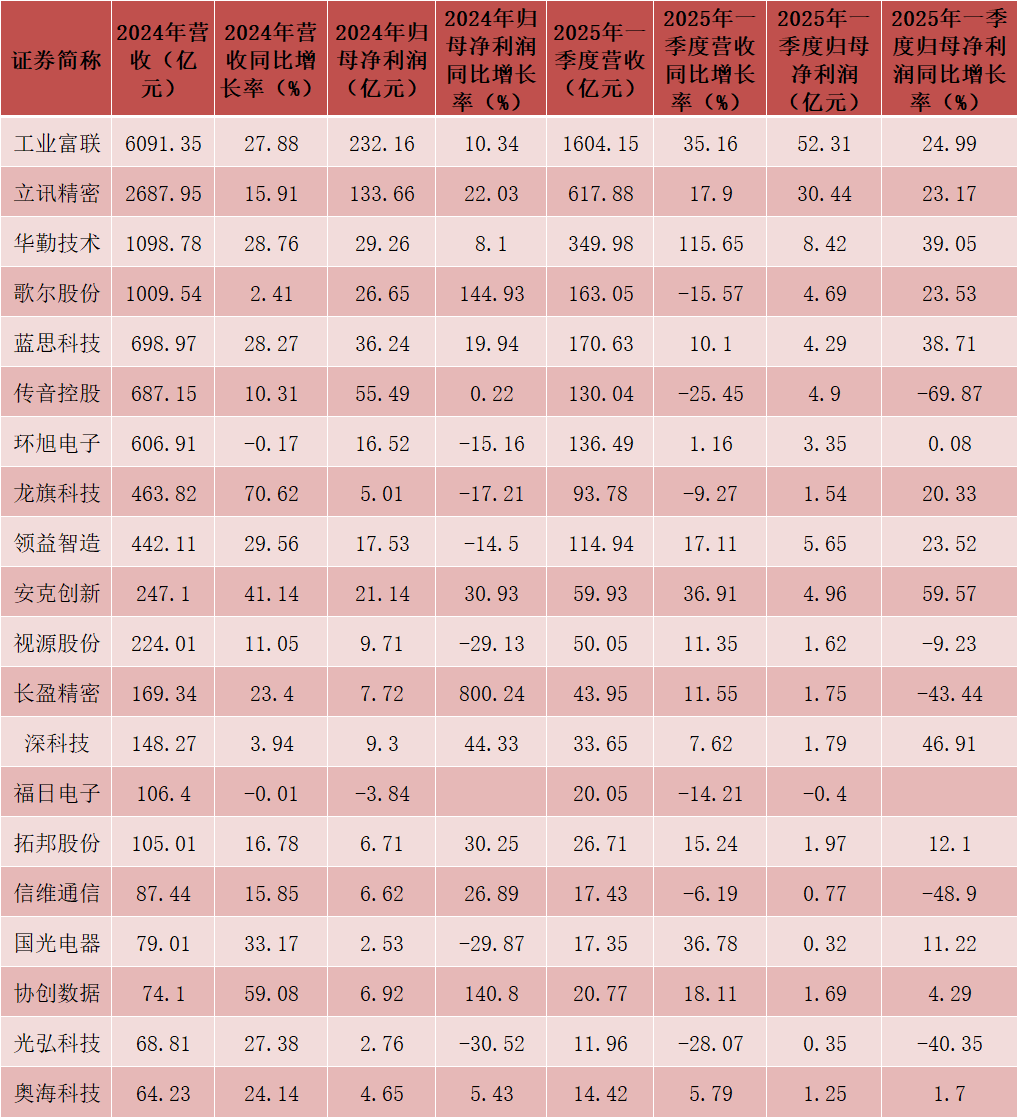

Consumer Electronics Leaders Report Significant Increases

Consumer electronics leaders have reported significant increases in performance for 2024, while still maintaining rapid growth in the first quarter of this year.

Consumer electronics leader Industrial Fulian achieved revenue of 609.135 billion yuan in 2024, a year-on-year increase of 27.88%; net profit attributable to shareholders was 23.216 billion yuan, a year-on-year increase of 10.34%. In the first quarter of this year, Industrial Fulian achieved operating revenue of 160.415 billion yuan, a year-on-year increase of 35.16%, and net profit attributable to shareholders was 5.231 billion yuan, a year-on-year increase of 24.99%.

In 2024, artificial intelligence technology entered a stage of large-scale application, with explosive growth in large model iterations and generative AI scenarios driving an exponential increase in computing power demand. Recently, demand for AI inference has gradually become the focus. As AI demand moves towards higher-level training and inference, the demand for computing power will be larger than ever, and high-end AI servers, along with complete network and storage architectures, will continue to play an indispensable role. TrendForce data shows that in 2024, global AI server shipments are expected to grow by 46% compared to the previous year, reaching 1.98 million units, accounting for 12.1% of the overall server market, with a market size expected to exceed $200 billion due to its higher value.

Guojin Securities believes that against the backdrop of a significant increase in global AI computing infrastructure demand, Industrial Fulian, as a core supplier of AI server chip substrates, will directly benefit from the industry’s high prosperity cycle. The first quarter of 2025 continues to show strength, with cloud computing revenue increasing by 50% year-on-year, and AI general server revenue also increasing by over 50%, with cloud service provider customers contributing over 60% growth, validating the sustained prosperity on the demand side.

Luxshare Precision achieved operating revenue of 268.795 billion yuan in 2024, a year-on-year increase of 15.91%; net profit attributable to shareholders was 13.366 billion yuan, a year-on-year increase of 22.03%. In the first quarter of this year, Luxshare Precision’s operating revenue was 61.788 billion yuan, a year-on-year increase of 17.90%; net profit attributable to shareholders was 3.044 billion yuan, a year-on-year increase of 23.17%.

Luxshare Precision stated that in the face of a complex and changing international political and economic environment, the company’s management is firmly guided by the “three five-year” strategic plan, continuously expanding the development of existing businesses through both endogenous and exogenous means, further deepening vertical integration of the industry chain, and actively laying out new products, new technologies, and new fields. With the company’s leading advantages in advanced process technology and strong platform capabilities in precision intelligent manufacturing, it has achieved cross-domain resource integration, promoting efficient collaboration among consumer electronics, communications, and automotive sectors, and steadily advancing the company along the expected growth trajectory for healthy development.

Huayuan Securities Research believes that the current consumer electronics sector offers significant value for money. The multiple rounds of tariff increases and policy fluctuations by the U.S. against China and many countries in the Asia-Pacific region have raised concerns about the consumer electronics industry chain. However, on one hand, countries are currently in a phase of tariff negotiations with the U.S., and it is highly likely that a balance will be found; on the other hand, while U.S. tariff increases will raise global trade costs and cause considerable disruption for an extended period, China’s strong manufacturing capabilities cannot be easily replaced in the short term, so the consumer electronics industry chain will continue to operate steadily. In this context, the current consumer electronics industry chain is already in the lower-middle range of historical valuations, and the operational rhythm is expected to steadily improve, suggesting a focus on selecting bottom varieties based on both “performance” and “valuation” dimensions for layout.

Editor: Li Dan

Proofreader: Yao Yuan