Author: Tie Liu, Columnist for Science and Technology

Author: Tie Liu, Columnist for Science and Technology

Providing professional commentary on Chinese high-tech enterprises and products

Recently, there have been rumors in the industry that “Jinan Quanxin” has already stalled. In recent years, a number of semiconductor projects in China, such as Dehuai Semiconductor, Wuhan Hongxin, and Guizhou Huaxintong, have either closed down or stalled, which can be described as “losing both the lady and the soldiers.” The root cause lies mainly in local governments not following the general laws of development, ignoring the existing technological capabilities and industrial levels, and blindly investing in projects. From practical experience, the development of the semiconductor industry should be grounded, advancing step by step, rather than blindly investing and seeking grandiosity.

Jinan Quanxin in Trouble

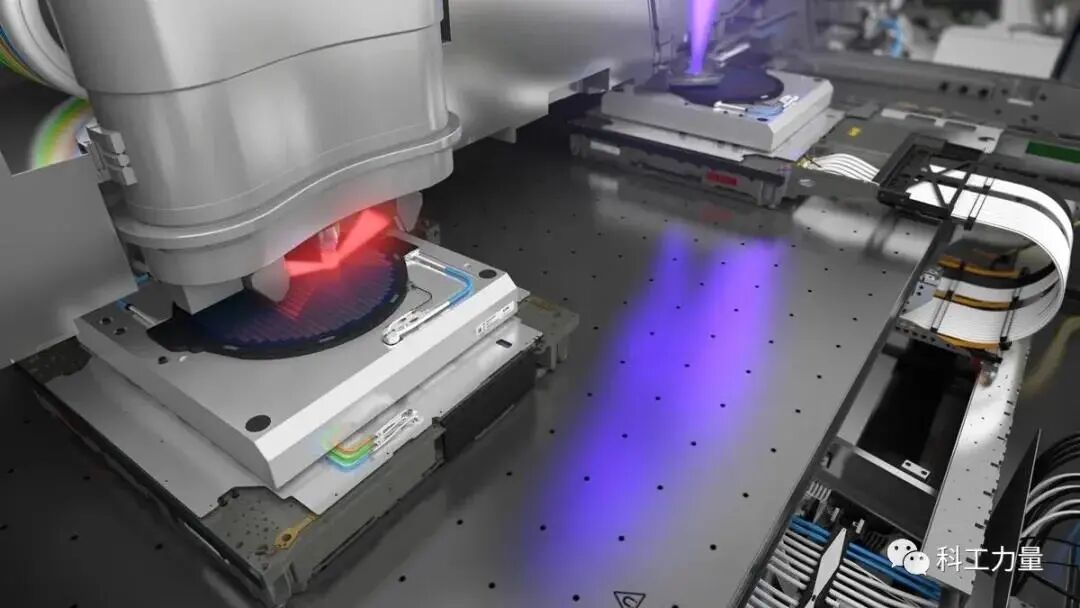

According to public information, the total investment in the Jinan Quanxin project is as high as 59.8 billion yuan, divided into three phases: the first phase involves an investment of 23 billion yuan to build a 12-inch 12nm production line with a monthly capacity of 7,000 wafers; the second phase involves an investment of 26 billion yuan to expand the monthly capacity to 23,000 wafers for 12nm logic chips; the third phase involves an investment of 10 billion yuan to increase the capacity by 10,000 wafers for 7nm chips. The project began construction in the first quarter of 2019, located in the Jinan Airport Economic Zone, covering an area of 39 hectares.

Although the planning for Jinan Quanxin is grand, the reality is harsh. According to employees of Jinan Quanxin, “the company is in a difficult situation, and since April, salaries have been suspended, forcing employees to resign.” Project construction has also gradually come to a halt, with contractors stating, “This project has changed general contractors multiple times during construction, which is very rare in the construction industry, indicating that the project has long been at great risk.” During the change of general contractors, there were also multiple instances of wage arrears for migrant workers.

Currently, Jinan Quanxin is in a precarious situation, with over two years of construction facing project suspension and employee layoffs. To purchase lithography, etching, and thin-film equipment, 1.7 billion yuan has already been paid as a deposit, and if the Quanxin project stalls, foreign equipment manufacturers will deduct high penalties from the deposit.

Jinan Quanxin and Wuhan Hongxin Share Common Behind-the-Scenes Controllers

Interestingly, Jinan Quanxin and Wuhan Hongxin share common behind-the-scenes controllers. In terms of equity, the four major shareholders of Jinan Quanxin are Jinan Jixin Industrial Development Investment Partnership (Limited Partnership), Yixin Integrated Technology (Zhuhai) Co., Ltd., Jinan High-tech Holding Group Co., Ltd., and Jinan Industrial Development Investment Fund Partnership (Limited Partnership), the latter two of which are affiliated with the Jinan State-owned Assets Supervision and Administration Commission. Yixin Integrated, which holds about 41.18% of Jinan Quanxin’s shares, is controlled by Cao Shan, who was the behind-the-scenes controller of the already stalled Wuhan Hongxin (Cao Shan was the major shareholder and legal representative of Beijing Guangliang Blueprint).

Moreover, the operational methods of Jinan Quanxin are strikingly similar to those of Wuhan Hongxin, both of which involve making grand promises to local governments and state-owned assets, and once the national funds are nearly exhausted, the projects stall and employees are laid off. In terms of registered capital, although Quanxin’s registered capital is as high as 5.95 billion yuan, the actual paid-in capital was initially only 510 million yuan, which was later gradually supplemented to 3.237 billion yuan. The additional tens of billions of capital mainly came from two subsidiaries under the Jinan State-owned Assets Supervision and Administration Commission, as well as the later joining of Jinan Jixin Industrial Development Company, indicating that the behind-the-scenes controllers of Jinan Quanxin are essentially “playing a shell game.”

In fact, there has always been controversy in the industry regarding Quanxin, especially after the failure of Wuhan Hongxin, the industry generally believes that Jinan Quanxin will become the next Wuhan Hongxin. Reports indicate that local governments have already taken measures to cut losses, abandoning the 12-inch factory while retaining the completed photomask factory and making it independent.

Developing the Semiconductor Industry Requires Policies, Funding, Technology, and Talent

In recent years, with the surge of interest in chips across the country, a large number of domestic and foreign enterprises have made grand promises and invested heavily, while some local governments have ignored local realities, seeking grandiosity and rushing to implement projects. A number of semiconductor projects, such as Dekoma/Dehuai, Chengdu GlobalFoundries, and Huaxintong, have already faced significant setbacks.

From a hindsight perspective, the reason these projects have faced setbacks is primarily due to local governments ignoring the actual conditions and forcibly pushing projects to cater to the current chip craze. From practical experience, developing the semiconductor industry requires not only policy and financial support but also a strong talent team and rich technological reserves.

In the case of the Dekoma/Dehuai project, there is not much technological reserve; most of the technology relies on purchases, having successively bought technology licenses from TowerJazz, ON Semiconductor, STMicroelectronics, and other foreign companies. The CMOS image sensor chips do not have a local design team but instead hired the original design and R&D team from Japan’s Toshiba CMOS image sensors for development.

GlobalFoundries, although it has the legacy of AMD and IBM, has still been pushed down several ranks in recent years’ technological competition, and GlobalFoundries is only willing to transfer second-hand equipment that has been eliminated from its Singapore factory, which can only be used for processing mature technology chips. Even so, GlobalFoundries still demands a 51% stake. Due to the overly harsh conditions, GlobalFoundries’ attempts to establish joint ventures in several Chinese cities have all been rejected. Four months after signing a cooperation agreement with Chongqing Yude, the project has still not been realized, with the reasons for the plan being shelved being the relatively backward technology transferred by GlobalFoundries and its high price demands.

Huaxintong introduced Qualcomm’s ARM CPU technology, but in the server CPU market, Intel and AMD’s x86 chips hold an absolute monopoly, and ARM CPUs can only survive in the server CPU market through policies, such as Huawei and Feiteng’s ARM CPUs targeting government and state-owned enterprise users, while in the commercial market (servers), ARM CPUs have virtually no competitiveness against x86 CPUs. It can be said that the technology introduced by Huaxintong is inherently lacking market competitiveness.

Due to the lack of market for ARM server CPUs in the commercial sector, many manufacturers that once bet on ARM have struggled to survive. Broadcom and AMD have already abandoned ARM server CPUs, with AMD shifting its focus to x86 CPUs, and Broadcom selling its heavily developed ARM server CPUs directly to Cavium.

In this broader context, Qualcomm decided to abandon ARM server CPUs, and Paul Jacobs (the son of Qualcomm’s founder), who advocated for the ARM server CPU project, was ousted by the board. After leading Qualcomm’s data center technology for nearly five years, Chandrasekher left, followed by a mass exodus of technical personnel. After Qualcomm abandoned ARM server CPUs, Huaxintong became a tree without roots, and naturally, it closed down.

The Semiconductor Leap Forward is Not Advisable

In recent years, some local governments have engaged in irrational semiconductor investment projects, which are evident to industry experts and even to grassroots observers like Tie Liu. The internal logic of these investment projects, in a sense, is similar to the various “spectacular” projects in Duyun, Guizhou Province, and can be seen as a semiconductor version of “spectacular architecture.” The root cause is that some local leaders have noticed that the semiconductor industry is being prioritized nationwide, and thus “follow the trend” and are eager for quick success. Just as “spectacular architecture” may succeed by boosting tourism, it does not mean that imitating the construction of “spectaculars” will necessarily lead to success.

Indeed, some local governments have achieved nationally recognized results by investing in manufacturing, and the desire of other peers to learn is understandable. However, this requires understanding the reasons for others’ success, recognizing their industrial history and opportunities, and how to develop and strengthen industries scientifically; locally, there must also be enough talent who understand technology, industry, and management, rather than just learning the “boldness” of investment.

In practice, the biggest lesson from the semiconductor industry’s leap forward is to respect the laws of technological development, which must be gradual. Local governments should not attempt to use policies and state-owned capital to achieve rapid success in the short term, nor should they try to use administrative resources to forcefully create an industry.

Tie Liu also hopes that there will be no blind faith in “overtaking on a curve.” From practical experience, in recent years, most of these so-called “curve overtaking” have been about playing concepts and creating hype, with very few truly succeeding, while many have ended up “overturning on the curve.” It is hoped that local officials will fully consider local realities and that the layout of local industries should rely more on existing enterprises with certain technological accumulation and on talents who have consistently performed well.

Source | Observer Network

Recommended Hot Videos📹

👇