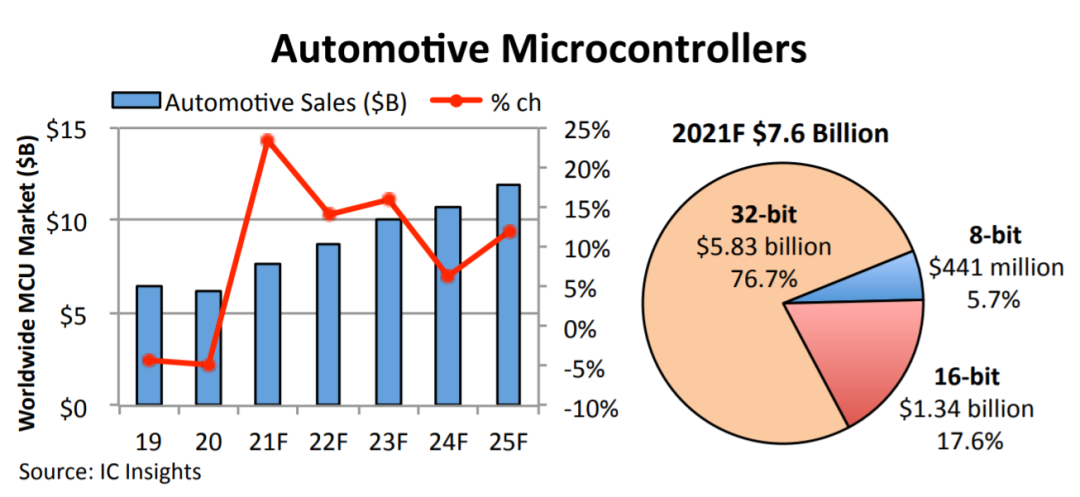

According to authoritative market research institutions, the global microcontroller (MCU) market is expected to reach a total sales of $19 billion in 2021, with shipments exceeding 25 billion units. From 2021 to 2028, the compound annual growth rate (CAGR) of MCUs is approximately 10%, increasing to $36 billion by 2028. A report released by IC Insights in August this year shows that automotive MCUs account for 40% of the global MCU market, with expected sales of $7.6 billion in 2021, a 23% increase from last year, where about 77% are 32-bit MCUs.

Besides the automotive market, the second largest market for MCUs is industrial applications (30%), with the remaining 30% primarily used in consumer electronics/appliances, the Internet of Things (IoT), smart cards, and computer and communication networks.

Arm Cortex-Based MCU Ecosystem

32-bit MCUs are predominantly based on Arm Cortex-M series microprocessor cores, with major MCU manufacturers including ST, Renesas, Infineon, NXP, and Microchip. The Cortex-M processor series is based on the Arm M-Profile architecture, designed specifically for embedded systems, offering advantages such as low latency and high deterministic operation. This processor series has various performance specifications, including M0, M0+, M1, M23, M3, M4, M33, M35P, M55, and M7, catering to different performance, power consumption, and cost requirements for microprocessor chips.

The MCU ecosystem based on Arm cores has matured significantly over the years. Arm provides various tools to facilitate MCU developers, ranging from development environments to software. For instance, integrated development environments (IDEs) include Arm Keil MDK and Arm Development Studio; compilers include Arm Compiler 6 and GCC; software includes the Cortex Microcontroller Software Interface Standard (CMSIS) and Trusted Firmware-M (TF-M); operating systems include Mbed OS and Keil RTX5; debugging tools and development boards include JTAG and SWD debugging hardware. Additionally, there are many third-party software and development toolchains available, such as compilers, debuggers, RTOS, and software libraries.

To enhance market leadership and increase customer stickiness, leading MCU manufacturers are also actively building ecosystems centered around their own MCU chips, with the STM32 MCU ecosystem being a prime example. As a leader in Arm Cortex 32-bit MCUs and MPUs, ST not only outlines and builds a complete development roadmap for STM32 MCU chips but also provides customers and developers with a comprehensive learning, development, testing, and evaluation environment, such as STM32 Cube.

The STM32 MCU ecosystem also brings together many third-party development tools and partners, including major global cloud access platforms; mainstream RTOS supporting the Chinese market, such as OneOS, TencentOS Tiny, and RT-Thread; and hardware development tools including various development boards and debugging and programming tools; software development tools like RT-Thread Studio.

RISC-V and MCU

Originating from the University of California, Berkeley, RISC-V has recently stirred significant interest in the global open-source hardware community, with universities, research institutions, chip manufacturers, and internet giants adopting and supporting this promising instruction set architecture (ISA) that may compete with Arm. China has been attempting to develop independent and controllable microprocessors for years but remains constrained by mainstream international architectures such as X86, MIPS, and Arm. RISC-V ignites new hope for domestic CPUs. Leaders from academia and industry, such as Ni Guangnan, Dai Weimin, and Bao Yungang, are actively promoting open-source hardware innovation centered around RISC-V.

RISC-V has now gained global support and active participation. In addition to the RISC-V International Foundation, which is dedicated to promoting RISC-V, there are several industry organizations in China focused on promoting RISC-V and open-source hardware, including the China RISC-V Industry Alliance, the China Open Instruction Ecosystem (RISC-V) Alliance, and the Taiwan RISC-V Industry Alliance. Global manufacturers supporting RISC-V include Intel, Google, NVIDIA, Western Digital, Qualcomm, NXP, Huawei, Alibaba, ZTE, and Unisoc.

Currently, companies focusing on developing RISC-V core IP include SiFive, Sifang Technology, Corechip Technology, Alibaba Pingtouge, and Andes Technology. The RISC-V core IP provided by these IP vendors includes both open-source and commercial options, as well as cores developed specifically for their own chips. In terms of RISC-V chip applications, RISC-V can be seen in high-performance computing processors with up to 1000 cores and ultra-low-power single-issue/two-stage pipeline microprocessors. Regarding RISC-V’s application and development in the MCU market, several domestic MCU manufacturers have developed MCU chips based on the RISC-V core. RISC-V MCU developers include Zhaoyi Innovation, Qinheng Micro, Espressif Technology, Boliu Intelligent, Tailin Microelectronics, Zhongwei Semiconductor, and Hangshun.

In MCU design, what advantages and disadvantages does the RISC-V core have compared to Arm? Yang Yong, Technical Director of Nanjing Qinheng Microelectronics, believes that while Arm has matured over decades, its CPU architecture has become extremely complex, as evidenced by the complexity of its architecture documentation and instruction count, along with issues such as expensive patents and architecture licensing fees. In contrast, RISC-V is positioned as fully open-source, with a simple and modular design that greatly facilitates customers to customize according to their needs (avoiding the issues faced by Arm over decades of development from the outset). However, RISC-V is still in its early stages of development, and elements of the ecosystem such as compilers and development tools are still evolving, unlike Arm’s relatively mature ecosystem.

Yang Yong, Technical Director of Nanjing Qinheng Microelectronics

Chen Feng, Director of Ecosystem Operations at RT-Thread, also agrees with the many advantages of RISC-V and emphasizes its value for MCUs. Designing MCUs using the RISC-V instruction set allows chip manufacturers/developers to quickly complete low-barrier, low-cost chip designs and customize instruction designs for specific application scenarios, offering great flexibility. However, the related compilers, toolchains, IDEs, and OS support for RISC-V are still not perfect. Furthermore, as more and more companies use RISC-V architecture to customize chips, the fragmentation issue becomes increasingly prominent.

Chen Feng, Director of Ecosystem Operations at RT-Thread

How to Build the RISC-V MCU Ecosystem?

For RISC-V to secure a place in the $20 billion MCU market, it must establish a healthy MCU ecosystem, especially in the fragmented emerging IoT application market. Building a RISC-V MCU ecosystem faces numerous challenges, briefly listed as follows:

-

Mixing of RISC-V processor cores: There are open-source, commercial, and self-developed RISC-V cores, making it difficult to form a unified ecosystem like Arm;

-

Trade-offs between RISC-V and Arm cores: Existing MCU manufacturers often choose to develop and support both Arm and RISC-V MCUs simultaneously, making it difficult for RISC-V to gain sufficient resource support in the general MCU market;

-

Software and development tools: Compared to the Arm ecosystem, it is still not sufficiently complete, and functionality, performance, and usability need improvement;

-

Developer community: Training tutorials, offline and online communication meetings, development boards, and application solutions all require resource investment and ongoing maintenance;

-

New model for open-source hardware: Unlike open-source software (like Linux), open-source hardware requires chip design and tape-out costs, and the profit model is still unclear.

What successful experiences in building Arm MCU ecosystems can RISC-V learn from? In addition to the development tools created by Arm and ST mentioned earlier, attracting support from third-party commercial software developers is also crucial. IAR Systems, Lauterbach, and SEGGER can now support both Arm and RISC-V. He Xiaoqing, Secretary-General of the Embedded Systems Alliance, believes that the RISC-V camp should learn from Arm’s active participation in industry alliances and standard-setting. Arm is not only an IP company but also a tools and software enterprise that actively participates in various industry alliances and standard-setting. For example, Arm recently launched a new software architecture and reference implementation—SOAFEE (Scalable Open Architecture for Embedded Edge)—in collaboration with several automotive supply chain companies.

He Xiaoqing, Secretary-General of the Embedded Systems Alliance

Chen Feng from RT-Thread offers some suggestions for RISC-V developers from the OS perspective: 1. More easily accessible RISC-V MCU chips and evaluation boards to quickly develop environments; 2. RISC-V MCU chips need to provide more open driver libraries, sample code, and application reference designs; 3. A rich product line to meet different user needs.

The development of RISC-V MCUs does not necessarily have to follow the successful model of the Arm ecosystem; the industry should think about how to learn from the development and survival paths of non-Arm MCUs. What key factors are needed to successfully build the RISC-V MCU ecosystem? The experts interviewed unanimously agree that active collaboration is key to a robust ecosystem. Building the RISC-V MCU ecosystem requires cooperation across the industry chain to provide a more user-friendly and universal application development environment. In terms of OS, RT-Thread is continuously supporting and improving RISC-V MCU BSP, from the earliest HiFive to RV32M1, GD32V103, AB32VG1, CH32V103, CH32V307, to K210, Allwinner D1, and the Pingtouge Xuantie series RISC-V processor IP; RT-Thread has supported all of these. Meanwhile, the RT-Thread Studio integrated development environment (IDE) allows users to quickly set up a development environment for RISC-V MCUs, significantly lowering the barriers to application development.

For RISC-V IP and chip design manufacturers, it is necessary to adhere to and utilize RISC-V standards while diversifying development characteristics on this basis and giving back to the upstream community. Yang Yong from Qinheng believes that IC manufacturers should actively innovate to highlight the modularity and customization advantages of RISC-V. For example, Qinheng has pioneered RISC-V high-speed two-wire debugging, Bluetooth low-power WFE instruction customization, code size custom compression instructions, HPE hardware stack, VTF interrupt-free table, and more.

The future application growth points of RISC-V MCUs are primarily in the Internet of Things, with edge AI and automotive chips also being promising application markets for RISC-V. In the short term, it should primarily focus on the embedded field of industrial control MCUs, especially in scenarios with customization needs. Based on this, as the market and RISC-V ecosystem develop, high-performance mobile computing scenarios will also be a place for RISC-V to shine.

For domestic MCU manufacturers, how to motivate them to actively embrace and promote RISC-V? Most domestic MCU manufacturers are still in a wait-and-see state regarding adopting RISC-V cores, with a small number either conducting internal research or trialing in specific application products. Currently, there are relatively few domestic MCU companies actively promoting RISC-V chips. He Xiaoqing believes that external incentives, such as industrial policies and government support, are difficult to sustain. The real motivation must come from within domestic MCU companies, allowing the development path of domestic RISC-V MCUs to be stable and long-lasting. Although domestic MCUs have made significant breakthroughs in domestic substitution and application innovation in recent years, there is still a considerable gap in basic hardware/software technology, product variety, and key system application solutions compared to leading international enterprises. The emergence of RISC-V is a good opportunity to bridge this gap, and we look forward to domestic MCUs actively embracing RISC-V.

Yang Yong added that in the current political and commercial environment (such as technological blockades, domestic substitutions, copyrights, and patents), active innovation is the source of vitality for IC design companies, and open-source RISC-V is both an opportunity and a platform. The application scenarios of the Internet of Things are quite fragmented, and traditional general-purpose MCUs are insufficient to meet the customization needs of different application scenarios. RISC-V allows domestic MCU manufacturers to achieve autonomous control, increase flexibility of choice, and reduce development costs. For instance, Qinheng is achieving an industrial closed loop (self-research across the entire chain from instruction set architecture, microarchitecture, peripherals, toolchains, etc.) and a commercial closed loop (mass commercialization of developed RISC-V MCUs), allowing RISC-V to first ignite in the embedded field and then drive robust development in areas like mobile phones and servers.

Conclusion

In the automotive electronics and industrial control fields where MCUs are most widely used, it is almost entirely the domain of Arm microprocessors. Although RISC-V-based MCUs cannot directly compete with Arm, they can carve out a niche in the customized application sub-markets, especially in the emerging fragmented IoT application market. RISC-V presents a rare opportunity for domestic MCU manufacturers, but for the entire MCU industry to develop healthily, cooperation across all links in the industrial chain is necessary to perfect and develop the RISC-V MCU ecosystem, thus enlarging this cake so that all parties involved can benefit.

Although building the RISC-V MCU ecosystem faces many challenges, the enormous development potential is worth the try. As long as the RISC-V community and manufacturers are willing to collaborate, a “chip” paradise for RISC-V can certainly be created.