Continuing from the article on April 26 (Finding Patterns in Financial Records: Part 6 – The ABC Model of the Bear Market is Due to the A-Share Market Being a Chip Market), today I will continue with the seventh article in the series.

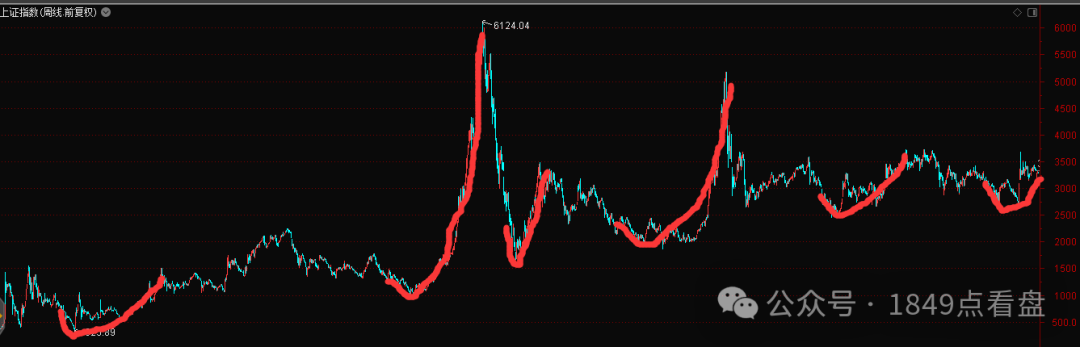

The Shanghai Composite Index fell from 1558 points on February 16, 1993, to 325 points on July 29, 1994, providing many classic references for the later A-share market.

Once a major bear market enters the C wave decline, due to the prolonged bear phase, many sectors have also dropped significantly, leading to a desire for a rebound. Often, during the C wave decline, the management will announce significant good news, but this good news can only trigger a short-term rebound, followed by a brutal C wave decline. It is only after the C wave decline has truly ended that a major bottom will be seen.

On March 14, 1994, the chairman of the China Securities Regulatory Commission, Liu Hongru, announced the “Four No Policies.” This included not listing 5.5 billion new shares in the first half of the year, not imposing a stock transfer income tax in 1994, not merging public and personal shares within the year, and prohibiting listed companies from randomly allocating shares.

As a result, on March 14, 1994, the market opened high and rose sharply, closing with a long lower shadow candlestick, gaining 10%, which is equivalent to a current limit-up increase.

Shortly after the sharp rise on March 14, 1994, the Shanghai Composite Index reached a high point and then accelerated its decline, eventually falling to 325 points to find a major bottom.

This script has been repeated many times since.

For example, in September 2004, after the management announced good news, the index quickly surged in the short term, only to continue the C wave decline. After the good news, the market faced criticism, ultimately falling to 998 points to find a major bottom.

Again, on August 28, 2023, the reduction of the stamp duty led to a one-day bull market, followed by a fierce C wave decline. This recent history is similar to past patterns, where the stamp duty relief led to a continued sharp decline, with various criticisms until the market found a bottom at 2635 points.

Over the past 30 years, the A-share market has performed similar scripts in almost every bear market. Although the tactics have continuously evolved, the underlying principles remain the same.

Why is it that after good news is announced during the C wave decline, a major bottom cannot be reached directly? Why is it that there is always a short-term rebound first, followed by a significant drop before a major bottom is found?

Everyone is an adult and can easily understand that after good news, there is a short-term rebound that initially leads you to believe in a bull market. However, as the market continues to decline, people gradually lose faith in the bull market, resulting in a transfer of shares. By the time the real bull market arrives, you may not be in the market, and you might miss out. Of course, the management has already made it clear, calling on everyone to be patient capital.

If you are willing to respond to the call to be patient capital, although it may be uncomfortable for a while, you will ultimately be rewarded when the bull market arrives. From this perspective, they are not misleading you. However, if you expect to buy at the lowest point and then enjoy a bull market, I have one thing to say: if you are speculating in stocks, you earn money without gratitude, and when you lose money, you blame the market. Why should they be obligated to fill your pockets with money?

Everyone is an adult, and coming to this market is inherently about speculation. Trading stocks is fundamentally about unearned gains, and there is nothing noble about it. Since we are here to speculate, we should be willing to take risks and accept losses.

Since everyone is smart, why not think from a different perspective? Since we are here to speculate, and since the market has such patterns, why not take advantage of these patterns?

For example, during the C wave decline when good news is announced, you can make a short-term profit and then exit. After the market declines further, you can buy the dip and then be patient capital to enjoy the bull market. Wouldn’t that be wonderful? This is the significance of studying history.

The above views are merely personal reflections and should not be used as trading advice.

As the saying goes, work and rest should be balanced; I will publish again after the May Day holiday.