On April 16, Beijing time, AI chip giant NVIDIA submitted an 8-K filing to the U.S. Securities and Exchange Commission (SEC), stating that it has received notification from the Trump administration that it will “indefinitely” ban the export of NVIDIA H20 chips to China and Israel, among other countries, unless a license is obtained. “The U.S. government stated that the licensing requirement is to address the risk that related products may be used or re-exported to Chinese supercomputers.”

NVIDIA revealed that in the first quarter ending April 27, 2025, the company will write down approximately $5.5 billion (about 40 billion RMB) in expenses related to the export of H20 GPU chips to China and other regions. At the same time, inventory, procurement commitments, and related reserve costs associated with H20 products amount to billions of dollars.

This means that the U.S. has completely banned the export of NVIDIA H20 chips to China. As NVIDIA’s only chip specifically designed for the Chinese market that complies with U.S. regulations, the H20 is also banned from sale. Furthermore, NVIDIA will no longer be able to sell any high-performance GPU products to China. This series of adjustments is expected to impact NVIDIA’s revenue by over $10 billion and severely undermine the effects of its previously launched “downgraded” technology.

The U.S. government has also increased tariffs to 245%

Meanwhile, the Trump administration announced in a White House document on April 15 that after the announcement of reciprocal tariff measures, over 75 countries are discussing new trade agreements, with some tariff increases currently suspended,except for China. Due to “China’s retaliatory measures,” it currently faces tariffs of up to 245% on U.S. imports.

This tariff has already triggered impacts on the chip, mobile phone, and other consumer electronics supply chains.

According to a Japanese news investigation, the hardware cost of the $999 iPhone 16 Pro is approximately $568, with the highest costs being the A18 Pro chip (manufactured by TSMC for $135) and the OLED screen provided by Samsung Electronics ($110). Once the tariffs are implemented, the price of the iPhone is expected to rise by at least $200.

Meanwhile, in “China’s Electronics First Street” Huaqiangbei in Shenzhen,many stalls have already suspended quotes for popular chips like CPUs and GPUs, and several stalls have closed, holding inventory in anticipation of price increases. “Everyone is waiting and holding back inventory, worried that prices will skyrocket or plummet.”

Why is the U.S. “going all out”? Analyzing Three Strategic Intentions

1. Technological Suppression: Locking in the “Computing Power Ceiling” for China’s AI Development

Computing Power = AI Competitiveness: Training large models requires GPU clusters with tens of thousands of cards. Although the H20 has limited performance, it is still a key transitional product during the domestic replacement gap.

Case Comparison: OpenAI’s GPT-5 requires 30,000 H100s, while if China relies solely on H20, the training costs will increase fivefold.

2. Industrial Encirclement: Hitting the Ground Applications of China’s “AI + Industry”

Chain Reaction: Industries relying on AI computing power, such as autonomous driving (NIO/Xpeng), cloud computing (Alibaba Cloud/Tencent Cloud), and biomedicine (WuXi AppTec), will face delays in R&D.

U.S. Companies Benefit: AMD and Intel seize the opportunity to capture the Chinese market, but performance gaps make “replacement difficult.”

3. Political Game: New Leverage for Pressuring China in the Tech Sector

Linked with Semiconductor Equipment Bans: In conjunction with ASML’s restrictions on lithography machines, forming a double blow to “chip design + manufacturing.”

Biden Administration’s Midterm Election Strategy: Showcasing a tough stance against China to divert domestic economic contradictions.

How Can China Break Through? Four Realistic Paths and Challenges

Path 1: Accelerating Domestic Substitution – Opportunities and Bottlenecks for Huawei Ascend and Cambricon

Progress: Huawei’s Ascend 910B achieves 80% of H20’s performance and has been used in Pengcheng Cloud Brain II; Cambricon’s Siyuan 590 has entered the procurement list of BAT.

Pain Points:

Reliance on SMIC’s 14nm process, energy efficiency lags behind TSMC’s 5nm;

The CUDA ecosystem barrier is difficult to break, and the cost of developer migration is high.

Path 2: Heterogeneous Computing and “Small Chip” Technology

Innovative Direction: Using Chiplet technology to combine multiple domestic chips to compensate for insufficient single-card computing power (e.g., Biren Technology’s BR100).

Case: Shanghai Tianshu Zhixin uses a combination of 7nm small chips to achieve a 200% increase in FP32 computing power.

Path 3: The “Dark Line” Game of the Global Supply Chain

Gray Channels: Re-export trade through Southeast Asia (Singapore/Vietnam) and the Middle East (UAE), but the U.S. Department of Commerce has required third-country companies to sign “end-user commitments.”

Risks: Dell was fined $320 million in 2024 for illegal transshipment.

Path 4: Basic Research “Overtaking on the Curve”

Quantum Computing: The University of Science and Technology of China’s “Jiuzhang” photonic quantum computer prototype;

Brain-like Chips: Tsinghua University’s Shi Luoping team has made breakthroughs in the storage-computing integrated architecture of the “Tianji Chip.”

Realistic Constraints: Industrialization still requires 5-10 years, making it difficult to solve the urgent problems at hand.

The “Domino Effect” of the Global Supply Chain

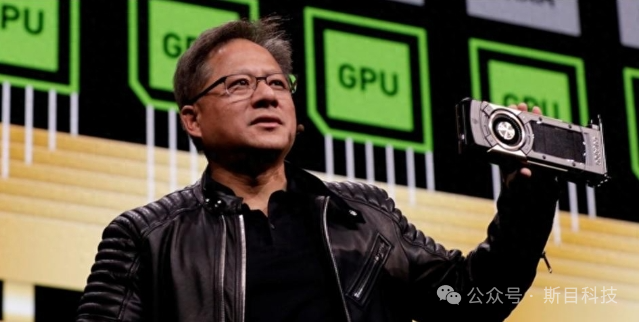

NVIDIA’s Predicament: Losing the Chinese market (which accounts for 25% of its revenue), its stock price plummeted 12% in a single day, and Jensen Huang urgently lobbied the U.S. government.

Shockwaves in the South Korean/Taiwanese Supply Chain: Samsung and SK Hynix have reduced memory orders, and TSMC’s 5nm capacity utilization has dropped below 70%.

Europe’s Ambivalence: ASML protests against “excessive regulation,” and BASF in Germany has postponed investments in chip materials in China.

Future Projections: Three Possible Scenarios in a Technological Cold War

Short-term (1-2 years): Chinese AI companies will shift towards “model lightweighting” (e.g., Huawei’s Pangu large model compression technology) + computing power leasing models.

Mid-term (3-5 years): Domestic 7nm GPUs will enter mass production, achieving partial replacement in edge computing (autonomous driving/industrial AI).

Long-term (5+ years): The RISC-V open-source architecture may become a “new battlefield” between China and the U.S., with a Chiplet standard alliance led by China emerging.

Conclusion: The Dialectics of Blockade and Innovation

“Every technological blockade is the strongest driving force for independent innovation.”

— Just as China developed its own “two bombs and one satellite” after the Soviet Union withdrew its experts in the last century, today’s chip war may be nurturing the seeds of the next generation of disruptive technologies.