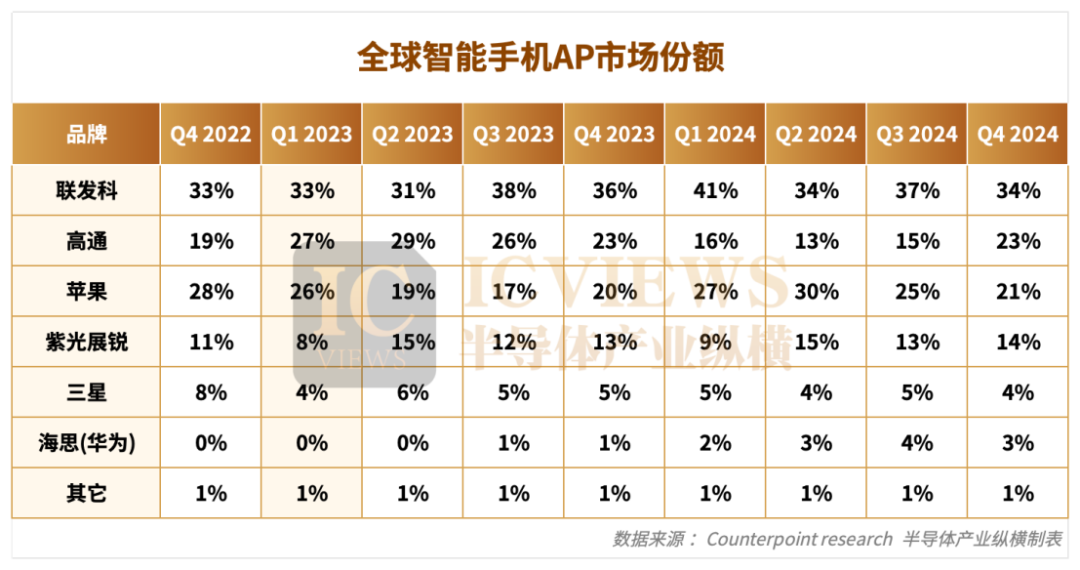

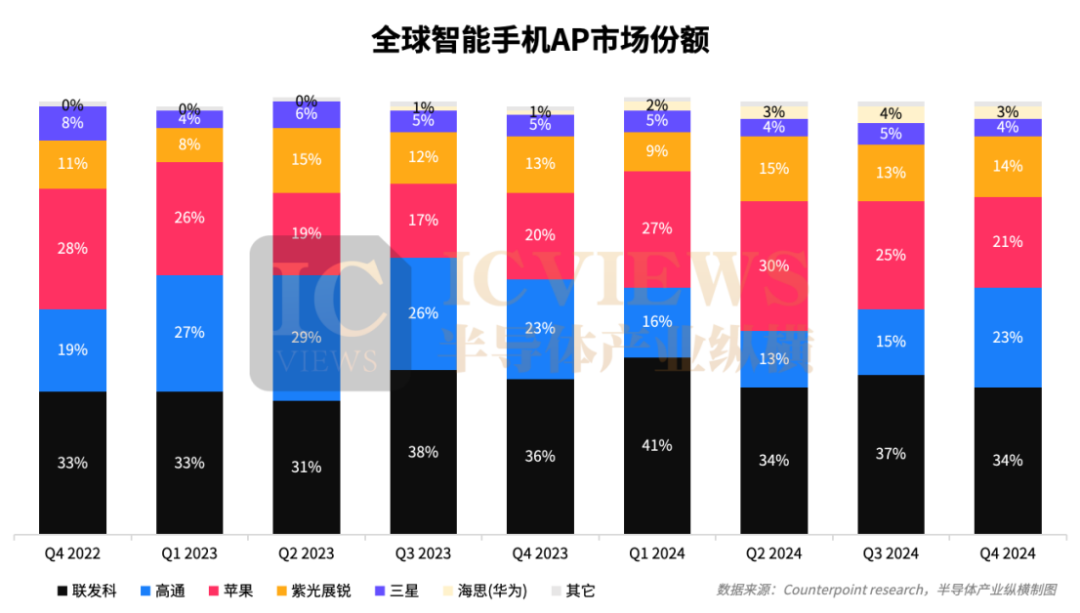

In the fourth quarter of 2024, the global smartphone application processor (AP SoC) market landscape is quietly changing. According to the latest data from Counterpoint, MediaTek (34%), Apple (23%), Qualcomm (21%), Unisoc (14%), Samsung (4%), and Huawei HiSilicon (3%) occupy the top six positions.

It can be seen that Unisoc’s market share continues to expand, becoming the second Chinese manufacturer to establish a foothold in the global AP market after Huawei HiSilicon. The largest increase in market share is in the mid-range and low-end markets.

01Global Smartphone AP SoC Market Landscape

01Global Smartphone AP SoC Market Landscape

Let’s first take a look at the changes in the global smartphone AP SoC market size..

In the fourth quarter of 2022, MediaTek, Qualcomm, and Apple remained at the top of the global smartphone AP market, with Unisoc’s market share reaching 11%. That year, HiSilicon’s market share was reduced to 0%, with the remaining 8% occupied by Samsung.

By the fourth quarter of 2023, MediaTek’s market share increased by 3% to 36%, maintaining its position as the global leader, with this 3% market share taken from Samsung and Apple. The third-generation flagship SoC, Dimensity 9300, launched by MediaTek, successfully drove market growth.

Apple’s market share in 2023 decreased by 8% compared to 2022, while Samsung’s decreased by 3%. During this year, Unisoc’s market share increased from 8% in Q1 to 13% in Q4. HiSilicon’s share rose from 0% to 1%, largely due to the strong sales of the Mate 60 series equipped with the Kirin 9000s, marking a significant improvement.

In mid-2024, the changes in smartphone AP market share from Q1 to Q4 are significant, with MediaTek’s market share reaching 41% in Q1, while Qualcomm dropped to 16%, and Unisoc’s share fell to 9%, with HiSilicon continuing to expand its market from 1% to 2%.

During this year, MediaTek’s LTE chip shipments remained stable, while 5G chip shipments increased. They also released a high-end chip, the Dimensity 9400, along with four mid-range chips: Dimensity 8400, Dimensity 8350, Helio G50, and Helio G92.

By the fourth quarter, Qualcomm regained market share, increasing to 23%. Compared to the fourth quarter of 2023, MediaTek’s market share decreased from 36% to 34%, while both Apple and Unisoc grew by 1%, reaching 21% and 14%, respectively. Apple’s growth was driven by the large shipment of new iPhone models, while Unisoc’s growth was propelled by its LTE product lineup.

HiSilicon saw a 2% increase, with its market share rising from 1% in Q4 2023 to 3%. The launch of the Huawei Mate 70 series smartphones marks Huawei’s strong return to the smartphone market. Currently, it appears that Huawei’s gradual recovery and development in the smartphone business will further enhance HiSilicon’s market share in the future.

02What Chips Does Unisoc Offer?

02What Chips Does Unisoc Offer?

The application processor (AP) is a dedicated integrated circuit that extends audio and video functions based on a low-power central processing unit (CPU). As the “brain” of smartphones, its importance is self-evident..

Currently, there are relatively few domestic smartphone AP SoCs, with notable representatives being Unisoc and Huawei HiSilicon mentioned earlier. In 2024, Unisoc’s shipment volume is expected to reach approximately 110 million units, a year-on-year increase of 67.2%, while HiSilicon’s chip shipments, driven by the Mate and P series, have shown significant growth, increasing by 133.3% year-on-year to about 42 million units.

In terms of products, the 4G LTE product lineup is rich, including:T7280, T7250, T7225, SC9832E, SC9863A.

T7280, supports FHD+ 90Hz high refresh rate displays, equipped with two Arm Cortex-A75 CPUs running at 2.2GHz and an Arm Mali-G57 GPU.T7255, is an octa-core LTE mobile platform based on the DynamIQ architecture, supporting hundreds of millions of pixels, with self-developed AI algorithms and a triple-core ISP.

T7250, is compatible with 720P and 1080P displays, supporting a maximum refresh rate of 120Hz, with LPDDR4x memory frequency reaching 1866MHz, providing higher frequency and bandwidth, while also supporting UFS flash memory, leading to overall performance in its class.

T7225, adopts the new generation big.LITTLE architecture design of DynamIQ, supporting hundreds of millions of pixels.T7200, is an octa-core LTE mobile platform based on the new generation big.LITTLE architecture design, using advanced 12nm technology.

SC9832E boasts the highest integration design globally, supporting 512MB of memory, smoothly running the Android Go system, and combined with 28nm HPC+ technology, reduces standby power consumption by 50%, while enhancing heavy usage battery life by 40%, making it particularly suitable for emerging markets’ demand for cost-effectiveness.

SC9863A is Unisoc’s first 4G SoC platform supporting artificial intelligence applications, featuring an 8-core 1.6 GHz Arm Cortex-A55 processor architecture, with a 20% performance improvement and a 6-fold increase in AI processing capability, enhancing the intelligent experience of mobile terminals.

Among the aforementioned chips, the SC9832E chip used in the Nokia C2 series is tailored for entry-level market demands with high integration and low power consumption characteristics. The Nubia V70 Max is equipped with the Unisoc T606 processor, manufactured using 12nm technology, featuring two Arm Cortex-A75 CPUs with a frequency of 1.6GHz and six Arm Cortex-A55 processors, achieving a balance between performance and energy consumption.

The vivo Y19e debuted in overseas markets, using the Unisoc T7225 processor, with specifications of 4GB RAM + 64GB storage, priced at only 7999 Indian Rupees (approximately 671 RMB). The ZTE Axon 60 and Axon 60 Lite entry-level models are powered by the Unisoc T616 processor, showcasing exceptional cost-effectiveness, driving brand sales growth in Southeast Asia and Latin America.

For 5G chip products, Unisoc has currently launched three models:T9100, T8200, T8100. Among them,T9100 uses advanced 6nm EUV technology, supporting 4K ultra-high-definition video recording, 108 million ultra-high pixel photography, and 120Hz high refresh rate display.T8200 is a mid-range 5G chip platform for enhanced audio-visual experiences, supporting high-definition photography with hundreds of millions of pixels, as well as 4K video recording and playback.T8100 is positioned as a more balanced 5G mobile platform in terms of endurance and performance, capable of supporting mainstream 64 million pixels and 120Hz high refresh rate.

At last year’s Unisoc Global Partner Conference, Unisoc co-founder Chen Datong reflected on Unisoc’s more than 20 years of development, stating: “Unisoc carries the hope of the entire industry, being the only hope for mainland China to achieve development and breakthroughs in all-scenario communication chips, and can only succeed.

03Avoiding the 5G Red Sea, Focusing on Blue Ocean Markets

03Avoiding the 5G Red Sea, Focusing on Blue Ocean Markets

Let’s look at Unisoc’s market share competition strategy, which primarily starts from 4G and overseas markets. Although 5G has always been the focus of discussion, Unisoc has not blindly followed the high-end market but has chosen to deeply cultivate the mid-range and low-end 4G markets. This strategy is based on two key judgments:

First, there is still huge demand in emerging markets. It is important to note that while the 5G market is dominated by giants, with Qualcomm, MediaTek, Apple, and Samsung occupying over 90% of the global high-end 5G chip market, new players find it difficult to break through. However, 4G remains the mainstream globally, with 4G network coverage still improving in emerging markets such as Latin America, Africa, and Southeast Asia, and the demand for 4G smartphones is strong.

Second, the cost-effectiveness advantage of mature processes. Unisoc optimizes 4G chips (such as T606, T616) using 12nm technology, finding a balance between performance, power consumption, and cost, making it highly competitive in the mid-range and low-end markets.

Therefore, the two key promotional focuses in the smartphone field are: Transsion and ZTE.

Transsion (TECNO, Infinix, itel) is a Chinese company, established in Shenzhen in 2013, but due to domestic competition, Transsion turned its attention to Africa. When Transsion entered Africa, it relied on the local situation, organizing a large team to promote offline in various locations. Now, Transsion has become the largest smartphone brand in Africa..

Transsion’s most classic case is the mid-range smartphones launched in overseas markets equipped with Unisoc’s Tiger chips, such as itel A70 and TECNO POP 8. These smartphones, while their overall configuration and performance may be considered as “electronic waste” by discerning users, meet the needs of the majority of local users in areas with low smartphone penetration, as they are affordable and can run apps normally.

Transsion’s expansion into overseas markets requires a large procurement of low-cost mid-range chips to sell smartphones in more regions. Unisoc also needs a large-volume smartphone manufacturer to help increase market share and revenue. This represents a mutual benefit between two domestic companies.

ZTE is one of Unisoc’s top four customers, with ZTE’s most typical case being the ZTE Voyager 30S and Hisense H60, which use Unisoc’s T770 chip, a 5G chip manufactured using 6nm EUV technology, supporting 108 million pixel high-definition cameras and 120Hz high refresh rates, providing a smooth multimedia and gaming experience.

Indeed, in terms of net profit on chips, Unisoc still has a significant gap compared to high-end chips like Snapdragon, Dimensity, and Kirin. However, one must admit that the thin profit margin and high sales volume strategy is quite effective.

Unisoc’s continuous growth in market share in the mid-range and low-end markets also proves the correctness of this strategy.

Currently, in the 5G business, Unisoc’s 5G chips have entered Europe, Latin America, and Southeast Asia in 2023, and in 2024, they will continue to push 5G chips into India, South Asia, and other regions. Unisoc is also accelerating its entry into overseas markets. This year, Unisoc announced that its 5G chips have entered the Japanese market, with the first model being the Nubia nubia S 5G smartphone, equipped with the Unisoc T8100 processor, marking another significant breakthrough for its chip technology in the international market.

04Conclusion

04Conclusion

Unisoc achieved a revenue of 14.5 billion yuan in 2024, setting a new record with a year-on-year growth of 11.5%, reversing the downward trend of 2023, and achieving global delivery of 1.6 billion chips. The net profit has not been disclosed, but industry insiders expect it to still be in a loss state. In September 2024, relevant personnel from the company revealed that Unisoc is expected to achieve breakeven by 2025, striving for further profitability by 2030.

Recently, Unisoc has completed its share reform. The official website of Shanghai chip unicorn Unisoc shows that the company’s name has changed from “Unisoc (Shanghai) Technology Co., Ltd.” to “Unisoc (Shanghai) Technology Co., Ltd.”

This marks the full completion of Unisoc’s shareholding reform.

According to insiders at Unisoc, this share reform is the result of support from all shareholders, board members, and employees. After the reform, Unisoc has the foundational prerequisites to become a public company, bringing it closer to its IPO goal.

Insiders stated, “Next, Unisoc will take the reform as a starting point, relying on a more complete corporate governance structure to improve operational performance, strengthen internal control systems, ensure that the company fully meets regulatory requirements for listed companies, and accelerate the pace of going public.”

The share reform is a key step in Unisoc’s IPO process. By advancing the IPO, Unisoc can raise more funds, optimize production capacity layout, and attract more technical talents to join, providing financial support for breakthroughs in fields such as 5G, satellite communications, and automotive electronics.

With the advancement of Unisoc’s IPO, we look forward to domestic AP SoCs capturing more market share.