Central Processing Unit (CPU)

The CPU generally consists of a logic unit, a control unit, and registers, serving as thecore of computation and control in a computer. The CPU’s control unit retrieves executable code from memory and converts it into executable instructions, which are then processed by the arithmetic unit.

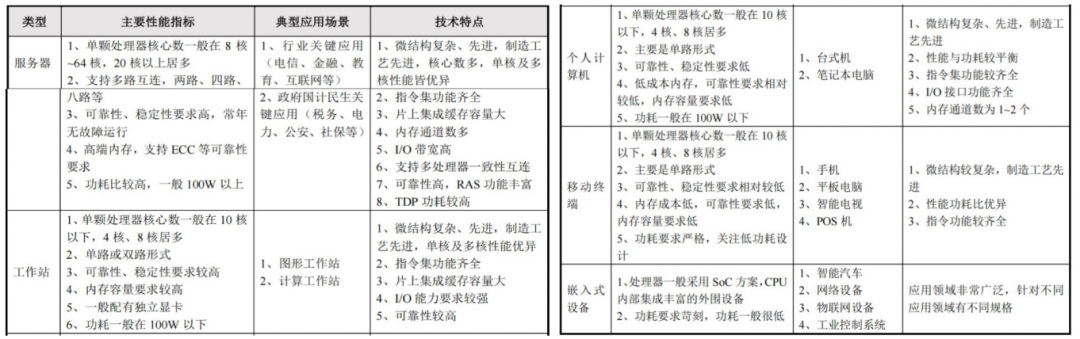

The CPU can be applied in various devices, including servers, workstations (which are high-end microcomputers typically used in scientific and engineering calculations, software development, computer-aided design, etc.), personal computers (desktops, laptops), mobile terminals (including smartphones, laptops, tablets, POS machines, etc.), and embedded devices (suitable for industrial control, portable devices, IoT terminals, etc.).

Embedded CPU

1. Concept

The embedded CPU, as the core of an embedded system, plays a crucial role in controlling the system’s operations. The design of embedded CPUs is fundamentally similar to that of standard desktop CPUs, but they require low power consumption, high performance, compact size, and strong adaptability to applications, necessitating a balance among power consumption, performance, and cost.

Microarchitecture design is one of the core technologies for embedded CPUs, determining key metrics such as performance and power consumption.

In simple terms, the microarchitecture defines the specific implementation of the CPU core (determining how efficiently the CPU executes instructions internally), while the CPU core is the concrete embodiment of the microarchitecture (responsible for executing instructions).

Currently, mainstream embedded CPU architectures have evolved from 32-bit to 64-bit. Additionally, embedded CPUs have transitioned from single-core to multi-core, forming an embedded software system that includes embedded operating systems and middleware.

2. Embedded CPU Technology

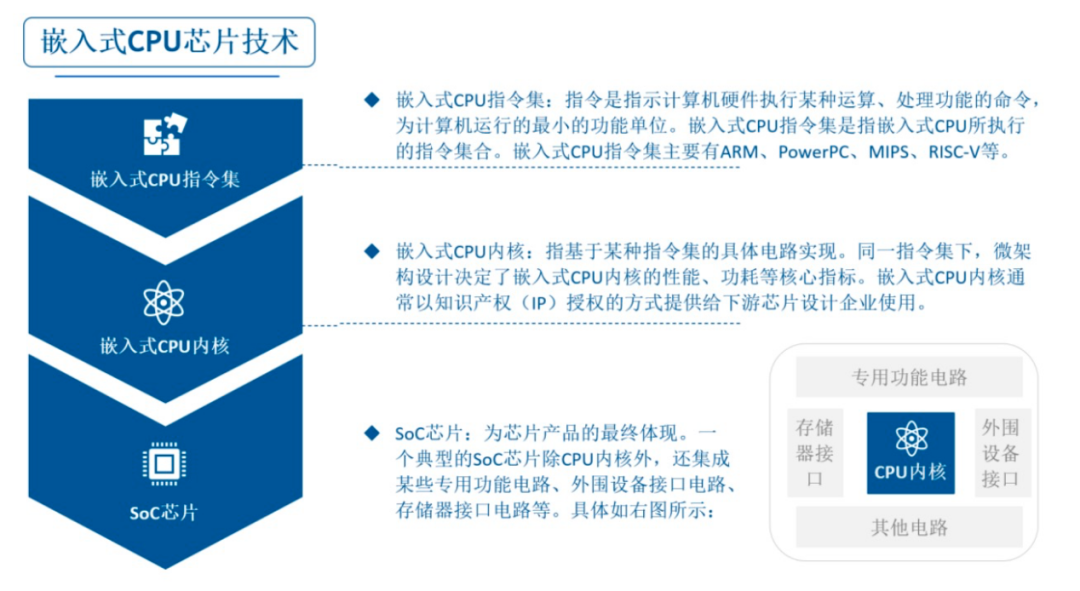

Embedded CPU technology primarily involves three levels: CPU instruction set, CPU core, and SoC chip.

The specific relationships are as follows:

1) Embedded CPU Instruction Set

The instruction set is the interface between software and hardware, a set of standard specifications (published in document form) that does not have a physical entity.

Chips that directly use the instruction set architecture are typically processors capable of executing program code, such as central processors (CPUs), graphics processors (GPUs), neural network processors (NPUs), video processing units (VPUs), microcontrollers (MCUs), digital signal processors (DSPs), image signal processors (ISPs), FPGAs, ASICs, and other general-purpose and specialized processors.

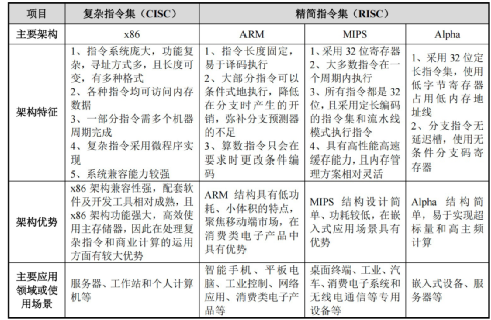

Instruction set architectures can be divided into two main categories: Complex Instruction Set Computer (CISC) and Reduced Instruction Set Computer (RISC).

-

Complex Instruction Set: Rich in instructions, flexible in addressing modes, centered around microprogram controllers, with variable instruction lengths, powerful functionality, and high efficiency in executing complex programs. The x86 architecture is a representative of complex instruction sets.

-

Reduced Instruction Set: Simple instruction structure, easy to design, with a high execution efficiency ratio. ARM, Power, MIPS, Alpha, and RISC-V architectures are representatives of reduced instruction sets.

-

x86 Architecture

In the global computer field, Intel relies on its strong x86 ecosystem to maintain a leading position.

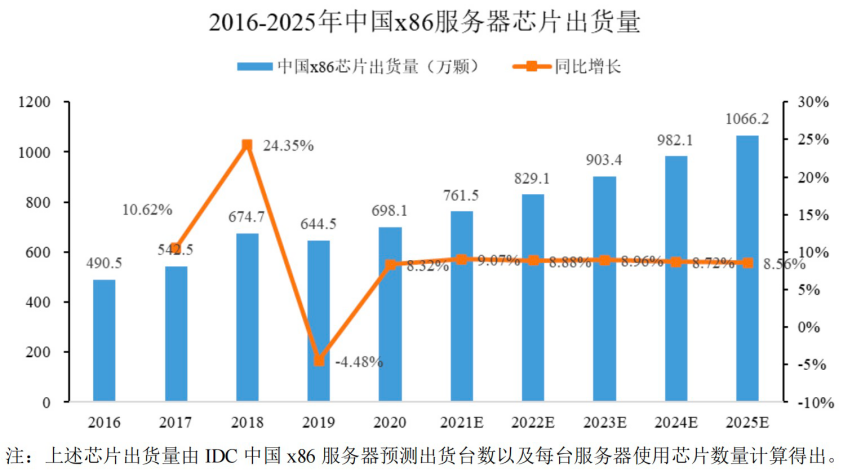

Typically, each desktop has only one CPU, while the number of CPUs in each server can vary. According to IDC data, in 2020, the global desktop shipment reached 303 million units (with approximately 50 million units in China); the global server shipment was 12.2 million units, of which x86 servers accounted for 11.8 million units, representing 97% (China’s x86 server shipment was 3.439 million units, and the shipment of x86 CPU chips was 6.981 million units).

-

ARM Architecture

In the field of embedded CPU IP licensing, ARM holds an absolute leading position. After decades of development, it has formed a complete industry and ecosystem.

a. According to ARM’s official website, ARM architecture processors occupy 90% of the global market share in smartphone application processors and IoT microcontrollers;

b. In the automotive electronics field, ARM architecture processors hold 75% of the global market share in in-vehicle entertainment and ADAS systems;

c. However, in the fields of body and engine control, the market share is still small, mainly occupied by PowerPC architecture and Tricore architecture.

-

Power Architecture

IBM owns the Power instruction architecture, which covers a wide range of applications from embedded systems to servers and supercomputing (it is a good alternative to the x86 instruction set in the server and high-performance computing fields). In October 2019, IBM officially announced the open-sourcing of its Power instruction architecture, which has been well-received in the industry, with a relatively mature application ecosystem.

-

RISC-V Architecture

Developed by the University of California, Berkeley, RISC-V, as an open-source instruction set, features simplicity, modularity, and scalability, allowing for the design of low-power, compact, personalized, and differentiated embedded CPUs, which align well with fragmented application scenarios.

In emerging application areas represented by IoT, the market’s long-tail and fragmented characteristics create a significant demand for personalization and differentiation, with a greater emphasis on low power consumption. Consequently, the open-source RISC-V architecture is gradually challenging ARM’s competitive position in the market.

According to Semico Research, it is predicted that by 2025, the number of chips using the RISC-V architecture will increase to 62.4 billion, with a compound annual growth rate of 146% from 2018 to 2025.

2) Embedded CPU Core

The CPU core (CPU kernel) is designed based on instruction sets such as Arm, M*Core, Power, and RISC-V, and is a physical entity at the hardware level. It is the basic unit of the CPU, executing all computations, receiving/storing commands, and processing data.

Currently, most chip design companies at home and abroad design chips by obtaining licenses for embedded CPU cores, while a few domestic companies obtain instruction set licenses to design their own embedded CPU cores for their chip development or for external IP core licensing.

Embedded CPU IP, due to its high performance, low power consumption, moderate cost, high technology density, concentrated intellectual property, and significant commercial value, is one of the core competitive advantages in the chip design industry.

3) SoC Chip

SoC chips have a wide range of applications, almost covering all major sectors of the national economy. To accelerate product time-to-market, SoC chips, supported by IP reuse, hardware-software co-design, and ultra-deep submicron/nanometer-level design, have become the mainstream direction of today’s large-scale integrated circuits.

The components of SoC chips: They are formed by integrating on-chip Flash, RAM, and various functional circuit modules based on the embedded CPU core.

Among them, the embedded CPU serves as the control and computation core of the SoC chip, with high technical implementation difficulty, emphasizing logical control, computation speed, and low power consumption, making it one of the most critical technologies in SoC chips, which has long been monopolized by foreign companies. Its localization is of significant importance for national strategic security and industrial safety.

As the core and foundation of SoC chips, embedded CPUs have vast market space and a long-term positive market outlook.

Taking the main general-purpose chip product MCU in SoC chips as an example, according to IC Insights data, the MCU market size grew to $20.4 billion in 2019, with shipments rising to 34.2 billion units; it is expected that by 2022, the MCU market size will reach $23.9 billion, with shipments reaching 43.8 billion units.

3. Development Trends

For a considerable period in the future, CPU performance will continue to improve, with new functions and features being added, primarily relying on improvements in processor architecture and microarchitecture, SoC integration innovations, advancements in manufacturing processes and packaging levels, and design optimizations aimed at typical industry applications.

Additionally, heterogeneous computing is on the rise, achieving task division through collaboration among processors of different architectures, such as the penetration rate of domestic CPU + GPU/FPGA solutions in AI inference scenarios has reached 18%.

4. Competitive Landscape

In the field of embedded CPU microarchitecture design, there are high technical barriers and ecosystem requirements. Major foreign players include ARM, SiFive, and a few others, while domestic companies capable of designing embedded CPU microarchitectures that are compatible with mainstream instruction sets and possess independent intellectual property include Guoxin Technology, Loongson Technology, and Tsinghua Unigroup (Alibaba subsidiary).

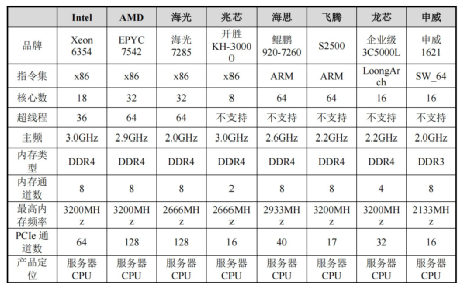

Moreover, representative companies in the CPU field mainly include foreign companies such as Intel and AMD; currently, there are six main domestic companies: Loongson Technology, Electronics Technology Group, Huawei HiSilicon, Phytium Information, Hygon Information, and Shanghai Zhaoxin.

-

Desktop CPU Market: Domestic CPUs have over 10% market share in the desktop PC market, but growth is slow, mainly limited by performance and software ecosystem, and are more used for government procurement or specific scenarios.

-

Server CPU Market: The market share of domestic CPU manufacturers in the domestic server market has increased from negligible levels a few years ago to around 25%, with a compound annual growth rate exceeding 40%. Among them, Hygon ranked first in the domestic server field in 2022, occupying about 53.6% of the market share.

(Among them, Loongson and Shenwei are self-developed instruction sets)

-

Xinchuang Market: Domestic CPUs are gradually forming three major tiers in the Xinchuang market. Hygon and Kunpeng are in the first competitive tier, Loongson and Phytium are in the second competitive tier, and Zhaoxin and Shenwei are in the third competitive tier.

The demand for domestic alternatives is strong, while new technologies, new architectures, and customization present development opportunities for domestic CPUs.

In terms of new technologies, the development and maturity of cloud computing, artificial intelligence, 5G, edge computing, and blockchain technologies will pose significant challenges to traditional computing demands and create new computing technology needs.

In terms of new instruction architectures, in addition to x86 and ARM architectures, open-source instruction systems will also become important options, allowing for the escape from the constraints of the development ecosystems of the two major architectures.

In terms of customization needs, as demands diversify, international giants cannot meet the rich target scenario needs with just a few competitive products. In emerging fields such as AIoT and edge computing, the modular characteristics of the RISC-V architecture and the customization capabilities of domestic CPUs form a synergy.

At the same time, as CPUs enter the post-Moore’s Law era, the pace of upgrades is slowing, creating a rare strategic window for domestic CPUs under the combined effects of various factors.