It has been observed that some readers are unclear about the development trends of the semiconductor industry in various countries (regions) around the world,

so this article will provide an overview.

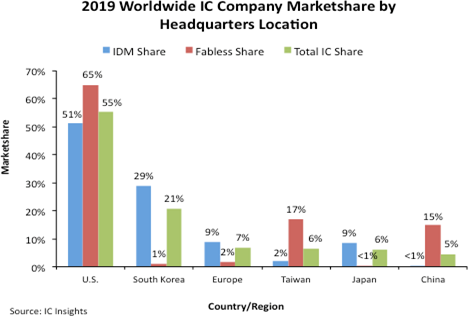

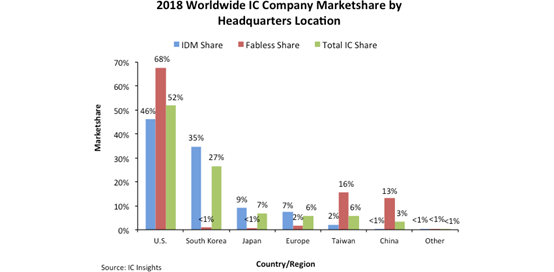

The following chart is from IC Insights official website, ranking the global market share based on the revenue of chip companies in different countries (regions).

Note that this refers to chip design companies, such as Intel, Broadcom, Qualcomm, Samsung, SK Hynix, HiSilicon, Sony, MediaTek, etc., including Fabless (pure design without manufacturing) and IDM (integrated design and manufacturing) companies. Pure chip manufacturing companies, such as TSMC, GlobalFoundries, UMC, and SMIC, are not included.

This can be understood as the brand share ranking of smartphones like Apple, Samsung, Huawei, Xiaomi, OPPO, VIVO without including upstream foundries.

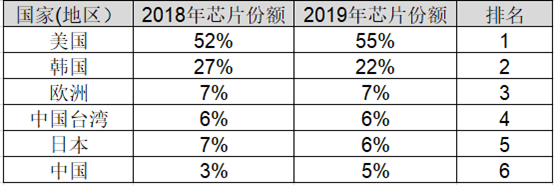

First, let’s look at the global total chip share ranking.

In 2018, the United States held 52% of the market, which increased to 55% in 2019, ranking first in the world;

South Korea had 27% in 2018, which decreased to 22% in 2019, ranking second in the world;

Europe maintained 7% in both 2018 and 2019, ranking third in the world;

Taiwan had 6% in both 2018 and 2019, ranking fourth in the world;

Japan’s share was 7% in 2018, which dropped to 6% in 2019, ranking fifth in the world;

China’s share was 3% in 2018, which increased to 5% in 2019, ranking sixth in the world.

If we put this into a table, it would look like this, with 2019 being the sixth globally.

It is very clear that the growth momentum of chip development in mainland China is the strongest.

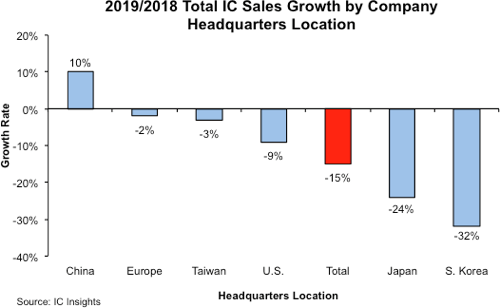

The following chart clearly shows the sales growth rate in 2019 compared to 2018,

with mainland China growing by 10% and being the only region with growth, while other major regions experienced negative growth in chip company sales.

Europe declined by 2% , Taiwan declined by 3% , the United States declined by 9% , Japan declined by 24% , and South Korea declined by 32%.

This raises a question: why did Japan and South Korea experience such significant declines?

This is related to the highly concentrated structure of the semiconductor industry in South Korea and Japan, primarily in memory and a few other fields.

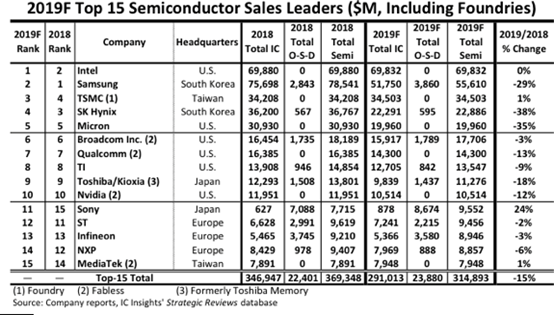

The following chart, which I believe everyone has seen, is also from IC Insights and ranks all companies in the semiconductor industry chain (including design, manufacturing, and packaging) based on revenue, showing the top 15 companies globally. In simple terms, it includes pure foundries like TSMC in the calculation.

Although South Korea’s chip share (based on sales) in 2019 remained second in the world, the production of South Korean semiconductors is mainly concentrated in the memory sectors of Samsung and SK Hynix (DRAM memory and NAND FLASH flash memory),

As seen in the chart of the global 15 companies, South Korea consists of only Samsung and Hynix,

with Samsung ranked second globally and Hynix ranked fourth.

If you were to name the third-largest chip company in South Korea besides these two, everyone would be left speechless.

We all know that memory chips are a cyclical industry with significant price fluctuations, so when prices soar, it can lead to a sharp increase in sales and profits, allowing Samsung to become the world’s largest chip company.

However, when prices drop, it can also lead to a significant decline in sales for Samsung and Hynix.

Japan’s semiconductor structure is slightly better than South Korea’s.

The largest semiconductor company in Japan is Kioxia (formerly Toshiba), which mainly produces NAND FLASH flash memory, competing with Samsung and SK Hynix, and ranked ninth globally in 2019.

The second-largest semiconductor company in Japan is Sony, whose revenue mainly comes from its CMOS image sensor business, ranking eleventh globally in 2019.

The third-largest semiconductor company in Japan is Renesas, which focuses on automotive chips and is not in the top 15 but is still among the top twenty.

These three companies dominate Japan’s semiconductor industry, especially Kioxia, which is the leader. Therefore, if Kioxia’s memory business declines due to market price fluctuations, it will lead to a drop in Japan’s semiconductor industry sales.

In the chip sector, China’s medium to long-term competitors are primarily the United States and South Korea.

In 2019, based on market share, Europe had 7%, Japan 6%, Taiwan 6%, and mainland China 5%. Given the rapid development of mainland China’s chip industry, it is expected that by 2022, it will surpass the previous three regions in market share.

Currently, domestic companies such as HiSilicon, Goodix (fingerprint recognition chips), Will Semiconductor (CMOS image sensors under OmniVision), GigaDevice, Yangtze Memory Technologies (NAND FLASH), and ChangXin Memory (DRAM) have all emerged in their respective fields and achieved significant growth.

Companies like Will Semiconductor, along with Sony and Samsung, are among the top three global CMOS image sensor manufacturers,

In the first three quarters of 2020, they achieved total revenue of 13.969 billion yuan, a year-on-year increase of 48.51%; net profit attributable to shareholders of the parent company was 1.727 billion yuan, a year-on-year increase of 1177.75%;

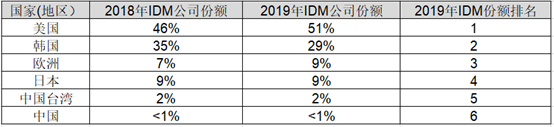

Next, let’s further categorize chip companies into two types,

one is those that manufacture their own products, known as IDM, and in 2019, the largest 10 IDM companies globally were:

Intel from the USA, Samsung from South Korea, SK Hynix from South Korea, Micron from the USA, Texas Instruments from the USA, Kioxia from Japan, Sony from Japan, STMicroelectronics from Italy, Infineon from Germany, and NXP from the Netherlands.

Currently, based on revenue, IDM companies still dominate, with the top four global chip companies in 2019 being IDM companies (Intel, Samsung, SK Hynix, Micron).

The three largest chip companies in Europe are also IDM companies (STMicroelectronics, Infineon, NXP).

Referring back to the chart from IC Insights, the revenue share and ranking of IDM companies in various countries (regions) in 2019 were as follows: the United States accounted for 51%, South Korea accounted for 29%, and Europe and Japan each accounted for 9%.

It is evident that China’s lack of IDM companies is a significant shortcoming, with a global share of less than 1%.

Interestingly, Taiwan’s IDM companies are also not strong, with a global share of only 2%.

In terms of revenue, the largest semiconductor IDM company in China is Nexperia, a subsidiary of Wingtech, which produces diodes and other discrete devices, MOSFETs, etc. In 2019, its revenue was 10.307 billion yuan, down from 10.431 billion yuan the previous year; its net profit was 1.258 billion yuan, down from 1.340 billion yuan the previous year.

However, Nexperia was acquired from NXP’s standard components division in Europe, so it is still considered a European company, with wafer production located in Hamburg, Germany, and Manchester, UK.

Although Wingtech has obtained the position of chairman of Nexperia, the company’s management and operational team is still the European team, maintaining a high degree of independence.

Therefore, it can be said that the largest IDM semiconductor factory in China is China Resources Microelectronics.

In 2019, the company achieved revenue of 5.743 billion yuan, a year-on-year decrease of 8.42%; net profit was 401 million yuan, a year-on-year decrease of 6.68%;

Of course, China Resources Microelectronics also has a foundry business, which accounts for a significant portion, but generally, pure foundries are still represented by SMIC and Huahong.

The second-largest IDM factory in China is Silan Microelectronics in Hangzhou, which achieved revenue of 3.11057 billion yuan in 2019, a year-on-year increase of 2.80%; net profit attributable to shareholders of the parent company was 14.532 million yuan, a year-on-year decrease of 91.47%.

In recent years, two large IDM factories, Yangtze Memory Technologies and ChangXin Memory, have been established in China, and both began ramping up production in 2020, marking their first year of significant scale production after starting mass production in 2019.

In the future, these two will likely become the largest IDM factories in China.

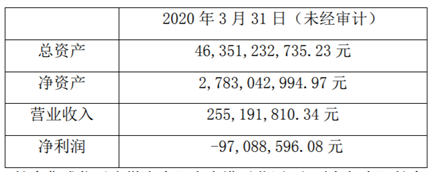

On July 13, 2020, Hefei Urban Construction announced that it had recently signed a project cooperation framework agreement with Hefei ChangXin Integrated Circuit Co., Ltd. (hereinafter referred to as “ChangXin Integrated”).

They will provide specialized project construction services for ChangXin Integrated, including factory areas, office areas, and living areas, aiming to create a first-class production, work, and living environment for the enterprise. ChangXin Integrated owns 100% of ChangXin Memory, making it the parent company of ChangXin Memory.

Due to the shareholders of Hefei Urban Construction and ChangXin Integrated both belonging to Hefei Industrial Investment Group, which forms a related transaction, the revenue for the first quarter of ChangXin Integrated was disclosed as 255.19 million yuan, with a net loss of 97.0886 million yuan.

ChangXin Integrated did not specify how much of this revenue came from DRAM product sales, but based on this data, it appears that Hefei ChangXin has become significant in scale for the first time this year, and Yangtze Memory Technologies is also experiencing rapid development, which will likely lead to an increase in mainland China’s ranking in this field.

Additionally, I believe that Huawei’s HiSilicon may also enter the IDM field, as I have consistently maintained this judgment. Logically, if Huawei does not develop its own manufacturing capabilities, it will be at a significant disadvantage, which is not conducive to its survival.

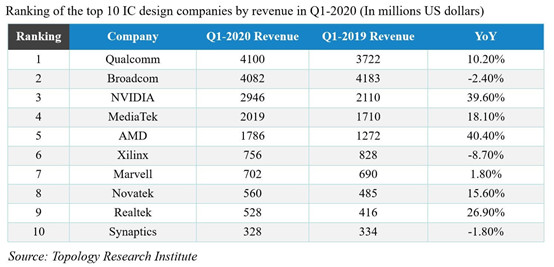

One type is those that only focus on design, known as Fabless, and in Q1 2020, the five largest globally were Qualcomm, Broadcom, NVIDIA, MediaTek, and AMD as shown in the following chart from Toppan.

However, it is generally estimated that in Q1 2020, HiSilicon’s revenue has already surpassed MediaTek, ranking fourth globally, but this is not disclosed separately. However, it is not meaningful to discuss this now, as HiSilicon is currently unable to find chip manufacturing suppliers, which will gradually lead to a decline.

Additionally, Apple is not included here, likely because it does not disclose its chip business revenue separately.

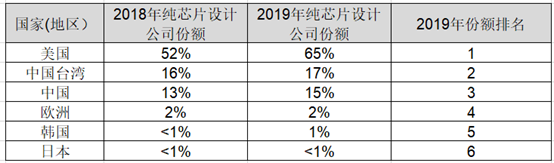

Based on the market share of pure chip design companies,

In 2019, the United States held 65% of the global market, leading by a wide margin, nearly double the total of all other regions combined.

Qualcomm, Broadcom, and NVIDIA are the giants, and in addition, there are AMD (Advanced Micro Devices), Xilinx, and Marvell, among which AMD announced on October 27, 2020, that it would acquire Xilinx for 35 billion USD.

Thus, the top four pure chip design companies globally are: Broadcom, Qualcomm, NVIDIA, and AMD, all of which are American companies. In fact, Apple should also be included, making all five of the top companies American.

Taiwan’s fabless companies held 17% of the global market share in 2019, ranking second globally,

while mainland China ranked third globally in 2019 with a share of 15%.

In contrast, the global market shares of pure chip design companies in other regions, such as Europe, Japan, and South Korea, are very small, with Europe at 2%, South Korea at 1%, and Japan at less than 1%.

It is expected that mainland China will surpass Taiwan between 2021 and 2022, ranking second globally.

In summary, in the chip sector, whether it is IDM chip companies that design and manufacture chips themselves,

or fabless chip companies that only focus on design, or a combination of both, the United States is far ahead, holding over 50% of the global market share.

In this field, it can be summarized as a situation of one dominant player and many strong competitors.

After reviewing the market shares of chip companies, let’s look at semiconductor manufacturing,

which is currently the biggest shortcoming for China in the semiconductor field and the main area where it is being constrained.

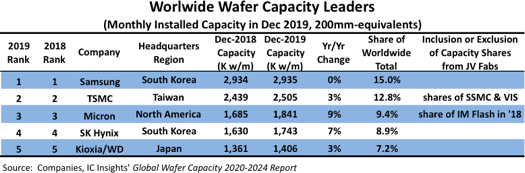

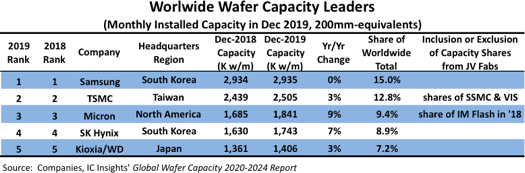

The following chart clearly illustrates the global semiconductor manufacturing capacity ranking as of December 2019, including both IDM and pure foundries, calculated based on 8-inch wafers.

We can see that Samsung ranks first globally with a capacity of 2.934 million wafers per month, accounting for 15% of the global market.

TSMC ranks second globally with a capacity of 2.439 million wafers per month, accounting for 12.8% of the global market.

Micron ranks third globally with a capacity of 1.685 million wafers per month, accounting for 9.4% of the global market.

SK Hynix ranks fourth globally with a capacity of 1.63 million wafers per month, accounting for 8.9% of the global market.

Kioxia ranks fifth globally with a capacity of 1.361 million wafers per month, accounting for 7.2% of the global market.

Thus, from the company perspective, Samsung is the largest chip manufacturer globally, while TSMC is second.

However, why do we often say that TSMC is the world’s number one?

Because when we refer to semiconductor manufacturers, we usually mean pure foundries.

IDM chip companies, including Intel, Samsung, SK Hynix, Micron, and Kioxia, have their own factories,

and generally do not outsource chip production to foundries.

However, there are many chip companies without their own factories, known as fabless, so they must rely on foundries for production.

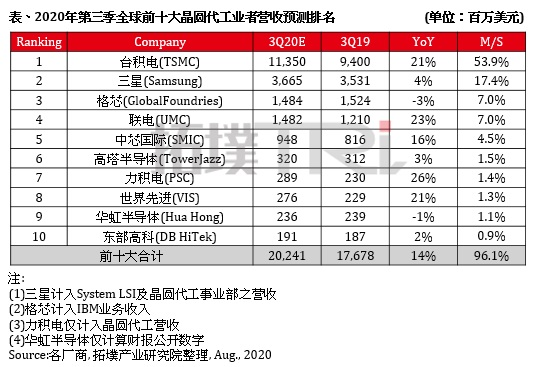

Looking at the following chart from Toppan,

the global foundry revenue ranking for Q3 2020 shows that TSMC is number one in the world with a share of 53.9%;

Samsung is second in the world with a share of 17.4%;

GlobalFoundries is third in the world with a share of 7%;

UMC is fourth in the world with a share of 7%;

and SMIC is fifth in the world with a share of 4.5%.

In the foundry ranking, Samsung only accounts for the revenue from its foundry business and system LSI (large scale integration) business. It does not include revenue from its memory department.

On Samsung’s official website, this System LSI is described as: “System LSI Business offers a full range of portfolio for mobile industry including mobile processor, image sensor, Bio-processor, security and display solution.” In simple terms, it provides chips for mobile electronic products such as Samsung mobile processors, image sensors, biochip processors, and display driver chips.

In other words, in the foundry field, Taiwan, led by TSMC, is undoubtedly the king, holding a significant share of the global foundry market, and fabless companies like Huawei, due to the lack of their own chip manufacturing factories, must rely on foundries to produce chips.

Now, let’s summarize.

In terms of chip market share,

the United States is undoubtedly the strongest, leading in new technologies. American chip companies such as Broadcom, Qualcomm, Intel, AMD, Apple, NVIDIA, and Texas Instruments all seem to have an unbeatable presence.

In terms of chip market share, South Korea ranks second globally due to its extremely high share in memory.

In contrast, other regions, including mainland China, Taiwan, Europe, and Japan, had shares between 5% and 7% in 2019,

indicating that China will soon stand out and is expected to rank third globally by 2023.

It is estimated that by 2025, China will likely rank second in the world, surpassing South Korea, and only after the United States after 2030.

In the semiconductor manufacturing field, if we look at the capacity ranking based on the location of company headquarters,

South Korea, due to Samsung and SK Hynix’s massive production capacity, ranks first in the world,

while Taiwan (TSMC, UMC, etc.) ranks second.

However, due to the fact that these two major South Korean companies have a large portion of their memory business produced in China,

Samsung’s Xi’an factory and SK Hynix’s Wuxi factory both have significant production capacity;

in contrast, due to the strict restrictions imposed by Taiwan authorities on semiconductor manufacturing investments in mainland China, TSMC’s factories in Nanjing and Shanghai have very small capacities, primarily producing in Taiwan.

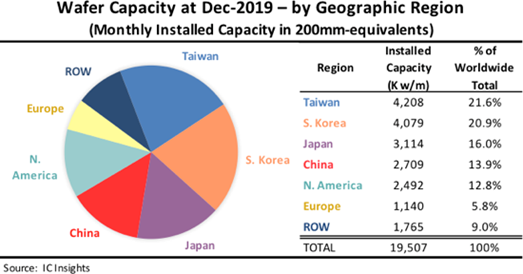

Therefore, if we look at the geographical location of the factories, Taiwan is the largest semiconductor production base in the world. The following chart shows the global wafer capacity distribution as of December 2019 (based on geographical location),

with Taiwan accounting for 21.6% of the global market,

South Korea accounting for 20.9%,

Japan accounting for 16%,

mainland China accounting for 13.9%,

the United States accounting for 12.8%,

and Europe accounting for 5.8%.

The remaining global regions account for 9.0%.

Note that mainland China’s chip production capacity has already surpassed that of the United States (but this is because many of mainland China’s capacities belong to foreign-funded factories).

In the manufacturing field, China is also making rapid progress.

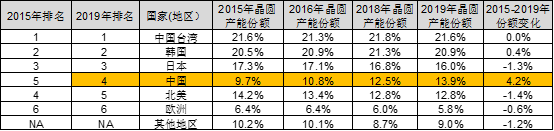

Therefore, I created a chart comparing the global wafer capacity changes from December 2015 to December 2019, using data from IC Insights.

From 2015 to 2019, mainland China’s wafer capacity share increased from 9.7% to 13.9%, an increase of 4.2 percentage points, ranking fourth globally in 2019, only behind Taiwan, South Korea, and Japan.

From 2015 to 2019, among the six major players in global wafer capacity,

North America, Europe, and Japan’s wafer capacity shares have shown a downward trend,

while mainland China and South Korea have increased by 4.2 percentage points and 0.4 percentage points, respectively,

with Taiwan remaining stable. It is evident that mainland China is the fastest growing.

It is very likely that mainland China’s wafer capacity will surpass Japan and rank third globally by 2022-2023. However, we need to note that this wafer capacity includes the capacity of foreign-funded semiconductor manufacturing plants in China.

Of course, some may ask, in 2019, mainland China’s total wafer capacity share was 13.9%, so what would the share be if we only counted mainland China’s own factories? This is more meaningful.

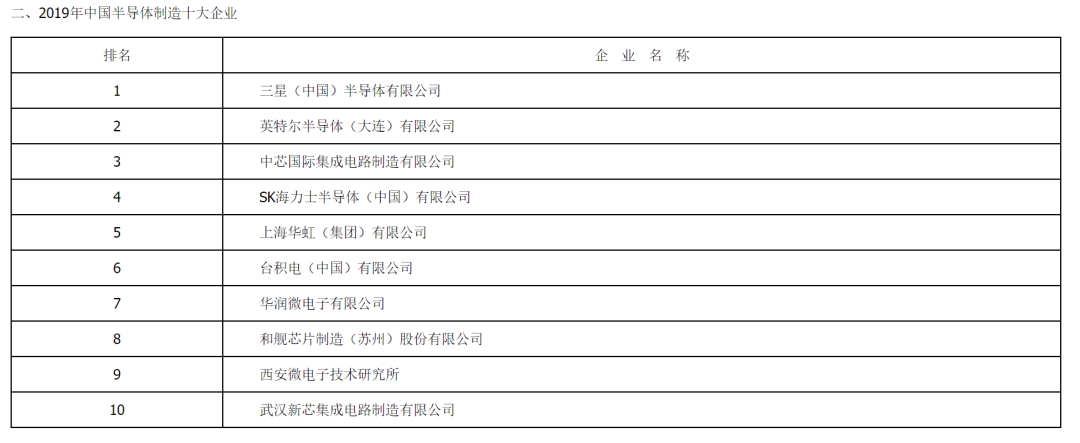

The following chart from the China Semiconductor Industry Association shows that in 2019, among the top ten semiconductor manufacturers in China, five were foreign-funded, with the top two being Samsung (Xi’an) and Intel (Dalian), both larger than SMIC.

Among the top four, three are foreign-funded factories, especially Samsung’s Xi’an factory, which is continuously expanding and is one of the largest memory factories in the world.

It is very clear that most of mainland China’s production capacity comes from foreign-funded factories, and our domestic factories’ global capacity share is estimated to be less than 5%.

Therefore, by 2025, it is estimated that our domestic factories’ global capacity share will exceed that of Europe (in fact, it is expected to surpass it before 2023), ranking fifth globally after Taiwan, South Korea, Japan, and the United States.

Now, let’s summarize briefly.

1: In the chip company market share sector, the United States is the absolute leader, holding over 50% of the global market.

In 2019, China’s global share was 5%, ranking sixth in the world, and it is expected to surpass Japan, Europe, and Taiwan within three years,

ranking third globally, only behind the United States and South Korea.

It is expected to surpass South Korea around 2025-2030.

2: In the semiconductor manufacturing sector, in 2019, mainland China’s companies held a global capacity share of less than 5%,

but by 2025, it is expected that mainland China’s companies will rank fifth globally, surpassing Europe, but still lagging behind Taiwan, South Korea, Japan, and the United States, although the gap will narrow.

Looking at the chart I posted earlier, the giants like Samsung and TSMC, which hold over 10% of global capacity, are not to be mentioned.

In the United States, Micron alone accounts for 9.4% of global capacity, along with Texas Instruments, Intel, and other factories.

In Japan, Kioxia alone accounts for 7.2% of global capacity, along with Sony and Renesas.

Therefore, our domestic manufacturing plants, with a global capacity share of about 5% in 2019, even if they double in five years, will still find it challenging to catch up with Taiwan, South Korea, Japan, and the United States.

This is still based on capacity; in terms of value, our share is likely to be even lower,

due to the lag in process and technology.

Achieving domestic production of 28nm is already a significant progress, so we should not even discuss catching up with the world leaders. We have a lot to learn in the semiconductor manufacturing field, not too little.

Moreover, it is even more critical that in the semiconductor manufacturing sector, the leading companies like SMIC, Huahong, Yangtze Memory Technologies, and ChangXin Memory are currently facing challenges. SMIC has not yet streamlined its internal operations, Huahong is developing slowly, and ChangXin Memory’s DRAM technology is complex and requires time to accumulate. Currently, Yangtze Memory Technologies is relatively stable, but its scale is still too small.

Therefore, more strong players need to enter the market. I still maintain the judgment that Huawei needs to enter the IDM field and manufacture its own chips. I believe Huawei will ultimately do this, as it is logical that if Huawei does not develop its own manufacturing capabilities, it will be at a significant disadvantage.

Finally, after three years of effort, by 2023, we expect our chip share to rise to third globally, and our domestic chip manufacturing capacity may exceed Europe, ranking fifth in the world after Taiwan, South Korea, Japan, and the United States (although it is expected to maintain this ranking until 2025). However, the more significant significance lies in achieving the domestic production of 28nm or building a de-Americanized production line. Once this goal is achieved, I believe it will be more meaningful than just increasing capacity.

Previous article links:

Analyzing the Direction of U.S. Attacks on Chinese Institutions in the Entity List

Two Charts Illustrating the Difficulty of Becoming a Developed Country

Reflections on Liang Mengsong and Shenzhen’s Chip Manufacturing Industry

The Mission of Giants – Starting from a Map of China

China, the West, and the Soviet Union – Two Ethical Reflections on Nations

Honestly Engaging in Manufacturing Will Bring Unexpected Returns to China

I Can, You Can’t – Insights from the Australian Incident on Western Psychology

Analyzing the Threat of Vietnamese Manufacturing to China’s Global Position

Reflections on Several Methods of U.S. Containment of China’s Manufacturing Development

Analysis of Taiwan’s Industrial Structure in 2020 and Governance of Public Sentiment After Unification