This article covers all processes and knowledge of the MEMS industry chain, aiming to provide a comprehensive view in the shortest content possible, helping us to understand the latest situation of the MEMS industry chain, with some data updated to 2022/2021.

What is the global & Chinese MEMS sensor industry chain like? What are the key research and representative enterprises? How is MEMS applied in various fields?

The content of this article is extensive, and you can find corresponding information through the following directory:

1. Introduction to MEMS

2. Classification of MEMS Sensors and Manufacturers and Applications

3. Development History of the MEMS Industry and Three Industrial Waves

4. Main Layout Areas of Domestic Sensor Enterprises

5. MEMS Industry Chain Process

6. Most Promising Application Areas and Markets for the Global MEMS Industry Chain

7. Global & Domestic MEMS Industry Chain Manufacturer Segmentation (over 200 enterprises & institutions)

8. Introduction to Segmented Applications of MEMS Sensors

9. MEMS Foundry Industry

10. MEMS Packaging and Testing

11. Revenue Ranking of Global & Chinese MEMS Sensor Manufacturers

12. Major Applications of MEMS Sensors

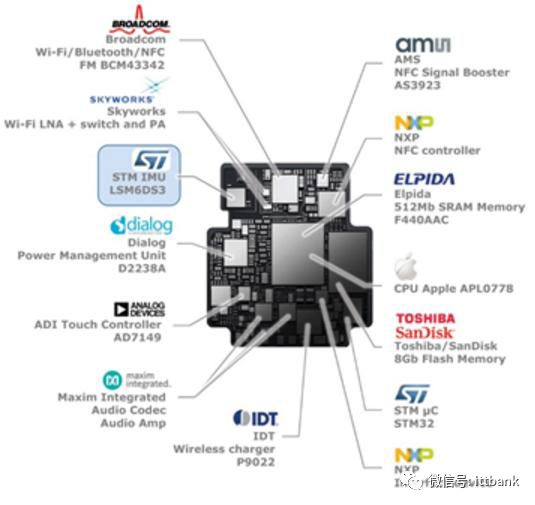

13. Applications of MEMS Sensors in Smartphones

14. Applications of MEMS Sensors in the Automotive Field

15. Applications of MEMS Sensors in Wearable Devices

16. Applications of MEMS Sensors in the Internet of Things

17. Applications of MEMS Sensors in Drones

18. Applications of MEMS Sensors in the Era of Smart Industry

MEMS stands for Micro Electromechanical System, which integrates sensors, actuators, mechanical structures, signal processing, and control circuits into a miniaturized device or system using semiconductor manufacturing processes and materials. Its internal structure is generally at the micrometer or even nanometer scale. MEMS mainly consists of two parts: sensors and actuators.

Compared to traditional mechanical sensors, MEMS sensors have advantages such as small size, integration, intelligence, and low cost, meeting the requirements for sensors in the Internet of Things era.

2. Classification of MEMS Sensors and Manufacturers and Applications

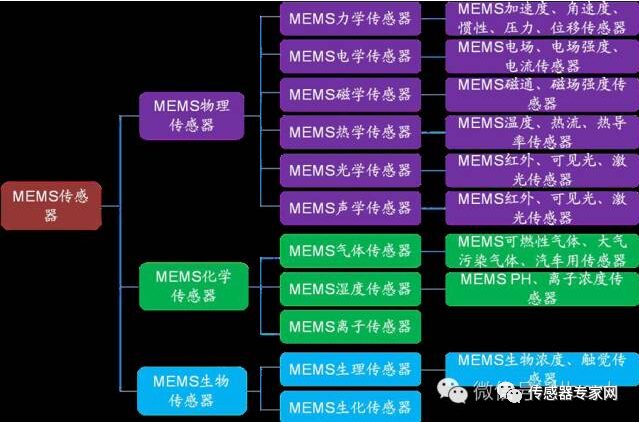

There are many types of MEMS sensors, which can be classified in various ways. Based on their working principles, they can be roughly divided into MEMS physical, chemical, and biological sensors, with each type further divided into many subcategories. Different MEMS sensors can measure different quantities and achieve various functions.

3. Development History of the MEMS Industry and Three Industrial Waves

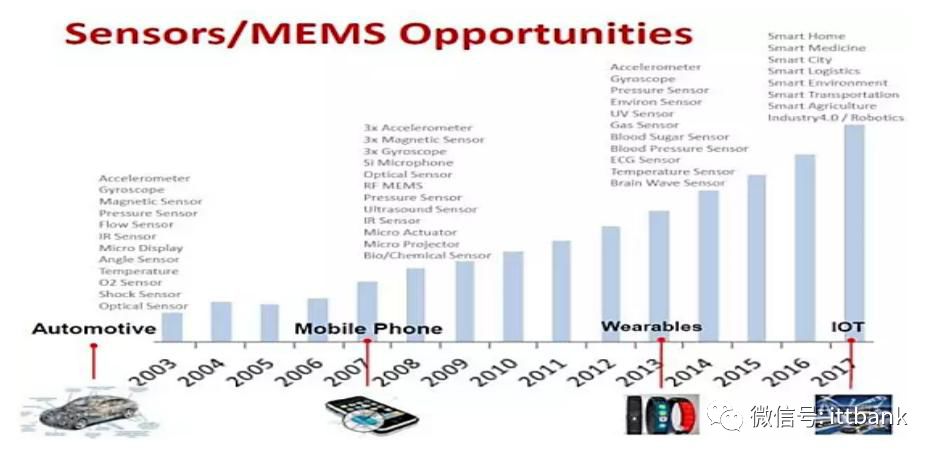

The origins of MEMS can be traced back to the 1950s when the piezoresistive effect of silicon was discovered, leading scholars to begin researching silicon sensors. However, the real development of the MEMS industry began in the 1980s, experiencing three waves of industrialization.

From the 1980s to the 1990s: In 1983, Honeywell used large-scale etching of silicon wafer structures and back-etched membranes to create integrated pressure sensors, integrating mechanical structures and circuits into a single chip. In the late 1980s to the 1990s, the rapid development of the automotive industry led to increased demand for automotive electronics applications such as airbags, brake pressure, and tire pressure monitoring systems, driving European, Japanese, and American companies to mass-produce MEMS, promoting the first wave of MEMS industry development.

From the late 1990s to the early 21st century: In the early stages of this phase, the huge demand for inkjet printheads and micro-optical devices promoted the development of the MEMS industry. After 2007, the strong demand for MEMS in consumer electronics, such as mobile phones, small home appliances, video games, remote control devices, and mobile internet devices, required MEMS components to be smaller and consume less power, leading to a second wave of MEMS industry development that will continue to push the industry forward.

From 2010 to present: The expansion of product applications has led to new trends in the MEMS industry. MEMS products are gradually being applied in new fields such as the Internet of Things and wearable devices, with increasingly rich application scenarios covering various dimensions of human life. In addition, MEMS is currently the direction of innovation for mobile terminals, with new device forms (such as wearable devices) requiring more miniaturized components and more convenient interaction methods.

However, while the applications of the Internet of Things and wearable devices are driving the third wave of MEMS industrialization, the industry still faces pressures from product specifications, power consumption, product integration, and costs. MEMS products and related technologies urgently need continuous improvement to meet the demands for smaller, lower energy consumption, and higher performance.

4. Main Layout Areas of Domestic Sensor Enterprises

Yangtze River Delta Region

•Centered around Shanghai, Wuxi, and Nanjing.

•Gradually forming a relatively complete sensor production system and industrial supporting system including thermal, magnetic, image, weighing, optoelectronic, temperature, and gas-sensitive sensors.

•Centered around Shenzhen.

•Composed of foreign-funded enterprises in nearby small and medium-sized cities, focusing on thermal, magnetic, ultrasonic, and weighing sensors.

•Centered around Shenyang, Changchun, and Harbin.

•Mainly producing MEMS force-sensitive sensors, gas-sensitive sensors, and humidity sensors.

•Mainly based in universities.

•Engaged in the research and development of new sensors, filling domestic gaps in certain fields. Beijing has established a national key laboratory for micrometers/nanometers.

•Centered around Zhengzhou, Wuhan, and Taiyuan.

•A model that closely combines production, education, and research has developed well in industries such as PTC/NTC thermistors, inductive digital level sensors, and gas sensors.

5. MEMS Industry Chain Process

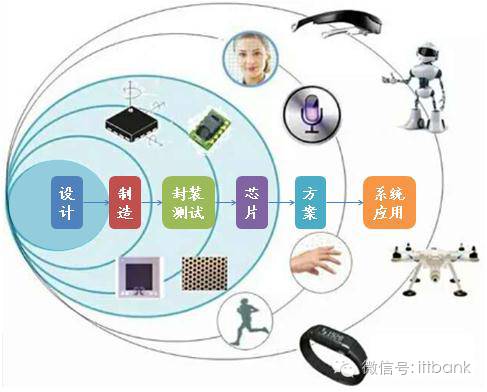

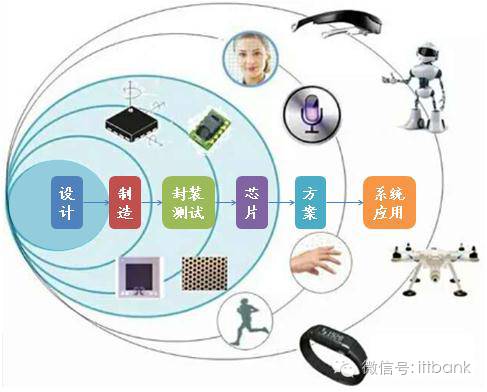

MEMS is a complex system involving multiple disciplines, and the entire industry chain includes design, manufacturing, packaging and testing, software, and application solutions.

MEMS Industry Chain Process

6. Most Promising Application Areas and Markets for the Global MEMS Industry Chain

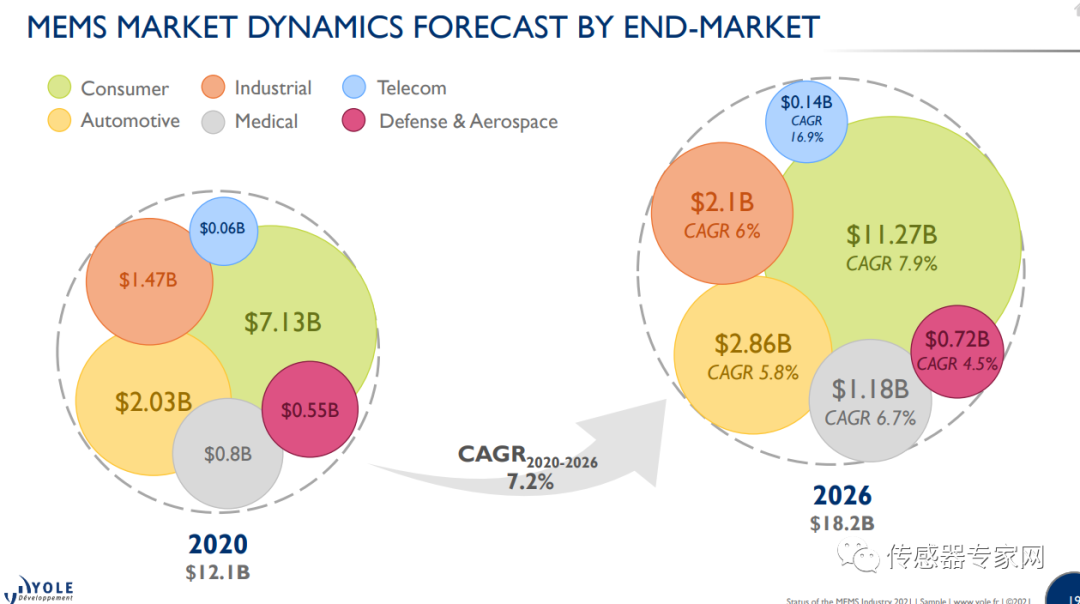

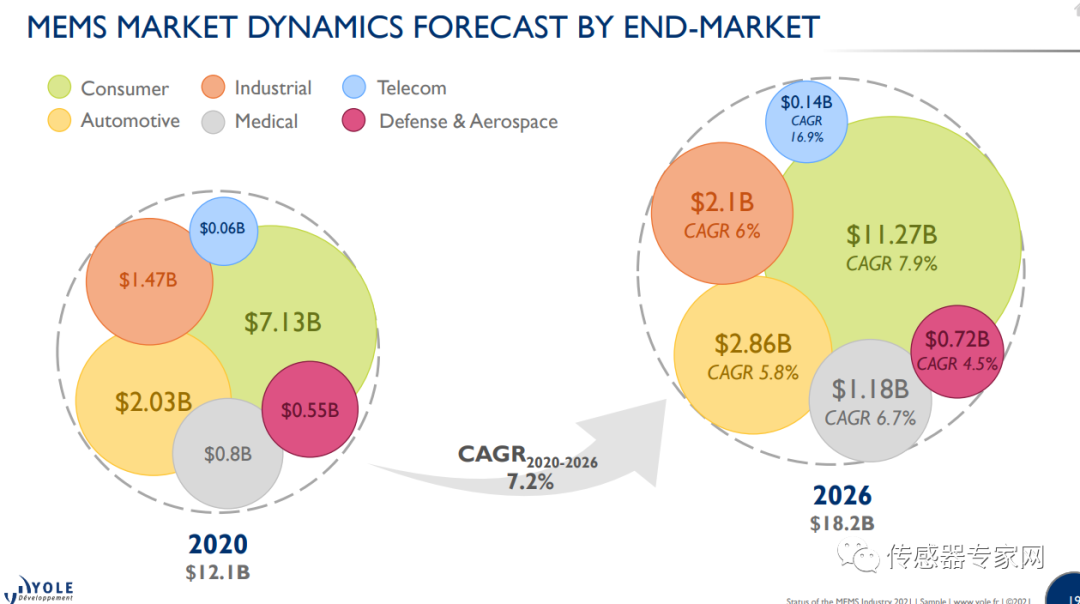

According to Yole’s forecast, the MEMS terminal market will grow at a compound annual growth rate of 7.2% from 2020 to 2026. Among them, the consumer sector is the largest MEMS application market, accounting for about 60% of global MEMS revenue, with a market size of approximately $11.27 billion by 2026. The automotive sector follows, with demand for MEMS in automobiles expected to rise from $2.03 billion in 2020 to $2.86 billion. Other application markets include industrial sectors, medical, telecommunications, defense, and aerospace.

MEMS Industry Chain Process

6. Most Promising Application Areas and Markets for the Global MEMS Industry Chain

According to Yole’s forecast, the MEMS terminal market will grow at a compound annual growth rate of 7.2% from 2020 to 2026. Among them, the consumer sector is the largest MEMS application market, accounting for about 60% of global MEMS revenue, with a market size of approximately $11.27 billion by 2026. The automotive sector follows, with demand for MEMS in automobiles expected to rise from $2.03 billion in 2020 to $2.86 billion. Other application markets include industrial sectors, medical, telecommunications, defense, and aerospace.

From the perspective of MEMS devices, Yole predicts that the overall MEMS device market will grow at a compound annual growth rate of 7.2% from 2020 to 2026, reaching a global MEMS device market space of $18.2 billion by 2026. Among them, RF MEMS devices will dominate, with a market space of about $4.04 billion by 2026, pressure MEMS devices will be approximately $2.362 billion, inertial devices about $2.127 billion, MEMS microphones around $1.871 billion, followed by accelerometers, inkjet heads, optics, micro-radiation thermometers, gyroscopes, microfluidics, etc.

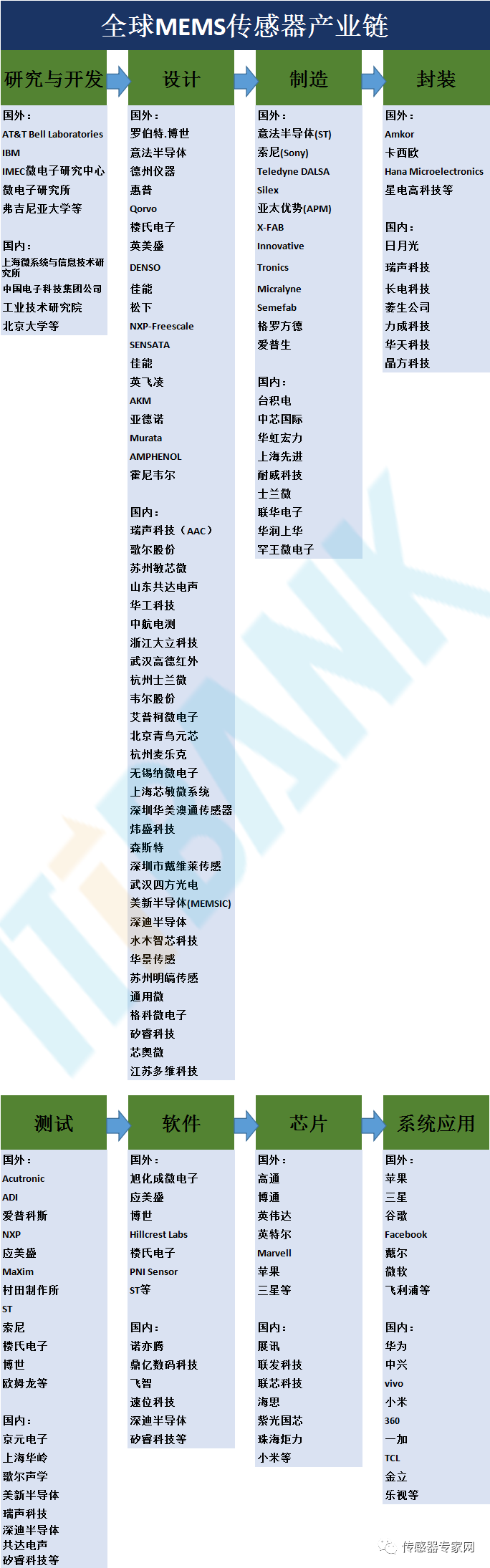

7. Global MEMS Industry Chain Manufacturer Segmentation (over 200 enterprises & institutions)

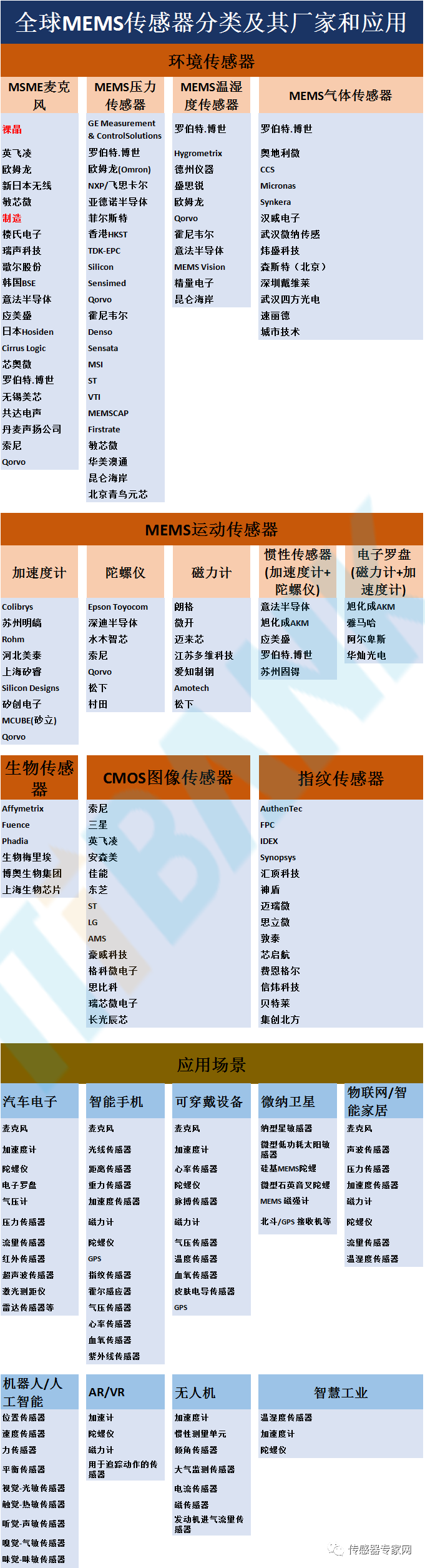

The global MEMS sensor industry chain is mainly concentrated in North America, Europe, and Japan, with the United States, Germany, and Japan dominating the global sensor industry chain.

From upstream to downstream, the global MEMS sensor industry chain can be divided into research and development → design → manufacturing → packaging → testing → software → chips → systems/applications and other links.

8. Introduction to Segmented Applications of MEMS Sensors

MEMS sensors come in many types, including motion sensors, pressure sensors, microphones, environmental sensors, light sensors, etc. Among them, motion sensors can be divided into gyroscopes, accelerometers, and magnetometers,

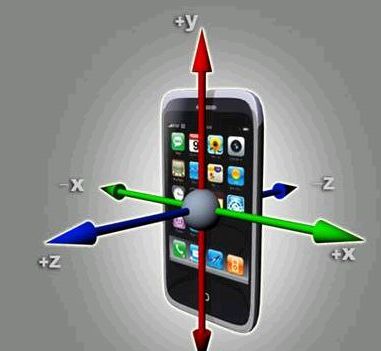

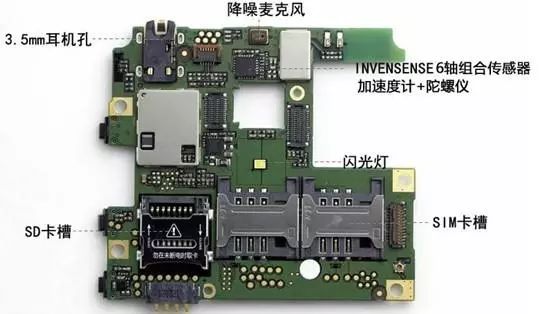

MEMS motion sensors mainly include three categories: accelerometers, gyroscopes, and magnetometers. Accelerometers and gyroscopes can be integrated into a six-axis inertial sensor; magnetometers and accelerometers can be combined into an electronic compass (e-compass), while accelerometers, gyroscopes, and magnetometers can be integrated into a nine-axis sensor.

MEMS gyroscopes measure angular velocity using the core principle of gyroscopic Coriolis force; MEMS accelerometers can sense acceleration in any direction. MEMS magnetometers can determine the device’s orientation by testing the strength and direction of the magnetic field.

MEMS microphones are widely used in consumer electronics, automotive, and medical fields. Currently, almost every smartphone uses at least one MEMS microphone, and high-end smartphones may use three microphones for voice capture, noise cancellation, and improving voice recognition. The iPhone 6S has even adopted four MEMS microphones. In the era of the Internet of Things, a large number of IoT devices will also use MEMS microphones. Apple’s iPhone 5S and 5C use two Knowles microphones and one AAC MEMS microphone.

Pressure sensors are mainly used to detect pressure and can be classified into low, medium, and high-pressure sensors based on the range. MEMS pressure sensors belong to low-pressure sensors and mainly utilize silicon capacitive and silicon piezoresistive principles.

Automotive and medical fields are the largest application areas for MEMS pressure sensors. Compared to MEMS inertial sensors, MEMS pressure sensors are not widely used in consumer electronics and mobile fields, mainly including applications in diving and sports watches, pedometers, and hiking altimeters, and some are used in household appliances like water dispensers, washing machines, and solar water heaters as water level sensors. Future smartphones and tablets may integrate MEMS pressure sensors to detect atmospheric pressure or serve as altimeters to support indoor positioning services.

4. MEMS Environmental Sensors

MEMS humidity sensors are widely used in industrial control, meteorology, agriculture, and mine detection industries. MEMS gas sensors are primarily used to detect the composition and concentration of target gases.

MEMS biosensors are currently in the early stages of development. They are devices that use biological molecules to detect biological reaction information and are listed as one of the five major medical testing technologies of the new century, resulting from the intersection of modern biotechnology with microelectronics, chemistry, and other disciplines. In the future, MEMS biosensors will have broad development space in medicine, food industry, environmental monitoring, and other fields.

Currently, major IDM manufacturers providing MEMS foundry services include STMicroelectronics, Sony, Texas Instruments, etc.; TSMC is currently the world’s largest independent MEMS foundry, with leading pure MEMS foundries such as Silex Microsystems, Teledyne DALSA, Asia Pacific Microsystems, X-FAB, and Innovative Micro Technology. Domestic companies like SMIC, Huahong Group, and Shanghai Advanced Semiconductor also have the capability to produce MEMS.

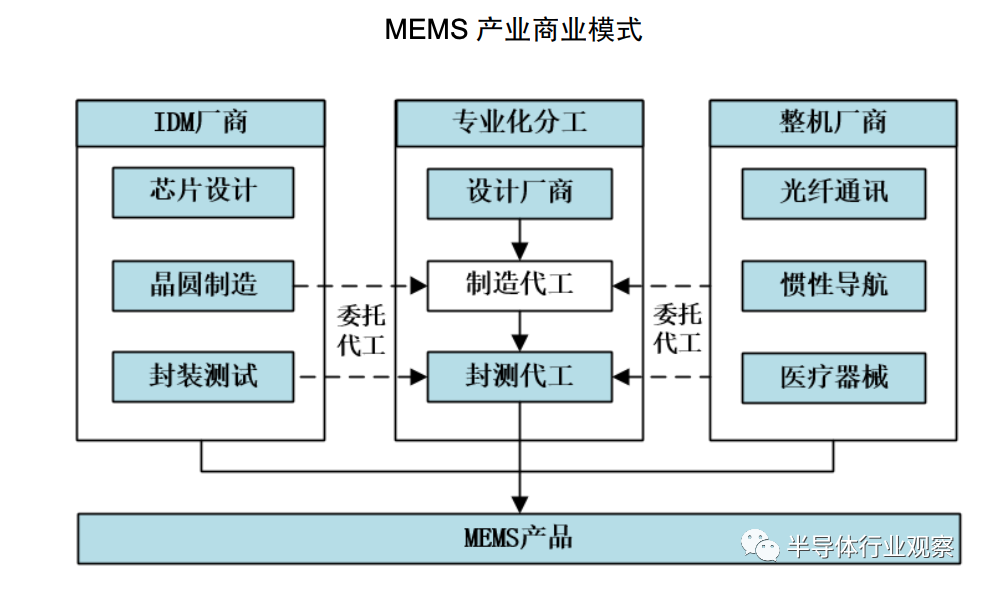

Similar to the traditional integrated circuit industry, from the perspective of the MEMS industry value chain, companies can be divided into three segments based on the products or services they provide: design, manufacturing, and packaging/testing. The MEMS manufacturing industry is a midstream segment that develops processes for various MEMS chips based on design requirements and achieves mass production, characterized by capital-intensive, technology-intensive, and knowledge-intensive features, posing high requirements for companies’ financial strength, R&D investment, and technological accumulation.

Currently, in the market, on the one hand, IDM companies face dual pressures from upgrading production lines and reducing costs to maintain profits, leading to cases where IDM companies outsource manufacturing; on the other hand, the explosive growth of MEMS product applications requires new MEMS companies from different fields and industries to participate, but the huge investment in factory construction, operational costs, and the complexity of MEMS process development and integration create high industry barriers that hinder continuous market expansion.

In this context, the business model of pure MEMS foundries collaborating with MEMS product design companies will become the mainstream of the industry’s business model in the future. Similar to the development trend of the traditional integrated circuit industry, the MEMS industry will gradually move towards a model of separation between design and manufacturing, with the manufacturing segment being outsourced.

MEMS manufacturing primarily refers to MEMS chip manufacturing, with two main operating models in the industry: one relies on self-owned production lines for production, and the other outsources to MEMS foundries for production. The companies providing MEMS manufacturing foundry services can be categorized into three types based on chip types and industry value chains: pure MEMS foundries, IDM company foundries, and traditional integrated circuit MEMS foundries.

Pure MEMS foundry companies do not provide any design services; they develop process technologies and provide foundry production services based on the MEMS chip design schemes provided by customers. Representative companies include Teledyne Dalsa, IMT, etc.

IDM companies, or integrated device manufacturers, engage in integrated circuit design and typically own their own packaging and testing facilities, covering all aspects of integrated circuit design, manufacturing, packaging, and testing. Due to the substantial capital investment required for wafer manufacturing, packaging, and testing production lines, the IDM model imposes high demands on companies’ R&D capabilities, financial strength, and market influence. After meeting their own wafer manufacturing needs, IDM companies will outsource excess capacity to provide MEMS foundry services. The companies adopting the IDM foundry model are global chip industry giants, with major representatives including Bosch, STMicroelectronics, Texas Instruments, etc.

3. Traditional Integrated Circuit MEMS Foundries

Traditional integrated circuit (mainly CMOS) foundry companies leverage their existing CMOS production lines to integrate specific MEMS manufacturing technologies, converting old production lines into MEMS foundry lines. Due to their outstanding mass production capabilities, traditional integrated circuit companies often focus on providing foundry services for MEMS products in the consumer electronics sector with high shipment volumes, represented by TSMC, Global Foundries, etc.

Throughout the historical development process, due to the significant differences in materials, processing, and manufacturing procedures for MEMS products, the low standardization of devices has affected the development of vertical division of labor in the industry, with IDM companies dominating. In recent years, with the development of MEMS technology and the gradual emergence of market demand, the standardization of MEMS has greatly improved, and a platform-based foundation is forming, making the vertical division conditions of the MEMS product industry chain increasingly mature.

10. MEMS Packaging and Testing

Currently, major international companies capable of MEMS packaging and testing include ASE, Amkor, SPIL, and Powertech, while domestic companies include Huahai Technology, Changdian Technology, and JF Technology. Although domestic MEMS front-end manufacturing lags behind international giants, domestic packaging technology started relatively early, and the back-end packaging of the domestic MEMS industry chain is relatively complete.

Packaging technology differs significantly from IC packaging and imposes high requirements on companies. It is well-known that the prices of MEMS devices are declining rapidly, and currently, the packaging cost of some MEMS devices accounts for 40% to 60% of the total price. Achieving low-cost packaging is a significant challenge faced by packaging and testing manufacturers.

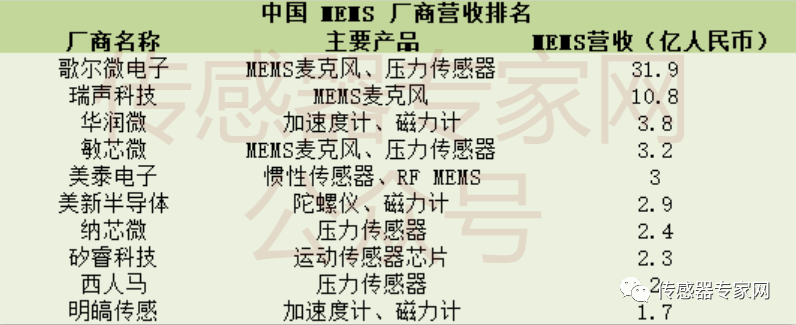

11. Revenue Ranking of Global & Chinese MEMS Sensor Manufacturers

From the perspective of the global MEMS sensor industry chain, Bosch ranks first with a revenue of 11.5 billion yuan, followed by Broadcom with 7.961 billion yuan, both leading far ahead of other MEMS sensor manufacturers.

Chinese companies’ MEMS business revenues still lag behind global giants, with GoerTek’s MEMS business revenue around 3.1 billion yuan, AAC’s 1.1 billion yuan, and Gaode Infrared’s 560 million yuan, making them the top three MEMS revenue companies in China.

12. Major Applications of MEMS Sensors

Applications in Wearable Devices

For example, the Xiaomi Mi Band uses ADI’s MEMS accelerometer and heart rate sensor to monitor movement and heart rate.

Inside the Apple Watch, in addition to the MEMS accelerometer, gyroscope, and MEMS microphone, there is also a pulse sensor.

VR devices require sufficient precision to measure head rotation speed, angle, and distance. Using MEMS accelerometers, gyroscopes, and magnetometers for measurement is one of the important solutions, almost becoming a standard configuration for VR devices. Oculus Rift, HTC Vive, and PlayStation VR all use MEMS accelerometers and gyroscopes, and future VR devices may also use MEMS eye-tracking technology.

In drone flight posture control technology, MEMS sensors have significant applications. By combining accelerometers and gyroscopes, it can calculate angular changes and determine position and flight posture. MEMS sensors can operate normally under various harsh conditions while providing high-precision output. The application of MEMS accelerometers and gyroscopes in drones can be described as remarkable.

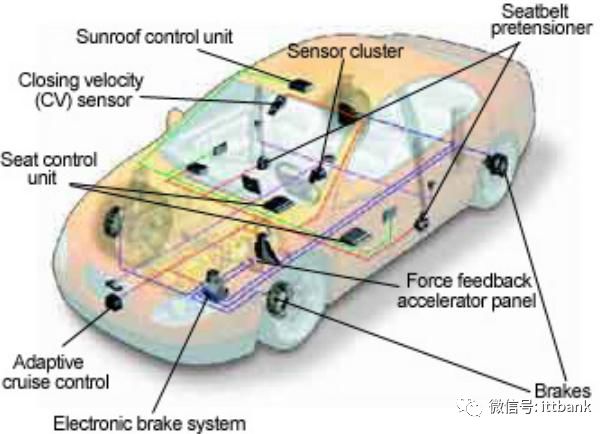

Smart Automotive Applications

The Internet of Vehicles is a significant area of IoT development, and smart vehicles are at the core of the Internet of Vehicles, currently undergoing rapid development. In the era of smart vehicles, active safety technology has become a highly concerned emerging field, requiring improvements to existing active safety systems, such as rollover and stability control, which necessitate MEMS accelerometers and angular velocity sensors to sense vehicle posture. Voice will become an important interaction method between people and smart vehicles, presenting new opportunities for MEMS microphones. MEMS sensors have many applications in the automotive field, including airbags (using high-g-value accelerometers for front collision airbags and pressure sensors for side airbags), automotive engines (for detecting intake volume with intake manifold absolute pressure sensors and flow sensors), etc.

13. Applications of MEMS Sensors in Smartphones

When it comes to sensors in mobile phones, the first to mention is the light sensor, which acts like the eyes of the phone. Just as our eyes can adjust to different lighting conditions, the light sensor allows the phone to sense the intensity of ambient light to adjust the screen brightness.

Principle: A photo-sensitive transistor generates varying currents in response to external light, thus sensing the brightness of the environment.

Applications: Typically used to adjust the automatic backlight brightness of the screen, increasing brightness during the day and reducing it at night for clearer visibility without glare; can be used to adjust automatic white balance when taking photos; using the light sensor to assist in adjusting screen brightness can further extend battery life; the light sensor can also work with other sensors to detect if the phone is placed in a pocket to prevent accidental touches.

Product Example: ST (STMicroelectronics) — OPT3007

A thin ambient light sensor with a precise spectral response highly matching the human eye’s visual response.

Applications in Phones: Apple iPhone XR, vivo X23, Huawei Mate 20, Samsung GALAXY Note 9, etc.

Light sensors and proximity sensors are generally placed together around the phone’s screen speaker. This creates a problem, as having too many holes or black bars above the phone screen does not look good, and major manufacturers have been trying to reduce or hide holes.

Principle: An infrared LED emits infrared light, which is reflected by an object; the infrared detector measures the intensity of the received infrared light to determine distance. Proximity sensors typically have both emitting and receiving devices and are generally larger in size.

Applications: Detects if the phone is pressed against the ear while making a call to automatically turn off the screen to save power; can also automatically unlock and lock the screen when in a case or pocket mode.

Product Example: TAOS — TMD2772

Composed of infrared emission, light reception, analog-to-digital conversion, I2C interface, and other components.

Principle: Utilizing the piezoelectric effect, the sensor integrates a heavy object with a piezoelectric chip to calculate the horizontal direction based on the voltage generated in two orthogonal directions.

Applications: Intelligent switching between landscape and portrait modes; direction of photo capture; gravity-sensing games, such as balance ball and racing games.

Product Example: Apple’s gravity sensing device.

Principle: Accelerometers measure instantaneous acceleration or deceleration actions across multiple dimensions. They have lower power consumption, but lower precision.

Applications: Pedometer applications, where accelerometers can detect AC signals and vibrations of objects. When a person is walking, a regular vibration pattern is produced, which the accelerometer can detect to calculate steps taken or distance traveled while running, and using certain formulas can calculate calorie consumption; common applications include shaking to change songs and flipping to mute.

Product Example: STMicroelectronics — LSM330D

Can measure pitch, roll, and yaw angular velocities from 250 dps to 2000 dps.

5. Magnetic Field Sensors

Principle: Anisotropic magnetoresistive materials experience changes in resistance when exposed to weak magnetic fields, causing the phone to need to rotate or shake to accurately indicate direction.

Applications: Compass, map navigation directions, metal detector apps.

Product Example: ADI (Analog Devices) — ADA4571

Highly sensitive to changes in air gaps.

Principle: According to the principle of conservation of angular momentum, a rapidly spinning object (gyroscope) maintains its axis of rotation direction unless influenced by external forces. Gyroscopes operate based on this principle to maintain a specific direction. Typically, a three-axis gyroscope is standard in phones, tracking displacement changes in six directions.

Applications: Used in shooting or racing games; 3D photography, panoramic navigation, etc.

Product Example: NXP (NXP Semiconductors) — FXAS21002C

Three-axis digital gyroscope suitable for game controllers, electronic compass stabilization, enhanced motion control, and other applications.

Principle: The phone’s GPS module receives information transmitted by GPS satellites through antennas. The chip in the module uses the instantaneous position of the fast-moving satellites as starting data, calculating the distance between the satellite and the phone based on the time difference between the satellite’s emitted coordinates and the reception time, determining the position coordinates of the point to be measured using spatial distance triangulation.

Applications: Maps, navigation, speed measurement, distance measurement.

Product Example: Fastrax — UP501

Can perform high-performance navigation under harsh conditions, providing stable positioning even in environments with low GPS satellite visibility.

Currently, capacitive fingerprint recognition and ultrasonic fingerprint recognition are widely used.

Capacitive Fingerprint Sensor Principle: A finger forms one pole of a capacitor, while the other pole is an array of silicon chips. The microcurrent generated between the human body’s microelectrical field and the capacitive sensor forms a difference in capacitance based on the peaks and valleys of the fingerprint, thereby depicting the fingerprint image.

Ultrasonic Fingerprint Sensor Principle: Using ultrasonic waves to directly scan and map fingerprint textures. The fingerprint obtained through ultrasonic waves is 3D, while the capacitive fingerprint is 2D. Ultrasonic recognition is not only faster but also less affected by sweat and oil, providing richer fingerprint detail that is harder to crack.

Applications: Encryption, unlocking, payment, etc.

Product Example: Synaptics — Clear ID FS9500

Only 1.55mm thick, can be placed directly under flexible screens or integrated directly into the screen.

Principle: The Hall effect states that when current flows through a conductor located in a magnetic field, the magnetic field exerts a force on the electrons in the conductor, creating a potential difference across the conductor.

Applications: Automatic unlocking, automatic screen locking, etc.

Product Example: Diodes — AH1883

Excellent temperature stability, insensitive to body pressure.

Principle: Divided into capacitive or resistive barometric sensors, connecting a membrane with a resistor or capacitor, where pressure changes lead to variations in resistance or capacitance, thus obtaining pressure data.

Applications: GPS can have an error of about ten meters in altitude calculations; barometric sensors are mainly used to correct altitude errors (to about one meter) and can also assist GPS in locating overpasses or floor levels.

Product Example: TI (Texas Instruments) — BMP180

High precision, small size, ultra-low power consumption barometric sensor.

11. Applications of MEMS Sensors in the Automotive Field

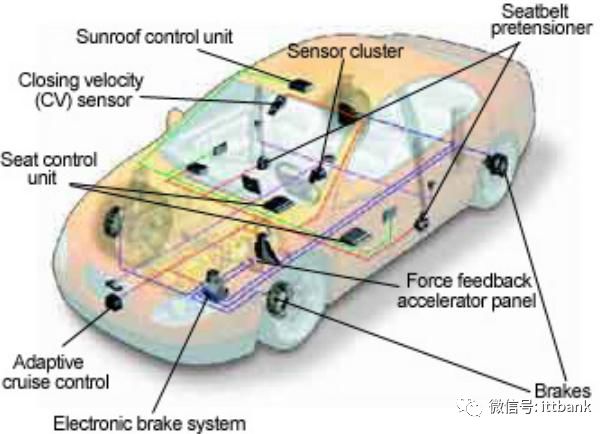

With increasing focus on automotive safety applications and reducing carbon emissions, the penetration rate of MEMS sensors in automotive electronics is gradually increasing; in addition, emerging technologies such as autonomous driving are also driving the further popularization of MEMS sensors.

In 2010, the global average number of sensors per vehicle was 9.2, while Chinese vehicles contained 5. However, with the expansion of airbag deployment and tire pressure monitoring systems (TPMS) in China, the average number of sensors in Chinese vehicles is expected to increase to 10 by 2015, with the TPMS system alone requiring 4.2 automotive MEMS sensors. Currently, China has surpassed Japan to become the third-largest automotive MEMS market.

Common sensors found in vehicles include accelerometers, gyroscopes, electronic compasses, barometers, infrared sensors, ultrasonic sensors, laser range finders, radar sensors, and more.

From the perspective of MEMS devices, Yole predicts that the overall MEMS device market will grow at a compound annual growth rate of 7.2% from 2020 to 2026, reaching a global MEMS device market space of $18.2 billion by 2026. Among them, RF MEMS devices will dominate, with a market space of about $4.04 billion by 2026, pressure MEMS devices will be approximately $2.362 billion, inertial devices about $2.127 billion, MEMS microphones around $1.871 billion, followed by accelerometers, inkjet heads, optics, micro-radiation thermometers, gyroscopes, microfluidics, etc.

7. Global MEMS Industry Chain Manufacturer Segmentation (over 200 enterprises & institutions)

The global MEMS sensor industry chain is mainly concentrated in North America, Europe, and Japan, with the United States, Germany, and Japan dominating the global sensor industry chain.

From upstream to downstream, the global MEMS sensor industry chain can be divided into research and development → design → manufacturing → packaging → testing → software → chips → systems/applications and other links.

8. Introduction to Segmented Applications of MEMS Sensors

MEMS sensors come in many types, including motion sensors, pressure sensors, microphones, environmental sensors, light sensors, etc. Among them, motion sensors can be divided into gyroscopes, accelerometers, and magnetometers,

MEMS motion sensors mainly include three categories: accelerometers, gyroscopes, and magnetometers. Accelerometers and gyroscopes can be integrated into a six-axis inertial sensor; magnetometers and accelerometers can be combined into an electronic compass (e-compass), while accelerometers, gyroscopes, and magnetometers can be integrated into a nine-axis sensor.

MEMS gyroscopes measure angular velocity using the core principle of gyroscopic Coriolis force; MEMS accelerometers can sense acceleration in any direction. MEMS magnetometers can determine the device’s orientation by testing the strength and direction of the magnetic field.

MEMS microphones are widely used in consumer electronics, automotive, and medical fields. Currently, almost every smartphone uses at least one MEMS microphone, and high-end smartphones may use three microphones for voice capture, noise cancellation, and improving voice recognition. The iPhone 6S has even adopted four MEMS microphones. In the era of the Internet of Things, a large number of IoT devices will also use MEMS microphones. Apple’s iPhone 5S and 5C use two Knowles microphones and one AAC MEMS microphone.

Pressure sensors are mainly used to detect pressure and can be classified into low, medium, and high-pressure sensors based on the range. MEMS pressure sensors belong to low-pressure sensors and mainly utilize silicon capacitive and silicon piezoresistive principles.

Automotive and medical fields are the largest application areas for MEMS pressure sensors. Compared to MEMS inertial sensors, MEMS pressure sensors are not widely used in consumer electronics and mobile fields, mainly including applications in diving and sports watches, pedometers, and hiking altimeters, and some are used in household appliances like water dispensers, washing machines, and solar water heaters as water level sensors. Future smartphones and tablets may integrate MEMS pressure sensors to detect atmospheric pressure or serve as altimeters to support indoor positioning services.

4. MEMS Environmental Sensors

MEMS humidity sensors are widely used in industrial control, meteorology, agriculture, and mine detection industries. MEMS gas sensors are primarily used to detect the composition and concentration of target gases.

MEMS biosensors are currently in the early stages of development. They are devices that use biological molecules to detect biological reaction information and are listed as one of the five major medical testing technologies of the new century, resulting from the intersection of modern biotechnology with microelectronics, chemistry, and other disciplines. In the future, MEMS biosensors will have broad development space in medicine, food industry, environmental monitoring, and other fields.

Currently, major IDM manufacturers providing MEMS foundry services include STMicroelectronics, Sony, Texas Instruments, etc.; TSMC is currently the world’s largest independent MEMS foundry, with leading pure MEMS foundries such as Silex Microsystems, Teledyne DALSA, Asia Pacific Microsystems, X-FAB, and Innovative Micro Technology. Domestic companies like SMIC, Huahong Group, and Shanghai Advanced Semiconductor also have the capability to produce MEMS.

Similar to the traditional integrated circuit industry, from the perspective of the MEMS industry value chain, companies can be divided into three segments based on the products or services they provide: design, manufacturing, and packaging/testing. The MEMS manufacturing industry is a midstream segment that develops processes for various MEMS chips based on design requirements and achieves mass production, characterized by capital-intensive, technology-intensive, and knowledge-intensive features, posing high requirements for companies’ financial strength, R&D investment, and technological accumulation.

Currently, in the market, on the one hand, IDM companies face dual pressures from upgrading production lines and reducing costs to maintain profits, leading to cases where IDM companies outsource manufacturing; on the other hand, the explosive growth of MEMS product applications requires new MEMS companies from different fields and industries to participate, but the huge investment in factory construction, operational costs, and the complexity of MEMS process development and integration create high industry barriers that hinder continuous market expansion.

In this context, the business model of pure MEMS foundries collaborating with MEMS product design companies will become the mainstream of the industry’s business model in the future. Similar to the development trend of the traditional integrated circuit industry, the MEMS industry will gradually move towards a model of separation between design and manufacturing, with the manufacturing segment being outsourced.

MEMS manufacturing primarily refers to MEMS chip manufacturing, with two main operating models in the industry: one relies on self-owned production lines for production, and the other outsources to MEMS foundries for production. The companies providing MEMS manufacturing foundry services can be categorized into three types based on chip types and industry value chains: pure MEMS foundries, IDM company foundries, and traditional integrated circuit MEMS foundries.

Pure MEMS foundry companies do not provide any design services; they develop process technologies and provide foundry production services based on the MEMS chip design schemes provided by customers. Representative companies include Teledyne Dalsa, IMT, etc.

IDM companies, or integrated device manufacturers, engage in integrated circuit design and typically own their own packaging and testing facilities, covering all aspects of integrated circuit design, manufacturing, packaging, and testing. Due to the substantial capital investment required for wafer manufacturing, packaging, and testing production lines, the IDM model imposes high demands on companies’ R&D capabilities, financial strength, and market influence. After meeting their own wafer manufacturing needs, IDM companies will outsource excess capacity to provide MEMS foundry services. The companies adopting the IDM foundry model are global chip industry giants, with major representatives including Bosch, STMicroelectronics, Texas Instruments, etc.

3. Traditional Integrated Circuit MEMS Foundries

Traditional integrated circuit (mainly CMOS) foundry companies leverage their existing CMOS production lines to integrate specific MEMS manufacturing technologies, converting old production lines into MEMS foundry lines. Due to their outstanding mass production capabilities, traditional integrated circuit companies often focus on providing foundry services for MEMS products in the consumer electronics sector with high shipment volumes, represented by TSMC, Global Foundries, etc.

Throughout the historical development process, due to the significant differences in materials, processing, and manufacturing procedures for MEMS products, the low standardization of devices has affected the development of vertical division of labor in the industry, with IDM companies dominating. In recent years, with the development of MEMS technology and the gradual emergence of market demand, the standardization of MEMS has greatly improved, and a platform-based foundation is forming, making the vertical division conditions of the MEMS product industry chain increasingly mature.

10. MEMS Packaging and Testing

Currently, major international companies capable of MEMS packaging and testing include ASE, Amkor, SPIL, and Powertech, while domestic companies include Huahai Technology, Changdian Technology, and JF Technology. Although domestic MEMS front-end manufacturing lags behind international giants, domestic packaging technology started relatively early, and the back-end packaging of the domestic MEMS industry chain is relatively complete.

Packaging technology differs significantly from IC packaging and imposes high requirements on companies. It is well-known that the prices of MEMS devices are declining rapidly, and currently, the packaging cost of some MEMS devices accounts for 40% to 60% of the total price. Achieving low-cost packaging is a significant challenge faced by packaging and testing manufacturers.

11. Revenue Ranking of Global & Chinese MEMS Sensor Manufacturers

From the perspective of the global MEMS sensor industry chain, Bosch ranks first with a revenue of 11.5 billion yuan, followed by Broadcom with 7.961 billion yuan, both leading far ahead of other MEMS sensor manufacturers.

Chinese companies’ MEMS business revenues still lag behind global giants, with GoerTek’s MEMS business revenue around 3.1 billion yuan, AAC’s 1.1 billion yuan, and Gaode Infrared’s 560 million yuan, making them the top three MEMS revenue companies in China.

12. Major Applications of MEMS Sensors

Applications in Wearable Devices

For example, the Xiaomi Mi Band uses ADI’s MEMS accelerometer and heart rate sensor to monitor movement and heart rate.

Inside the Apple Watch, in addition to the MEMS accelerometer, gyroscope, and MEMS microphone, there is also a pulse sensor.

VR devices require sufficient precision to measure head rotation speed, angle, and distance. Using MEMS accelerometers, gyroscopes, and magnetometers for measurement is one of the important solutions, almost becoming a standard configuration for VR devices. Oculus Rift, HTC Vive, and PlayStation VR all use MEMS accelerometers and gyroscopes, and future VR devices may also use MEMS eye-tracking technology.

In drone flight posture control technology, MEMS sensors have significant applications. By combining accelerometers and gyroscopes, it can calculate angular changes and determine position and flight posture. MEMS sensors can operate normally under various harsh conditions while providing high-precision output. The application of MEMS accelerometers and gyroscopes in drones can be described as remarkable.

Smart Automotive Applications

The Internet of Vehicles is a significant area of IoT development, and smart vehicles are at the core of the Internet of Vehicles, currently undergoing rapid development. In the era of smart vehicles, active safety technology has become a highly concerned emerging field, requiring improvements to existing active safety systems, such as rollover and stability control, which necessitate MEMS accelerometers and angular velocity sensors to sense vehicle posture. Voice will become an important interaction method between people and smart vehicles, presenting new opportunities for MEMS microphones. MEMS sensors have many applications in the automotive field, including airbags (using high-g-value accelerometers for front collision airbags and pressure sensors for side airbags), automotive engines (for detecting intake volume with intake manifold absolute pressure sensors and flow sensors), etc.

13. Applications of MEMS Sensors in Smartphones

When it comes to sensors in mobile phones, the first to mention is the light sensor, which acts like the eyes of the phone. Just as our eyes can adjust to different lighting conditions, the light sensor allows the phone to sense the intensity of ambient light to adjust the screen brightness.

Principle: A photo-sensitive transistor generates varying currents in response to external light, thus sensing the brightness of the environment.

Applications: Typically used to adjust the automatic backlight brightness of the screen, increasing brightness during the day and reducing it at night for clearer visibility without glare; can be used to adjust automatic white balance when taking photos; using the light sensor to assist in adjusting screen brightness can further extend battery life; the light sensor can also work with other sensors to detect if the phone is placed in a pocket to prevent accidental touches.

Product Example: ST (STMicroelectronics) — OPT3007

A thin ambient light sensor with a precise spectral response highly matching the human eye’s visual response.

Applications in Phones: Apple iPhone XR, vivo X23, Huawei Mate 20, Samsung GALAXY Note 9, etc.

Light sensors and proximity sensors are generally placed together around the phone’s screen speaker. This creates a problem, as having too many holes or black bars above the phone screen does not look good, and major manufacturers have been trying to reduce or hide holes.

Principle: An infrared LED emits infrared light, which is reflected by an object; the infrared detector measures the intensity of the received infrared light to determine distance. Proximity sensors typically have both emitting and receiving devices and are generally larger in size.

Applications: Detects if the phone is pressed against the ear while making a call to automatically turn off the screen to save power; can also automatically unlock and lock the screen when in a case or pocket mode.

Product Example: TAOS — TMD2772

Composed of infrared emission, light reception, analog-to-digital conversion, I2C interface, and other components.

Principle: Utilizing the piezoelectric effect, the sensor integrates a heavy object with a piezoelectric chip to calculate the horizontal direction based on the voltage generated in two orthogonal directions.

Applications: Intelligent switching between landscape and portrait modes; direction of photo capture; gravity-sensing games, such as balance ball and racing games.

Product Example: Apple’s gravity sensing device.

Principle: Accelerometers measure instantaneous acceleration or deceleration actions across multiple dimensions. They have lower power consumption, but lower precision.

Applications: Pedometer applications, where accelerometers can detect AC signals and vibrations of objects. When a person is walking, a regular vibration pattern is produced, which the accelerometer can detect to calculate steps taken or distance traveled while running, and using certain formulas can calculate calorie consumption; common applications include shaking to change songs and flipping to mute.

Product Example: STMicroelectronics — LSM330D

Can measure pitch, roll, and yaw angular velocities from 250 dps to 2000 dps.

5. Magnetic Field Sensors

Principle: Anisotropic magnetoresistive materials experience changes in resistance when exposed to weak magnetic fields, causing the phone to need to rotate or shake to accurately indicate direction.

Applications: Compass, map navigation directions, metal detector apps.

Product Example: ADI (Analog Devices) — ADA4571

Highly sensitive to changes in air gaps.

Principle: According to the principle of conservation of angular momentum, a rapidly spinning object (gyroscope) maintains its axis of rotation direction unless influenced by external forces. Gyroscopes operate based on this principle to maintain a specific direction. Typically, a three-axis gyroscope is standard in phones, tracking displacement changes in six directions.

Applications: Used in shooting or racing games; 3D photography, panoramic navigation, etc.

Product Example: NXP (NXP Semiconductors) — FXAS21002C

Three-axis digital gyroscope suitable for game controllers, electronic compass stabilization, enhanced motion control, and other applications.

Principle: The phone’s GPS module receives information transmitted by GPS satellites through antennas. The chip in the module uses the instantaneous position of the fast-moving satellites as starting data, calculating the distance between the satellite and the phone based on the time difference between the satellite’s emitted coordinates and the reception time, determining the position coordinates of the point to be measured using spatial distance triangulation.

Applications: Maps, navigation, speed measurement, distance measurement.

Product Example: Fastrax — UP501

Can perform high-performance navigation under harsh conditions, providing stable positioning even in environments with low GPS satellite visibility.

Currently, capacitive fingerprint recognition and ultrasonic fingerprint recognition are widely used.

Capacitive Fingerprint Sensor Principle: A finger forms one pole of a capacitor, while the other pole is an array of silicon chips. The microcurrent generated between the human body’s microelectrical field and the capacitive sensor forms a difference in capacitance based on the peaks and valleys of the fingerprint, thereby depicting the fingerprint image.

Ultrasonic Fingerprint Sensor Principle: Using ultrasonic waves to directly scan and map fingerprint textures. The fingerprint obtained through ultrasonic waves is 3D, while the capacitive fingerprint is 2D. Ultrasonic recognition is not only faster but also less affected by sweat and oil, providing richer fingerprint detail that is harder to crack.

Applications: Encryption, unlocking, payment, etc.

Product Example: Synaptics — Clear ID FS9500

Only 1.55mm thick, can be placed directly under flexible screens or integrated directly into the screen.

Principle: The Hall effect states that when current flows through a conductor located in a magnetic field, the magnetic field exerts a force on the electrons in the conductor, creating a potential difference across the conductor.

Applications: Automatic unlocking, automatic screen locking, etc.

Product Example: Diodes — AH1883

Excellent temperature stability, insensitive to body pressure.

Principle: Divided into capacitive or resistive barometric sensors, connecting a membrane with a resistor or capacitor, where pressure changes lead to variations in resistance or capacitance, thus obtaining pressure data.

Applications: GPS can have an error of about ten meters in altitude calculations; barometric sensors are mainly used to correct altitude errors (to about one meter) and can also assist GPS in locating overpasses or floor levels.

Product Example: TI (Texas Instruments) — BMP180

High precision, small size, ultra-low power consumption barometric sensor.

11. Applications of MEMS Sensors in the Automotive Field

With increasing focus on automotive safety applications and reducing carbon emissions, the penetration rate of MEMS sensors in automotive electronics is gradually increasing; in addition, emerging technologies such as autonomous driving are also driving the further popularization of MEMS sensors.

In 2010, the global average number of sensors per vehicle was 9.2, while Chinese vehicles contained 5. However, with the expansion of airbag deployment and tire pressure monitoring systems (TPMS) in China, the average number of sensors in Chinese vehicles is expected to increase to 10 by 2015, with the TPMS system alone requiring 4.2 automotive MEMS sensors. Currently, China has surpassed Japan to become the third-largest automotive MEMS market.

Common sensors found in vehicles include accelerometers, gyroscopes, electronic compasses, barometers, infrared sensors, ultrasonic sensors, laser range finders, radar sensors, and more.

MEMS sensors applied in vehicles

12. Applications of MEMS Sensors in Wearable Devices

MEMS sensors are widely used in wearable smart devices. The Apple Watch is equipped with over ten types of MEMS sensors.

MEMS sensors applied in vehicles

12. Applications of MEMS Sensors in Wearable Devices

MEMS sensors are widely used in wearable smart devices. The Apple Watch is equipped with over ten types of MEMS sensors.

-

Accelerometers: Measure body movement and can record user steps and sleep habits.

-

Gyroscopes: Can detect rotations; additionally, the gyroscope allows the iWatch to “sense” the user, such as when the wrist is raised to check the time, the screen automatically lights up.

-

Magnetometers: Used to enhance the accuracy of motion tracking.

-

Barometers/Pressure Sensors: Provide more accurate weather data and detect changes in altitude.

-

Ambient Temperature Sensors: Provide more accurate biological data.

-

Heart Rate Monitors: Monitor heart rates.

-

Blood Oxygen Sensors: Measure blood oxygen levels, crucial for accurate pulse rate detection.

-

Skin Conductance Sensors: Calculate the user’s sweat levels.

-

Skin Temperature Sensors: Help users understand their exercise intensity.

-

GPS: GPS can help us understand where we are going and where we have been.

MEMS sensors applied in the Apple Watch

13. Applications of MEMS Sensors in the Internet of Things

The Internet of Things (IoT) connects any objects to the internet for information exchange and communication, enabling intelligent identification, positioning, tracking, monitoring, and management. In short, the Internet of Things is the “internet of connected objects.”

As an important component of the perception layer, which is one of the three structural levels of the Internet of Things, sensors convert physical, chemical, and biological quantities from the real world into digital signals that can be processed, serving as the foundation and prerequisite for the realization of the Internet of Things. At the same time, MEMS (Micro-Electromechanical Systems) technology plays a crucial role in the development of the Internet of Things.

The development of MEMS sensors has gone through three stages, corresponding to different driving forces. Around 2000, the driving force was automotive electronics; around 2007, it was smartphones; around 2013, it was wearable devices; and the next driving force for MEMS sensors is expected to be the Internet of Things, with industry predictions indicating that global sensor demand is expected to surge from the current tens of billions to the trillion-sensor level by 2025.

MEMS technology has extensive applications in IoT segments such as wearable devices, smart homes, healthcare, Industry 4.0, smart cars, and smart cities, with common MEMS sensors such as microphones, body sound wave filters, pressure sensors, and temperature sensors existing in rich application scenarios.

MEMS products have wide applications in IoT

14. Applications of MEMS Sensors in Drones

1. Accelerometers: Accelerometers are used to determine the position and flight posture of drones. Similar to the Nintendo Wii controller or iPhone screen position, these small MEMS sensors play a crucial role in maintaining flight control. MEMS accelerometers can perceive motion posture through various methods; one type of technology senses micro-movements of integrated circuits. Another type of accelerometer uses thermal convection technology, which has no moving parts but senses motion changes through the displacement of a “thermal plume.” These sensors are highly sensitive and play a critical role in stabilizing onboard cameras and in film production.

2. Inertial Measurement Units: Inertial measurement units combined with GPS are key to maintaining direction and flight path. With the intelligent development of drones, direction and path control are important rules for air traffic management. Inertial measurement units utilize multi-axis magnetic sensors, which are essentially highly accurate small compasses that transmit data to the central processor to indicate direction and speed.

3. Tilt Sensors: Tilt sensors integrate gyroscopes and accelerometers to provide data for maintaining level flight in the flight control system. These sensors, along with gyroscopes and accelerometers, can measure subtle motion changes, allowing tilt sensors to be applied in mobile programs such as compensating for gyroscopes in cars or unmanned aerial vehicles.

4. Atmospheric Monitoring Sensors: Air quality is a topic of significant concern. Real-time monitoring of air quality and pollution levels has become a hot topic, and atmospheric monitoring sensors play a crucial role in this. Currently, Weisheng Technology’s atmospheric monitoring sensors are widely used in urban atmospheric environment monitoring, factory area unorganized emission pollution gas monitoring, and environmental evaluation monitoring. They can monitor various gases, including ozone, carbon monoxide, sulfur dioxide, nitrogen dioxide, etc.

5. Current Sensors: The monitoring and usage of electrical energy in drones is very important, especially when powered by batteries. Current sensors can be used to monitor and optimize energy consumption, ensuring the safety of the internal battery charging and motor fault detection systems of drones. Current sensors work by measuring current (bidirectionally), ideally providing electrical isolation to reduce energy loss and eliminate the risk of electric shock damaging user systems.

6. Magnetic Sensors: In drones, electronic compasses provide critical information for inertial navigation and direction positioning systems. Sensors based on anisotropic magnetoresistance (AMR) technology have significant power consumption advantages over other sensors, along with high precision and short response times, making them ideal for drone applications.

7. Engine Intake Flow Sensors: Flow sensors can effectively monitor the small air flow rates of gas engines in electric drones. Many gas engine mass flow sensors use thermal technology, primarily quantifying mass flow through heated elements and at least one temperature sensor. MEMS thermal gas mass flow sensors also utilize thermal principles within micro-quantities, making them suitable for weight-sensitive applications.

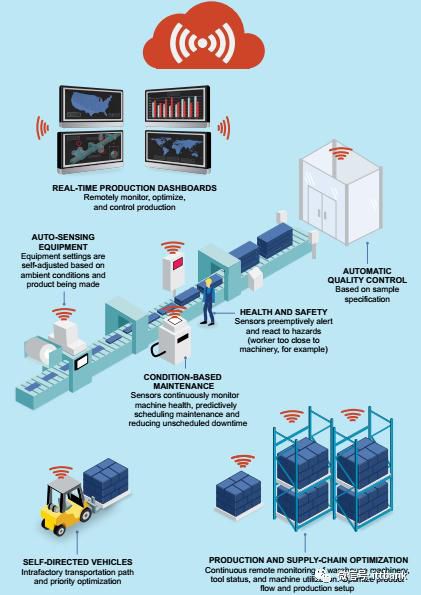

15. Applications of MEMS Sensors in the Era of Smart Industry

Smart factories utilize IoT technology to enhance information management and services, master production and sales processes, improve controllability during production, reduce human intervention on production lines, and timely and accurately collect production line data to reasonably arrange production plans and schedules while optimizing the supply chain. Sensors are widely used, and various stages of industrial production require sensors for monitoring and feedback data to control centers to enable timely intervention at abnormal nodes and ensure normal industrial production.

It is widely believed that the next generation of smart sensors is the “heart” of smart industry, allowing product production processes to operate continuously while keeping workers away from production lines and equipment, ensuring personal safety and health.

Application scenarios in smart factories

MEMS enables sensor miniaturization and intelligence, and MEMS sensors will have great potential in the era of smart industry. MEMS temperature and humidity sensors can be used for environmental condition detection, while MEMS accelerometers can monitor vibrations and rotational speeds of industrial equipment.

High-precision MEMS accelerometers and gyroscopes can provide accurate location information for the navigation and rotation of industrial robots.

Welcome all angel round and A round enterprises in the automotive industry chain (including the power battery industry chain) to join the group (which will recommend to over 800 automotive investment institutions including top-tier organizations); there are communication groups for leading sci-tech innovation companies, and dozens of groups in the automotive industry including whole vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking. Please scan the administrator’s WeChat to join the group (Please indicate your company name).

MEMS Industry Chain Process

MEMS Industry Chain Process

MEMS sensors applied in vehicles

MEMS sensors applied in vehicles