Executive Director of the Japan Research Institute (China)

The fifth China International Import Expo, which opened on November 5, saw around 400 Japanese companies participating, according to data from the Japan External Trade Organization. Since the opening, I have been almost daily immersed in the expo venue, visiting all the halls multiple times.

Compared to previous expos, the impact of the COVID-19 pandemic, the decoupling policies between the U.S. and China, and Japan’s economic security policies that restrict high-tech exchanges with China have significantly changed the domestic and international environment. Nevertheless, the large number of Japanese companies (and companies from other countries) participating is still due to the rapid development of the Chinese economy, which far exceeds that of other countries.

According to the International Monetary Fund (IMF) forecast for economic growth rates in 2022, China is projected to grow at 3.21%, the U.S. at 1.64%, and Japan at 1.75%. In terms of total economic output, Japan’s economy (predicted by the IMF to be $4.93 trillion in 2022) is only a quarter of China’s ($17.74 trillion). Given its slower growth rate, Japan cannot compete with China. Moreover, China’s GDP is 77.2% of the U.S. GDP ($22.99 trillion), meaning that China produces an economic output that exceeds the U.S. by $2 trillion annually, roughly equivalent to half of Japan’s GDP.

In other words, the Chinese market compels companies from different regions to evaluate it positively and participate as much as possible to seize development opportunities.

Expo scene (photo provided by the author)

As China opens its doors and encourages foreign companies to export products and technologies to China, Japan, as the first developed country in Asia, still possesses a wealth of advanced technologies, particularly a large number of products and technologies that have been operational longer than those in China. What technologies do Japanese companies plan to showcase to attract the attention of Chinese enterprises at this expo?

From the exhibition content, I believe the most eye-catching aspects are the use of new energy, dual carbon technologies, and Japan’s semiconductor products, including photolithography machines.

Of course, as in previous years, Japanese sake, beer, and other food and beverage products were popular among consumers at the expo. Japanese automotive manufacturers are also vigorously promoting their various concepts in electric vehicles, but currently, there is no trend of Japanese electric vehicles becoming popular in China. In terms of fashion and other aspects, it is hard to feel that Japanese electric vehicles are significantly better than those from other countries, similar to Japanese mobile phones. Even if they are superior, the lack of consumer habits for Japanese mobile phones has led to a loss of market share both in Japan and globally. Currently, Japanese electric vehicles seem to be following the same path as Japanese mobile phones, lacking the determination and confidence to enter the global market.

In the dual carbon field, Japanese companies can confidently showcase their technologies

China has decided to peak carbon emissions by 2030 and achieve carbon neutrality by 2060 (the 3060 goal), while Japan has set a similar timeline for peaking carbon emissions but aims for carbon neutrality by 2050 (the 2050 goal).

Japan can propose such goals partly due to its years of experience in energy conservation and emission reduction, and partly because Japan holds a certain technological advantage compared to other countries, allowing it to promote its technologies to other countries and regions while contributing to global carbon neutrality and seizing significant business opportunities.

Therefore, at the fifth expo, many Japanese companies focused on dual carbon and environmental protection to launch their products. Overall, the dual carbon strategy of Japanese companies has chosen to utilize new energy—especially hydrogen energy. In this area, Japanese companies possess technologies that are ahead of other countries, making their exhibits particularly prominent at the expo.

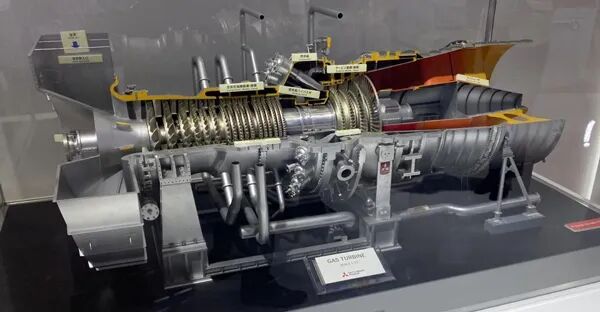

Mitsubishi Heavy Industries showcased its system concept for achieving a zero-carbon society this year. Takashi Kubo, General Manager of Mitsubishi Heavy Industries (China) Co., Ltd., shared with me the specific implementation steps the company is taking towards zero emissions.

“For existing coal-fired power plants, which are major carbon emitters, we hope to improve the efficiency of coal-fired power generation—using IGCC technology and ammonia-biomass co-firing boilers to retrofit inefficient coal power plants—to potentially reduce carbon emissions by 20%. In areas where conditions permit, we will use natural gas combined cycle technology, such as Mitsubishi’s JAC-type high-efficiency gas turbine, which can reduce carbon emissions by 65% compared to coal-fired power generation.”

“Subsequently, by further installing carbon capture, utilization, and storage (CCUS) devices on coal and gas power generation, we can achieve over 90% carbon reduction. Around 2030, Mitsubishi Heavy Industries will launch zero-carbon technologies such as hydrogen turbines and ammonia turbines, promoting the widespread adoption of zero-carbon products to help the power generation sector achieve decarbonization and carbon neutrality as soon as possible.”

Mitsubishi’s JAC-type high-efficiency gas turbine

During my visits to Mitsubishi Heavy Industries’ booth over the past few days, I noticed that major domestic power companies require Mitsubishi’s technologies for emission reduction and energy transition, and many technical and management executives from various companies are discussing technology introduction and cooperation with the company. In addition to high-efficiency gas turbines, Mitsubishi Heavy Industries is also a significant manufacturer of air conditioning systems, and I saw that the company signed a strategic cooperation agreement with a Jiangsu company regarding air conditioning during the expo.

At Hitachi’s booth, Takashi Iida, General Representative of Hitachi Group in China, shared with me, “This year, our exhibition concept is to achieve a sustainable society through data and technology, supporting people’s happy lives. Specifically, we are launching related technologies and products in the areas of digital, green, and innovation.”

Iida showed me Hitachi Energy’s latest technology in wind power generation. “Hitachi’s latest technology is first used in China, including the OceaniQ offshore energy solution and environmentally friendly, efficient transformers. Some materials can be recycled, effectively reducing environmental burdens.”

Like Mitsubishi Heavy Industries and Hitachi, Panasonic also participated in the expo for the fifth time this year.

Tetsuro Honma, Global Vice President and General Representative of Panasonic Group in Northeast Asia, mentioned in an interview, “In previous expos, we focused on health and elderly care, but this time we slightly adjusted our direction to focus on environmental business. We did not introduce core components for new energy vehicles in previous expos, but this time we showcased related content.”

Honma also introduced the pure hydrogen fuel cell exhibited by the company: “This battery was used in the Tokyo Olympics last year, and this is the first time it has been showcased at the expo.”

Hydrogen energy is an important energy source beyond fossil fuels. Although hydrogen-powered vehicles may not have a solid foundation for widespread adoption in the passenger car sector, photovoltaic and wind energy generation can provide the basis for hydrogen production, and hydrogen can be reused in industrial processes. It can be said that effectively utilizing hydrogen energy not only addresses carbon emission issues but also provides a crucial pathway for efficient energy utilization.

In summary, the carbon neutrality solutions presented by Japanese companies at this expo include: using hydrogen energy (Mitsubishi Heavy Industries) to replace fossil fuels; reducing carbon emissions through recycling materials and improving transformer efficiency (Hitachi); and applying hydrogen energy in daily life (Panasonic).

In the semiconductor field, Japanese companies cautiously showcase their technologies

The U.S. has imposed strict restrictions on China in the semiconductor field, and Japan is also strictly controlling its companies’ high-tech exchanges with China due to economic security concerns, which has raised my concerns about this year’s Japanese companies’ semiconductor exhibitions.

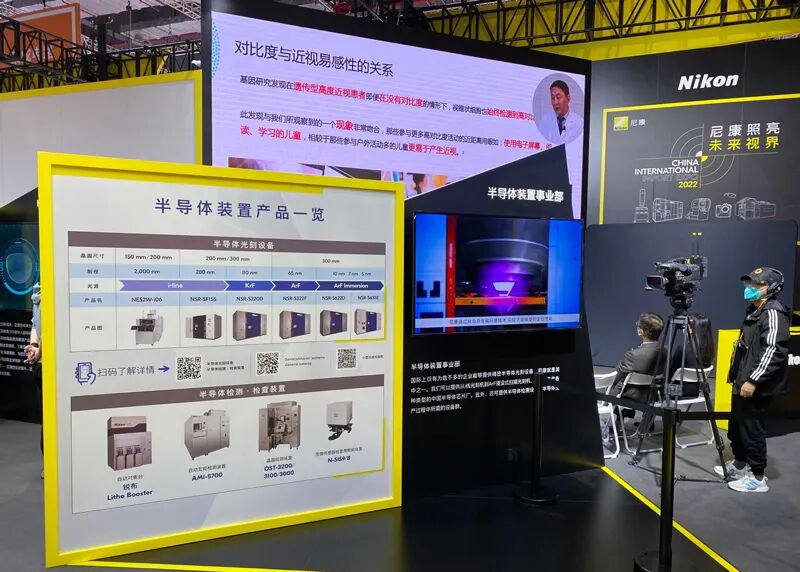

Upon entering the expo venue, I repeatedly observed the booths of various countries in the semiconductor sector and found that both ASML from the Netherlands and U.S. companies like Qualcomm and Texas Instruments had rich exhibits and crowded booths. How about Japanese companies? What technologies will be showcased at the China International Import Expo?

Semiconductor photolithography machines and similar equipment are often the size of a room or a small building, making them difficult to transport to the venue for display. At Nikon’s booth, a display board showcased images of scanning photolithography machines, automatic macro inspection devices, and wafer inspection devices. I wanted to inquire about their sales in China, but the staff were busy attending to other visitors and could not provide a definitive answer.

Nikon booth

At Canon’s booth, three large screens provided a detailed introduction to the usage of photolithography machines in China. A staff member approached me with promotional materials, stating that their optical products have a significant user base in China, and Canon is actively training employees for these users.

Globally, Mitsubishi Electric is one of the major manufacturers of functional semiconductor chips, and at this expo, it showcased several functional products with product catalogs, although its display location was not very prominent.

Mitsubishi Electric’s semiconductor products on display

In contrast, companies like Texas Instruments presented a bold message of “Chips for China, Innovation for the World.” This indicates a certain distance between U.S. government policies and corporate market expansion, as companies like Texas Instruments are willing to engage directly with the Chinese market, showcasing products and information at the expo, demonstrating their determination and confidence to expand in China.

Conclusion

China is the largest semiconductor market in the world, and decoupling and economic security policies cannot guarantee that the U.S. and Japan will establish complete supply chains in new markets outside of China. Moreover, at least in sectors such as smartphones, 5G base stations, electric vehicles, and the industrial internet, we currently do not see any single market that can rival China’s scale. If ties with China are completely severed, it remains uncertain whether the semiconductor supply chain, deprived of market support, can continue to sustain itself.

Japanese companies must clearly recognize how to stabilize market expansion in China and how to build a “local production for local consumption” supply chain in China. There are still many challenges that Japanese companies need to address in the future.

Source | Observer Network